Global Oral Care Market By Product Type (Toothbrush, Toothpaste, Mouthwash, and Others), Application (Household and Commercial), Distribution Channel (Hypermarket/Supermarket, Online, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov 2023

- Report ID: 36426

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

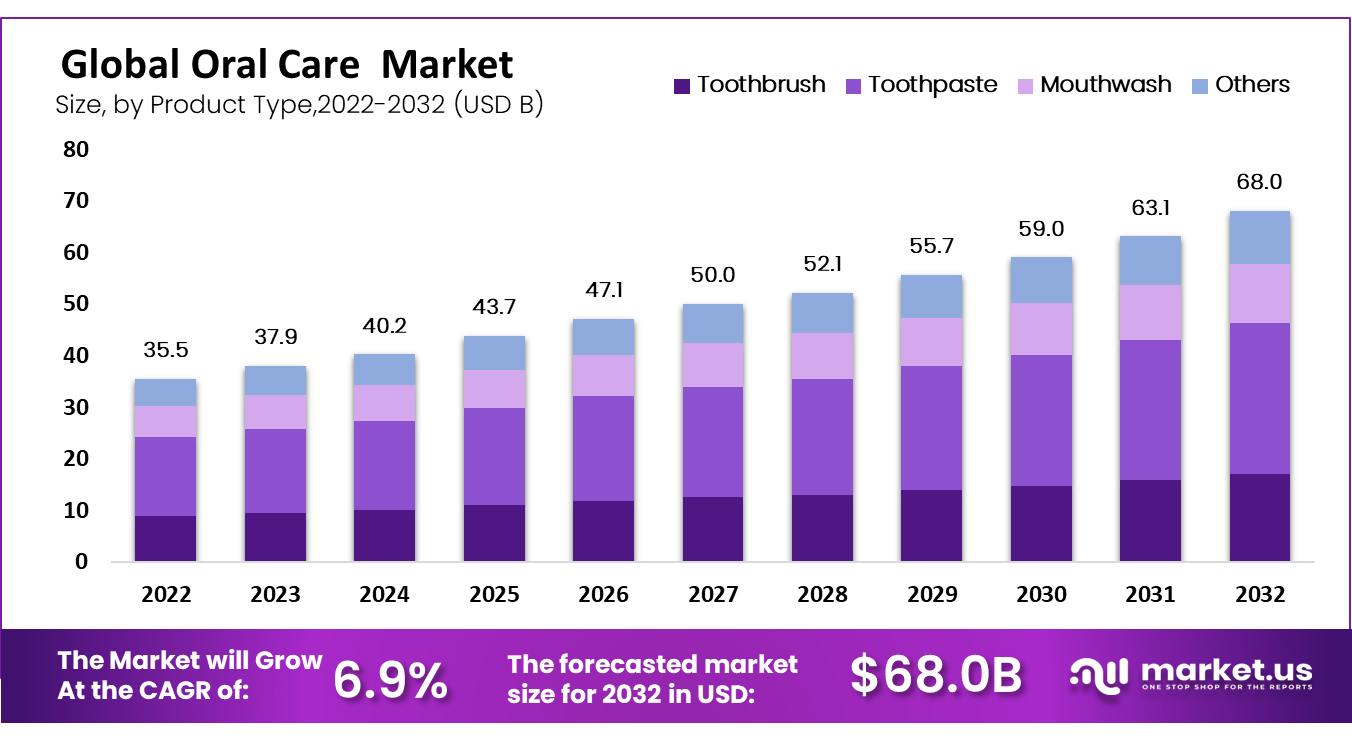

The Global Oral Care Market size is expected to be worth around USD 68 Billion by 2032 from USD 35.5 Billion in 2022, growing at a CAGR of 6.90% during the forecast period from 2022 to 2032.

Tooth decay is more common in children than adults due to poor hygiene and unhealthy eating habits. Dental caries is more common in the younger population. A recent study found that nearly half of all preschool children in the world suffer from dental caries. The demand for oral care products that treat dental caries in children is on the rise.

