Global Food Processing Market By Type (Extrusion and Thermal Equipment, Cleaning, Sorting, and Grading Equipment, Cutting, Peeling and Grinding Equipment, Mixers, Blenders and Homogenizers, Others), By Category (Semi-Automated, Fully Automated), By Application (Fruit, Vegetable and Beverages, Bakery, Confectionery and Dairy Products, Meat, Poultry, and Seafood Products, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145803

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

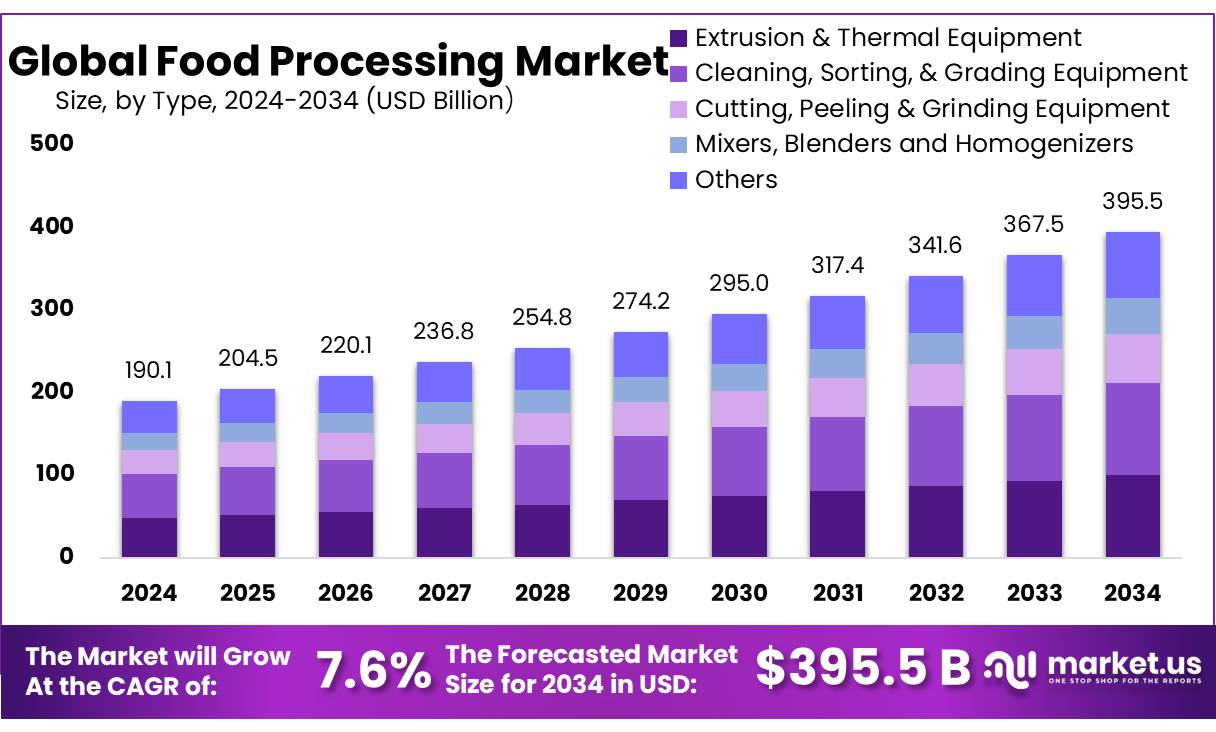

The Global Food Processing Market size is expected to be worth around USD 395.5 Bn by 2034, from USD 190.1 Bn in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

The food processing industry is a cornerstone of the global food and beverage sector, characterized by its vast range and depth of products. This industry transforms raw agricultural commodities into consumable food products that are easy to prepare and safe to eat. In 2024, the industry reported significant growth, underscored by an increasing global demand for processed foods fueled by rising urbanization and the expansion of the middle class, particularly in emerging economies.

Driving factors for the industry include the rising consumer preference for convenient, ready-to-eat products that do not compromise on nutritional value. According to the Food and Agriculture Organization (FAO), global processed food sales are expected to continue their upward trajectory, driven by urban lifestyles and changing dietary preferences.

