Dental Biomaterials Market By Type (Ceramic Biomaterials, Metallic Biomaterials, and Polymeric Biomaterials), By Application (Prosthodontics, Implantology, and Orthodontics), By End-user (Dental Product Manufacturers, Dental Hospitals & Clinics, Dental Laboratories, and Dental Academies & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 61711

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

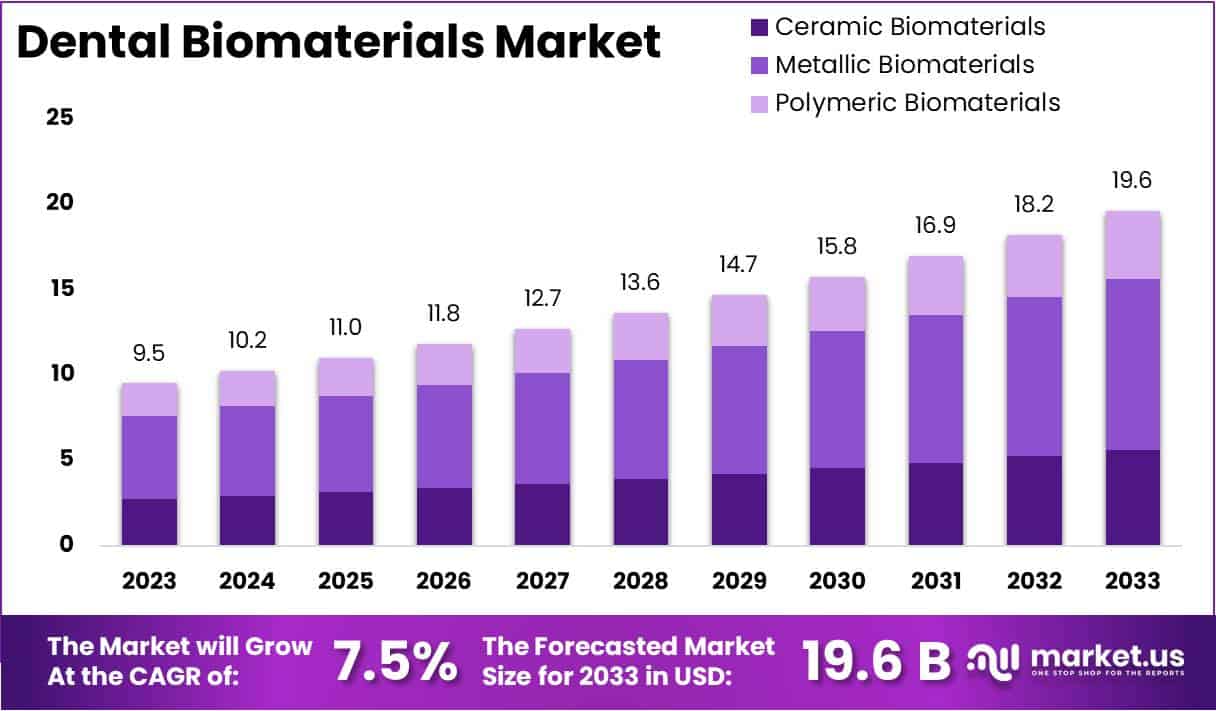

The Dental Biomaterials Market size is expected to be worth around USD 19.6 billion by 2033 from USD 9.5 billion in 2023, growing at a CAGR of 7.5% during the forecast period 2024 to 2033.

Growing demand for dental biomaterials is being driven by the rising prevalence of oral diseases and advancements in restorative and cosmetic dentistry. Biomaterials are widely used in applications such as dental implants, bone grafting, and tissue regeneration, playing a crucial role in improving patient outcomes and oral health. As per a March 2021 update by the WHO, oral diseases affect approximately 3.5 billion people worldwide, particularly severe periodontal disease, fueling the need for advanced dental solutions.Additionally, dental implant tourism is becoming a significant business, with patients seeking cost-effective treatments abroad, according to a December 2021 report by Dentaly.org. This trend offers opportunities for growth as demand for high-quality, affordable biomaterials continues to rise. Recent innovations in biocompatible materials, such as polymers and ceramics, along with growing awareness of dental health, are further propelling the market, positioning it for sustained expansion.