A dentist can help to choose the right products for oral health. According to the American College of Prosthodontists, almost 15% of the population who are edentulous choose dentures every year. The American College of Prosthodontists also estimates that approximately 23 million seniors are totally edentulous.

Due to the increasing prevalence of dental disease due to aging, the Market for oral care is greatly affected. Tooth decay has risen due to poor oral hygiene and unhealthy eating habits. Dental care products that prevent dental caries have been in high demand. This has increased the demand for oral care products.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- The oral care market is expected to reach over USD 68.0 billion, Globally by 2032.

- This market growth is driven by increased awareness about taking care of your mouth, teeth, and gums to prevent dental problems.

- Factors contributing to this growth include more people knowing about oral hygiene, more dental diseases, and a higher demand for cosmetic dentistry.

- In 2022, toothpaste was the most popular oral care product.

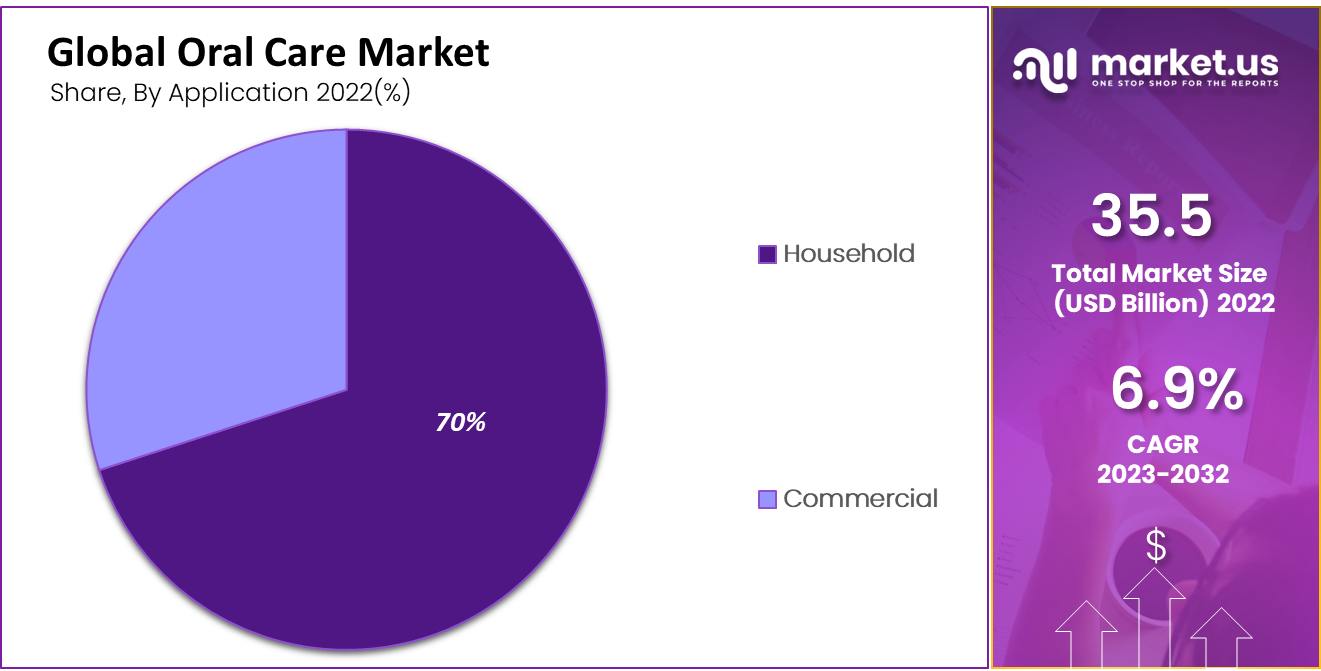

- In the same year, the household segment was the largest user of oral care products, making up more than 70.3% of the market.

- Hypermarkets and supermarkets were the main places where people bought oral care products.

