In Vitro Diagnostics Market By Product Type (Reagents, Instruments, and Services), By Technology (Hematology, Immunology, Coagulation, Molecular Diagnostics, Clinical Chemistry, Microbiology, and Others), By Application (Diabetes, Infectious Disease, Oncology, Cardiology, Nephrology, Drug Testing, Autoimmune Diseases, and Others), By End-use (Hospital, Laboratory, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 96594

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

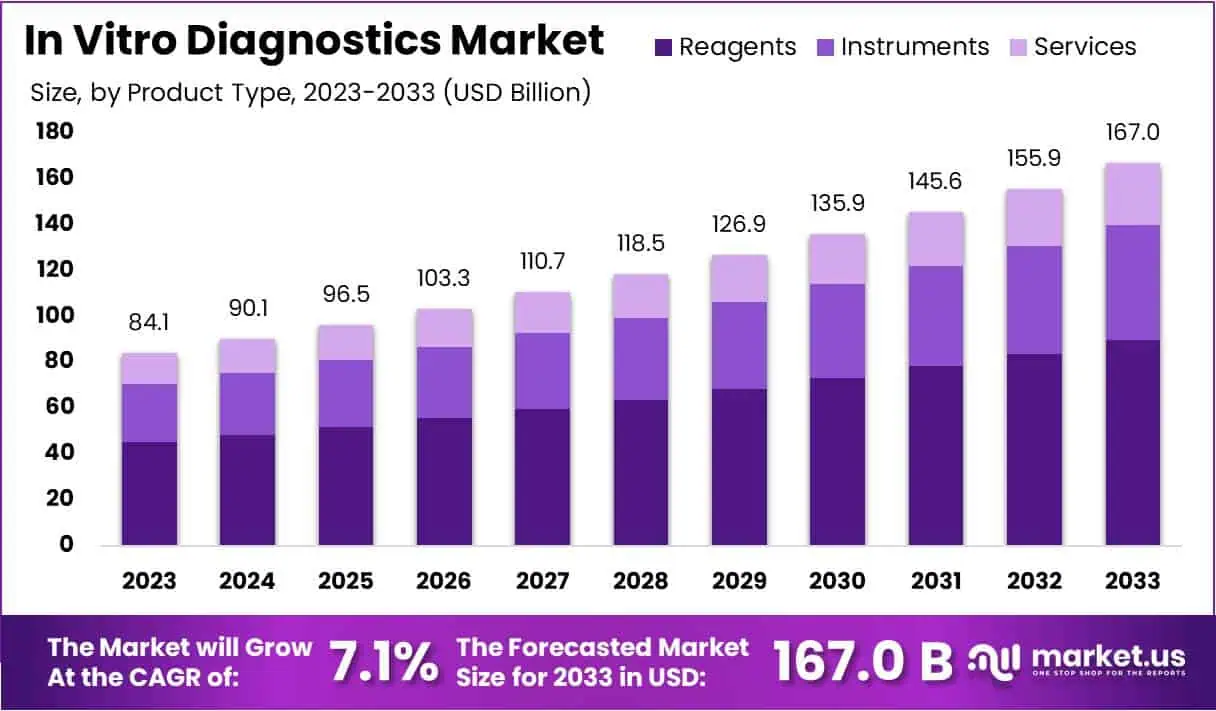

The In Vitro Diagnostics Market Size is expected to be worth around US$ 167.0 billion by 2033 from US$ 84.1 billion in 2023, growing at a CAGR of 7.1% during the forecast period 2024 to 2033.

Rising technological innovations significantly propel growth in the in vitro diagnostics (IVD) market, which plays a crucial role in areas such as infectious disease detection, oncology, and chronic disease management. The demand for precise and timely diagnostic solutions continues to escalate as healthcare systems emphasize early disease detection and effective patient management.

