Global Household Cleaners Market By Product Type (Laundry Detergents, Surface Cleaners, Dishwashing Products, Toilet Cleaners, Others), By Ingredient (Organic/Natural, Chemical/Synthetic), By Application (Kitchen Cleaners, Bathroom Cleaners, Fabric Care, Floor Cleaners, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 36738

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

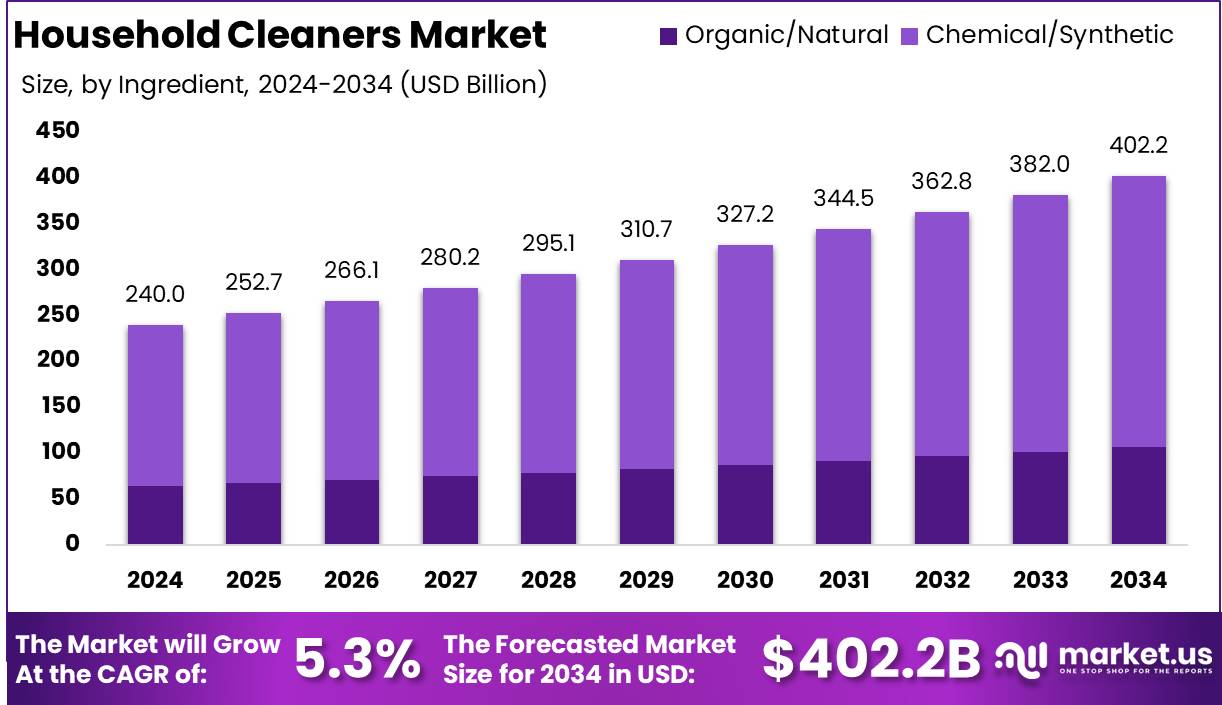

The Global Household Cleaners Market size is expected to be worth around USD 402.2 Billion by 2034 from USD 240.0 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Household cleaners are a broad range of products designed to clean, disinfect, and maintain hygiene in domestic environments. These products encompass a variety of cleaning agents, including surface cleaners, laundry detergents, dishwashing liquids, floor cleaners, bathroom sanitizers, and air fresheners. Household cleaners are specifically formulated to remove dirt, stains, and germs from various surfaces such as countertops, sinks, floors, and appliances.

The market for household cleaners has seen significant evolution over time, with increasing emphasis on safety, ease of use, and environmental impact. Consumers are increasingly opting for non-toxic, biodegradable, and environmentally friendly cleaning solutions that offer the same efficacy as traditional chemical-based products.

