Global Physical Security Market By Component (Systems (Physical Access Control System (PACS), Video Surveillance System, Perimeter Intrusion Detection And Prevention, Physical Security Information Management (PSIM), Physical Identity and Access Management (PIAM), and Fire And Life Safety), and Services (System Integration, Remote Monitoring, and Other Services)), By End-Use Verticals, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct. 2023

- Report ID: 27784

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

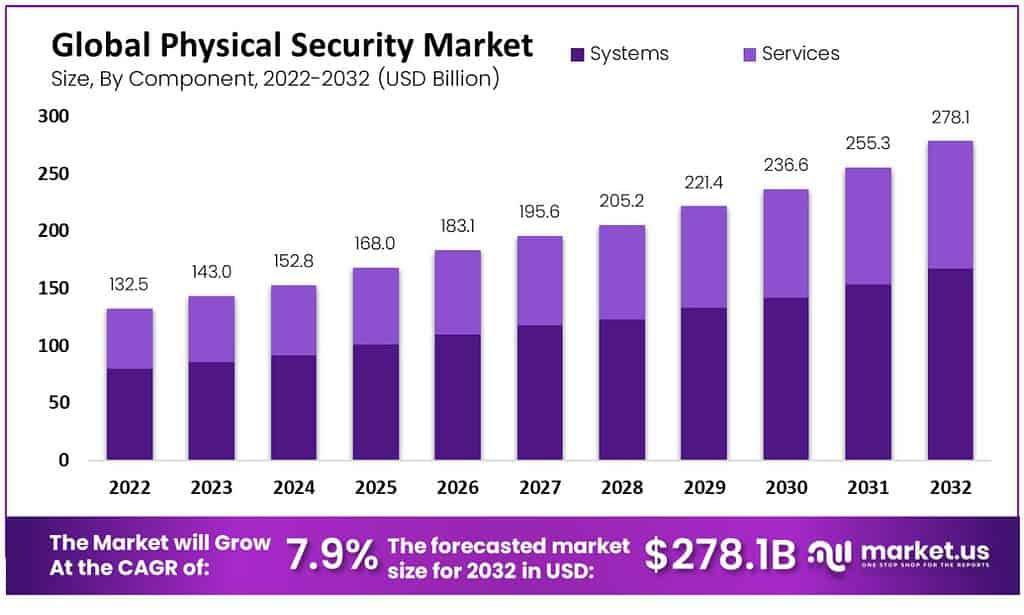

The global Physical Security market is valued at USD 143.5 Billion in 2023. The overall demand for physical security is expected to develop at an 7.9% CAGR over the forecast period from 2023 to 2032. global sales of physical security are anticipated to reach USD 278.1 Billion by 2032.

Physical security solutions are widely used in many sectors to protect people, assets, and facilities from real-world threats. Physical security solutions can detect intruders and deal with real-world threats. Effective physical security systems are required to combat security breaches. The protection of people, data, software, hardware, and networks from physical acts in order to prevent data loss or damage to institutions, agencies, organizations, and enterprises. Physical security systems are in high demand due to rising crime rates around the world.

Note: Actual Numbers Might Vary In The Final Report

The organization and government agencies have been able to reduce crime incidence and breaches by shifting their focus away from traditional solutions like badge readers, alarm systems, and door locks, to more advanced logical security that includes threat management, breach detection, intrusion prevention, and threat management. Different countries and regions have taken up smart city initiatives to improve their infrastructure. They are also deploying better security systems.

Governments in developed countries have made it a priority to modernize the infrastructure and strengthen the security of their agencies. Organizations are becoming more concerned about employee safety. They are therefore setting up systems to prevent unauthorized entry; this further drives the need for physical security solutions. Globally, the physical security environment is constantly changing.

Key Takeaways

- Market Valuation: The global Physical Security market is currently valued at USD 143.5 billion, expected to grow at a 7.9% CAGR, reaching USD 278.1 billion by 2032.

