Agricultural Biotechnology Market By Organism Type (Plants, Animals, Microbes), By Application (Vaccine Development, Transgenic Crops & Animals, Antibiotic Development, Nutritional Supplements, Flower Culturing, Biofuels, and Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 37333

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

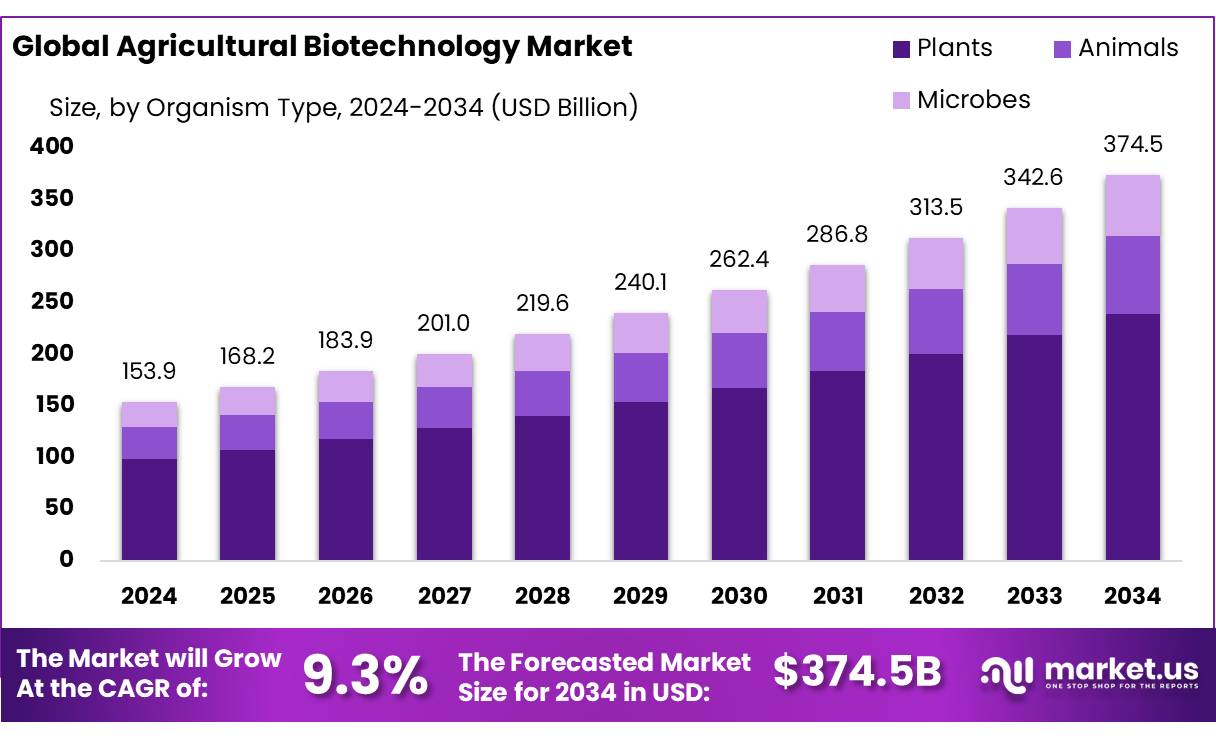

The Global Agricultural Biotechnology Market size is expected to be worth around USD 374.5 Billion by 2034, from USD 153.9 Billion in 2024, growing at a CAGR of 9.30% during the forecast period from 2025 to 2034.

Agricultural biotechnology is a field of agriculture that uses scientific tools and processes to improve plant yield. To increase crop production, agricultural biotechnology is used. It is a set of scientific techniques and methods applied to plants and other living organisms. Crops altered in some way are genetically modified or transgenic crops. Demand for innovative breeding techniques is anticipated to surge in the market.

This is due to the increased penetration of biotechnological tools to invent or modify organisms’ traits, including animals, plants, and microbes, in response to yield, color, or size. Biotechnology tools are getting significant demand in agricultural applications. These involve tissue culture and micro propagation, market-assisted selection or molecular breeding, genetically modified crops and genetic engineering, conventional plant breeding and molecular diagnostic technologies.

