Global Mobility as a Service Market By Solution (Journey Planning & Management Solutions, Payment Solutions, Booking & Ticketing Solutions, Application Technology Solutions, Other Solutions), By Service (Ride-hailing Services, Ride-sharing Services, Micromobility Services, Public Transport Services, Other Services), By Propulsion Type (Internal Combustion Engine (ICE) Vehicle, Electric Vehicle (EV), Compressed Natural Gas (CNG)/Liquefied Petroleum Gas (LPG) Vehicle), By Payment Type (On-demand, Subscription-based), By Operating System (Android, iOS, Others), By Application (Business-to-Business (B2B), Business-to-Consumer (B2C), Peer-to-Peer (P2P)), By End-User (Automotive, Government, Healthcare, Retail, Entertainment, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 110596

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Solution Analysis

- Service Analysis

- Propulsion Type Analysis

- Payment Type Analysis

- Operating System Analysis

- Application Analysis

- End-User Analysis

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenges

- Key Market Trends

- Key Market Segments

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

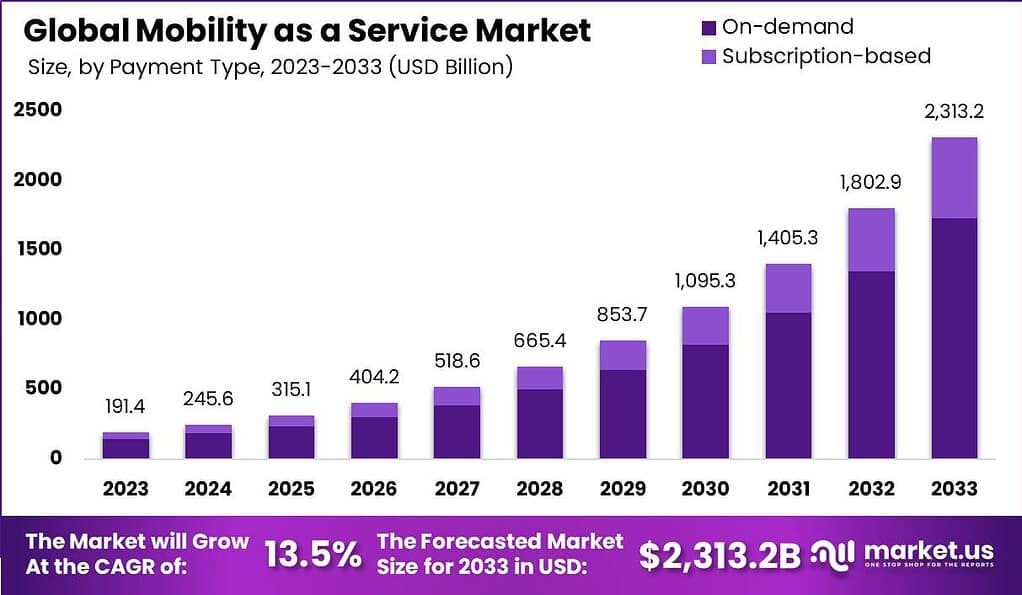

The global Mobility as a Service Market is anticipated to be USD 2,313.2 billion by 2033. It is estimated to record a steady CAGR of 13.5% in the Forecast period 2024 to 2033. It is likely to total USD 245.6 billion in 2024.

Mobility as a Service (MaaS) is the term used to describe the integration of a various transportation services into a unified platform that lets users organize, book, and even pay for trips with a single app or platform. MaaS aims to offer a flexible and interconnected transportation system that makes it easier for individuals to navigate and use a variety of transportation options based on their specific needs.

The Mobility as a Service Market is a reference to the business as well as economic aspects associated with mobility as a Service concept. It covers the companies technology, services, and technologies that offer and support the integration of mobility services. This market involves participation from software and platform developers, transportation service providers, vehicle manufacturers, and other stakeholders dedicated to the progress and implementation of MaaS.

