Global Animal Feeds Additives Market By Additive Type (Antibiotics, Vitamins, Amino Acids, Minerals, Binders, Antioxidants, Feed Enzymes, Feed Acidifiers, and Others), By Form (Dry and Liquid), By Livestock (Pork/Swine, Poultry, Cattle, Aquaculture, and Other Livestock), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 105968

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

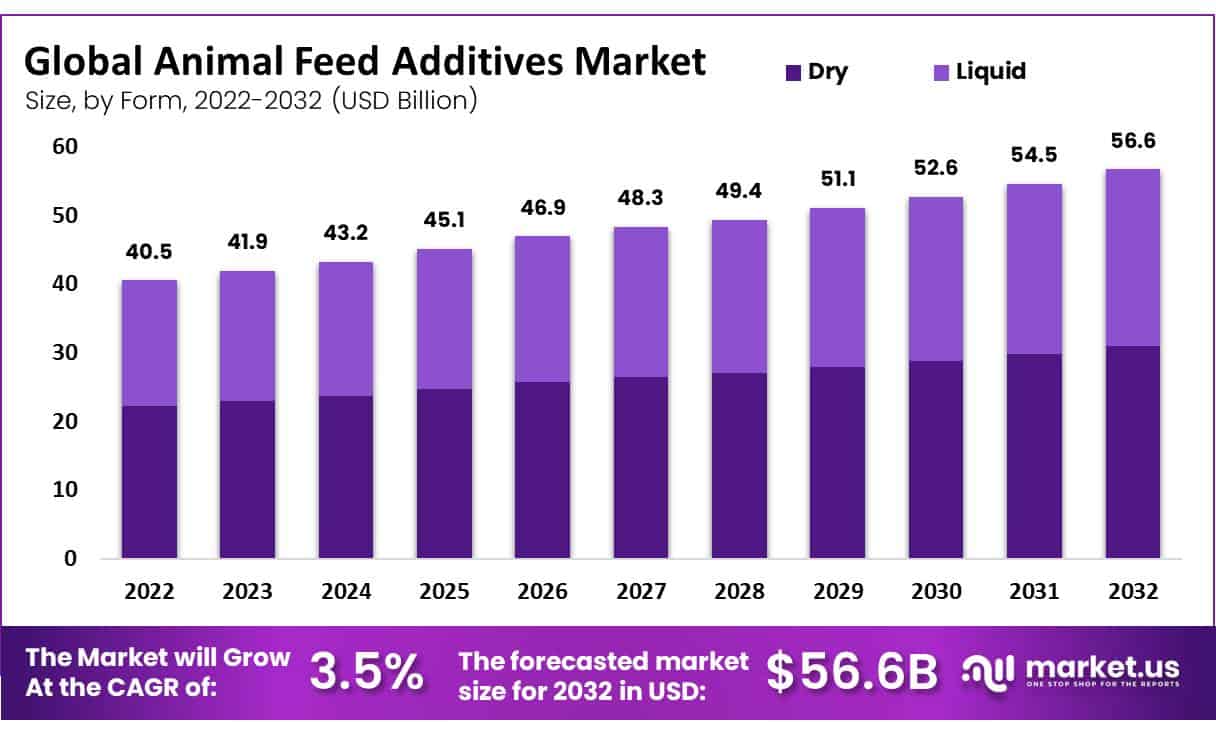

In 2022, the global Animal Feeds Additives Market was valued at USD 40.5 billion and is expected to reach USD 56.6 Billion in 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 3.5%.

Animal feed additives are generally intended to supply nutrition, add aroma, aid stability, or sometimes alter food characteristics. The growing awareness of the benefits of feed additives and recent outbreaks of numerous diseases are having a positive impact on the industry.

In addition, growing consumer awareness of livestock diseases such as swine flu and foot-and-mouth disease has raised concerns about meat quality and safety, leading to the use of feed additives.

Key Takeaways

- Market Size: It is projected that the animal feed additives market will experience (CAGR) of 3.5% from 2023-2032.

- Market Trend: Animal feed additives have witnessed tremendous success on the market recently due to increased interest in improving animal health and productivity across agriculture sectors.

- Additive Type Analysis: Furthermore, minerals held a substantial total revenue share at 36.1% in 2022.

- Form Analysis: It is expected that dry feed additives will prove the most lucrative segment in the animal feed additives market, boasting a 54.7% market share and the projected highest compound annual growth through 2022.

