Global Big data as a Service Market Size, Share, Statistics Analysis Report By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), Solution Type(Hadoop-as-a-Service, Data-as-a-Service, Data Analytics-as-a-Service), Enterprise Size (Small and Medium-sized business, Large enterprise), End-Use (BFSI, Manufacturing, Retail, Media & Entertainment, Healthcare, IT & Telecommunication, Government, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 62488

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

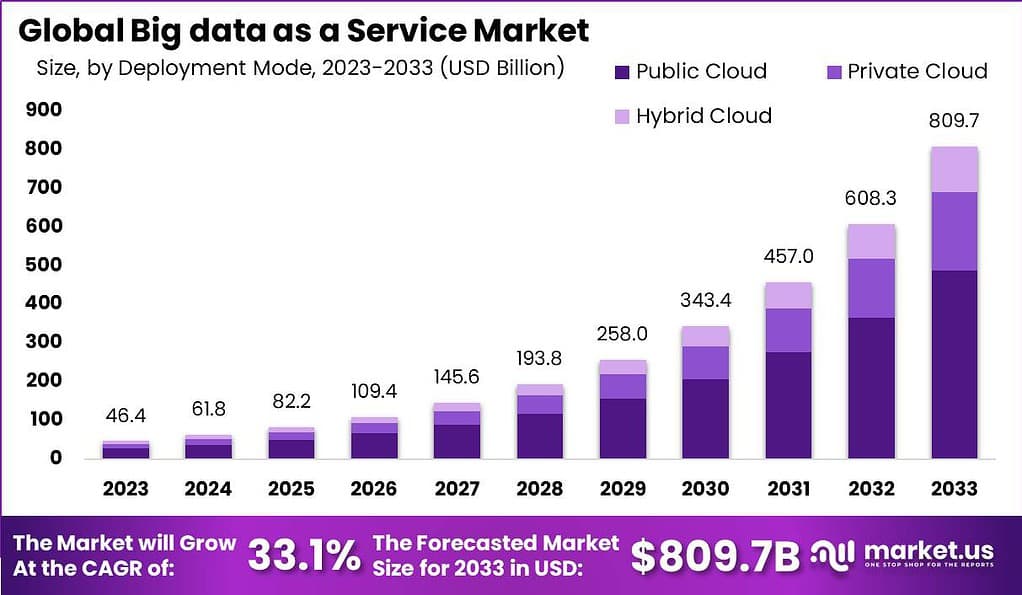

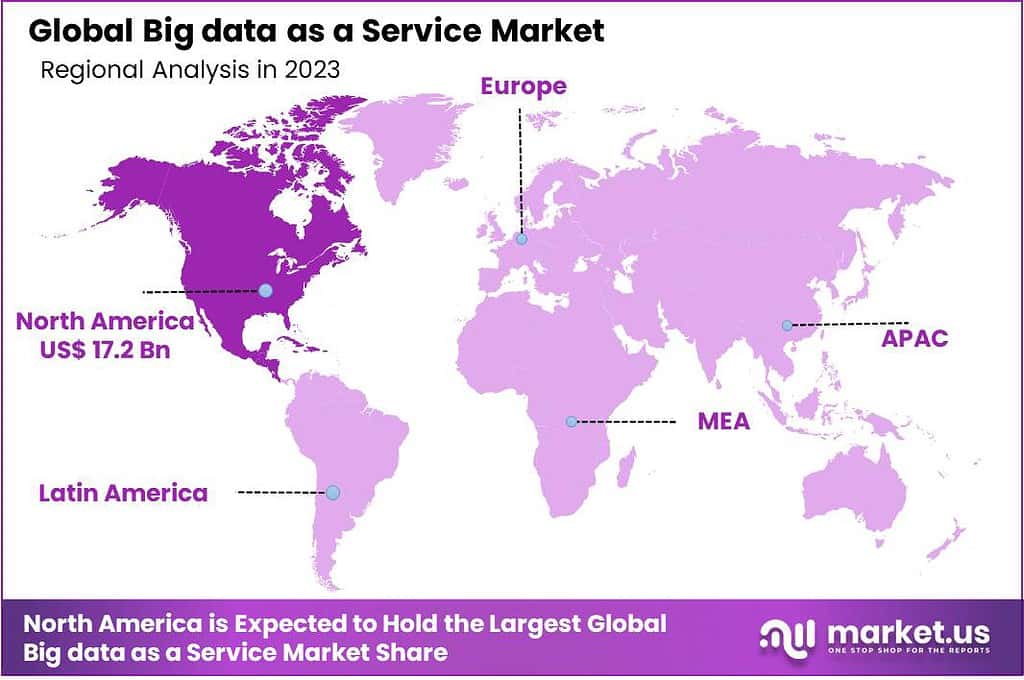

The global Big data as a Service Market is likely to secure a valuation of USD 61.8 Billion in 2024, with a CAGR of 33.1% during the forecast period. The global market is anticipated to capture a valuation of USD 809.7 Billion by 2033. In 2023, North America held a dominant market position, capturing more than a 37% share, holding USD 17.2 Billion revenue.

Big Data as a Service, or BDaaS, is a cloud-based service model that provides organizations with comprehensive tools to manage, analyze, and utilize vast amounts of data without the need for substantial on-premise infrastructure. These services encompass data storage, analytics, processing, and visualization tools, offered typically on a subscription basis. This allows businesses to engage in big data analytics and harness its benefits, such as improved decision-making and enhanced business insights, without the complexities and high capital costs.

The Big Data as a Service market is witnessing substantial growth, driven by the increasing demand for cost-effective data management solutions and the proliferation of data from various digital sources. Organizations across different sectors are leveraging BDaaS to enhance operational efficiency, improve decision-making, and gain a competitive edge in the market.

The market is characterized by the presence of prominent cloud service providers and is expected to expand further with the increasing adoption of artificial intelligence and machine learning technologies. The primary driving factor for the Big Data as a Service market is the exponential growth in data volume generated by digital transformation initiatives across industries.