Note: Actual Numbers Might Vary In Final Report

This market has been driven by rising need for sustainable, efficient and user-friendly transportation options and advancements in technology that facilitate seamless integration of different transportation services. The primary objective of the Mobility as a Service Market is to establish a more interconnected and accessible transportation ecosystem for both individuals and communities.

Key Takeaways

- Market Size and Growth: the Mobility as a Service (MaaS) market expected to grow to USD 2,313.2 billion in 2033. This will be accompanied by a a steady annual compound rise (CAGR) at 13.5% from 2024 to 2033

- Solution Analysis: Application Technology Solutions dominate the MaaS market, with over 27% market share in 2023. These solutions provide feature-rich mobile apps for planning journeys, accessing real-time transportation information, and making bookings.

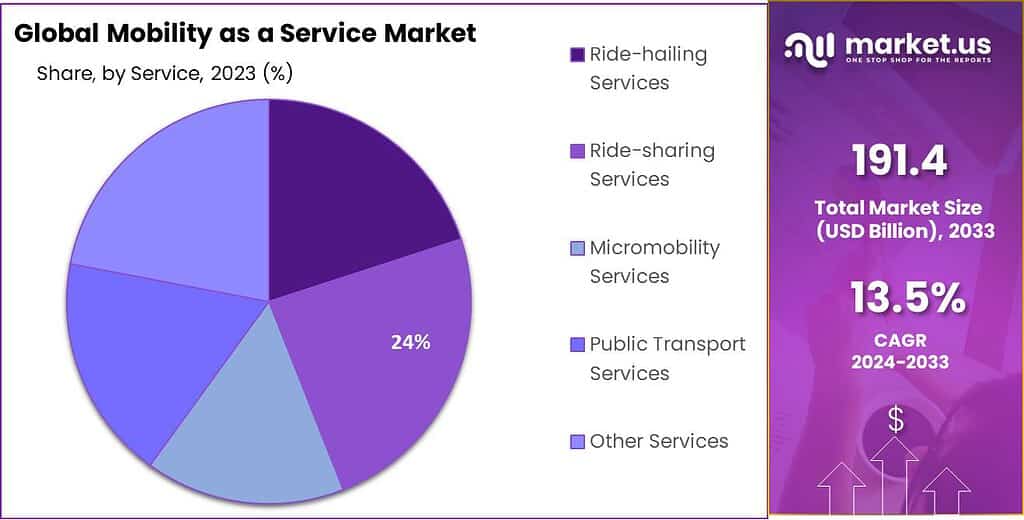

- Service Analysis: Ride-hailing Services lead the market with a share of more than 24% in 2023. These services offer convenience and accessibility, especially in urban areas.

- Propulsion Types: Internal Combustion Engine (ICE) Vehicles still dominate the market with over 48% market share in 2023, followed by Electric Vehicles (EVs) with a growing presence due to their environmental friendliness.

- Payment Types: On-demand payments are the preferred choice, capturing over 75% of the market in 2023, offering flexibility for users.

- Operating Systems: Android is the dominant operating system with more than 44% market share, while iOS caters to a specific demographic that values integration and reliability.

- Applications: Business-to-Consumer (B2C) applications hold a dominant position with more than 40% market share, catering to individual consumers’ transportation needs.

- End-Users: The Automotive sector leads with over 25% market share, with other sectors like Government, Healthcare, Retail, Entertainment, and others playing essential roles.

- Driving Factors: Key drivers of MaaS adoption include digital transformation in transportation, urbanization, environmental sustainability, and cost savings.

- Challenges: Challenges include resistance to change in traditional transportation systems, regulatory complexities, infrastructure limitations, and concerns about user privacy and data security.

- Growth Opportunities: Growth opportunities include global expansion, integration of autonomous vehicles, personalized mobility services, and partnerships and collaborations.

- Key Market Trends: Trends include multi-modal integration, micro-mobility solutions, mobility hubs, and data-driven decision-making.