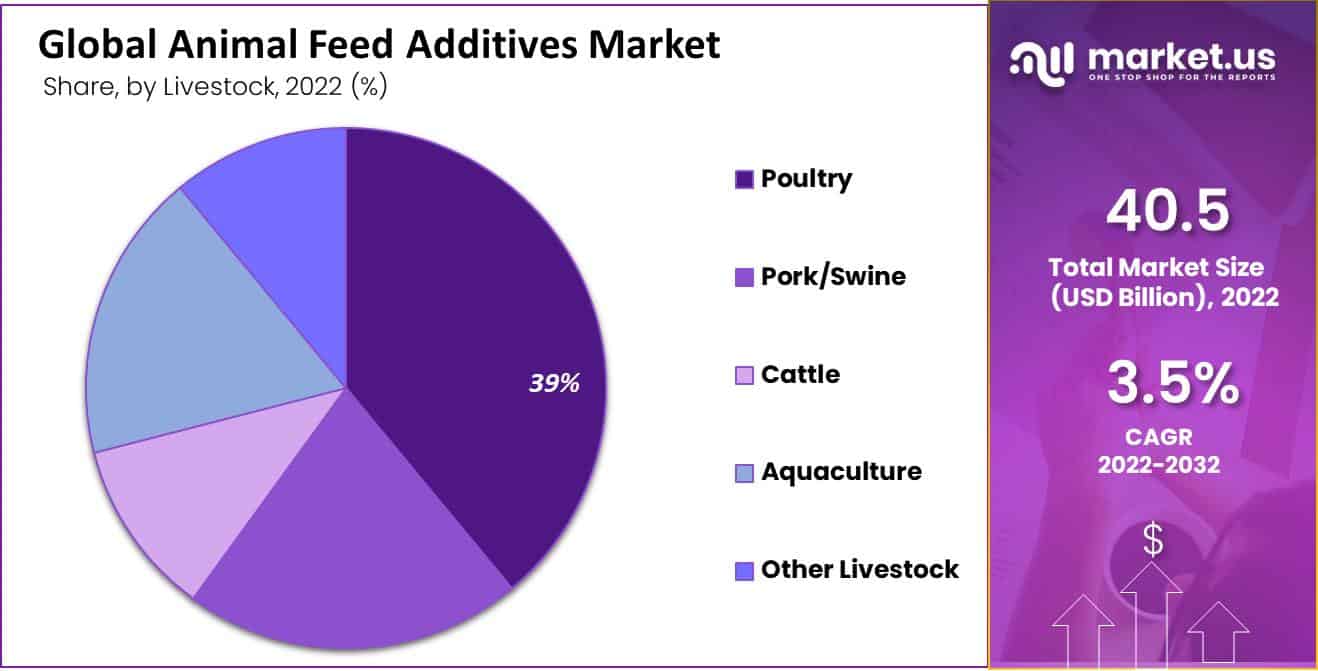

- Live Stock Analysis: Punter Analysis: The poultry feed additives market is estimated to hold the largest revenue share and compound annual growth over its forecast period at 39%, making poultry feed additives amongst the most lucrative animal feed additives products for purchase by consumers worldwide.

- Drivers: Rising demand for premium meat and dairy products, greater awareness about animal nutrition, and innovations in feed technology are driving this market trend.

- Restraints: Regulations restricting certain additives’ usage, fluctuating raw material prices, and limited awareness among small-scale farmers present major impediments to progress.

- Opportunities: Aquaculture expansion and innovation of feed additives that focus on eco-friendly attributes present opportunities.

- Challenges: Striking an equilibrium between cost-efficiency and quality feed production, guaranteeing feed safety, and meeting the varied nutritional needs of various animals are major obstacles to overcome.

