Global Companion Diagnostics Market By Product Type (Assays, Kits, & Reagents, Software & Services, and Instruments & Systems), By Technology (Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Magnetic Resonance Imaging (MRI), In Situ Hybridization (ISH), Immunohistochemistry (IHC), and Others), By Application (Oncology, Neurological Disorders, Infectious Diseases, Cardiovascular Diseases, and Others), By Sample Type (Tissue Samples, Blood Samples, and Others), By End-User (Academic & Research Centers, Reference Laboratories, Pharmaceutical & Biotechnology Companies, Hospitals & Physician Laboratories, CROs, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 57777

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Technology Analysis

- Application Analysis

- Sample Type Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

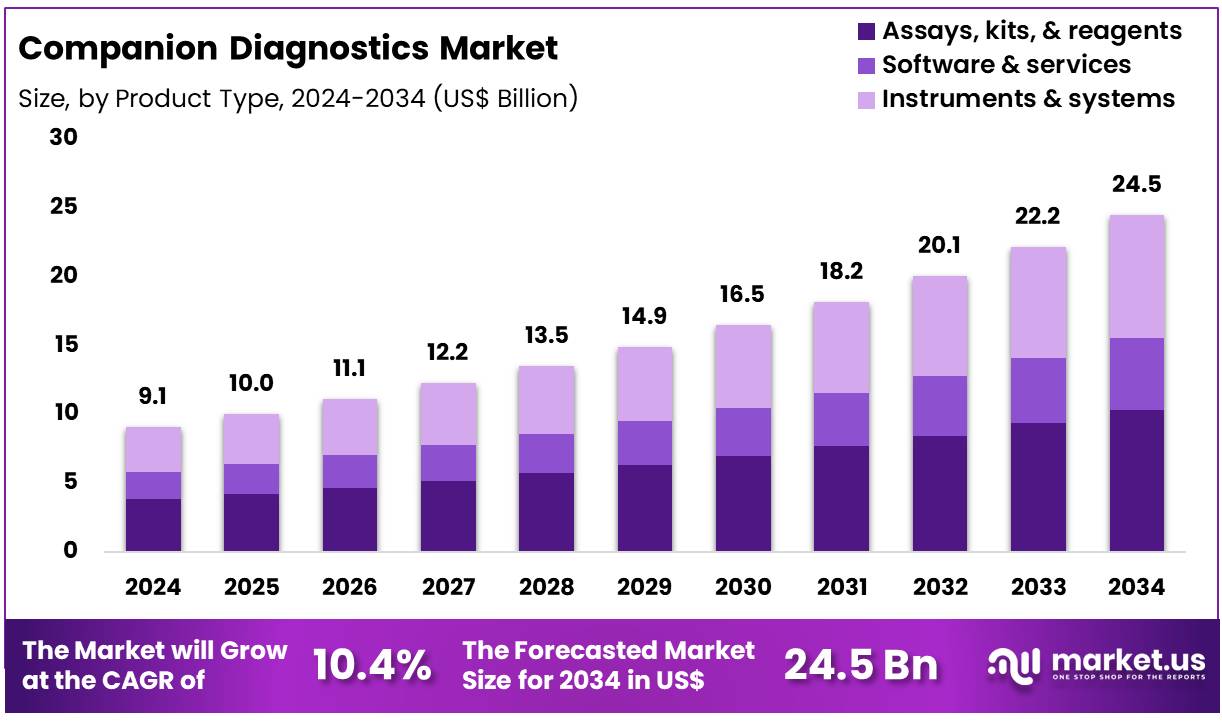

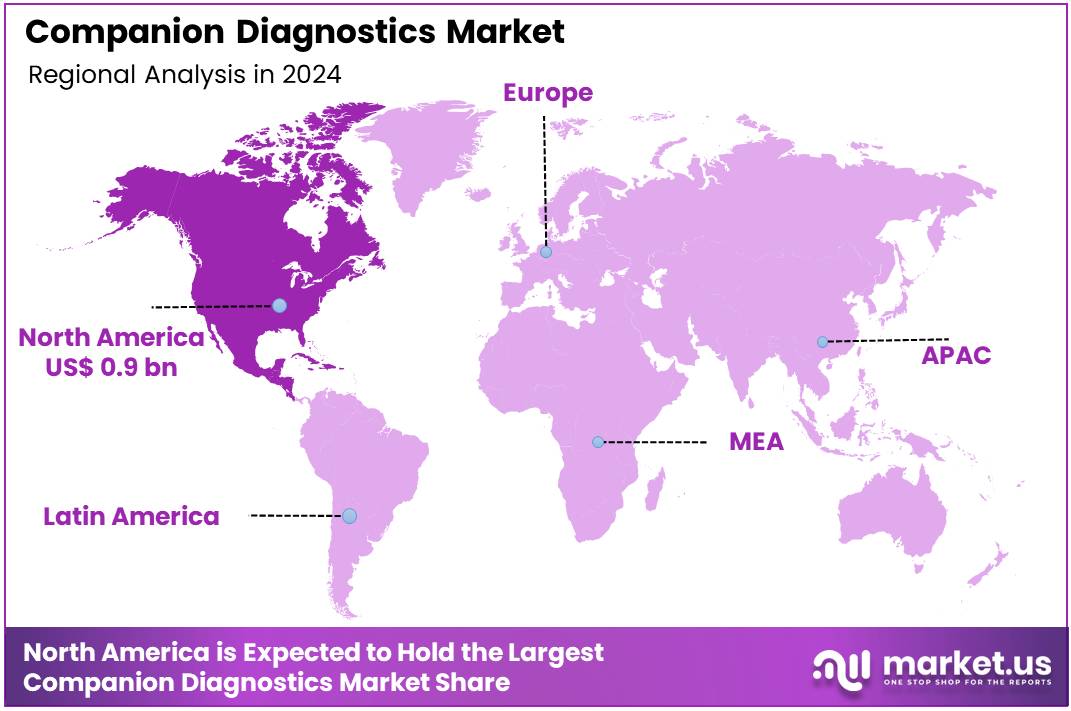

The Global Companion Diagnostics Market size is expected to be worth around US$ 24.5 Billion by 2034 from US$ 9.1 Billion in 2024, growing at a CAGR of 10.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.3% share with a revenue of US$ 0.9 Billion.

Increasing demand for personalized medicine is driving the growth of the companion diagnostics market, as healthcare providers seek precise tools to optimize patient treatment plans. Companion diagnostics help determine the right patients for specific therapies, particularly in oncology, rare diseases, and genetic disorders. The rising prevalence of chronic conditions and cancer has made personalized treatment essential for improving clinical outcomes.