Future growth opportunities in the food processing sector are linked to the integration of digital technologies like the Internet of Things (IoT) and Artificial Intelligence (AI). These technologies enhance production efficiency, improve food safety, and reduce operational costs. The market is also seeing a significant shift towards plant-based and alternative protein food products, responding to the growing consumer awareness of health and environmental issues. The U.S. government’s investment in sustainable agriculture, including a $4 billion commitment as part of the Build Back Better initiative, underscores the push towards more sustainable food processing methods.

Key Takeaways

- Food Processing Market size is expected to be worth around USD 395.5 Bn by 2034, from USD 190.1 Bn in 2024, growing at a CAGR of 7.6%.

- Extrusion and Thermal Equipment held a dominant market position, capturing more than a 25.30% share of the food processing equipment market.

- Fully Automated systems held a dominant market position within the food processing sector, capturing more than a 57.30% share.

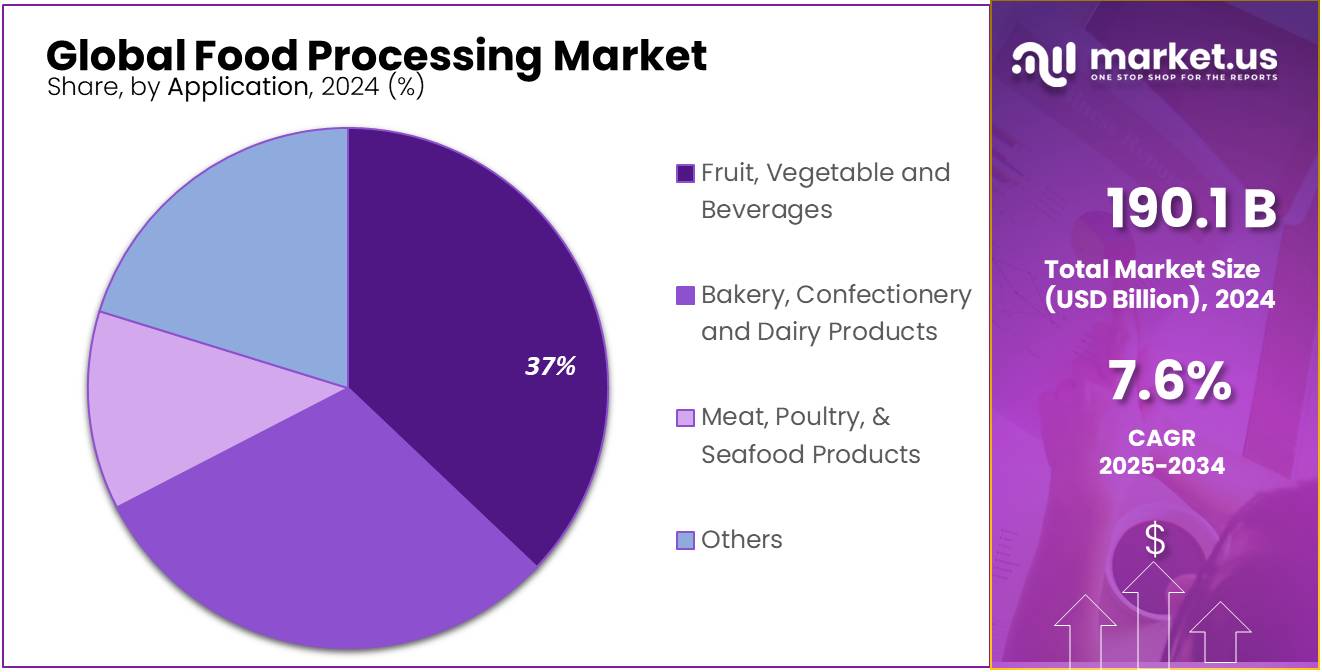

- Fruit, Vegetable, and Beverages segment held a dominant market position in the food processing industry, capturing more than a 37.30% share.