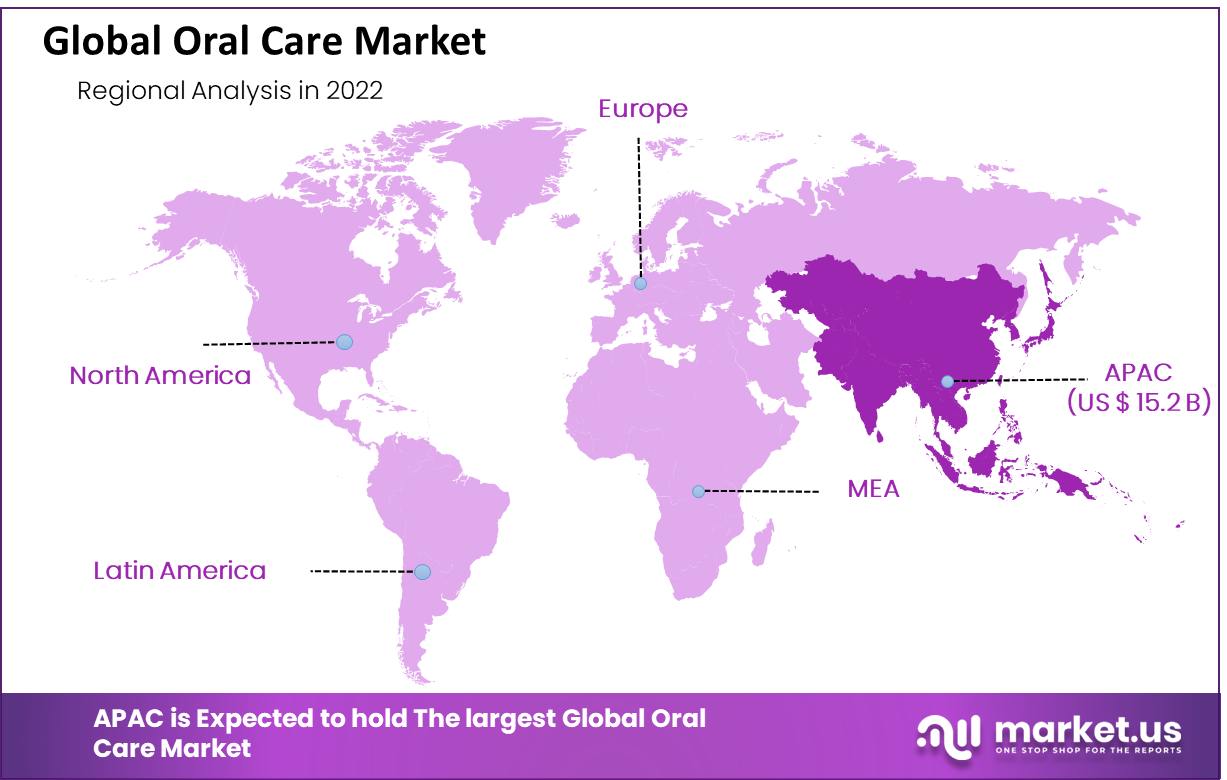

- Asia Pacific led the market in 2022 with 43% of the revenue share due to a growing population and increased spending on oral care.

- North America followed with 25% of the revenue share in 2022.

- The market will also benefit from a growing elderly population, higher income, and better products.

- Challenges for the market include the high cost of oral care products, lack of awareness in some countries, and strict rules.

- Companies are trying to make new products to meet the changing needs of people.

- More people are learning about oral health because of advertising from dental groups and the government.

- Many people want to use products with natural ingredients.

- More people are shopping online for oral care products.

- People are also more interested in Ayurvedic products.

- North America has lots of people who care about their oral health and good healthcare.

Product Analysis

The toothpaste segment holds the largest revenue share in the oral care market.

Based on a Product analysis, in 2022, toothpaste had the largest revenue share, up to 25.0%. It is the most widely used oral care product and is essential for all income levels. There are many kinds of toothpaste on the Market that can be used to cater to customers with different tastes. Colgate Trolls Mild Fruit Toothpaste was sent out by Colgate.