- Emerging Trends: Increasing focus on residential security solutions, investments in smart city initiatives, and the growing demand for efficient video surveillance systems highlight current industry trends.

- Driving Factors: Rising crime rates and security breaches worldwide have led to increased demand for physical security solutions, emphasizing threat management and breach detection.

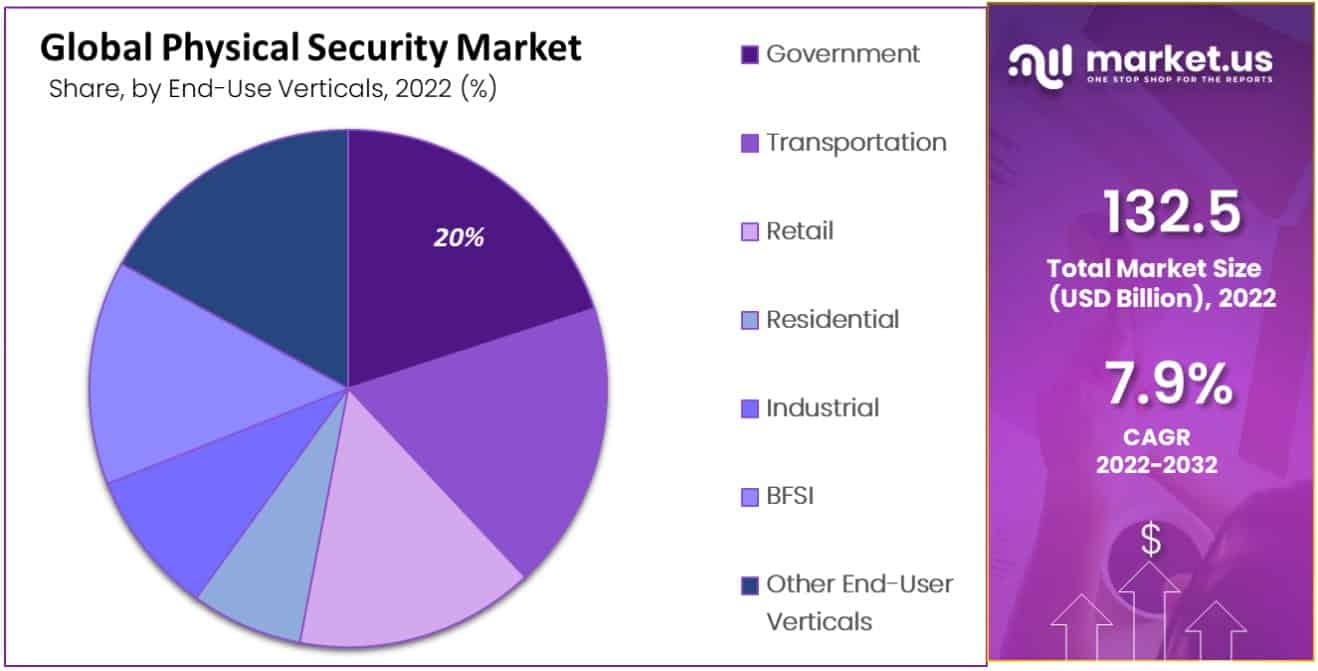

- Government Dominance: Government agencies lead the market, focusing on infrastructure modernization and security reinforcement, with significant investments in physical security.

- System Segment Domination: Systems like video surveillance, access control, and fire safety hold a 60.0% share, reflecting the widespread implementation and demand for such systems.

