Global Yeast Market Size, Share, And Business Benefits By Form (Dry Yeast, Instant Yeast, Fresh Yeast, Others), By Type (Baker’s Yeast, Brewer’s Yeast, Wine Yeast, Bioethanol Yeast, Feed Yeast, Others), By Nature (Conventional, Organic), By Yeast Extract (Yeast Autolysates, Yeast Hydrolysates, Yeast Cell Wall), By Application (Food (Bakery, Alcoholic Beverages, Prepared Food, Others), Feed (Swine Feed, Poultry Feed, Cattle Feed, Others), Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147421

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

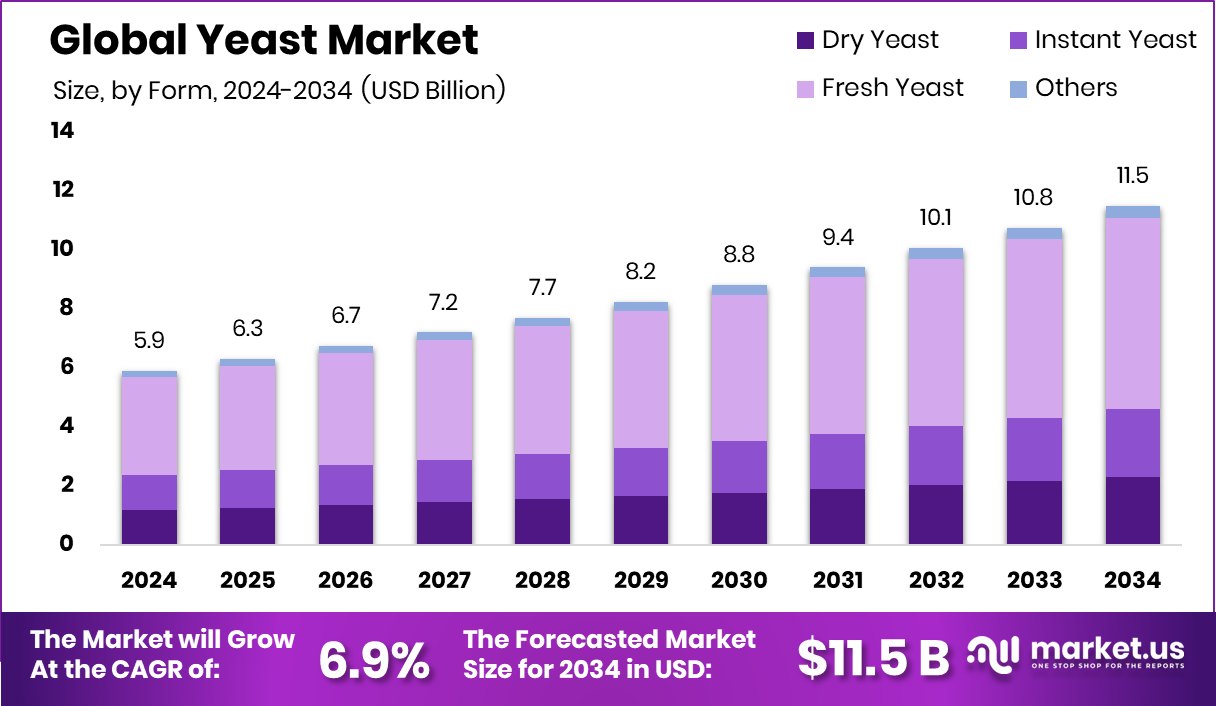

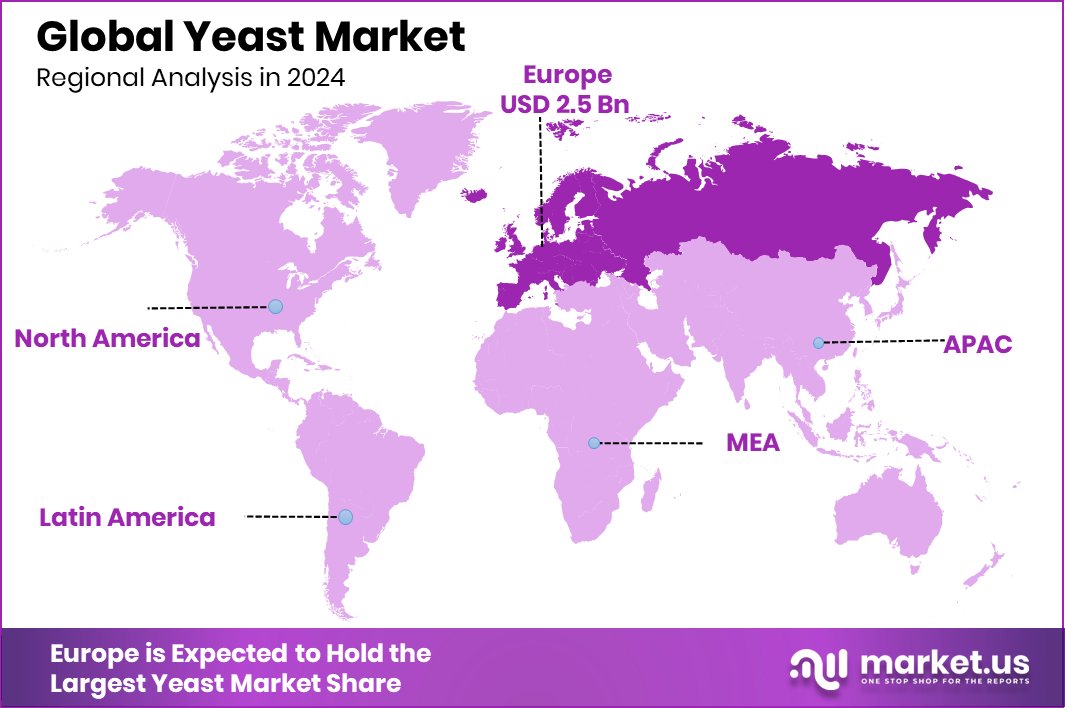

Global Yeast Market is expected to be worth around USD 11.5 billion by 2034, up from USD 5.9 billion in 2024, and grow at a CAGR of 6.9% from 2025 to 2034. With strong food processing growth, Europe reached 43.5%, totaling USD 2.5 Bn.

Yeast is a single-celled microorganism that belongs to the fungus kingdom. It plays a vital role in the fermentation process, converting sugars into alcohol and carbon dioxide. Yeast is most commonly used in baking, brewing, and winemaking. It also has applications in biofuel production and animal feed. Nutritional yeast, a deactivated form, is used as a food supplement due to its high protein and vitamin B content. With its ability to rapidly multiply and survive in diverse environments, yeast has become indispensable across food, beverage, and biotechnological industries.