According to the US National Cancer Institute, nearly 1.9 million people are diagnosed with cancer annually in the US, underscoring the need for tailored therapies. In April 2024, Labcorp’s nAbCte Anti-AAVRh74var HB-FE Assay was approved by the FDA as a companion diagnostic for Pfizer’s BEQVZ™ gene therapy for hemophilia B, ensuring accurate patient selection and enhancing treatment efficacy. As the focus on precision medicine intensifies, the demand for companion diagnostics that support targeted therapies is expected to continue its upward trajectory.

Growing regulatory support for personalized treatments and the increasing adoption of targeted therapies in oncology and immunology are creating new opportunities for the companion diagnostics market. Regulatory bodies, such as the FDA, have streamlined approval pathways for companion diagnostics in recent years, encouraging the development of innovative diagnostic tests. The FDA approved over 20 new molecular entity drugs in 2023, with several requiring companion diagnostics for patient stratification.

Companies are also leveraging advances in artificial intelligence (AI) and machine learning to enhance the predictive accuracy of companion diagnostics, helping clinicians select the most effective therapies. Additionally, partnerships between pharmaceutical companies and diagnostic providers are fostering the development of integrated solutions for tailored therapies, particularly in oncology, where personalized treatment is critical. These collaborations will continue to open new avenues for growth and innovation in the companion diagnostics space.

