Global Antibiotics Market By Drug Class (Penicillin, Cephalosporin, Tetracycline, Aminoglycosides, Sulfonamides, Fluoroquinolone, Others) By Application (Urinary Tract Infections, Respiratory Infections, Skin Infections, Septicemia, Ear Infection, Gastrointestinal Infections, Other Applications) By Route of Administration (Oral, Parenteral, Topical, Others) By Spectrum of Activity (Broad-spectrum Antibiotic, Narrow- spectrum Antibiotic) By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Other Distribution Channels) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2032

- Published date: Nov 2023

- Report ID: 65175

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

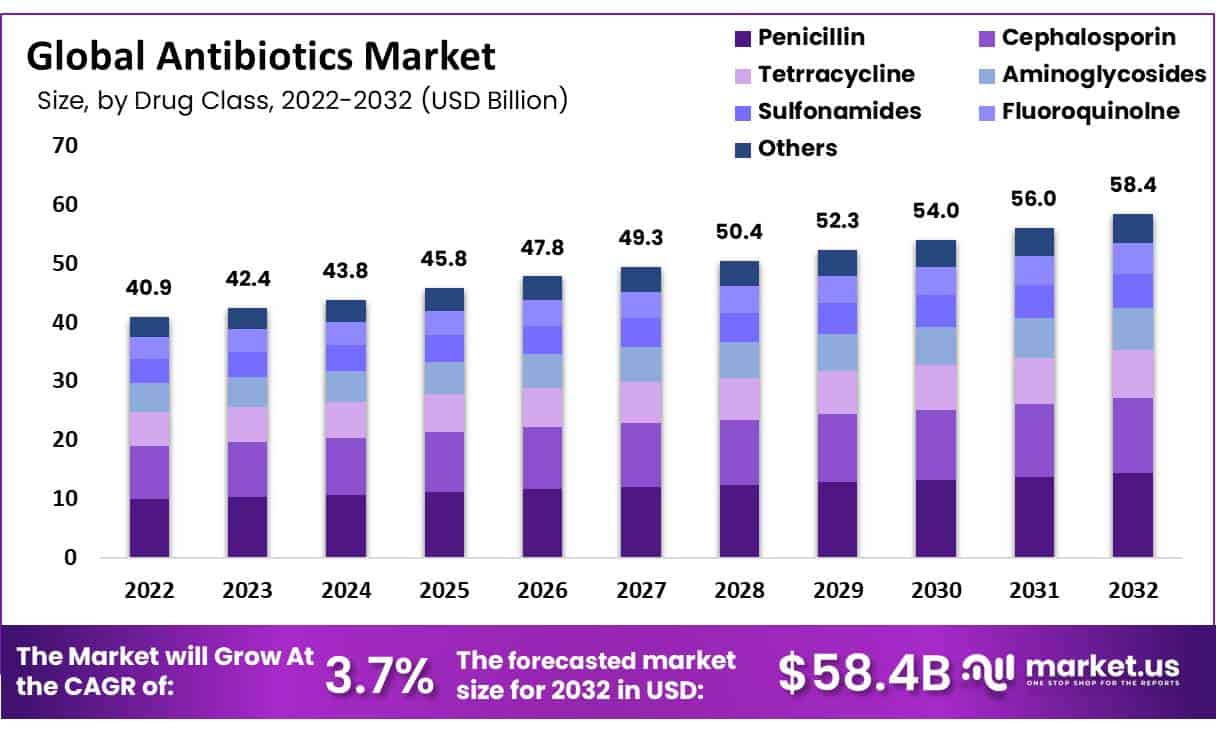

Global Antibiotics Market size is expected to be worth around USD 58.4 Billion by 2032 from USD 42.4 Billion in 2023, growing at a CAGR of 3.7% during the forecast period from 2024 to 2032.

Antibiotics are drugs used to treat infections caused by bacteria and other microorganisms. Antibiotics either kill bacteria or restrain them from reproducing and growing. There are various ways to classify antibiotics. At the same time, the most common classification is based on their spectrum of activity, chemical structure, and mode of action. The increasing prevalence of infectious disorders and helpful government legislation are the main drivers of the market.

Therefore, the requirement for antibiotics is considerably increased due to the rising incidence of infectious diseases.

Key Takeaways

- Antibiotics Market Size: It’s expected to reach USD 58.4 billion by 2032.

- Growth Rate: The market is projected to grow at a 3.7% CAGR.