The yeast market refers to the global trade and production of various types of yeast, including baker’s yeast, brewer’s yeast, and nutritional yeast. It encompasses industries like food & beverages, pharmaceuticals, bioethanol, and animal nutrition. This market is driven by increasing global consumption of processed and baked foods, alcoholic beverages, and bio-based products. Manufacturers focus on enhancing yeast strains and developing clean-label solutions.

The market is growing due to rising demand for fermented foods, especially bread, beer, and yogurt. Urban lifestyles and convenience food preferences are pushing bakery product consumption upward. Technological advancements in yeast biotechnology, particularly in genetic modification and fermentation processes, are further expanding its industrial use. Growing awareness about gut health and the popularity of probiotic-rich products are also fueling yeast demand in nutritional applications.

Global demand is strongly backed by the increasing trend toward organic baking and artisanal food production. Developing regions are showing growing interest in the bakery and brewery sectors. The shift toward plant-based diets is supporting nutritional yeast consumption. Moreover, yeast’s use in animal feed is gaining traction as farmers seek more sustainable and efficient livestock nutrition options.

The market has immense potential in biotechnology, particularly in bioethanol and sustainable fuel production. Innovations in yeast strains could open doors to enzyme production and pharmaceutical applications. Additionally, as more consumers seek clean-label, non-GMO ingredients, there’s an opportunity for natural yeast solutions. Yeastup Raises €9.47M to Turn Dairy Site Into Facility Upcycling Spent Brewers’ Yeast.