The household cleaners market refers to the production, distribution, and consumption of cleaning products intended for residential use. It includes various categories such as all-purpose cleaners, specialty cleaners (e.g., glass, carpet, and oven cleaners), and hygiene-focused products like disinfectants and air fresheners.

This market is driven by the need for cleanliness, convenience, and hygiene, and is influenced by factors such as consumer behavior, regional preferences, product innovations, and regulatory standards. The market is segmented into product types, distribution channels (e.g., retail, e-commerce), and regions, with leading players ranging from large multinational corporations to emerging eco-friendly brands targeting environmentally conscious consumers.

Several key factors are contributing to the growth of the household cleaners market. The rising consumer focus on health, hygiene, and overall cleanliness in domestic spaces is a major driver of demand.

Consumer demand for household cleaners has steadily risen due to heightened awareness of the importance of maintaining clean and hygienic living spaces. There is increasing preference for products that combine cleaning and disinfecting properties, reducing the need for multiple separate products.

The household cleaners market presents numerous opportunities, especially in the areas of sustainability and product innovation. With consumers becoming more environmentally conscious, brands that offer eco-friendly, non-toxic, and biodegradable solutions are well-positioned to capture market share. There is also a growing trend toward premiumization, with consumers willing to pay a premium for high-quality, effective, and safe cleaning products. The potential for growth in emerging markets, where increasing incomes and urbanization are driving demand for cleaning products, is significant.

According to Upmetrics, the household cleaners market is poised for significant growth, driven by increasing consumer preference for both traditional and eco-friendly cleaning products. The residential cleaning market alone is set to grow at a 6.2% year-over-year rate between 2023 and 2030, with the household green cleaning products segment expected to reach a market size of $320.95 billion by 2024.

Commercial cleaning also remains a major driver, representing 31% of the overall cleaning industry market share. With over 875,000 cleaning companies in the U.S. and carpet cleaning businesses generating $5 billion annually, the industry is a significant economic player. Dyson leads the cleaning equipment segment with a 20% market share, highlighting the impact of technological innovation. Furthermore, the cleaning industry employs over 3 million people in the U.S., with 10% of commercial cleaning jobs being contractual, illustrating the sector’s scale and the evolving dynamics of its workforce.

According to Ohsospotless, the U.S. cleaning industry is a substantial segment, with over two million janitors and cleaners, alongside 723,430 maids and housekeepers. This expansive labor force supports more than 1 million janitorial service businesses, highlighting the fragmentation and widespread nature of the market. The sector’s growth is reflected in its increasing demand for cleaning products and services, driven by both residential and commercial needs.

Cleaners earn an average hourly wage of $13, reflecting the labor-intensive nature of the industry. In the hospitality sector, hotel housekeepers, who are responsible for 100 checkpoints per room, typically take 31.5 minutes to clean a room between guests. The physical demands of cleaning are also notable, as workers can burn up to 400 calories per hour, underscoring the industry’s role in promoting physical activity. This data indicates a strong, growing market with significant opportunities in both the residential and commercial cleaning segments.

Key Takeaways

- The Global Household Cleaners Market is projected to grow from USD 240.0 Billion in 2024 to USD 402.2 Billion by 2034, at a CAGR of 5.3%, driven by increasing consumer demand for effective and convenient cleaning solutions.

- Laundry Detergents dominate the Household Cleaners Market, capturing a 43.4% share in 2024, due to growing demand for effective laundry solutions.

- Chemical/Synthetic cleaners hold a dominant 73.4% market share in 2024, driven by their efficacy and cost-effectiveness in cleaning tasks.

- Fabric Care is the leading segment in the Household Cleaners Market, accounting for 37.4% of the share in 2024, driven by increasing consumer focus on fabric longevity and cleanliness.