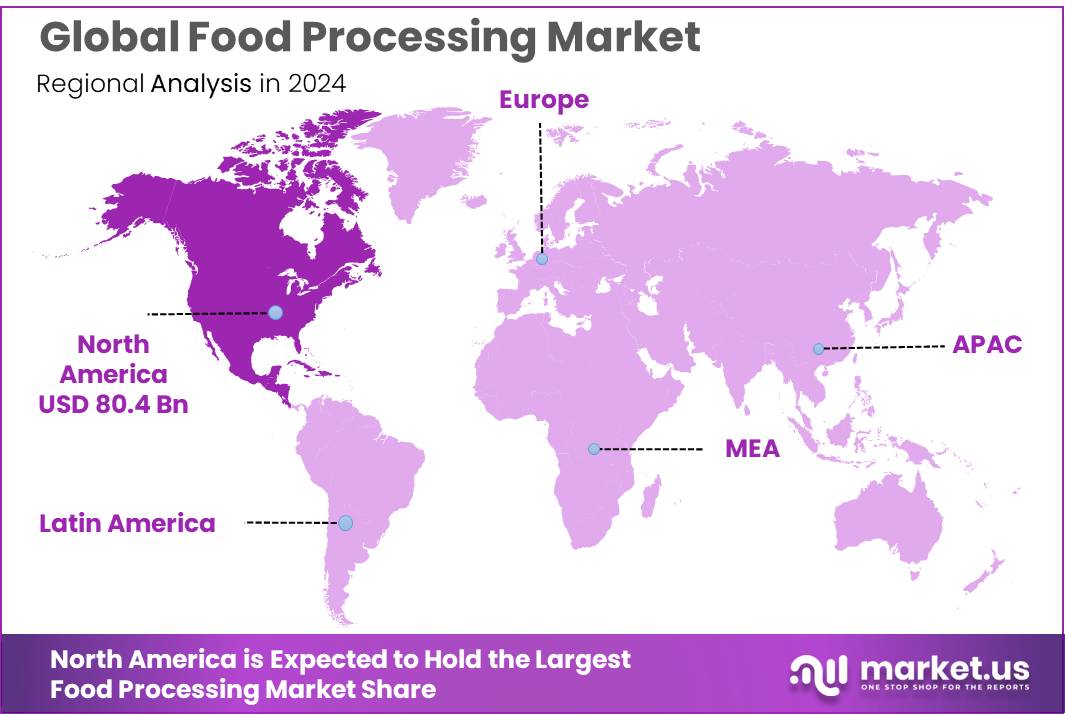

- North America stands out as a dominating region, holding a substantial 42.30% market share, translating to a value of approximately USD 80.4 billion.

By Type

Extrusion and Thermal Equipment Shine with a 25.30% Market Share in 2024, Driven by Advanced Food Processing Demands.

In 2024, Extrusion & Thermal Equipment held a dominant market position, capturing more than a 25.30% share of the food processing equipment market. This segment has shown remarkable resilience and growth, driven by the increasing demand for processed foods that require extensive pre-cooking and shaping through extrusion processes. Extrusion equipment, pivotal in producing snacks, cereals, and a variety of textured products, has benefitted from advancements in technology that allow for greater efficiency and product variety.

Similarly, thermal equipment, essential for processes such as pasteurization, sterilization, and drying, has seen substantial adoption. The focus on food safety and extended shelf life has propelled the usage of thermal techniques, making this type of equipment indispensable in the food industry. By 2025, the integration of automation and continuous processing technologies is expected to further enhance the efficiency of these systems, potentially increasing their market share and operational footprint across global food processing industries.

By Category

Fully Automated Systems Command a 57.30% Market Share in 2024, Marking a Shift Towards High-Efficiency Production.

In 2024, Fully Automated systems held a dominant market position within the food processing sector, capturing more than a 57.30% share. The significant tilt towards fully automated solutions is a reflection of the industry’s ongoing shift towards greater efficiency and precision in food production. These systems are highly prized for their ability to reduce labor costs, increase production speed, and minimize human error, leading to higher quality products with consistent standards.

