Global Data Center Construction Market By Type (Enterprise Data Centers, Colocation Data Centers, Hyperscale Data Centers), By Tier Type (Tier I, Tier II, Tier III, Tier IV), By End-User Industry (IT & Telecom, Healthcare, Government & Defense, Retail & E-commerce, Energy & Utilities, Other End-User Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 15340

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

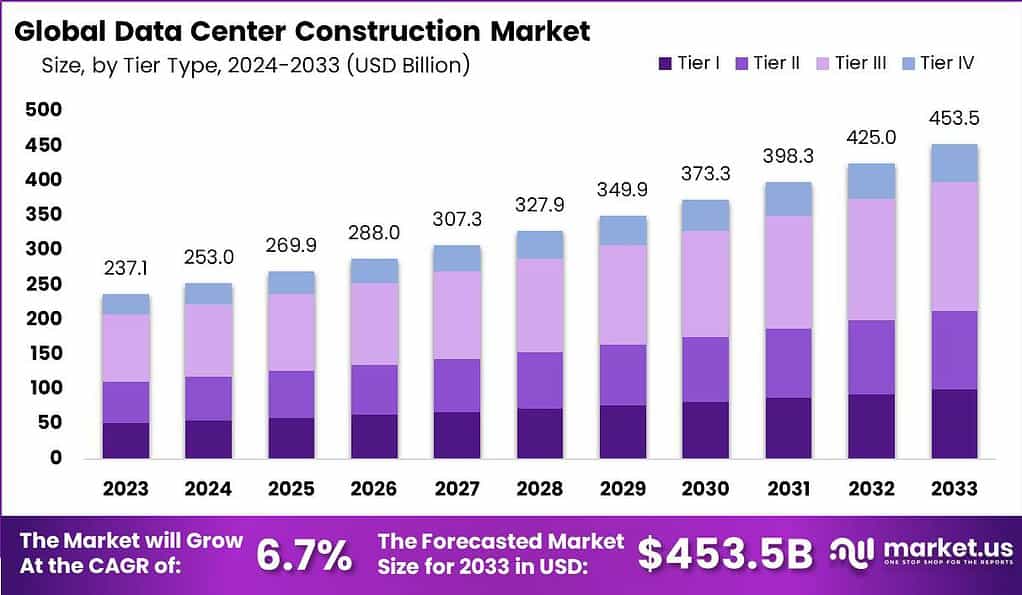

The Global Data Center Construction Market size is expected to be worth around USD 453.5 Billion By 2033, from USD 237.1 Billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position in the Data Center Construction Market, capturing more than a 38% share, equating to approximately USD 90.1 Billion in revenue

Data center construction involves the design, build, and maintenance of facilities that house critical IT infrastructure, such as servers, storage systems, and networking equipment. These facilities are essential for storing, managing, and disseminating large volumes of data, making them crucial for businesses that rely heavily on digital operations. The construction of a data center is a complex process that requires careful consideration of location, scalability, energy efficiency, and security.

The Data Center Construction Market is witnessing significant growth, driven by the increasing demand for data processing power and storage solutions. This surge is largely attributed to the proliferation of cloud computing, big data analytics, and the expansion of Internet of Things (IoT) applications. Companies are investing heavily in building state-of-the-art data centers to ensure efficient data management, bolster cybersecurity measures, and support AI-driven technologies.

The collaboration between human expertise and cutting-edge technologies plays a crucial role in the success of data center construction projects. Skilled architects, engineers, project managers, and technicians work in tandem with advanced automation tools, AI-driven systems, and IoT devices to create efficient, sustainable, and scalable data center infrastructures that meet the evolving needs of businesses in the digital age.

The market’s expansion is further fueled by technological advancements, including the adoption of green data centers, which aim to minimize environmental impact through energy-efficient designs and operations. Moreover, the ongoing shift towards 5G networks is prompting upgrades in data center infrastructure to handle increased data traffic and support new services.

