Global Dental Lasers Market By Product (Soft Tissue Dental Lasers, Dental Welding Lasers, All Tissue Dental Lasers, and Other Products), By Application (Periodontics, Conservative Dentistry, Endodontic Treatment, Oral Surgery, Implantology, and Other Applications), By End-User (Hospitals, Dental Clinics, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 40388

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

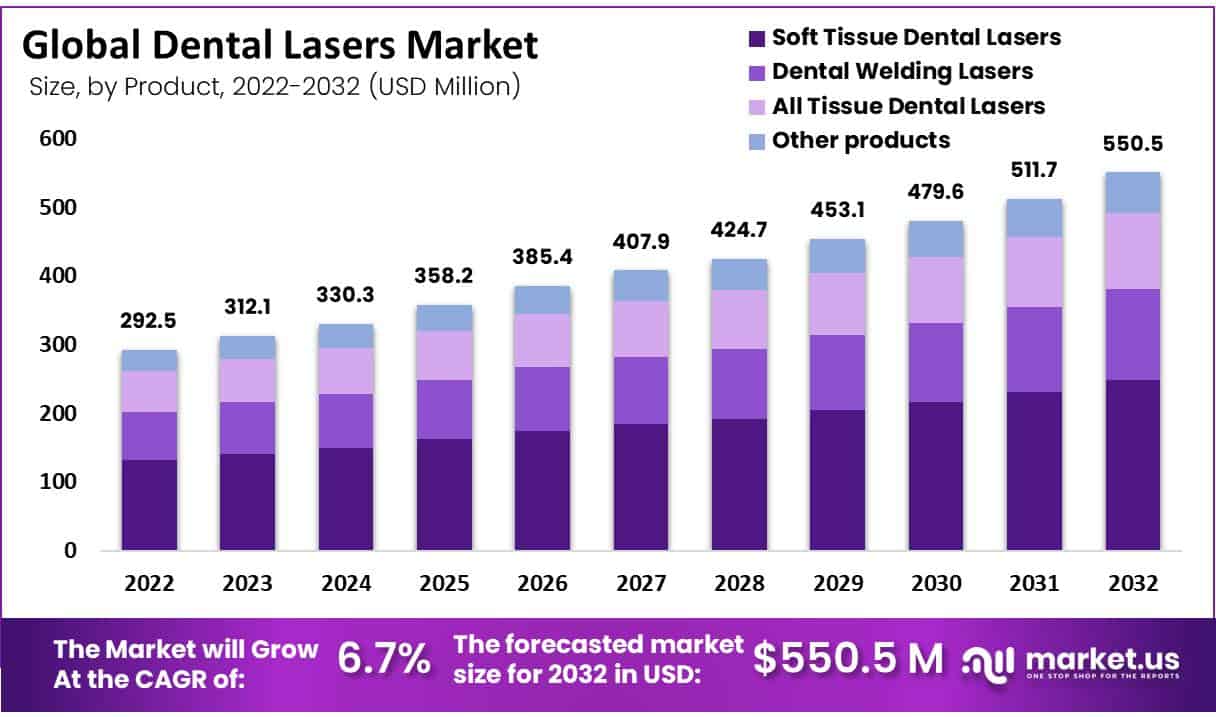

In 2022, the global dental lasers market accounted for USD 292.5 million and is expected to grow to around USD 550.5 Million in 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 6.7%.

The market is expected to benefit from advancements in dental problem treatment and diagnostic technologies. Some important elements that have a beneficial impact on the market are minimally invasive procedures and the speed with which dental operations may be completed. The market is being driven by improvements in surgery and therapy.

Also, rising consumer acceptance of dental equipment and devices produced by manufacturers is boosting the market for dental lasers. It is anticipated that these technical advances would present the industry with profitable potential. A few new trends in the market include the expanding usage of lasers in dentistry and the rising adoption of devices with novel technology by dental surgeons.

Key Takeaways

- In 2022, the dental lasers market was worth USD 292.5 million.

- It is projected to reach approximately USD 550.5 million by 2032.

- The market is expected to grow at a CAGR of 6.7% between 2023 and 2032.

- The market is segmented based on product, application, and end-user.

- Soft Tissue Dental Lasers are expected to have the fastest growth in the product category.

- Oral Surgery is predicted to dominate the application segment.

- Dental clinics are the largest end-users of dental lasers.

- The growth of the dental lasers market is driven by increasing demand for non-invasive procedures.

- The elderly population and edentulous cases are also contributing to market growth.

- High costs of dental lasers and a shortage of competent workers in healthcare are restraining factors.

