Global Managed Security Services Market By Deployment Model (Cloud and On-Premises), By Security Type (Network Security, and Cloud Security), By End-Use (BFSI, Communications Industry, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 12760

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

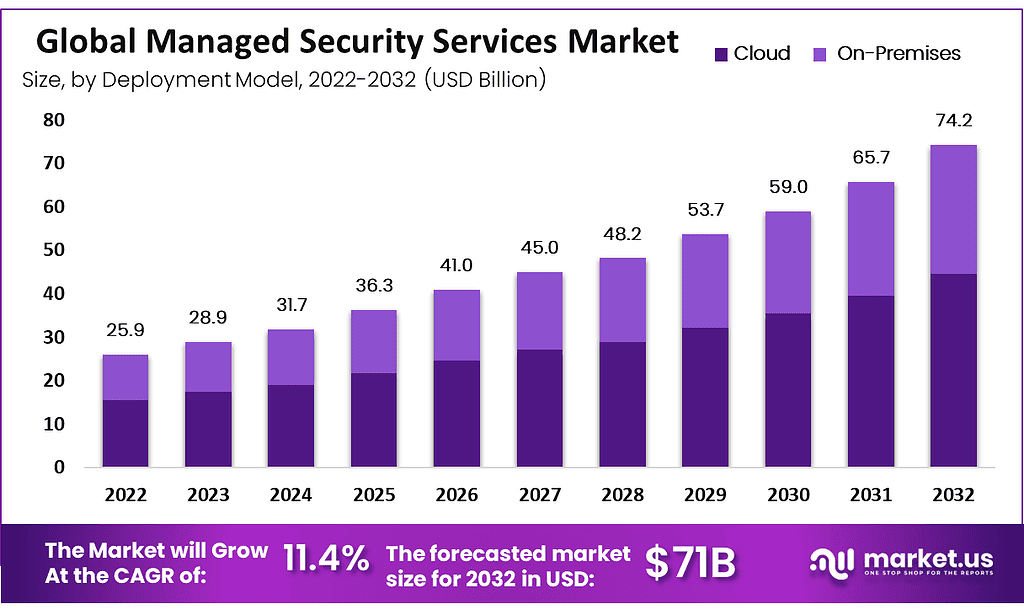

The Global managed security services (MSS) Market size is expected to be worth around USD 74.2 Billion by 2032 from USD 28.9 Billion in 2023, growing at a CAGR of 11.40% during the forecast period from 2023 to 2032.

As they help protect corporate networks, assets, and passwords, managed security service providers have been proven to be a successful solution. Managed security services are gaining popularity among companies of all sizes as they increase their investments in network protection. Service providers offer reliable, efficient, and economically managed security solutions that help consumers secure their data. Managed security services providers offer clients/clients affordable, reliable, and efficient security solutions to help secure their sensitive data and their business.

Note: Actual Numbers Might Vary In The Final Report

Global managed security services are driven by increasing cybercrime activity, cost-effectiveness, and strict government regulations. The managed security services market for managed security services is also growing due to the increasing use of mobile devices in workplaces and the increase in electronic data. The market’s growth is impeded by the unwillingness to share sensitive information. The market will expand during the forecast period due to increasing awareness of data security and the growing importance of e-commerce.

Key Takeaways

- The managed security services (MSS) market is anticipated to reach USD 74.2 Billion by 2032, growing at an expected compound annual growth rate of 11.40% from 2023-2032.

- The primary factors driving growth in the managed security services market include increasing incidences of cybercrimes, an increasing adoption of connected devices, and demand for reliable security solutions.

- Market expansion is hindered by end users’ trust issues with third-party service providers, leading to limited adoption of managed security services.

- Key trends in the managed security services market include Advanced Endpoint Protection (AEP), Data Loss Protection (DLP), Identity Access Management (IAM), and Single Sign-On (SSO), among others.

- Cloud deployment models are expected to lead the market due to their accessibility, security and cost-effectiveness; and cloud security segment is projected to remain the leader when considering security type.

- Banking, Financial Services & Insurance (BFSI) sector is projected to experience the highest compound annual growth rate over its forecast period due to increased security breaches and growing need for data protection solutions.

