Dental 3D Printing Market By System Type (Frequency/Power Dental 3D Printing, Slow Cortical Potential Neurofeedback (SCP-NF), Low-Energy Dental 3D Printing (LENS), Hemoencephalographic (HEG) Dental 3D Printing, Low-Resolution Electromagnetic Tomography (LORE-TA) and Functional Magnetic Resonance Imaging (fMRI)), By Application (Attention Deficit Hyperactivity Disorder (ADHD), Anxiety Disorders, Pain Management, Insomnia and Other Applications), By End User (Hospitals, Physician Offices, Ambulatory Surgical Centers (ASCs), Home Care, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 12413

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

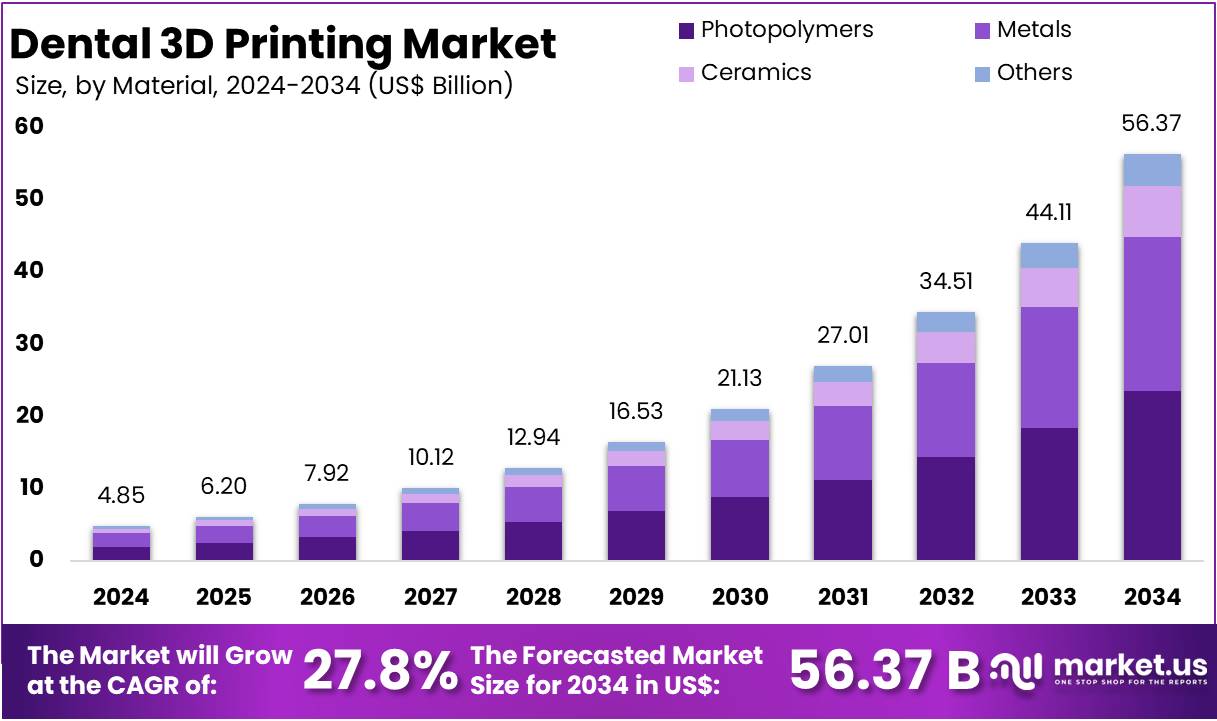

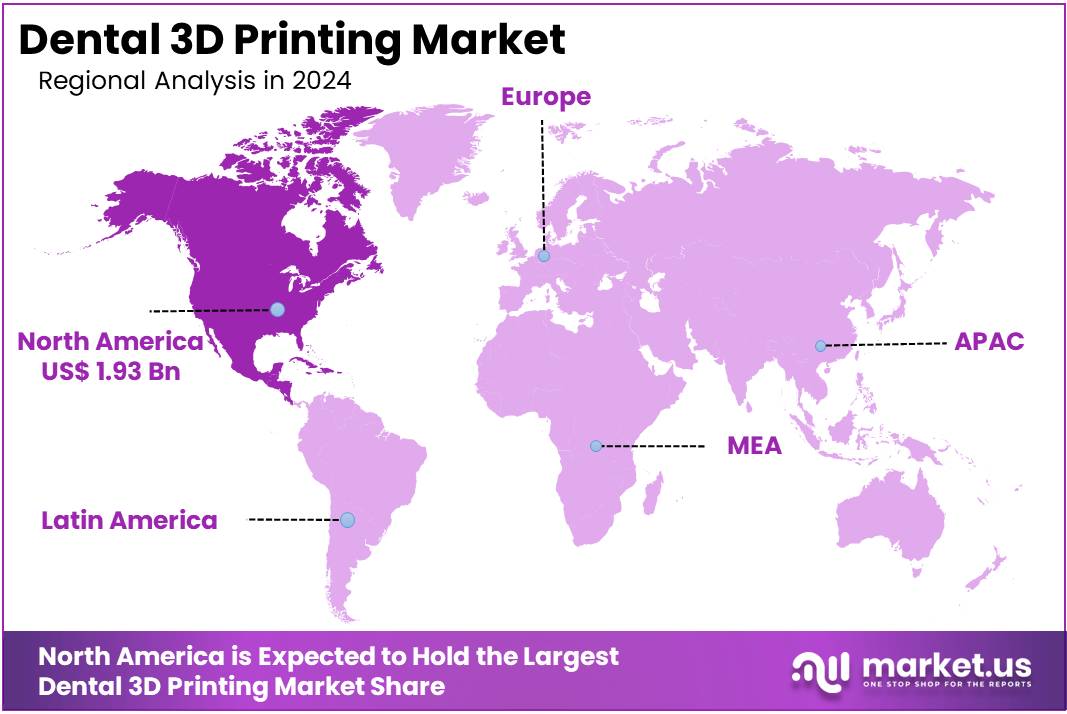

The Dental 3D Printing Market Size is expected to be worth around US$ 56.37 billion by 2034 from US$ 4.85 billion in 2024, growing at a CAGR of 27.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.7% share and holds US$ 1.93 Billion market value for the year.

