Global Dental Loupe Market By Product By Type(Clip-On Loupe, Headband Mounted Loupe) By End-User(Hospitals, Dental Clinics , Others) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Dec 2023

- Report ID: 15434

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

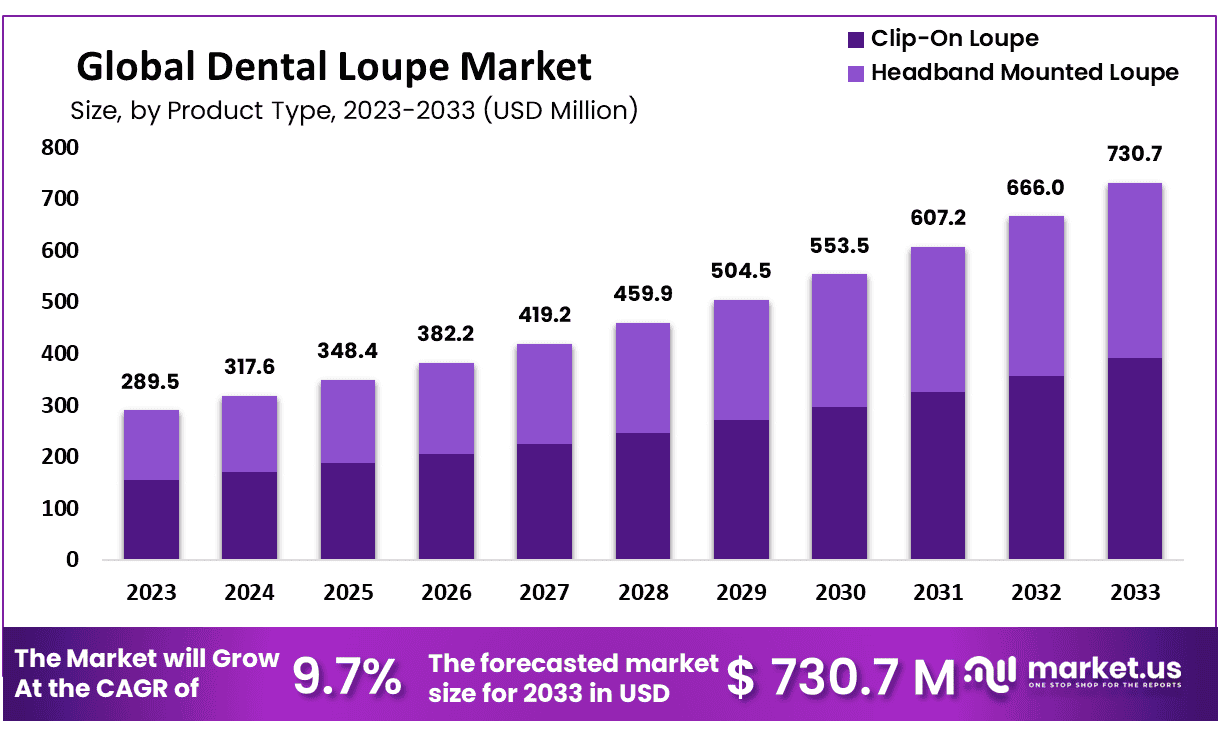

The Global Dental Loupe Market size is expected to be worth around USD 730.7 Million by 2033 from USD 289.5 Million in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

Dental loupes Market have become indispensable tools for dentists when it comes to complex surgery and treatment procedures. By providing a detailed view of the treatment area, dental loupes allow dentists to operate even in tiny spaces not visible with naked eye. Dental loupes ensure optimal performance, working distance, field of vision as well as optimal performance of various designs such as Galilean, Flip-up Prismatic Front Lens Mounted loupes in this market.

Increasing application of dental loupe in restorative dentistry and endodontic practice is the prime factor which bolsters the growth of the dental loupe market across the globe. Moreover, continual increasing incidence of the musculoskeletal disorder among dentist is also supporting the growth of the Dental Loupe market. Furthermore, the extension of dental insurance coverage has led to an increase in dental treatment, which is directly driving the dental loupe market. Also, the increase in disposable income among consumer is accountable for the rising growth of dental loupe market in coming years.