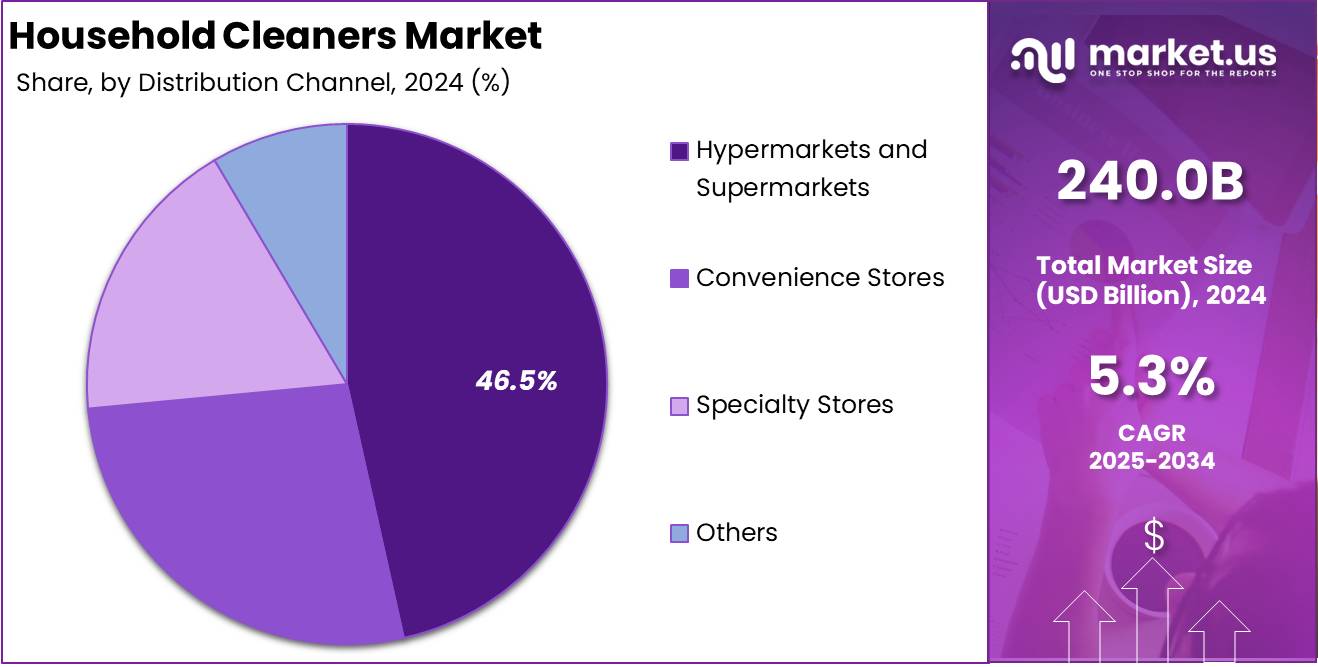

- Hypermarkets and Supermarkets lead Household Cleaners distribution, holding a dominant 46.5% share in 2024, due to their wide selection and competitive pricing.