Three-dimensional (3D) printing enables the construction of a 3D object from a digital model. In contrast to traditional subtractive manufacturing methods, 3D printing allows the creation of complex shapes or geometries that would otherwise be difficult to achieve with other technologies. With advancements in precision, accuracy, and 3D-printable materials, various industries have adopted 3D printing not only for creating functional prototypes but also for producing final products tailored to specific applications in a cost-effective and efficient manner.

In the fields of medicine and dentistry, the development of 3D printing technology has significantly transformed the delivery of clinical care, offering a range of applications that contribute to improved clinical outcomes.

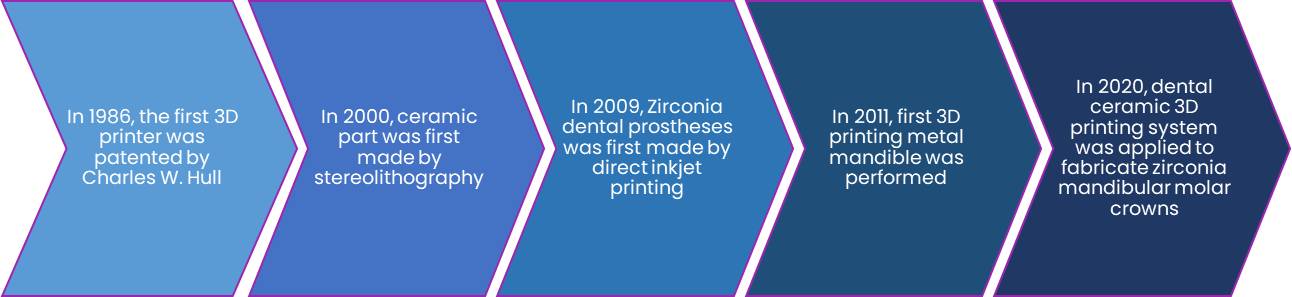

Historical Advancements of 3D Printing in Dentistry

Manufacturing technology can be classified into two main types: subtractive and additive. Additive manufacturing, or 3D printing, offers versatile and customized applications that go beyond the capabilities of subtractive milling. The most widely used material in 3D printing is light-cured resin, and the resin curing techniques have played a crucial role in shaping the development of practical dental 3D printing procedures.