Recent advancements underscore this trend; for instance, in August 2022, Roche introduced the Digital LightCycler System, a state-of-the-art digital polymerase chain reaction (PCR) platform designed to enhance diagnostic accuracy in cancer and various other diseases. Following this, Danaher Corporation launched the Xpert Xpress MVP in November 2022, a multiplexed PCR test that allows simultaneous detection of multiple pathogens, streamlining the diagnostic process. Moreover, Agilent Technologies Inc. made strides in the market with its launch of a real-time reverse transcription (qRT) PCR diagnostic kit in March 2021, specifically developed for detecting SARS-CoV-2 RNA.

These developments reflect a broader industry trend toward integrating advanced technologies and automation in IVD systems, which improves efficiency and reduces turnaround times. Additionally, the increasing focus on point-of-care testing opens new opportunities for market expansion, as healthcare providers seek rapid diagnostic solutions that can be deployed outside traditional laboratory settings. As regulatory support for innovative diagnostic technologies continues to strengthen, the IVD market stands poised for sustained growth, driven by an urgent need for effective disease prevention and management strategies.

Key Takeaways

- In 2023, the market for In Vitro Diagnostics generated a revenue of US$ 84.1 billion, with a CAGR of 7.1%, and is expected to reach US$ 167.0 billion by the year 2033.

- The product type segment is divided into reagents, instruments, and services, with reagents taking the lead in 2023 with a market share of 53.8%.

- Considering technology, the market is divided into hematology, immunology, coagulation, molecular diagnostics, clinical chemistry, microbiology, and others. Among these, molecular diagnostics held a significant share of 39.5%.

- Furthermore, concerning the application segment, the market is segregated into diabetes, infectious disease, oncology, cardiology, nephrology, drug testing, autoimmune diseases, and others. The infectious disease sector stands out as the dominant player, holding the largest revenue share of 44.3% in the In Vitro Diagnostics market.

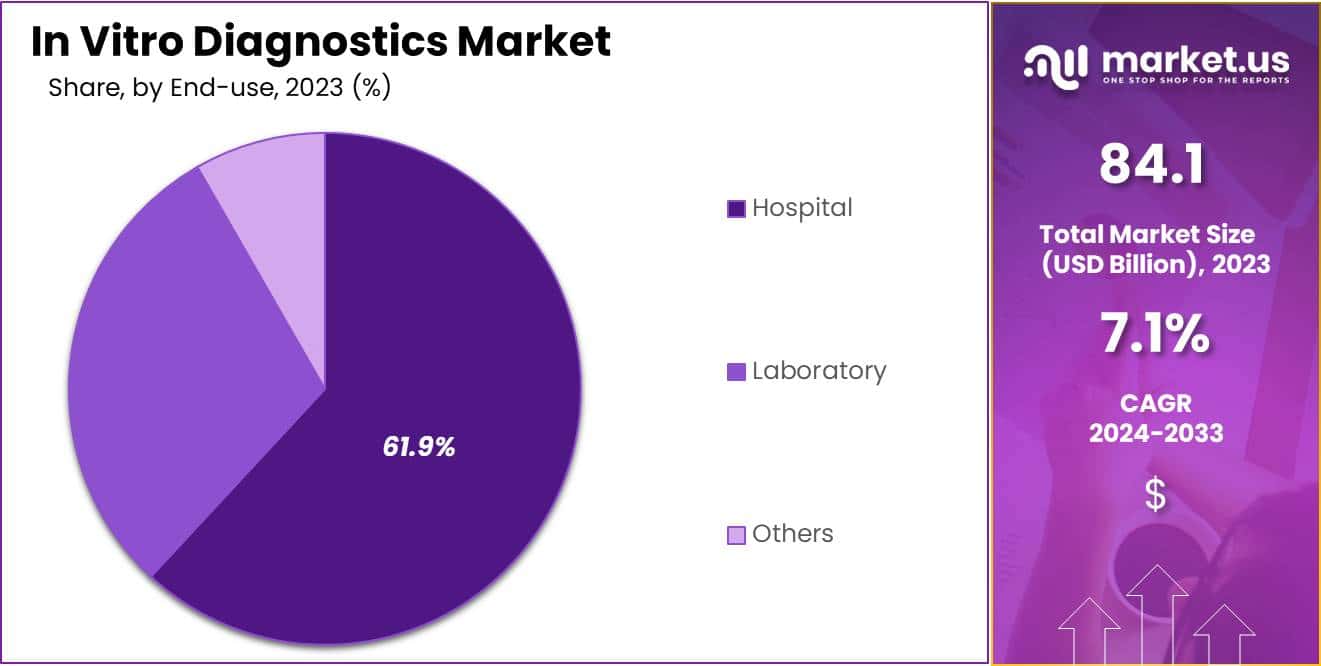

- The end-use segment is segregated into hospital, laboratory, and others, with the hospital segment leading the market, holding a revenue share of 61.9%.

