Cancer Diagnostics Market Analysis By Product Type (Consumables, Instruments, Imaging Instruments, Biopsy Instruments), By Technology (IVD Testing, Imaging, Biopsy Techniques), By Application (Breast Cancer, Skin Cancer, Prostate Cancer, Lung Cancer, Liver Cancer, Kidney Cancer, Blood Cancer, Pancreatic Cancer, Ovarian Cancer, Others), By End-User (Diagnostic Laboratories & Imaging Centers, Hospitals & Clinics, Research Institutes), By End-User (Diagnostic Laboratories & Imaging Centers, Hospitals & Clinics, and Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 59341

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

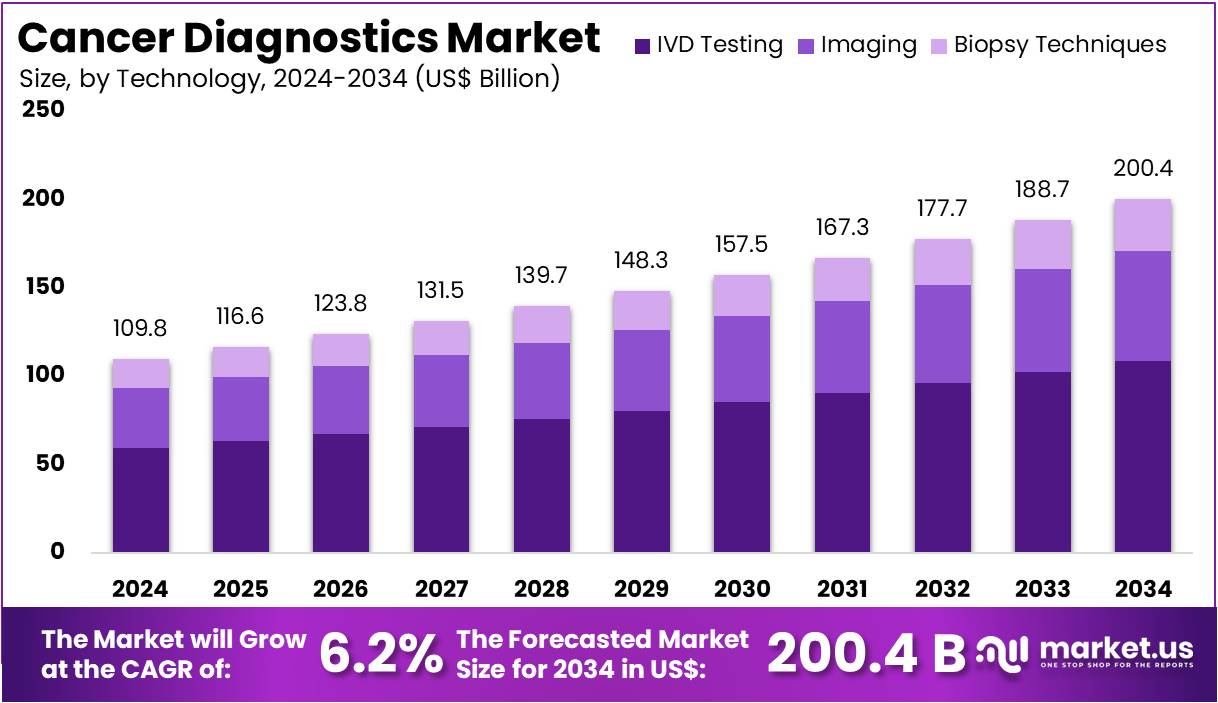

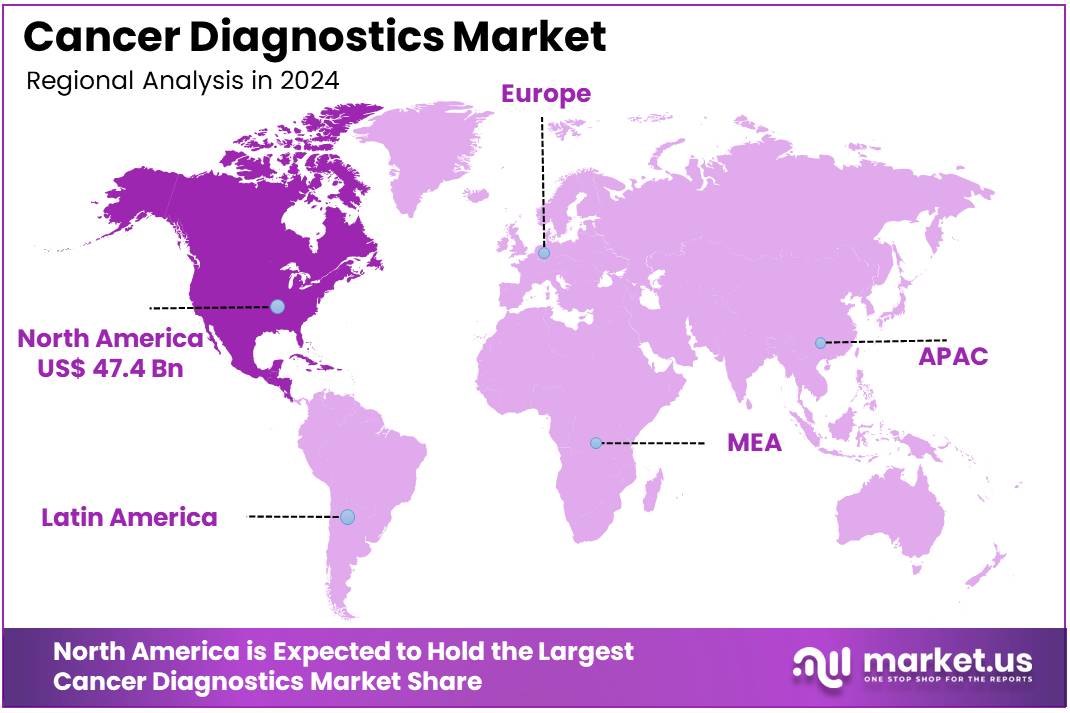

The Cancer Diagnostics Market size is expected to be worth around US$ 200.4 billion by 2034 from US$ 109.8 billion in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.2% share and holds US$ 47.4 Billion market value for the year.

The global rise in cancer cases is significantly increasing the demand for cancer diagnostics. In 2022, nearly 20 million new cancer cases and 9.7 million deaths were recorded worldwide. This number is projected to reach 35.3 million new cases and 18.2 million deaths by 2050. In the U.S., the cancer incidence rate was 445.8 per 100,000 people from 2018 to 2022. India may witness a 12.8% increase in cancer incidence by 2025 compared to 2020. These statistics underscore the urgent need for early and accurate cancer detection solutions.

Cancer diagnostics are becoming essential in enabling early intervention and improving survival rates. Early diagnosis increases treatment effectiveness and reduces overall healthcare burden. Diagnostic advancements support the identification of cancer at earlier, more treatable stages. This includes innovations in imaging, pathology, and molecular testing. The growing cancer burden is pushing healthcare systems to invest in sophisticated diagnostic technologies. Governments and healthcare providers are prioritizing early detection programs to manage the rising caseload efficiently and improve patient outcomes across all cancer types.