For instance, in January 2021, Keystone Industries (Keystone) and Henkel continued their collaboration in 3D printing applications for the dental industry with the development of KeyModel Ultra. This next-generation 3D dental modeling resin delivers enhanced accuracy, detail, and speed. Formulated for rapid printing and quick post-curing, KeyModel Ultra is also engineered to reduce peel forces, thereby improving print accuracy.

Key Takeaways

- In 2024, the market for Dental 3D Printing generated a revenue of US$ 4.85 billion, with a CAGR of 27.8%, and is expected to reach US$ 56.37 billion by the year 2034.

- The Material segment is divided into Photopolymers, Metals, Ceramics, and Others with Photopolymerstaking the lead in 2024 with a market share of 41.9%.

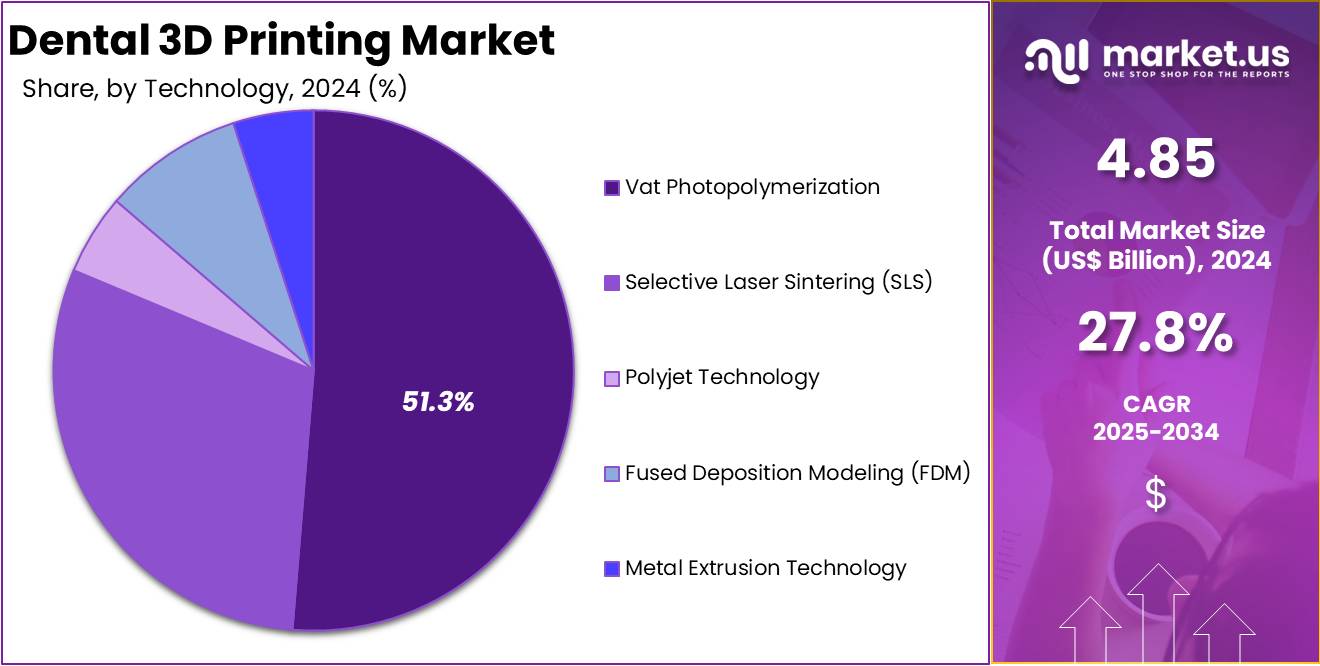

- By Technology, the market is bifurcated into Vat Photopolymerization, Selective Laser Sintering (SLS), Polyjet Technology, Fused Deposition Modeling (FDM), and Metal Extrusion Technology, with Vat Photopolymerizationdominating the market with 51.3% of market share in 2024.

