Global Influenza Diagnostics Market Analysis By Test Type (RIDT, RT-PCR, Cell Culture, Other Test Types), By End-use (Hospitals, POCT, Laboratories), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 16459

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

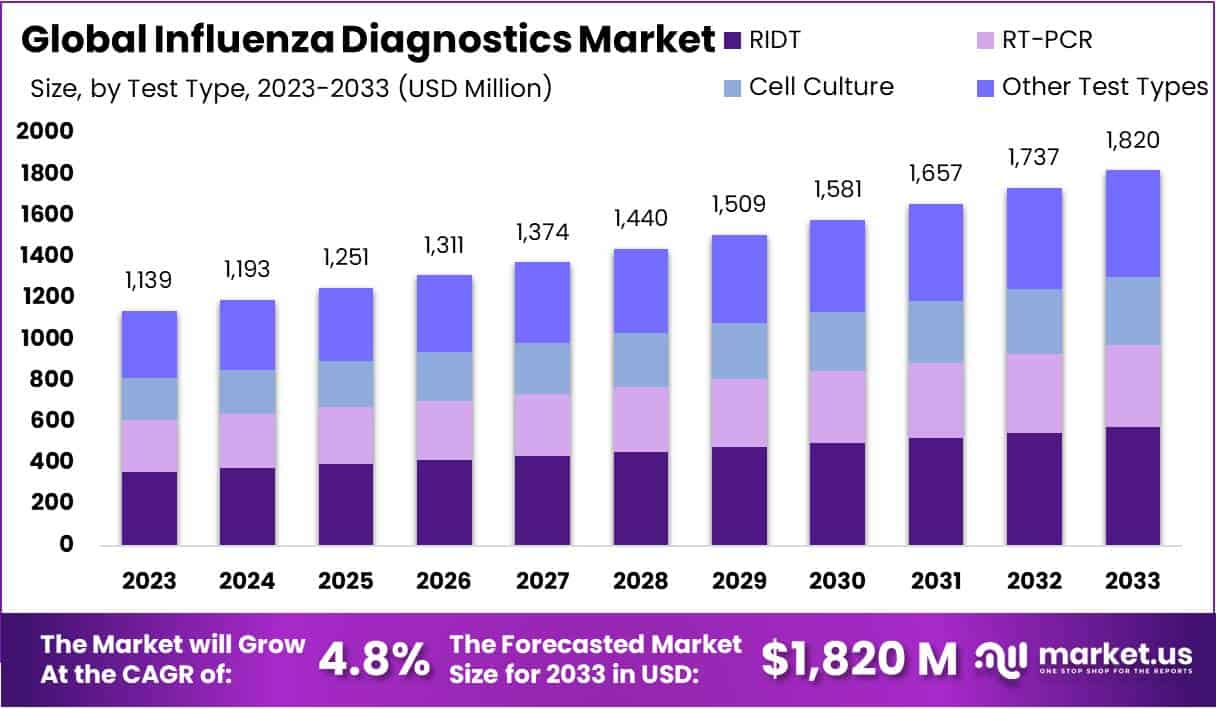

The Influenza Diagnostics Market Size is anticipated to reach approximately USD 1820 Million by 2033, showing a significant growth from its value of USD 1139 Million in 2023. This growth is projected at a Compound Annual Growth Rate (CAGR) of 4.8% throughout the forecast period spanning from 2024 to 2033.

Influenza Diagnostics refers to the processes and technologies used for the identification and characterization of influenza viruses, commonly known as the flu. This field is crucial in healthcare, as it enables the rapid and accurate detection of flu strains, facilitating timely treatment and management of the disease.

The Influenza Diagnostics market, a dynamic and rapidly evolving sector, encompasses a wide array of diagnostic tests and technologies designed for flu detection. This market is characterized by significant investments, groundbreaking innovations, and strategic partnerships, reflecting the growing demand for advanced diagnostic solutions.