- The COVID-19 pandemic had a significant impact on the dental laser sector but is now recovering.

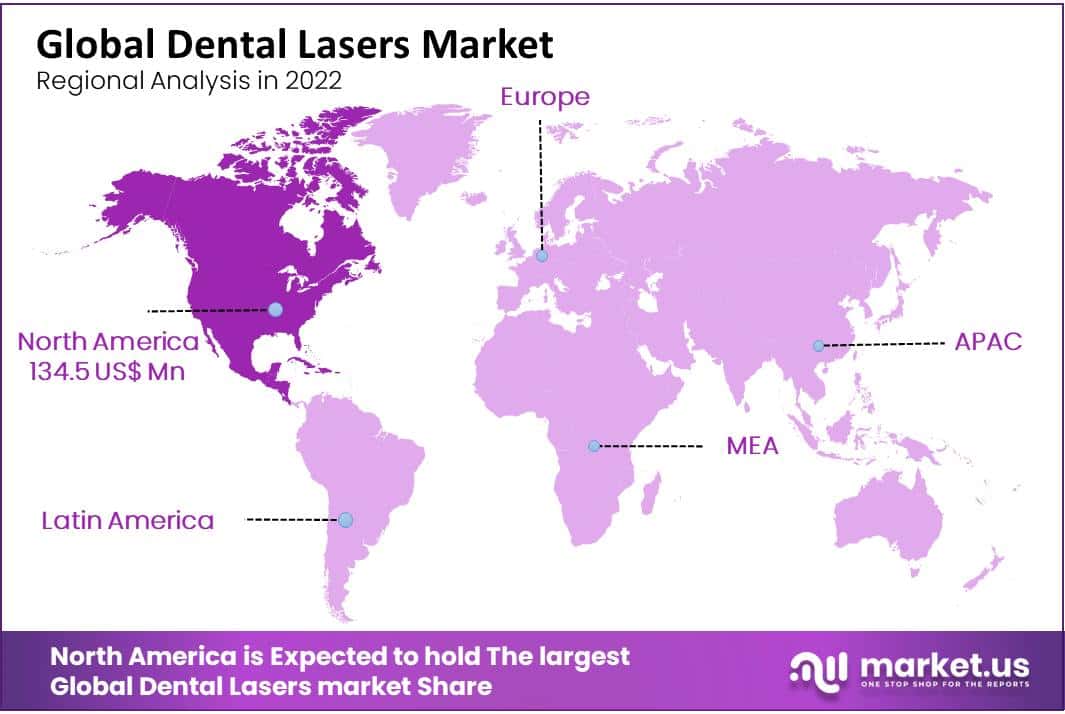

- North America holds a 45% market share in the dental lasers industry.

Product Analysis

Soft tissue is predicted to be the segment with the fastest growth. The expansion of this market segment is anticipated to be driven by an increase in soft tissue operations because diode lasers are primarily used in these procedures. Diode laser therapy for soft tissue offers greater portability, cost, and user-friendliness. As a result, more and more surgeons favor using diode lasers during operations.

Also, rising disposable income and rising customer preference for minimally invasive procedures are both contributing to the segment’s growth. Due to the product’s high effectiveness, the all-tissue category is predicted to have significant growth. Oral cavity issues can benefit from these gadgets. Moreover, all-laser technology is a multipurpose instrument that has a number of clinical advantages over conventional equipment.

According to predictions, this aspect will favor segment expansion in the near future. In addition, by removing the need for a needle, the drilling sound, and the discomfort associated with post-operative procedures, all tissue devices have the potential to enhance the patient experience. Due to these characteristics, investors are anticipated to invest more in the development of these devices so that patients can be as comfortable as possible and doctors can operate them with ease.

Application Analysis

The market is divided into categories like as endodontic therapy, teeth whitening, implantology, periodontics, oral surgery, and conservation dentistry. the oral surgery segment is predicted to dominate the market over the forecast period. Because oral disorders are increasing such as oral cancer, gum disease, tooth decay, and others.

