Global Automotive Cyber Security Market By Type (Wireless Security, Network Security, Endpoint Security, Application Security, and Cloud Security), by Vehicle Type, By Application By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: April 2024

- Report ID: 22888

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

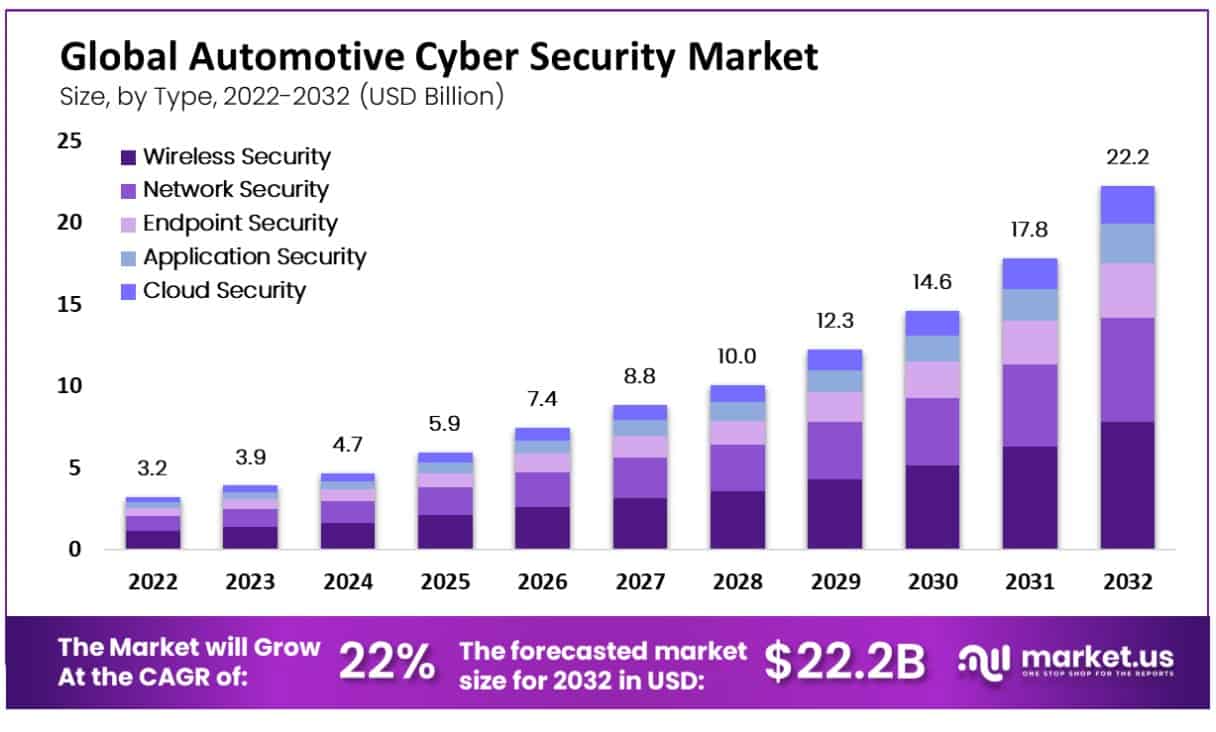

The global Automotive Cyber Security market is anticipated to be USD 22.2 billion by 2032. It is estimated to record a steady CAGR of 22% in the review period 2023 to 2032. It is likely to total USD 3.9 billion in 2023.

Automotive Cybersecurity is a database that guards automotive communication systems, internet-connected vehicles, users, and data against unauthorized access, and damage. Automotive cyber security is experiencing a fast revolution by socio-economic and environmental drifts due to new manufacturing methods and consumer-challenging technologies.

The automotive cyber security market is growing due to an increase in the cases of automotive cyber-attacks. The use of electronics for reducing the overall weight of vehicles is made on a large scale which in-turns inclined the automotive industry more exposed to cyber-attacks.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Valuation: By 2032, the Automotive Cyber Security market is projected to reach USD 22.2 billion with an anticipated compound annual growth rate of 22% between 2023-2032. It was estimated at being worth USD 3.9 billion in 2023.