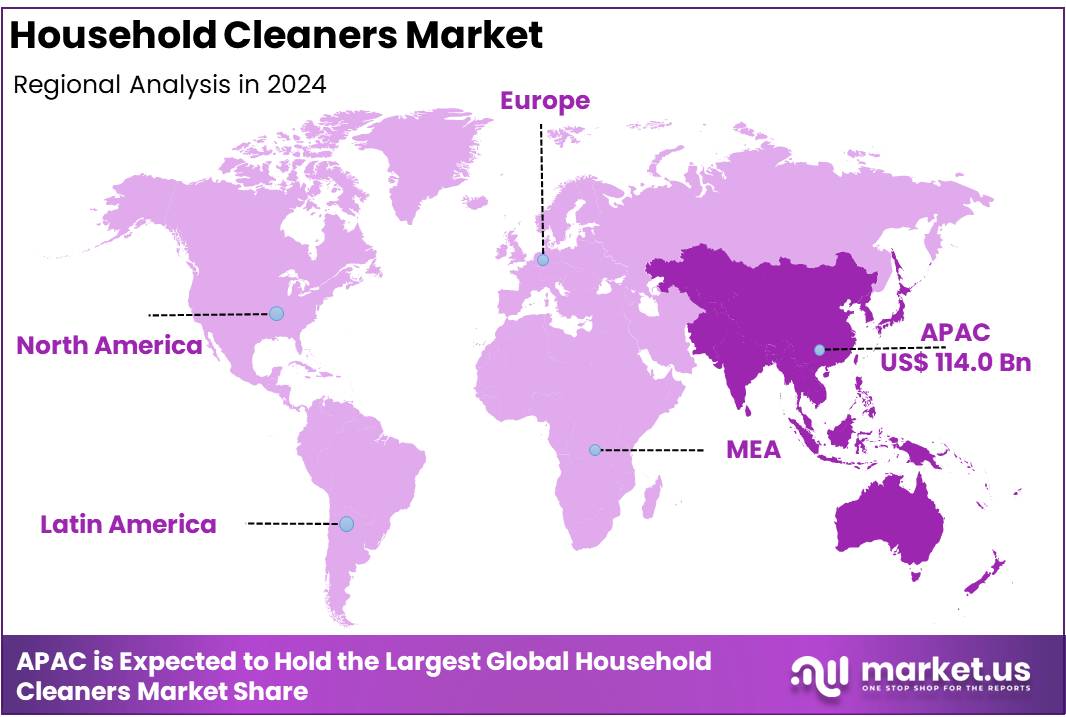

- Asia Pacific (APAC) holds the largest share of the Household Cleaners Market at 47.5% in 2024, driven by rapid urbanization, rising disposable incomes, and increased hygiene awareness.

By Product Analysis

Laundry Detergents Dominating Segment in Household Cleaners Market with 43.4% Market Share

In 2024, Laundry Detergents held a dominant market position in the Household Cleaners market, capturing more than 43.4% share. This product type continues to lead due to increasing consumer demand for effective and convenient laundry solutions.

Laundry detergents are essential for everyday household cleaning and are widely used across various demographics. The growing awareness of hygiene, coupled with advancements in detergent formulations that cater to diverse washing needs, has fueled their strong market presence.

Surface Cleaners are also an important segment within the Household Cleaners market. These products are widely used for cleaning various surfaces in kitchens, bathrooms, and living areas. The increasing trend towards home hygiene, especially in light of heightened health concerns, has contributed to the growing demand for surface cleaners.

Dishwashing Products, another key segment, remain in steady demand, driven by the necessity of cleaning dishes and utensils daily. Their demand is particularly high in regions with large populations and busy households, where convenience and efficiency are paramount. These products continue to evolve, with more eco-friendly formulations gaining traction in the market.

Toilet Cleaners are crucial for maintaining sanitation in bathrooms, and although they are a smaller segment compared to the others, they still hold significant importance. The focus on germ-free and odor-eliminating solutions has been a driving factor in the consistent demand for toilet cleaners.

Lastly, the Others category encompasses a variety of household cleaning products that don’t fall under the primary segments mentioned above. These include products for specialty cleaning tasks, such as air fresheners, oven cleaners, and carpet cleaners. While their market share is comparatively smaller, they cater to specific cleaning needs, contributing to the overall growth of the Household Cleaners market.

By Ingredient Analysis

Chemical/Synthetic Dominating Segment in Household Cleaners Market with 73.4% Market Share

In 2024, Chemical/Synthetic holds a dominant market position in the Household Cleaners segment by ingredient, capturing more than 73.4% share. This segment remains the leading choice due to the efficacy and cost-effectiveness of chemical-based cleaners, which continue to be favored for their strong performance in eliminating dirt, stains, and germs.