Businesses are increasingly reliant on data-driven strategies to optimize operations, personalize customer experiences, and innovate product offerings. Additionally, the shift towards remote work environments has necessitated more robust data management and analytics solutions that are accessible from anywhere, further fueling the demand for BDaaS solutions.

Market demand for BDaaS is significantly high among sectors that manage large data sets, such as telecommunications, finance, healthcare, and retail. These industries require advanced analytics to process and interpret complex data structures. The flexibility and scalability offered by BDaaS allow these sectors to manage costs effectively while enhancing analytical capabilities.

Based on data from Data Never Sleeps 5.0 report by Domo, Inc., the digital world is buzzing with nonstop activity every single minute. On Snapchat, an incredible 527,700 photos are shared, capturing moments from around the globe. Over on LinkedIn, approximately 100 to 120 professionals join the platform to network and grow their careers.

Meanwhile, YouTube sees an astonishing 4,146,600 videos viewed, highlighting the endless appetite for content. On Twitter, about 456,000 tweets fly across the platform, reflecting real-time thoughts and updates. And let’s not forget Instagram, where users post 46,740 photos every minute, filling feeds with creativity and inspiration.

Significant market opportunities for BDaaS lie in the expansion into emerging markets where digital infrastructure is rapidly developing. Additionally, there is a growing opportunity for integration of BDaaS with advanced technologies such as the Internet of Things (IoT), artificial intelligence, and predictive analytics. These integrations can provide deeper insights and foresight into market trends, consumer behavior, and operational efficiencies, opening new avenues for business innovations.

Technological advancements in cloud computing, data analytics, and artificial intelligence are key enablers for the BDaaS market. Improved data processing technologies and the introduction of machine learning algorithms have enhanced the accuracy and speed of data analysis, making BDaaS more appealing to enterprises seeking real-time analytics solutions.