- North America led the market by securing a market share of 39.2% in 2023.

Product Type Analysis

The reagents segment led in 2023, claiming a market share of 53.8% owing to an increasing demand for precise and reliable testing solutions. Healthcare providers are likely to prioritize accurate diagnostics to enhance patient outcomes, leading to a rise in reagent consumption. The growing prevalence of chronic diseases and infectious conditions is anticipated to spur the need for a variety of reagents used in diagnostic tests, including those for blood glucose monitoring and infectious disease detection.

Additionally, advancements in reagent technology, such as the development of high-throughput assays and multiplex testing capabilities, are projected to make diagnostics more efficient and effective. As laboratories and healthcare facilities continue to adopt automated systems, the demand for compatible reagents will likely increase, further bolstering this segment’s growth. The trend toward personalized medicine, which relies on tailored testing, will also create additional opportunities for reagent manufacturers, making this segment a critical component of the overall diagnostics landscape.

Technology Analysis

The molecular diagnostics held a significant share of 39.5% due to technological advancements that enhance the accuracy and efficiency of testing methods. The increasing demand for personalized healthcare solutions is likely to drive the adoption of molecular diagnostics, especially in fields like oncology and infectious disease management.

Techniques such as polymerase chain reaction (PCR) and next-generation sequencing (NGS) are anticipated to improve the detection of genetic disorders and pathogens, making them essential tools in clinical settings. The rise in chronic diseases and the growing awareness of genetic testing will further boost this segment.

Additionally, the integration of molecular diagnostics into routine clinical practice is expected to increase, as healthcare providers seek to implement precise and timely testing protocols. As the market continues to evolve, molecular diagnostics is likely to play a pivotal role in advancing patient care and therapeutic strategies.

Application Analysis

The infectious disease segment had a tremendous growth rate, with a revenue share of 44.3% as public health initiatives increasingly emphasize rapid and accurate disease detection. The ongoing emergence of new infectious agents and the resurgence of previously controlled diseases will likely drive demand for diagnostic tests capable of quickly identifying pathogens.

Innovations in testing technologies, such as point-of-care diagnostics and multiplex assays, are expected to enhance the speed and accuracy of infectious disease detection, making them invaluable in clinical and emergency settings. Furthermore, the global focus on vaccination and preventive healthcare strategies will create additional opportunities for diagnostic tests that monitor vaccine effectiveness and disease prevalence.

The increasing prevalence of antibiotic-resistant infections is also projected to enhance the need for advanced diagnostic solutions that can guide appropriate treatment options. As healthcare systems prioritize efficient disease management, the infectious disease segment is poised for robust expansion.

End-use Analysis

The hospital segment grew at a substantial rate, generating a revenue portion of 61.9% due to its critical role in patient care and disease management. Hospitals are likely to invest in advanced diagnostic technologies to improve patient outcomes and streamline operations, driving significant demand for in vitro testing solutions.

The growing emphasis on early diagnosis and treatment, especially for chronic and infectious diseases, will further enhance the reliance on diagnostic tools within hospital settings. As patient populations increase and healthcare demands evolve, hospitals are anticipated to expand their diagnostic capabilities to meet the need for accurate and timely results.

The trend toward integrated healthcare services, where diagnostics play a key role in treatment planning, is also projected to drive growth in this segment. Furthermore, the increasing adoption of electronic health records (EHR) will facilitate better data management and patient tracking, further solidifying the importance of hospital-based diagnostics in the overall healthcare landscape.