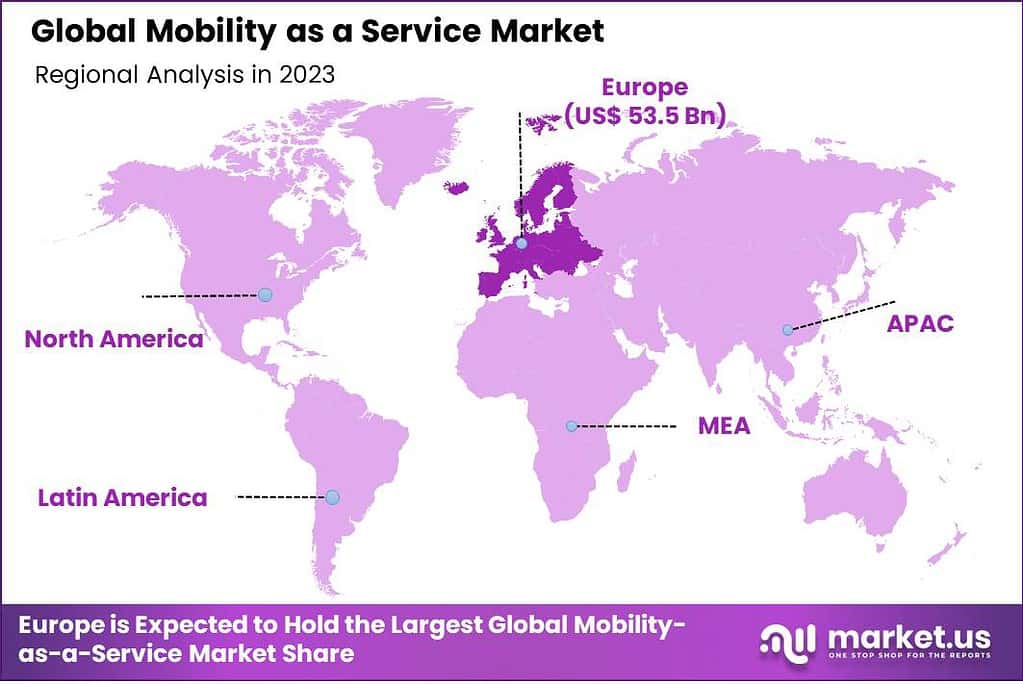

- Regional Analysis: Europe leads the market with more than 28% market share in 2023, driven by its focus on sustainability and well-established public transportation infrastructure.

- Key Players: Major players in the MaaS market include Lyft Inc., Uber Technologies Inc., Moovit Inc., and others.

Solution Analysis

In 2023, the Mobility-as-a-Service (MaaS) market demonstrated a compelling segmentation by solutions, encompassing Journey Planning & Management Solutions, Payment Solutions, Booking & Ticketing Solutions, Application Technology Solutions, and Other Solutions. Remarkably, the Application Technology Solutions Segment emerged as the dominant force in this market, firmly securing a commanding share of over 27%.

The dominance of the Application Technology Solutions Segment can be attributed to several pivotal factors. Firstly, the proliferation of smartphones and the widespread availability of mobile applications have transformed the way individuals plan and access their transportation needs. Application Technology Solutions within the MaaS ecosystem provide users with user-friendly, feature-rich mobile apps that serve as hubs for planning journeys, accessing real-time transportation information, and making seamless bookings. This convenience and accessibility have propelled the segment’s growth, making it an essential component of the MaaS landscape.

Furthermore, Application Technology Solutions have been instrumental in integrating various modes of transportation into a unified platform. Users can effortlessly combine public transit, ride-sharing, bike-sharing, and more through these applications, fostering multi-modal transportation adoption. The ability to view different transportation options, compare prices, and select the most efficient route contributes significantly to the segment’s market share.

Additionally, the Application Technology Solutions Segment plays a pivotal role in enhancing the overall user experience within the MaaS ecosystem. These solutions often incorporate innovative features like predictive analytics, personalized recommendations, and loyalty programs, thereby increasing user engagement and retention.

