Global Biometric Technology Market By Authentication Type (Single-Factor Authentication, Multi-Factor Authentication), By Component(Hardware and Software), By Type(Contact-Based, Contact-less, Hybrid), By Mobility (Fixed and Portable), By Application (Face, Hand geometry, Voice, Signature, Iris, AFIS, Non-AFIS, Others), By End-User (Government, Banking and Finance, Consumer Electronics, Healthcare, Transport/Logistics, Defense & Security, Other End-Users), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 67654

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Authentication Type Analysis

- Component Outlook

- Type Analysis

- Mobility Analysis

- Application Insights

- By End User

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenges

- Key Market Trend

- Key Market Segments

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

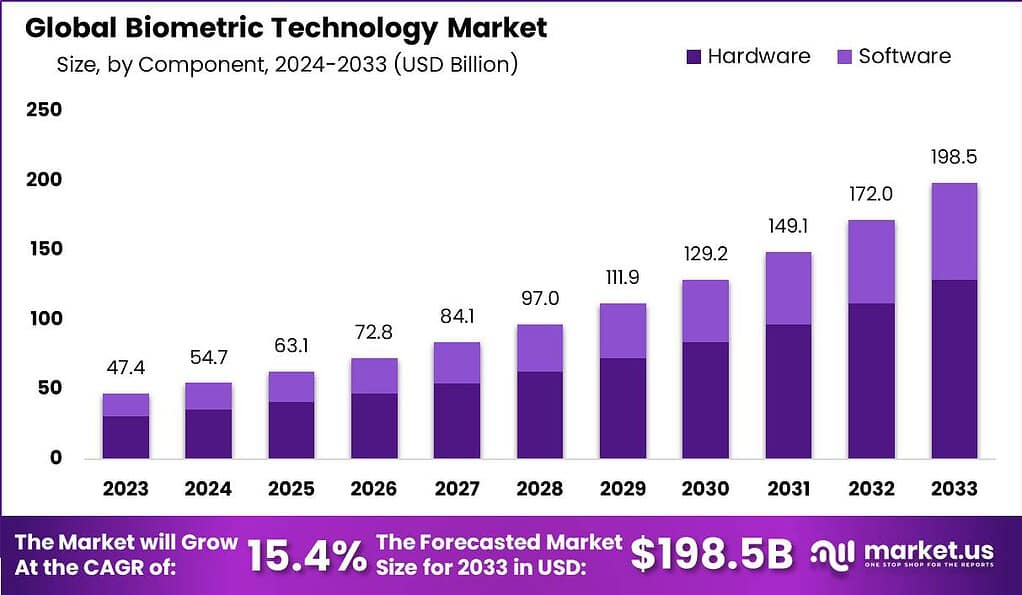

The Global Biometric Technology Market size is expected to be worth around USD 198.5 Billion By 2033, from USD 47.4 Billion in 2023, growing at a CAGR of 15.4% during the forecast period from 2024 to 2033.

The Biometric technology involves using individual physical or behavioral characteristics to identify or authenticate an individual. This method relies on the principle that every person is distinct and possess certain features which can be accurately measured to distinguish them from one another.

The biometric technology market has experienced significant growth in recent years, revolutionizing the way we authenticate and verify identities. Biometric technology refers to the use of unique physical or behavioral characteristics, such as fingerprints, facial features, iris patterns, or voice, for identification and authentication purposes. This market expansion can be attributed to several key factors.

One of the primary drivers of growth in the biometric technology market is the increasing need for secure and convenient identity verification. Traditional methods of authentication, such as passwords or PINs, are prone to security breaches and can be easily compromised. Biometric technology provides a more robust and reliable solution by leveraging unique biological traits that are difficult to duplicate or forge.

Furthermore, advancements in biometric technology, particularly in areas such as image processing, machine learning, and artificial intelligence, have fueled market growth. These technological advancements have improved the accuracy, speed, and reliability of biometric systems, making them more practical and effective for large-scale deployments. In addition, the decreasing costs of biometric sensors and hardware have made the technology more accessible to a wider range of industries and applications.

