Global Cloud Security Market By Security Type (Data Loss Prevention, Security Information & Event Management, and Others), By Enterprise Size, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct. 2023

- Report ID: 58235

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

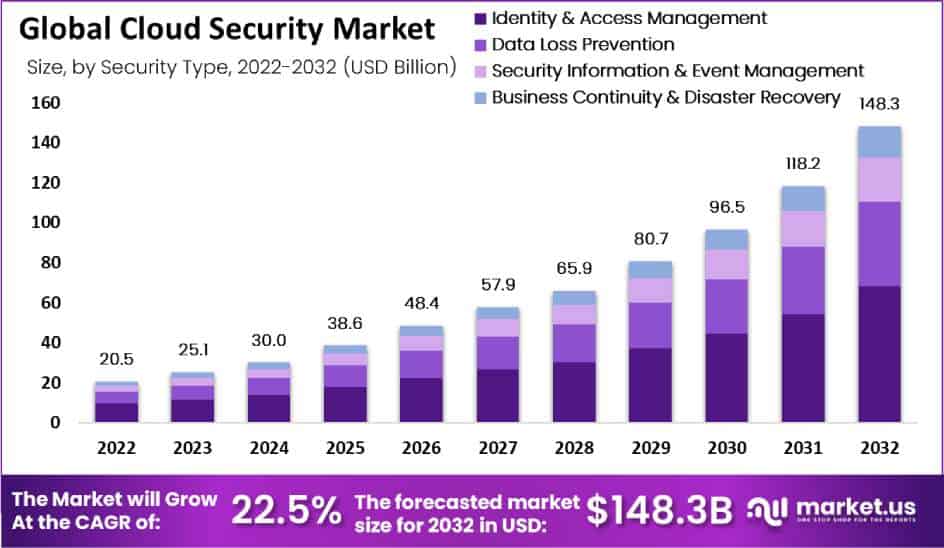

The Global Cloud Security Market size is expected to reach USD 148.3 billion by 2032, exhibiting an impressive CAGR of 22.5% between 2022 and 2032, from its current value of USD 20.5 billion in 2022.

Cloud security is a wide category of technologies and practices that helps to protect data from cloud attacks and unauthorized access by providing secure networks. Cloud security services and solutions provide reasonable security and privacy to cloud computing. In addition, cloud security designs effectively provide prevention and remediation controls and improve reputation and security features. The urgent demand for cloud computing among enterprises and the population is anticipated to boost the market growth. The rise of technology and cyberattacks has shifted the focus to maintaining security. Therefore, businesses should take certain precautions before cyber threats occur.

Note: Actual Numbers Might Vary In Final Report

Recent data shows that about 90% of enterprises are using cloud-based security solutions. The key factors pushing the cloud security market are increased sophisticated cybercrimes, consequences of new cyberattacks, cyber espionage activities, and widespread adoption of cloud-based solutions. Increased government efforts to support innovative infrastructure projects and secure social media, operating systems, and online financial applications provide encouraging opportunities for cloud security providers. Corporate cybercrime efforts are helping developing countries and developed countries contribute to the growth of the global cloud security market.

Key Takeaways

- Market Size and Growth: In 2022, the Cloud Security Market was estimated at USD 20.5 billion; by 2032 it is anticipated to grow at an average compound annual growth rate of 22.5% and reach USD 148.3 billion in market value.

- Trends: The market is witnessing an increase in crypto-jacking attacks in cryptocurrencies, driving the need for robust security solutions. The increasing adoption of BYOD policies is also influencing the market’s growth.

- Drivers of Market Growth: Increased sophistication in cybercrimes and data breaches have fueled the demand for cloud security solutions.

- Challenges and Restraints: Data privacy concerns, high costs of advanced security solutions, and a lack of trust in cloud service providers are some of the challenges hindering market growth. Strict government protocols and laws regarding data security are also impeding the market’s expansion.

- Identity & Access Management (IAM) holds the largest market share at 46%, followed by Data Loss Prevention (DLP) and Security Information & Event Management (SIEM).