Looking ahead to 2025, the trend towards automation is expected to grow even stronger. Companies are increasingly investing in smart technologies that integrate AI and machine learning to further enhance the capabilities of these systems. This technology not only improves the operational aspects of food processing but also helps in adhering to stringent food safety regulations more effectively. As the demand for processed foods continues to rise globally, fully automated systems are set to play an even more critical role in meeting the market needs.

By Application

Fruit, Vegetable, and Beverage Processing Captures a 37.30% Market Share in 2024, Driven by Health Trends and Technological Innovations.

In 2024, the Fruit, Vegetable, and Beverages segment held a dominant market position in the food processing industry, capturing more than a 37.30% share. This segment benefits significantly from the growing consumer preference for fresh, organic, and conveniently packaged food and beverage options. As health consciousness rises and more people lean towards plant-based diets, the demand for processed fruits and vegetables has surged, driving growth in this segment.

By 2025, this trend is expected to continue with technological advancements in processing techniques such as cold-pressing and minimal processing that help retain nutritional value while extending shelf life. Beverage processing, particularly in the non-alcoholic sector, is also seeing innovative shifts towards natural ingredients and reduced sugar content, which align well with the current consumer preferences and regulatory landscape.

Key Market Segments

By Type

- Extrusion & Thermal Equipment

- Cleaning, Sorting, & Grading Equipment

- Cutting, Peeling & Grinding Equipment

- Mixers, Blenders and Homogenizers

- Others

By Category

- Semi-Automated

- Fully Automated

By Application

- Fruit, Vegetable and Beverages

- Bakery, Confectionery and Dairy Products

- Meat, Poultry, & Seafood Products

- Others

Drivers

Rising Demand for Processed Foods Due to Changing Lifestyle Patterns

One major driving factor for the food processing market is the rising demand for processed foods, influenced by changing lifestyle patterns around the world. As lifestyles become busier and more urbanized, consumers increasingly look for convenience in their dietary choices. This shift has been significantly noted by the Food and Agriculture Organization (FAO), which highlights that urbanization and higher income levels lead to an increased demand for processed foods. This trend is not just limited to developed nations but is also gaining momentum in developing countries where the middle class is expanding rapidly.

According to a report by the United Nations Industrial Development Organization (UNIDO), the global processed food market is expected to continue its growth trajectory, driven by these evolving consumer behaviors. The report notes that in many cities across the world, quick service restaurants, takeaway food outlets, and ready-to-eat meals are becoming more popular, thus pushing the food processing industry to upscale their production capabilities to meet this demand.

Government initiatives also play a crucial role in supporting the food processing sector. For instance, various national governments have introduced policies aimed at promoting food security and sustainability, which indirectly boost the processed food market. These include tax incentives for food manufacturers, subsidies for adopting advanced technologies, and support for exporting processed foods to new markets.

Furthermore, leading food organizations like Nestlé and PepsiCo have reported an increase in sales of their processed food products, attributing this growth to innovative product offerings and effective adaptation to consumer preferences. These companies have been focusing on developing products that align with the health-conscious trends without compromising on convenience, which has proven successful according to their annual reports.

Restraints

Health Concerns Over Processed Foods Pose Challenges to Market Growth

A significant restraining factor in the food processing market is the increasing consumer concern over the health impacts of processed foods. This concern is rooted in widespread public awareness about the potential negative health effects associated with the consumption of foods that are high in preservatives, sodium, and sugars. Various health organizations, including the World Health Organization (WHO), have issued guidelines and reports highlighting the risks of chronic diseases such as diabetes, heart disease, and obesity linked to diets rich in highly processed foods.

The push towards healthier lifestyles has led many consumers to prefer fresh, organic, and minimally processed foods over traditional processed options. For example, a study published by the Centers for Disease Control and Prevention (CDC) noted that there is an increasing trend in populations moving towards diets that emphasize fruits, vegetables, whole grains, and lean meats, which are perceived as healthier alternatives.

Government initiatives further amplify this trend by promoting nutritional awareness and healthier eating habits. Policies aimed at reducing sugar intake, such as the implementation of sugar taxes in several countries, directly impact the sales of sugar-rich processed foods. These initiatives encourage food manufacturers to reformulate their products to meet the new health standards, often at a higher production cost.

