Global Identity and Access Management Market Size, Share Analysis Report By Component (Password Management, Multifactor Authentication, Audit, Compliance, and Governance, Provisioning, Single Sign-On, Directory Services, Other Components), By Deployment Mode (On-Premise and Cloud-Based), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT & Telecommunication, BFSI, Manufacturing, Healthcare, Education, Retail, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Sept. 2025

- Report ID: 49431

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Identity and Access Management (IAM) Statistics

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Top Use Cases

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

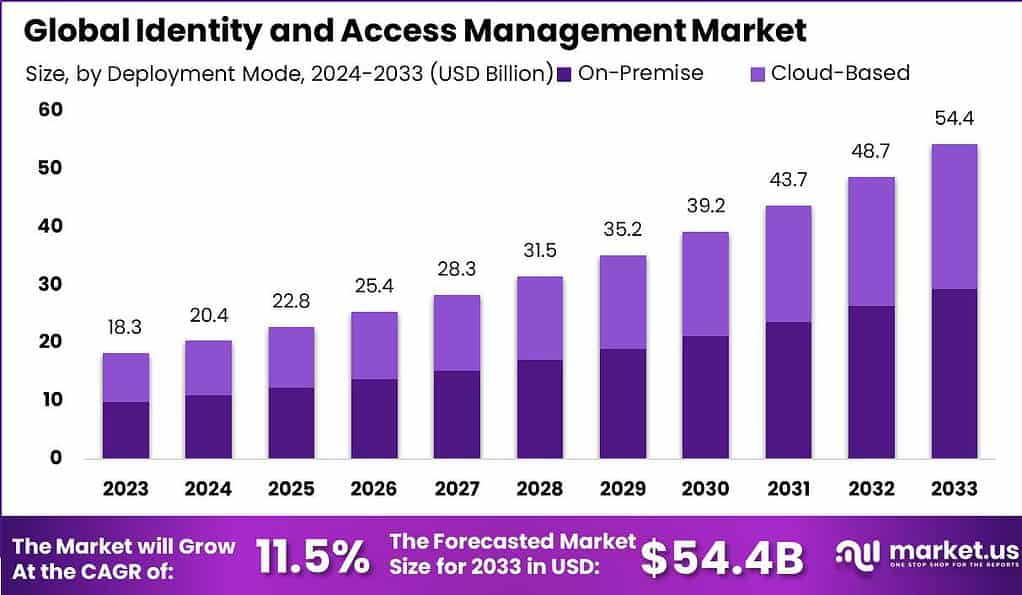

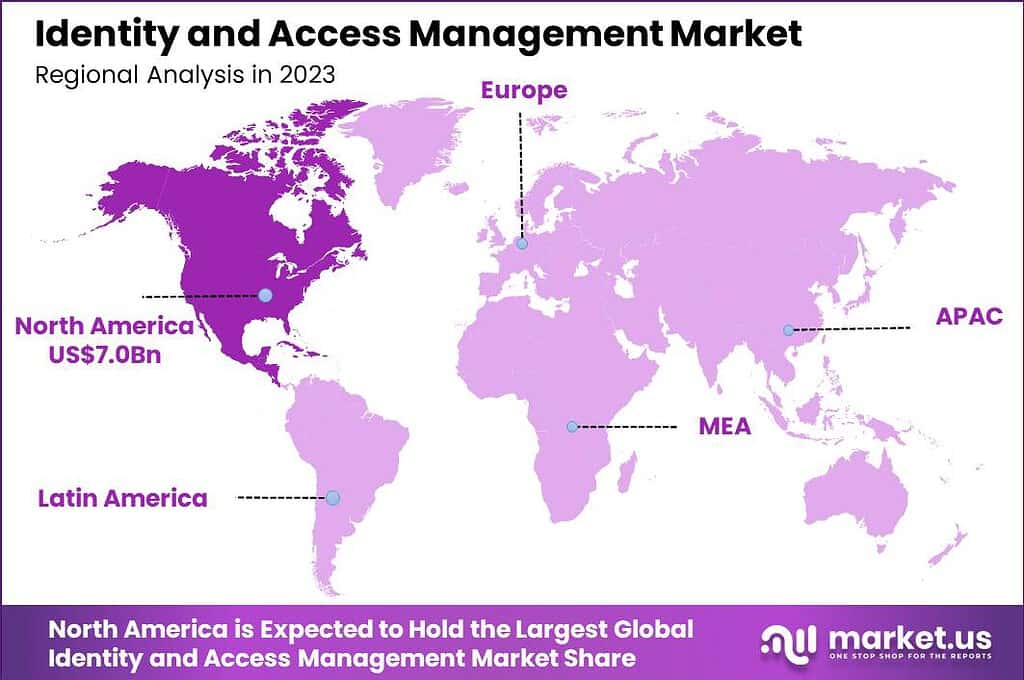

The Global Identity and Access Management Market size is expected to be worth around USD 54.4 Billion by 2033, from USD 18.3 Billion in 2023, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38.3% share, holding USD 7.0 Billion revenue.