While the Application Technology Solutions Segment leads the way, other segments such as Journey Planning & Management Solutions, Payment Solutions, Booking & Ticketing Solutions, and Other Solutions each offer unique contributions to the MaaS market. Journey Planning & Management Solutions assist users in optimizing their travel itineraries, Payment Solutions streamline transactions, Booking & Ticketing Solutions simplify the booking process, and Other Solutions may include vehicle connectivity and maintenance management. These segments collectively contribute to the evolution and growth of the Mobility-as-a-Service market, reflecting the dynamism and diversity within this transformative industry.

Service Analysis

In 2023, the Mobility-as-a-Service (MaaS) market displayed a distinctive segmentation based on services, encompassing Ride-hailing Services, Ride-sharing Services, Micromobility Services, Public Transport Services, and Other Services. Impressively, the Ride-hailing Services Segment stood out as the dominant force in this dynamic market, securing a substantial share of more than 24%.

The popularity of the Ride-hailing Services segment can be attributed to a variety of important reasons. First, ride-hailing has emerged as a preferred method of transport for urban dwellers. It offers an unparalleled level of convenience and accessibility. Users can easily reserve rides using mobile apps, and take advantage of the variety of vehicles available and usually enjoy affordable prices, making it a popular option for everyday commuting and travel.

Moreover, ride-hailing platforms have expanded their reach across cities and regions, fostering a loyal user base. These services have capitalized on their widespread availability, both domestically and internationally, enhancing their market position. Additionally, ride-hailing providers have been quick to adapt to evolving trends, introducing eco-friendly and electric vehicle options, aligning with the sustainability movement in the mobility sector.

While the Ride-hailing Services Segment leads the way, other service segments, including Ride-sharing Services, Micromobility Services (such as e-scooters and bikes), Public Transport Services, and Other Services (encompassing carpooling, shuttle services, and on-demand transit), contribute to the comprehensive MaaS landscape. Each of these segments addresses specific transportation needs, catering to diverse preferences and reflecting the multifaceted nature of modern urban mobility solutions.

Propulsion Type Analysis

In 2023, the Mobility-as-a-Service (MaaS) market exhibited distinct segmentation based on propulsion types, with the Internal Combustion Engine (ICE) Vehicle segment holding a dominant market position, capturing more than a 48% share. This segment’s prominence can be attributed to the existing prevalence of ICE vehicles in many regions, particularly in mature markets where they remain a popular choice for personal and shared mobility. Despite the growing shift toward greener alternatives, the familiarity and extensive infrastructure supporting ICE vehicles have contributed to their continued dominance in the MaaS landscape.

Shifting focus to the Electric Vehicle (EV) sector, it witnessed significant expansion in 2023, demonstrating a steadily growing market presence. The rise of EVs can be attributed to their environmentally friendly and sustainable features, aligning with worldwide initiatives to decrease emissions and address climate change. The sector’s progress is influenced by advancements in battery technology, the enlargement of charging infrastructure, and positive government incentives designed to encourage the adoption of electric vehicles. As a result, the EV segment is becoming an increasingly significant player in the MaaS market, appealing to environmentally conscious consumers.

Meanwhile, the Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG) Vehicle segment also had a presence in the MaaS market, albeit with a more modest share. These alternative fuel options offer a greener choice compared to traditional ICE vehicles but face challenges related to infrastructure and availability. Their market share is expected to grow gradually as infrastructure for CNG and LPG vehicles expands and environmental considerations continue to shape consumer preferences. While still a smaller segment, it represents a niche market catering to those seeking cleaner mobility solutions.

Payment Type Analysis

In 2023, the Mobility-as-a-Service (MaaS) market exhibited a clear segmentation based on payment types, with the On-demand segment holding a dominant market position, capturing more than a 75% share. This segment’s prominence can be attributed to the convenience it offers to consumers, allowing them to access transportation services as needed, without the commitment of a long-term subscription. On-demand MaaS services have become particularly popular in urban areas, where commuters value flexibility and the ability to choose transportation options on a per-use basis. The convenience and simplicity of on-demand payments have driven its substantial market share.