Rising investment in gene therapies and immunotherapies is shaping the latest trends in the companion diagnostics market, particularly for rare diseases and precision oncology treatments. Companion diagnostics play a crucial role in identifying patients who are most likely to benefit from gene-based therapeutics and immunotherapies, especially as these treatments become more widespread. For instance, a recent report from the FDA indicated that over 20 gene therapies received approval in 2023, emphasizing the growing need for diagnostic tools to ensure safe and effective treatment.

As gene editing technologies, such as CRISPR, gain traction in clinical settings, the role of companion diagnostics in personalized therapies will expand. Additionally, the use of liquid biopsy tests for early cancer detection and monitoring therapeutic responses is increasingly prevalent, providing a non-invasive option for patients. These trends suggest that companion diagnostics will play an integral role in the evolution of modern medicine, enabling better patient outcomes through tailored therapeutic interventions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 9.1 Billion, with a CAGR of 10.4%, and is expected to reach US$ 24.5 Billion by the year 2034.

- The product type segment is divided into assays, kits, & reagents, software & services, and instruments & systems, with assays, kits, & reagents taking the lead in 2023 with a market share of 42.1%.

- Considering technology, the market is divided into polymerase chain reaction (PCR), next-generation sequencing (NGS), magnetic resonance imaging (MRI), in situ hybridization (ISH), immunohistochemistry (IHC), and others. Among these, polymerase chain reaction (PCR) held a significant share of 30.3%.

- Furthermore, concerning the application segment, the market is segregated into oncology, neurological disorders, infectious diseases, cardiovascular diseases, and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 43.5% in the market.

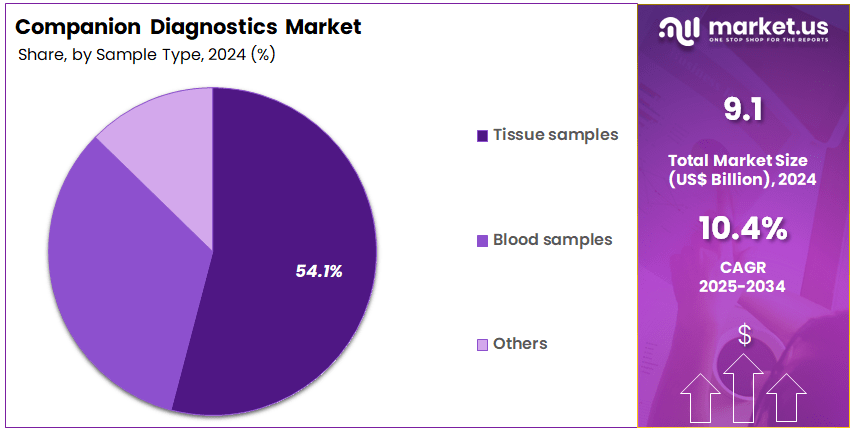

- The sample type segment is segregated into tissue samples, blood samples, and others, with the tissue samples segment leading the market, holding a revenue share of 54.1%.

- The end-user segment is divided into academic & research centers, reference laboratories, pharmaceutical & biotechnology companies, hospitals & physician laboratories, CROs, and others, with academic & research centers taking the lead in 2023 with a market share of 27.5%.

- North America led the market by securing a market share of 40.3% in 2023.

Product Type Analysis

Assays, kits, and reagents hold a 42.1% share of the companion diagnostics market and are expected to maintain strong growth due to increasing demand for accurate, rapid diagnostic testing. The rising prevalence of chronic diseases, especially cancer and infectious diseases, is driving demand for advanced diagnostic solutions. These products enable precise, personalized treatment plans, crucial for improving patient outcomes. The expansion of biomarker testing, particularly in oncology, is expected to fuel growth.

The ongoing trend of moving diagnostics to decentralized settings, such as clinics and patient homes, further increases the use of these products. Technological innovations and developments in multiplex testing are likely to enhance assay capabilities, enabling detection of multiple biomarkers simultaneously. Furthermore, regulatory support and rising healthcare investments in diagnostic technologies are expected to contribute to the market’s growth.