- Driving Factors: The market is witnessing growth due to an increase in cyber-attacks on vehicles, partly attributed to the use of electronic components on a large scale to reduce the overall weight of vehicles.

- Restraining Factors: Implementation of multiple pricing models by software companies has become a challenge for cybersecurity solution providers, affecting their revenue generation.

- Type Analysis: Among the various segments, wireless security holds the majority share in the Automotive Cyber Security Market, protecting wireless networks from unauthorized access.

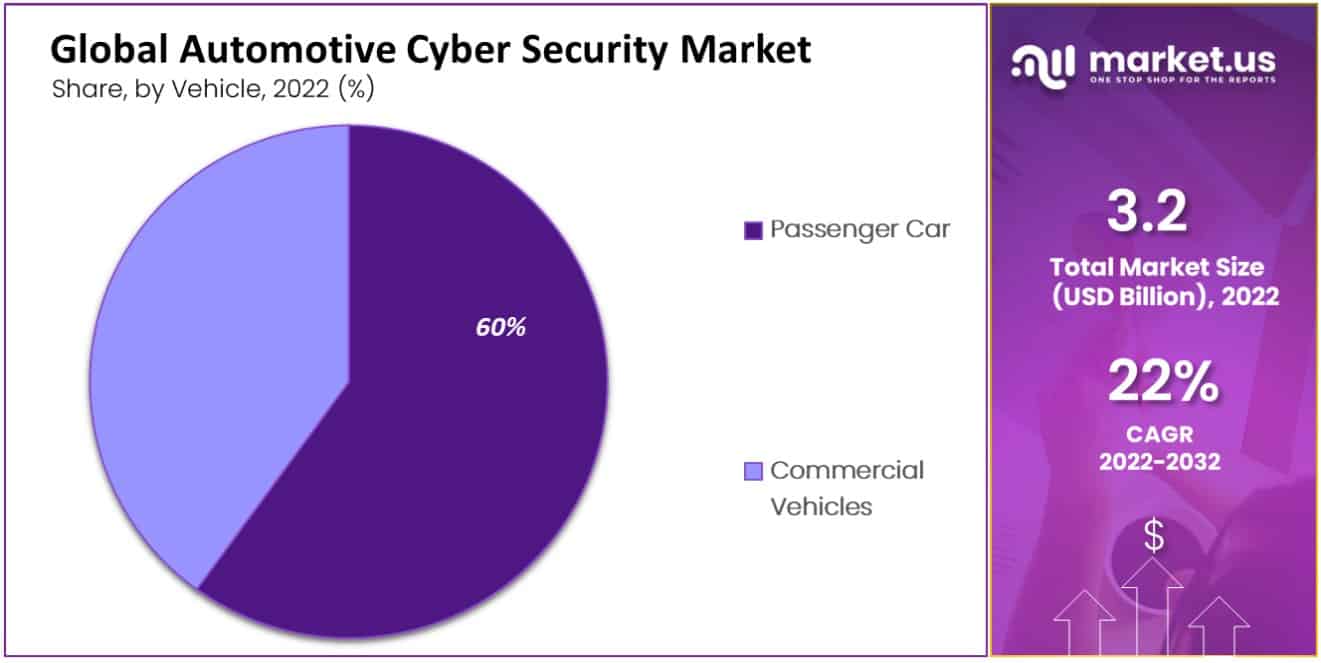

- Vehicle Analysis: Passenger cars dominate the market due to their high connectivity with external cloud services, making them more exposed to cyber-attacks. Additionally, the increasing demand for safety, comfort, and convenience features in vehicles is also contributing to market growth.

- Application Analysis: Infotainment applications, catering to communication, entertainment, and information needs, hold the largest market share, highlighting the essential role of instant access to communication and information in the automotive sector.

- Latest Trends: The digitization and connectedness of vehicles have increased the likelihood of cyber-attacks on the automotive sector, leading to a growing need for robust cybersecurity measures.