However, the biometric technology market also faces challenges that need to be addressed. One of the main challenges is privacy concerns related to the storage and use of biometric data. As biometric systems capture and store individuals’ unique biological characteristics, there is a need for strict data protection measures to safeguard personal information and prevent misuse.

Key Takeaway

- The Global Biometric Technology Market size is expected to be worth around USD 198.5 Billion By 2033, growing at a CAGR of 15.4%.

- In 2023, the Multi-Factor Authentication (MFA) segment held a dominant position in the Biometric Technology Market, capturing more than a 58% share.

- In 2023, the Hardware segment in the Biometric Technology Market held a dominant position, capturing more than a 65% share.

- In 2023, the Contact-less segment in the Biometric Technology Market held a dominant market position, capturing more than a 45% share.

- In 2023, the Fixed segment held a dominant position in the biometric technology market, capturing more than a 70% share.

- In 2023, the Face Segment held a dominant market position, capturing more than a 26% share in the biometric technology market.

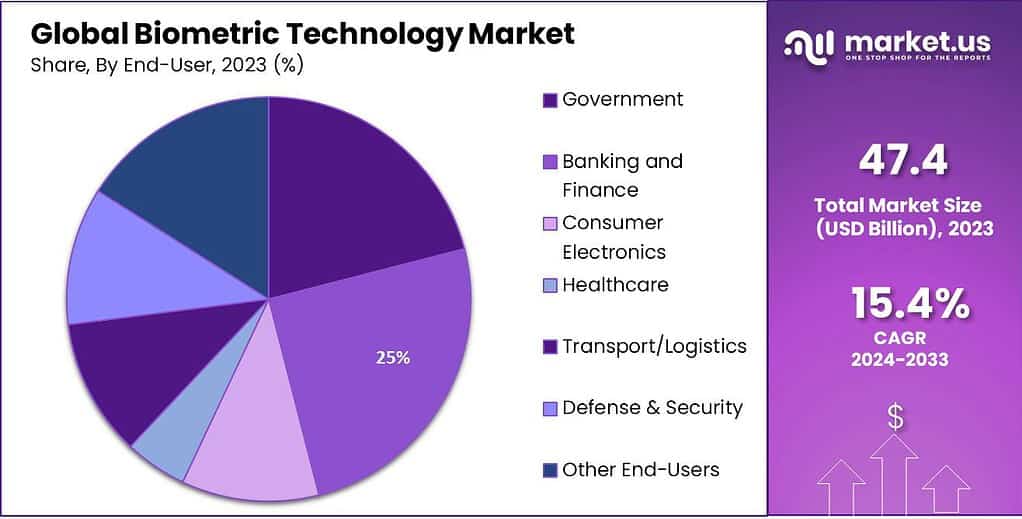

- In 2023, the Banking and Finance segment held a dominant market position in the biometric technology market, capturing more than a 25% share.