Technology Analysis

Polymerase chain reaction (PCR) holds a 30.3% share and is anticipated to remain the leading technique in the companion diagnostics market, projected to grow significantly due to its critical role in DNA/RNA analysis. PCR’s high sensitivity and precision in detecting genetic mutations, infections, and various biomarkers make it essential in personalized medicine. The adoption of PCR in oncology and infectious diseases, driven by its ability to detect early-stage diseases, is expected to contribute to substantial growth.

The increased focus on liquid biopsy technologies, in which PCR plays a vital role, is likely to enhance the testing capabilities for non-invasive cancer diagnostics. Additionally, PCR’s applications in identifying genetic mutations that influence drug responses are expected to increase its use in precision medicine. Innovations in PCR-based diagnostic kits and growing demand for point-of-care PCR testing further support the segment’s continued expansion.

Application Analysis

Oncology represents 43.5% of the market and remains the dominant application in the companion diagnostics sector, expected to witness robust growth driven by rising cancer incidence and the increasing adoption of targeted therapies. Companion diagnostics in oncology are essential for identifying the most suitable treatments for patients, enhancing therapeutic efficacy and minimizing adverse effects. The rapid advancements in precision oncology, where diagnostic tests match patients with the best-targeted therapies, are anticipated to further propel this segment.

The expanding approval of biomarker-based diagnostic tests by regulatory authorities is expected to support market growth. Additionally, increasing government and healthcare provider focus on personalized cancer treatments, along with the growing demand for genetic testing, is likely to drive the oncology companion diagnostics segment forward. Partnerships between diagnostic companies and pharmaceutical firms are expected to accelerate the development and adoption of companion diagnostics in oncology.

Sample Type Analysis

Tissue samples dominate the sample type segment with a 54.1% share and are projected to continue growing due to their pivotal role in diagnosing cancer and other chronic diseases. Tissue biopsies remain the gold standard for obtaining a comprehensive molecular profile of tumors, making them essential for companion diagnostics, particularly in oncology. As precision medicine evolves, tissue samples are expected to play a critical role in identifying actionable biomarkers and developing personalized treatment regimens.

Advances in tissue sampling techniques, such as liquid biopsy and minimally invasive biopsy methods, are likely to enhance the efficiency of tissue collection and testing. The growing demand for molecular diagnostics in oncology and neurological disorders is expected to sustain this segment’s dominance. Furthermore, improvements in tissue preservation and analysis technologies are anticipated to enhance diagnostic accuracy, driving growth in the tissue sample market.

End-User Analysis

Academic and research centers account for 27.5% of the market share and are expected to remain the leading end-users in the companion diagnostics market due to their role in developing and validating new diagnostic tests. These centers are at the forefront of cutting-edge research in genomics, proteomics, and molecular diagnostics, driving innovation in companion diagnostics. As research into personalized medicine continues to grow, the demand for high-quality diagnostic tools and assays in academic settings is anticipated to increase.

These centers play a crucial role in discovering new biomarkers and developing diagnostic tests that will later be commercialized. With substantial funding from both public and private sectors, academic institutions are expected to continue investing in state-of-the-art diagnostic equipment and technologies. The collaboration between academic researchers, biotechnology companies, and pharmaceutical firms is likely to further accelerate the growth of the companion diagnostics market in academic and research environments.

Key Market Segments

By Product Type

- Assays, Kits, & Reagents

- Software & Services

- Instruments & Systems

By Technology

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Magnetic Resonance Imaging (MRI)

- In Situ Hybridization (ISH)

- Immunohistochemistry (IHC)

- Others

By Application

- Oncology

- Neurological Disorders

- Infectious Diseases

- Cardiovascular Diseases

- Others

By Sample Type

- Tissue Samples

- Blood Samples

- Others

By End-User

- Academic & Research Centers

- Reference Laboratories

- Pharmaceutical & Biotechnology Companies

- Hospitals & Physician Laboratories

- CROs

- Others

Drivers

Growing Adoption of Personalized Medicine is driving the market

The increasing focus on personalized medicine, particularly in oncology, is the principal driver fueling the expansion of the Companion Diagnostics (CDx) market. Personalized medicine aims to tailor medical treatment to the individual characteristics of each patient, and CDx are indispensable for identifying patients who are most likely to benefit from specific targeted therapies, thereby maximizing drug efficacy and minimizing adverse effects.