- North America currently leads the managed security services (MSS) market, boasting the highest market share with numerous MSS vendors present, followed by Asia Pacific which is witnessing rapid expansion due to digital transformation initiatives.

- Major players in the market include IBM Corporation, SecureWorks Inc., Symantec Enterprise Cloud and Trustwave Holdings; these entities compete alongside Verizon Communications Inc. and AT&T Inc. among others.

Driving Factors

Increasing cybercrime and increased adoption of connected devices are boosting the managed security services market.

The increasing incidence of cybercrimes in various industry verticals propels the market growth in managed security services. This drives the necessity to provide solutions that serve different application areas, such as threat identification, data protection, and risk assessment. In turn, this increases the demand for managed security services within organizations.

Cybercrimes such as data hacking, ransomware, network intrusions, identity thefts, and credit card fraud have increased in severity, resulting in the need for 24/7 monitoring to improve organizational security standards. Managed cybersecurity services can help companies improve their security management, increase profitability, protect company reputations, and maintain market share.

The market growth for managed security services has been positive due to the increasing number of cyberattacks on retail and e-commerce businesses, the increased adoption of work-from-home policies and bring-your-own-device policies in the face of the pandemic, and rising digital and online frauds.

The demand for managed security services is increasing due to the increased adoption of connected devices. This has a positive effect on managed security services market growth. Manufacturers have begun to focus on greater utilization of connected devices in order to increase work productivity and flexibility.

Many industries are moving towards IoT-based connected devices. This means that there is a need to find solutions to reduce security threats, such as malware, cyber security risk, data protection, and other vulnerabilities. The managed security services market is growing due to a lack of computing power for IoT device security. These devices are more susceptible to malware, mismanagement, online exposure, and other threats.

Restraining Factor

Lack of trust among end users.

The managed security services market growth is being slowed by a limited adoption of managed security services provided by third-party service providers. This could be due to a lack of trust among end users. Many small businesses and enterprises that lack the resources or budget to hire security experts or have limited access to them rely on third-party service providers to maintain their business operations.

It is essential that end-user customers verify the security of the service providers and the latest cybersecurity tools before outsourcing security operations. Managed security service providers give you complete control over your organization’s data. Any security breach or vulnerability can negatively impact your business reputation.

Growth Opportunities

Need for reliable and robust security services.

As the overall IT landscape is evolving with increased digitalization, sophisticated cyberattacks have also been increasing at an alarming rate. Data and information security protect public and private sectors from sophisticated cyber threats and professional cybercriminals.

Multilayered cyberattacks are used by cybercriminals to monitor the intelligence and commercial aspects of individuals, companies, and countries. Enterprises are looking for security services that can provide even more safety in their facilities with decreased costs.

These unified threats are impossible to handle with basic security solutions. It is also expensive to implement and monitor individual services. The managed security services market will continue to grow because of the increasing demand for cost-effective and robust security services that can manage and monitor security events.

Trending Factors

AEP, DLP, IAM, and SSO are the new trends in the managed security services market.

MSS area systematic approach to managing a company’s security needs. Among the trends in MSS, advanced endpoint protection (AEP), e-mail security, data loss protection (DLP), security framework & compliance auditing, identity access management (IAM) & single sign-on (SSO), anti-malware, two-factor authentication, managed firewall and managed remote access service, are major trends.

Advanced endpoint protection with machine learning and behavior analysis protects against file and script-based threats. Firewalls and antivirus software are traditional endpoint security tools that detect attacks using available threat information. Advanced technology can be utilized to recognize new complex threats using advanced technologies like machine learning. AEP involves machine learning, security analysis, real-time threat intelligence, IoT security, and endpoint detection and response (EDR).

MSS offers managed email security services to help customers of Server Message Block. These services are highly effective in protecting users against highly malicious email threats and web threats, such as phishing attacks and ransomware. With the help of DLP, we can ensure that sensitive data is not accessed or misused by unauthorized users or even lost. DLP software categorizes commercially critical, confidential, and regulated data. It also identifies violations of policies set by organizations or in policy packs. This is usually driven by regulatory compliance. Managed Services Providers are also key significant players in the global supply chain, serving customers from all verticals, including retail, wholesale, and critical infrastructure.