Key Takeaways

- The Big Data as a Service (BDaaS) market is expected to achieve a remarkable Compound Annual Growth Rate (CAGR) of 33.1% by 2033, with an estimated valuation of USD 809.7 billion.

- In 2023, the Public Cloud segment dominated the BDaaS market with over 60.3% market share. Its popularity is attributed to scalability, cost-effectiveness, and agility, making it the go-to choice for organizations of all sizes.

- Hadoop-as-a-Service emerged as a dominant player in the BDaaS market in 2023, capturing over 34.7% market share. Its appeal lies in scalability, cost-effectiveness, and accessibility, simplifying data processing and analysis.

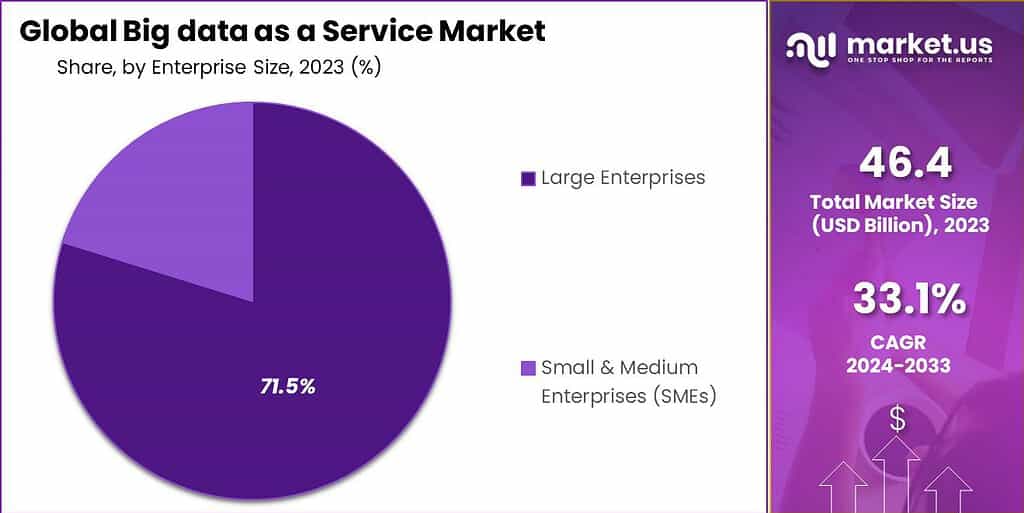

- Large enterprises took the lead in adopting BDaaS solutions in 2023, holding a substantial 71.5% market share. Their extensive data requirements and resources enable them to fully leverage BDaaS platforms for operational efficiency and growth.

- The Banking, Financial Services, and Insurance (BFSI) sector led the BDaaS market in 2023, with over 24.4% market share. This industry’s data-intensive nature, regulatory requirements, and competitive landscape drive the adoption of BDaaS solutions.

- In 2023, North America stood out as the dominant region in the BDaaS market, capturing over 37.0% market share. Its well-established tech companies, data-driven business landscape, and favorable regulatory environment contribute to its leadership.

By Deployment Mode Analysis

In 2023, the Public Cloud segment held a dominant market position in the Big Data as a Service (BDaaS) market, capturing more than a 60.3% share. This impressive market share can be primarily attributed to the Public Cloud’s scalability, cost-effectiveness, and accessibility. Organizations, regardless of size, are increasingly adopting Public Cloud solutions for their big data needs due to the minimal upfront costs and the pay-as-you-go pricing model. This model allows businesses to scale their data analytics capabilities as needed without significant capital investment.

Furthermore, the Public Cloud offers a high degree of flexibility and agility, enabling companies to rapidly deploy and manage big data applications. This is especially crucial in today’s fast-paced business environment where speed and efficiency are key competitive advantages. The Public Cloud’s robust infrastructure and advanced analytics tools also play a significant role in its dominance. These tools provide businesses with the ability to process and analyze large volumes of data efficiently, deriving insights that can lead to better decision-making and strategic planning.