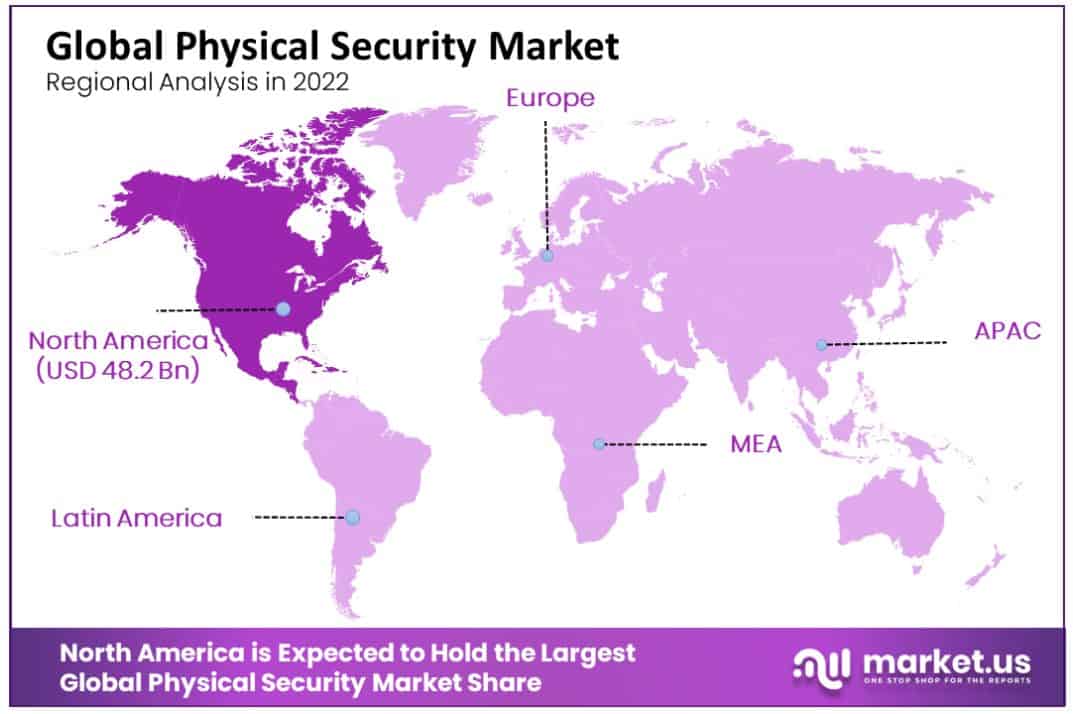

- North America’s Lead: North America holds a significant 36.4% market share, driven by advanced security system adoption and increased emphasis on compliance and regulations.

- Rapid Expansion in Asia Pacific: The Asia Pacific market is expected to experience rapid compound annual growth at 5.2% due to rising demand for smart security solutions, particularly within countries like China and India.

- Key Market Players: Leading companies such as Honeywell International Inc., Robert Bosch GmbH, and Cisco Systems Inc. are actively contributing to the growth and development of the physical security sector.

- Opportunities in Technology: Technological advancements, including AI integration and IoT innovations, present promising opportunities for enhanced security measures and cost reduction.

- Challenges in Integration: Complex integration of security systems and high installation costs pose challenges, especially for small and medium-sized enterprises with limited budgets.

Drivers

Increasing Security Breach and Terrorist Activities are Driving the Growth of the Physical Security Market.

People are more concerned about safety and security due to the increase in terrorist activity and crime. Many lives have been taken and infrastructure severely damaged as a result of these attacks. This highlights the importance of physical security solutions. According to the US Department of State, terrorist activity is on the rise worldwide. Despite the fact that terrorist attacks in the United States have declined since 9/11, they have increased substantially since 2012.

Due to increased terror and security concerns, global governments have increased their spending on security. Many government institutions, such as embassies and courts, parliaments, and government offices have installed advanced video surveillance and access control systems. Smart fence sensors, drones, and mass notification systems (MNS) are all used to monitor major events in Tier I and II cities.

Many government agencies have established strict guidelines and policies for the installation of physical security systems. The U.S. Government has enacted many laws, regulations, and industry guidelines. 552) and the Payment Card Industry Data Security Standard(PCI DSS), for increased security. This is a key factor in the expansion of the market for physical security software.