Key Takeaways

- Agricultural Biotechnology Market size is expected to be worth around USD 374.5 Billion by 2034, from USD 153.9 Billion in 2024, growing at a CAGR of 9.30%.

- plants held a dominant market position in the Agricultural Biotechnology Market, capturing more than a 64.40% share.

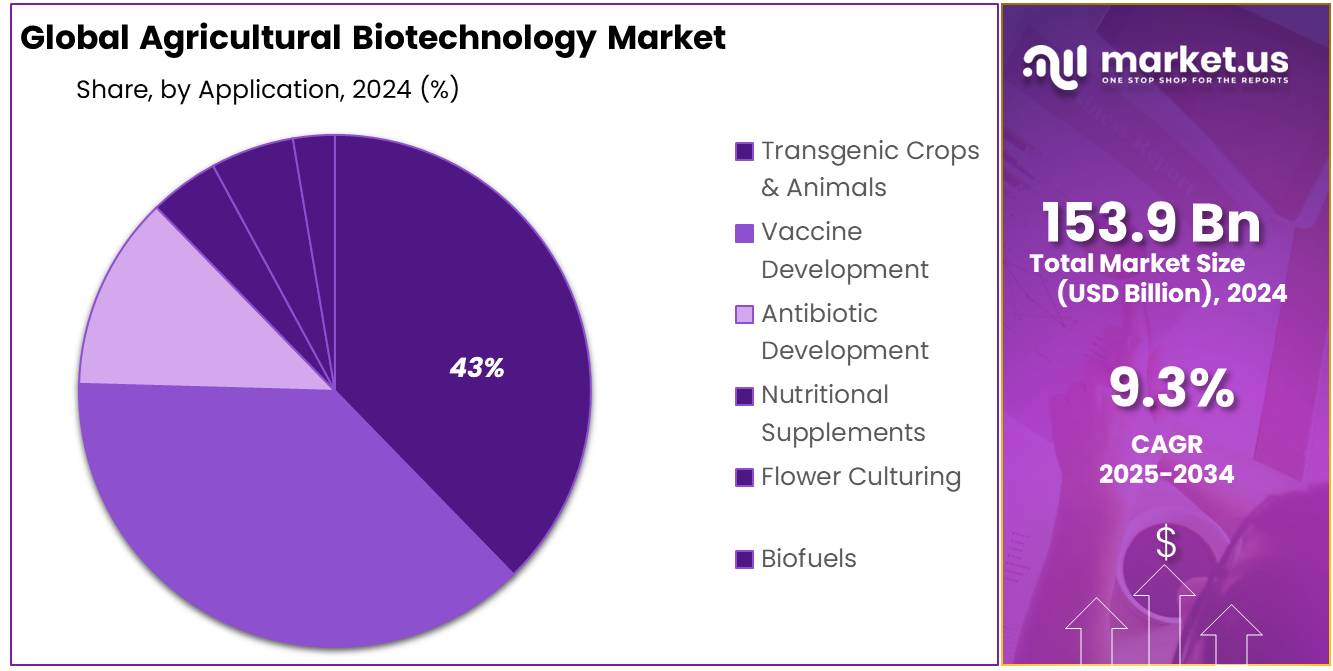

- Transgenic Crops & Animals held a dominant market position in the Agricultural Biotechnology Market, capturing more than a 43.40% share.