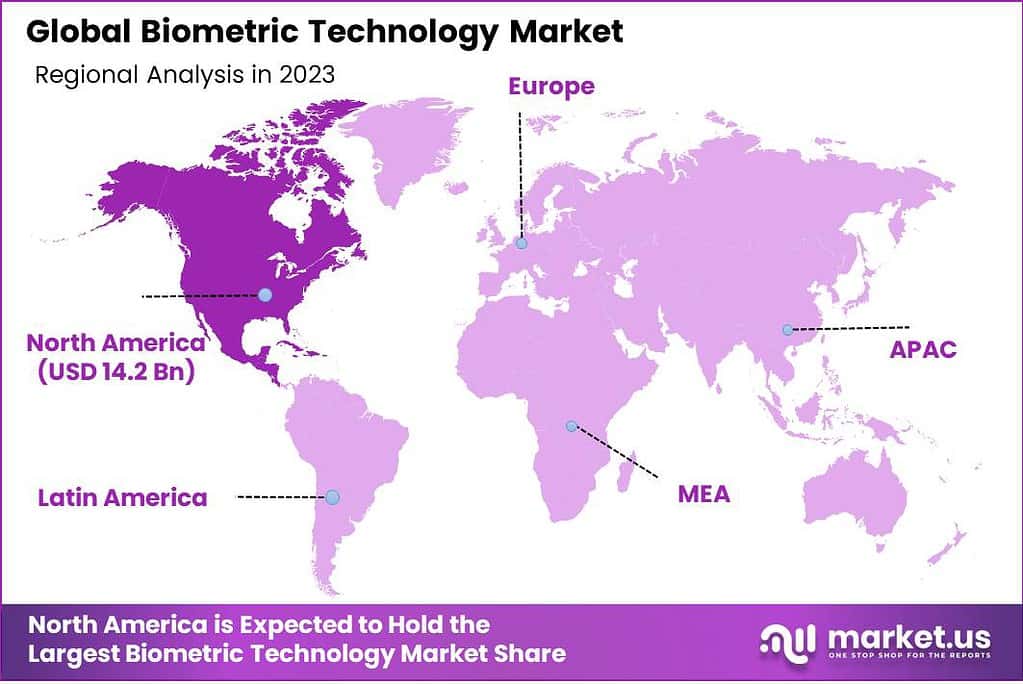

- In 2023, North America emerged as a frontrunner in the Biometric Technology market, holding a commanding share of over 30%

Authentication Type Analysis

In 2023, the Multi-Factor Authentication (MFA) segment held a dominant position in the Biometric Technology Market, capturing more than a 58% share. This substantial market presence can be attributed to the escalating demand for enhanced security measures across various industries.

Multi-Factor Authentication, which integrates biometric elements like fingerprints, facial recognition, or iris scans with other authentication factors (like passwords or tokens), has become increasingly vital in safeguarding sensitive data and systems. The adoption of MFA has been particularly pronounced in sectors such as banking, healthcare, and government, where data security is paramount. Furthermore, advancements in biometric technologies have made MFA solutions more accessible and user-friendly, contributing to their widespread implementation.

In contrast, the Single-Factor Authentication (SFA) segment, while still significant, has seen relatively slower growth. SFA, which typically relies on a single biometric element for identity verification, offers a lower security level compared to MFA. Its market share, though considerable, is gradually declining in the face of growing cyber threats and the rising sophistication of security breaches. Nonetheless, SFA remains prevalent in applications where convenience and speed are prioritized over high-security levels, such as consumer electronics and some areas of retail and hospitality. As of 2023, the segment continues to evolve with emerging biometric technologies aimed at balancing security with user experience.

Component Outlook

In 2023, the Hardware segment in the Biometric Technology Market held a dominant position, capturing more than a 65% share. This notable market dominance is largely due to the increasing deployment of biometric devices like fingerprint scanners, facial recognition cameras, and iris scanners across various sectors.

The demand for such hardware has surged, particularly in industries where security and identity verification are crucial, such as government, healthcare, and financial services. These devices have become more sophisticated and cost-effective, enabling wider adoption. Additionally, the integration of biometric hardware in consumer electronics like smartphones and laptops has further fueled its growth, making biometric security a standard feature in personal devices.

On the other hand, the Software segment, while smaller in comparison, plays a critical role in the efficacy of biometric systems. Biometric software, responsible for processing and analyzing the data captured by hardware, has seen steady growth. This segment focuses on the development of advanced algorithms and software solutions that enhance the accuracy and efficiency of biometric systems. As of 2023, with the rise in AI and machine learning, the software segment is poised for significant growth, driven by the need for more sophisticated, secure, and user-friendly biometric authentication solutions. Despite its smaller market share, the software component is integral to the continued evolution and effectiveness of biometric technologies.

Type Analysis

In 2023, the Contact-less segment in the Biometric Technology Market held a dominant market position, capturing more than a 45% share. The preference for contact-less biometrics, such as facial recognition and iris scanning, has grown significantly due to their convenience and hygiene factors, particularly in the wake of global health concerns.

These technologies are increasingly being employed in high-traffic areas like airports, offices, and retail environments, offering secure and efficient identity verification without physical contact. The rise of smart city initiatives and the integration of contact-less biometrics in public security and surveillance systems have further propelled this segment’s growth.