- Regional Analysis: Asia-Pacific held the largest market share in 2022, driven by factors such as lack of protection measures and an increase in cyber-attacks, particularly in the context of digitization and connected vehicles.

- Key Players: The automotive cybersecurity industry includes prominent players such as Intel Corporation, Argus Cyber Security, NXP Semiconductors N.V, Guardknox Cyber-Technologies Ltd., and others, who are focusing on strategic policies and advanced software development to expand their businesses.

Type Analysis

Wireless Network Dominated the Market by Protecting Wireless Networks from Unauthorized Access

Based on type the automotive cybersecurity market is segmented into network security, endpoint security, application security, wireless security, and cloud security. Cloud security contains protections related to data encryption, database monitoring, multifactor authentication, application, server, scanning, and analytics tools. The wireless network security segment held the majority share in 2022 in the Automotive Cyber Security Market in and is expected to grow at a higher rate in the forecast period. Wireless network security generally protects a wireless network from unauthorized access.

Endpoint security safeguards the endpoints or entry points of end-user devices such as laptops, desktops, and mobile devices from being misused by malicious performers and movements. Network security focuses on tools used for the protection of applications, data, and resources at the network level with a primary focus on protecting against unauthorized access in between parts of the complete network structure. Application security is the technique of testing and developing security features within the applications to avoid security susceptibilities against threats like unauthorized access and modification.

Vehicle Analysis

Passenger Cars Dominated the Market Due to Increasing Demand for Safety, Comfort, and Convenience Features In the Vehicle.

Based on vehicle type market can be segmented into passenger cars and Commercial vehicles. Passenger cars dominated the market as they become generally connected to external cloud services for quick management software and telematics which makes them exposed to cyber–attacks. Passenger vehicles like sedans and SUVs are leading the global cybersecurity market. The automotive cyber security market is expanding due to increasing demand for safety, comfort, and convenience features in the vehicle. The usage of cyber security in light & heavy commercial vehicles has also increased due to the increased use of electronic components and autonomous driving features.

Demand for the cyber security market in commercial vehicles is also increasing with the rise in technological advancements, increasing amount of vehicle electronics, the rising advent of smart transportation systems, and government stringent emission norms in commercial vehicles.

Note: Actual Numbers Might Vary In The Final Report

Application Analysis

Instant Access to Communication and Information Makes the Infotainment Segment Dominant

Based on application market is segmented into Onboard Diagnostic [OBD], Communication, Safety Systems, Infotainment, and Telematics. The infotainment segment dominated the market, in 2022 with the largest revenue share of 37% and is anticipated to increase at a remarkable growth rate during the forecast period. Infotainment applications include connectivity, information, entertainment, communication, lifestyle, leisure, fashion, and gaming activities. Instant access to communication and information is essential in such a fast-changing world which made the automotive vehicle more inclined to cyber-attacks which in turn has given the growth in acceptance of cyber security solutions in vehicles.

Key Market Segments

Based on Type

- Wireless Security

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

Based on Vehicle Type

- Passenger Cars

- Commercial Vehicles

Based on Application

- On-board Diagnostic

- Communication

- Safety Systems

- Infotainment

- Telematics

Driving Factors

Use of Electronic Components in Vehicles on Large Scale

The automotive cyber security market is witnessing a rise in demand as cyber-attacks on vehicles are increasing. For reducing the overall weight of vehicles, electronic components are used on a large scale which made automotive vehicles more exposed to cyber-attacks which has created the need for the adoption of cybersecurity solutions in vehicles. The advancement of vehicle connectivity has made vehicles more inclined to cyber-attacks. the rising advent of smart transportation systems and government stringent emission norms in commercial vehicles is fueling the automotive cybersecurity solution market.

Increasing Use Of Infotainment In Vehicles

A major factor fueling the market growth is the increasing use of Infotainment in the vehicle which includes connectivity, information, entertainment, communication, lifestyle, leisure, fashion, and gaming activities. Instant access to communication and information is essential in such a fast-changing world which made the automotive vehicle more inclined to cyber-attacks which in turn has given the growth in acceptance of cyber security solutions in vehicles.