- By Application, the market is classified into Orthodontics, Prosthodontics, Implantology, and Others, with Orthodonticstaking the dominant position in the market in 2024 with 39.9% market share.

- Considering the end user segment, the market is bifurcated into Dental Laboratories and Clinics, Hospitals & Clinics, and Academic & Research Institutes, with Dental Laboratories and Clinicstaking the lead in 2024 with 55.6% market share.

- North America led the market by securing a market share of 39.7% in 2024.

Material Analysis

The Photopolymers segment dominated the dental 3D printing market which accounted for over 41.9% market share due to their versatility and high precision properties. Photopolymers are widely used for creating dental models, crowns, bridges, and aligners. These materials offer excellent resolution and smooth finishes, making them ideal for intricate dental applications. Their ease of use, fast curing times, and the ability to create customized solutions contribute to their popularity.

Photopolymers are cost-effective, ensuring faster turnaround times for dental professionals, which accelerates patient treatment and drives demand, further establishing their dominance in the market. As technology advances, the demand for photopolymers in dental applications is expected to grow significantly. In January 2022, with the introduction of the new cara 3D Printing Pro Solution, Kulzer provided a fully validated 3D printing workflow from a single source.

The system ensures process stability and reliable quality, thanks to its perfectly matched devices and materials, all while being user-friendly. Along with the new workflow system, Kulzer also launched its photopolymer, dima Print Stone Gray, which offers an ideal backdrop for ceramic veneering and staining.

Technology Analysis

Vat Photopolymerization technology dominated the dental 3D printing market with 51.3% market share due to its high precision and ability to produce detailed dental restorations, such as crowns, bridges, and implants. This technology uses light to cure liquid photopolymer resin layer by layer, offering excellent resolution and smooth surface finishes. It is particularly favored for its speed, accuracy, and ability to handle complex designs. As dental practices increasingly require customized and precise solutions, Vat Photopolymerization has become the go-to choice for many dental professionals.

A variety of resin formulations have been investigated for clinical applications, but no standard formulation has yet emerged. Commonly recognized dental polymer bases, such as PMMA, BisGMA, UDMA, and TEGDMA, have been explored. However, a major challenge in research is the widespread use of trade secrets in the manufacturing of current materials.

Studies have also tested VPP printed interim fixed partial dentures assessing printing orientations and accuracy. This demonstrates the practical implementation of VPP technologies for quick, dimensionally stable, and patient-customized temporary dental restorations during treatment phases.

Application Analysis

The orthodontics segment held the largest share in the dental 3D printing market, accounting for 39.9%. This dominance is due to the growing demand for clear aligners and custom-made orthodontic devices. 3D printing enables precise, patient-specific solutions that enhance treatment comfort and outcomes. The technology supports mass customization and reduces production time. As orthodontic care becomes more personalized, clinics are increasingly adopting 3D printing to improve accuracy and reduce chair time, making the treatment process more efficient and appealing for patients.

In orthodontic applications, several 3D printing technologies are commonly used. These include stereolithography (SLA), fused deposition modeling (FDM), digital light processing (DLP), Polyjet photopolymer (PPP), and selective laser sintering (SLS). Among them, SLA was the first developed and is widely used. It works by curing liquid resin with an ultraviolet laser beam. The process forms one layer at a time, with the build platform lowering incrementally to create the next layer. This method enables high-resolution prints, making it suitable for producing detailed aligners and dental models with superior precision and fit.