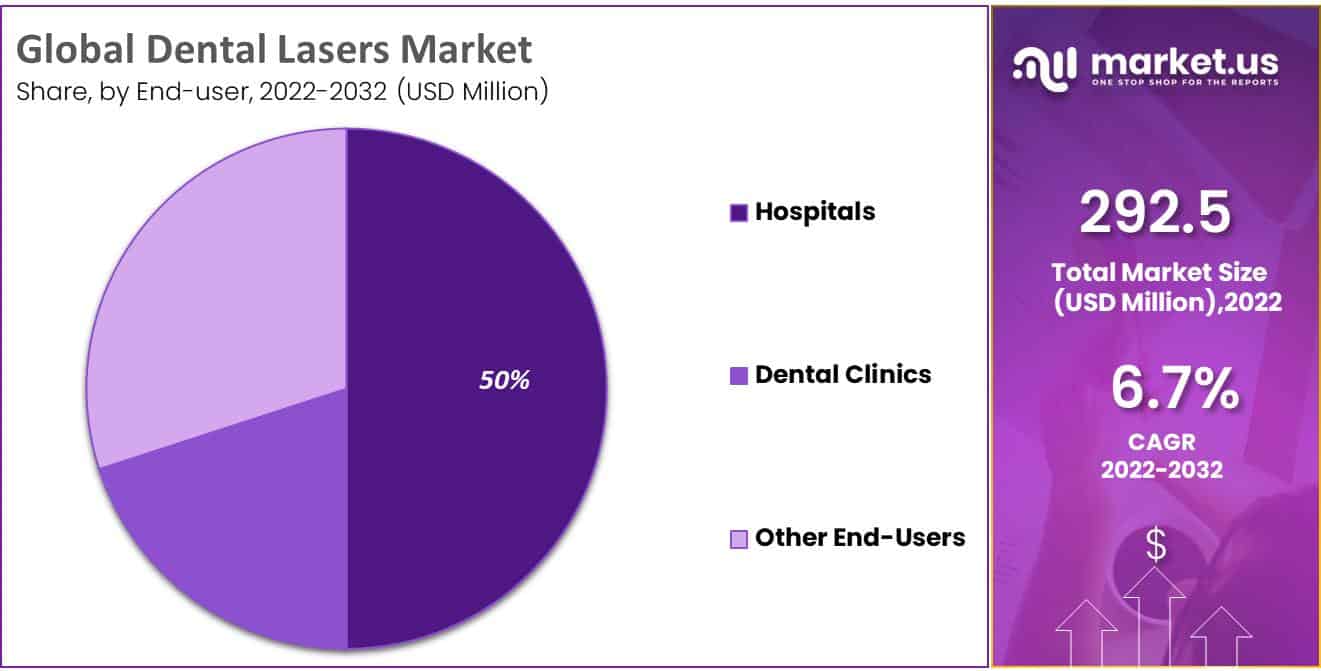

End-User Analysis

Dental clinics are the largest end-users of dental lasers. The adoption of dental lasers by dental clinics is increasing due to their ability to provide minimally invasive and more efficient treatments. The availability of a wide range of dental laser products and favorable reimbursement policies are also driving the growth of this segment.

Key Market Segments

Based on Product

- Soft Tissue Dental Lasers

- Dental Welding Lasers

- All Tissue Dental Lasers

- Other products

Based on Application

- Conservative Dentistry

- Endodontic Treatment

- Oral Surgery

- Implantology

- Peri-Implantitis

- Periodontics

- Tooth Whitening

- Other Applications

Based on End-User

- Hospitals

- Dental Clinics

- Other End-Users

Drivers

The market’s growth rate will be driven by rising desires for minimally or non-invasive procedures:

Increased demand for non-invasive procedures will help the market for dental lasers grow globally. Owing to the advantages of non-invasive blue and blue-green light therapy, including reduced discomfort and improved patient care. These lights are frequently employed to address problems with dental health as well.

The market will develop at a faster rate over the forecast period due to the growing number of geriatric populations:

The growing elderly population and an increase in edentulous cases are driving the global market for dental lasers. 60-80% of the elderly population worldwide has immediate dental needs, and 20-80% of them are edentulous.

Also, a significant factor supporting the market expansion for dental lasers is the increase in the prevalence of dental problems. Moreover, favorable reimbursement practices and increased disposable income are the key reasons for boosting the market for dental lasers. Also, the rise in changing lifestyles and rising infrastructure spending on healthcare are the key industry factors that will further accelerate the growth of the dental lasers market.

The increasing emphasis of manufacturers on the adoption of cutting-edge technologies is another important factor that will moderate the development rate of the dental laser market. Also, rising public awareness of the importance of maintaining oral cleanliness would moderate the market growth rate for dental lasers.

Restraints

The dental laser market’s growth rate will be hampered by its high price:

The rate of growth of the dental lasers market will be slowed down by the high cost of dental lasers. On the other hand, the market for dental lasers will face difficulties due to the shortage of competent workers in the healthcare industry.