On the other hand, the Subscription-based segment, while representing a smaller share in 2023, is also gaining traction in the MaaS market. Subscription-based models provide consumers with access to a variety of transportation services for a fixed recurring fee, offering cost savings for those who frequently utilize different modes of transportation. This segment’s growth is driven by the desire for predictable and budget-friendly mobility solutions, appealing to individuals and businesses seeking long-term convenience and affordability.

Operating System Analysis

In 2023, the Mobility-as-a-Service (MaaS) market displayed a distinct segmentation based on operating systems, with the Android segment holding a dominant market position, capturing more than a 44% share. The popularity of Android is due to its wide-spread acceptance as the primary operating system for mobile devices including tablets and smartphones. The open-source nature of Android, its broad app ecosystem along with its compatibility to a vast variety of hardware have led to it being a top choice for MaaS service providers.

Concurrently, the iOS segment, representing Apple’s operating system, held a substantial but smaller share in 2023. iOS users are known for their loyalty to the Apple ecosystem, and MaaS apps designed for iOS devices provide a seamless and user-friendly experience. While iOS may have a more limited user base compared to Android, it appeals to a specific demographic that values the integration, security, and reliability offered by Apple products. Consequently, the iOS segment continues to be an important player in the MaaS market, catering to Apple device users seeking top-notch mobility services.

Additionally, the “Others” segment includes alternative operating systems that may have niche market presence. This segment offers diversity in choice but typically commands a smaller market share compared to Android and iOS. The specific operating systems within this category can vary, reflecting the industry’s drive to accommodate a broad spectrum of user preferences and device compatibility.

Application Analysis

In 2023, the Mobility-as-a-Service (MaaS) market exhibited a notable segmentation based on applications, with the Business-to-Consumer (B2C) segment holding a dominant market position, capturing more than a 40% share. This segment’s prominence is a reflection of the growing demand for convenient and accessible mobility solutions among individual consumers. B2C, MaaS applications are gaining popularity due to their user-friendly interfaces and ability to meet the needs of daily transportation for commuters and tourists. They offer a range of options for transportation that make it simple for users to organize, plan and even pay for trips and contribute significantly to their large market share.

Conversely, the Business-to-Business (B2B) segment, while representing a substantial portion of the market, holds a comparatively smaller share. B2B MaaS applications are tailored to meet the mobility requirements of businesses, enterprises, and organizations. They provide comprehensive solutions for employee transportation, fleet management, and logistics, catering to the specific needs of corporate clients. This segment’s growth is fueled by businesses recognizing the advantages of optimizing transportation costs, enhancing efficiency, and ensuring seamless mobility operations for their workforce.

Furthermore, the Peer-to-Peer (P2P) segment, although having a smaller market share, introduces an emerging and innovative approach to mobility solutions. P2P MaaS platforms connect individual vehicle owners with users seeking shared rides or vehicle rentals. This segment capitalizes on the principles of resource sharing and collaborative consumption, offering unique and sustainable mobility options for those looking to reduce costs and environmental impact.

End-User Analysis

In 2023, the Mobility-as-a-Service (MaaS) market displayed a distinctive segmentation based on end-users, with the Automotive segment holding a dominant market position, capturing more than a 25% share. This segment’s prominence is a testament to the automotive industry’s pivotal role in shaping the MaaS landscape.

Automotive companies have taken the lead in Mobility-as-a-Service (MaaS) innovations, providing a broad spectrum of mobility solutions that encompass ride-sharing, car rentals, and integrated transportation services. Their robust presence and extensive offerings have firmly established them as key players in the MaaS market, addressing the diverse transportation needs of consumers.

Beyond the Automotive segment, other noteworthy end-user segments include Government, Healthcare, Retail, Entertainment, and Other End-Users. The Government sector plays a pivotal role in the development and regulation of MaaS initiatives, contributing to the market’s growth by promoting sustainable transportation solutions and fostering public-private partnerships.