Organic/Natural cleaners, though gaining popularity due to their eco-friendly and health-conscious appeal, still account for a smaller share of the market compared to their chemical counterparts. However, this segment is witnessing steady growth as consumers increasingly seek sustainable and non-toxic alternatives in their household products.

By Application Analysis

Fabric Care Dominating Segment in Household Cleaners Market with 37.4% Market Share

In 2024, Fabric Care held a dominant market position in the Household Cleaners market, capturing more than 37.4% share. This segment has seen sustained growth, driven by the increasing demand for specialized laundry products that ensure fabric longevity, cleanliness, and freshness. Consumers are becoming more conscious of fabric care, with an emphasis on using products that not only clean but also maintain the quality of their clothes, leading to the continued rise of fabric care solutions.

Kitchen Cleaners, an important segment, are highly sought after due to the necessity of maintaining hygiene in food preparation areas. The growing awareness of foodborne illnesses and the demand for easy-to-use, effective cleaning products have spurred growth in this category. Kitchen cleaners include products designed to tackle grease, stains, and bacteria, addressing the specific needs of modern kitchens.

Bathroom Cleaners are also in significant demand as consumers prioritize cleanliness and sanitation in one of the most frequently used areas of the home. These products are formulated to target tough stains, soap scum, and germs that accumulate in bathrooms, making them essential for maintaining hygiene in these spaces.

Floor Cleaners remain a staple in households, with consumers looking for easy and efficient ways to clean different types of flooring. Whether it’s wood, tile, or carpet, floor cleaners are designed to provide a deep clean while protecting the surface of the floors. The growing trend of multi-functional floor cleaning products that cater to a range of surfaces has further boosted this segment.

Finally, the Others category includes a variety of niche cleaning products, such as air fresheners, specialty stain removers, and upholstery cleaners. Though this segment represents a smaller portion of the market, it plays an important role in addressing unique cleaning needs that cannot be met by the more mainstream products.

By Distribution Channel Analysis

Hypermarkets and Supermarkets Dominating Segment in Household Cleaners Market with 46.5% Market Share

In 2024, Hypermarkets and Supermarkets held a dominant market position in the Household Cleaners market, capturing more than 46.5% share. These large retail chains continue to lead due to their wide product assortment, competitive pricing, and convenience for consumers. The ease of accessing a variety of household cleaning products in one location, along with frequent promotional offers, makes hypermarkets and supermarkets the go-to choice for most consumers.

Convenience Stores, while not as dominant, also contribute to the Household Cleaners market by catering to consumers seeking quick and easy access to essential cleaning products. With their extended hours and strategic locations, these stores provide a convenient option for busy individuals who need to make last-minute purchases or who prefer smaller quantities of cleaning products.

Specialty Stores focus on offering high-quality or niche cleaning products that may not be available in larger retail outlets. These stores are often favored by consumers looking for premium brands, eco-friendly options, or specific cleaning solutions for unique needs. Specialty stores provide a personalized shopping experience and cater to a more specific customer base.

The Others category includes various distribution channels, such as e-commerce platforms and direct sales. These channels have become increasingly important, particularly in the digital age, where consumers can shop from the comfort of their homes. The rise of online marketplaces and subscription services has significantly impacted the way household cleaners are purchased, offering greater convenience and a wider range of options.

Key Market Segments

By Product Type

- Laundry Detergents

- Surface Cleaners

- Dishwashing Products

- Toilet Cleaners

- Others

By Ingredient

- Organic/Natural

- Chemical/Synthetic

By Application

- Kitchen Cleaners

- Bathroom Cleaners

- Fabric Care

- Floor Cleaners

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Others

Driver

Rising Awareness of Health and Hygiene

The global Household Cleaners market is witnessing a significant boost due to the rising awareness of health and hygiene, particularly post-pandemic. Consumers are becoming more mindful of the importance of maintaining clean environments not just for aesthetic purposes, but for overall health and well-being. As people spend more time indoors, especially in their homes, the demand for effective household cleaning products has surged.