Conversely, the Contact-Based segment, which includes technologies like fingerprint and palm vein recognition, maintains a substantial market presence. Despite facing competition from contact-less solutions, contact-based biometrics are widely adopted due to their established reliability and widespread acceptance, particularly in sectors like law enforcement and banking. As of 2023, ongoing advancements in sensor technology and material science are enhancing the performance and durability of contact-based biometric systems, ensuring their continued relevance in the market.

The Hybrid segment, combining both contact and contact-less technologies, represents an emerging trend in the biometric market. This approach offers flexibility and enhanced security by leveraging the strengths of both types. Hybrid systems are particularly appealing in scenarios where multi-modal biometric authentication is required, providing a balance between user convenience and high-security demands. While currently smaller in market share, the Hybrid segment is anticipated to grow as organizations seek comprehensive and versatile biometric solutions in increasingly complex security environments.

Mobility Analysis

In 2023, the Fixed segment held a dominant position in the biometric technology market, capturing more than a 70% share. This segment’s prominence is primarily attributed to the widespread integration of fixed biometric systems in high-security areas, such as government buildings, airports, and financial institutions.

Fixed biometric systems, renowned for their robustness and higher accuracy levels, offer reliable security solutions, making them the preferred choice for stationary applications. Their market dominance is further bolstered by the increasing adoption of these systems in developing economies, driven by governmental initiatives for enhanced security infrastructures.

On the other hand, the Portable segment, while smaller in market share, demonstrates a rapidly growing trend. This growth can be attributed to the rising demand for mobile security solutions and the proliferation of portable devices equipped with biometric sensors. Advances in technology have enabled the development of compact, efficient biometric devices suitable for personal use, such as smartphones and laptops.

The portable biometrics market is projected to expand significantly, fueled by the increasing need for convenient and on-the-go security solutions in various sectors, including finance, healthcare, and retail. The versatility and user-friendly nature of portable biometric devices are expected to drive their adoption at a higher rate in the coming years, gradually narrowing the market share gap with the fixed segment.

Application Insights

In 2023, the Face Segment held a dominant market position, capturing more than a 26% share in the biometric technology market. This segment’s prominence is primarily due to the widespread adoption of facial recognition technologies across various sectors, including security, finance, and healthcare. The technology’s ease of use and non-intrusive nature contribute to its popularity. Facial recognition systems, which offer both identification and verification services, are increasingly utilized for border control, attendance tracking, and even payment authentication.

The Hand Geometry segment, while smaller, also plays a significant role. It is particularly valued in high-security areas due to its reliability and the uniqueness of hand geometry metrics. Voice recognition, another critical segment, is gaining traction in customer service and security industries, driven by advances in natural language processing and artificial intelligence.

The Signature segment, though traditional, continues to find relevance in banking and legal services for its familiarity and legal acceptance. The Iris segment, known for its high accuracy, is expanding, especially in identity verification for security-sensitive applications.

Automated Fingerprint Identification Systems (AFIS) and Non-AFIS are both crucial in law enforcement and public security. AFIS, with its high accuracy and extensive use in criminal databases, holds a significant market share. Non-AFIS applications, simpler and less costly, are popular in consumer electronics for unlocking devices and authorizing transactions.

Other emerging segments in the biometric technology market include vein pattern recognition, DNA matching, and gait analysis, each offering unique advantages and expanding the market’s scope. These segments demonstrate the dynamic and evolving nature of biometric technologies, continually adapting to meet the diverse needs of security, identity verification, and user authentication across industries.

By End User

In 2023, the Banking and Finance segment held a dominant market position in the biometric technology market, capturing more than a 25% share. This sector’s leading position is attributed to the increasing adoption of biometric systems for enhancing security and customer experience in banking operations. Biometric technologies, such as fingerprint and facial recognition, are widely used for authenticating transactions and accessing bank accounts, offering a blend of convenience and security to customers.

The Government sector, another major end-user, utilizes biometric technology for identity management, border control, and voter registration, driven by the need for efficient and secure public administration. This sector’s investment in biometric systems is significant, aiming to enhance national security and public service delivery.

Consumer Electronics is a rapidly growing segment, with biometrics being integrated into smartphones, laptops, and other personal devices for secure access and user authentication. This trend is propelled by the demand for personal data protection and the ease of use offered by such technologies.