The IAM market comprises software and services that verify and control who (and what) can access systems, data, and resources in an organization. IAM covers user identity creation and management, authentication, authorization, role and entitlement management, privileged access, single sign-on, identity governance, and lifecycle management of users and devices. It ensures that only the right entities at the right time have access to the right resources under the right conditions.

One major driver is the rising frequency and sophistication of cyberattacks targeting user credentials and identities. As breaches and identity fraud become more common, organizations must harden their access controls. Another driver is the shift to cloud computing, hybrid IT environments, and remote work, which scatters systems and increases identity surfaces to protect.

For instance, In May 2024, Microsoft announced a significant update regarding the security of its Azure platform. Starting in July 2024, multi-factor authentication (MFA) will become mandatory for all Azure users. This decision is part of Microsoft’s Secure Future Initiative, which is focused on strengthening security measures and reducing the risk of data breaches.

The benefits of implementing IAM are extensive. It enhances security by reducing the risk of data breaches through stringent access controls. IAM improves user experience by facilitating seamless access to applications and systems without compromising security. It also aids compliance with various regulatory requirements by providing tools to monitor and manage user activities efficiently.

Furthermore, IAM systems reduce IT costs by automating many aspects of user management and reducing the need for manual intervention. The demand for IAM solutions is driven by businesses across all sectors seeking to secure their digital environments. This demand is particularly strong in industries such as healthcare, finance, and government, where protecting sensitive data is paramount.

According to Tenfold’s findings, 80% of cyberattacks now exploit identity-based methods, making identity management a critical area of concern. Additionally, 99% of security decision makers expect to face an identity-related breach within the next year. This highlights a significant challenge, especially with the average cost of a data breach reaching $4.45 million, creating serious financial implications for businesses.

Ransomware remains a top threat, with 48% of organizations identifying it as their main concern for the coming year. Furthermore, 42% of organizations have already experienced a ransomware attack in the past year, emphasizing the need for stronger defense mechanisms. The situation is compounded by the increasing use of collaboration tools, which 75% of CISOs believe introduce new security risks. A striking 94% even find the built-in security features of Microsoft 365 inadequate for protecting their systems.

Finally, improving identity and access management could be a key solution. 80% of CISOs believe that enhanced identity management could have prevented some or all of the attacks they faced, making it a priority for future security strategies.

Key Takeaways

- The Global Identity and Access Management (IAM) Market is projected to reach USD 54.4 Billion by 2033, growing from USD 18.3 Billion in 2023 at a CAGR of 11.5% during the forecast period from 2024 to 2033.

- In 2023, North America led the market, accounting for over 38.3% of the global share, translating to approximately USD 7.0 Billion in revenue.

- The Provisioning segment emerged as the largest within the IAM market, capturing more than 32.5% share in 2023.

- The On-Premise segment secured a significant portion of the market, holding over 54.1% share in 2023.