Recent investments have been substantial in this market. For instance, Abbott Laboratories received a notable ~USD 314 million from BARDA for developing a rapid test that distinguishes between influenza A and B strains. Similarly, FluGen’s advancement of an AI-powered platform for flu virus identification was supported by a USD 30 million Series B funding. Mesa Biotech’s expansion in production capacity for its QuickVue Influenza A+B Test, backed by ~USD 17 million, also exemplifies the market’s growth trajectory.

In terms of innovation, Roche Diagnostics and LumiraDx have launched highly sensitive and specific tests for flu detection, marking a shift towards more precise and user-friendly diagnostic methods. Additionally, BGI Genomics’ next-generation sequencing approach represents a significant advancement in flu virus surveillance and mutation identification.

Strategic alliances and acquisitions are also shaping the market. Notable examples include BD’s acquisition of BioGX and Qiagen’s collaboration with Alnylam Pharmaceuticals, both aimed at enhancing diagnostic capabilities. Abbott Laboratories’ partnership with the University of Washington School of Medicine in developing an AI-based surveillance system is another key development.

The Influenza Diagnostics market is further characterized by regulatory milestones such as the FDA’s EUA for new rapid tests and WHO’s updated diagnostic recommendations. This highlights the sector’s alignment with global health standards and its responsiveness to emerging flu trends.

Key Takeaways

- Market Growth Projection: The Influenza Diagnostics Market is forecasted to reach USD 1820 Million by 2033, with a notable 4.8% CAGR from 2024 to 2033.

- Recent Investments: Significant funding, e.g., Abbott Laboratories’ USD 314 million, emphasizes robust financial support for innovative diagnostic solutions.

- Innovative Trends: Advances from Roche Diagnostics, LumiraDx, and BGI Genomics reflect a market shift towards more precise and user-friendly diagnostic methods.

- Strategic Alliances: Notable collaborations, such as BD’s acquisition of BioGX and Qiagen’s partnership with Alnylam Pharmaceuticals, shape the market’s landscape.

- Dominant Test Type: In 2023, the Rapid Influenza Diagnostic Test (RIDT) segment dominated with a 31.6% market share, driven by efficiency and swift results.

- Emerging Molecular Diagnostics: Molecular diagnostic tests, integrating PCR technology, gain traction, offering heightened sensitivity and specificity.