Key Market Segments

By Product Type

- Reagents

- Instruments

- Services

By Technology

- Hematology

- Immunology

- Coagulation

- Molecular Diagnostics

- Clinical Chemistry

- Microbiology

- Others

By Application

- Diabetes

- Infectious Disease

- Oncology

- Cardiology

- Nephrology

- Drug Testing

- Autoimmune Diseases

- Others

By End-use

- Hospital

- Laboratory

- Others

Drivers

Growing Prevalence of Cancer Drives Market Growth

Increasing prevalence of cancer significantly drives the in vitro diagnostics market. The rising number of cancer cases worldwide necessitates improved diagnostic solutions that facilitate early detection and effective treatment monitoring.

In February 2022, Invitae Corporation, a prominent medical genetics firm, launched its initial CE-IVD Cancer Testing Kits in Europe, featuring the FusionPlex Dx and LiquidPlex Dx. These kits represent a significant advancement in cancer diagnostics by enabling healthcare professionals to identify genetic mutations associated with various malignancies.

As awareness of cancer’s impact on public health grows, patients and healthcare providers are likely to demand more sophisticated and precise diagnostic tools. The expanding focus on personalized medicine further enhances the need for advanced testing solutions, leading to robust growth in the market for in vitro diagnostic technologies.

Restraints

Surge in New Product Launches Restraints Market Expansion

High levels of new product launches can restrain the growth of the in vitro diagnostics market. While innovation is crucial for advancing medical testing, the rapid introduction of numerous products may lead to market saturation, causing confusion among healthcare providers and patients.

This overwhelming variety of options can impede effective decision-making for practitioners, making it challenging to select the most suitable diagnostic solutions. Additionally, frequent product changes may disrupt established clinical practices, as laboratories and healthcare facilities must continually adapt to new technologies.

The competition among manufacturers to differentiate their offerings could also hamper the overall growth of the market by complicating regulatory approvals and increasing costs related to training and integration.

Opportunities

Surge in New Product Launches Creates Opportunities

Rising number of new product launches presents significant opportunities for the in vitro diagnostics market. The continuous introduction of innovative diagnostic solutions enhances the capacity of healthcare providers to accurately and efficiently detect diseases. For instance, in November 2023, Roche introduced the Elecsys Anti-HEV IgM and Elecsys Anti-HEV IgG immunoassays, aimed at detecting hepatitis E virus infections in countries that accept the CE mark.

Additionally, BioGX launched a CE-marked point-of-care three-gene multiplex COVID-19 test on its pixl platform in July 2022, reflecting the demand for rapid and reliable testing solutions. In March 2021, F. Hoffmann-La Roche Ltd. unveiled the Cobas pulse point-of-care blood glucose testing instrument, expected to replace the Accu-Chek Inform IIs. As these products enter the market, they are anticipated to improve diagnostic capabilities and drive growth, enabling healthcare systems to better respond to emerging health challenges and enhance patient outcomes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a vital role in shaping the market for diagnostic testing solutions. Economic downturns often lead to budget cuts in healthcare spending, which can restrict access to advanced testing technologies. Rising inflation affects the costs of raw materials and manufacturing, leading to higher prices for diagnostic products.

Geopolitical tensions can disrupt supply chains, resulting in delays and shortages of essential components. On the positive side, increased government focus on healthcare reform and investments in diagnostic technologies create opportunities for market growth. The rising prevalence of infectious diseases and chronic conditions drives demand for accurate testing solutions. Overall, while challenges exist due to economic and geopolitical uncertainties, the ongoing commitment to improving healthcare outcomes and advancing diagnostic capabilities presents a promising outlook for the industry.

Trends

Impact of Growing Awareness of Non-Communicable Diseases on the In Vitro Diagnostics Market: Growing awareness of non-communicable diseases is expected to significantly drive growth in the market for diagnostic testing solutions. As the public and healthcare professionals recognize the importance of early detection and management of these conditions, the demand for effective screening tools continues to rise.

This trend promotes innovation and leads to the development of advanced diagnostic technologies that enhance patient care. For example, in January 2023, Cipla Inc. introduced a point-of-care testing device designed to address various non-communicable diseases and other medical conditions. This launch reflects the industry’s responsiveness to the increasing need for accessible and timely diagnostic solutions. As individuals and healthcare providers prioritize proactive health management, the market is likely to witness substantial growth, ultimately improving health outcomes for populations worldwide.