Key Takeaways

- In 2023, the market for dental biomaterials generated a revenue of USD 9.5 billion, with a CAGR of 7.5%, and is expected to reach USD 19.6 billion by the year 2033.

- The type segment is divided into ceramic biomaterials, metallic biomaterials, and polymeric biomaterials, with metallic biomaterials taking the lead in 2023 with a market share of 51.2%.

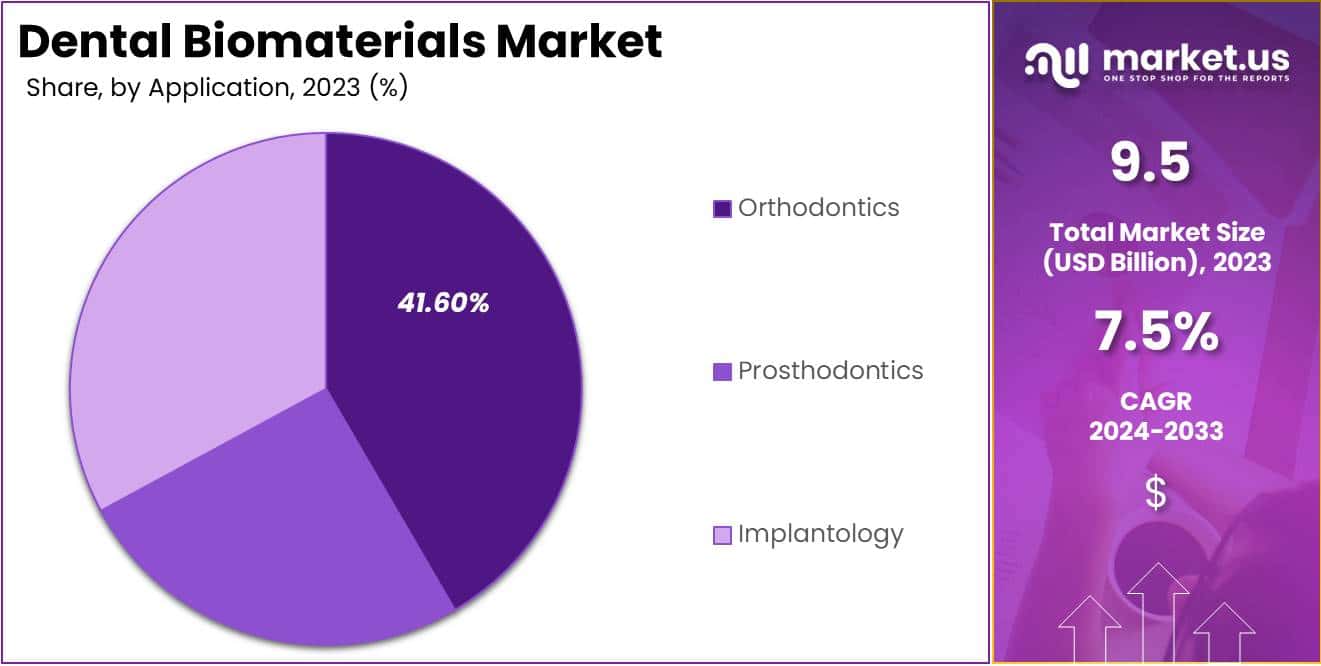

- Considering application, the market is divided into prosthodontics, implantology, and orthodontics. Among these, orthodontics held a significant share of 41.6%.

- Furthermore, concerning the end-user segment, the dental laboratories sector stands out as the dominant player, holding the largest revenue share of 41.5% in the dental biomaterials market.