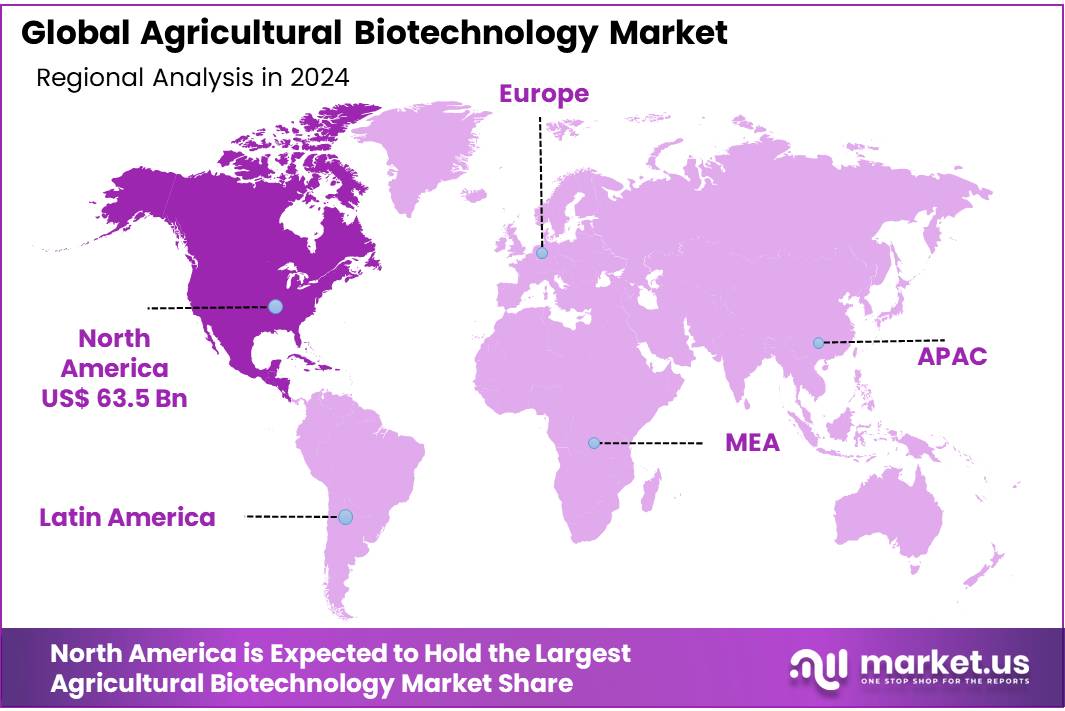

- North America emerging as the dominant player. Capturing a significant 41.30% market share, this region accounted for USD 63.5 billion

Organism Type Analysis

In 2024, plants held a dominant market position in the Agricultural Biotechnology Market, capturing more than a 64.40% share. This substantial segment of the market primarily benefits from advancements in genetic modification techniques that enable increased crop yield and resistance to pests and diseases. Researchers and developers have focused on creating plant varieties that can thrive in less-than-ideal soil conditions and withstand environmental stressors such as drought and frost, which are becoming increasingly prevalent due to climate change. This focus not only supports sustainable agricultural practices but also addresses the growing global food demand.

The animal segment also plays a crucial role in agricultural biotechnology, though it holds a smaller share compared to plants. Innovations in this area include genetic engineering to produce animals with desirable traits such as enhanced growth rates and resistance to illnesses. These advancements contribute to increased efficiency in meat and dairy production, aligning with efforts to meet the protein needs of a growing population while reducing the ecological footprint of livestock farming.

Microbes, often an underappreciated segment, have shown promising growth in 2024, driven by their critical role in enhancing soil fertility and plant health. The development of microbial products such as biofertilizers and biopesticides has gained traction, offering an eco-friendly alternative to chemical inputs. These products help in nutrient absorption, degrade pollutants, and combat pathogenic threats to crops, thereby supporting holistic and sustainable agricultural practices.

Application Analysis

In 2024, Transgenic Crops & Animals held a dominant market position in the Agricultural Biotechnology Market, capturing more than a 43.40% share. This segment’s strength lies in its ability to introduce new genetic material into plants and animals to enhance traits such as yield, nutritional value, and resistance to pests and diseases. These modifications not only help farmers reduce crop losses but also ensure more efficient use of land and resources.