- 2023 Market Size: The market was valued at USD 42.4 billion in 2023.

- Purpose of Antibiotics: Antibiotics are medicines used to treat infections caused by bacteria and other microorganisms.

- Antibiotics Classification: They can be classified based on their spectrum of activity, chemical structure, and mode of action.

- Penicillin Segment: In 2022, the penicillin segment generated a revenue share of 24.5%.

- Respiratory Infections: The respiratory infections segment held the largest revenue share during the forecast period from 2023 to 2032.

- Parenteral Administration: Parenteral administration held the highest market revenue share in the global antibiotics market.

- Broad-spectrum Antibiotics: The broad-spectrum antibiotic segment held a significant share of the global antibiotics market.

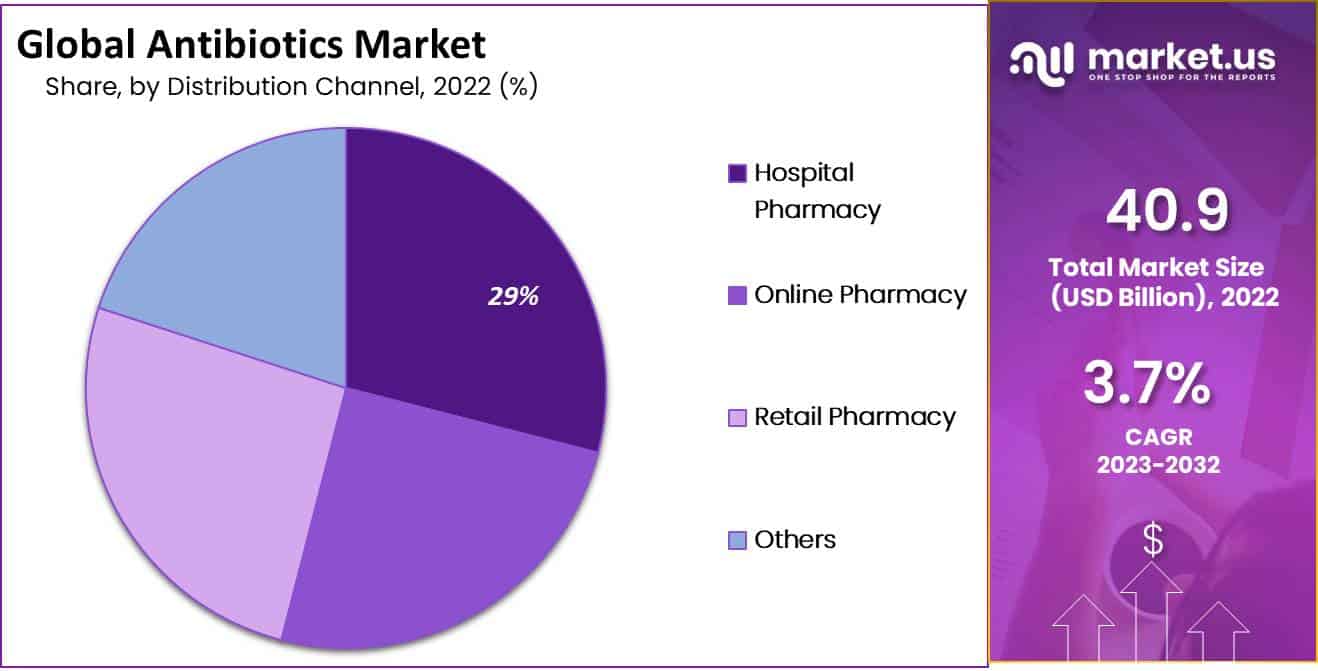

- Hospital Pharmacy: The hospital pharmacy segment dominated the market with a revenue share of 28% and is growing at the highest CAGR from 2023 to 2032.