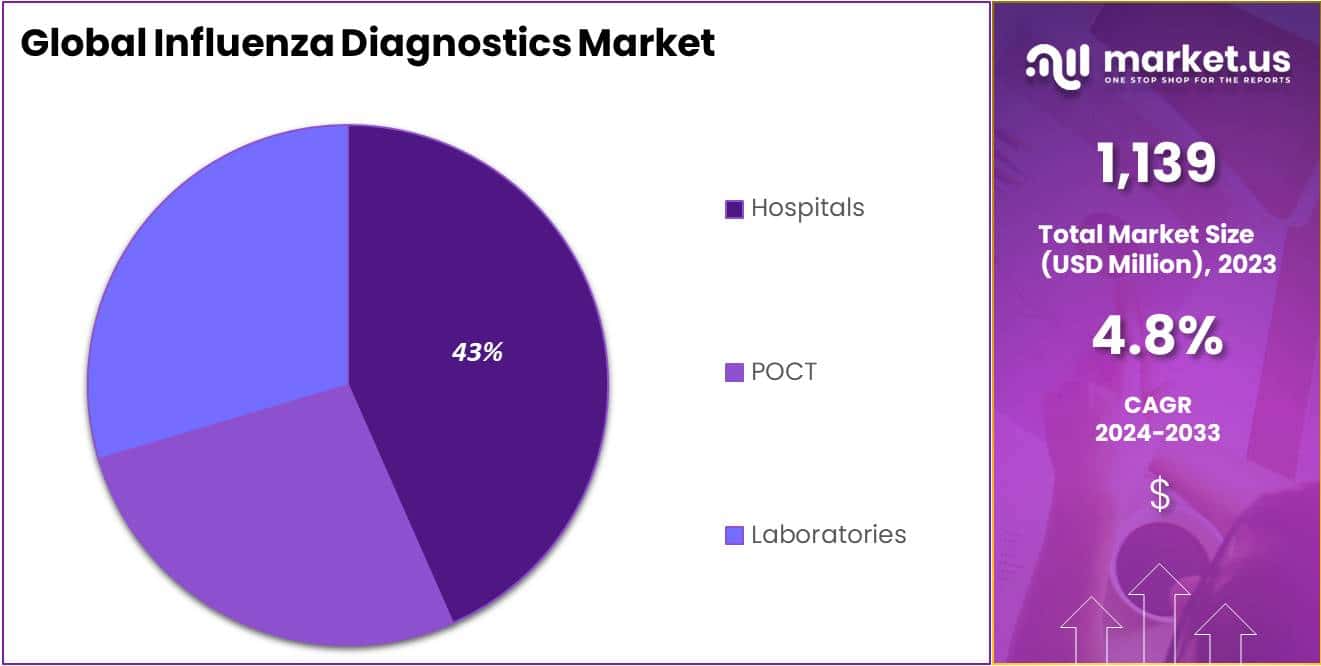

- Leading End-use Segment: Hospitals led the market in 2023, holding over 43.4% market share, attributed to comprehensive diagnostic and treatment services.

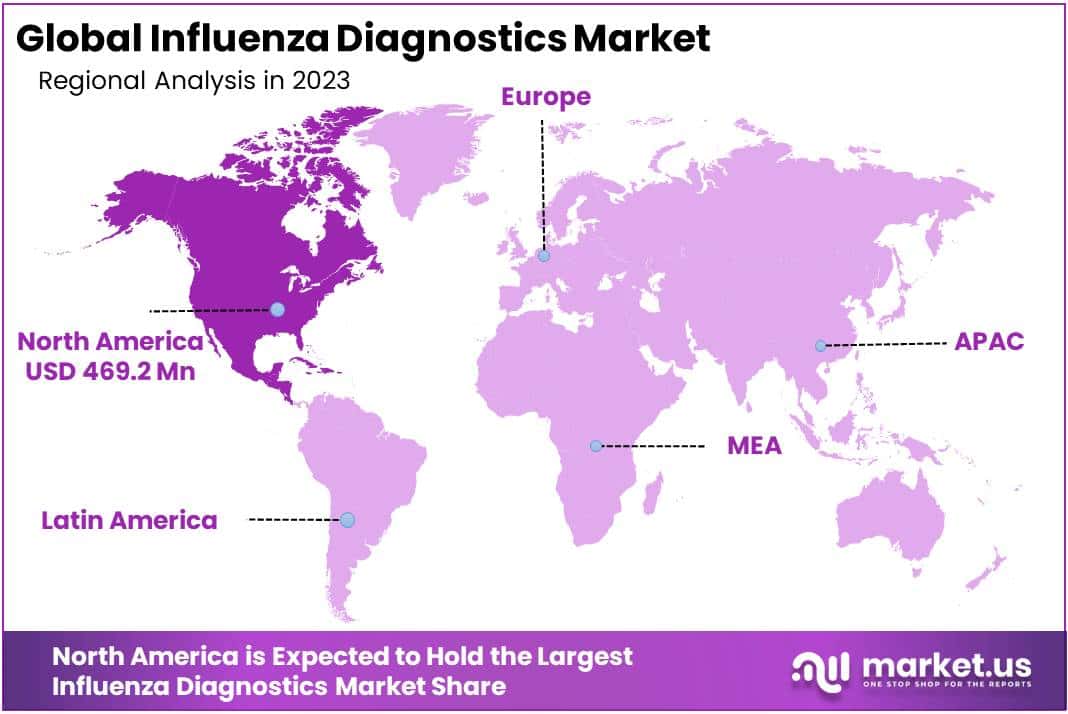

- Regional Dominance: In 2023, North America captured a dominant market position with a 41.2% share, driven by advanced healthcare infrastructure and substantial investments.