Additionally, leading food companies like Kraft Heinz and General Mills have reported in their corporate sustainability reports the need to adapt to these changing consumer preferences by enhancing their product lines with healthier, less processed options. This shift not only represents a challenge to maintain market share but also increases the operational costs involved in research and development of new products that meet these stringent health criteria.

Opportunity

Technological Advancements Open New Avenues in Food Processing

A significant growth opportunity within the food processing market stems from technological advancements that enhance food safety, extend shelf life, and increase production efficiency. Innovations such as High-Pressure Processing (HPP), blockchain for traceability, and AI-driven quality control systems are revolutionizing how food is processed, packaged, and tracked through the supply chain.

For instance, HPP technology, which uses cold pasteurization technique by applying high pressure to destroy pathogens without affecting the food’s nutritional value or taste, has gained considerable attention. According to the Institute of Food Technologists (IFT), this method not only ensures food safety but also meets consumer demand for ‘clean label’ products that are free from preservatives.

Further, the implementation of blockchain technology in the food industry enhances traceability and transparency, allowing consumers to track the origin and processing of the food products they purchase. This technological shift is largely driven by consumer demand for greater transparency following numerous food safety scandals. Leading food corporations, including Walmart and Nestlé, have begun implementing blockchain to streamline their supply chains and build consumer trust, as reported by their corporate initiatives.

Governments are also recognizing the potential of these technologies to improve food system efficiencies and are thus facilitating their adoption through supportive regulations and funding innovations. For example, the European Union has funded research projects under its Horizon 2020 program that focuses on integrating advanced technologies into food processing to boost competitiveness and sustainability.

Trends

Plant-Based Products Surge as a Trendsetter in the Food Processing Market

A major trend shaping the food processing market is the rise in popularity of plant-based products. This shift is largely driven by consumer interest in healthier and more sustainable dietary choices. According to a report by the Food and Agriculture Organization (FAO), there has been a noticeable increase in demand for plant-based proteins and alternatives to dairy and meat products. Consumers are increasingly aware of the environmental impact of traditional animal farming, and many are choosing plant-based options for ethical and health reasons.

Food processors are responding by expanding their offerings of plant-based foods. Innovations include plant-based meats that mimic the taste and texture of animal products, dairy-free cheeses, and vegan ready-to-eat meals. These products are not only appealing to vegans and vegetarians but also to a broader audience looking to reduce meat consumption due to health concerns.

The trend is supported by government initiatives promoting sustainable agriculture and food security. Several countries have introduced guidelines that encourage the consumption of plant-based foods to reduce the environmental footprint of the food sector. These policies support the growth of the plant-based market segment by encouraging research and development and by providing subsidies to farmers who grow crops used in plant-based food products.

Leading global food companies like Beyond Meat and Impossible Foods have reported significant growth in sales, attributed to their successful penetration into mainstream supermarkets and restaurant chains. Their expansion is a testament to the robust demand for plant-based products.

Regional Analysis

In the food processing market, North America stands out as a dominating region, holding a substantial 42.30% market share, translating to a value of approximately USD 80.4 billion. This leadership position is underpinned by advanced manufacturing infrastructures, a high degree of automation, and robust regulatory frameworks that ensure food safety and quality. The United States leads within this region, driven by massive consumer demand for processed foods and beverages, which is fueled by high income levels and a preference for convenience foods.

Technological advancements are a significant growth catalyst in North America’s food processing sector. Innovations such as precision processing, integrated AI, and robotics are increasingly being adopted to enhance production efficiency and product quality. These technologies also address labor shortages and reduce the dependency on manual labor, making processes faster and less prone to errors.

The region’s focus on sustainability has led to the adoption of energy-efficient practices in food processing plants. North American companies are at the forefront of using renewable energy sources and reducing waste through circular economy practices, aligning with global sustainability trends and regulatory mandates.