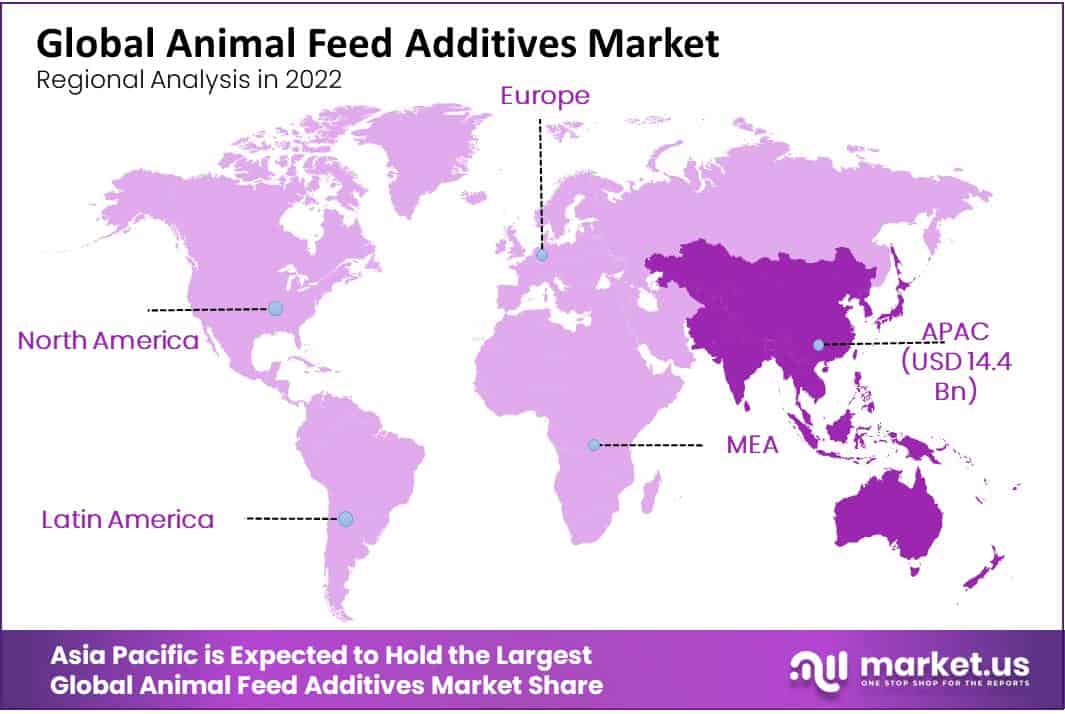

- Regional Analysis: Asia Pacific is projected to become the most profitable animal feed additives market worldwide, accounting for 35.8% market share with an anticipated growth rate over its projected lifespan of 5-10% compound annual growth over the forecast.

- Key Players Analysis: Major players in the animal feeds additives market include Cargill, Inc., Hong Ha Nutrition, BASF SE, Kemin Industries Inc., ANOVA Group, BIOMIN Holding GmbH, Olmix Group, The Archer-Daniels-Midland Company, Evonik Industries AG, Hansen Holding A/S, Alltech, Inc, Archer Daniels Midland Company, Nutreco N.V, Novus International, Biotech JSC, Novus International Inc, Other Key Players.

Market Scope

Additive Type Analysis

The Amino Acids Segment Dominates due to Its Ability to Enhance Immunity

Based on additive type, the market for animal feed additives is segmented into antibiotics, vitamins, amino acids, minerals, binders, antioxidants, feed enzymes, feed acidifiers, and others. Among these types, the amino acids segment is the most lucrative in the global animal feeds additives market, with the highest CAGR. The total revenue share of the minerals segment is 36.1% in 2022.

The high prevalence of amino acids is due to their ability to enhance immunity and promote the growth of animals. It helps prevent nail and skin problems in animals. In addition, it plays an important role in preventing brain dysfunction, which can cause loss of muscle coordination in animals. Therefore, amino acids are expected to be in high demand from the commodity industry as a dietary supplement, as well as a pet food ingredient.

Antibiotics’ ability to promote growth in livestock is one of the key factors driving the growth of the antibiotic market. Antibiotics also improve meat quality and lead to higher protein and less fat content. The vitamin segment is further classified into vitamins A, B, E, and C. Vitamins are also given to animals to improve fertility.

Furthermore, increasing consumer awareness about the benefits of fat-soluble vitamins is expected to drive its demand in the industry. Binders like Mycotoxin are nutritionally inert substances that are added to animal feed in order to reduce bioavailability. Other additives like feed acidifiers and feed enzymes are used to improve feed nutrition and improve health.

Form Analysis

Dry Segment is Dominant

By form, the market is further divided into dry and liquid. The dry feed additives segment is estimated to be the most lucrative segment in the animal feeds additives market, with a market share of 54.7% and a projected highest CAGR in 2022. Dry segments are popular with pet owners because they are easy to mix with feed, store, and handle.