Healthcare organizations utilize MaaS to enhance patient mobility and medical transport services, ensuring efficient and timely healthcare access. Retail and Entertainment sectors leverage MaaS to enhance customer experiences, providing convenient transportation options to and from their establishments. The “Other End-Users” category encompasses various industries that benefit from MaaS, including education, tourism, and logistics.

While the Automotive segment dominates, the collaborative efforts of various end-user sectors collectively shape the dynamic MaaS market. Each sector contributes to the expansion of mobility options and the integration of transportation services, ultimately driving the evolution of MaaS as a comprehensive and accessible solution for a wide range of consumers and industries.

Driving Factors

- Digital Transformation in Transportation: The increasing integration of technology in the transportation sector is a significant driving factor. MaaS utilizes technology like digital platforms, mobile applications and data analytics to simplify transport services, improving user convenience and efficiency.

- Urbanization and Congestion: The population of urban areas is growing and congestion in traffic increases the need for alternative solutions to mobility. MaaS addresses this issue by offering integrated and multi-modal transportation options, reducing the reliance on personal vehicles.

- Environmental Sustainability: Concerns regarding the impact of climate change on the environment and environmental impacts have led to a more intense focus on sustainable transport. MaaS encourages environmentally friendly modes of transportation like public transportation bicycles, electric, and bike vehicles, in line with the worldwide push towards greener mobility solutions.

- Cost Savings and Affordability: MaaS offers cost-effective mobility by permitting users to pay the transportation service on a pay-as you-go basis, or through subscription models. This affordability attracts budget-conscious consumers and businesses looking to optimize transportation expenses.

Restraining Factors

- Resistance to Change: The traditional transportation ecosystem may resist adopting MaaS due to concerns about disrupting established business models, including public transit agencies and traditional taxi services. Resistance to change can slow down MaaS adoption.

- Regulatory Challenges: Complex and evolving regulations can pose challenges to MaaS implementation. Navigating various legal frameworks, data privacy laws, and safety standards can be time-consuming and costly for MaaS providers.

- Infrastructure Limitations: MaaS relies on robust digital infrastructure, including reliable connectivity and data networks. In areas with limited or outdated infrastructure, the full potential of MaaS may not be realized, hindering its adoption.

- User Privacy and Data Security: Gathering and sharing user data for MaaS services raise concerns about privacy and data security. Addressing these concerns and ensuring the protection of user information is a significant challenge for MaaS providers.

Growth Opportunities

- Global Expansion: MaaS providers have opportunities for international expansion as urbanization and transportation challenges are not limited to specific regions. Expanding into new markets can unlock substantial growth potential.

- Integration of Autonomous Vehicles: The integration of autonomous vehicles into MaaS platforms presents an exciting growth opportunity. Self-driving cars and shuttles can offer efficient and convenient transportation options within MaaS ecosystems.

- Personalized Mobility Services: Tailoring MaaS offerings to individual preferences and needs can attract a more diverse user base. Personalized mobility solutions, such as customized routes and vehicle choices, have the potential to drive growth.

- Partnerships and Collaboration: Collaborating with public transportation agencies, automakers, and other stakeholders can open doors to new opportunities. Partnerships can lead to seamless interconnectivity between various modes of transport and improved user experiences.

Challenges

- Competition and Market Saturation: The MaaS market is becoming increasingly competitive, with numerous providers vying for market share. Staying ahead in a crowded field requires constant innovation and differentiation.

- User Adoption and Behavior Change: Convincing users to embrace MaaS and change their transportation behavior can be challenging. Overcoming habits and preferences for personal vehicles is a hurdle that MaaS providers must address.

- Data Management and Integration: Managing and integrating data from multiple transportation providers and sources can be complex. Ensuring data accuracy, timeliness, and compatibility is a continuous challenge in the MaaS ecosystem.