However, technology advancement and ergonomics are the factors that can hamper the dental loupe market in future. Global dental loupe market is excepted to grow significantly throughout the furcated period. The market is segmented into product and application type. Further product type is segmented on the basis of clip-on loupe and headband mounted loupe. Based on application type is segmented the into the hospital, dental clinic, and ambulatory surgical centres. Increasing usage of loupe in the dental application is expected to boost the market growth rate positively.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size: Dental Loupe Market size is expected to be worth around USD 730.7 Million by 2033 from USD 289.5 Million in 2023.

- Market Growth: The market growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

- Product Type Analysis: Clip-On Loupes dominate the dynamic Dental Loupe Market with an impressive 53.6% market share.

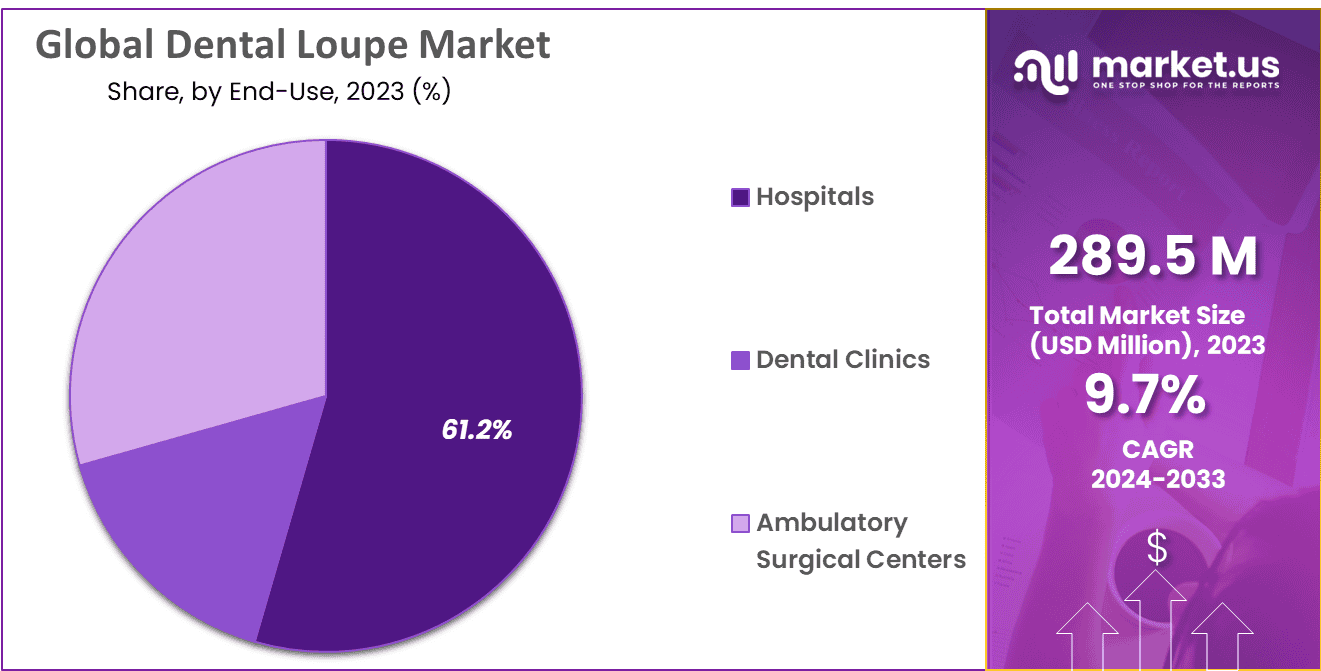

- End-Use Analysis: End-use analysis places Dental Clinics with an impressive 61.2% market share

- Regional Analysis: North America is projected to lead this segment, accounting for approximately USD 137.8 Million in revenue and boasting 48.2% market share.