The market is also gaining from the shift toward precision medicine. Diagnostic tests now guide therapy decisions based on the genetic makeup of both the tumor and the patient. Technologies like next-generation sequencing (NGS) and liquid biopsy are becoming mainstream. These tools offer faster, more accurate, and less invasive diagnostics than traditional methods. Biomarker discovery continues to grow, helping clinicians identify cancer subtypes and predict treatment responses. Such personalized approaches are improving treatment success rates and driving sustained demand for advanced diagnostics.

Artificial intelligence (AI) is increasingly integrated into cancer diagnostics. AI-driven platforms assist in interpreting imaging, pathology slides, and genomic data. These tools improve diagnostic accuracy and speed while reducing human error. Machine learning algorithms support oncologists in identifying patterns that may not be visible through conventional methods. This leads to quicker clinical decision-making and more effective treatment planning. The AI integration trend is expected to expand further, offering a competitive edge to diagnostics providers focusing on smart healthcare technologies.

The rising demand for companion diagnostics is another key market driver. These tests help select targeted therapies tailored to individual patients. For example, in February 2023, F. Hoffmann-La Roche extended its partnership with Janssen to develop companion diagnostics. This collaboration supports the growth of personalized oncology solutions. As treatments become more targeted, the diagnostics sector must evolve accordingly. Ongoing innovations in both molecular and imaging diagnostics are enhancing cancer care by enabling earlier detection and more precise monitoring of therapy effectiveness.