Vaccine development is another vital application within agricultural biotechnology, with ongoing innovations aimed at improving animal health and reducing outbreaks of diseases. The development of vaccines has become more targeted, allowing for the prevention of specific diseases in livestock and poultry, which is crucial for maintaining the stability of food supplies.

Antibiotic development continues to be a significant focus, especially with the increasing concern over antibiotic resistance. Biotechnological advancements are enabling the creation of more effective and safer antibiotics to protect the health of both animals and humans.

The sector of nutritional supplements is expanding as biotechnology aids in the enhancement of food products with vitamins and minerals. This application is particularly important in addressing nutritional deficiencies in global populations, providing essential nutrients through genetically enhanced food sources.

Flower culturing has also benefitted from biotechnological methods, particularly in extending the shelf life and enhancing the colors and sizes of commercially sold flowers. This application not only increases the aesthetic value of floral products but also supports the economic stability of the floriculture industry.

The biofuels segment is gaining momentum as biotechnology contributes to the development of bioenergy sources from agricultural waste and non-food crops. This application supports the shift towards more sustainable energy solutions, reducing reliance on fossil fuels and mitigating the impacts of climate change.

Key Market Segments

By Organism Type

- Plants

- Animals

- Microbes

By Application

- Vaccine Development

- Transgenic Crops & Animals

- Antibiotic Development

- Nutritional Supplements

- Flower Culturing

- Biofuels

Drivers

Restraints

Regulatory and Public Acceptance Challenges

A significant restraining factor in the growth of agricultural biotechnology is the complexity of regulatory approvals combined with limited public acceptance. The development and commercialization of genetically modified (GM) crops are heavily regulated, requiring extensive safety evaluations and approvals from multiple governmental and international bodies. This lengthy and costly process can deter investment in biotechnological advancements and slow down the pace of innovation.

Regulatory frameworks for GM crops vary significantly across different countries, creating a challenging environment for biotechnology companies that operate internationally. For example, while some countries have embraced biotechnological advances in agriculture, others have stringent regulations or outright bans on the cultivation and import of genetically modified organisms (GMOs). The European Union, for instance, has one of the strictest regulatory processes for GM crops in the world, which significantly limits the market for biotechnological products in Europe.

Public acceptance is another critical barrier. Despite scientific assurances regarding the safety of GM foods, public skepticism remains high in many regions. Misinformation and the lack of understanding about the scientific principles behind GMOs contribute to ongoing debates and resistance among consumers. A survey conducted by the Pew Research Center found that 49% of Americans believe GM foods are worse for health, reflecting widespread public reservations about biotechnological advances in agriculture.

The economic implications of these regulatory and public acceptance challenges are considerable. According to the International Service for the Acquisition of Agri-biotech Applications (ISAAA), the global area planted with biotech crops has seen fluctuating growth rates, partly due to regulatory and market dynamics influenced by public opinion. This instability can affect the profitability and sustainability of investments in agricultural biotechnology.

Governments and international bodies play a pivotal role in shaping the landscape for agricultural biotechnology. Some have launched initiatives to better educate the public on the benefits and safety of GM foods. For example, the U.S. Department of Agriculture (USDA) provides resources and outreach programs designed to disseminate factual information about biotechnology and its role in sustainable agriculture.

Despite these efforts, the biotechnology sector continues to face uphill battles in gaining consumer trust and regulatory clearance. Advocates argue that enhancing transparency in biotechnological research and product development, along with engaging with the public through open dialogues, could help bridge the gap between scientific evidence and public perception.

Opportunity

Expanding Biofuel Production: A Thriving Opportunity for Agricultural Biotechnology

One of the most promising growth opportunities in agricultural biotechnology lies in the expanding biofuel sector. As the world seeks cleaner, more sustainable energy sources to combat climate change, the demand for biofuels has seen a significant rise. Agricultural biotechnology plays a crucial role in this sector by enhancing the yield and efficiency of biofuel-producing crops.