The co-development of a therapeutic drug and its corresponding diagnostic test ensures that a drug is used safely and effectively, embedding the diagnostic step directly into the treatment protocol. This synergistic approach drastically improves clinical trial success rates and patient outcomes, pushing pharmaceutical companies toward more CDx co-development strategies. This trend is clearly reflected in the regulatory landscape, as the US Food and Drug Administration (FDA) continues to clear and approve new CDx devices alongside novel drug therapies.

The year 2024 saw the FDA’s Center for Drug Evaluation and Research (CDER) approve 50 novel drug therapies. This continuous pipeline of new therapeutics creates an inherent and growing demand for paired companion diagnostics. Looking back at the recent past, the FDA approved 37 novel drugs in 2022 and 55 in 2023, which underscores the consistent volume of new approvals that require CDx for safe and effective use. The steady flow of new targeted therapies, as evidenced by these yearly figures from the FDA, directly sustains the demand and growth of the companion diagnostics market.

Restraints

Complex and Variable Reimbursement Policies are restraining the market

The fragmented and often inconsistent reimbursement landscape for Companion Diagnostics presents a significant restraint on market growth, particularly in major healthcare systems like the United States. Unlike therapeutic drugs, which have relatively established reimbursement pathways, CDx tests often face complex and protracted coverage decisions from various payers, including government entities and private insurance companies. This variability creates uncertainty for manufacturers and diagnostic laboratories, delaying patient access to essential testing.

The lack of standardized coding and the requirement for separate reimbursement approval from local or regional payers complicates the commercialization of new CDx. This is further exacerbated by the evolving regulatory oversight for Laboratory Developed Tests (LDTs). As part of its greater oversight, the FDA issued a final rule in May 2024, which is set to phase out the general enforcement discretion for LDTs. This change is anticipated to impose new, significant compliance costs on laboratories, thereby affecting their ability to offer certain CDx tests and complicating the cost structure for payers.

The challenge is magnified when considering that many laboratories use LDTs to provide necessary companion diagnostic testing, and the increased regulatory burden from the 2024 rule introduces new hurdles that must be overcome before widespread patient access and smooth reimbursement can be achieved.

Opportunities

Expansion of Companion Diagnostics Beyond Oncology is creating growth opportunities

The expansion of Companion Diagnostics into non-oncology therapeutic areas represents a substantial growth opportunity for the market. While oncology has historically been the primary focus, the principle of personalized medicine is increasingly being applied to other complex diseases where specific genetic or proteomic profiles can predict response to therapy. This includes areas such as infectious diseases, autoimmune disorders, neurological conditions, and cardiovascular diseases.

The success demonstrated in oncology is serving as a blueprint for extending CDx utility to these new therapeutic fields. A key marker of this diversification is the increasing number of CDx-drug co-development deals outside of cancer. An example of this is the 2024 FDA approval of a specific companion diagnostic developed by Labcorp, designed to assess patient eligibility for a gene therapy used to treat hemophilia B, which is a rare, non-cancerous bleeding disorder.

This approval demonstrates that regulatory bodies are actively supporting the application of CDx technology in new areas, validating its role beyond cancer. This therapeutic diversification broadens the potential patient pool for CDx and provides new, high-value revenue streams for diagnostic developers and pharmaceutical partners outside of the highly competitive oncology space.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic pressures, including a US inflation rate of 2.9% for the 12 months ending August 2025, elevate costs for precision oncology testing developers, straining R&D budgets and slowing biomarker assay innovation. Geopolitical tensions, such as US-China trade disputes and Middle East conflicts, disrupt reagent supplies, delaying validation timelines and increasing compliance costs for global partnerships. Still, firms pivot to domestic innovation hubs and European supplier networks to enhance supply chain resilience.