Healthcare is an emerging segment in biometric technology application, where it’s used for patient identification, access control to medical records, and ensuring the privacy of health information. The Transport/Logistics sector also benefits from biometrics, especially in improving security measures and operational efficiency in airports, seaports, and freight handling.

The Defense & Security segment employs biometrics for access control, surveillance, and identity verification, critical for national security. Advanced biometric systems are increasingly adopted in military and law enforcement applications.

Other End-Users, including sectors like education, hospitality, and entertainment, are progressively embracing biometric technology for identity verification, attendance tracking, and personalized services. These diverse applications underscore the growing penetration and versatility of biometric technologies across various industries, driven by the need for enhanced security and user authentication solutions.

Note: Actual Numbers Might Vary In The Final Report

Driving Factors

- Increasing Demand for Enhanced Security: The increasing demand for strong security measures in industries like banking, healthcare, government, and transportation is a key driver for the growth of the biometric technology market. Biometric solutions provide enhanced security by using unique physical or behavioral traits for identity verification, lowering risks compared to traditional authentication methods.

- Government Initiatives and Regulations: Global governments are implementing stringent regulations and initiatives to boost security measures and combat identity theft and fraud. The adoption of biometric technology is on the rise across various sectors, driven by regulations such as mandatory biometric identification programs and the implementation of e-passports, contributing to the growth of the market.

- Growing Popularity of Mobile Biometrics: The rise in smartphone and mobile device usage has made more people use fingerprint scanning, facial recognition, and iris scanning for security. These easy and convenient mobile biometric methods are boosting the growth of biometric technology.

- Advancements in Technology: The market is experiencing growth due to continuous advancements in biometric technology. These improvements, like enhanced accuracy, speed, and scalability, play a key role. Innovations such as multimodal biometrics, AI-based algorithms, and cloud-based solutions are making biometric systems more efficient and user-friendly, resulting in increased applications across various industries.

Restraining Factors

- Privacy and Data Security Concerns: Biometric technology gathers and stores sensitive personal information, sparking worries about privacy and data security. The risk of misuse or unauthorized access to this data is a major hurdle to the widespread use of biometric solutions, particularly in regions with strict data protection regulations.

- High Implementation Costs: The implementation of biometric systems carries notable costs, encompassing hardware, software, integration, and maintenance. These expenses may serve as a hurdle for entry, especially for small to medium-sized enterprises (SMEs) or organizations with restricted resources, impeding market growth.

- Integration Challenges: Making existing systems work with biometrics can be tricky and time-consuming. Challenges like compatibility issues, interoperability, and the need for system upgrades or replacements can slow down the adoption of biometric solutions, especially in established organizations.

- Lack of Standardization: The lack of widely agreed-upon standards for biometric technology creates challenges in how these systems communicate and work together. This absence of standardization makes it difficult for different biometric systems to seamlessly exchange data and integrate with one another, hindering their widespread use.

Growth Opportunities

- Biometrics in Healthcare: In the healthcare industry, there are big chances for growth with biometric technology. Using it for things like identifying patients, managing access to medical records, and making sure medication is given securely can make healthcare safer, reduce mistakes, and make the overall delivery of healthcare better.

- Biometrics in Automotive Sector: The automotive industry is embracing biometric solutions to enhance vehicle security, identify drivers, and customize in-car experiences. These solutions enable keyless entry, improve driver monitoring for safety, and offer personalized settings, opening up growth prospects in the automotive sector.

- Adoption in Emerging Economies: The growth prospects for biometric technology are substantial in emerging economies. Governments in these regions are actively investing in biometric identification programs, and the push towards digitalization and financial inclusion is creating a positive environment for the adoption of biometric solutions.

- Biometrics in IoT and Smart Devices: Combining biometric technology with Internet of Things (IoT) devices and smart home systems has the potential for growth. This integration can improve security and user experience in smart devices such as door locks, wearables, and voice-activated assistants, leading to the expansion of the market.

Challenges

- User Acceptance and Resistance: To use biometric technology, individuals must share their unique physical or behavioral data for authentication. Some users may be hesitant due to concerns about privacy, cultural acceptance, or personal preferences regarding such personal information.