Deployment Model Analysis

The cloud segment is expected to dominate the market due to its accessibility, security, and low cost.

Based on the deployment model, the managed security services market is divided into cloud and on-premises segments. The cloud segment has the highest value of these two segments and is expected to grow at a CAGR of 12.9% during the forecast period 2023-2032. The managed security services market growth is credited to various factors, including increased adoption of cloud-based services in enterprises, increased cloud management and storage apps, and a significant shift in workloads towards private and public cloud environments.

Cloud-deployed managed security services are gaining popularity due to their many capabilities, including decreased dependency on humans, faster threat identification, real-time monitoring, and better data protection. Cloud security services are cheaper than on-premise. They offer automated updates, greater security, flexibility in pricing, and lower IT infrastructure requirements.

Cloud-managed security services are also in demand due to technological advances like IoT implementation across industries and increased dependence on cloud computing. IBM Security launched its enhanced services in 2021 to aid organizations with managing their cloud security controls, policies, and strategies across hybrid cloud environments.

These services were created to combine cloud-native and third-party technologies with IBM expertise to assist organizations in creating a uniform security strategy across all cloud ecosystems. The increasing use of cloud servers and apps within enterprises and the shift to work-from-home and BYOD trends can be crucial in driving the managed security services market growth.

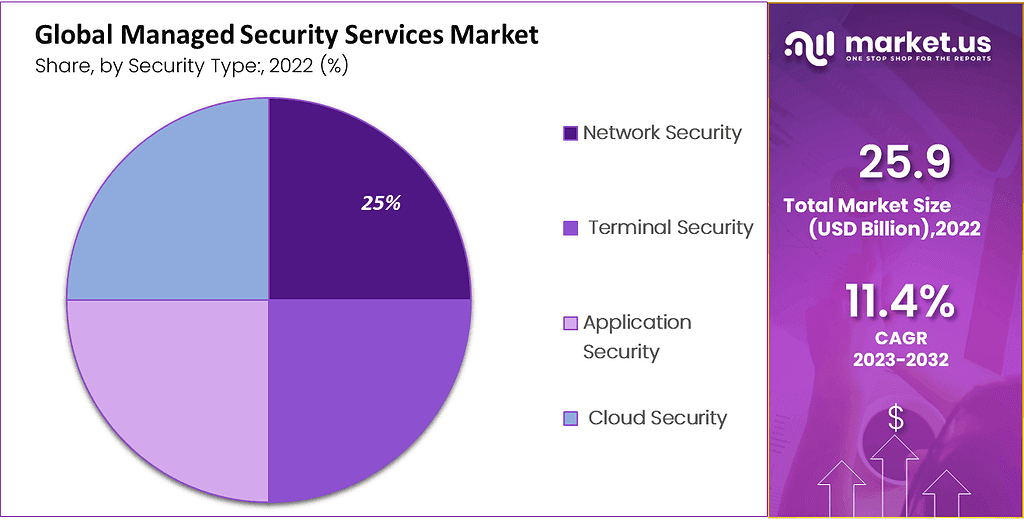

Security Type Analysis

The cloud security segment offers complete security.

By security type, the managed security services market is segmented into network security, terminal security, application security, and cloud security. Out of these cloud security segment dominated the market in 2022 and is supposed to keep dominating the market during the forecast period.

Cloud security solutions offer complete protection for the enterprise cloud against file-sharing and internal email risks, as well as ransomware. Cloud security solutions can easily be integrated into existing processes and operational teams. Cloud security covers both virtual and physical security across a variety of service models, software, platforms, and infrastructures.

Cloud security solutions include cloud application governance, risk assessment, IAM, and DLP. They also protect against malware detection & prevention, SIEM, encryption, and vulnerability assessments. These solutions protect sensitive data and ensure compliance, security, and governance. As cloud storage becomes more popular, so is the demand for cloud security. Cloud security is available in private, public, or hybrid cloud networks for many verticals, including media, healthcare, manufacturing, retail, and other industries.