Restraining Factors

Multiple Pricing Models Implementation by Software Companies Affecting Cybersecurity Solution Providers

The arrival of corresponding services such as E-calls, multimedia streaming, and remote diagnostics in connected cars is affecting the whole automotive industry ecosystem. from a fixed to dynamic ecosystem automotive ecosystem has developed itself in which stakeholder accounts for the revenue share. presence of multiple stakeholders becomes a major challenge for the pricing model connected to the ecosystem. Various companies are struggling from managing cost and complexity with different types of pricing models. To earn more revenue software companies are implementing multiple pricing models which is affecting cybersecurity solution providers.

Growth Opportunities

Use of Adaptive Security Technique in the Automobile Industry is Anticipated to fuel Market Growth.

Cybersecurity technique such as Adaptive security which provides automotive cybersecurity solution is likely to boost the market growth and analyses behaviors and events to prevent and adapt the attacks before they occur. various companies are using this adaptive security technique to continuously analyze risk and prevent vehicles from cyber-attacks. Using analytics and automation, adaptive security protects against adaptable and targeted cyberattacks as well as trusted insiders and other insider threats. adaptive security also protects the ecosystem of an automobile manufacturer, which is expanding daily as a result of connected car activities. Thus, during the projected period, an increase in adaptive security in the automobile industry is anticipated to fuel market growth.

Latest Trends

Digitization and Connected Vehicles are Increasing the Chances of Cyberattacks on the Automobile Sector

lack of protection measures and Growing acceptance of work-from-home arrangements have resulted in a rise in cyberattacks. malware and ransomware attacks are the major thefts in the automotive industry that generate the need for automotive cyber security. digitization and connected vehicles are increasing the chances of cyberattacks on the automobile industry. Adaptive security technique is on trend as various companies are using this adaptive security technique to continuously analyze risk and prevent the vehicle from cyber-attacks.

Regional Analysis

Asia pacific dominated the market with a revenue share of 36%, in 2022. During the forecast period, the growth of the region is expected to be steady. lack of protection measures and Growing acceptance of work-from-home arrangements have resulted in a rise in cyberattacks. malware and ransomware attacks are the major thefts for the region which generally needs automotive cyber security. digitization and connected vehicles are increasing the chances of cyberattacks on the automobile industry. Attacking vital vehicle data, leads owners to suffer huge losses.

North America accounted for the second-largest automotive cybersecurity market and is expected to grow at the highest CAGR during the forecast period. The automotive cybersecurity market is expected to boost in this region by the adoption of automated passenger vehicles. the rising advent of smart transportation systems and government stringent emission norms are likely to fuel the market in the region.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Furthermore, businesses in the automotive cybersecurity market are developing advanced software and portfolio expansion strategies through investments and mergers, and acquisitions. In addition, major players are now focusing on different marketing strategies which are boosting the target products’ growth.

Market Key Players in Automotive Cyber Security

Listed below are some of the most prominent automotive cybersecurity industry players.

- Intel Corporation

- Argus Cyber Security

- NXP Semiconductors N.V

- Guardknox Cyber-Technologies Ltd.

- Argus Cyber Security

- Vector Informatik GmbH

- Arilou Technologies

- Arxan Technologies, Inc.

- Bayerische Motoren Werke (BMW) AG

- Broadcom Inc.

- C2A Security Ltd.

- Centri Technology Inc

- Dellfer, Inc.

- ESCRYPT GmbH

- Ford Motor Company

- Guardknox Cyber-Technologies Ltd.

- Mocana Corporation

- Nvidia Corporation

- Saferide Technologies Ltd

- Toyota Motor Corporation

- Trillium Secure Inc.

- Upstream Security

- Volkswagen AG

- Other key players

Recent Developments

- In February 2023, ETAS, a subsidiary of Robert Bosch GmbH, introduced ESCRYPT C_ycurRISK, a software tool for threat analysis and risk assessment in vehicle development. This tool enables automotive OEMs and suppliers to identify security vulnerabilities and systematically reduce cyber risks.