Challenges in the data center construction market include the high initial capital expenditure and ongoing operational costs, the need for sustainable and energy-efficient designs, and the shortage of skilled labor. Despite these challenges, the market is poised to grow, fueled by ongoing technological advancements and the global shift towards digital transformation, making data centers an integral part of the modern digital landscape.

For instance, Microsoft has significantly expanded its data center capacity, now exceeding 5GW. This expansion is part of a strategic initiative to double the new data center capacity in the first half of fiscal year 2024, aiming to add 1GW of server power within the next six months. Looking ahead to the first half of fiscal year 2025, Microsoft plans to increase its capacity by 1.5GW.

Recent strategic investments underscore this growth trajectory. Since July 2023, Microsoft has acquired over 500MW of additional data center space. The company’s global expansion includes substantial financial commitments, such as a $2.9 billion investment in Japan, $3.16 billion in the United Kingdom, and a significant $3.3 billion investment by 2026 to initiate a new data center development in Wisconsin, USA

The data center landscape is experiencing significant growth and transformation globally. As of the current landscape, there are 8,000 data centers worldwide. The United States holds a predominant share with 33% of these facilities located within its borders. This concentration underscores the country’s pivotal role in global data infrastructure.

A notable projection for the industry is the substantial increase in power consumption, with data centers expected to consume 20% of the world’s power supply by 2025. This surge highlights the escalating energy demands of modern data storage and processing needs.

According to CBRE reports, despite challenges such as limited power availability, new development persists across all regions. Northern Virginia stands out as the world’s largest data center market, boasting a total inventory of 2,132 megawatts (MW). This region’s capacity underscores its strategic importance in the data center market.

However, the industry is not without its challenges. Vacancy rates are declining across all four regions, driven by robust demand. Singapore, noted as the world’s most power-constrained data center market, reports less than 4 MW of available capacity and a record-low vacancy rate of less than 2%. These figures reflect intense competition and limited space for expansion in key markets.

The global shortage of data center capacity is prompting upward price adjustments. Rental rates in Singapore are the highest, ranging from $300 to $450 per month for a 250- to 500-kilowatt (kW) requirement, contrasted with Chicago, which has the lowest rates at $115 to $125. The disparity in pricing across regions indicates varying market dynamics and operational costs.

Key Takeaways

- The Data Center Construction Market is projected to expand significantly, with expectations to reach a valuation of USD 453.5 Billion by 2033, up from USD 237.1 Billion in 2023. This growth translates to a compound annual growth rate (CAGR) of 6.7% during the forecast period from 2024 to 2033.

- In the segment breakdown, Colocation Data Centers emerged as a major force within the market, accounting for over 46% of the market share in 2023. This dominance underscores the growing preference for colocation facilities, which offer scalability, flexibility, and cost-efficiency, driving their increased adoption.

- Moreover, the Tier III category of data centers also showcased significant market leadership, securing more than 41% of the market share. These facilities are favored for their balance between cost and redundancy, providing concurrent maintainability without significantly driving up capital expenditures.