Data breaches are on the rise across all organizations. Large organizations invest heavily in data security and safety solutions. This has increased the market’s potential for growth. The market is experiencing a rapid upward trend due to the shift towards cloud-based data platforms that can manage and mitigate cyber security threats and data theft.

Other important market drivers include rising urbanization, increasing industrialization, and the need to gain in-depth insights and benchmarking from the growing data volumes. The market will grow due to rising investments by enterprises in data storage centers, and increasing demand for easier access to organizational information from silos.

Restraints

Complex Integration of Security Systems and High Costs are Hindering the Physical Security Market Growth.

Physical security systems are expensive to install and maintain because they require high-quality hardware. SMEs are limited by their budget and cannot afford to adopt new technologies. They must continue using traditional security software. Organizations tend to focus only on protecting critical servers, and not much attention to data stored in resting databases.

Insufficient budgets are a major concern for physical security professionals in order to efficiently execute their IT security functions. Integration of physical and logical security systems, such as access control, refers to integrated physical security applications with logic security programs such as biometric ID programs. This convergence can help organizations improve the efficiency and completeness of their security infrastructure.

If the intrusion alarm and access control system are linked, it is possible to program the access control system to lock down a facility according to the type of alarm that sounds whenever the system detects an intrusion. Although the integration of security systems is a simple process, it can be difficult. Integration of security systems requires that you purchase everything from one vendor. If the vendor offers little support or leaves the company, customers could be stuck with a system that doesn’t fit their needs. If this issue is not addressed soon, it will severely limit the market’s growth.

Component Analysis

System Segment Shows Domination in the Physical Security Market.

In 2022, the system segment accounted for a 60.0% share of global revenue. The sub-segments include video surveillance systems, physical access control systems, perimeter intrusion detection systems and prevention (PSIM), physical identity and access management (PIAM) plus fire and safety.

With a major market share, the video surveillance system segment is the dominant market segment than others in the market. Analog cameras, axis network cameras, video encoders, and monitors are all part of video surveillance systems. Increased use of cameras for video surveillance systems for remote monitoring and security has been possible due to technological advancements like UHD.

This segment is likely to grow due to increasing safety and security concerns, as well as strict regulatory compliance. The rapid growth of several regions like commercial and institutional infrastructures has also driven the demand for video surveillance, which in turn has boosted segment growth.

The services segment will experience significant growth over the forecast period. The services include the deployment, maintenance, updating, and maintenance of equipment and software. This further enhances performance by giving the user the best control over the entire security infrastructure. Increasing demand for physical security services has resulted from rapid infrastructure development in emerging countries and technological advancements such as Ultra High Definition (UHD), and surveillance.

The sub-segments of service include remote monitoring and system integration. With a market share of 43.0%, the system integration segment is dominant. This segment is driven by new technologies, changing customer attitudes towards security operations, the need for cost-effective security systems, strict regulatory compliance, and rapid growth of businesses. The implementation of integrated solutions will be driven by the widespread use of cloud computing solutions within organizations, increased automation, and a more integrated approach to business processes.

End-Use Verticals

Government Agencies are Heavily investing in Physical security, Which Helps the Government Segment Dominate the Market.

In 2022, the government segment dominated the physical security market. Government agencies need to figure out how they can improve their security defenses of physical security infrastructure in this complex and rapidly changing environment. They also need to work with legacy equipment while staying within budget. In July 2022, the European Parliament, European Commission, and the European Union (EU), agreed to a European guideline for critical entity resilience. This directive is intended to protect the essential providers of the process by increasing their resilience and stability, thus ensuring a more consistent operation.

Due to the high amount of damage caused to resources and assets during thefts and other attacks, the residential segment will see significant growth over the forecast period. The application of video surveillance systems in residential properties enhances user experience and protects assets from potential risks. The integration of smart access control and rapid intrusion detection systems into comprehensive video surveillance systems provides safety.