Key Takeaways

- In 2024, the market for cancer diagnostics generated a revenue of US$ 109.8 billion, with a CAGR of 6.2%, and is expected to reach US$ 200.4 billion by the year 2034.

- The product type segment is divided into consumables, instruments, imaging instruments, and biopsy instruments, with consumables taking the lead in 2024 with a market share of 42.3%.

- Considering technology, the market is divided into IVD testing, imaging, and biopsy techniques. Among these, IVD testing held a significant share of 54.2%.

- Concerning the application segment, the breast cancer sector stands out as the dominant player, holding the largest revenue share of 30.8% in the cancer diagnostics market.

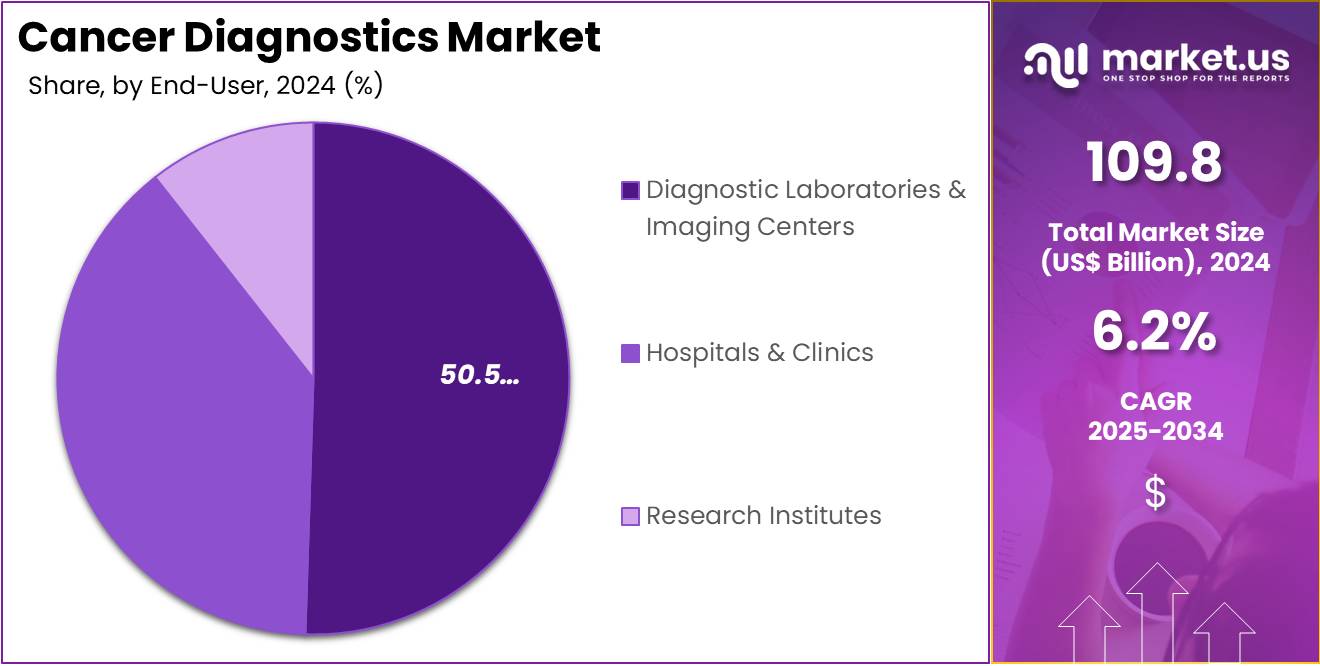

- The end-user segment is segregated into diagnostic laboratories & imaging centers, hospitals & clinics, and research institutes, with the diagnostic laboratories & imaging centers segment leading the market, holding a revenue share of 50.5%.

- North America led the market by securing a market share of 43.2% in 2024.

Product Type Analysis

Consumables are expected to lead the cancer diagnostics market, holding 42.3% of the market share. The demand for consumables, such as reagents, test kits, and diagnostic tools, is projected to increase as the prevalence of cancer continues to rise globally. Consumables are a fundamental part of any diagnostic process, particularly in molecular diagnostics, where accurate and timely test results are critical for effective treatment decisions. The growing adoption of advanced technologies in cancer diagnosis, such as IVD testing and imaging, will drive the demand for consumables used in these processes.