Key Takeaways

- Global Yeast Market is expected to be worth around USD 11.5 billion by 2034, up from USD 5.9 billion in 2024, and grow at a CAGR of 6.9% from 2025 to 2034.

- In 2024, fresh yeast held 56.4% market share due to its popularity in artisanal baking.

- Baker’s yeast led the type segment, accounting for 46.2% because of its wide bakery applications.

- Conventional yeast dominated with an 89.9% share, driven by cost-effectiveness and large-scale food processing use.

- Yeast autolysates captured 56.1% in the extract segment, valued for flavor enhancement in savory products.

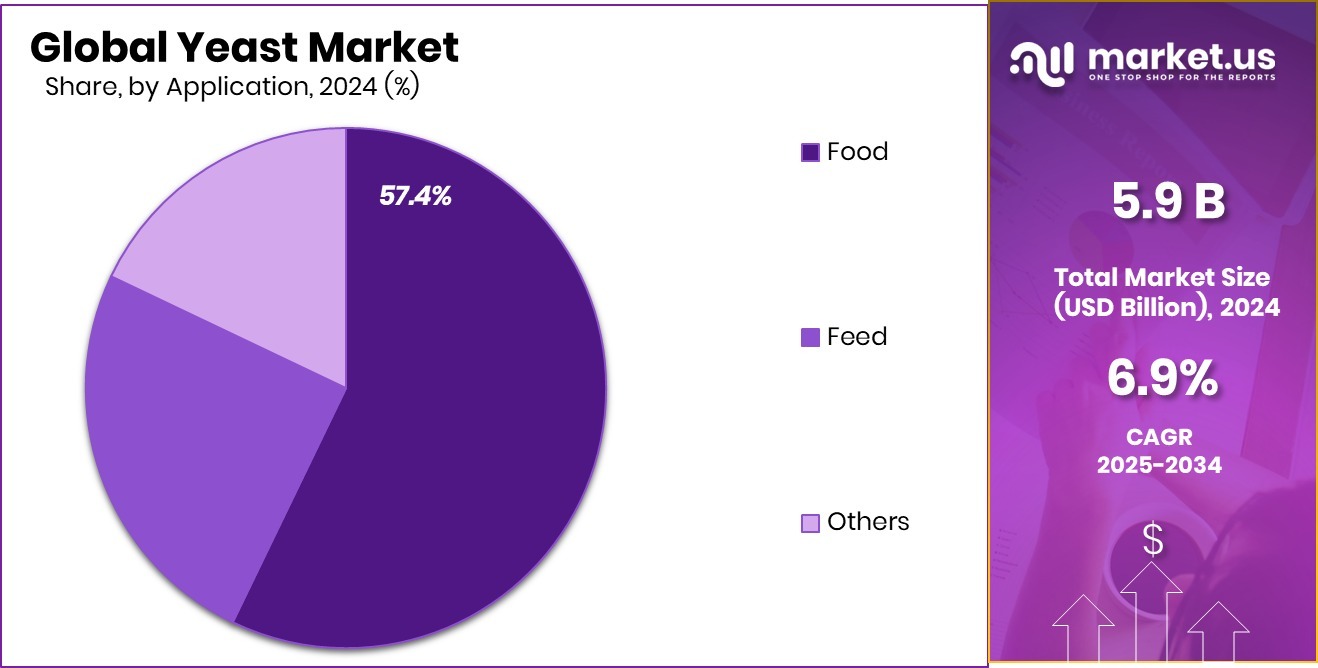

- The food segment led with a 57.4% share, supported by strong demand in the bakery and snack sectors.

- Europe’s bakery sector fueled yeast demand, capturing a 43.5% share worth USD 2.5 Bn.

By Form Analysis

In 2024, fresh yeast accounted for 56.4% of total yeast consumption.

In 2024, Fresh Yeast held a dominant market position in the By Form segment of the Yeast Market, with a 56.4% share. This leadership reflects its strong usage in bakery applications where live yeast activity is essential for optimal fermentation. Its natural leavening properties and ability to enhance dough elasticity made it the preferred choice among commercial and artisanal bakers alike.