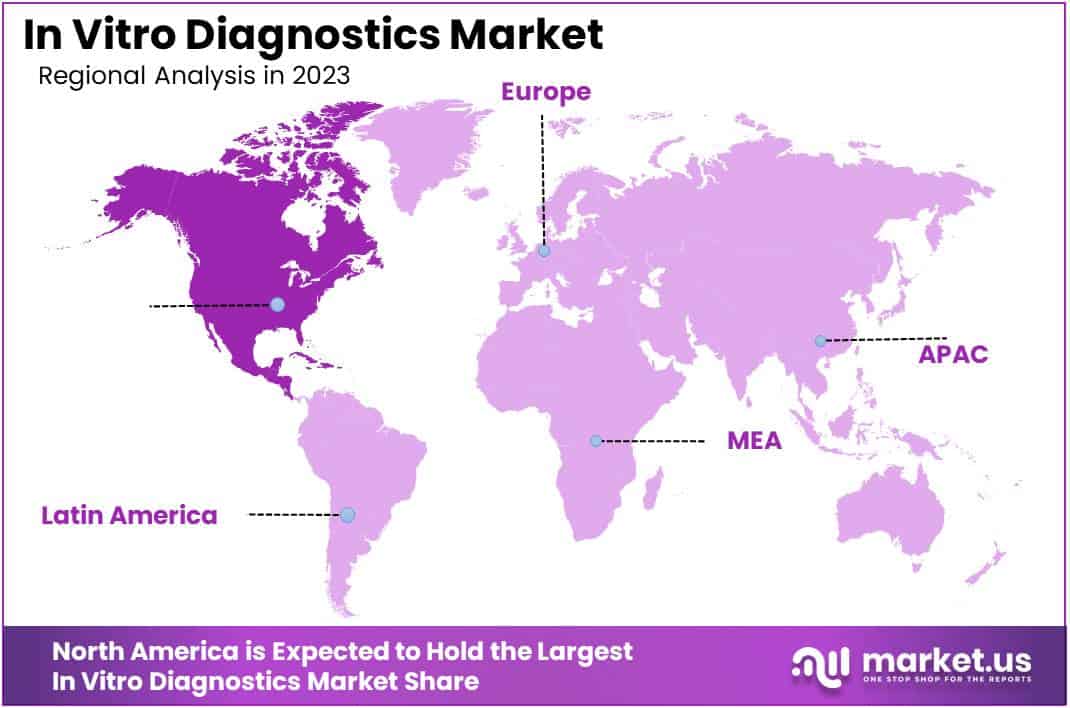

Regional Analysis

North America is leading the In Vitro Diagnostics Market

North America dominated the market with the highest revenue share of 39.2% owing to several key factors that reflect the increasing demand for advanced diagnostic solutions. The rising incidence of chronic diseases, coupled with a growing emphasis on preventive healthcare, has intensified the need for effective diagnostic tools that enable early detection and management of various health conditions.Furthermore, technological advancements in laboratory automation and point-of-care testing have enhanced the efficiency and accuracy of diagnostic processes.

A significant milestone occurred in July 2023, when Siemens obtained FDA clearance for its Atellica CI Analyzer, which is designed for immunoassay and clinical chemistry applications. This launch in major global markets highlights the trend toward integrating cutting-edge technologies into laboratory settings, providing healthcare professionals with reliable and timely test results.

Additionally, the increasing focus on personalized medicine and the integration of artificial intelligence in diagnostics have further propelled market growth. Collectively, these factors have fostered a conducive environment for the in vitro diagnostics market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the in vitro diagnostics market is expected to experience substantial growth during the forecast period. The rising prevalence of chronic and infectious diseases, along with an expanding aging population, is anticipated to drive demand for effective diagnostic solutions.

Significant investments in healthcare infrastructure and technology across countries such as India, China, and Japan are likely to enhance access to innovative diagnostic tools.