Additionally, as more healthcare facilities and diagnostic labs embrace cancer screening and early detection initiatives, the market for consumables is expected to expand, contributing significantly to overall market growth. With innovations in testing reagents and diagnostic kits that offer higher sensitivity and specificity, the consumables segment is likely to maintain its dominant position.

Technology Analysis

In vitro diagnostic (IVD) testing is projected to be the leading technology in the cancer diagnostics market, holding 54.2% of the market share. The growth of this segment is expected to be driven by the increasing reliance on IVD technologies for early detection and diagnosis of various cancers.

IVD testing provides accurate and reliable results, which are crucial for determining treatment plans and monitoring patient progress. As more healthcare providers adopt IVD solutions for cancer screening, particularly for high-incidence cancers such as breast and lung cancer, the demand for IVD technologies will continue to rise.

The advancements in molecular diagnostics, biomarker detection, and genetic testing are anticipated to drive the further expansion of the IVD testing market. Additionally, the growing preference for non-invasive testing and home-based diagnostic solutions will further fuel the adoption of IVD technologies, making it a dominant technology in cancer diagnostics.

Application Analysis

Breast cancer is expected to be the largest application segment in the cancer diagnostics market, comprising 30.8% of the market share. The demand for diagnostic solutions for breast cancer is projected to rise due to the increasing prevalence of the disease and the growing focus on early detection and personalized treatment. Technologies like mammography, breast ultrasound, and biopsy techniques are widely used for screening and diagnosing breast cancer, and advancements in these methods are likely to enhance their effectiveness.

The growing awareness about breast cancer, combined with the increasing availability of screening programs and diagnostic tests, will likely drive market growth in this segment. Furthermore, the rise in targeted therapies and personalized medicine for breast cancer patients is anticipated to increase the need for more precise and reliable diagnostic tools. As early detection improves outcomes, the demand for breast cancer diagnostics will continue to grow, maintaining its dominant share in the market.

End-User Analysis

Diagnostic laboratories and imaging centers are projected to remain the largest end-users in the cancer diagnostics market, holding 50.5% of the market share. These facilities play a vital role in the diagnosis and early detection of cancer by offering advanced imaging services, laboratory testing, and screenings. The increasing number of diagnostic laboratories and imaging centers worldwide, coupled with the growing demand for cancer screening services, is expected to drive the expansion of this segment.

The shift towards more centralized diagnostic services, along with advancements in diagnostic imaging technologies such as MRI, CT scans, and PET scans, is anticipated to further boost the demand for cancer diagnostic services in these centers. Additionally, the rising healthcare awareness among the general population and the increasing focus on preventive healthcare will likely lead to higher patient volumes, supporting the growth of this segment in the market. As healthcare systems continue to prioritize cancer detection and management, diagnostic laboratories and imaging centers will maintain a dominant role in the market.

Key Market Segments

By Product Type

- Consumables

- Antibodies

- Probes

- Kits & Reagents

- Other Consumables

- Instruments

- Tissue Processing Systems

- Slide Staining Systems

- PCR Instruments

- Pathology-based Instruments

- NGS Instruments

- Microarrays

- Cell Processors

- Other Pathology-based Instruments

- Imaging Instruments

- Biopsy Instruments

By Technology

- IVD Testing

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Microarrays

- In Situ Hybridization (ISH)

- Immunohistochemistry (IHC)

- Immunoassays

- Flow Cytometry

- Other IVD Testing Technologies

- Imaging

- Ultrasound

- Positron Emission Tomography (PET)

- Mammography

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Biopsy Techniques

By Application

- Breast Cancer

- Skin Cancer

- Prostate Cancer

- Lung Cancer

- Liver Cancer

- Kidney Cancer

- Blood Cancer

- Pancreatic Cancer

- Ovarian Cancer

- Others

By End-User

- Diagnostic Laboratories & Imaging Centers

- Hospitals & Clinics

- Research Institutes

Drivers

Rising Global Cancer Incidence is Driving the Market

The increasing global incidence of various cancer types stands as a primary driver for the cancer diagnostics market. As more individuals are diagnosed with cancer, the demand for effective and accurate diagnostic tools, including imaging, laboratory tests, and biopsies, naturally escalates. Early and precise diagnosis is crucial for effective treatment planning and improving patient outcomes, making diagnostic solutions indispensable.