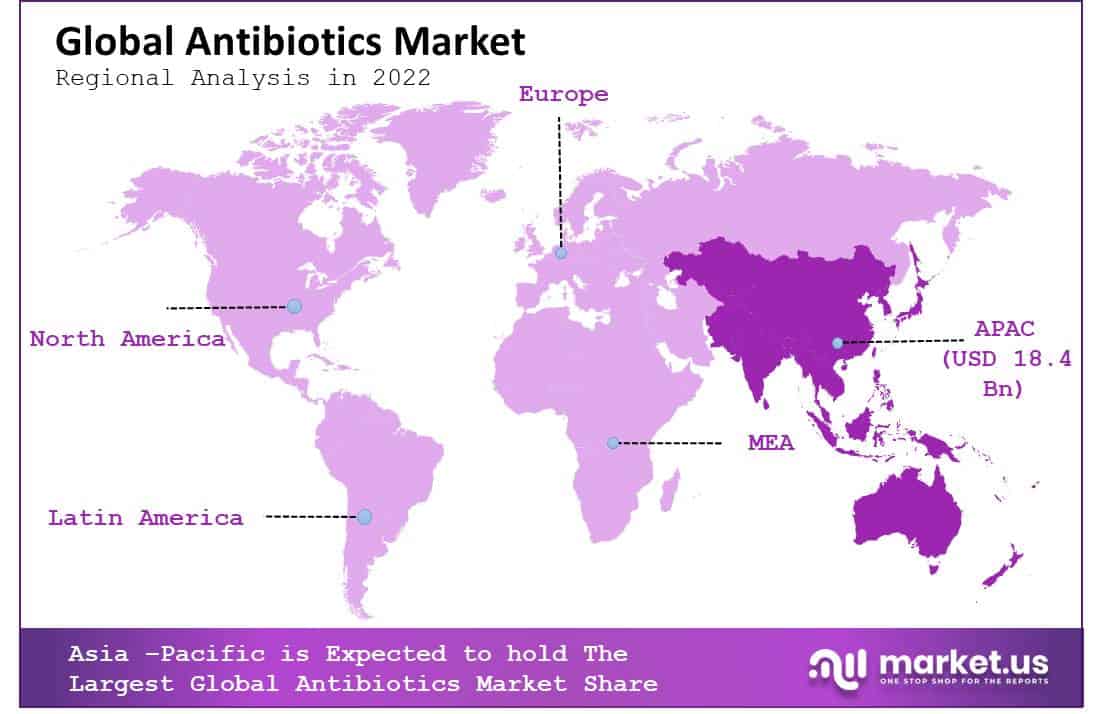

- Asia-Pacific Dominance: In 2022, Asia-Pacific dominated the market with the highest revenue share of 45%.

- North America Share: North America held a 32% revenue share in 2022.

- Market Drivers: The increasing prevalence of bacterial infections, pharmaceutical companies’ efforts, and rising advances in antibiotic drugs drive market growth.

- Market Restraints: Strict regulatory guidelines for new products and antibiotic resistance hinder market growth.

- Market Opportunities: Collaboration for antibiotic development and increased efforts by pharmaceutical companies provide growth opportunities.

Drug Class Analysis

The Penicillin Segment to Held Major Portion of the Market

Based on drug class, the global antibiotics market is segmented into cephalosporin, tetracycline, penicillin, aminoglycosides, sulfonamides, fluoroquinolone, and others. The penicillin segment accounted for the largest market revenue share of 24.5% in 2022, Owing to the increased sales for various bacterial infections.

These drugs are the first line of choice in treating bronchitis, pharyngitis, and skin infections. In addition, the increasing use of penicillin in various developed and emerging countries would contribute to the higher segment of the market. Countries like Italy, Hong Kong, and South Korea have been the most important markets for the penicillin drug class.

The Cephalosporin segment is projected to increase at a higher CAGR during the forecast period. This growth is owing to the more significant investments in manufacturing therapeutically effective drugs for bacterial infectious diseases such as urinary tract infections, upper respiratory tract infections, etc.

Moreover, the high use of cephalosporins in developed countries would contribute to the increasing growth of the market. According to the Economics & Policy and Center for Disease Dynamics, advanced countries such as japan have a high intake of cephalosporin, as related to other antibacterial drugs. The other segment is anticipated to grow at the highest rate in the upcoming years due to the presence of new therapies, which are estimated to launch during the forecast period.

By Application Analysis

The Respiratory Infections Segment is Expected to Show Lucrative Growth During the Forecast Period

Based on application, the global antibiotics market is divided into urinary tract infections, respiratory infections, skin infections, septicemia, ear infections, gastrointestinal infections, and others. Among these applications, the respiratory infection segment showed the maximum market share in 2022 due to the vast number of patients who fall under this category.

Furthermore, with the vastly rising global pollution and climate change, the number of individuals suffering from respiratory disorders has increased dramatically. In addition, the pandemic’s outbreak influenced the respiratory system of individuals, which has proved to be a boosting factor for the market.