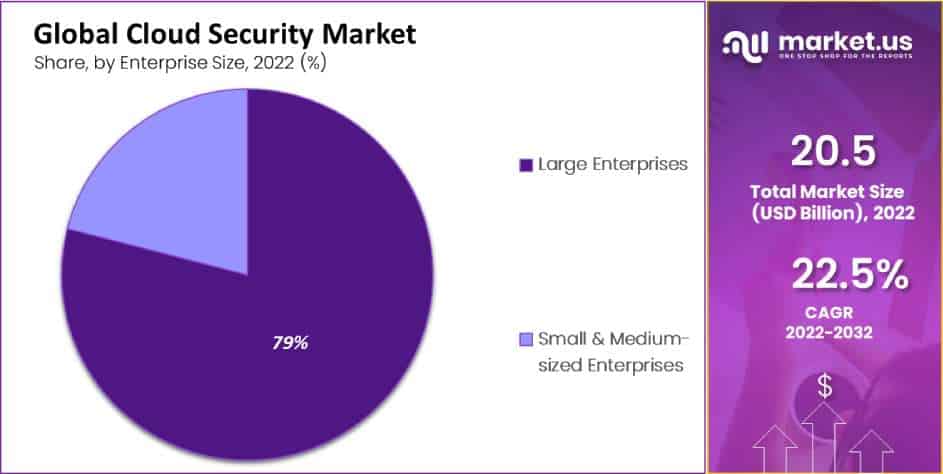

- Enterprise Size Analysis: Large enterprises are the primary adopters of cloud security solutions, driven by their extensive use of cloud and IoT-based applications.

- End-User Analysis: The IT & Telecommunications industry is expected to experience the highest growth during the forecast period, followed by the healthcare and retail sectors.

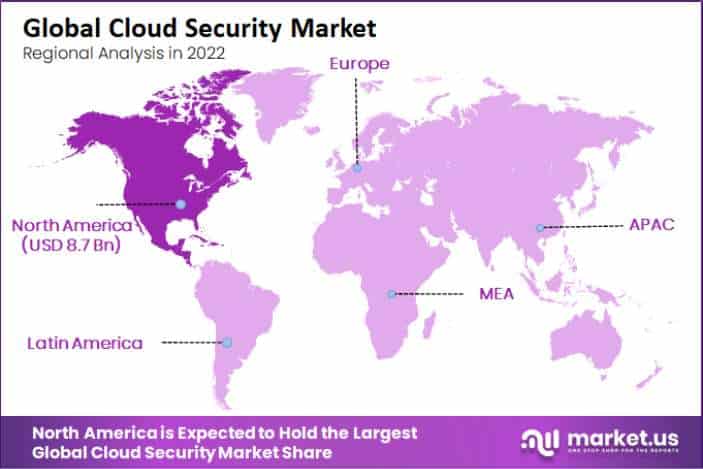

- Regional Analysis: North America leads the market, followed by Europe and then Asia-Pacific – which is projected to experience rapid expansion.

- Some of the biggest players in the cloud security market include Amazon Web Services, Microsoft, Palo Alto Networks, Trend Micro, Broadcom, Check Point Software Technologies, Google, McAfee, IBM, Zscaler, Cisco Systems, and Fortinet.

Drivers

Cyberattacks and data breach fuels the cloud security market to skyrocket

As people use the Internet to launch targeted, politically motivated attacks against cloud IT infrastructure, large-scale cyberattacks occur worldwide, resulting in the loss of personal, corporate, and government data. The cloud security market is gaining momentum due to increased enterprise data leaks and breaches. Cloud data is more susceptible to attacks than data on enterprise servers.

As a result of COVID-19 distributed work from home, the implementation of cloud collaboration services and tools such as Zoom, Cisco WebEx, and Microsoft Teams has increased. SMEs are storing data quickly on cloud servers. As the number of SMEs using web- and cloud-based apps and tools grow, these companies become attractive targets for cybercriminals, leading to increased acceptance of cloud security solutions.

Strict government protocols, laws, and the risk of information leakage are the major factors hindering market growth. Data can be lost if the cloud technology fails, the machine will shut down, and the backup data will be lost forever. In addition, increased complexity from virtual infrastructure, lack of trained experience, and lack of trust in cloud service providers are barriers to the growing market.

Restraints

Data Privacy and High Costs

The rise of smarter attack tools and new security threats has dramatically increased the need for advanced IT/network security solutions to combat such attacks. Organizations’ traditional security solutions fail to protect enterprises from threats associated with cloud, network, security, and application.

Technological development by security providers requires enormous funds and advanced responses. The high cost of such solutions has severely limited their acceptance by enterprises, especially small & medium enterprises. Also, security solution providers’ capital expenditures increase as their R&D teams grow. Other highlighted market challenges are unauthorized access to security platforms, data leakage or loss, and privacy breaches.

Security Type Analysis

The Identity & Access Management Segment Accounted for the Largest Market Share, with 46%

The identity & access management (IAM) segment encompasses multiple technologies such as multi-factor authentication (MFA), password management, single sign-on (SSO), and profile management. Increased cloud adoption translates directly to increased adoption of IAM solutions. The data loss prevention (DLP) segment is anticipated to grow at a high CAGR during the forecast period for the cloud security market. This is primarily due to the increased promotion of data security and network security solutions among enterprises which has caused due to the increase in data breaches.