Biofuels are derived from biomass materials such as crops and agricultural waste. Through biotechnological advancements, crops can be genetically modified to increase their biomass output and improve their suitability for biofuel production. For instance, modifications can enable plants to grow in marginal soils with less water, thus not competing with food crops for prime agricultural land. This not only makes biofuel production more sustainable but also more economically viable.

According to the International Energy Agency (IEA), biofuel production needs to triple by 2030 to meet the targets set by the Paris Agreement on climate change. This highlights a substantial market opportunity for agricultural biotechnology firms that can develop high-yielding, resilient biofuel crops. The IEA also notes that advancements in biotechnology that increase the energy content of biofuel crops could significantly reduce the cost of biofuel production, making it a more competitive alternative to fossil fuels.

Government initiatives play a vital role in supporting this growth opportunity. Many countries have implemented policies and subsidies to encourage the development and adoption of biofuels. For example, the United States has various federal renewable fuel standards and programs that promote biofuel use, which in turn drives research and development in biofuel crop technologies.

Furthermore, public-private partnerships are essential in harnessing the full potential of biotechnological innovations in biofuels. These collaborations help align the goals of academic research, government policy, and commercial interests, ensuring that scientific breakthroughs can be rapidly translated into marketable products that contribute to sustainable energy solutions.

The economic benefits of biofuels extend beyond environmental impact. The biofuel industry provides rural jobs and creates new markets for farmers, which can help stabilize rural economies and reduce urban migration. Additionally, as the biofuel sector grows, it can reduce national dependence on imported oil, enhancing energy security.

Trends

CRISPR Technology Revolutionizing Crop Development

A significant trend in agricultural biotechnology that is shaping the future of farming is the use of CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats) technology. This genetic editing tool has transformed how scientists approach crop improvement, offering a precise and cost-effective method to enhance crop traits such as yield, nutritional quality, and resistance to pests and diseases.

CRISPR technology enables researchers to make specific changes in a plant’s DNA, quickly and accurately. This method surpasses traditional breeding techniques that are often time-consuming and less precise. One of the most notable applications of CRISPR in agriculture is its ability to develop crops that can withstand climatic stresses such as drought and extreme temperatures, which are increasingly prevalent due to climate change.

The adoption of CRISPR in agricultural practices is rapidly expanding. According to the Food and Agriculture Organization (FAO), using CRISPR technology can significantly accelerate the development of new crop varieties to meet global food demands sustainably. The FAO also emphasizes that CRISPR could be crucial in addressing food security challenges, especially in underdeveloped regions where agricultural productivity needs to be improved without harming the environment.

Government initiatives have been pivotal in fostering the research and deployment of CRISPR technology. For example, the United States Department of Agriculture (USDA) has streamlined regulations around genetically edited crops, which encourages innovation and faster introduction of these crops into the market. Similarly, several European countries are reconsidering their regulatory stance on genetically edited organisms to facilitate research and application in agriculture.

Public perception of CRISPR technology is generally more favorable compared to traditional genetically modified organisms (GMOs). This is largely due to the precision of CRISPR, which does not necessarily involve introducing foreign DNA into the plant. Instead, it often involves editing the existing genes in ways that could occur naturally over time or through conventional breeding. This aspect could help in gaining consumer acceptance as it aligns with the natural evolution of plant species.

Moreover, the economic implications of adopting CRISPR are profound. It reduces the cost and time involved in developing new crop varieties. This efficiency can significantly benefit small to medium-sized enterprises and research institutions that previously could not compete with large corporations in the field of genetic modification.

Regional Analysis

In 2024, the Agricultural Biotechnology Market experienced substantial growth across various regions, with North America emerging as the dominant player. Capturing a significant 41.30% market share, this region accounted for USD 63.5 billion in market value, primarily driven by robust investments in biotechnology research and a favorable regulatory environment that encourages innovation in genetically modified crops and bioengineered solutions.

Europe also displayed strong growth in agricultural biotechnology, focusing on sustainability and reducing the environmental impact of agriculture. The region’s emphasis on eco-friendly farming practices and substantial government funding for agricultural science have catalyzed advancements in crop yield and disease resistance.