Market players are advancing through innovation and strategic collaborations. In April 2023, SprintRay Inc. partnered with Braces On Demand to improve in-office orthodontic appliance production. The partnership focuses on automated, end-to-end 3D printing workflows. This approach is expected to reduce patient turnaround times and boost clinical productivity. Such developments highlight a growing trend toward digital transformation in orthodontics, where enhanced treatment delivery and workflow optimization are becoming core business priorities for dental care providers globally.

End Use Analysis

The Dental Laboratories and Clinics segment held a dominant position in the dental 3D printing market, capturing 55.6% of the overall share. This leadership can be attributed to the widespread use of advanced 3D printing technologies in creating custom restorations such as crowns, bridges, and dentures. These facilities benefit significantly from the technology’s speed, accuracy, and adaptability. The ability to manufacture personalized dental products in-house helps reduce turnaround times and elevates the level of patient care. As a result, adoption within this segment continues to accelerate steadily.

The increasing demand for customized and rapid dental treatments is reinforcing the role of dental clinics and laboratories. 3D printing enables dental professionals to improve workflow efficiency while ensuring precise treatment outcomes. The personalized approach made possible by these technologies enhances patient satisfaction and treatment acceptance. Given these advantages, the Dental Laboratories and Clinics segment is anticipated to maintain its leading market position. Continuous investments in digital dentistry tools are further strengthening this trend and improving overall operational effectiveness in dental practices.

In March 2025, SprintRay announced major product innovations during the International Dental Show (IDS) 2025. The company launched the Midas Digital Press 3D printer in Europe and introduced new sports guard and accessory kits. These additions support faster print speeds and multi-material workflows. The developments reflect SprintRay’s focus on boosting clinical efficiency and patient experience. Digital-first tools like these are becoming standard in modern dental labs and clinics. Their integration is expected to drive broader adoption of 3D printing across the dental industry in the coming years.

Key Market Segments

By Material

- Photopolymers

- Metals

- Ceramics

- Others

By Technology

- Vat Photopolymerization

- Selective Laser Sintering (SLS)

- Polyjet Technology

- Fused Deposition Modeling (FDM)

- Metal Extrusion Technology

By Application

- Orthodontics

- Prosthodontics

- Implantology

- Others

By End User

- Hospitals

- Physician Offices

- Ambulatory Surgical Centers (ASCs)

- Home Care

- Others

Drivers

Growing demand for personalized dental solutions

The rising demand for personalized dental care is a major driver in the dental 3D printing market. Patients today expect dental treatments that are tailored to their unique anatomical needs. These include customized crowns, bridges, implants, and clear aligners. 3D printing enables dental professionals to produce accurate, patient-specific solutions quickly and affordably. The ability to customize restorations reduces discomfort and enhances fit. This results in improved treatment outcomes and higher patient satisfaction, making 3D printing an essential technology in modern dental practices.

Dental 3D printing also supports cost and time efficiency in clinical workflows. Traditional dental product manufacturing is often labor-intensive and time-consuming. In contrast, 3D printing allows rapid production of complex dental restorations with high precision. This innovation benefits dental laboratories by increasing output and consistency while reducing material waste. The streamlined process also helps in minimizing chair time for patients. As a result, more dental practices are adopting 3D printing technologies to improve productivity and patient care standards.

Key players are actively investing in new product developments to meet the growing demand for customized solutions. In July 2025, 3D Systems introduced the NextDent® Jetted Denture Solution to the U.S. market. This one-piece denture uses multiple materials in a single print. It creates durable, aesthetic prosthetics faster and more cost-effectively than traditional methods. The product supports scalability for dental labs and enhances patient outcomes. This innovation strengthens the role of 3D printing in delivering high-quality, personalized dental treatments.

Restraints

High initial cost associated with 3D printing systems and materials

The cost of purchasing 3D printers, acquiring specialized materials, and training staff to use the technology effectively can be prohibitive. This significant upfront investment can discourage many dental professionals from incorporating 3D printing into their practice, particularly in regions where the dental market is still developing. Additionally, the ongoing maintenance costs, including the replacement of parts and materials, can add to the financial burden. As a result, smaller dental clinics may opt for traditional methods, which remain more affordable in comparison.