Moreover, the rise in data generation and the increasing emphasis on data-driven decision-making across industries have propelled the demand for accessible and efficient data processing solutions. The Public Cloud meets these needs by offering a wide range of services that cater to different aspects of big data processing, from data collection and storage to analysis and visualization.

In terms of market growth, the Public Cloud segment in the BDaaS market is projected to continue its upward trajectory. The increasing adoption of cloud-based solutions in emerging economies, coupled with ongoing technological advancements, are expected to further bolster this segment’s growth. As such, the Public Cloud’s dominance in the BDaaS market is not only a reflection of its current state but also indicative of the future trends in big data management and analytics.

Solution Type Outlook

In 2023, the Hadoop-as-a-Service segment emerged as the dominant player in the Big Data as a Service (BDaaS) market, capturing a significant market share of over 34.7%. This segment’s strong position can be attributed to several factors that have contributed to its widespread adoption and popularity among organizations.

Firstly, Hadoop-as-a-Service offers a scalable and cost-effective solution for managing and analyzing large volumes of data. Hadoop, an open-source framework, provides a distributed computing environment capable of processing and storing massive datasets across clusters of computers. By offering Hadoop as a service, providers eliminate the need for organizations to invest in expensive hardware infrastructure and skilled personnel, significantly reducing upfront costs and operational complexities.

Secondly, Hadoop-as-a-Service enables organizations to harness the power of big data analytics without the need for in-depth technical expertise. The platform simplifies data processing and analysis by providing user-friendly interfaces, pre-built analytical models, and automated workflows. This accessibility empowers business users, data analysts, and data scientists to extract valuable insights from data without extensive programming knowledge, thereby accelerating the decision-making process.

Furthermore, the scalability and flexibility offered by Hadoop-as-a-Service make it an attractive choice for organizations dealing with dynamic data requirements. The platform allows businesses to easily scale their data storage and processing capabilities based on demand, ensuring they can handle increasing data volumes without disruptions. Additionally, the flexibility of Hadoop-as-a-Service enables organizations to integrate it seamlessly with existing IT infrastructure and tools, facilitating a smooth transition and minimizing disruption to current operations.

Moreover, Hadoop-as-a-Service providers offer robust security measures and data protection mechanisms, addressing concerns related to data privacy and regulatory compliance. By implementing advanced security protocols, encryption techniques, and access controls, these providers instill confidence in organizations that their data assets are protected against unauthorized access and breaches.

Enterprise Size

In 2023, the Big Data as a Service (BDaaS) market witnessed the dominance of the Large Enterprises segment, capturing a significant market share of over 71.5%. This segment’s strong position can be attributed to several factors that have contributed to its preference and adoption of BDaaS solutions.

Large enterprises have a distinct advantage in terms of their data requirements due to their scale of operations, extensive customer base, and complex business processes. These organizations generate massive volumes of data from various sources, including customer interactions, transactions, supply chain operations, and internal systems. Managing and analyzing such vast amounts of data require robust infrastructure and advanced analytics capabilities, which BDaaS provides.

Furthermore, large enterprises often have greater financial resources and organizational capabilities to invest in and implement BDaaS solutions. They can allocate substantial budgets for data analytics initiatives and have the capacity to recruit and retain skilled data scientists, analysts, and IT professionals. This enables them to fully leverage the potential of BDaaS platforms and extract valuable insights from their data assets.

Moreover, large enterprises typically operate in highly competitive industries, where data-driven decision-making and operational efficiency are crucial for staying ahead of the competition. BDaaS solutions offer these organizations the agility, scalability, and real-time analytics capabilities necessary to make informed business decisions promptly. By harnessing the power of BDaaS, large enterprises can identify market trends, customer preferences, and operational bottlenecks, enabling them to optimize their strategies, enhance customer experiences, and drive revenue growth.

End-Use Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment emerged as the dominant player in the Big Data as a Service (BDaaS) market, capturing a significant market share of over 24.4%. This segment’s strong position can be attributed to several factors that have contributed to its preference and adoption of BDaaS solutions.