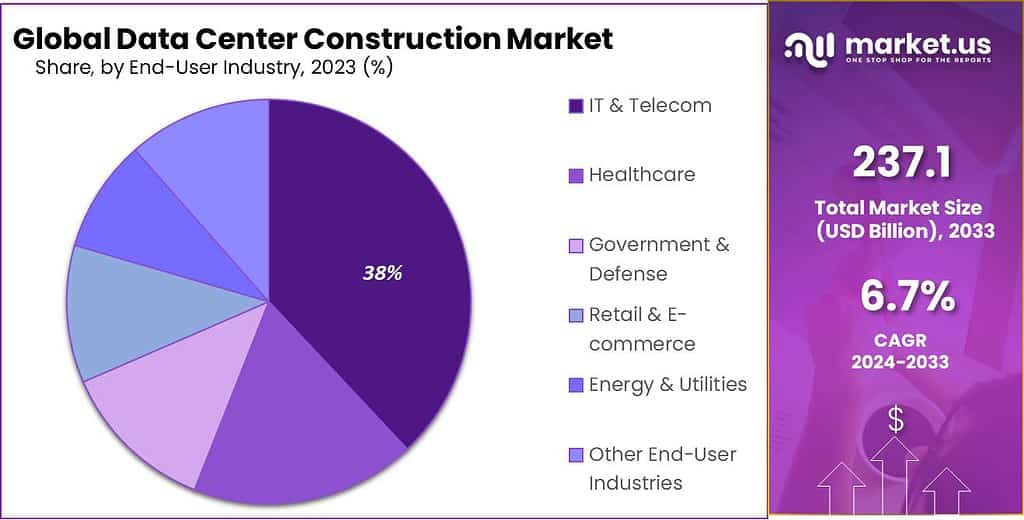

- In terms of industry applications, the IT & Telecom sector was the most substantial end-user, commanding more than 38% of the market. The sector’s reliance on robust data management and processing capabilities underpins this substantial market uptake.

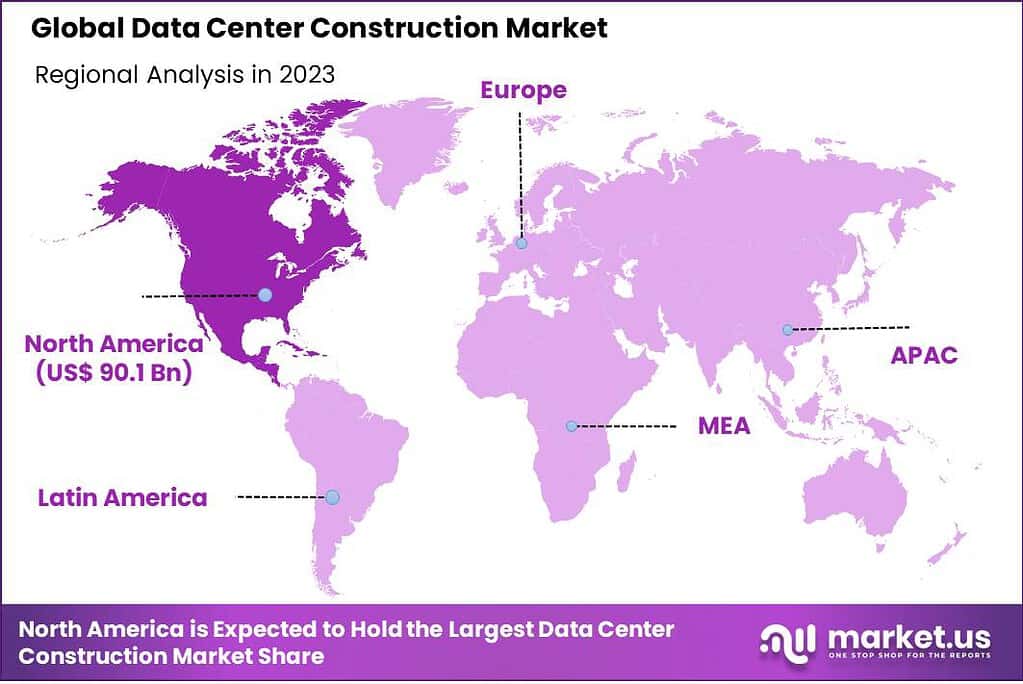

- Geographically, North America continued to lead the global landscape with over 38% of the market share in 2023, fueled by advanced technological infrastructure and stringent data regulation policies which promote substantial investments in data center construction within the region.

Type Analysis

In 2023, the Colocation Data Centers segment held a dominant market position, capturing more than a 46% share. This segment’s strong standing is due to businesses increasingly preferring to rent server space and infrastructure to reduce costs and increase scalability. Colocation centers offer the benefits of large-scale data facilities, such as advanced security, bandwidth, and power, without the associated capital expenditure.

Enterprise Data Centers follow, with a substantial share of the market. These are typically built and used by a single organization for its own data and IT needs. While the trend is shifting towards cloud and colocation services, many large corporations still rely on enterprise data centers for security, control, and the handling of large amounts of proprietary data.