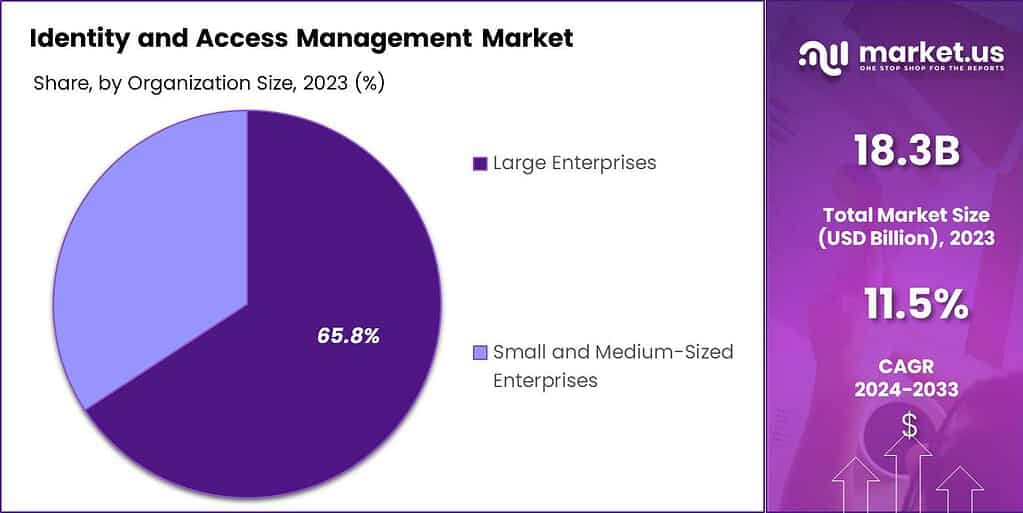

- In terms of enterprise size, Large Enterprises dominated the market with a commanding 65.8% share in 2023, as these organizations prioritize sophisticated identity management to secure vast amounts of sensitive data.

- Finally, the BFSI sector accounted for more than 23% share of the IAM market in 2023, driven by the financial industry’s critical need for secure and compliant identity management systems.

Identity and Access Management (IAM) Statistics

- Based on data from llcbuddy, In 2023, 60% of medium-sized companies reported a hacking incident affecting 250 to 5000 employees, particularly those requesting remote work from their colleagues.

- A significant 56% of these companies experienced credential theft, while 48% faced social engineering attacks, including phishing.

- In 61% of all cybersecurity incidents, credentials were either stolen through social engineering or compromised via brute force attacks.

- Interestingly, 71% of firms that had experienced a data breach believed that improved security awareness training could have prevented the intrusion.

- A striking 89% of organizations disclosed they were targeted by ransomware in the past year.

- Among 1,700 IT professionals, 97% stated they were hit by phishing emails, highlighting the persistent threat of email-based attacks.

- When considering investment in an Identity and Access Management (IAM) solution, 72% of enterprises prioritized ease of integration, while 62% focused on user experience, followed closely by 61% who emphasized product performance and effectiveness.

- Only 34% of companies with a forward-thinking security culture experienced identity-related breaches last year.

- However, 80% of all cyberattacks now leverage identity-based techniques, showcasing the growing focus on exploiting user access.

- In 2023, cybercrime caused a staggering 8 trillion dollars in global losses. Despite this, 63% of IT decision-makers admitted that highly sensitive access within their organizations remains insufficiently secured.

Component Analysis

In 2023, the Provisioning segment held a dominant position within the Identity and Access Management (IAM) market, capturing more than a 32.5% share. This leadership can be attributed primarily to the critical role that provisioning plays in managing digital identities across various systems and platforms.

As organizations continue to expand their digital footprints, the need to efficiently manage user access to multiple applications and systems becomes paramount. Provisioning solutions facilitate this by automating the creation, modification, and termination of user privileges, thus ensuring that access rights are both accurately granted and promptly deactivated when no longer needed.

The heightened focus on security and compliance mandates has further propelled the Provisioning segment to the forefront. With regulations such as GDPR and HIPAA imposing strict guidelines on data access and privacy, companies are investing more in robust IAM frameworks that can streamline compliance. Provisioning tools are integral to these frameworks, as they provide detailed logs and reports that help in monitoring and auditing access controls, thereby simplifying compliance processes.

Moreover, the integration capabilities of provisioning systems have made them indispensable in modern IT environments. These systems integrate seamlessly with a wide array of IT infrastructures and business applications, which is vital for organizations undergoing digital transformation. The ability to manage and synchronize identity data across cloud-based and on-premise systems helps businesses maintain operational continuity and improves overall security posture.

These factors collectively explain why the Provisioning segment has taken a leading position in the Identity and Access Management market. As businesses continue to navigate complex digital landscapes, the demand for effective provisioning solutions is expected to remain robust, underscoring their pivotal role in IAM strategies.

Deployment Mode Analysis

In 2023, the On-Premise segment held a dominant market position within the Identity and Access Management (IAM) market, securing more than a 54.1% share. This leading position is largely due to the high level of control and security that on-premise solutions offer to organizations.

Many enterprises continue to favor on-premise IAM systems because they provide direct oversight of security protocols and data management, reducing reliance on third-party service providers and mitigating potential data breaches that can occur in cloud-based solutions.