For instance, Primeprint by Dentsply Sirona is considered one of the most expensive dental 3D printing systems on the market, with a complete setup costing around $22,500 USD. It features DLP technology with a 2K projector and is a closed system with proprietary cartridges and materials designed for a range of dental applications including crowns, models, and surgical guides. The package includes CAD software valued between $6,000 to $10,000 USD. Moreover, Dentafab Sega is a high-end DLP dental 3D printer priced at about $9,000 USD, it is recognized for its speed and affordable resin costs in comparison to other options in the market. However, as 3D printing technology advances and more affordable solutions become available, this barrier may gradually reduce over time.

Opportunities

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

These advanced technologies are revolutionizing the design, production, and customization of dental products. AI and ML algorithms help in the development of more precise and efficient dental restorations by analyzing patient data and improving the overall design process. AI-driven tools are capable of automating the design of dental models, creating highly accurate and personalized prosthetics and restorations. Additionally, AI can be used for predictive analytics, allowing dental professionals to make more informed decisions about treatment plans based on real-time data.

Key players in the industry are following this trend and innovating and implementing AI and ML technologies in their products which allows them to have a stronger positioning and hold of the continuously changing market. For instance, in July 2025, PDS Health, a leading integrated healthcare support organization, has successfully completed a nationwide rollout of advanced dental imaging technologies in collaboration with DEXIS, a global leader in dental imaging and diagnostic solutions.

The rollout includes the DTX Studio™ Clinic, an AI-powered imaging platform that serves as the central hub for diagnostics, patient education, and treatment planning. Additionally, the deployment features DEXIS CBCT systems, including the OP 3D and OP 3D Pro, which provide high-resolution 3D imaging to support diagnostic accuracy, surgical planning, and enhance provider confidence.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the dental 3D printing market, influencing both demand and production dynamics. Economic growth, particularly in emerging markets, has increased disposable incomes, driving greater demand for advanced dental care, including 3D-printed restorations. As healthcare systems improve, the affordability and accessibility of dental treatments also rise, boosting the adoption of 3D printing technologies.

However, economic downturns or fluctuations in currency exchange rates can hinder market growth. During recessions, healthcare budgets are often cut, and dental procedures may be considered non-essential, leading to reduced spending on advanced technologies like 3D printing. Additionally, the high initial investment required for 3D printers and materials can deter smaller practices in economically struggling regions.

For instance, according to World Bank report 2024, the ongoing reductions in per capita government spending have slowed the growth of health investments. Between 2019 and 2023, per capita government health spending grew by just 1.2% annually in both Low-Income Countries (LICs) and Lower-Middle-Income Countries (LMICs). This marks a significant drop compared to the pre-pandemic growth rates of 4.2% in LICs and 2.4% in LMICs between 2015 and 2019.

Geopolitical factors, such as trade tariffs and regulatory changes, also affect the market. Trade tensions, particularly between major economies like the US and China, can lead to disruptions in the supply of 3D printing materials and equipment, impacting production costs. Regulatory barriers, particularly in countries with stringent healthcare standards, may slow down the adoption of new technologies. Conversely, governments’ initiatives to enhance healthcare infrastructure in developing regions create opportunities for market expansion.

Latest Trends

Advancement of high-precision resins tailored for cosmetic dentistry

High-precision dental resins are redefining restorative workflows by offering exceptional detail, translucency, and surface finish. These materials are designed to mimic the appearance of natural tooth structures. Companies like Formlabs and BEGO have launched advanced options such as Formlabs’ Premium Teeth Resin and BEGO™ VarseoSmile® TriniQ®. The compatibility of TriniQ® Resin with the Form 4B 3D printer now enables dental professionals to create permanent single-unit implant crowns and three-unit bridges. This capability significantly improves turnaround time and patient outcomes in dental laboratories and clinical settings.