The Hyperscale Data Centers segment, though smaller, is growing rapidly. These centers support extensive and scalable applications and are typically used by major players in tech and cloud services. The growth in cloud computing, big data, and e-commerce is driving the demand for hyperscale facilities. Their ability to provide massive scale computing and storage, coupled with energy efficiency, makes them increasingly popular as the data and computing needs of the world grow exponentially.

Tier Type Analysis

In 2023, the Tier III segment held a dominant market position in the Data Center Construction Market, capturing more than a 41% share. Tier III data centers are popular because they offer a balanced blend of affordability and reliability. With features like dual-powered equipment and multiple uplinks, they ensure less downtime and are suitable for businesses requiring high availability without the extensive costs of the most advanced facilities.

Tier I and Tier II data centers, while less prevalent, serve specific market needs. Tier I provides the most basic infrastructure, with a single path for power and cooling and no redundant components, making it the most cost-effective but least reliable option. This suits small businesses or those with minimal IT requirements. Tier II adds some redundant components, offering improved reliability over Tier I, making it a middle ground for companies looking for a bit more assurance but still on a tight budget.

Tier IV data centers are the most advanced and secure, featuring fully fault-tolerant components with redundancy and dual-powered cooling, storage, and networking links. While they represent a smaller market share due to their higher construction and operational costs, they are crucial for mission-critical operations that require 99.995% uptime. Financial institutions, large enterprises, and cloud service providers often rely on Tier IV centers for their most sensitive and essential operations.

As businesses increasingly depend on data and IT infrastructure, the demand across all tiers of data centers is set to grow, each serving unique market needs based on the balance of cost, reliability, and operational requirements. The choice among Tier I, II, III, and IV will continue to depend on the specific business needs, size, and criticality of the IT operations they support.

End-User Industry

In 2023, the IT & Telecom segment held a dominant market position in the Data Center Construction Market, capturing more than a 38% share. This sector’s significant demand stems from the massive amounts of data generated and processed, requiring robust and scalable data center solutions. As we move further into the digital age, the reliance on data centers for cloud computing, data storage, and telecommunications services continues to drive substantial growth in this segment.

The Healthcare sector is also making notable strides, increasingly turning to data centers to manage the vast data from patient records, telemedicine, and medical research. As healthcare technology evolves, including the rise of AI and machine learning for diagnostics and treatment planning, the demand for secure and powerful computing is rising.

Government & Defense is another critical sector, relying heavily on data centers for secure, reliable information storage and processing. With the growing need for cybersecurity and robust IT infrastructure to handle sensitive data and national security operations, this segment is seeing significant investment in data center construction.

The Retail & E-commerce sector is undergoing a digital transformation, with data centers playing a key role in handling the surge in online transactions, customer data, and inventory management systems. The growth of online shopping and the need for efficient, secure, and fast IT infrastructure to support this are driving investments in this area.

Energy & Utilities are also turning to data centers to manage and analyze data from a range of sources, including smart grids and renewable energy sources. As the sector moves towards more sustainable and efficient operations, the role of data centers in managing this transition is becoming increasingly important.

Other End-User Industries, including education, entertainment, and manufacturing, are also contributing to the growth of the data center construction market. Each sector has unique needs, driving the demand for data centers that offer a range of services, from basic storage and computing to advanced analytics and real-time processing.

Key Market Segments

Type

- Enterprise Data Centers

- Colocation Data Centers

- Hyperscale Data Centers

Tier Type

- Tier I

- Tier II

- Tier III

- Tier IV

End-User Industry

- IT & Telecom

- Healthcare

- Government & Defense

- Retail & E-commerce

- Energy & Utilities

- Other End-User Industries

Driver

Increasing Demand for Cloud Services

The escalating demand for cloud-based services is a significant driver of the data center construction market. As more businesses adopt cloud computing to enhance operational efficiency and data accessibility, the need for robust data centers has surged.

These facilities are crucial for managing and processing the vast amounts of data generated by cloud services. The growth in cloud applications, AI, and big data technologies has intensified this demand, as data centers must evolve to handle more sophisticated workloads and larger data volumes.