- The international centre for automotive technology (ICAT) announced in January 2023 its plan to invest in a facility for developing cyber security skills. ICAT is responsible for certifying autos for security and compliance with local regulations.

- HL Mando Corporation collaborated with Argus Cyber Security in January 2023. This collaboration resulted in the application of Argus CAN Intrusion Detection Systems (IDS) solution to HL Mando’s electrification system products, such as brakes and steering.

- In October 2022, NTT Communications Corporation and DENSO Corporation partnered to develop the security operation center technology for vehicles (VSOC1). This technology aims to address the growing threat of sophisticated cyber-attacks against vehicles.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Bn Forecast Revenue (2032) USD 22.2 Bn CAGR (2023-2032) 22% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type – Wireless Security, Network Security, Endpoint Security, Application Security, and Cloud Security: by Vehicle type- Type Passenger Cars and Commercial Vehicles; By Application – On-board Diagnostic [OBD], Communication, Safety Systems, Infotainment, and Telematics Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Intel Corporation, Argus Cyber Security, NXP Semiconductors N.V, Guardknox Cyber-Technologies Ltd., Argus Cyber Security, Vector Informatik GmbH, Arilou Technologies, Arxan Technologies, Inc., Bayerische Motoren Werke (BMW) AG, Broadcom Inc., C2A Security Ltd., Centri Technology Inc, Dellfer, Inc., ESCRYPT GmbH, Ford Motor Company, Guardknox Cyber-Technologies Ltd., Mocana Corporation, Nvidia Corporation, Saferide Technologies Ltd, Toyota Motor Corporation, Trillium Secure Inc., Upstream Security, Volkswagen AG, Other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the automotive cybersecurity market?The automotive cybersecurity market involves the development and implementation of security measures to protect vehicles and their electronic systems from cyber threats and attacks.

Why is automotive cybersecurity important?Automotive cybersecurity is essential in protecting modern vehicles' increasing array of electronic systems and connectivity features from potential cyber threats that could compromise safety, data privacy, or vehicle functionality.

How big is Automotive Cyber Security market?The global Automotive Cyber Security market is anticipated to be USD 22.2 billion by 2032. It is estimated to record a steady CAGR of 22% in the review period 2023 to 2032. It is likely to total USD 3.9 billion in 2023.

What is the need for automotive cybersecurity?Need for Automotive Cybersecurity

Automotive cybersecurity is important to protect vehicles from cyberattacks, which can have serious consequences, including:

- Loss of control of the vehicle

- Access to sensitive data, such as personal information or financial data

- Theft of the vehicle

- Damage to infrastructure

- Injuries or deaths

What are the main challenges facing the automotive cybersecurity market?Key challenges facing vehicle systems today include increasing complexity, connected and autonomous vehicle technology development, the need for industry-wide cybersecurity standards and sophisticated cyber threats against automotive systems.

What are the top 3 targeted industries for cyber security?Top 3 Targeted Industries for Cybersecurity

- Healthcare

- Financial services

- Government

How does the automotive cybersecurity market impact the automotive industry?Automotive cybersecurity markets play an integral part in maintaining consumer trust in vehicle safety and data privacy, encouraging innovation within secure connected vehicle technologies, as well as contributing to industry-wide cybersecurity regulations and standards.

Automotive Cyber Security MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Cyber Security MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Intel Corporation

- Argus Cyber Security

- NXP Semiconductors N.V

- Guardknox Cyber-Technologies Ltd.

- Argus Cyber Security

- Vector Informatik GmbH

- Arilou Technologies

- Arxan Technologies, Inc.

- Bayerische Motoren Werke (BMW) AG

- Broadcom Inc.

- C2A Security Ltd.

- Centri Technology Inc

- Dellfer, Inc.

- ESCRYPT GmbH

- Ford Motor Company

- Guardknox Cyber-Technologies Ltd.

- Mocana Corporation

- Nvidia Corporation

- Saferide Technologies Ltd

- Toyota Motor Corporation

- Trillium Secure Inc.

- Upstream Security

- Volkswagen AG

- Other key players