The ability to produce same-day restorations is transforming cosmetic dental practices. With the integration of BEGO™ TriniQ® Resin and Formlabs’ Form 4B, clinics can deliver durable and aesthetic restorations directly from the chairside. This development improves patient satisfaction by reducing wait times and enhancing procedural efficiency. It also streamlines operations by minimizing the need for external lab work. As high-precision resins continue to advance, they are expected to raise the standard of care in aesthetic and restorative dentistry.

For optimal results, BEGO™ TriniQ® Resin must be printed using the Build Platform Flex on the Form 4B printer. This platform includes a stainless steel surface and patented quick-release technology. Users can choose between 50 µm and 100 µm layer heights. Unlike traditional dental materials, parts made with TriniQ® Resin do not require sandblasting. They offer excellent polishability, enabling the creation of highly aesthetic, patient-ready dental appliances. This innovation ensures both functional durability and visual appeal in restorative solutions.

Regional Analysis

North America is leading the Dental 3D Printing Market

High-precision dental resins are redefining restorative workflows by offering exceptional detail, translucency, and surface finish. These materials are designed to mimic the appearance of natural tooth structures. Companies like Formlabs and BEGO have launched advanced options such as Formlabs’ Premium Teeth Resin and BEGO™ VarseoSmile® TriniQ®. The compatibility of TriniQ® Resin with the Form 4B 3D printer now enables dental professionals to create permanent single-unit implant crowns and three-unit bridges. This capability significantly improves turnaround time and patient outcomes in dental laboratories and clinical settings.

The ability to produce same-day restorations is transforming cosmetic dental practices. With the integration of BEGO™ TriniQ® Resin and Formlabs’ Form 4B, clinics can deliver durable and aesthetic restorations directly from the chairside. This development improves patient satisfaction by reducing wait times and enhancing procedural efficiency. It also streamlines operations by minimizing the need for external lab work. As high-precision resins continue to advance, they are expected to raise the standard of care in aesthetic and restorative dentistry.

For optimal results, BEGO™ TriniQ® Resin must be printed using the Build Platform Flex on the Form 4B printer. This platform includes a stainless steel surface and patented quick-release technology. Users can choose between 50 µm and 100 µm layer heights. Unlike traditional dental materials, parts made with TriniQ® Resin do not require sandblasting. They offer excellent polishability, enabling the creation of highly aesthetic, patient-ready dental appliances. This innovation ensures both functional durability and visual appeal in restorative solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Dental 3D Printing market includes Printer Manufacturers such as 3D Systems, Inc., Stratasys Ltd., Desktop Metal, Formlabs Inc., EnvisionTEC, Renishaw plc, SLM Solutions, Roland DG Corporation, Zortrax S.A., Planmeca Oy, and Other key players and service providers which include Glidewell Dental, Whip Mix Corporation, StratFab, Inc., SprintRay, Materialise Dental, Formlabs, EnvisionTEC, and Other service providers.

Top Key Players in the Dental 3D Printing Market

Printer Manufacturers

- 3D Systems, Inc.

- Stratasys Ltd.

- Desktop Metal

- Formlabs Inc.

- EnvisionTEC

- Renishaw plc

- SLM Solutions

- Roland DG Corporation

- Zortrax S.A.

- Planmeca Oy

- Other key players

Service Providers

- Glidewell Dental

- Whip Mix Corporation

- StratFab, Inc.