- Procedural Need: Demand for dental loupes stems from their need to ensure precise procedures, particularly endodontics such as root canals and periodontal interventions for severe cases.

- National Centre of Health Statistics (NCHS): Recent statistics from NCHS demonstrate the significance of dental loupes for addressing common oral health challenges and conducting essential dental procedures to combat high levels of caries and untreated tooth decay.

Product Type Analysis

Clip-On Loupes dominate the dynamic Dental Loupe Market with an impressive 53.6% market share, thanks to their versatility and ease of use. Recognized for providing detailed views of treatment areas at close range with their clip-on design easily attaching eyeglasses, they allow practitioners to seamlessly incorporate magnification into routine procedures without impacting performance or working distance. Thanks to advances in technology and materials advancements, Clip-On Loupes now provide optimal performance, extended working distance, and wider fields of vision than ever before.

Headband Mounted Loupes are another essential segment in the market, giving dental professionals access to an assortment of options. These headband-mounted loupes offer comfortable viewing experiences that are customizable. As the Dental Loupe Market develops further, practitioners have access to an expanding selection of innovative solutions tailored specifically for meeting specific needs in this rapidly-evolving field of dentistry.

End-User Analysis

End-use analysis places Dental Clinics with an impressive 61.2% market share. Tailor made to meet the individual needs of dental professionals, dental loupes play an invaluable role in aiding precision during intricate procedures in a clinic setting. Renowned for their magnification capabilities and ergonomic designs, these loupes contribute significantly to overall efficiency and accuracy during treatments provided at these establishments. Thanks to continuous technological and material advancements, clinic personnel now have access to cutting edge loupes which deliver optimal performance while meeting customizable features – an essential tool in ensuring accuracy during procedures performed there

Hospitals represent another key end user for dental loupes, thanks to their wide array of dental departments and special units that recognize the value of incorporating loupes into their practices. As the Dental Loupe Market expands further, meeting both Clinics’ and Hospitals’ unique needs through innovative loupe solutions helps foster advancements in dental care practices.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

Product Type

- Clip-On Loupe

- Headband Mounted Loupe

End-User

- Hospitals

- Dental Clinics

- Others

Driver

Technological Advancement

Technological innovations play an integral part in driving the Dental Loupe Market. Advancements in optics, materials, and design have resulted in loupes with improved magnification power, improved clarity, ergonomic features like LED illumination and adjustable focal lengths to offer dental professionals unparalleled precision during procedures – further contributing to market expansion. By adopting cutting-edge technologies dental loupe manufacturers can address both practitioner needs and elevate performance as a means of market expansion.

Increased Dental Procedures

Due to increasing dental issues and increasing awareness of oral health issues, an increase in dental procedures worldwide has occurred. With dental professionals seeking greater precision and accuracy when diagnosing and treating oral conditions, demand for dental loupes has skyrocketed; these magnifying lenses give a magnified and detailed view of oral cavities, helping dentists perform intricate procedures more confidently and precisely. As demand for these services escalates as emphasis on high-quality patient care increases, so too does adoption of these loupes driving market growth and market expansion.

Trend

Integration of Imaging and Recording Capabilities

One prominent trend in the Dental Loupe Market is the addition of imaging and recording capabilities. Dental loupes equipped with built-in cameras enable real-time image capture and video recording of treatment sites, serving both to document patient records as well as providing valuable educational tools for training or case reviews. Digitization trends coupled with incorporation of imaging features enhance dental loupes functionality – becoming part of healthcare’s wider digital transformation.

Customization to Improve User Comfort

A noteworthy trend in dental loupe technology today is an increased emphasis on customizing for user comfort. Dental professionals possessing different preferences and ergonomic requirements can now personalize their loupes based on factors like working distance, declination angle and frame design to meet these individual requirements. This trend shows a user-centric approach catering specifically to each dentist while increasing acceptance across dental specialties.