DLP is a purpose-built product suite that uses fingerprinting, classification, and precise data-matching technologies. They can identify, protect, and monitor critical corporate data. Business continuity & disaster recovery solutions along with security information & event management (SIEM) are expected to grow in demand over the forecast period. Visibility & risk assessment could increase the demand for SIEM solutions. SIEMs have a variety of uses in the modern threat landscape. These include regulatory compliance, IoT security, and insider threat prevention.

By Enterprise Size Analysis

Large Enterprises Rise Due to the Widespread Adoption of Network Security Solutions

Large companies invest heavily in cutting-edge technology to improve overall productivity and efficiency. As a result, large enterprises increasingly turn to cloud security solutions. They are expected to invest heavily in modern cloud security solutions to protect their businesses in today’s highly competitive environment.

Large enterprises implement cloud security solutions because they use a large number of cloud and IoT-based applications that are particularly vulnerable to cyberattacks. Additionally, they are vulnerable to certain attacks aimed at disrupting information technology (IT) services. These are the key factors driving the growth of the large enterprise segment of the global market during the forecast period 2023-2032.

Small & mid-sized businesses were forced to cut their cloud spending as the pandemic reduced demand for products & services and reduced capital spending due to a lack of budget flexibility. Even so, they are predicted to be back on track in post-pandemic years.

Note: Actual Numbers Might Vary In Final Report

By End-User Analysis

The IT & Telecommunications Industry is Expected to Grow at the Highest CAGR During the Forecast Period

A powerful, low-latency 5G network will ensure unrestricted connectivity for mobile applications and connected devices that require a high degree of security and privacy. Telcos are reaping the benefits of AI and data analytics at scale from the cloud. As a result, the IT and telecom sector is expected to hold the largest market share.

Cloud computing is changing the healthcare sector by using real-time data processing, backup and business continuity, and healthcare information sharing in everyday operations. Real-time processing prioritizes compliance and privacy. Healthcare, therefore, presents a lucrative market opportunity for cloud security companies. Retailers are using artificial intelligence to help customers shop without going through standard checkout lines. Retailers continuously arrange cloud security for their customers to protect sensitive digital data and sensitive identities associated with each customer stored in the cloud.

Key Market Segments

By Security Type

- Data Loss Prevention

- Security Information & Event Management

- Identity & Access Management

- Business Continuity & Disaster Recovery

By Enterprises Size

- Large Enterprises

- Small & Medium-Sized Enterprises

By End-User

- IT & Telecommunication

- Banking

- Finance

- Security & Insurance

- Healthcare & Life Sciences

- Manufacturing

- Retail

- Energy & Utilities

- Government

Opportunities

Governments Supporting the Smart Infrastructure Projects for Cloud

Governments of all countries are investing in cloud-based delivery models. They partner with private companies through public-private partnerships (PPPs) to drive smart enterprises in metropolitan cities and smart transportation systems. Cloud-based technology provides reliable, cost-effective, and scalable results. In recent years, organizations have adopted cloud-based deployments significantly. Experts assume that this trend will continue for the next few years.

Organizations are moving workloads to the cloud to increase agility, speed time, and reduce costs. Additionally, advanced technologies such as IoT and Industry 4.0 are contributing to more data being stored in the cloud. With the emergence of BYOD and WFH trends and the growing popularity of the Internet in new markets, enterprises are increasingly turning to cloud solutions. This eventually increases the need for cloud security.

Cloud security has become essential to protect organizations moving to secure the cloud from cyberattacks. Organizations are now choosing cloud-level security monitoring across public and private clouds to facilitate vulnerability detection in IoT devices. As such, the benefits of cloud security solutions and services have led to widespread adoption.

Trends

Cloud Security Market Share is Going to Increase Due to Crypto-Jacking in Cryptocurrencies

Different values of cryptocurrencies aligned for better decision-making skills lead to crypto-jacking attacks in the cloud. For example, CoinStomp is malware consisting of shell scripts that attempt to mine cryptocurrency by exploiting cloud computing instances hosted by network security providers.

VPN technology, cloud computing, the increasing number of cyber threat cases, the increasing acceptance of BYOD devices, and the growing use of blockchain by various business organizations worldwide are the major trends emerging in the cloud.

BYOD stands for Bring Your Own Devices and is a policy used by many companies. This allows employees to bring their own devices and use them to access your organization’s sensitive data. This policy can be used for data alteration, loss, and deletion. Additionally, cloud security is used by company employees for secure remote access to data.