Furthermore, there are various sorts of brightening toothpaste easily available, but Colgate-Palmolive is emerging in the global toothpaste market with a big portfolio of whitening toothpaste. This is driving the toothpaste market. Pepsodent toothpaste and Closeup toothpaste have been made gels, which has increased their popularity.

Colgate-Palmolive is also producing tooth gels, for example, Colgate Sparkling White gel. Numerous local players like Patanjali and Himalaya are active in countries such as China and India.

Application Analysis

The household segment holds the largest revenue share in the oral care market.

The major share of the Household segment dominated the Market in 2022, with a revenue share exceeding 70.3%. Patients with a high level of awareness about dental hygiene will choose to use home-use oral irrigations. Home-use oral irrigators are becoming more popular due to increasing awareness about the dangers of string floss, and the difficulty in maintaining good dental hygiene. Water floss is also much easier than traditional flossing, and takes far less time to prepare.

This makes it a good choice for those who want to reduce their effort in maintaining healthy teeth. Increased use of home-based oral care products has been a result of the COVID-19 epidemic. Due to the possibility of being infected at dental facilities, consumers are opting for home treatment. Consumers are now able to use their products at home thanks to key players. The home segment is expected to experience significant growth over the next few years.

Distribution Channel Analysis

A wide Range of Products with high availability and schemes Provision Makes Hypermarkets Supermarkets Dominant Segment in the Market

The large market share in the hypermarkets and supermarkets segment for oral care is due to the availability and variety of everyday-use products such as toothpaste, toothbrushes, liquid washers, and other items. The frequent availability of select products at these stores, as well as other types of discounts on selected items, has resulted in a consumer preference to buy regularly used groceries from them.

However, the online segment will continue to grow and experience exponential growth due to increasing consumer preference to buy groceries online. According to The Food Industry Association data, one in five Americans shops for grocery items online. Retail merchants are more likely to sell these items online due to the ease of tracking consumer behavior through these online stores.

Key Market Segments

By Product Type

- Toothbrush

- Toothpaste

- Mouthwash

- Others

By Application

- Household

- Commercial

By Distribution Channel

- Hypermarket/Supermarket

- Online

- Others

Drivers

High Product Demand due to increasing incidence of Gum- and Dental-related Diseases

Over the last few years, dental conditions like mouth cancer, bad breath, decay, and tooth loss have increased in frequency. This has led to an increased demand for dental care products. According to the American Cancer Society report ‘Cancer Facts & Statistics 2019″, 38,140 cases of tooth cavities & pharynx were reported in the United States as of 2019, a 4% increase from the previous year.

A positive effect on the market growth will be due to factors such as increasing awareness of oral hygiene and maintaining health, the increasing number of oral cosmetic shops, specialty stores, and dental clinics, along with the rising income of the population.

Market Leaders Need to Focus on Product Innovations and Design.

Consumers want innovative products to treat and prevent gum disease. Recent developments in the design and manufacturing of various gum care staples will help to drive the Market’s growth. Colgate-Palmolive Company released Colgate Plaques PRO, a smart electric toothbrush, in January 2020.

It uses newer optic sensor technology to detect biofilm buildup in the mouth and can be easily removed with a brush. Additionally, digital impressions, 3D printing, AI, and laser dentistry are all widely used technologies in dental care instruments that can increase the effectiveness of dental operations and help to support market growth.

Restraints

Adverse effects due to the incidence of Product or materials which restrains the market growth

Certain additives like humectants and abrasive agents in toothpaste or mouthwash products may cause allergic reactions such as contact dermatitis and urticarial. This has a significant impact on the market for such products. The market growth is also impeded by the fierce competition from local market players and their highly competitive pricing.

Trends

Focusing on Oral Health Among the Global Population is Popularizing Oral Care Products

Due to the rapid changes in lifestyles, poor diets (including sugar-rich ones), and an increase in alcohol and tobacco consumption, oral health has become a significant public health problem. According to the World Health Organization, oral diseases are a serious problem for many countries. They affect people all their lives and cause discomfort, pain, disfigurement, and even death.