Restraint

High Initial Costs

One key restraint in the Dental Loupe Market is its high initial costs associated with purchasing these precision optical instruments. Due to advanced materials used for their production, quality loupes command high price points which may present financial barriers for smaller dental practices or individual practitioners who wish to adopt dental loupes but are unwilling to make substantial upfront investments; thus creating barriers of entry into certain segments of this market.

Lack of Awareness and Education

Limited awareness among dental professionals regarding the advantages of using loupes can act as a roadblock to their use. Furthermore, in certain regions there may be insufficient education on their benefits for dental practice use; without this information dentists who do not fully appreciate its positive effects on precision, posture, and overall procedural outcomes may be less inclined to invest in these devices; eliminating knowledge gaps by raising awareness could overcome this barrier and increase market penetration.

Opportunity

Rising Dental Tourism

As dental tourism becomes an increasingly attractive prospect for individuals looking for cost-effective yet high-quality treatments abroad, more dental professionals could find value in investing in advanced equipment – including loupes. With an increased demand for precise procedures in dental tourism destinations like Las Vegas or Thailand, manufacturers and suppliers could expand their market presence by catering specifically to these facilities’ specific requirements.

Focus on Ergonomics and Comfort

Manufacturers have an opportunity to capitalize on the growing emphasis on ergonomics and user comfort, especially among dental professionals who understand the significance of maintaining good posture during lengthy procedures. As more clinicians appreciate this need for ergonomically sound loupes designed with lightweight adjustable designs in mind, manufacturers that meet this specific market need can create something truly revolutionary; improving overall user experiences while spurring market expansion.

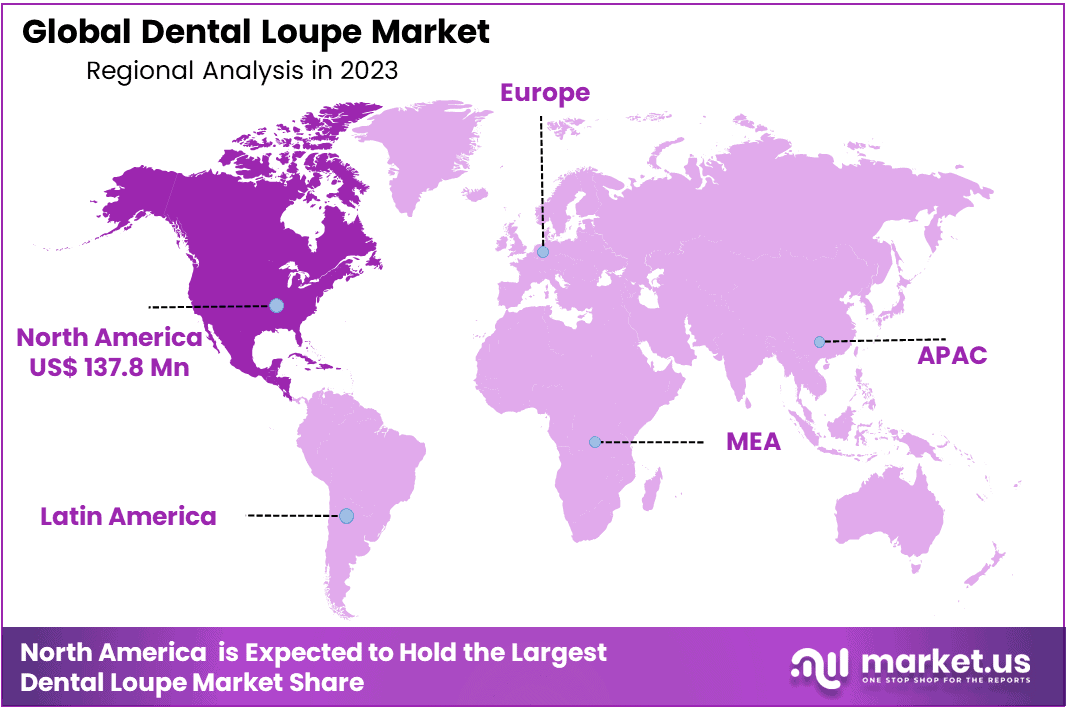

Regional Analysis

The global dental loupes market can be divided geographically into North America, Latin America, Europe, Asia Pacific, Middle East and Africa. North America is projected to lead this segment, accounting for approximately USD 137.8 Million in revenue and boasting 48.2% market share – due to an increasing number of orthodontic and endodontic procedures as well as rising levels of oral health issues in its borders.