The United States is the world’s largest market for residential security equipment. This growth can be attributed to the advancement of smart homes and the increased use of advanced video surveillance systems and access control systems. Knightscope, Inc., an American robotics and security camera company, introduced the Knightscope K5 Autonomous Security Robot in April 2022. K5 ASR has been implemented in various U.S. companies’ outdoor spaces, both residential and commercial, to provide a secure environment and ensure that employees and customers are safe.

The demand for physical security systems for government and bank institutions is driven by advances in IoT security technology. Remote monitoring via cloud-based services makes it easier to monitor and control the physical environment.

The forecast period also predicts significant growth in transportation. Equipment used for surveillance, traffic congestion monitoring, and crowd control is in high demand. Increasing incidents like terror attacks and accidents around the world has resulted in increased spending on safety measures and security.

Cybercrime is a growing threat to the physical security environment. Many sectors and industries, including transportation, BFSI, residential, government, and government, have seen security breaches in the last few years. These factors will continue to drive demand for physical security systems.

Note: Actual Numbers Might Vary In The Final Report

Note: Actual Numbers Might Vary In The Final ReportOpportunity

Technological Innovation is Expected to Create Many Opportunities in the Physical Security Market.

As security threats change from physical thefts to attacks via digital means, it is important to update physical security measures in light of increasing automation and digitalization. Technological innovation has made it possible to improve surveillance, monitoring, defense systems, and gadgets.

Artificial intelligence is combined with existing physical security measures to improve asset safety and security. They can also reduce long-term costs and the need to employ staff to operate or manage them. IoT innovations in access control systems, surveillance cameras, and other security devices provide greater and more complete security control. Market participants will have attractive prospects for the future because of the increased need for security measures.

Trends

The market is seeing a positive outlook due to increased security concerns and an increase in terrorist attacks around the world. Different governments are investing in advanced access control and video surveillance systems to protect citizens and prevent terrorist attacks and other serious incidents.

The market is also booming due to the increasing use of smart fence sensors, drones, and mass notification systems (MNS), for surveillance at major events or assemblies. The market is also gaining momentum due to the use of artificial intelligence (AI), which can be used to detect potential areas of compromise and analyze images, videos, or other data to distinguish threats from normal activities.

Another factor driving growth is the growing awareness of physical security solutions for residential spaces, owing to increasing instances of theft, criminal activities, and robbery. This key trend is also being positively influenced by the introduction of home security systems for intruder, fire, and LPG gas leakage detections. The market growth is also supported by other factors such as increasing digitization and the widespread adoption of cloud-based storage. Also, there is a growing demand for video surveillance solutions that allow for efficient monitoring of large areas.

Many governments around the world have been eager to implement PSIM solutions in order to enhance their security systems beyond video surveillance. Governments are being pressured to adopt more physical security management systems in order to protect their citizens from the threat of terrorist attacks. Major industries trust that PSIM solutions will improve employee behavior and yield better results.

The United States federal government recognized the need to improve the security of its facilities as well as integrate with logical networks. Federal agencies discovered that their existing video surveillance systems were not adequate to protect their facilities due to a lack of facial recognition and video analytics support. They also are not compatible with federal enterprise IT architecture.

Emerging countries, like the Indian government, are pushing for public projects. This includes installing video surveillance equipment for traffic monitoring, city surveillance, education, and railway surveillance. The market growth is expected to be driven by the increasing investments in greenfield foreign direct investment.

Regional Analysis

North America Dominates the Physical Security Market with a Major Market Share of 36.4%.

North America held more than 36.4% of the largest share in the market and will continue to dominate the market for the forecast period. This region is a leader in the adoption of advanced physical security systems. The regional market is driven by a number of factors including regulatory reforms, economic growth, and SMEs investing in physical security solutions. Many public places such as bus stations, airports, railways, and seaports have security measures in place to protect their infrastructure.