- Fastest-Growing Region: The Asia-Pacific region emerges as the fastest-growing market, driven by increasing healthcare expenditure and a growing prevalence of influenza cases.

- Opportunities in Technology: Advancements in molecular diagnostics, point-of-care testing, and AI integration present opportunities for market expansion and improved accessibility.

Test Type Analysis

In 2023, the Rapid Influenza Diagnostic Test (RIDT) segment emerged as a dominant force in the Influenza Diagnostics Market, securing a substantial 31.6% share. This prominence is attributed to RIDT’s efficiency, delivering swift results crucial for timely influenza management. The global market experienced notable growth, fueled by the escalating influenza prevalence and increased awareness of early diagnosis. Technological advancements, enhancing diagnostic accuracy, further propelled this expansion.

RIDTs, providing results within 15 minutes, gained favor in outpatient and emergency settings, pivotal for quick decision-making during influenza outbreaks. The demand for rapid solutions aligns with the global surge in influenza cases, underscoring the significance of immediate diagnostics. Concurrently, molecular diagnostic tests are gaining traction, offering heightened sensitivity and specificity.

The integration of PCR technology in influenza diagnostics is pivotal in this shift. However, challenges such as the high cost and skilled personnel requirements limit the accessibility of molecular tests, particularly in resource-limited settings. Nevertheless, RIDTs remain relevant in these scenarios, ensuring a balance between efficiency and accessibility in influenza diagnostics.

End-use Analysis

In 2023, the Hospitals segment notably dominated the Influenza Diagnostics Market, holding over 43.4% of the market share. This dominance is attributed to the comprehensive diagnostic and treatment services offered by hospitals, including advanced influenza diagnostic technologies like rapid tests and RT-PCR.

The high influx of patients, particularly during flu seasons, further elevates the demand for these diagnostic tools in hospital settings. Skilled healthcare professionals in hospitals are adept in using these advanced tools, ensuring accurate and prompt influenza diagnosis.

Moreover, hospitals often collaborate with governmental health bodies for influenza surveillance, benefiting from healthcare infrastructure investments, especially in developing regions. While hospitals continue to lead in the market, it is essential to keep an eye on other segments like diagnostic laboratories and point-of-care testing, as they might alter the market dynamics in the future.

Key Market Segments

Test Type

- RIDT

- RT-PCR

- Cell Culture

- Other Test Types

End-use

- Hospitals

- POCT

- Laboratories

Drivers

Increased Prevalence of Influenza

The Global Influenza Diagnostics Market is experiencing significant growth, primarily driven by the increasing prevalence of influenza worldwide. Influenza, often referred to as the flu, is a respiratory illness caused by flu viruses. It’s known for its widespread impact, leading to seasonal epidemics and, at times, pandemics. This surge in influenza cases globally necessitates effective and timely diagnostic solutions, propelling the demand for advanced diagnostic tools.

Annually, influenza results in approximately 3 to 5 million severe cases and up to 650,000 respiratory-related deaths, as reported by the World Health Organization. These alarming figures highlight the urgent need for efficient diagnostic methods to manage and mitigate influenza outbreaks. The market’s growth is bolstered by the escalating need for rapid and accurate influenza diagnosis, which is vital for both patient treatment and the prevention of virus spread, particularly among vulnerable populations.

In response, there’s been an increase in the development of diverse diagnostic techniques, from rapid testing to sophisticated molecular diagnostics. These advancements are key to ensuring early detection and treatment, which is crucial in minimizing the impact of influenza on public health and economies. Additionally, heightened public awareness and government-led vaccination programs are further stimulating the market, as they underscore the importance of early detection.

Restraints

High Costs and Complexity of Diagnostic Tests

The influenza diagnostics market is encountering a notable restraint due to the high costs and complexity of advanced diagnostic tests. These sophisticated diagnostic methods, crucial for timely and accurate detection of influenza, come with significant financial and operational demands. The complexity of such tests requires specialized equipment and skilled personnel, presenting a substantial challenge, especially in lower-income countries. These regions, often hit hard by influenza, struggle with the affordability and implementation of these advanced diagnostic tools, hindering the market’s expansion.