The BFSI industry operates in a highly data-intensive environment, where large volumes of financial transactions, customer data, market data, and regulatory information are generated and processed on a daily basis. Managing and analyzing this vast amount of data is crucial for these organizations to gain insights, identify patterns, detect fraud, and make informed business decisions. BDaaS solutions offer the scalability and data processing capabilities necessary to handle the complex and dynamic data requirements of the BFSI sector.

Furthermore, the BFSI industry is heavily regulated, with strict compliance requirements and data security standards. BDaaS providers catering specifically to the needs of this sector offer robust security measures, encryption protocols, and compliance frameworks to ensure data privacy and regulatory adherence. This addresses the concerns of BFSI organizations and provides them with the confidence to leverage BDaaS solutions without compromising data security or violating regulatory obligations.

Additionally, the BFSI sector is highly competitive, with organizations constantly striving to improve operational efficiency, optimize risk management, and enhance customer experiences. BDaaS platforms offer advanced analytics capabilities, including predictive modeling, machine learning, and real-time data analysis, enabling BFSI organizations to derive actionable insights and drive innovation. By leveraging BDaaS, these organizations can enhance fraud detection, personalize customer offerings, streamline loan underwriting processes, and improve risk assessment, giving them a competitive edge in the market.

Moreover, the BFSI industry has a strong focus on customer-centricity and delivering personalized services. BDaaS solutions enable organizations to analyze vast amounts of customer data, including transaction history, behavior patterns, and preferences, to gain a deep understanding of their customers. This enables BFSI organizations to offer tailored products, personalized recommendations, and targeted marketing campaigns, leading to improved customer satisfaction and loyalty.

Key Market Segments

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

Solution Outlook

- Hadoop-as-a-Service

- Data-as-a-Service

- Data Analytics-as-a-Service

Enterprise Size

- Small and Medium-sized business

- Large enterprise

End-Use

- BFSI

- Manufacturing

- Retail

- Media & Entertainment

- Healthcare

- IT & Telecommunication

- Government

- Others

Driver

Exponential Growth in Data Volume

The BDaaS market is significantly driven by the exponential growth in data volume, a trend that is reshaping the landscape of various industries. This growth is primarily fueled by the widespread adoption of digital technologies, the proliferation of Internet of Things (IoT) devices, and the increasing online presence of consumers and businesses. As more activities shift to digital platforms, the volume of data generated escalates, creating both challenges and opportunities for organizations. This vast amount of data, encompassing structured and unstructured forms, necessitates advanced analytics and storage solutions, making BDaaS an indispensable tool for modern businesses.

The surge in data volume has a domino effect on several fronts. It aids in more precise and comprehensive analytics, enabling businesses to garner deeper insights into customer behavior, market trends, and operational efficiencies. This, in turn, drives innovation and strategic decision-making, allowing companies to gain a competitive edge in their respective markets. Furthermore, the ability to efficiently process and analyze large datasets enables organizations to identify and capitalize on new business opportunities, optimize operations, and personalize customer experiences.

Restraint

Data Privacy and Security Concerns

Data privacy and security concerns constitute a significant restraint in the BDaaS market. In the era of big data, where vast amounts of sensitive information are processed and stored, the risk of data breaches and unauthorized access has escalated. This risk is particularly acute in industries dealing with highly confidential data, such as healthcare, finance, and government. The increasing frequency of cyber-attacks and data breaches has heightened awareness and concern about data security, impacting the adoption of BDaaS solutions.

Organizations are often hesitant to adopt third-party BDaaS platforms due to fears of losing control over their data and the potential vulnerabilities that might arise from external data management. The complexity of ensuring data security is compounded by the need to comply with a myriad of data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and various other national and regional laws. These regulations impose strict rules on data handling, storage, and processing, and non-compliance can result in severe penalties.