The WHO Global Oral Health Status Report (2022) estimates that approximately 3.5 billion people around the world are affected by oral diseases. Caries of permanent teeth are the most common. Due to the high prevalence of these conditions among consumers, many people choose to use clinically supported and expert-recommended oral health products over random products.

With the increase in oral healthcare costs, including the rising use of OTC mouthwashes and oral antiseptics, many consumers have taken preventive measures. This has led to an increase in the demand for oral care products.

In 2022, the cordless segment accounted for the highest revenue share in the market

It is expected to grow the fastest during the forecast period due to increased in-home care. These products are portable and easy to use, as well as being cheaper than countertop devices. Some cordless oral irrigators also include new air-pressured water flossing technology that reduces water refills and provides greater convenience for consumers.

The countertop segment is expected to grow at a rapid pace during the forecast period. These oral irrigators don’t require charging and can usually run for longer on one water tank than cordless models. Countertop oral irrigators can be used in households that have enough space for additional floss tips and water.

Regional Analysis

Asia Pacific’s region Dominated the Position in oral care Market due to its Increasing Population and Increased Spending on Oral Care products

Asia Pacific is the largest global Market, held the largest revenue shares. Older people are more likely to experience tooth loss, decay, and gum problems. Due to the high number of elderly people in countries like Japan and China, the market dominance in the Asia Pacific is due to their large consumption of care products.

The market growth is also being supported by the presence of large players in India and other countries. According to the Pew Research Centre, China is home to 1.4 billion people, followed by India. Due to their high population, oral consideration products are in great demand. For all pay groups, toothpaste and toothbrushes are essential. Japan is home to the largest geriatric population in the world.

According to the U.S. Enumeration Bureau Japan has 26.6% of the world’s population who are 65 years old or older. This increases the incidence of oral infections. The high demand for oral health products in Japan is expected to boost the market’s overall growth. The United Nations Department of Economic and Social Affairs published the report “World Population Ageing 2019”, which shows that China has nearly 164.49 million people over 65.

The Market is also being driven by rising demand for herbal toothpaste products. The report ‘Effectiveness of Herbal Oral Care Products to Reduce Dental Plaque & Gingivitis’ was published by the National Centre for Biotechnology Information (NCBI) in 2018. It was based on a survey of over 1597 East Asian adults. 899 of these respondents were more likely to use herbal toothpaste than non-herbal-based products. 698 respondents believed that herbal mouth rinses could reduce plaque.

The rising demand for oral healthcare products can explain the significant growth in North America as well as South American markets. The U.S. Bureau of Labor Statistics published a report titled “Consumer Expenditures 2018,” which shows that U.S. healthcare spending rose to USD 4968 per person in 2018, a rise of 0.8% over the previous year.

Further, there is a growing number of oral-related illnesses in countries like Canada and Mexico, which drives the demand for these products. According to statistics from the World Health Organization (WHO), the number of new cases of oral cancer in Mexico in 2017 and 2018 was 1.1% higher than the previous year.

Key Regions

North America

- The US

- Canada

- Mexico

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Innovative products have been launched by key companies that have enjoyed significant success. Procter & Gamble’s Oral-B brand announced in August 2020 the launch of Oral-B iO. This electric toothbrush offers a gentle brushing experience and professional cleaning. These players have a number of key strategies for launching new products.

Colgate-Palmolive Company introduced a smart toothbrush in August 2020, It is called hum by Colgate. The advanced sensors allow consumers to track their brushing habits and provide personalized instruction on where they need to focus more. Manufacturers are actively involved in the development of innovative products that provide convenience for users and are easy to use.

There are many types of denture cleaning products available that have further supported the market growth. Glaxo SmithKline’s Extra Strength SuperPoligrip Denture Adhesive powder is a fixative that helps keep dentures in place during eating. Procter & Gamble introduced Fixodent Plus TrueFeel Denture Adhesive cream.

This gives dentures a strong hold and allows them to fit properly in the mouth. It makes them look just like natural teeth. Some of the new products in the Market include cleaner tablets and wipes for dentures.