The pandemic underscored the need for sanitization and cleanliness to prevent the spread of infections, leading to heightened consumer interest in products that can ensure a hygienic living space. This awareness is translating into consistent demand for household cleaners, with a particular focus on disinfectants, sanitizers, and multi-surface cleaners that can eliminate harmful bacteria and viruses.

In addition to general health concerns, growing awareness around the harmful effects of allergens, pollutants, and microbes has further driven demand. Consumers now seek cleaners that not only remove dirt but also address more specific issues like dust mites, mold, and germs. This shift towards more functional cleaning products is enhancing market growth, as consumers are willing to invest in premium products that promise better efficacy and safety for their homes.

The growing availability of health-oriented products that promise chemical-free or eco-friendly ingredients also aligns with consumers’ growing preference for holistic wellness, driving further expansion in the market. With health and hygiene as a top priority, the household cleaners industry is expected to continue thriving, with these factors creating a robust foundation for sustained market growth in 2024.

Restraint

Environmental Concerns and Sustainability

Environmental concerns and the growing emphasis on sustainability represent one of the major restraints facing the Household Cleaners market. As consumers become more eco-conscious, there is increasing scrutiny on the environmental impact of cleaning products, particularly in terms of chemical ingredients and packaging waste.

Traditional household cleaners, which often contain harsh chemicals and come in single-use plastic packaging, are facing backlash from environmentally aware customers. This shift in consumer preferences has led to a demand for eco-friendly alternatives, such as biodegradable ingredients, refillable packaging, and non-toxic formulas. However, this transition poses a challenge for many brands in terms of production costs, ingredient sourcing, and product efficacy.

For companies operating in this space, meeting the growing demand for sustainability without compromising on the performance of their products can be difficult. Many cleaning products contain chemicals that, while effective in cleaning, may contribute to pollution or pose health risks when used over time. Consumers are increasingly prioritizing products that are free from harmful substances like ammonia, chlorine bleach, and phosphates, which can negatively affect the environment.

Additionally, the need to adhere to stricter regulations around packaging waste disposal is putting pressure on manufacturers to innovate more sustainable solutions. This tension between maintaining product effectiveness and meeting sustainability goals creates a challenging environment for the Household Cleaners market in 2024, as companies strive to balance these demands while remaining competitive.

Opportunity

Growth in Natural and Eco-friendly Cleaners

The demand for natural and eco-friendly household cleaners presents a significant growth opportunity in the market. As consumer awareness about environmental issues and the harmful effects of chemicals in cleaning products grows, there is a rising shift towards natural alternatives. Consumers are becoming increasingly conscious of the ingredients in their household cleaners and are actively seeking products that are free from harsh chemicals, synthetic fragrances, and artificial preservatives. This demand is driving the growth of organic, plant-based, and non-toxic cleaning products, which offer a safer, more sustainable option for both users and the environment.

The market is also witnessing the emergence of eco-friendly packaging innovations, such as refill stations and recyclable or biodegradable containers, which are becoming key selling points for natural cleaning products. This trend not only appeals to health-conscious consumers but also resonates with those who want to reduce their environmental footprint. Furthermore, with the rise of the eco-conscious consumer segment, brands that offer green certifications, such as the EPA’s Safer Choice label, are gaining consumer trust and loyalty.

The growing availability of these sustainable cleaning products at a broader range of price points is helping to expand the market further, making natural cleaners accessible to a wider audience. As this trend continues to gain momentum in 2024, the Household Cleaners market stands to benefit from this shift towards greener, more sustainable solutions.