Rising chronic disease prevalence fuels healthcare investments, boosting demand for targeted diagnostic platforms. Concurrently, US Section 301 tariffs of up to 100% on Chinese medical device components, effective September 27, 2025, raise procurement costs for diagnostic kits, pressuring provider margins and risking equipment shortages. Proactive companies leverage federal incentives to expand US-based manufacturing, creating high-tech jobs. These efforts streamline AI-driven workflows, strengthening the sector’s foundation. Such adaptations ensure sustained growth and innovation leadership.

Latest Trends

Increased Adoption of Liquid Biopsy as a Companion Diagnostic Platform is a recent trend (2024)

A highly significant recent trend is the rapid increase in the adoption of liquid biopsy as a platform for Companion Diagnostics, moving beyond the traditional reliance on tissue-based biopsies. Liquid biopsy, which typically analyzes circulating tumor DNA (ctDNA) from a simple blood draw, offers a non-invasive, repeatable, and less painful alternative for cancer patients. This method is particularly valuable for monitoring disease progression, detecting residual disease, and identifying mechanisms of drug resistance in real-time without the need for additional invasive procedures.

The superior convenience and ability to capture tumor heterogeneity have led to significant regulatory milestones. In August 2024, Illumina’s comprehensive cancer biomarker test was FDA-approved as a companion diagnostic to swiftly match patients with targeted therapies. This approval specifically included the use of this liquid biopsy test as a CDx for detecting NTRK gene fusions in solid tumors to guide treatment with a targeted drug. This is part of a broader acceleration in approvals for liquid biopsy CDx.

For example, another prominent diagnostic firm, Foundation Medicine, received an updated FDA approval in August 2024 for its liquid biopsy test, FoundationOne Liquid CDx, expanding its use to include patients with specific mutations in their prostate cancer for whom a targeted drug may be beneficial. These 2024 regulatory actions confirm the liquid biopsy trend by formally validating its utility as a primary companion diagnostic tool.

Regional Analysis

North America is leading the Companion Diagnostics Market

In 2024, North America held a 40.3% share of the global Companion Diagnostics market, sustained by accelerated regulatory endorsements for co-developed tests that enable precise patient selection for targeted anticancer agents, amid rising oncology caseloads and a push for value-based prescribing. Biopharmaceutical developers increasingly partnered with diagnostic innovators to validate biomarker assays, shortening time-to-market for therapies like PARP inhibitors and streamlining reimbursement pathways under Medicare Part B.

The FDA’s prioritized review mechanisms facilitated integrations with electronic health records, empowering oncologists to incorporate real-time genotyping for HER2-positive breast cancers and BRAF-mutated melanomas. Collaborative consortia between research institutes and industry refined multi-omic platforms, improving analytical validity for low-prevalence variants in underrepresented groups. Post-approval surveillance programs enhanced post-market confidence, mitigating risks of off-label use while supporting adaptive trial designs.

Economic imperatives from healthcare cost containment underscored the role of CDx in averting futile treatments, attracting institutional investments in scalable lab networks. Venture ecosystems nurtured liquid biopsy advancements, offering dynamic monitoring for resistance mutations in chronic myeloid leukemia. These synergies affirmed the region’s preeminence in biomarker-driven therapeutic ecosystems. The FDA approved five drugs with companion diagnostics in 2023, tying the record set in 2018.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific Companion Diagnostics sector to flourish during the forecast period, as regulatory bodies fortify frameworks to accelerate test-drug pairings for endemic cancers like nasopharyngeal and gastric types. Governments in China and India bolster national labs with grants for NGS validation, equipping clinicians to identify PD-L1 expression for immunotherapy eligibility in head and neck tumors.

Pharmaceutical leaders ally with domestic firms to adapt assays for ALK fusions, projecting enhanced trial enrollment in lung adenocarcinoma cohorts. Innovation centers in Tokyo and Bangalore pioneer cost-effective IHC kits, positioning district hospitals to detect KRAS alterations for colorectal regimens. Regional alliances harmonize data standards, enabling seamless import of validated panels for HER2 assessment in gastric cancers.