Market Key Players

With the presence of many local and regional players, the Market for oral care is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. To stay on top of the Market, companies have gained various expansion strategies such as partnerships and product launches.

- Procter & Gamble Company

- Johnson & Johnson Services Inc.

- Colgate-Palmolive Company

- GlaxoSmithKline plc.

- Church & Dwight Co. Inc.

- Fresh LLC

- Dentaid

- Lion Corporation

- Sunstar Suisse S.A.

- Henkel AG & Co. KGaA

- Unilever PLC

- DABUR INDIA LTD.

- ULTRADENT PRODUCTS

- Other Key Players.

Recent Development

- Colgate partnered up with Shopee in April 2022 to launch an electric toothbrush. Shopee is a leading online marketplace in Southeast Asia and Taiwan. According to the company, the Product offers four cleaning modes: sparkle, shine, gum care, and night spa. The Product is available only online in five countries: Singapore, Malaysia, Thailand, Vietnam, Vietnam, and the Philippines.

- Crest, an American toothpaste brand owned by P&G, launched Crest Densify in March 2022 to prolong the life of teeth. It actively rebuilds its density by re-mineralizing enamel.

- Proctor and Gamble’s Oral B brand launched the Oral B IO line of brushes in January 2022. According to the company, the iO4 & iO5 electric toothbrushes are for deep cleaning and include a linear magnetic drive, bimodal innovative pressure sensor, redesigned brush heads, and a bi-modal magnetic drive.

- The January 2021 deal was signed by the Dental Care Alliance (DCA), the largest dental support organization (DSO) in America with over 330 member practices across 20 states, and BIOLASE Inc. to expand laser adoption and offer hands-on training programs for targeted regions.

- In September 2021 The prominent player GlaxoSmithKline plc, UK, announced Drs. BEST Green Clean Toothbrush The first carbon-neutral toothbrush made with renewable cellulose.

- In April 2020 GlaxoSmithKline Consumer Healthcare Limited(India) and Hindustan Unilever Limited(HUL) were merged. HUL is accounted for distributing products of GSK Consumer Healthcare to India including Sensodyne (its leading oral healthcare product).

Report Scope

Report Features Description Market Value (2022) USD 35.5 Billion Forecast Revenue (2032) USD 68 Billion CAGR (2023-2032) 6.9% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type- Toothbrush, Toothpaste, Mouthwash, and Others; By Application- Household and Commercial; By Distribution Channel- Hypermarket/Supermarket, Online, and Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Procter & Gamble Company, Johnson & Johnson Services Inc., Colgate-Palmolive Company, GlaxoSmithKline plc., Church & Dwight Co. Inc., Dr. Fresh LLC, Dentaid, Lion Corporation, Sunstar Suisse S.A., Henkel AG & Co. KGaA, Unilever PLC, DABUR INDIA LTD., ULTRADENT PRODUCTS, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the key players in oral care market?Procter & Gamble Company, Johnson & Johnson Services Inc., Colgate-Palmolive Company, GlaxoSmithKline plc., Church & Dwight Co. Inc., Dr. Fresh LLC, Dentaid, Lion Corporation, Sunstar Suisse S.A., Henkel AG & Co. KGaA, Unilever PLC, DABUR INDIA LTD., ULTRADENT PRODUCTS , Other Key Players.,

What is the growth rate of global oral care market?The global oral care market is expected to reach at a CAGR of 6.9% from 2022 to 2032.

What is the current size of oral care market?According to Market.us, global oral care market size is expected to be worth around USD 62.2 billion by 2032 from USD 35.5 billion in 2022

-

-

- Procter & Gamble Company

- Johnson & Johnson Services Inc.

- Colgate-Palmolive Company

- GlaxoSmithKline plc.

- Church & Dwight Co. Inc.

- Fresh LLC

- Dentaid

- Lion Corporation

- Sunstar Suisse S.A.

- Henkel AG & Co. KGaA

- Unilever PLC

- DABUR INDIA LTD.

- ULTRADENT PRODUCTS

- Other Key Players.