Moreover, the operational intricacies of these tests necessitate a high level of expertise, which may not be universally available. This factor not only influences the immediate adoption of these methods but also adds to the overall costs of training and operation. Furthermore, in areas where healthcare systems are less developed or patients bear a significant portion of healthcare costs, the expense of these tests limits their accessibility. This financial barrier impacts early detection and treatment of the flu, crucial for controlling its spread.

Opportunities

Technological Advancements in Diagnostic Methods

The influenza diagnostics market is experiencing a major opportunity through advancements in technology, revolutionizing influenza detection. Notably, molecular diagnostics, like PCR tests, deliver precise results quickly, essential during flu seasons and pandemics for efficient patient management. Point-of-care testing also marks a significant stride, allowing tests to be conducted in varied settings, including clinics and homes.

This facilitates immediate clinical decisions, enhancing patient care. Additionally, the integration of artificial intelligence (AI) in diagnostics heralds a new era, enabling quicker outbreak identification and aiding in the creation of advanced diagnostic tools. These technological progressions present a substantial opportunity for the influenza diagnostics market, driving its expansion and accessibility.

Trends

Integration of Artificial Intelligence and Big Data

The integration of Artificial Intelligence (AI) and Big Data in the Influenza Diagnostics Market is a significant trend, transforming the way influenza is diagnosed and managed. AI algorithms, adept at processing vast data sets, enhance the accuracy of diagnostic tests, helping in identifying various virus strains crucial for treatment and vaccine development.

Big Data analytics contributes to predicting and tracking influenza outbreaks by analyzing data from diverse sources, aiding in better resource allocation and preparedness. This trend not only improves diagnostics but also monitors treatment effectiveness, offering a holistic approach to influenza management. It reflects a shift towards technologically advanced, data-centric solutions in healthcare, aligning with the trend of digitalization and personalized medicine. This integration is pivotal in advancing diagnostic capabilities and improving patient care in the face of global influenza challenges.

Regional Analysis

In 2023, North America held a dominant market position in the Influenza Diagnostics Market, capturing more than a 41.2% share and holding a USD 469.18 Billion market value for the year. This substantial market share can be attributed to several key factors, including advanced healthcare infrastructure, increased public awareness regarding influenza diagnostics, and substantial investment in healthcare research and development.

The North American market is characterized by the presence of major players in the diagnostics field, state-of-the-art healthcare facilities, and a high adoption rate of advanced diagnostic technologies. Furthermore, government initiatives and funding in healthcare research, particularly in the United States and Canada, have significantly contributed to the market’s growth. These factors have facilitated the development and adoption of innovative influenza diagnostic methods, such as rapid molecular diagnostic tests, which offer quicker and more accurate results.

In contrast, the Asia-Pacific (APAC) region is emerging as the fastest-growing market for influenza diagnostics. The market growth in this region is driven by increasing healthcare expenditure, rising awareness about early diagnosis and treatment of influenza, and the growing prevalence of influenza cases. Countries like China, India, and Japan are at the forefront of this growth, investing heavily in healthcare infrastructure and diagnostic technologies.

The APAC market benefits from a growing middle-class population, increased government focus on healthcare, and a rising number of public-private partnerships aimed at improving healthcare services. Additionally, the expansion of local and international diagnostic companies into the APAC region, coupled with technological advancements, is expected to further fuel the market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Influenza Diagnostics Market presents a dynamic landscape with established players and emerging entities, reflecting a competitive environment fueled by global healthcare emphasis. Key players are actively innovating and investing, driven by a focus on healthcare and disease management. This overview highlights prominent market participants, considering factors like market share, product portfolios, and strategic initiatives.

These players engage in mergers, acquisitions, collaborations, and geographical expansion to fortify their market positions. Market dynamics are shaped by technological advancements, regulatory frameworks, and evolving global healthcare needs. The market is poised for sustained growth due to the rising prevalence of influenza and increasing awareness regarding the significance of prompt and accurate diagnosis. As the sector evolves, players continue to adapt through strategic measures, ensuring ongoing expansion and relevance.