- Vulnerability to Spoofing and Attacks: Biometric systems face security challenges as they can be vulnerable to attacks and spoofing attempts. Methods like copying fingerprints, tricking facial recognition, or imitating voices present risks that can erode trust in biometric solutions. To address this, ongoing improvements in anti-spoofing measures are essential.

- Scalability and Performance: As biometric systems are implemented on a larger scale, it’s essential to ensure they can handle the increased size and perform effectively. Ensuring accurate and reliable identification for a massive user base in real-time can be demanding and requires strong infrastructure and algorithms.

- Legal and Regulatory Compliance: Biometric technology providers face challenges in complying with legal and regulatory requirements, including data protection and privacy laws. Adhering to various regional or international standards is complex, requiring constant monitoring and adaptation to changing rules.

Key Market Trend

- Behavioral Biometrics: The adoption of behavioral biometrics, examining how users behave, is on the rise. This involves studying typing patterns, walking styles, and mouse movements to add an extra level of security.

- Contactless Biometrics: The use of contactless biometrics like facial recognition and touchless fingerprint scanning is on the rise due to the COVID-19 situation. This is particularly evident in applications such as payment and access control.

- AI and Machine Learning Integration: The integration of artificial intelligence (AI) and machine learning into biometric systems is increasing precision and adaptability and making biometrics more efficient and flexible.

- Biometric Fusion: An emerging trend involves blending various biometric methods, like facial recognition and fingerprints. This fusion enhances accuracy and reliability, particularly in applications requiring high security.

Key Market Segments

By Authentication Type

- Single-Factor Authentication

- Multi-Factor Authentication

By Component

- Hardware

- Software

By Type

- Contact-Based

- Contact-less

- Hybrid

By Mobility

- Fixed

- Portable

By Application

- Face

- Hand geometry

- Voice

- Signature

- Iris

- AFIS

- Non-AFIS

- Others

By End User

- Government

- Banking and Finance

- Consumer Electronics

- Healthcare

- Transport/Logistics

- Defense & Security

- Others

Regional Analysis

In 2023, North America emerged as a frontrunner in the Biometric Technology market, holding a commanding share of over 30%. This can be largely attributed to the region’s robust technological infrastructure, particularly in the United States and Canada, fostering widespread adoption of biometric solutions.

The heightened emphasis on security and the integration of advanced authentication measures across various sectors, including government, finance, and healthcare, propelled North America to its dominant market position. As the region continues to prioritize security initiatives and technological advancements, it is poised to remain a key player in the global biometric landscape.

With a substantial market share in 2023, Europe demonstrated significant growth in the adoption of Biometric Technology. This expansion is closely tied to the region’s increasing awareness of cybersecurity threats and the implementation of regulatory measures promoting advanced security solutions.

European countries, driven by the need for secure authentication, witnessed notable adoption in sectors such as finance, healthcare, and government. As Europe continues to navigate the evolving landscape of data security, the market is expected to maintain its upward trajectory, driven by ongoing technological advancements and regulatory compliance efforts.

The Asia-Pacific region showcased a burgeoning market share in 2023, reflecting the rapid technological advancements and growing demand for secure authentication solutions. Countries like China and India played a pivotal role in driving the adoption of Biometric Technology across diverse sectors.

The region’s dynamic economic growth, coupled with an increasing focus on cybersecurity, has propelled the demand for advanced biometric solutions. As APAC continues to witness technological evolution and addresses security challenges, the biometric market is anticipated to witness sustained growth, making it a key player in the global landscape.

In 2023, Latin America demonstrated a steady uptake of Biometric Technology, securing a market share. Governments and financial institutions in the region were key drivers in adopting biometric solutions for identity verification purposes.

The growing emphasis on enhancing security measures and addressing identity-related challenges contributed to the gradual expansion of the biometric market in Latin America. As the region continues to prioritize technological advancements and regulatory compliance, the adoption of biometric solutions is expected to witness further growth.

With a market share in 2023, the Middle East and Africa exhibited a growing interest in Biometric Technology. The region’s investment in security infrastructure, driven by governments and various sectors, contributed to the adoption of advanced authentication measures.