The Asia Pacific region is another key player, showing rapid growth due to increasing demands for food security and high-quality crop yields. Countries like China and India are leading this surge, investing heavily in biotechnological research to enhance agricultural productivity and tackle challenges such as pest infestations and erratic weather patterns.

Meanwhile, the Middle East & Africa and Latin America are experiencing gradual growth in agricultural biotechnology. These regions are exploring biotech solutions to improve crop resilience and agricultural output, vital for their economic development and food self-sufficiency. The adoption of modern biotechnological techniques is seen as a critical step towards enhancing agricultural practices and supporting local economies.

Key Regions

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the Agricultural Biotechnology Market, several key players stand out due to their significant contributions and influence. Among them, BASF SE, Bayer AG, and Corteva are prominent leaders, known for their extensive research and development capabilities and broad portfolios of biotechnological solutions in agriculture. These companies have been at the forefront of innovations in genetically modified crops and eco-friendly pesticides, helping to drive sustainable agricultural practices globally. Bayer AG, in particular, has been pivotal in advancing seed genetics and biotech traits that enhance crop yield and resistance to environmental stresses.

ADAMA Ltd., ChemChina, and KWS SAAT SE & Co. KGaA. These companies focus on integrating advanced biotechnological tools to improve the efficacy and safety of agricultural products. ADAMA Ltd. is noted for its innovative crop protection solutions, whereas ChemChina has made significant strides through strategic acquisitions that expand its biotechnological reach and capabilities. KWS SAAT SE & Co. KGaA specializes in seed breeding, employing biotechnology to develop seeds that offer improved performance under varying climatic conditions.

Marrone Bio Innovations and Valent BioSciences LLC are also shaping the industry landscape by focusing on bio-based agricultural solutions. These companies are leading the charge in developing biopesticides that reduce the ecological footprint of crop protection. Meanwhile, smaller entities like Performance Plants Inc. and Evogene Ltd. are making notable advancements in plant yield and drought tolerance technologies. The collaborative efforts of these companies, along with ongoing investments and research, continue to propel the growth of the agricultural biotechnology market, highlighting a trend towards more sustainable and technologically advanced farming methodologies.

Market Key Players

- BASF SE

- ADAMA Ltd

- Bayer AG

- ChemChina

- Corteva

- Evogene Ltd.

- KWS SAAT SE & Co. KGaA

- Limagrain

- Marrone Bio Innovations

- MITSUI & CO., LTD

- Nufarm

- Performance Plants Inc.

- Valent BioSciences LLC

- Other Key Players

Recent Developments

In 2024 BASF SE, the company announced plans to partially list its agricultural division, aiming to unlock its full market potential. This division, known as Agricultural Solutions, generated approximately €10 billion in sales last year.

In 2024, Bayer’s Crop Science division reported sales of approximately €4.98 billion, a slight increase from the previous year. However, the company faced challenges due to lower demand for glyphosate-based herbicides and corn seeds, leading to a net loss of €4.18 billion.

Report Scope

Report Features Description Market Value (2024) USD 153.9 Bn Forecast Revenue (2034) USD 374.5 Bn CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Organism Type (Plants, Animals, Microbes), By Application (Vaccine Development, Transgenic Crops and Animals, Antibiotic Development, Nutritional Supplements, Flower Culturing, Biofuels) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, ADAMA Ltd, Bayer AG, ChemChina, Corteva, Evogene Ltd., KWS SAAT SE & Co. KGaA, Limagrain, Marrone Bio Innovations, MITSUI & CO., LTD, Nufarm, Performance Plants Inc., Valent BioSciences LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Biotechnology MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Biotechnology MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- ADAMA Ltd

- Bayer AG

- ChemChina

- Corteva

- Evogene Ltd.

- KWS SAAT SE & Co. KGaA

- Limagrain

- Marrone Bio Innovations

- MITSUI & CO., LTD

- Nufarm

- Performance Plants Inc.

- Valent BioSciences LLC

- Other Key Players