Restraint

High Initial Investment Costs

One of the primary restraints in the data center construction market is the high upfront cost associated with establishing these facilities. Building a data center involves significant expenditures on land, infrastructure, and advanced technological equipment, along with regulatory and environmental compliance costs.

The capital-intensive nature of data center projects can deter new entrants and is particularly challenging in urban areas where space is limited and expensive. Furthermore, the need to adhere to stringent environmental standards adds to the overall expense, impacting the pace and scalability of new data center constructions.

Opportunity

Advancements in Hyperscale Data Centers

The trend towards hyperscale data centers presents a substantial opportunity within the data center construction market. These large-scale facilities support extensive cloud platforms and big data analytics, providing the infrastructure needed for high-volume, high-velocity data.

Investments by tech giants in hyperscale data centers are on the rise, driven by the increasing consumption of digital media, the expansion of IoT, and the broader shift towards online services. Hyperscale data centers offer improved data management and storage capabilities, which are critical in an era of exponential data growth.

Challenge

Balancing Expansion with Sustainability

A major challenge in the data center construction market is balancing the rapid expansion of facilities with environmental sustainability. Data centers are energy-intensive, and as their number grows, so does their environmental impact.

The industry faces pressure to adopt green building practices and sustainable energy sources to mitigate effects such as high power consumption and carbon emissions. Achieving this balance requires innovative construction strategies that incorporate energy-efficient technologies and renewable energy sources, which can be complex and costly to implement.

Growth Factors

The data center construction market is primarily driven by the surging demand for digital infrastructure, which is critical as businesses across various sectors continue their digital transformation journeys. This includes an increased reliance on cloud computing, big data analytics, and the Internet of Things (IoT), which collectively necessitate the expansion of robust and scalable data center capacities.

Another significant growth factor is the global increase in data consumption, fueled by rising internet usage and the proliferation of connected devices across different verticals. This exponential growth in data requires substantial data storage and processing capabilities, making the construction of new data centers essential.

Emerging Trends

One of the most significant trends in the data center construction market is the shift towards hyperscale data centers. These facilities are designed to provide scalable applications and services by accommodating large-scale data storage and processing needs, and are increasingly utilized by major cloud service providers and technology firms.

The push for sustainability is also a key trend, with an emphasis on building green data centers that utilize renewable energy sources and innovative cooling technologies to minimize environmental impact. Furthermore, the market is seeing a rise in the adoption of modular and prefabricated data centers, which allow for quicker deployment and easier scalability to meet the rapidly changing technology landscape

Regional Analysis

In 2023, North America held a dominant market position in the Data Center Construction Market, capturing more than a 38% share, equating to approximately USD 90.1 Billion in revenue. This leading position is attributed to several key factors, including the region’s advanced technological infrastructure, robust demand from various industries, and significant investments in cloud services and digital transformation initiatives.

The presence of major cloud service providers like Amazon Web Services, Google Cloud, and Microsoft Azure has further fueled the growth in data center construction within North America. The high demand for data processing and storage capabilities across sectors such as IT, telecom, finance, and healthcare necessitates the expansion and modernization of data center facilities.

Additionally, the region’s stringent data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe influencing North American policies, drive the need for state-of-the-art data centers that comply with these standards. Furthermore, North America’s innovation-driven environment and strong economic support for tech development foster continuous advancements in data center technologies.

The widespread adoption of emerging technologies such as artificial intelligence (AI), the Internet of Things (IoT), and 5G also contributes significantly to the demand for high-performance data centers. These technologies require substantial computational power and data handling capabilities, which in turn propels the market for data center construction.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

The data center construction market is characterized by its competitive landscape, where major players are continually evolving through strategic initiatives such as mergers, acquisitions, and launching new products to enhance their market presence and meet the burgeoning demand for sophisticated data infrastructure.

Among the prominent companies, Turner Construction Company, Holder Construction Group, and DPR Construction are particularly noteworthy for their dynamic market activities and comprehensive service offerings in project management, architectural design, and construction expertise.