The urinary tract infection segment considered the second-largest segment, dominated the market with the highest supply and demand. Additionally, the skin infections segment has grown significantly due to the huge population suffering from it. Furthermore, the rapid R&D carried out by the market players has made the drugs related to these diseases.

By Route of Administration Analysis

The Parenteral Segment Held the Largest Revenue Share in 2022

Based on the route of administration, the global antibiotics market is classified into oral, parenteral, topical, and others. The parenteral segment accounted for the largest market revenue share in 2022. Additionally, the higher CAGR of this segment is attributed to the gradually rising number of inpatient admissions in hospitals worldwide.

The increasing technological development and the least amount of dose being administered with the help of syringes have driven the demand significantly. The World Health Organization (WHO) and The Centers for Disease Control and Prevention (CDC) have established guidelines for the management of Hospital Acquired Infections (HAIs), which suggest the usage of parenteral drugs as prophylaxis for HAIs.

The oral segment held a significant revenue share of the market. The rising number of patients opting for the self-administration of drugs is the prominent factor anticipated to drive segmental growth during the forecast period.

By Spectrum of Activity Analysis

The Broad-Spectrum Antibiotic Held the Largest Market Growth

Based on the spectrum of activity, the global antibiotics market is divided into broad-spectrum and narrow-spectrum antibiotics. The broad-spectrum antibiotic segment is anticipated to witness the highest market revenue share in 2022. Broad-spectrum antibiotic acts against two major bacterial groups, gram-positive and gram-negative. Due to the information that broad-spectrum antibiotics act against a wide range of diseases. Which helps to conflict antimicrobial resistance. Broad-spectrum antibiotics target many types of bacteria to treat infections.

By Distribution Analysis

The Hospital Pharmacy Segment is Estimated to Contribute Significantly to the Market Growth

The global antibiotics market is divided into hospital pharmacies, online pharmacies, and retail pharmacies based on distribution channels. The hospital pharmacy segment dominated the market with the highest revenue share of 28% in 2022 due to the significant number of patients choosing a hospital pharmacy set up for getting treated in case of infections over the other types of healthcare sectors. In addition, the presence of professionals in hospitals has also proved to boost the market growth.

On the other hand, the online pharmacy section is anticipated to register a significant CAGR during the forecast period. Furthermore, with the rising trend of online shopping, individuals prefer to purchase medicines through online pharmacies.

Key Market Segments

By Drug Class

- Penicillin

- Cephalosporin

- Tetracycline

- Aminoglycosides

- Sulfonamides

- Fluoroquinolone

- Others

By Application

- Urinary Tract Infections

- Respiratory Infections

- Skin Infections

- Septicemia

- Ear Infection

- Gastrointestinal Infections

- Other Applications

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Spectrum of Activity

- Broad-spectrum Antibiotic

- Narrow- spectrum Antibiotic

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Other Distribution Channels

Drivers

Increasing Prevalence of Bacterial Infections to Fuel the Market Growth

The rising prevalence of various bacterial infections worldwide is one of the major factors supporting the market’s growth. Bacterial infections include respiratory infections, skin infections, and urinary tract infections. Additionally, the rising demand for innovative treatment has increased the R&D expenditure of pharmaceutical companies. To develop antibacterial drugs and strengthen the supply chain by approving digital technologies.

Advances in Antibiotics Drugs

Pharmaceutical companies are making massive progress in developing more advanced antibiotics than generic medicine, which will further boost the growth of the antibiotics market. In addition, ongoing clinical trials being conducted by many pharmaceutical companies will result in the expansion of the antibiotics market.

Restraints

Strict Regulatory Guidelines for Approval of New Products Hamper the Market Growth

The stringent regulatory guidelines for approving novel products are hindering the growth of the antibiotics market. Additionally, the adverse effects produced by antibiotic drugs and the lack of knowledge among individuals about antibiotic drugs restrict the market’s growth—the increasing number of healthcare agencies taking several advantages to impede the unwanted use of bacterial drugs. Also, the lesser overall bacterial infection rates due to social distancing and school closures were crucial in hampering the market growth. However, the development of antibiotic resistance and the rise in drug acceptance are anticipated to impede market growth.

Opportunity

Increase the Number of Patients Suffering from Infectious Diseases. Develop New Diagnostic Devices

An increase in the number of patients from infectious diseases develops novel diagnostic devices for treating various diseases. The increased efforts of pharmaceutical companies in developing new therapies to treat infectious diseases are providing significant growth opportunities to the market and rising disease burden in convincing non-government and government bodies to invest in R&D initiatives and drive the expansion of new antibiotics in the market. The partnerships for developing antibiotics are anticipated to grow several antibiotic drugs in development.