End-User Analysis

BFSI is predicted to have the highest CAGR during the forecast period.

By end-user, this market is divided into Banking, Financial Services & Insurance (BFSI), the communications industry, the public sector, media, retail, manufacturing, medical, and other end-users. According to an analysis, the BFSI sector will experience the highest growth rate with a CAGR of 12.3% in the global managed security services market between 2023-2032.

Market growth is being influenced by the increasing number of security breaches at banks and financial institutions, the growing demand for security solutions for data security, the shift to online banking, and other factors. This sector uses sensitive data, so it is crucial to ensure its confidentiality and security.

Managed security services are now widely available. Because of its ceaseless real-time monitoring, managed security services have been popularized in the BFSI vertical. This allows for early detection and prevention of security threats.

The market has been growing in demand for managed security services due to increased government focus on cyber security management in the banking sector, increased spending by financial institutions on IT security, an increase in ransomware attacks, and a shift in IT workloads in the cloud. UiPath launched its Automation as a Services offering on Finastra cloud in April 2022. This service is designed to offer a managed service model for Finastra’s many credit unions and financial institution customers.

The company will provide automated services to the banking sector, including the design, installation, deployment, maintenance, and security of Finastra’s cloud-based infrastructure. These factors will help to increase the managed security services market growth for managed security services in the BFSI sector over the long term.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Based on the Deployment Model

- Cloud

- On-Premises

Based on the Security Type

- Network Security

- Terminal Security

- Application Security

- Cloud Security

Based on End-User

- BFSI

- Communications Industry

- Public Sector

- Media

- Retail

- Manufacturing

- Medical

- Others

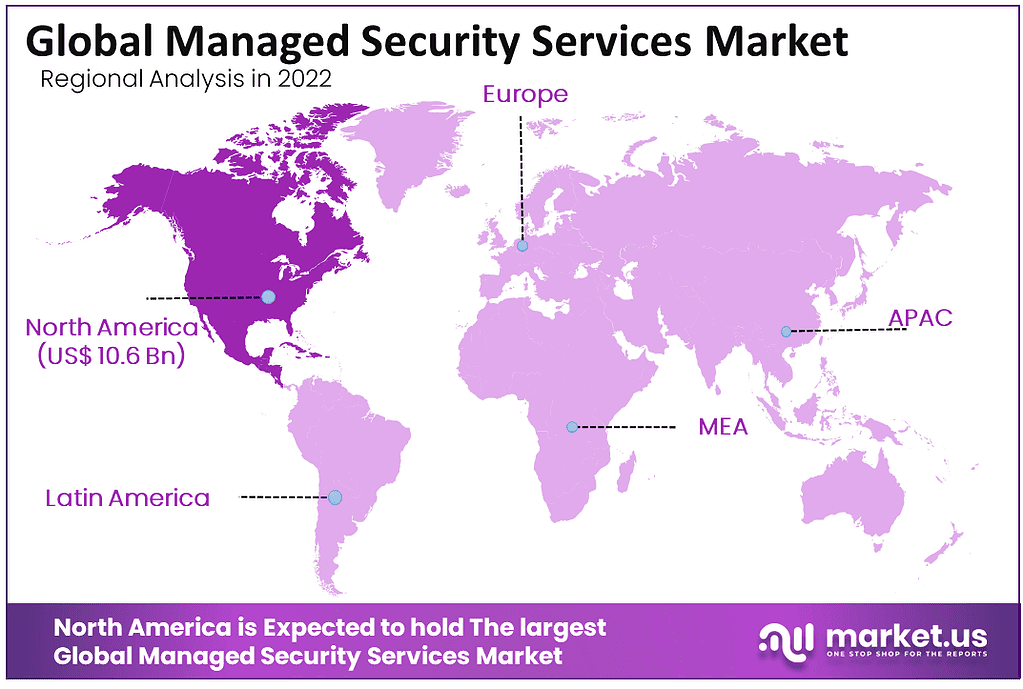

Regional Analysis

North America has the largest market share due to increasing activities like cybercrime, data breach, etc.

Based on geography, the managed security services market is analyzed across North America, Western Europe, Eastern Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America region dominated the market in 2022 with the largest share of around 41% in the global managed security service market.