The market in North America is heavily influenced by increasing security concerns due to domestic crime, theft, terrorist attacks, and other factors. The country’s increasing number of bank robberies is also driving the need for video analytics solutions. This will drive market growth during the forecast period.

Protecting sensitive customer data can be done by organizations following PCI DSS, GLBA, and HIPAA guidelines. North America is home to the largest number of service providers and solutions for physical security. This is because it’s one of the most susceptible regions to cyberattacks, particularly identity theft. North American organizations are using physical security solutions because of changing work situations, COVID-19, IoT and BYOD trends, compliance and regulations, as well as increasing threats such as BEC and malware. Because of specific budgetary allocations, and physical security policies North America is expected to dominate during the forecast period.

The Asia Pacific market is forecast to grow at the fastest pace during the forecast period. The region will experience a 5.2% CAGR between 2023 and 2032. This growth is largely due to rising demand in India and China for smart security solutions. The Chinese government’s investments in safe city projects that mainly focus on traffic surveillance and monitoring are expected to drive market growth. Since 2010, the China Smart City Industry Alliance was established, and 500 smart cities have been built in China.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Market Segments

Component

- Systems

- Physical Access Control System (PACS)

- Video Surveillance System

- Perimeter Intrusion Detection And Prevention

- Physical Security Information Management (PSIM)

- Physical Identity & Access Management (PIAM)

- Fire And Life Safety

- Services

- System Integration

- Remote Monitoring

- Other Services

End-Use Verticals

- Transportation

- Government

- Retail

- Residential

- Industrial

- BFSI

- Other End-User Verticals

Key Player Analysis

To gain greater market share, market leaders are known for providing solutions that cater to different applications. To increase their product offerings and increase their market share, companies also look at strategic alliances, mergers, acquisitions, and other forms of collaboration. They pursue many strategic initiatives such as partnerships, mergers and acquisitions, collaborations, new product/technology development, and partnership.

Market Key Players

- Honeywell International Inc.

- Robert Bosch GmbH

- Genetec Inc.

- Cisco Systems Inc.

- Axis Communications AB

- Pelco

- Hanwha Techwin America

- Johnson Controls

- ADT LLC

- Siemens

- Anixter Inc.

- Other Key Players

Recent Developments

- In February 2022, Hangzhou Hikvision Digital Technology Co. Ltd. has introduced the Hikvision AXPRO wireless external tri-tech detector and dedicated cam. The new product is designed to provide small businesses and home workers with precise detection, clear images, and a modular design that makes alarms safer. Hikvision AXPRO wireless external Tritech detectors will be equipped with dedicated cameras and smart cities in China.

- In July 2021, Hexagon AB acquired Immersal-Part, a company that creates visual positioning systems and mapping systems. Hexagon AB has acquired Immersal-Part of Hexagon, a company that develops visual positioning and mapping systems. This acquisition will allow Hexagon AB to use augmented reality technologies.

Report Scope

Report Features Description Report Features Description Market Value (2022) US$ 132.5 Bn Forecast Revenue (2032) US$ 278.1 Bn CAGR (2023-2032) 7.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component – Systems (Physical Access Control System (PACS), Video Surveillance System, Perimeter Intrusion Detection And Prevention, Physical Security Information Management (PSIM), Physical Identity and Access Management (PIAM), and Fire And Life Safety), and Services (System Integration, Remote Monitoring, and Other Services); By End-Use Verticals – Transportation, Government, Retail, Residential, Industrial, BFSI and Other End-User Verticals. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Honeywell International Inc., Robert Bosch GmbH, Genetec Inc., Cisco Systems Inc., Axis Communications AB, Pelco, Hanwha Techwin America, Johnson Controls, ADT LLC, Siemens, Anixter Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Honeywell International Inc.

- Robert Bosch GmbH

- Genetec Inc.

- Cisco Systems Inc.

- Axis Communications AB

- Pelco

- Hanwha Techwin America

- Johnson Controls

- ADT LLC

- Siemens

- Anixter Inc.

- Other Key Players