Local authorities anticipate expanding coverage under public insurance, incentivizing uptake of CDx for ALK inhibitors in non-small cell lung cancer. These dynamics forge a pathway for localized precision oncology infrastructure. As of June 2023, Japan’s PMDA approved 36 in vitro companion diagnostic products, underscoring progressive regulatory maturation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent organizations in the precision oncology testing field advance their market standing by deploying advanced assays that pinpoint biomarkers for targeted therapies, streamlining patient selection and treatment efficacy. They secure co-development pacts with biopharma entities to synchronize diagnostic launches with novel drugs, expediting FDA nods and amplifying commercial uptake. Executives spearhead R&D endeavors to harness NGS and liquid biopsy innovations, yielding more sensitive profiles for early detection and monitoring.

Firms consolidate through buyouts of specialized biotech ventures, weaving in proprietary panels to fortify their end-to-end offerings. They intensify outreach in rising economies across Asia-Pacific and the Middle East, aligning assays with evolving reimbursement policies to capture untapped volumes. Moreover, they institute outcome-based pricing and bundled analytics to reinforce provider trust and underpin consistent profitability.

Roche Diagnostics, a Basel, Switzerland-based powerhouse within the Roche Group, spearheads in vitro diagnostic innovations that empower personalized medicine through biomarker-driven insights. The division crafts automated IHC and ISH platforms, including the VENTANA suite, to guide oncologists in selecting therapies like Enhertu for HER2-low breast cancer.

Roche channels deep expertise into co-creating over 40 companion tests, partnering with pharma leaders to bridge lab-to-clinic gaps. CEO Thomas Schinecker steers a global operation spanning 100-plus nations, blending hardware automation with digital pathology for faster, reliable results. The entity collaborates with research consortia to pioneer liquid biopsies, enhancing accessibility in resource-limited settings. Roche Diagnostics cements its preeminence by fusing rigorous quality protocols with agile commercialization to accelerate life-altering care.

Top Key Players

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Myriad Genetics

- Illumina, Inc

- Guardant Health

- Foundation Medicine

- Hoffmann La Roche Ltd

- Agilent Technologies, Inc.

- Abbott

Recent Developments

- In January 2025, Roche received FDA approval to expand the labeling of its PATHWAY anti-Rabbit Monoclonal Primary Antibody. This enhancement allows clinicians to identify patients with HR-positive, HER2-ultralow metastatic breast cancer, facilitating more precise selection for targeted treatment regimens and strengthening Roche’s presence in precision oncology diagnostics.

- In August 2024, Illumina gained FDA clearance for its comprehensive cancer biomarker assay, integrating two companion diagnostics to match patients with personalized therapies. The test examines 500 genes in solid tumors, improving detection of actionable targets, while the TSO Comprehensive CDx identifies NTRK gene fusions, supporting the use of Bayer’s VITRAKVI (larotrectinib) for eligible patients.

Report Scope

Report Features Description Market Value (2024) US$ 9.1 Billion Forecast Revenue (2034) US$ 24.5 Billion CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Assays, Kits, & Reagents, Software & Services, and Instruments & Systems), By Technology (Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Magnetic Resonance Imaging (MRI), In Situ Hybridization (ISH), Immunohistochemistry (IHC), and Others), By Application (Oncology, Neurological Disorders, Infectious Diseases, Cardiovascular Diseases, and Others), By Sample Type (Tissue Samples, Blood Samples, and Others), By End-User (Academic & Research Centers, Reference Laboratories, Pharmaceutical & Biotechnology Companies, Hospitals & Physician Laboratories, CROs, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., QIAGEN, Myriad Genetics, Illumina, Inc, Guardant Health, Foundation Medicine, F. Hoffmann La Roche Ltd, Agilent Technologies, Inc., Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Companion Diagnostics MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Companion Diagnostics MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Myriad Genetics

- Illumina, Inc

- Guardant Health

- Foundation Medicine

- Hoffmann La Roche Ltd

- Agilent Technologies, Inc.

- Abbott