Being available in pellet and slush form gives consumers more options when it comes to mixing methods, which should make this segment dominant. The dry segment is further classified into granular and powdered. The liquid segment is estimated to hold a lucrative market as it is easier to use and digest than dry feed additives.

Live Stock Analysis

The Poultry Segment is the Dominant

Based on livestock, the market is segmented into pork/swine, poultry, cattle, aquaculture, and other livestock. Among these, the poultry section is estimated to be the most lucrative segment in the global animal feeds additives market, with the largest revenue share of 39% and a projected highest CAGR during the forecast period.

The high share of this segment is due to the constant growth of broiler production in all regions and increasing trends towards a protein-rich diet. The various chicken feed additives on the market are enzymes, vitamins, acidifiers, and antioxidants that are used to enhance and improve the nutritional value of the products.

Consumption is increasing in developing countries, where rising incomes and development are forcing consumers to diversify their diets. Emerging countries will therefore continue to dominate the poultry feed segment due to their rising population and increased meat consumption.

Aquatic feed is equipped by mixing different raw materials and additives taking into account the age and species of different aquatic animals such as shrimp, cod, tilapia, salmon perch, and oysters.

Since this is a niche market, there is a strong demand for a methodical R&D approach from new entrants in the market. In addition, rising incomes, growing demand for aquatic products, and increasing customer consciousness are expected to boost demand for these products.

Key Market Segments

Based on the Additive Type

- Antibiotics

- Vitamins

- Vitamin A

- Vitamin C

- Vitamin E

- Vitamin B

- Others

- Amino Acids

- Tryptophan

- Lysine

- Methionine

- Threonine

- Others

- Minerals

- Binders

- Antioxidants

- Feed Enzymes

- Phytase

- Non-Starch Polysaccharides

- Others

- Feed Acidifiers

- Others

Based on Form

- Dry

- Powdered

- Granular

- Liquid

Based on Livestock

- Pork/Swine

- Poultry

- Cattle

- Aquaculture

- Other Livestock

Drivers

Increasing Consumption of Dairy Products

Rising consumption of dairy products is expected to boost the growth of the industry over the forecast period due to its associated health benefits and wide range of applications. As cows are the main source of dairy products such as milk, cream, butter, yogurt, and cheese, cattle farming is booming in various regions. This is expected to increase the demand for the product in the coming years.

Growing Demand for Animal Feed Additives in Livestock Worldwide

Livestock production requires substantial production of feed, land, water, and energy to feed, transport, and process animals. Feed is the main component of the livestock production process because it is responsible for the nutritional value of the product.

Yield increases have been successful through the growth of raw material production and factory farming methods, which have been improved through technological/genetic advances and fertilizers. Furthermore, it is estimated that an increase in the global meat trade will stimulate the industrialization of meat production, especially in developing regions of the world, such as China, India, and Brazil, resulting in a boost in demand for animal feed additives in the global market.

Restraints

Increasing Raw Material Cost and Availability of Alternative Feed

An increase in raw material prices is the major factor restraining market growth. Vitamins, minerals, antioxidants, and feed acids are extracted from natural sources such as seeds, plant leaves, and tree bark. Increasing initial costs for extraction of such natural products hamper the growth of the market. Also, the availability of alternative animal feeds hampers the growth of the global animal feeds additives market.

Opportunity

Government Regulations on Synthetic Additives

Increased demand for processed meats has increased the consumption of feed additives, thereby increasing the demand for additives in the animal nutrition and feed industries. The animal feed additives industry is also boosted due to the growing consumption of dairy products in several emerging economies such as Brazil, India, South Africa, and China.

The rapidly increasing livestock adoption and spiking awareness among individuals regarding the health of livestock are driving the need for enhancing the animal feed additives industries in these nations. Therefore, the governments in these economies are increasing their investments aimed at improving facilities & infrastructure. However, different government regulations towards the use of synthetic additives will create lucrative opportunities for natural animal feed additives in the market during the forecast period.

Trends

Competitive Landscape of Manufacturers

Manufacturers are now more inclined toward raw material procurement at competitive pricing. Raw material procurement involves engaging in long-term supply contracts with raw material suppliers. Some independent manufacturers hire third-party suppliers to sell their products.