Trends

Rigorous R&D Activities to Develop Advanced Combination Therapies to Treat Antibiotic – Resistant Infections is a Vital Trend

Due to the increasing awareness of antibiotic-resistant infections, biopharmaceutical companies focus on developing advanced combination therapies. For example, Allecra Therapeutics GmbH is developing cefepime to address critical resistance issues. In addition, Cefepime has completed a pivotal phase III clinical trial in Complicated Urinary Tract infections. Such associations will open various opportunities in the global antibiotics market growth during the forecast period.

Regional Analysis

Asia-Pacific Region Accounted Significant Revenue Share of the Global Antibiotics Market

Asia-Pacific accounted for a significant antibiotics market revenue share of 45%. This can be attributed to the rise in the incidence of infectious diseases, increasing government initiatives to develop new therapies and the high consumption of antibiotics. Additionally, the presence of generic players contributed to the regional market’s growth. North America dominated the second-largest regional market for antibiotics during the forecast period.

This market is highly regulated with well-developed healthcare infrastructure. The increasing prevalence of infectious diseases and the increasing healthcare expenditure by the government are the key factors boosting the North America market.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market players are focusing on collaborations, strategies, acquisitions, and novel product development and launches to strengthen their positions worldwide. Small and medium-sized biotech manufacturers are primarily involved in developing new therapies, and these companies market products targeting bacterial resistance mechanisms. Some prominent players in the market include Pfizer Inc., Abbott, Novartis AG, Merck & Co., Inc., GlaxoSmithKline plc, and others.

Market Key Players

- Pfizer Inc.

- Abbott

- Sanofi S.A.

- GlaxoSmithKline plc.

- Bayer AG

- Bristol-Myers Squibb Company

- Merck & Co, Inc.

- Johnson & Johnson

- Astellas Pharma Inc.

- Novartis AG

- Melinta Therapeutics

- Bayer Healthcare

- Eli Lilly and Company

- Arixa Pharmaceuticals Inc.

- Other Key Players

Recent Development

- Pfizer Inc. (June 2023): Pfizer reported positive outcomes from the Phase 3 studies of aztreonam-avibactam (ATM-AVI), a novel antibiotic combination aimed at treating resistant bacterial infections.

- Pfizer Inc. (December 2023): Pfizer completed its acquisition of Seagen Inc., a move that expands its oncology and biopharmaceutical capabilities, indirectly supporting its broader pharmaceutical endeavors including antibiotics.

- Abbott (April 2024): Abbott introduced the CSI, a new addition to their pharmaceutical division, after acquiring CSI in April 2023. This strategic acquisition aims to enhance their established pharmaceuticals sector, potentially influencing their antibiotics offerings.

- Abbott (July 2024): Abbott reported significant organic growth in their pharmaceuticals segment, which includes their antibiotic products, indicating a strong performance and continued market presence.

Report Scope

Report Features Description Market Value (2023) USD 42.4 Billion Forecast Revenue (2033) USD 58.4 Billion CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Penicillin, Cephalosporin, Tetracycline, Aminoglycosides, Sulfonamides, Fluoroquinolone, Others) By Application (Urinary Tract Infections, Respiratory Infections, Skin Infections, Septicemia, Ear Infection, Gastrointestinal Infections, Other Applications) By Route of Administration (Oral, Parenteral, Topical, Others) By Spectrum of Activity (Broad-spectrum Antibiotic, Narrow- spectrum Antibiotic) By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Other Distribution Channels) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Pfizer Inc., Abbott, Sanofi S.A., GlaxoSmithKline plc., Bayer AG, Bristol-Myers Squibb Company, Merck & Co, Inc., Johnson & Johnson, Astellas Pharma Inc., Novartis AG, Melinta Therapeutics, Bayer Healthcare, Eli Lilly and Company, Arixa Pharmaceuticals Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pfizer Inc.

- Abbott

- Sanofi S.A.

- GlaxoSmithKline plc.

- Bayer AG

- Bristol-Myers Squibb Company

- Merck & Co, Inc.

- Johnson & Johnson

- Astellas Pharma Inc.

- Novartis AG

- Melinta Therapeutics

- Bayer Healthcare

- Eli Lilly and Company

- Arixa Pharmaceuticals Inc.

- Other Key Players