Also, the market’s growth rate will be constrained and hampered further by the fierce competition among small market participants and the lack of reimbursement regulations. The emergence of unfavorable conditions brought on by the COVID-19 outbreak and a lack of awareness in underdeveloped nations would act as a restraint and further hinder the growth rate of the market.

Opportunity

The global dental lasers market is expected to witness significant growth in the coming years. The market is driven by several factors, including the increasing demand for non-invasive and painless dental procedures, the rising prevalence of dental disorders, and the growing adoption of advanced dental technologies.

The advent of new technologies such as erbium lasers, diode lasers, and carbon dioxide lasers has revolutionized the dental industry, offering a range of benefits over traditional methods. Dental lasers are used in a variety of procedures, including teeth whitening, cavity detection, gum disease treatment, and oral surgeries.

Trends

Soft tissues are currently treated with conventional 10,600 nm CO2 lasers, which are highly effective and have excellent hemostasis. For soft tissue surgeries like gingivectomy, diode lasers use invisible near-infrared wavelengths that range from 805 to 1064 nm in current technology.

Due to their small size and often low cost, diode lasers are highly popular. Diode lasers are used for laser-assisted teeth whitening and supplementary periodontal therapies. They have antibacterial properties. The main application of Nd: YAG lasers, which have a near-infrared wavelength of 1064 nm, is periodontal therapy.

Regional Analysis

In 2022, North America held a dominant market position, capturing more than a 45% share and holds US$ 134.5 Million market value for the year. The Centers for Disease Control and Prevention (CDC) estimate that 27% of individuals in the United States have tooth decay and that 46% of adults over the age of 30 have gum diseases. Moreover, the American Dental Association (ADA) estimates that there are 10,658 orthodontists now working in the US, or 3.27 orthodontists for every 100,000 population.

Additionally, improvements in dental laser technology, rising dental hygiene awareness, an increase in dental practitioners, and the presence of a well-established healthcare infrastructure are all contributing significantly to the growth of the regional market as a whole.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Biolase, Inc., Danaher, Dentsply Sirona, Laserstar Technologies, and Fotona D.D. are some of the major industry players. The majority of manufacturers are concentrating on new product launches, improvements to current products, and mergers and acquisitions. For managing soft tissue, Biolase Inc. introduced Epic Pro. Compared to other diodes on the market, it provides more power and innovation.

For consistent, dependable, and predictable outcomes with every usage, the device measures and monitors the laser temperature. The operator can lase with confidence and speed because of the unique innovation used in the design of Epic Pro.

Market Key Players

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Fotona

- Cryolife, Inc.

- Ellex Medical

- Danaher

- Carl Zeiss AG

- Lumenis

- IPG Photonics Corporation

- Koninklijke Philips N.V.

- Dentsply Sirona

- AMD Lasers, Inc.

- Biolase, Inc.

- The Yoshida Dental MFG. Co., Ltd.

- Gigaalaser

- A.O. Group, Inc.

- Kavo Dental

- Han’s Laser Technology Industry Group Co., Ltd.

- R.C. Laser Gmbh

- Den-Mat Holdings, L.L.C.

- Sisma SpA

Recent Developments

The world’s top producer of dental lasers, Biolase, announced the opening of a new platform for research grants in October 2022. The portal will support clinical investigations pertaining to the invention and development of new and improved dental laser technology.

Report Scope

Report Features Description Market Value (2022) USD 292.5 Mn Forecast Revenue (2032) USD 550.5 Mn CAGR (2023-2032) 6.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product, By Application, By End-User Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Fotona, Cryolife, Inc., Ellex Medical, Danaher, Carl Zeiss AG, Lumenis, IPG Photonics Corporation, Koninklijke Philips N.V., Dentsply Sirona, AMD Lasers, Inc., Biolase, Inc., The Yoshida Dental MFG. Co., Ltd., Gigaalaser, C.A.O. Group, Inc., Kavo Dental, Han’s Laser Technology Industry Group Co., Ltd., A.R.C. Laser Gmbh, Den-Mat Holdings, L.L.C., Sisma SpA. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Fotona

- Cryolife, Inc.

- Ellex Medical

- Danaher

- Carl Zeiss AG

- Lumenis

- IPG Photonics Corporation

- Koninklijke Philips N.V.

- Dentsply Sirona

- AMD Lasers, Inc.

- Biolase, Inc.

- The Yoshida Dental MFG. Co., Ltd.

- Gigaalaser

- A.O. Group, Inc.

- Kavo Dental

- Han’s Laser Technology Industry Group Co., Ltd.

- R.C. Laser Gmbh

- Den-Mat Holdings, L.L.C.

- Sisma SpA