According to the World Health Organization (WHO) and the International Agency for Research on Cancer (IARC), there were an estimated 20 million new cases of cancer globally in 2022, and 9.7 million deaths from cancer. The IARC also projects that the global cancer burden will increase significantly, by about 77% by 2050, further straining health systems. This alarming and growing prevalence of cancer worldwide creates a continuous and urgent need for advanced diagnostic technologies, driving investment in research, development, and commercialization of new diagnostic assays and platforms.

Restraints

High Cost of Advanced Diagnostic Technologies is Restraining the Market

A significant restraint on the cancer diagnostics market is the prohibitively high cost associated with many advanced diagnostic technologies and sophisticated equipment. Modern diagnostic modalities, such as Positron Emission Tomography (PET) scans, advanced Magnetic Resonance Imaging (MRI), next-generation sequencing (NGS), and complex immunohistochemistry platforms, require substantial capital investment for acquisition, installation, and maintenance.

Furthermore, the reagents and consumables used in molecular diagnostic tests can also be expensive, contributing to the overall cost burden. While exact government-published figures for the comprehensive cost of all cancer diagnostic equipment are not centrally available, it is widely acknowledged that establishing and maintaining high-quality diagnostic facilities, especially in low- and middle-income countries, presents a significant financial challenge.

For instance, discussions around improving cancer care access, as highlighted in “CANCER CONTROL 2024” publications, often point to the insufficient health infrastructure and financial resources in many regions globally, where high equipment costs are a major barrier to widespread adoption of advanced diagnostics. This economic barrier limits accessibility, particularly in resource-constrained healthcare settings, thereby restricting the market’s full potential.

Opportunities

Advancements in Liquid Biopsy Technologies Create Growth Opportunities

Ongoing advancements in liquid biopsy technologies are creating strong growth opportunities in the cancer diagnostics market. Liquid biopsies are minimally invasive tests that detect cancer-related biomarkers such as circulating tumor DNA, circulating tumor cells, and exosomes from fluids like blood. These tests offer a less painful and lower-risk alternative to traditional tissue biopsies. The clinical use of liquid biopsy is growing due to its effectiveness in early detection, monitoring treatment response, and tracking minimal residual disease. Its adoption is expected to increase across several cancer care pathways.

Regulatory support has accelerated this trend. The U.S. Food and Drug Administration (FDA) continues to approve companion diagnostic devices that use liquid biopsy. As of March 2025, UnitedHealthcare’s medical policy considers both tissue and liquid biopsy testing medically necessary for certain advanced cancers. When ordered within 30 days and meeting defined criteria, such dual testing is now recognized as clinically valid. This policy shift highlights growing clinical acceptance and the movement toward routine integration of liquid biopsy in cancer diagnostics.

At the American Association for Cancer Research (AACR) Annual Meeting in April 2025, new research confirmed the promise of liquid biopsy. Data showed its ability to detect molecular relapse months before clinical symptoms appear. This enables timely interventions and supports better outcomes. The non-invasive approach also allows repeated testing and broader molecular profiling. These benefits position liquid biopsy as a key technology driving market expansion and future clinical adoption.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the cancer diagnostics market, primarily through their impact on healthcare expenditure, government funding for research, and patient affordability. During periods of economic stability and growth, governments and private payers often increase their healthcare budgets, which can facilitate greater investment in advanced diagnostic technologies and broader coverage for diagnostic procedures.

Conversely, economic downturns or high inflation rates can lead to tightened healthcare budgets, potentially delaying the adoption of new, expensive diagnostic equipment or limiting patient access to crucial tests due to higher out-of-pocket costs. The International Monetary Fund (IMF) indicated in their April 2025 “World Economic Outlook” that global population aging will increase fiscal pressures, which directly impacts healthcare systems’ ability to fund costly cancer care.

Geopolitical factors, such as international trade policies affecting the import and export of medical equipment and reagents, and the stability of global supply chains for diagnostic components, also play a crucial role. Political instability or trade disputes can disrupt supply chains, increase manufacturing costs, and create uncertainty for global distribution, affecting the timely availability and pricing of essential diagnostic tools.

However, the universally recognized urgency of early and accurate cancer diagnosis, given its profound impact on public health and treatment outcomes, ensures sustained advocacy and investment in the cancer diagnostics market, fostering its continued innovation and global reach despite broader economic and political challenges.