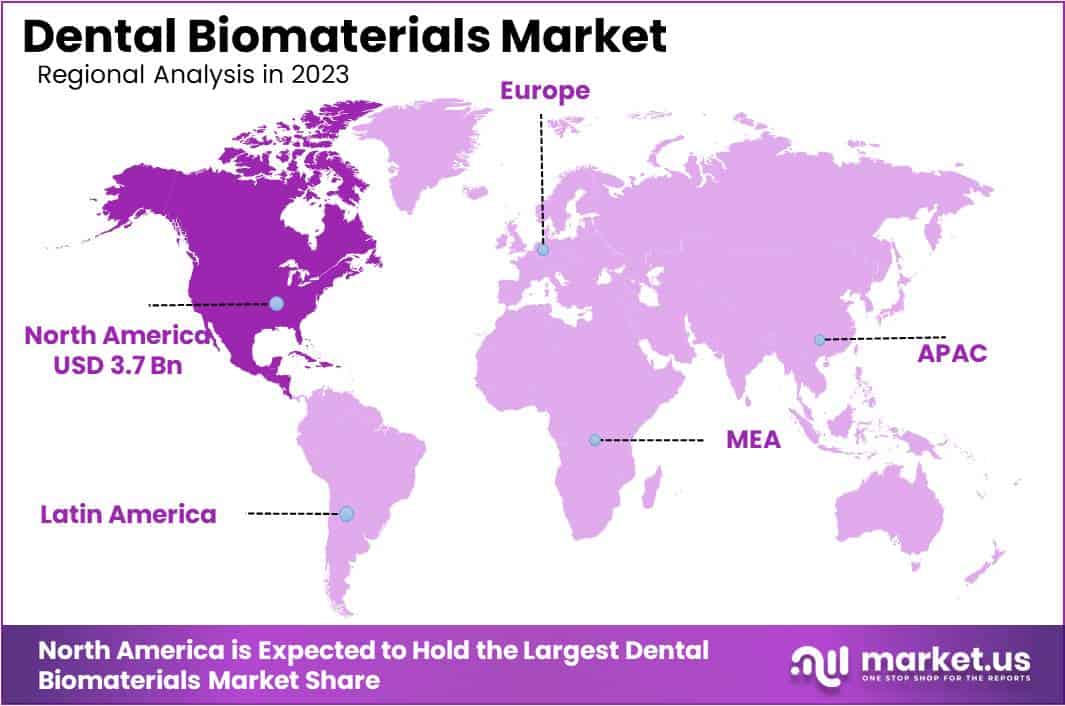

- North America led the market by securing a market share of 38.9% in 2023.

Type Analysis

The metallic biomaterials segment led in 2023, claiming a market share of 51.2% owing to their durability, strength, and biocompatibility. Titanium and titanium alloys are commonly used in dental implants and prosthetics because they integrate well with bone, reducing the risk of implant failure.

The increasing demand for dental implants, driven by the aging population and rising awareness of oral health, is expected to propel the growth of metallic biomaterials. Advancements in surface modification technologies, which enhance the osseointegration of these materials, are likely to further contribute to their adoption in dental procedures. Additionally, the growing preference for long-lasting dental restorations supports this segment’s expansion.

Application Analysis

Orthodontics held a significant share of 41.6% due to the increasing prevalence of malocclusion and the rising demand for aesthetic dental treatments. The growing popularity of clear aligners and other advanced orthodontic devices, which rely on biomaterials for strength and flexibility, is anticipated to boost this segment.

Technological innovations in orthodontic materials, such as shape-memory alloys and biocompatible polymers, are likely to further enhance treatment outcomes and patient comfort. Additionally, the increasing awareness of early orthodontic intervention and the rising disposable income in emerging markets are expected to drive the growth of orthodontic treatments.

End-user Analysis

The dental laboratories segment had a tremendous growth rate, with a revenue share of 41.5% owing to the growing demand for customized dental prosthetics and restorations. Dental laboratories play a crucial role in fabricating crowns, bridges, and dentures, which require high-quality biomaterials for durability and biocompatibility.