Feed additive manufacturers are increasingly focused on product innovation and differentiation as they are steadily moving toward consolidation through mergers & acquisitions, joint ventures, and collaborative partnerships. Such trends are currently being witnessed in this market, thereby bolstering the demand for animal feed additives in the process.

Regional Analysis

Asia Pacific Region Holds Largest Market Share in Global Animal Feeds Additives Market

Asia Pacific is estimated to be the most lucrative market in the global animal feed additives market, with the largest market share of 35.8%, and is expected to register the highest CAGR during the forecast period.

This is attributed to the presence of abundant livestock as well as the presence of diverse agrarian economies. Large companies are likely to expand their poultry feed portfolio as consumers’ meat consumption preferences are changing.

The market in Europe is driven by innovation and is strictly regulated in terms of human health and well-being as well as the environment. This leads to frequent changes in product guidelines, such as bans and restrictions. Regional free trade agreements for European Union countries will positively affect revenue growth over the forecast period.

The pork industry in Spain is experiencing significant growth due to lower product prices, lower pork production costs through increased efficiency, and increased exports of Spanish pork. The growing pig population across the country is creating increased feed demand for the pig industry, which is expected to drive the growth of the market.

Rising meat consumption in North America will create lucrative opportunities in the global animal feeds additives market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Major players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Several animal feeds additives market companies are concentrating on expanding their existing operations and R&D facilities.

Furthermore, businesses in the animal feeds additives market are developing new products and portfolio expansion strategies through investments mergers, and acquisitions. In addition, several key players are now focusing on different marketing strategies, such as spreading awareness about natural ingredients, which is boosting the target products’ growth.

Market Key Players

- Cargill, Inc.

- Hong Ha Nutrition

- BASF SE

- Kemin Industries Inc.

- ANOVA Group

- BIOMIN Holding GmbH

- Olmix Group

- The Archer-Daniels-Midland Company

- Evonik Industries AG

- Hansen Holding A/S

- Alltech, Inc.

- Archer Daniels Midland Company

- Nutreco N.V.

- Novus International

- Biotech JSC

- Novus International Inc.

- Other Key Players

Recent Developments

- In January 2022, BASF SE expanded its feed enzyme production capacity at the Ludwigshafen plant. Through expanding its existing plant, BASF has significantly increased its annual production.

- In June 2022, Cargill, Inc. acquired a plant-based additives manufacturing company Delacon.

Report Scope

Report Features Description Market Value (2022) USD 40.5 Bn Forecast Revenue (2032) USD 56.6 Bn CAGR (2023-2032) 3.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Additives Type – Antibiotics, Vitamins, Amino Acids, Minerals, Binders, Antioxidants, Feed Enzymes, Feed Acidifiers, and Others; By Form – Dry and Liquid; and By Livestock – Pork/Swine, Poultry, Cattle, Aquaculture, and Other Livestock Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cargill, Inc., Hong Ha Nutrition, BASF SE, Kemin Industries Inc., ANOVA Group, BIOMIN Holding GmbH, Olmix Group, The Archer-Daniels-Midland Company, Evonik Industries AG, Chr. Hansen Holding A/S, Alltech, Inc., Archer Daniels Midland Company, Nutreco N.V., Novus International, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Animal Feeds Additives Market Size?In 2022, the global Animal Feeds Additives Market was valued at USD 40.5 billion and is expected to reach USD 56.6 Billion in 2032. Between 2023 and 2032

What is the CAGR for the Animal Feeds Additives Market?The Animal Feeds Additives Market is registered to grow at a CAGR of 3.5% during 2023-2032.Q: Which region is more attractive for vendors in the Animal Feeds Additives Market?Asia Pacific accounted for the highest Share of 35.8% among the other regions. Therefore, the Animal Feeds Additives Market in Asia Pacific is expected to garner significant business opportunities for the vendors during the forecast period.

Animal Feeds Additives MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample

Animal Feeds Additives MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill, Inc.

- Hong Ha Nutrition

- BASF SE

- Kemin Industries Inc.

- ANOVA Group

- BIOMIN Holding GmbH

- Olmix Group

- The Archer-Daniels-Midland Company

- Evonik Industries AG

- Hansen Holding A/S

- Alltech, Inc.

- Archer Daniels Midland Company

- Nutreco N.V.

- Novus International

- Biotech JSC

- Novus International Inc.

- Other Key Players