The main factor behind this was increasing investment in information technology infrastructure security, increasing data breach incidents across enterprises, and increased dependency on cloud-based services and applications. Therefore, North America has the largest number of MSS vendors. Government intervention in providing cybersecurity is also a major factor in the growth of the market in the region.

Asia Pacific is the fastest-growing region in this market. The region has made digital transformation a priority. This trend is rapidly spreading as more companies execute formal strategies that support their efforts.

This drives the managed security services market demand. Outsourcing managed services can help a company save substantial money, provide more resilience, and increase network performance and uptime. Institutions in China are now required to use managed security services due to the growing cybersecurity threats in the region. These include DDoS attacks, IT ransomware attacks, and data exfiltration.

The rapid advancement of 5G, AI, virtual reality, and IoT technologies and their commercial application is driving the demand for data processing in the Asia Pacific. This could increase the number of data centers built in the region and help to propel the industry’s growth.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

There are many vendors that offer security services for companies, including Denial of services, network attacks, and even risk assessments. This fragmentation has led to the managed security services market being fragmented. As organizations continue to invest strategically, this market will see many mergers, service launches, and acquisitions.

Managed Security Services Market Players:

- IBM Corporation

- SecureWorks Inc.

- Symantec Enterprise Cloud

- Trustwave Holdings

- Verizon Communications Inc.

- AT&T Inc.

- Atos Syntel

- BAE Systems PLC

- BT Group PLC

- CenturyLink

- DXC Technology

- Fortinet Technology

- Fujitsu Limited

- NTT Security

- Wipro Limited

- Other Key Players

Recent Key Developments

- Ace Cloud Hosting, a global cloud service provider for application hosting and virtual desktops, announced the launch of Managed Security Services (MSS) in April 2022.

- Accenture also acquired Symantec’s cybersecurity business to add flexibility to security services.

- Verizon integrated Blackberry Cyl ance’s AI-based antivirus solution into its security service portfolio. This integration is indicative that there is a growing demand for AI-based cybersecurity products. These developments highlight the managed security services market’s potential growth.

Report Scope

Report Features Description Market Value (2023) USD 28.9 Bn Forecast Revenue (2032) USD 74.2 Bn CAGR (2023-2032) 11.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Model- Cloud and On-Premises; By Security Type- Network Security, Terminal Security, Application Security, and Cloud Security; and By End-User- BFSI, Communications Industry, Public Sector, Media, Retail, Manufacturing, Medical, and Others. Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, SecureWorks Inc., Symantec Enterprise Cloud, Trustwave Holdings, Verizon Communications Inc., AT&T Inc., Atos Syntel, BAE Systems PLC, BT Group PLC, CenturyLink, DXC Technology, Fortinet Technology, Fujitsu Limited, NTT Security, Wipro Limited, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Managed Security Services in 2032?In 2032, the Managed Security Services will reach USD 74.2 billion.

What CAGR is projected for the Managed Security Services?The Managed Security Services is expected to grow at 11.4% CAGR (2023-2032).

Name the major industry players in the Managed Security Services.IBM Corporation, SecureWorks Inc., Symantec Enterprise Cloud, Trustwave Holdings, Verizon Communications Inc. and Other Key Players are the main vendors in Cosmetic Packaging.

List the segments encompassed in this report on the Managed Security Services?Market.US has segmented the Managed Security Services by geographic (North America, Europe, APAC, South America, and MEA). By Deployment Model, market has been segmented into Cloud and On-Premises. By Security Type, the market has been further divided into, Network Security, Terminal Security, Application Security and Cloud Security.

What are the main business areas for the Managed Security Services?North America and Europe are the largest market share in Managed Security Services.

Managed Security Services MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Managed Security Services MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- SecureWorks Inc.

- Symantec Enterprise Cloud

- Trustwave Holdings

- Verizon Communications Inc.

- AT&T Inc.

- Atos Syntel

- BAE Systems PLC

- BT Group PLC

- CenturyLink

- DXC Technology

- Fortinet Technology

- Fujitsu Limited

- NTT Security

- Wipro Limited

- Other Key Players