Moreover, Fresh Yeast’s high activity level and minimal processing align with consumer preferences for clean-label ingredients. Its refrigerated storage requirements, while considered a logistical challenge, are outweighed by its superior performance in short shelf-life baked goods. The market share of 56.4% underlines its widespread acceptance across both industrial-scale operations and local bakeries.

As the baking industry expands and consumer demand for fresh, preservative-free products grows, Fresh Yeast maintains its edge by offering both functional and sensory benefits. Its prominent position in the By Form category reflects steady usage trends in Europe and Asia-Pacific, where traditional bread consumption remains high.

By Type Analysis

Baker’s yeast led the market with a dominant 46.2% segmental share.

In 2024, Baker’s Yeast held a dominant market position in the By Type segment of the Yeast Market, with a 46.2% share. This significant presence highlights its widespread use in the baking industry, where it plays a crucial role in bread, pastry, and dough preparation. Baker’s Yeast continues to be a fundamental ingredient in commercial and household baking due to its effective leavening ability, ease of use, and compatibility with a wide variety of flour-based formulations.

The strong performance of Baker’s Yeast is closely tied to the consistent demand for baked goods across global markets, especially in regions where bread is a dietary staple. Its versatility in fresh, dry, and instant forms caters to diverse consumer needs and baking environments, ensuring its sustained relevance. The 46.2% share underlines how this segment meets the functional requirements of both small-scale bakers and industrial food processors.

Moreover, its cost-effectiveness and long-standing reliability make it a preferred choice for maintaining consistent fermentation and flavor profiles in baked products. As consumer interest in home baking and artisanal products continues to grow, Baker’s Yeast remains a key driver in the yeast industry’s Type segment, firmly holding its lead with nearly half of the market share in 2024.

By Nature Analysis

Conventional yeast use remains high, capturing around 89.9% market segment share.

In 2024, Conventional held a dominant market position in the By Nature segment of the Yeast Market, with an overwhelming 89.9% share. This dominance highlights the continued reliance of the global food and beverage industry on conventionally produced yeast, which remains a cost-effective and widely accepted option for large-scale applications. Conventional yeast is extensively used across the baking, brewing, and food processing sectors due to its consistent quality, high productivity, and ease of availability.

The 89.9% share reflects the widespread commercial adoption of conventional yeast strains, which are optimized for industrial performance and meet the volume demands of global manufacturers. It also indicates that, despite the growing awareness of organic and natural alternatives, cost-sensitive and volume-driven sectors still favor conventional options for efficiency and stability in production.

Moreover, conventional yeast’s strong regulatory compliance and established supply chains make it a preferred choice in regions with high food manufacturing activity. Its versatility across applications—from bread and beer to seasonings and supplements—supports its continued market leadership.

By Yeast Extract Analysis

Yeast autolysates held 56.1%, dominating the yeast extract segment in usage.

In 2024, Yeast Autolysates held a dominant market position in the Yeast Extract segment of the Yeast Market, with a 56.1% share. This substantial share highlights the growing preference for yeast autolysates in flavor enhancement, nutritional supplementation, and functional food formulations. Known for their rich umami profile and natural origin, yeast autolysates have become an essential ingredient across the food and beverage industry, particularly in ready meals, soups, sauces, and meat substitutes.

The 56.1% share reflects their widespread use due to their clean-label appeal and ability to provide savory depth without synthetic additives. Their functional benefits—such as improved mouthfeel and masking of undesirable flavors—make them a favorite among food technologists. Additionally, yeast autolysates are valued for their high protein content, making them suitable for nutritional products and dietary supplements.

Their dominant position also indicates strong adoption across both developed and emerging markets, where consumer demand is shifting toward natural flavoring agents. The ease of incorporation into various formulations and compatibility with vegetarian and vegan products further boost their appeal.

By Application Analysis

Food applications drove yeast demand, contributing 57.4% to total market utilization.

In 2024, Food held a dominant market position in the By Application segment of the Yeast Market, with a 57.4% share. This clear lead demonstrates the integral role yeast plays in the global food industry, especially in the production of bread, baked goods, seasonings, sauces, and meat alternatives. Yeast’s fermentation properties, ability to enhance flavor, and contribution to nutritional value make it indispensable in food applications.