For instance, In February 2023, Procyon, a pioneering platform in Privilege Access Management (PAM) for multi-cloud environments, announced the successful closure of $6.5 million in equity financing. This funding round was led by Lobby Capital, with additional support from GTM Capital and First Rays Venture Partners. The investment highlights the growing demand for solutions addressing the challenges of identity and access management (IAM) in increasingly complex cloud environments.

Organizations with stringent regulatory compliance requirements particularly benefit from on-premise IAM solutions. These organizations operate in sectors such as banking, government, and healthcare, where data privacy is paramount. On-premise systems allow them to maintain complete control over sensitive user and customer information within their own IT environments, which is crucial for adhering to legal and regulatory standards.

Moreover, on-premise IAM solutions are preferred by organizations that require complex, customized integrations with legacy systems. These organizations often find that on-premise solutions can be more effectively tailored to fit their specific needs without the latency issues sometimes associated with cloud-based services. The ability to customize and integrate directly with existing infrastructure without compromising performance or security is a significant factor driving the dominance of the on-premise segment.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Identity and Access Management (IAM) market, capturing more than a 65.8% share. This significant market share is largely attributable to the complex security needs and extensive infrastructure requirements that large enterprises manage. With the vast amounts of sensitive data they handle, robust IAM systems are crucial to safeguarding information and ensuring regulatory compliance.

Large enterprises often operate across multiple geographic locations, often with numerous systems and applications that require careful coordination and management. IAM solutions offer these organizations a streamlined way to manage user access across this dispersed IT environment, enhancing security protocols while maintaining operational efficiency. This is particularly critical as these enterprises face more sophisticated cyber threats and stringent regulatory scrutiny, making advanced IAM solutions not just beneficial but essential.

Furthermore, the financial capability of large enterprises to invest in comprehensive, often custom-tailored IAM solutions adds to the segment’s dominance. They are more likely to allocate substantial budgets towards sophisticated IAM frameworks that include features such as biometric authentication, advanced encryption, and AI-driven security measures. These investments are aimed at mitigating risks and enhancing security postures, driving the segment’s growth within the IAM market.

This alignment of IAM capabilities with the operational scale and security requirements of large enterprises explains their leading position in the market. As technology and compliance requirements continue to evolve, the demand within this segment is expected to grow, reinforcing its prominence in the IAM landscape.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Identity and Access Management (IAM) market, capturing more than a 23% share. This leadership is primarily driven by the critical necessity for stringent security and compliance measures in the financial sector.

IAM solutions are integral in managing and securing sensitive financial data, protecting against breaches, and ensuring customer trust, which is paramount in this industry. The BFSI sector faces a unique set of challenges such as managing multifactor authentication and securing transaction processing, which necessitates robust IAM systems.

In 2023, the Data Breach Investigations Report (DBIR) highlighted a concerning trend, with 16,312 security incidents analyzed, and 5,199 confirmed data breaches. This has put immense pressure on industries, particularly the BFSI sector (Banking, Financial Services, and Insurance), which handles sensitive financial data.

To combat rising threats, the BFSI sector is increasingly adopting sophisticated technologies to safeguard their IT systems and protect customer data. These measures are not just driven by the need for security, but also by government regulations that demand stringent data protection. By implementing advanced solutions, BFSI companies aim to prevent fraud and cyber-attacks, ensuring compliance and customer trust

Moreover, IAM solutions in BFSI help streamline the customer identity verification processes, essential for both onboarding and ongoing transactional security. By implementing comprehensive IAM frameworks, BFSI organizations can enhance operational efficiencies, reduce fraud risks, and deliver a better customer experience. This dual benefit of security and efficiency is a key driver behind the segment’s leading position in the IAM market.

Given these factors, the BFSI segment’s strong hold in the IAM market is not only a reflection of its current security and compliance needs but also indicative of the critical role IAM plays in the broader digital transformation initiatives across financial institutions. As these trends continue, the importance of IAM in BFSI is expected to grow further, maintaining its lead in the market.

Key Market Segments

Component

- Password Management

- Multifactor Authentication

- Audit, Compliance, and Governance

- Provisioning

- Single Sign-On

- Directory Services

- Other Components

Deployment Mode

- Cloud-Based

- On-Premise

Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Industry Vertical

- IT & Telecommunication

- BFSI

- Manufacturing

- Healthcare

- Education

- Retail

- Other Industry Verticals

Driver

Growing Threat of Cyber Attacks

The increasing prevalence of cyber threats significantly drives the identity and access management (IAM) market’s growth. As digital transformation escalates across sectors, the cyber attack surface also broadens, making robust IAM systems crucial.