Turner Construction Company has reinforced its market position through strategic acquisitions aimed at expanding its technological capabilities and geographic reach. Recently, Turner acquired a smaller engineering firm specializing in advanced cooling solutions for data centers, aiming to enhance its offerings in sustainable and energy-efficient building designs. This move not only broadens Turner’s service portfolio but also strengthens its competitiveness in attracting clients looking for green data center solutions.

Holder Construction Group remains a key player in the market, known for its innovation-driven approach. In the past year, Holder launched a new software tool that leverages AI to optimize construction processes and project management for data centers. This product has been well-received, as it significantly reduces project delivery times and improves budget accuracy, catering well to the needs of fast-paced data center projects.

DPR Construction has recently completed a notable merger with a European construction firm renowned for its data center construction prowess. This strategic merger allows DPR to enhance its service offerings and expand its footprint in the European market, where demand for data centers is rapidly growing due to increased data protection regulations and digital transformation initiatives.

Top Key Players

- Turner Construction Company

- Holder Construction Group

- DPR Construction

- Skanska AB

- Mortenson Construction

- AECOM

- Jacobs Engineering Group

- M. A. Mortenson Company

- Hensel Phelps Construction Co.

- Holder Construction Company

- Other Key Players

Recent Developments

- In July 2024, Turner Construction announced the acquisition of Dornan Engineering Group, a specialist in mechanical, electrical, instrumentation, and commissioning engineering. This acquisition aims to expand Turner’s footprint in Europe, with Dornan’s team delivering significant projects, including data centers and biopharma facilities. This acquisition is expected to enhance Turner’s capabilities in complex large-scale projects across various sectors.

- In January 2024, Turner Construction began work on a hyperscale data center campus for Meta in Jeffersonville, Indiana. The project includes multiple data center buildings within a nearly 700,000-square-foot campus, contributing to Meta’s global infrastructure.

- In May 2024, CyrusOne closed a $1.175 billion asset-backed securitization offering, highlighting the use of innovative financing methods in data center investments.

Report Scope

Report Features Description Market Value (2023) US$ 237.1 Bn Forecast Revenue (2033) US$ 453.5 Bn CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Enterprise Data Centers, Colocation Data Centers, Hyperscale Data Centers), By Tier Type (Tier I, Tier II, Tier III, Tier IV), By End-User Industry (IT & Telecom, Healthcare, Government & Defense, Retail & E-commerce, Energy & Utilities, Other End-User Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Turner Construction Company, Holder Construction Group, DPR Construction, Skanska AB, Mortenson Construction, AECOM, Jacobs Engineering Group, M. A. Mortenson Company, Hensel Phelps Construction Co., Holder Construction Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the data center construction market?The data center construction market involves the planning, design, and physical construction of data center facilities to meet the growing demand for data storage, processing, and management.

How big is the global data center construction market?The global data center construction market size is projected to reach a valuation of USD 453.5 Billion by 2033 at a CAGR of 6.7%, from USD 237.1 Billion in 2023.

What are the largest data center construction companies?Some of the largest data center construction companies globally include DPR Construction, Turner Construction, Holder Construction, Jacobs Engineering Group, and Skanska.

Who builds data centers in India?Several companies are involved in building data centers in India. Some prominent players include Larsen & Toubro (L&T), Sterling and Wilson, and Hiranandani Group. International companies like Equinix and NTT Ltd. also have a presence in the Indian data center market.

What factors are driving the growth of the data center construction market?Factors such as increasing data storage needs, the rise of cloud computing, demand for edge computing, and the expansion of digital services contribute to the growth of the data center construction market.

What are the key challenges faced by the data center construction industry?Challenges include high initial costs, energy efficiency concerns, environmental considerations, and the need for skilled labor in constructing and managing complex data center infrastructure.

Data Center Construction MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample

Data Center Construction MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Turner Construction Company

- Holder Construction Group

- DPR Construction

- Skanska AB

- Mortenson Construction

- AECOM

- Jacobs Engineering Group

- M. A. Mortenson Company

- Hensel Phelps Construction Co.

- Holder Construction Company

- Other Key Players