As awareness of the importance of biometric solutions for security purposes increases, the Middle East and Africa are poised for further growth in the biometric technology market. Ongoing developments in technology and a focus on enhancing security protocols will likely shape the region’s trajectory in the coming years.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The biometric technology market has witnessed significant growth in recent years, driven by increasing demand for secure and convenient authentication solutions across various industries. Biometric technology uses unique physiological or behavioral characteristics of individuals, such as fingerprints, facial features, iris patterns, voice, and hand geometry, for identification and verification purposes.

Top Key Players

- NEC Corporation

- HID Global Corporation

- Thales Group

- Gemalto (A Thales Company)

- Morpho (Safran Identity & Security)

- Fujitsu Limited

- Crossmatch Technologies

- Idemia (formerly OT-Morpho)

- Suprema Inc.

- Aware, Inc.

- Bio-key International, Inc.

- SecuGen Corporation

- Other Key Players

Recent Developments

- In 2023, NEC Corporation: Introduced NeoFace Watch X9, featuring the world’s fastest face recognition algorithm. Focus on multi-modal biometrics, integrating fingerprint, iris, and voice recognition for enhanced security.

- In 2023, HID Global Corporation: Launched “bioConnect”, a modular platform for integrating various biometric modalities and Developed strong solutions for physical and logical access control with advanced biometrics.

- In 2023, Morpho (Safran Identity & Security): Contactless fingerprint reader for seamless access control and Focus on biometric solutions for secure mobile payments and e-commerce transactions.

Report Scope

Report Features Description Market Value (2023) US$ 47.4 Bn Forecast Revenue (2033) US$ 198.5 Bn CAGR (2024-2033) 15.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Authentication Type (Single-Factor Authentication, Multi-Factor Authentication), By Component(Hardware and Software), By Type(Contact-Based, Contact-less, Hybrid), By Mobility (Fixed and Portable), By Application (Face, Hand geometry, Voice, Signature, Iris, AFIS, Non-AFIS, Others), By End-User (Government, Banking and Finance, Consumer Electronics, Healthcare, Transport/Logistics, Defense & Security, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NEC Corporation, HID Global Corporation, Thales Group, Gemalto (A Thales Company), Morpho (Safran Identity & Security), Fujitsu Limited, Crossmatch Technologies, Idemia (formerly OT-Morpho), Suprema Inc., Aware, Inc., Bio-key International, Inc., SecuGen Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is biometric technology, and how does it work?Biometric technology uses physical or behavioral characteristics such as fingerprints, facial patterns or iris scans to uniquely identify and authenticate individuals. It does so by collecting and analyzing these distinctive features - creating a digital template for comparison and verification during the authentication process.

What are the primary applications of biometric technology?Biometric technology finds applications in various sectors, including security systems, access control, time management, healthcare, banking, and government services. It is commonly used for identity verification, secure access, and fraud prevention.

How big is Biometric Technology Market?The Global Biometric Technology Market size was projected to be USD 47.3 billion in 2023. By the end of 2024, the industry is likely to reach a valuation of USD 54.7 billion. During the forecast period, the global market for biometric technology is expected to garner a 15.4% CAGR and reach a size of USD 198.5 billion by 2033.

Who are the prominent players operating in the biometric technology market?The top players operating in the biometric technology market are NEC Corporation, Precise Biometrics AB, Fujitsu Limited 3M Cogent, Hitachi, FaceFirst, Nuance CommunicationsWhich region will lead the global biometric technology market?Asia Pacific region will lead the global biometric technology market during the forecast period 2023 to 2032.How is the government leveraging biometric technology for security and identification purposes?Governments are turning to biometric technology for various uses, including national identification systems, border control, law enforcement and public services. Biometrics enable government operations by authenticating citizens while reducing identity fraud and increasing security within government operations.

Biometric Technology MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Biometric Technology MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- NEC Corporation

- HID Global Corporation

- Thales Group

- Gemalto (A Thales Company)

- Morpho (Safran Identity & Security)

- Fujitsu Limited

- Crossmatch Technologies

- Idemia (formerly OT-Morpho)

- Suprema Inc.

- Aware, Inc.

- Bio-key International, Inc.

- SecuGen Corporation

- Other Key Players