- Infrastructure Investments: Developing the necessary digital infrastructure, including mobile apps, payment gateways, and data analytics platforms, requires significant investments. Securing funding for these infrastructure developments can be a challenge for MaaS providers.

Key Market Trends

- Multi-Modal Integration: MaaS platforms increasingly focus on integrating various modes of transport, offering users seamless transitions between options like buses, trains, bikes, and ride-sharing services.

- Micro-Mobility Solutions: The rise of micro-mobility options, such as electric scooters and e-bikes, is a notable trend. MaaS providers are incorporating these compact and eco-friendly alternatives into their offerings.

- Mobility Hubs: The concept of mobility hubs, where different transportation modes converge, is gaining traction. These hubs facilitate efficient transfers and serve as centralized points for MaaS services.

- Data-Driven Decision-Making: MaaS providers are harnessing data analytics and artificial intelligence to optimize transportation routes, predict demand, and enhance user experiences, reflecting the trend toward data-driven decision-making in the industry.

Key Market Segments

Solution

- Journey Planning & Management Solutions

- Payment Solutions

- Booking & Ticketing Solutions

- Application Technology Solutions

- Other Solutions

Service

- Ride-hailing Services

- Ride-sharing Services

- Micromobility Services

- Public Transport Services

- Other Services

Propulsion Type

- Internal Combustion Engine (ICE) Vehicle

- Electric Vehicle (EV)

- Compressed Natural Gas (CNG)/Liquefied Petroleum Gas (LPG) Vehicle

Payment Type

- On-demand

- Subscription-based

Operating System

- Android

- iOS

- Others

Application

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Peer-to-Peer (P2P)

End-User

- Automotive

- Government

- Healthcare

- Retail

- Entertainment

- Other End-Users

Regional Analysis

In 2023, Europe held a dominant market position in the Mobility as a Service (MaaS) market, capturing more than a 28% share. This regional leadership can be attributed to several key factors. Firstly, Europe has been at the forefront of adopting sustainable and integrated transportation solutions, driven by environmental concerns and stringent emission regulations.

The demand for Mobility-as-a-Service in Europe was valued at US$ 53.5 billion in 2023 and is anticipated to grow significantly in the forecast period. Cities across Europe have enthusiastically adopted Mobility-as-a-Service (MaaS) initiatives, providing all-encompassing mobility solutions that incorporate public transit, bike-sharing, car-sharing, and ride-hailing services seamlessly integrated into MaaS platforms. Furthermore, Europe enjoys the advantages of a well-established public transportation infrastructure and a cultural inclination towards utilizing various modes of transport for daily commuting.

Moreover, regulatory support and government initiatives in Europe have played a pivotal role in promoting MaaS adoption. Financial incentives, subsidies, and favorable policies have encouraged both MaaS providers and users. As a result, European consumers are increasingly relying on MaaS to navigate urban areas efficiently while reducing their carbon footprint.

While Europe maintains its robust position, other regions, including North America, APAC, Latin America, and the Middle East and Africa, are experiencing notable growth in the Mobility-as-a-Service (MaaS) market. In North America, this growth is propelled by its tech-savvy population and an increasing interest in alleviating traffic congestion. APAC, with its expanding urban centers and investments in smart transportation, presents a fertile ground for MaaS expansion. Latin America and the Middle East and Africa are embracing MaaS to address urban mobility challenges, indicating a promising future for the global MaaS landscape.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Mobility as a Service (MaaS) market is a dynamic and rapidly evolving sector that has attracted several key players aiming to revolutionize the transportation industry. These companies bring expertise in technology, transportation, and digital platforms to create comprehensive MaaS solutions that offer seamless mobility experiences

Top Key Player

- Lyft Inc.

- Moovit Inc.

- Uber Technologies Inc

- Communauto Inc.

- Citymapper Ltd

- MaaS Gobal Oy

- uBIgO Innovation AB

- SkedGo Pty Ltd.