Trends

Increasing Adoption of Smart Home Technology in Cleaning

A key trend shaping the Household Cleaners market in 2024 is the growing integration of smart home technology into the cleaning process. With the rise of connected devices and smart home ecosystems, consumers are increasingly seeking cleaning solutions that complement their tech-savvy lifestyles. Smart cleaning appliances, such as robotic vacuum cleaners, smart air purifiers, and automatic floor cleaners, are becoming more mainstream. These devices not only promise greater convenience but also improved cleaning efficiency by utilizing sensors, AI, and IoT technology.

In response, traditional cleaning products are evolving to work in tandem with these smart devices, creating new opportunities for product development and market expansion. For instance, cleaning product manufacturers are introducing innovations such as app-controlled dispensers, which allow users to control the amount of cleaning solution dispensed for optimal use. This trend toward automation and tech-enabled cleaning solutions is reshaping the way consumers approach household maintenance.

Moreover, as smart home technology becomes more affordable and accessible, it is expected to drive a deeper integration of these devices into the average household, further boosting the demand for innovative household cleaning solutions. With smart home integration becoming more common in 2024, the Household Cleaners market is well-positioned to capitalize on the growing intersection of technology and cleaning.

Regional Analysis

APAC – Household Cleaners Market with Largest Market Share (47.5% in 2024)

The global household cleaners market is experiencing dynamic growth across various regions, with Asia Pacific (APAC) leading the way, holding the largest market share of 47.5% in 2024, valued at USD 114.0 billion. APAC’s dominance in this sector is driven by rapid urbanization, increasing disposable incomes, and a growing emphasis on hygiene and cleanliness. The region’s large population, combined with rising consumer awareness and demand for effective and environmentally friendly cleaning products, continues to fuel market expansion.

North America follows closely, holding a substantial share in the market. The region benefits from high consumer spending, a preference for premium and eco-friendly products, and advanced distribution channels. The increasing trend of health-conscious households and sustainable cleaning solutions is boosting the demand for household cleaners in this region, though it lags behind APAC in overall market size.

Europe holds a significant position in the market, with consumers increasingly opting for green and sustainable cleaning products. The European market for household cleaners is growing steadily, supported by stringent environmental regulations that push for the adoption of safer, non-toxic cleaning solutions. In countries such as Germany and the UK, demand for premium household cleaners is rising as consumers become more aware of environmental and health impacts.

The Middle East & Africa (MEA) region, while smaller in comparison, is witnessing rapid growth in the household cleaners market, fueled by increasing urbanization, improved living standards, and a growing preference for convenience. The market in MEA is evolving, with greater adoption of cleaning products driven by expanding retail networks and higher disposable incomes in key regions like the UAE and Saudi Arabia.

Latin America, though having a smaller share, continues to demonstrate steady growth, particularly in emerging economies such as Brazil and Mexico. Economic development and increasing urban populations are contributing to a gradual increase in demand for household cleaning solutions. However, the market in Latin America still lags behind more mature regions in terms of size and spending power.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global household cleaners market in 2024 is highly competitive, with leading players focusing on innovation, sustainability, and expanding their product portfolios to meet evolving consumer demands. Procter & Gamble (P&G) and Reckitt Benckiser Group Plc. remain dominant forces, with strong brand recognition and an extensive range of eco-friendly and effective cleaning solutions.

P&G’s Tide and Mr. Clean, along with Reckitt’s Lysol and Finish, are well-positioned to leverage their distribution networks and market presence across various regions. Similarly, Unilever NV and Colgate-Palmolive Co. continue to lead through product diversification, offering solutions targeting specific consumer segments such as sensitive skin and environmentally conscious buyers.

Ecolab and Henkel have also made significant strides with their commercial and industrial-grade cleaning products, capitalizing on the growing demand for advanced cleaning technologies in both household and business settings. Bona and Method Products are noteworthy for their focus on natural and sustainable ingredients, aligning with the increasing preference for eco-friendly products. Other players like Godrej Consumer Products Ltd., Church & Dwight, and S. C. Johnson & Son Inc. remain focused on affordable, accessible cleaning solutions that appeal to value-conscious consumers.