These systems are pivotal in managing user access rights, thereby mitigating unauthorized access risks and enhancing overall cybersecurity measures. Cyber threats are becoming more sophisticated, prompting organizations to adopt advanced IAM solutions that provide more efficient user privilege management, authentication, and authorization processes.

Restraint

Complexity in Implementation

One of the main challenges facing the IAM market is the complexity involved in integrating and managing IAM solutions. Organizations often struggle with the deployment and continuous management of these systems, especially in environments with legacy systems and multiple user databases.

This complexity can lead to higher costs and extended deployment times, deterring some organizations from updating or implementing new IAM solutions. Additionally, there is a noticeable scarcity of skilled professionals who specialize in IAM, further complicating effective implementation and management.

Opportunity

Integration of IoT and Biometrics

The IAM market sees significant opportunities in integrating Internet of Things (IoT) devices and biometric authentication technologies. As IoT devices proliferate within various sectors, managing access becomes more complex and critical.

Biometric technologies, such as facial recognition and fingerprint scanning, offer a more secure and user-friendly way to manage identity verification. These integrations can provide more precise access control and enhanced security, particularly important in sectors like healthcare, banking, and government, where sensitive information handling is crucial.

Challenge

Rapid Technological Changes

The IAM market is continually challenged by the rapid pace of technological advancement. Keeping up with evolving tech trends, such as cloud-based solutions, blockchain, and machine learning, requires constant updates and adaptations of IAM systems.

This rapid evolution can strain resources as organizations must regularly invest in new technologies and training to stay current. Additionally, the integration of new technology often involves complex transitions and compatibility issues with existing systems.

Growth Factors

The Identity and Access Management (IAM) market is poised for substantial growth, driven by several key factors. First and foremost, the rising prevalence of cyber threats necessitates robust security solutions, making IAM systems integral for safeguarding digital identities and sensitive data across various sectors.

Additionally, the increasing adoption of cloud-based services and the widespread digital transformation across industries enhance the demand for effective IAM solutions to manage and secure user access, regardless of location.

For instance, In October 2023, ManageEngine, the IT management division of Zoho Corporation, introduced a significant new offering in the realm of identity management. The company launched Identity360, a cloud-native platform designed to tackle the growing complexities of identity and access management (IAM) faced by enterprise workforces.

Emerging Trends

Several emerging trends are shaping the future of the IAM market. Cloud-based IAM solutions are gaining traction due to their scalability and cost-effectiveness, offering enhanced security measures and simplified user authentication processes.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) within IAM systems is revolutionizing cybersecurity by automating crucial tasks like user provisioning and real-time threat detection. Moreover, the implementation of multi-factor authentication (MFA) and single sign-on (SSO) continues to grow, providing more robust security measures and a seamless user experience.

Business Benefits

Implementing IAM systems offers significant business benefits. These systems enhance security by managing and restricting user access to sensitive information, thus reducing the risk of data breaches. IAM solutions also improve operational efficiency by automating identity management processes, which can lower costs and reduce the administrative burden on IT departments.

Furthermore, IAM supports regulatory compliance by ensuring that access controls and data security measures meet industry standards and regulations, which is crucial for maintaining corporate integrity and customer trust.

Top Use Cases

IAM systems are versatile and find application in various critical scenarios across industries. One prominent use case is in managing customer identities to enhance customer experiences and secure access to services in sectors like e-commerce and financial services.

In the enterprise sphere, IAM is crucial for enabling secure remote work environments by managing employee access to internal systems and applications. The healthcare sector also leverages IAM to protect patient data and ensure compliance with health privacy laws, which is critical for maintaining confidentiality and trust.

Regional Analysis

In 2023, North America held a dominant market position in the Identity and Access Management (IAM) market, capturing more than a 38.3% share with revenues amounting to USD 7.0 billion. This leadership is largely attributed to the region’s strong focus on cybersecurity frameworks and advanced technological adoption across various sectors, including government, healthcare, and finance.

North America’s leading position is further bolstered by its robust regulatory landscape, which mandates stringent data protection measures. Regulations such as HIPAA for healthcare, and the Sarbanes-Oxley Act for corporate governance, drive the demand for comprehensive IAM solutions to ensure compliance and protect sensitive data.

for instance, In January 2024, Stack Identity, a Silicon Valley-based leader in identity security, took a major step forward by expanding its Identity Access Risk Management Platform. This update includes identity threat detection and response (ITDR) capabilities, specifically aimed at addressing growing concerns around shadow access and shadow identities. With these new tools, organizations can better identify hidden risks within their identity systems, which have become a major threat in today’s security landscape.