The 57.4% share reflects sustained demand from both industrial food manufacturers and home bakers, driven by rising consumption of processed and convenience foods. As consumers seek natural ingredients and clean-label products, yeast-based solutions—such as extracts and autolysates—continue to gain traction in savory foods and plant-based innovations.

Yeast is also valued in food applications for its ability to provide texture, leavening, and shelf-life enhancement. Its multifunctional use across a variety of food categories ensures high usage volume, especially in regions with strong bakery and packaged food sectors. With consistent innovation in food technology and rising global food production, yeast remains a core functional ingredient.

Key Market Segments

By Form

- Dry Yeast

- Instant Yeast

- Fresh Yeast

- Others

By Type

- Baker’s Yeast

- Brewer’s Yeast

- Wine Yeast

- Bioethanol Yeast

- Feed Yeast

- Others

By Nature

- Conventional

- Organic

By Yeast Extract

- Yeast Autolysates

- Yeast Hydrolysates

- Yeast Cell Wall

By Application

- Food

- Bakery

- Alcoholic Beverages

- Prepared Food

- Others

- Feed

- Swine Feed

- Poultry Feed

- Cattle Feed

- Others

- Others

Driving Factors

Rising Bakery Consumption Fuels Yeast Market Growth

One of the main reasons the yeast market is growing is the increasing global demand for bakery products like bread, cakes, and pastries. Yeast plays a key role in baking because it helps dough rise and gives baked goods their texture and flavor. As more people eat ready-to-eat snacks and fresh-baked items, bakeries, food chains, and home bakers are using more yeast than before.

Countries with growing urban populations and changing food habits—especially in Asia-Pacific and Europe—are seeing higher bread and baked food consumption. This steady growth in bakery demand continues to be the strongest driver for the yeast market, making it a critical ingredient in the food industry’s expansion.

Restraining Factors

Storage and Shelf Life Limit Yeast Usability

One major factor holding back the yeast market is the limited shelf life and storage sensitivity of certain yeast forms, especially fresh yeast. It requires refrigeration and has a relatively short usage window, which makes transportation and long-term storage difficult, particularly in regions with poor cold chain infrastructure. If not stored properly, yeast can lose its activity and become ineffective, leading to food quality issues.

This concern becomes critical for small bakeries, food manufacturers, or remote distributors who face challenges in maintaining ideal storage conditions. As a result, despite strong demand, these storage and stability concerns restrict wider adoption and create logistical burdens that slow down market expansion in developing or rural regions.

Growth Opportunity

Health-Conscious Consumers Drive Yeast Market Expansion

A significant growth opportunity in the yeast market is the increasing consumer demand for health-oriented and natural food products. Yeast, especially nutritional yeast, is rich in essential nutrients like B vitamins, proteins, and minerals, making it a popular choice among health-conscious individuals. As more people adopt plant-based and vegan diets, the demand for yeast-based products that serve as meat and dairy alternatives has surged.

Additionally, the clean-label trend, where consumers prefer products with simple and natural ingredients, has further propelled the use of yeast in various food applications. This shift towards healthier eating habits presents a substantial opportunity for the yeast industry to innovate and cater to this growing market segment.

Latest Trends

Innovative Yeast Applications Transform Food and Health

A significant trend in the yeast market is the development of innovative yeast-based applications across various industries. Companies are leveraging yeast’s versatility to create new products that cater to evolving consumer preferences.

For instance, yeast is being used to produce plant-based dairy alternatives, offering similar taste and texture to traditional dairy products. Additionally, advancements in yeast fermentation techniques are enabling the production of bio-based chemicals and fuels, contributing to more sustainable industrial processes.

In the health sector, yeast-derived ingredients are being incorporated into dietary supplements and functional foods, providing nutritional benefits and supporting overall well-being. These innovative applications not only expand the utility of yeast but also align with global trends towards sustainability and health consciousness, driving growth in the yeast market.

Regional Analysis

In 2024, Europe led the Yeast Market with a 43.5% share, USD 2.5 Bn.

In 2024, Europe held the dominant position in the global Yeast Market, capturing a significant 43.5% share valued at USD 2.5 billion. This leadership is primarily supported by the region’s strong demand for baked goods, processed foods, and alcohol-based products, which extensively utilize various forms of yeast.