- SprintRay

- Materialise Dental

- Formlabs

- EnvisionTEC

- Other key players

Key Opinion By Industry Leaders

The dental 3D printing industry is undergoing a revolutionary transformation. With the continuous development of high-precision resins and advanced technologies, we are now able to offer patients fully customized dental restorations that not only enhance aesthetics but also improve overall comfort. 3D Systems has played a pivotal role in this shift by providing solutions that allow dental professionals to create lifelike crowns, bridges, and aligners in a fraction of the time. The future of cosmetic dentistry is undeniably digital, and I firmly believe we are only scratching the surface of what’s possible. As more clinics adopt 3D printing, I expect patient satisfaction to reach new heights. Dr. Emily Carter – 3D Systems, Inc. In my years of research and collaboration with Stratasys, I’ve witnessed firsthand how PolyJet technology has revolutionized the way we approach dental applications. Stratasys’ innovations have allowed us to move away from traditional, labor-intensive methods, leading to faster turnaround times and more precise results. The ability to print complex models in multiple materials simultaneously is a game-changer, especially when it comes to creating functional and aesthetic dental restorations. The next frontier for dental 3D printing lies in further material advancements, which I believe will offer even more versatile solutions for the industry. We’re entering an exciting phase where the potential to scale 3D printing in clinical settings is greater than ever. Professor Mark Jenkins – Stratasys Ltd. I’ve always been passionate about the future of dental implants, and 3D printing is driving us toward unprecedented advancements in this area. StratFab’s metal 3D printing solutions have allowed us to create more durable, customized dental implants than ever before. The precision and flexibility of 3D printing enable me to offer my patients a level of personalization that was unimaginable a decade ago. Moreover, the speed at which we can design and produce these implants has drastically reduced the overall treatment time. The trend I see is a future where 3D printed implants become the standard, allowing dental professionals to offer faster, more accurate, and more affordable solutions to patients worldwide. Dr. Samuel Davis – StratFab, Inc. Recent Developments

- In July 2025: HeyGears introduced its Multi-Material Fusion resin 3D printed one-piece dentures at LMT LAB DAY Chicago 2025 in the United States, capturing significant attention across the industry. These OnePrint Dentures utilize HeyGears’ Multi-Material Fusion DLP (Digital Light Processing) photopolymerization technology, allowing the direct 3D printing of products with a combination of resin materials. This innovative process enables the seamless fusion of different dental materials, such as those used for teeth and denture bases, in a single 3D printing operation.

- In March 2025: Stratasys announced new strategic partnerships with Spain-based Nueva Galimplant, as well as Germany-based Gold Quadrat and Metaux Precieux, to offer Stratasys’ complete suite of dental 3D printing solutions, including TrueDent™ monolithic, full-color digital dentures. These partnerships broaden the availability of Stratasys’ dental offerings in Europe, further reinforcing the company’s commitment to providing advanced, scalable 3D printing solutions that help reduce labor time and costs for dental laboratories.

- In July 2024: Stratasys introduced the DentaJet XL, a high-speed 3D printer aimed at enhancing dental lab productivity and reducing costs. This new PolyJet multi-material 3D printer is built for production environments with minimal human intervention. Featuring advanced software for print preparation and management, along with capabilities for unattended printing and curing, Stratasys claims that dental labs can reduce labor costs by up to 90%.

Report Scope

Report Features Description Market Value (2024) US$ 4.85 billion Forecast Revenue (2034) US$ 56.37 billion CAGR (2025-2034) 27.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Photopolymers, Metals, Ceramicsa and Others), By Technology (Vat Photopolymerization, Selective Laser Sintering (SLS), Polyjet Technology, Fused Deposition Modeling (FDM), Metal Extrusion Technology), By Application (Orthodontics, Prosthodontics, Implantology and Others), By End Use (Dental Laboratories and Clinics, Hospitals & Clinics, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Printer Manufacturers: 3D Systems, Inc., Stratasys Ltd., Desktop Metal, Formlabs Inc., EnvisionTEC, Renishaw plc, SLM Solutions, Roland DG Corporation, Zortrax S.A., Planmeca Oy, and Other key players Service Providers: Glidewell Dental, Whip Mix Corporation, StratFab, Inc., SprintRay, Materialise Dental, Formlabs, EnvisionTEC, and Other key players

Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

Printer Manufacturers

- 3D Systems, Inc.

- Stratasys Ltd.

- Desktop Metal

- Formlabs Inc.

- EnvisionTEC

- Renishaw plc

- SLM Solutions

- Roland DG Corporation

- Zortrax S.A.

- Planmeca Oy

- Other key players

Service Providers

- Glidewell Dental

- Whip Mix Corporation

- StratFab, Inc.

- SprintRay

- Materialise Dental

- Formlabs

- EnvisionTEC

- Other key players