Regional Analysis

North America is Expected to Account for the Largest Share of the Cloud Security Market

North America leads the market with 42.4% of the share in the global cloud security market. High entrance of connected devices, rising cybercrime, presence of prominent cloud security players, and growing awareness of cloud security among SMBs are expected to support market growth in the region during the forecast period.

Government agencies and private companies are increasing their investment in security solutions by initiating various initiatives and incorporating research and development into existing solutions. For example, in April 2021, MIT Researcher in the United States launched a new privacy-focused initiative to address changing attitudes toward AI-driven analytics and personal data. This includes collaborations in five different technical areas data protection, data portability, database systems, AI and machine learning, human-computer interaction, and new information architectures.

Note: Actual Numbers Might Vary In Final Report

In Europe, the increasing adoption of IoT-connected devices, rising cybercrime, data breaches, and increasing adoption of database technologies are demonstrating enormous demand for cybersecurity solutions and services. Additionally, stringent data protection rules and regulations implemented by EU governments, such as the GDPR, are driving demand for public and private sector security solutions to meet government standards in European countries.

Asia-Pacific is projected to register the fastest growth rate of 25.4% during the forecast period. The growing economic importance of security is driving increased investment in national security in the Middle East and Africa. Countries such as Oman, Qatar, the United Arab Emirates (UAE), and Bahrain are making strong moves towards digitizing their security and surveillance sectors and are expected to see increased adoption of security solutions.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major Market Players to Merge and Embrace Partnership to Cover Share

Market-leading players such as Microsoft Corporation, Cisco Systems, Inc., IBM Corporation, Palo Alto Networks Inc., Broadcom Inc., and others try to improve their products by including advanced technologies. Other players have entered into strategic partnerships to strengthen their market positions and gain competitive advantages.

Market Key Players

- Amazon Web Services, Inc.

- Microsoft

- Palo Alto Networks, Inc

- Trend Micro, Inc

- Broadcom, Inc

- Check Point Software Technologies Ltd.

- Palo Alto Networks.

- McAfee, LLC.

- IBM Corporation

- Zscaler, Inc.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Sophos Ltd.

- Other Key Players

Recent Developments

- In 2022, AWS Security Hub connected to AWS Control Tower, allowing to manage investigative control from Security Hub and proactive actions from Control Tower. Security Hub controls are now linked to relevant control objectives in the Control Tower, which controls the library, providing a complete picture of the controls required to achieve a specific control objective.

Report Scope

Report Features Description Market Value (2022) USD 20.5 Bn Forecast Revenue (2032) USD 148.3 Bn CAGR (2023-2032) 22.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Security Type – Data Loss Prevention, Security Information & Event Management, Identity & Access Management, and Business Continuity & Disaster Recovery; By Enterprise Size – Large Enterprises and Small & Medium-Sized Enterprises; By End-User – IT & Telecommunication, Banking, Finance, Security & Insurance, Healthcare & Life Sciences, Manufacturing, Retail, Energy & Utilities, and Government. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amazon Web Services, Inc., Microsoft, Palo Alto Networks, Inc, Trend Micro, Inc, Broadcom, Inc, Check Point Software Technologies Ltd., Google, Palo Alto Networks., McAfee, LLC., IBM Corporation, Zscaler, Inc., Cisco Systems, Inc., Fortinet, Inc., Sophos Ltd., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Cloud Security Market?The Global Cloud Security Market size was estimated to be USD 20.5 Bn in 2022.

What is the overall market value stated in the Cloud Security Market report?The Global Cloud Security Market size was USD 20.5 Bn in 2022 and is expected to reach USD 148.3 Bn by 2032 at a CAGR of 22.5% over the forecast period of 2023-2032.

Which region is projected to be at the forefront of the Global Cloud Security Market?North America led the Cloud Security Market in 2022 with a market share of over 42.4% and is expected to expand further at the same rate.

Who are some key players in the cloud security market?Some key players in the cloud security market include Amazon Web Services, Microsoft Azure, Google Cloud Platform, IBM Cloud, Cisco Systems, Palo Alto Networks, Symantec, and McAfee.

What are some current trends in the cloud security market?Some current trends in the cloud security market include the use of artificial intelligence (AI) and machine learning (ML) to improve threat detection and response, the adoption of a zero-trust security approach, and the increasing importance of cloud compliance and regulatory requirements.

List the segments included in this report on the Cloud Security Market .The Global Cloud Security Market is segmented By Security Type, By Enterprises Size, By End-User, and By Region

-

-

- Amazon Web Services, Inc.

- Microsoft

- Palo Alto Networks, Inc

- Trend Micro, Inc

- Broadcom, Inc

- Check Point Software Technologies Ltd.

- Palo Alto Networks.

- McAfee, LLC.

- IBM Corporation

- Zscaler, Inc.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Sophos Ltd.