Additionally, the prevalence of cyber threats in this region has prompted enterprises to invest heavily in cybersecurity, with IAM being a cornerstone for securing digital assets and managing user access control effectively. Moreover, the presence of key industry players and technology innovators in North America contributes significantly to the region’s market dominance.

For instance, in January 2024, Tuebora, known for its interactive Identity Governance Administration (IGA) solutions, introduced Ask Tuebora, an innovative tool powered by generative AI. Ask Tuebora is designed to simplify the often-complicated workflows involved in Identity Access Management (IAM) by allowing users to ask natural language questions.

These companies not only push for technological advancements in IAM solutions but also help foster a culture of security-first approaches within organizations. The widespread adoption of cloud computing and the increasing move towards digital transformation initiatives across enterprises further amplify the need for IAM systems, ensuring secure user access and identity management across cloud-based platforms.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Identity and Access Management (IAM) market is highly competitive, with several key players driving its growth. Microsoft Corporation remains a dominant force in this market, leveraging its Azure Active Directory solutions to offer seamless identity management for enterprises of all sizes. With a focus on cloud security and innovation, Microsoft continues to expand its offerings, helping organizations safeguard user identities.

IBM Corporation is another major player, known for its robust security solutions like IBM Security Identity Governance and Intelligence. IBM’s strength lies in its comprehensive approach to IAM, combining AI-driven insights with advanced identity governance, which has positioned it as a trusted provider for large enterprises.

Oracle Corporation offers a powerful suite of identity management solutions through Oracle Identity Cloud Service. Oracle’s strength in integrating IAM with its broader cloud services makes it an attractive choice for businesses looking for end-to-end security and cloud efficiency. This integration allows for streamlined user access while ensuring security across hybrid environments.

Top Key Players in the Market

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- Broadcom Inc.

- BeyondTrust Corporation

- CyberArk Software Ltd.

- Zoho Corporation

- One Identity LLC

- Thales Group

- Fortinet, Inc.

- Other Key Players

Recent Developments

- In March 2024, Securden, Inc. introduced Unified PAM MSP, a breakthrough solution for Managed Service Providers (MSPs). This unique offering combines Privileged Access Management (PAM) features in a scalable, multi-tenant architecture, ensuring data segregation and security. It addresses the growing need for MSPs to manage client systems effectively while maintaining robust security measures.

- In July 2023, Infisign launched its innovative Identity and Access Management (IAM) platform, offering a passwordless authentication solution grounded in the Zero Trust approach. This method moves away from traditional security measures and focuses on authentication and access control at all points of the network, enhancing overall system security.

- In March 2023, the National Security Agency (NSA) and the Cybersecurity and Infrastructure Security Agency (CISA) released a critical guide for system administrators. This guide, part of the Enduring Security Framework (ESF), offers best practices for improving identity and access management (IAM) security. With cyber threats rising, this document provides actionable steps to strengthen system defenses, particularly in the face of evolving threats.

- IBM Corporation: In 2023, IBM expanded its capabilities in identity management by integrating its AI-powered security solutions with its IAM offerings. This integration allows businesses to enhance their security postures by automating identity verification and risk assessments. IBM’s partnership with Thales Group also bolstered its IAM framework, especially in industries requiring stringent data protection.

Report Scope

Report Features Description Market Value (2023) USD 18.3 Bn Forecast Revenue (2033) USD 54.4 Bn CAGR (2023-2032) 11.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Password Management, Multifactor Authentication, Audit, Compliance, and Governance, Provisioning, Single Sign-On, Directory Services, Other Components), By Deployment Mode (On-Premise and Cloud-Based), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT & Telecommunication, BFSI, Manufacturing, Healthcare, Education, Retail, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, IBM Corporation, Oracle Corporation, Broadcom Inc., BeyondTrust Corporation, CyberArk Software Ltd., Zoho Corporation, One Identity LLC, Thales Group, Fortinet Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Identity and Access Management MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Identity and Access Management MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- Broadcom Inc.

- BeyondTrust Corporation

- CyberArk Software Ltd.

- Zoho Corporation

- One Identity LLC

- Thales Group

- Fortinet, Inc.

- Other Key Players