The increasing adoption of digital dentistry, including CAD/CAM systems, has enhanced the precision and efficiency of dental laboratories, further driving demand for biomaterials. Additionally, the rising number of dental procedures, coupled with an aging population requiring dental restorations, is likely to support the growth of this segment. Advancements in material science, improving aesthetic and functional outcomes, are projected to further fuel this expansion.

Key Market Segments

By Type

- Ceramic Biomaterials

- Metallic Biomaterials

- Polymeric Biomaterials

By Application

- Prosthodontics

- Implantology

- Orthodontics

By End-user

- Dental Product Manufacturers

- Dental Hospitals & Clinics

- Dental Laboratories

- Dental Academies & Research Institutes

Drivers

Increasing Prevalence of Dental Problems

Increasing prevalence of dental problems is expected to drive the dental biomaterials market as more individuals seek treatments for conditions like tooth decay, gum disease, and tooth loss. According to a March 2022 update by the WHO, severe periodontal disease, which often leads to tooth loss, affects nearly 10% of the global population.

In the U.K., the NHS Dental Statistics for England 2021 report highlighted that 18.2 million adults and 3.9 million children were seen by NHS dentists within the stated periods, indicating a high demand for dental care. This growing need for dental procedures is anticipated to boost the adoption of advanced biomaterials used in implants, restorations, and regenerative treatments, driving the market’s expansion.

Restraints

Rising Cost of Dental Biomaterials

Rising costs of dental biomaterials impede market growth by limiting accessibility for patients and dental practices, particularly in regions with lower healthcare budgets. High-quality biomaterials, including ceramic, polymer, and composite materials, often come with a substantial price tag, making dental procedures expensive for patients. These costs hamper the widespread adoption of cutting-edge dental treatments, particularly in developing countries.

The financial burden also affects dental practices that must invest in expensive materials to offer advanced procedures. This pricing barrier is projected to restrain the market as it restricts access to innovative solutions and limits patient adoption of certain procedures requiring premium biomaterials.

Opportunities

Rising Technological Advancements

Rising technological advancements present a significant opportunity for the dental biomaterials market, as innovations continue to improve patient outcomes and treatment efficiency. In May 2023, Straumann’s acquisition of GalvoSurge, which specializes in laser therapy for peri-implantitis, underscores the growing interest in new solutions to address implant-related complications.

Such advancements align with the increasing demand for minimally invasive techniques and durable biomaterials, which enhance the success rates of dental implants and other restorative treatments. As the industry continues to invest in research and development, the adoption of new technologies is projected to drive market growth by offering more effective and patient-friendly solutions in dental care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the dental biomaterials market, shaping both its challenges and growth prospects. Economic slowdowns can lead to reduced consumer spending on elective dental procedures, which may hinder demand in key regions. Geopolitical tensions, such as trade restrictions and supply chain disruptions, can increase production costs and delay the distribution of essential raw materials.

However, rising healthcare investments in emerging markets and increasing awareness of dental care drive market expansion. Governments are also emphasizing oral health as part of broader healthcare initiatives, creating growth opportunities. Despite challenges, advancements in biomaterial technologies continue to support the positive outlook for the market.

Latest Trends

Surge in Mergers and Acquisitions

Rising mergers and acquisitions are driving substantial growth in the dental biomaterials market. Companies are expanding their portfolios and market reach by acquiring firms that offer innovative solutions. In May 2022, the Straumann Group acquired PlusDental, a teledentistry company specializing in orthodontic solutions across Europe.

This acquisition is anticipated to strengthen Straumann’s doctor-led orthodontic segment, enhancing its presence in the European market. Growing consolidation within the industry is projected to increase competition and accelerate innovation, as firms leverage new technologies and expanded expertise. These strategic moves are likely to further drive market growth by improving access to advanced dental solutions.

Regional Analysis

North America is leading the Dental Biomaterials Market

North America dominated the market with the highest revenue share of 38.9% owing to increasing awareness of oral health and advancements in dental technology. Factors such as a rising aging population and an increase in dental procedures, including restorative and cosmetic treatments, have spurred demand for innovative materials.