To overcome these challenges, BDaaS providers must ensure that their solutions adhere to the highest standards of data security and privacy. This includes implementing robust encryption methods, secure data transfer protocols, and regular security audits. Additionally, providers must stay abreast of evolving regulations and ensure compliance to maintain customer trust and market viability. The ability to effectively address data privacy and security concerns is crucial for the growth and sustainability of the BDaaS market.

Opportunity

Integration of Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) with BDaaS presents a significant opportunity in the market. AI and ML technologies have the potential to transform how data is analyzed, offering more sophisticated and predictive insights. This integration enables BDaaS solutions to not only process large volumes of data but also to uncover deeper patterns, trends, and associations within the data, facilitating more informed decision-making.

The application of AI and ML in BDaaS can lead to advancements in predictive analytics, natural language processing, and automated decision-making systems. For instance, AI-driven BDaaS solutions can predict consumer behavior, optimize supply chain operations, and enhance risk management strategies. They can also automate routine data analysis tasks, freeing up human resources for more complex and strategic activities.

The continual advancements in AI and ML technologies suggest a future where BDaaS solutions become more powerful and versatile. This could lead to the development of new services and applications across various sectors, including healthcare, finance, retail, and manufacturing. For businesses, this means access to more advanced analytics capabilities, which can drive innovation, improve operational efficiency, and create new revenue streams.

Challenge

Shortage of Skilled Big Data Professionals

A significant challenge facing the BDaaS market is the shortage of skilled professionals capable of effectively managing, analyzing, and interpreting big data. The complexity of big data technologies and analytics requires a high level of expertise in areas such as data science, machine learning, statistics, and database management. This talent gap can limit the effectiveness of BDaaS solutions, as organizations may struggle to fully utilize their capabilities without the necessary human capital.

The shortage of skilled big data professionals is a bottleneck for the growth and adoption of BDaaS solutions. It impedes organizations’ ability to implement and leverage BDaaS effectively, potentially leading to underutilization of data and missed opportunities. The rapid evolution of big data technologies further exacerbates this challenge, as the skill sets required are constantly evolving.

Addressing this talent gap is crucial for the sustained growth of the BDaaS market. This can be achieved through a combination of educational initiatives, training programs, and partnerships between industry and academia to develop relevant curricula. Additionally, organizations can invest in upskilling their existing workforce to meet the demands of an increasingly data-driven world. Bridging the skills gap is essential not only for the success of individual organizations but also for the broader advancement and innovation in the field of big data and analytics.

Key Market Trends

- AI-Driven Analytics: AI-powered analytics and machine learning are becoming central to BDaaS offerings. These technologies enable organizations to uncover hidden patterns, automate decision-making, and enhance predictive analytics, driving a key trend in the market.

- Edge Computing Integration: The integration of edge computing with BDaaS is gaining traction. Edge computing enables real-time data processing at the source, allowing organizations to analyze data closer to where it’s generated, reducing latency and enhancing insights.

- Data Democratization: BDaaS providers are focusing on making data more accessible to non-technical users through user-friendly interfaces and self-service analytics tools. This trend democratizes data access and analysis across organizations.

- Sustainability Initiatives: BDaaS providers are increasingly emphasizing sustainability and eco-friendly data processing. Efficient data center operations and reduced energy consumption are aligning with the growing awareness of environmental concerns in the industry.

Regional Analysis

In 2023, North America emerged as the dominant region in the Big Data as a Service (BDaaS) market, capturing a significant market share of over 37.0%. This regional dominance can be attributed to several factors that have contributed to the adoption and growth of BDaaS solutions in North America.

Firstly, North America is home to a large number of leading technology companies, including major cloud service providers and BDaaS vendors. These companies have made significant investments in developing and offering advanced BDaaS platforms, attracting organizations across various industries. Their strong presence and continuous innovation have contributed to the overall growth and maturity of the BDaaS market in the region.

Secondly, North America has a highly developed and data-driven business landscape. Organizations in sectors such as finance, technology, healthcare, and e-commerce generate vast amounts of data, making them early adopters of BDaaS solutions. With a strong focus on data analytics and digital transformation, these industries have been at the forefront of leveraging BDaaS to gain insights, optimize operations, and drive business growth.