Additionally, North America benefits from stringent food safety regulations enforced by bodies such as the FDA and CFIA, which help maintain high standards of food quality and consumer trust. These regulatory frameworks not only ensure domestic product integrity but also enhance the competitiveness of American and Canadian food products in international markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AFE Group Ltd. is a prominent player in the food processing market, known for its robust range of equipment and solutions tailored to enhance food production efficiency. The company specializes in innovative cooling and freezing technologies, which are crucial for maintaining the safety and quality of food products. AFE Group’s commitment to sustainability and energy efficiency in its designs makes it a preferred choice for food processors seeking to reduce environmental impact and operational costs.

Alfa Laval AB stands out in the food processing industry for its high-quality heat transfer, separation, and fluid handling technologies. This Swedish company is pivotal in helping food manufacturers improve productivity while maintaining the highest hygiene standards. Alfa Laval’s equipment is widely recognized for its durability, efficiency, and ability to handle a range of processes, making it essential for operations looking to optimize their processing lines and reduce waste.

Atlas Pacific is a key provider of food processing machinery, particularly known for its pioneering fruit processing equipment. The company offers a variety of peelers, corers, and slicers that are essential in the production of canned, dried, and preserved fruits. Atlas Pacific’s technology is designed to maximize yield and efficiency, reducing processing time and enhancing the quality of the final product.

B.K Engineers is renowned for its bespoke engineering solutions in the food processing sector. The company designs and manufactures a wide range of equipment, specializing in animal feed processing. Their machinery is known for its robustness and reliability, ensuring optimal performance under continuous operational conditions. B.K Engineers is committed to innovation and customer satisfaction, making it a go-to for businesses looking to streamline their feed production processes.

Top Key Players in the Market

- AFE Group Ltd.

- Alfa Laval AB

- Atlas Pacific

- B.K Engineers

- Bigtem Makine A.S.

- Bucher Industries AG

- Clextral S.A.S

- FENCO Food Machinery s.r.l.

- GEA Group AG

- Heat and Control, Inc.

- JBT Corporation

- Krones AG

- Marel

- Meyer Industries

- Paul Mueller Company

- SPX Flow

- The Bühler Holding AG

- TNA Solution Pty Ltd

- Tomra Systems

- ZIEMANN HOLVRIEKA

Recent Developments

In 2023, AFE Group reported a commendable growth, with a revenue increase to £132 million, reflecting a 9.5% rise from the previous year, showcasing their effectiveness in navigating the competitive landscape.

Alfa Laval AB, a key player in the food processing market, demonstrated robust financial performance in 2024. The company reported an 8% organic increase in order intake, reaching SEK 18.5 billion for the fourth quarter, and an overall annual increase to SEK 74.6 billion. Their net sales rose by 6% to SEK 66.95 billion for the year, reflecting consistent growth in their operations

Report Scope

Report Features Description Market Value (2024) USD 190.1 Bn Forecast Revenue (2034) USD 395.5 Bn CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Extrusion and Thermal Equipment, Cleaning, Sorting, and Grading Equipment, Cutting, Peeling and Grinding Equipment, Mixers, Blenders and Homogenizers, Others), By Category (Semi-Automated, Fully Automated), By Application (Fruit, Vegetable and Beverages, Bakery, Confectionery and Dairy Products, Meat, Poultry, and Seafood Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AFE Group Ltd., Alfa Laval AB, Atlas Pacific, B.K Engineers, Bigtem Makine A.S., Bucher Industries AG, Clextral S.A.S, FENCO Food Machinery s.r.l., GEA Group AG, Heat and Control, Inc., JBT Corporation, Krones AG, Marel, Meyer Industries, Paul Mueller Company, SPX Flow, The Bühler Holding AG, TNA Solution Pty Ltd, Tomra Systems, ZIEMANN HOLVRIEKA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AFE Group Ltd.

- Alfa Laval AB

- Atlas Pacific

- B.K Engineers

- Bigtem Makine A.S.

- Bucher Industries AG

- Clextral S.A.S

- FENCO Food Machinery s.r.l.

- GEA Group AG

- Heat and Control, Inc.

- JBT Corporation

- Krones AG

- Marel

- Meyer Industries

- Paul Mueller Company

- SPX Flow

- The Bühler Holding AG

- TNA Solution Pty Ltd

- Tomra Systems

- ZIEMANN HOLVRIEKA