U.S. adults over 20-64 years experienced caries or untreated tooth decay at some point during 2017, according to statistics released by the National Centre for Health Statistics; 91% experienced caries while 27% had untreated decay, thus necessitating endodontic procedures such as root canals or periodontal interventions and consequently increasing demand for dental loupes in this region.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

Under the Competitive Landscape and Company Profile chapters of the market report, key participants in the Dental Loupe Market are profiled. Assessment is undertaken by looking at product or service offerings, financial statements, pivotal developments, strategic approach to market positioning, geographic reach, market position and other salient characteristics of major players in this market.

Market Key Players

- KaWe

- Orascoptic (Kavo Kerr)

- SurgiTel (GSC)

- Heine

- ADMETEC

- Designs For Vision

- Rose Micro Solutions

- Carl Zeiss Meditec

- Xenosys

- Seiler Instrument

- Sheer Vision

- PeriOptix (DenMat)

Recent Developments

- KaWe: Launched the LumiPlus LED headlamps that integrate seamlessly with their loupes, offering improved illumination and ergonomics.

- Orascoptic (Kavo Kerr): Introduced the Veridian loupe system with enhanced magnification and working distance options for various dental procedures.

- SurgiTel (GSC): Focused on developing loupes compatible with surgical microscopes for improved precision in endodontics and implant dentistry.

- Heine: Emphasized wireless loupe systems with rechargeable batteries for increased convenience and mobility.

- ADMETEC: Expanded their educational initiatives by sponsoring workshops and webinars on loupe selection and ergonomics.

- Rose Micro Solutions: Continued their specialization in custom-made loupes for dentists with unique visual needs or prescription adjustments.

Report Scope

Report Features Description Market Value (2023) USD 289.5 Million Forecast Revenue (2033) USD 730.7 Million CAGR (2024-2033) 9.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type-(Clip-On Loupe 53.6%, Headband Mounted Loupe);By End-User(Hospitals, Dental Clinics , Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape KaWe, Orascoptic (Kavo Kerr), SurgiTel (GSC), Heine, ADMETEC, Designs For Vision, Rose Micro Solutions, Carl Zeiss Meditec, Xenosys, Seiler Instrument, Sheer Vision, PeriOptix (DenMat) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Why is there a demand for dental loupes in the market?Dental loupes are in demand due to their essential role in precise dental procedures, particularly in endodontics, including root canals, and addressing severe cases through periodontal interventions.

How big is the Dental Loupe Market?The global Dental Loupe Market size was estimated at USD 289.5 Million in 2023 and is expected to reach USD 730.7 Million in 2033.

What is the Dental Loupe Market growth?The global Dental Loupe Market is expected to grow at a compound annual growth rate of 9.7%. From 2024 To 2033

Who are the key companies/players in the Dental Loupe Market?Some of the key players in the Dental Loupe Markets are KaWe, Orascoptic (Kavo Kerr), SurgiTel (GSC), Heine, ADMETEC, Designs For Vision, Rose Micro Solutions, Carl Zeiss Meditec, Xenosys, Seiler Instrument, Sheer Vision, PeriOptix (DenMat)

How do dental loupes contribute to procedural precision?Dental loupes enhance procedural precision by providing a magnified and detailed view of the treatment area, enabling practitioners to perform intricate dental procedures with greater accuracy.

-

-

- KaWe

- Orascoptic (Kavo Kerr)

- SurgiTel (GSC)

- Heine

- ADMETEC

- Designs For Vision

- Rose Micro Solutions

- Carl Zeiss Meditec

- Xenosys

- Seiler Instrument

- Sheer Vision

- PeriOptix (DenMat)