- Moovel Group GmbH

- Other Key Players

Recent Developments

- In February 2023, Uber collaborated with financial services firm HSBC to introduce a digital payments solution. This solution enables unbanked drivers in Egypt to receive on-demand cash outs directly into their mobile wallets.

- In January 2023, DiDi initiated a partnership with Jordan Transfer Guidance, commencing taxi dispatch services on routes that include the last mile in the transfer guidance app. This collaboration aims to enhance the overall transportation experience.

- In December 2022, Moovit, a newly launched urban mobility app in Tampa, assisted users in planning multimodal trips, offering options such as walking, biking, scooting, driving, riding the streetcar, or taking the bus.

- In November 2022, Moovit introduced a new feature to reduce uncertainty and stress for commuters. This feature allows Moovit users to track their transit line’s movements along the map in real time, providing an additional layer of reliable information on route progress.

- In October 2022, Citymapper’s Cycling SDK facilitated the instant integration of cycle routing and turn-by-turn navigation with just a few lines of code.

- Also in October 2022, SkedGo announced its support for the Leicester Buses Partnership in the UK. This integration aims to offer travelers personalized, door-to-door bus trip planning based on their preferences.

Report Scope

Report Features Description Market Value (2023) US$ 191.4 Bn Forecast Revenue (2033) US$ 2,313.2 Bn CAGR (2024-2033) 13.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Journey Planning & Management Solutions, Payment Solutions, Booking & Ticketing Solutions, Application Technology Solutions, Other Solutions), By Service (Ride-hailing Services, Ride-sharing Services, Micromobility Services, Public Transport Services, Other Services), By Propulsion Type (Internal Combustion Engine (ICE) Vehicle, Electric Vehicle (EV), Compressed Natural Gas (CNG)/Liquefied Petroleum Gas (LPG) Vehicle), By Payment Type (On-demand, Subscription-based), By Operating System (Android, iOS, Others), By Application (Business-to-Business (B2B), Business-to-Consumer (B2C), Peer-to-Peer (P2P)), By End-User (Automotive, Government, Healthcare, Retail, Entertainment, Other End-Users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Lyft Inc., Moovit Inc., Uber Technologies Inc, Communauto Inc., Citymapper Ltd, MaaS Gobal Oy, uBIgO Innovation AB, SkedGo Pty Ltd., Moovel Group GmbH, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Mobility as a Service?Mobility as a Service (MaaS) is a concept that integrates different transportation services into a unified and user-centric platform. It allows individuals to plan, book, and pay for various modes of transportation seamlessly, providing a comprehensive solution to meet diverse mobility needs.

What role do technology companies play in the MaaS market?Technology companies play a crucial role in developing and maintaining the digital infrastructure of MaaS platforms, including mobile apps, data analytics, and seamless integration with transportation services.

How big is Mobility as a Service Market?The global Mobility as a Service Market is anticipated to be USD 2,313.2 billion by 2033. It is estimated to record a steady CAGR of 13.5% in the Forecast period 2024 to 2033. It is likely to total USD 245.6 billion in 2024.

What is an Example of Mobility as a Service?An example of Mobility as a Service is a digital platform or mobile app that enables users to access and combine different transportation options, such as ride-sharing, public transit, bike-sharing, and more. Users can plan and pay for their entire journey through a single interface.

What challenges does the MaaS market face?Challenges in the MaaS market include regulatory hurdles, interoperability issues between different transportation modes, and the need for collaboration among stakeholders to create a cohesive and efficient system.

How does MaaS contribute to the future of transportation?MaaS is seen as a transformative force in the future of transportation, offering a more integrated, efficient, and sustainable approach to mobility. It aims to create a seamless and interconnected transportation ecosystem that meets the diverse needs of individuals and communities.

Mobility as a Service MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Mobility as a Service MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Lyft Inc.

- Moovit Inc.

- Uber Technologies Inc

- Communauto Inc.

- Citymapper Ltd

- MaaS Gobal Oy

- uBIgO Innovation AB

- SkedGo Pty Ltd.

- Moovel Group GmbH

- Other Key Players