Influenza Diagnostics Market Key Players

- 3M

- Abbott Laboratories Inc.

- Becton Dickinson and Company (Bd)

- Meridian Bioscience Inc.

- Quidel Corporation

- F. Hoffmann-LA Roche AG

- SA Scientific

- Sekisui Diagnostics

- Thermo Fisher Scientific Inc.

- Hologic Inc.

Recent Developments

- In December 2023, Abbott Laboratories Inc. made significant strides in influenza diagnostics by expanding the availability of their ID NOW COVID-19 Influenza A & B Combo Test. This expansion specifically targeted point-of-care settings in Europe and Latin America. The ID NOW test, known for its rapid molecular analysis, now delivers results in under 13 minutes. This accelerated diagnostic capability holds the promise of expediting diagnosis and enabling prompt treatment decisions.

- In December 2023, A significant move to bolster its diagnostics portfolio, Thermo Fisher Scientific Inc. completed the acquisition of Mesa Biotech, Inc. The acquisition included Mesa Biotech’s automated immunoassay analyzers, notably the QuickPlex POCT System designed for respiratory infections, including influenza. This strategic acquisition positions Thermo Fisher Scientific as a formidable player in the point-of-care segment, expanding its capabilities in respiratory virus identification.

- In December 2023, SA Scientific Ltd. entered the market with the launch of the FluoroType AR Influenza A/B/RSV Multiplex Real-Time PCR Kit. This kit offers a highly sensitive and specific solution for the simultaneous detection and differentiation of Influenza A, B, and RSV in a single reaction. Targeted at laboratories seeking efficiency and comprehensive respiratory virus identification, the FluoroType® AR kit contributes to the diversification of diagnostic tools available in the market.

Report Scope

Report Features Description Market Value (2023) USD 1139 Mn Forecast Revenue (2033) USD 1820 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type( RIDT, RT-PCR, Cell Culture, Other Test Types), By End-use(Hospitals, POCT, Laboratories) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M, Abbott Laboratories Inc., Becton Dickinson and Company (Bd), Meridian Bioscience Inc., Quidel Corporation, F. Hoffmann-LA Roche AG, SA Scientific, Sekisui Diagnostics, Thermo Fisher Scientific Inc., Hologic Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Influenza Diagnostics market in 2023?The Influenza Diagnostics market size is USD 1139 million in 2023.

What is the projected CAGR at which the Influenza Diagnostics market is expected to grow at?The Influenza Diagnostics market is expected to grow at a CAGR of 4.5% (2024-2033).

List the segments encompassed in this report on the Influenza Diagnostics market?Market.US has segmented the Influenza Diagnostics market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Test Type the market has been segmented into RIDT, RT-PCR, Cell Culture, Other Test Types. By End-use the market has been segmented into Hospitals, POCT, Laboratories.

List the key industry players of the Influenza Diagnostics market?3M, Abbott Laboratories Inc., Becton Dickinson and Company (Bd), Meridian Bioscience Inc., Quidel Corporation, F. Hoffmann-LA Roche AG, SA Scientific, Sekisui Diagnostics, Thermo Fisher Scientific Inc., Hologic Inc., and other key players.

Which region is more appealing for vendors employed in the Influenza Diagnostics market?North America is expected to account for the highest revenue share of 31.6% and boasting an impressive market value of USD 469.1 million. Therefore, the Influenza Diagnostics industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Influenza Diagnostics?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Influenza Diagnostics Market.

Influenza Diagnostics MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Influenza Diagnostics MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Abbott Laboratories Inc.

- Becton Dickinson and Company (Bd)

- Meridian Bioscience Inc.

- Quidel Corporation

- F. Hoffmann-LA Roche AG

- SA Scientific

- Sekisui Diagnostics

- Thermo Fisher Scientific Inc.

- Hologic Inc.