Current U.S. tariff policies have a direct impact on the cancer diagnostics market. These policies influence the cost of imported medical devices, diagnostic equipment, and lab reagents. The cancer diagnostics sector heavily depends on global supply chains. Many imaging systems and molecular diagnostic tools are made abroad or contain foreign components. According to the U.S. Census Bureau’s 2024 trade report, imports of medical, surgical, and optical instruments totaled US$ 124.8 billion. Pharmaceutical preparation imports reached US$ 247 billion. Any new tariffs could raise acquisition costs for hospitals and labs.

As costs rise due to tariffs, U.S.-based diagnostic labs and healthcare providers may face financial pressure. This could lead to increased pricing for diagnostic tests. Investment in new technology may slow down. It may also reduce the speed at which innovative diagnostic tools are adopted. These effects could delay patient access to advanced cancer diagnostics. Institutions might postpone equipment upgrades, impacting diagnostic accuracy and timely treatment planning.

On the other hand, tariffs could incentivize domestic manufacturing. Companies may shift production of cancer diagnostic equipment and reagents to the U.S. This approach could enhance the security and resilience of diagnostic supply chains. Though initial setup and compliance costs are high, localized production may reduce dependence on global suppliers. Long-term benefits may include greater control over technology availability and a stronger U.S. diagnostics ecosystem.

Latest Trends

Increasing Integration of Artificial Intelligence (AI) in Pathology is a Recent Trend

A prominent recent trend in the cancer diagnostics market is the increasing integration of Artificial Intelligence (AI) into digital pathology workflows for enhanced diagnostic accuracy, efficiency, and accessibility. AI-powered algorithms analyze high-resolution digital images of tissue slides, assisting pathologists in identifying cancerous cells, classifying tumor subtypes, and even predicting patient outcomes with greater precision and speed. This augments human expertise, reduces inter-observer variability, and can help in prioritizing complex cases.

The American Society of Clinical Oncology (ASCO) Annual Meeting 2025 featured research on AI-supported pathology training, demonstrating significant advancements. For instance, a study presented at ASCO 2025 showed that AI-supported training led to a 40% increase in accurate identification of HER2-ultralow breast cancer cases, crucial for targeted therapies.

Furthermore, as discussed in a June 2025 OncoDaily article, AI systems are now processing large volumes of medical images, pathology slides, and genomic sequences to identify hidden patterns, transforming how cancer is detected. This technological advancement is improving diagnostic consistency and making high-quality pathology services more accessible, especially through telepathology, which uses AI to address disparities in remote areas.

Regional Analysis

North America is leading the Cancer Diagnostics Market

North America dominated the market with the highest revenue share of 43.2% owing to rising cancer burden, continuous advancements in diagnostic technologies, and robust healthcare infrastructure. The Centers for Disease Control and Prevention (CDC) reported that in the United States, 1,851,238 new cancer cases were identified in 2022, underscoring the pervasive need for effective detection methods.

Canada similarly projected 247,100 new cancer cases in 2024, with lung, breast, prostate, and colorectal cancers being the most common diagnoses, according to the Canadian Cancer Statistics Dashboard. This high incidence necessitates widespread and early detection.

Regulatory bodies like the U.S. Food and Drug Administration (FDA) have facilitated this growth by approving numerous innovative diagnostic devices and tests; for instance, in 2023, the FDA’s Center for Devices and Radiological Health (CDRH), in collaboration with the Oncology Center of Excellence (OCE), authorized 118 oncology devices, including 61 in-vitro diagnostics (IVDs), with 26 IVDs having new indications. Key players in the region’s market also reflect this expansion.

Exact Sciences, a prominent provider of cancer screening and diagnostic tests, reported total revenue of US$ 2.76 billion for the full year 2024, an increase of 10% compared to 2023, with its Precision Oncology revenue reaching US$ 655 million. These factors collectively highlight a dynamic and expanding market for detecting malignant conditions in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing prevalence of cancer across the region, improving healthcare infrastructure, and rising public awareness about early diagnosis. In China, an estimated 4,824,700 new cancer cases occurred in 2022, as reported by the National Cancer Center of China, emphasizing the immense demand for screening tools.

The World Health Organization (WHO) also estimates that in the South-East Asia Region, 2.37 million new cases of cancer were recorded in 2022, highlighting the significant disease burden. Governments in key Asian countries are actively implementing strategies to enhance early detection. For example, Japan saw its colorectal cancer screening participation increase from 40.5% in 2021 to 48.7% in 2022, indicating a recovery in screening efforts post-pandemic.