Companies like Cleansing Solutions, Goodmaid Chemicals, and Kimberly-Clark, while more regionally focused, continue to maintain strong positions through innovation and localized product offerings. With increasing environmental awareness, brands that can balance efficacy with sustainability are expected to secure a competitive edge in the market.

Top Key Players in the Market

- Bona

- Church & Dwight

- Cleansing Solutions

- Clorox

- Colgate-Palmolive Co.

- Ecolab

- Godrej Consumer Products Ltd.

- Goodmaid Chemicals Corporation

- Henkel

- Henkel AG & Co. KGaA

- Kao Group

- Kimberly-Clark

- Method Products

- Procter & Gamble (P&G)

- Reckitt Benckiser Group Plc.

- S. C. Johnson & Son Inc.

- Seventh Generation

- The Procter & Gamble Co.

- Unilever NV

Recent Developments

- In Nov. 1, 2024, Clorox formed a strategic partnership with M2030 to help their suppliers reduce carbon emissions. This collaboration aligns with Clorox’s goal of achieving net-zero emissions by 2050.

- In Feb. 4, 2025, Jelmar, known for its CLR and Tarn-X brands, announced the launch of CLR PRO MAX Industrial Degreaser. This new product is specifically designed to break down tough grease, oil, and grime on various industrial surfaces, machinery, and equipment.

- In Oct. 30, 2024, Tineco, a leader in smart home appliances, launched a Trade-Up Campaign. The initiative encourages customers to upgrade their old cleaning devices to Tineco’s advanced products, offering better performance and eco-friendly features.

- In 2024, Mr. Clean introduced new products: Magic Eraser Ultra Foamy and Magic Eraser Ultra Thick. These innovations promise to make cleaning even more efficient, continuing the brand’s tradition of offering powerful and convenient cleaning solutions.

- In 2024, P&G Professional expanded its range with Tide Professional Commercial Laundry Detergent and Downy Professional Fabric Softener. These products help businesses improve cleaning efficiency while reducing time and costs associated with laundry tasks.

- In Nov. 30, 2023, Paladin Holdings LLC acquired Texize, a South Carolina-based manufacturer of industrial cleaning products. Texize’s inclusion expands Paladin’s portfolio of cleaning solutions.

- In 2023, Koparo secured $1.5 million in a pre-Series A round led by Saama Capital. The funding will support the direct-to-consumer home cleaning brand in building its offline presence and expanding product offerings.

Report Scope

Report Features Description Market Value (2024) USD 240.0 Billion Forecast Revenue (2034) USD 402.2 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Laundry Detergents, Surface Cleaners, Dishwashing Products, Toilet Cleaners, Others), By Ingredient (Organic/Natural, Chemical/Synthetic), By Application (Kitchen Cleaners, Bathroom Cleaners, Fabric Care, Floor Cleaners, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bona, Church & Dwight, Cleansing Solutions, Clorox, Colgate-Palmolive Co. , Ecolab, Godrej Consumer Products Ltd. , Goodmaid Chemicals Corporation , Henkel, Henkel AG & Co. KGaA , Kao Group , Kimberly-Clark, Method Products, Procter & Gamble (P&G), Reckitt Benckiser Group Plc. , S. C. Johnson & Son Inc., Seventh Generation, The Procter & Gamble Co. , Unilever NV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bona

- Church & Dwight

- Cleansing Solutions

- Clorox

- Colgate-Palmolive Co.

- Ecolab

- Godrej Consumer Products Ltd.

- Goodmaid Chemicals Corporation

- Henkel

- Henkel AG & Co. KGaA

- Kao Group

- Kimberly-Clark

- Method Products

- Procter & Gamble (P&G)

- Reckitt Benckiser Group Plc.

- S. C. Johnson & Son Inc.

- Seventh Generation

- The Procter & Gamble Co.

- Unilever NV