The acquisition of Condor Dental Research Company, SA by Henry Schein, Inc. in June 2022 illustrates the strategic efforts of key players to enhance their service offerings and capture a larger market share. This acquisition enables Henry Schein to expand its dental care services, ultimately boosting sales and facilitating access to high-quality dental biomaterials.

Additionally, the growing emphasis on minimally invasive techniques and biocompatibility has led to the development of advanced materials that improve patient outcomes. The overall increase in dental insurance coverage and consumer spending on dental care has further supported the expansion of this market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing urbanization and rising disposable incomes. Countries like China and India are likely to see substantial growth due to their expanding healthcare infrastructures and heightened awareness of oral hygiene. The demand for aesthetic dentistry is projected to rise as more consumers seek cosmetic procedures, fueling the need for advanced biomaterials.

Technological innovations in dental procedures, along with a focus on improving patient comfort and outcomes, are anticipated to further propel this market. For instance, increased research and development activities will contribute to the introduction of more effective and durable materials. Furthermore, collaborations between local and international firms are expected to enhance product availability and expand market reach. Overall, these factors will drive significant growth in the dental biomaterials market across the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the dental biomaterials market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning.

Key players in the dental biomaterials market focus on developing advanced and biocompatible materials to improve patient outcomes and durability in dental procedures. They collaborate with dental clinics and research institutions to stay at the forefront of innovation and ensure product relevance. Companies invest in expanding their product portfolios with new materials that cater to aesthetic and functional needs.

Strategic partnerships with distributors and dental supply companies help enhance their market reach. Additionally, they target emerging regions where increasing dental awareness and healthcare infrastructure fuel demand for advanced solutions.

Top Key Players in the Dental Biomaterials Market

- Ultradent Products Inc.

- SprintRay Inc.

- Medtronic PLC

- IvoclarVivadent AG

- Henry Schein Inc.

- Geistlich Pharma’s

- GC Corporation

- Datum Dental Ltd.

- Danaher Corporation

Recent Developments

- In October 2022: SprintRay Inc. introduced OnX Tough, a hybrid ceramic resin designed for 3D printing dental prosthetics. This launch is significant for the dental biomaterials market as it incorporates advanced technologies like NanoFusion to enhance durability and aesthetics, addressing the increasing demand for high-performance materials in digital dentistry.

- In February 2022: Ultradent Products Inc. launched MTApex, a bioceramic root canal sealer. This product supports the growth of the dental biomaterials market by offering versatile endodontic solutions that are compatible with various obturation techniques, improving treatment outcomes and meeting evolving clinical needs.

- In November 2021: Geistlich Pharma acquired Meta Technologies S.r.l., expanding its product portfolio in the dental biomaterials market. This acquisition strengthens Geistlich’s position as a specialist in tissue regeneration and dental implantology, contributing to the market’s growth by providing comprehensive solutions for dental restoration and regeneration.

Report Scope

Report Features Description Market Value (2023) USD 9.5 billion Forecast Revenue (2033) USD 19.6 billion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2019-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Ceramic Biomaterials, Metallic Biomaterials, and Polymeric Biomaterials), By Application (Prosthodontics, Implantology, and Orthodontics), By End-user (Dental Product Manufacturers, Dental Hospitals & Clinics, Dental Laboratories, and Dental Academies & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ultradent Products Inc., SprintRay Inc., Medtronic PLC, IvoclarVivadent AG, Henry Schein Inc., Geistlich Pharma’s, GC Corporation, Datum Dental Ltd., and Danaher Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Company

- Carpenter Technology Corporation

- Koninklijke DSM N.V

- Zimmer Biomet Holdings Inc

- Straumann Holding AG

- Danaher Corporation

- Kuraray Co Ltd

- Henry Schein Inc

- Mitsui Chemicals Inc

- Victrex PLC

- Geistlich Pharma AG

- Dentsply Sirona Inc

- Medtronic PLC

- Ivoclar Vivadent AG

- GC Corporation