The mature bakery industry and consumer preference for artisanal and fermented foods further drive yeast consumption across countries like Germany, France, and the UK. In North America, the yeast market is supported by the growing interest in nutritional yeast and clean-label ingredients, particularly in the U.S., where plant-based diets and home baking are trending.

Asia Pacific shows promising momentum with increasing use of yeast in packaged foods, especially in emerging economies. Meanwhile, the Middle East & Africa and Latin America represent developing markets where industrial food processing and urban consumption are gradually expanding. However, these regions remain smaller in market value compared to Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Associated British Foods plc continued to hold a strong position in the global yeast market, leveraging its well-established bakery ingredient segment under AB Mauri. The company emphasized operational efficiency, expanding its production capabilities across Europe and the Americas. Its focus on clean-label and non-GMO yeast solutions aligned well with evolving consumer demands, especially in developed markets.

Angel Yeast (Chifeng) Co., Ltd. remained a vital contributor to the yeast market in 2024, especially within Asia-Pacific. The firm’s strategy revolved around product innovation and export expansion. Angel Yeast strengthened its presence in functional and nutritional yeast varieties, including yeast extracts for savory applications and feed-grade yeast for animal nutrition. The company saw notable growth in Southeast Asia and Latin America, supported by a rise in demand for natural flavor enhancers and protein-rich yeast ingredients.

Meanwhile, Lallemand Inc. focused on diversification and specialty yeast applications. In 2024, it deepened its footprint in biotech and fermentation sectors, expanding its offerings into wine, brewing, probiotics, and bio-ingredients. Its technical collaboration with food and beverage processors gave Lallemand a competitive edge in producing customized yeast strains. North America and Europe remained its core regions, with increasing demand from the baking, brewing, and animal nutrition sectors boosting its revenues.

Top Key Players in the Market

- Associated British Foods plc

- Angel Yeast (Chifeng) Co., Ltd.

- Lallemand Inc.

- Lesaffre International

- Oriental Yeast India Pvt Ltd.

- AB Mauri Foods, Inc.

- Novonesis Group

- Kerry Group Plc

- Koninklijke DSM N.V.

- Leiber GmbH

- Ohly GmbH & Co. KG

- AGRANO GmbH & Co. KG

- Kothari Fermentation and Biochem Ltd.

Recent Developments

- In October 2024, Oriental Yeast India Pvt Ltd. invested approximately ₹900 crore (USD 130 million) to develop one of Asia’s largest yeast manufacturing facilities in Kesurdi, Maharashtra. OYI’s product portfolio includes high-quality baker’s yeast and distiller’s yeast, such as the Kobo brand, which are tailored to meet the specific needs of Indian wheat flour conditions and fermentation processes.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Billion Forecast Revenue (2034) USD 11.5 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Dry Yeast, Instant Yeast, Fresh Yeast, Others), By Type (Baker’s Yeast, Brewer’s Yeast, Wine Yeast, Bioethanol Yeast, Feed Yeast, Others), By Nature (Conventional, Organic), By Yeast Extract (Yeast Autolysates, Yeast Hydrolysates, Yeast Cell Wall), By Application (Food (Bakery, Alcoholic Beverages, Prepared Food, Others), Feed (Swine Feed, Poultry Feed, Cattle Feed, Others), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Associated British Foods plc, Angel Yeast (Chifeng) Co., Ltd., Lallemand Inc., Lesaffre International, Oriental Yeast India Pvt Ltd., AB Mauri Foods, Inc., Novonesis Group, Kerry Group Plc, Koninklijke DSM N.V., Leiber GmbH, Ohly GmbH & Co. KG, AGRANO GmbH & Co. KG, Kothari Fermentation and Biochem Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Associated British Foods plc

- Angel Yeast (Chifeng) Co., Ltd.

- Lallemand Inc.

- Lesaffre International

- Oriental Yeast India Pvt Ltd.

- AB Mauri Foods, Inc.

- Novonesis Group

- Kerry Group Plc

- Koninklijke DSM N.V.

- Leiber GmbH

- Ohly GmbH & Co. KG

- AGRANO GmbH & Co. KG

- Kothari Fermentation and Biochem Ltd.