Furthermore, North America has a favorable regulatory environment and data protection laws that encourage the adoption of BDaaS solutions. The region has established frameworks, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States, which emphasize the protection of personal data. BDaaS providers in North America adhere to these regulations and offer robust security measures, thereby instilling confidence in organizations to leverage BDaaS platforms.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Big Data as a Service (BDaaS) market is highly competitive, with several key players offering a range of cloud-based big data analytics solutions. These companies provide infrastructure, tools, and services to help organizations store, process, and analyze large volumes of data.

Top Key players

- IBM Corporation

- Amazon Web Services Inc.

- Oracle Corporation

- SAP SE

- Google LLC

- Dell Inc.

- Microsoft Corporation

- Teradata Corporation

- Lumen Technologies, Inc.

- Cloudera Inc.

- Qubole Inc.

- SAS Institute Inc.

- Hitachi Ltd.

- Other Key Players

Recent Developments

- In 2023, Project Apex, recently introduced by Dell Technologies, encompasses an extensive array of cloud-based data management solutions. This includes the incorporation of Dell EMC PowerStore and VxRail, with the primary objective of streamlining data infrastructure for contemporary applications.

- In 2023, Microsoft Azure has recently enriched its Synapse Analytics platform by introducing new elements like data lake storage and serverless options. This strategic expansion is designed to enhance flexibility and cost-efficiency, particularly for Big Data as a Service (BDaaS) workloads.

Report Scope

Report Features Description Market Value (2023) US$ 46.4 Bn Forecast Revenue (2033) US$ 809.7 Bn CAGR (2024-2033) 33.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), Solution Type(Hadoop-as-a-Service, Data-as-a-Service, Data Analytics-as-a-Service), Enterprise Size (Small and Medium-sized business, Large enterprise), End-Use (BFSI, Manufacturing, Retail, Media & Entertainment, Healthcare, IT & Telecommunication, Government, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Amazon Web Services Inc., Oracle Corporation, SAP SE, Google LLC, Dell Inc., Microsoft Corporation, Teradata Corporation, Lumen Technologies, Inc., Cloudera Inc., Qubole Inc., SAS Institute Inc., Hitachi Ltd., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Big Data as a Service (BDaaS)?BDaaS refers to a cloud-based service that provides organizations with on-demand access to big data processing and analytics tools without the need for investing in and maintaining complex infrastructure.

How big is Big data as a Service Market?The global Big data as a Service Market is likely to secure a valuation of USD 61.8 Billion in 2024, with a CAGR of 33.1% during the forecast period. The global market is anticipated to capture a valuation of USD 809.7 Billion by 2033.

What is the Data as a Service (DaaS) Market?The Data as a Service (DaaS) market refers to a business model where third-party vendors provide data on demand to organizations. It allows businesses to access, integrate, and use data from external sources without having to manage the underlying infrastructure.

What industries benefit the most from BDaaS?BDaaS is beneficial for a wide range of industries, including finance, healthcare, retail, manufacturing, and more. Any industry dealing with large and complex datasets can benefit from the scalability and analytics capabilities of BDaaS.

What are the advantages of using BDaaS for businesses?BDaaS offers advantages such as cost savings, scalability, faster time-to-insight, and the ability to focus on data-driven decision-making without the burden of managing complex infrastructure.

What factors should organizations consider when choosing a BDaaS provider?Organizations should consider factors such as scalability, data security, compliance, integration capabilities, and the provider's track record when selecting a BDaaS service.

Big Data as a Service MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Big Data as a Service MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Amazon Web Services Inc.

- Oracle Corporation

- SAP SE

- Google LLC

- Dell Inc.

- Microsoft Corporation

- Teradata Corporation

- Lumen Technologies, Inc.

- Cloudera Inc.

- Qubole Inc.

- SAS Institute Inc.

- Hitachi Ltd.

- Other Key Players