For instance, in January 2023, FUJIFILM Sonosite, Inc. introduced the Sonosite PX ultrasound system in India, aiming to improve clinician ergonomics and enhance operational efficiency. This launch exemplifies the region’s commitment to advancing healthcare delivery through modern diagnostic technologies.

Additionally, the increasing awareness of the importance of early disease detection, along with the growing adoption of home-based testing, is projected to further stimulate market growth. As healthcare systems evolve to meet rising demands for efficient diagnostics, the market for in vitro solutions in Asia Pacific is likely to flourish, driven by innovation and enhanced healthcare access.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the In Vitro Diagnostics market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the diagnostics market drive growth through a strong emphasis on technological innovation and comprehensive product portfolios.

They allocate significant resources to research and development, focusing on advanced testing methods, such as next-generation sequencing and point-of-care diagnostics, which enhance accuracy and speed. Forming strategic alliances with healthcare providers and research institutions allows them to expand their market presence and ensure the adoption of their products in clinical settings.

Companies actively engage in mergers and acquisitions to enhance their capabilities and integrate complementary technologies that bolster their offerings. Additionally, they prioritize regulatory compliance and robust marketing strategies to build trust and establish strong relationships with healthcare professionals and patients.

Top Key Players in the In Vitro Diagnostics Market

- Sysmex Corporation

- Hoffmann-La Roche Ltd.

- Danaher

- Bio-Rad laboratories

- Becton Disckinson

- Beckman Coulter

- Arkray

- Abbott Laboratories

- Thermo Fisher

- NeoGenomics

Recent Developments

- In December 2023: Thermo Fisher introduced the Applied Biosystems MagMAX Dx Viral/Pathogen NA Isolation Kit along with the Thermo Scientific KingFisher Apex Dx, an automated nucleic acid purification device designed for the separation and purification of bacterial and viral pathogens from respiratory biological specimens. The launch of these advanced diagnostic tools is expected to enhance the efficiency and accuracy of respiratory pathogen testing, thereby driving growth in the in vitro diagnostics market.

- In March 2023: NeoGenomics, a prominent provider of oncology testing and global contract research services, announced the expansion of its next-generation sequencing (NGS) portfolio with the commercial release of several tests, including Neo Comprehensive – Solid Tumor, a comprehensive genomic profile (CGP) for solid tumors, and Neo Comprehensive – Myeloid Disorders, a CGP for myeloid neoplasms. This expansion signifies the increasing demand for advanced genomic testing in oncology, which is likely to contribute significantly to the growth of the in vitro diagnostics market as healthcare providers increasingly adopt innovative diagnostic solutions.

- In February 2021: Thermo Fisher Scientific launched its CE-IVD-marked Applied Biosystems TaqPath COVID–19 HT Kit, compatible with the Amplitude platform. This product launch represented a key advancement in COVID-19 testing capabilities, underscoring the essential role of in vitro diagnostics during public health emergencies. The heightened focus on rapid and reliable diagnostic solutions during the pandemic has accelerated market growth, fostering innovation and expansion in the in vitro diagnostics sector.

Report Scope

Report Features Description Market Value (2023) US$ 84.1 billion Forecast Revenue (2033) US$ 167.0 billion CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents, Instruments, and Services), By Technology (Hematology, Immunology, Coagulation, Molecular Diagnostics, Clinical Chemistry, Microbiology, and Others), By Application (Diabetes, Infectious Disease, Oncology, Cardiology, Nephrology, Drug Testing, Autoimmune Diseases, and Others), By End-use (Hospital, Laboratory, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sysmex Corporation, Hoffmann-La Roche Ltd., Danaher, Bio-Rad laboratories, Becton Disckinson, Beckman Coulter, Arkray, Abbott Laboratories, Thermo Fisher, and NeoGenomics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  In Vitro Diagnostics MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

In Vitro Diagnostics MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Sysmex Corporation

- Hoffmann-La Roche Ltd.

- Danaher

- Bio-Rad laboratories

- Becton Disckinson

- Beckman Coulter

- Arkray

- Abbott Laboratories

- Thermo Fisher

- NeoGenomics