India’s Ministry of Health and Family Welfare continues to bolster its cancer control programs, which often include provisions for improved diagnostic facilities, although specific funding allocations for diagnostics alone are integrated into broader health budgets. Furthermore, the growing adoption of advanced medical technologies and the increasing investment by international diagnostic companies in these rapidly developing economies are projected to propel the availability and utilization of advanced tools, thereby facilitating robust growth for early disease detection across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cancer diagnostics market are using several strategies to sustain growth. One key focus is the expansion of product portfolios. This includes developing novel tools for early cancer detection and personalized treatment. Many companies are investing in automation and high-throughput technologies. These technologies help improve accuracy, scalability, and speed. Strategic collaborations with biotech firms, research centers, and hospitals also support innovation. Furthermore, establishing manufacturing and distribution networks in high-demand regions ensures efficient delivery and meets the rising need for advanced cancer diagnostics.

Illumina, Inc., based in San Diego, California, is a major player in the cancer diagnostics market. The company focuses on next-generation sequencing (NGS) technologies. Its comprehensive product range supports various genomic research and clinical applications. Illumina’s high-throughput sequencing platforms allow precise identification of cancer-related genetic mutations. This makes it a vital contributor to early and personalized cancer diagnostics. Its technologies help in mapping tumor genomes, which is critical for targeted therapy and better patient outcomes.

Through ongoing innovation, Illumina continues to lead advancements in genomic diagnostics. The company invests heavily in R&D and forms partnerships to expand its global reach. Its collaborations with clinical labs and healthcare providers enhance technology integration. Illumina also focuses on improving accessibility by expanding into emerging markets. These efforts reinforce its position as a market leader. The company’s strategy aligns with the rising global demand for precise, personalized cancer detection solutions.

Top Key Players in the Cancer Diagnostics Market

- QIAGEN

- Hologic, Inc

- Guardant Health, Inc

- GE Healthcare

- Hoffmann-La Roche Ltd

- Danaher Corporation

- BD

- Abbott

Recent Developments

- In December 2024, Guardant Health, Inc. formed a collaboration with Boehringer Ingelheim aimed at securing regulatory approval and expanding the market reach of the Guardant360 CDx liquid biopsy. This innovative diagnostic tool will be used in conjunction with zongertinib, a new tyrosine kinase inhibitor (TKI) designed to target HER2 in non-small cell lung cancer (NSCLC), with a focus on reducing its impact on EGFR.

- In November 2024, it was reported that Danaher Corporation had announced the launch of two new Centers of Innovation in Diagnostics as part of its commitment to advancing precision medicine. According to the update, the first center is scheduled to open in July in Newcastle, United Kingdom, where it will serve as a research hub fostering collaboration with top pharmaceutical companies and academic institutions. The facility will be operated by Leica Biosystems, a Danaher subsidiary, and notably, it will mark the company’s first CLIA CAP-accredited laboratory.

Report Scope

Report Features Description Market Value (2024) US$ 109.8 billion Forecast Revenue (2034) US$ 200.4 billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables (Antibodies, Probes, Kits & Reagents, and Other Consumables), Instruments (Tissue Processing Systems, Slide Staining Systems, PCR Instruments, Pathology-based Instruments, NGS Instruments, Microarrays, Cell Processors, and Other Pathology-based Instruments), Imaging Instruments, and Biopsy Instruments), By Technology (IVD Testing (Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Microarrays, In Situ Hybridization (ISH), Immunohistochemistry (IHC), Immunoassays, Flow Cytometry, and Other IVD Testing Technologies), Imaging (Ultrasound, Positron Emission Tomography (PET), Mammography, Magnetic Resonance Imaging (MRI), and Computed Tomography (CT)), and Biopsy Techniques), By Application (Breast Cancer, Skin Cancer, Prostate Cancer, Lung Cancer, Liver Cancer, Kidney Cancer, Blood Cancer, Pancreatic Cancer, Ovarian Cancer, and Others), By End-User (Diagnostic Laboratories & Imaging Centers, Hospitals & Clinics, and Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape QIAGEN, Hologic, Inc, Guardant Health, Inc, GE Healthcare, F. Hoffmann-La Roche Ltd, Danaher Corporation, BD, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- QIAGEN

- Hologic, Inc

- Guardant Health, Inc

- GE Healthcare

- Hoffmann-La Roche Ltd

- Danaher Corporation

- BD

- Abbott