Mobile Imaging Services Market By Product Type (X-ray, MRI, CT, Ultrasound, and Others), By Application (Oncology, Cardiology, Gynecology, Orthopedics, and Others), By End-User (Hospitals & ASCs, Diagnostic Imaging Centers, Specialty Clinics, Homecare Settings, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 77959

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Mobile Imaging Services Market Size is expected to be worth around US$ 30 Billion by 2034, from US$ 18.1 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Increasing demand for convenient and cost-effective healthcare solutions is driving the growth of the mobile imaging services market. Mobile imaging services offer on-site diagnostic imaging, including X-rays, ultrasound, MRI, and CT scans, providing critical diagnostic support in hospitals, outpatient centers, and remote locations.

These services are particularly beneficial in emergency situations, home healthcare, and rural settings where access to traditional imaging facilities may be limited. The rising prevalence of chronic diseases, including cancer, cardiovascular conditions, and neurological disorders, is fueling demand for more frequent and accessible imaging.

In 2023, a report published by the National Center for Biotechnology Information (NCBI) estimated nearly 2 million new cancer cases in the United States, underscoring the increasing need for advanced diagnostic and treatment solutions. Recent trends show a growing preference for mobile imaging due to its ability to reduce patient wait times and improve workflow efficiency.

Additionally, advancements in imaging technologies, such as portable MRI and digital X-rays, are expanding the capabilities of mobile imaging services. As healthcare providers seek to improve patient care, reduce costs, and enhance operational efficiency, the mobile imaging services market presents significant opportunities for innovation and expansion. The ability to provide high-quality diagnostic services in real-time continues to drive the adoption of mobile imaging across healthcare settings.

Key Takeaways

- In 2024, the market for mobile imaging services generated a revenue of US$ 18.1 billion, with a CAGR of 5.2%, and is expected to reach US$ 30.0 billion by the year 2033.

- The product type segment is divided into X-ray, MRI, CT, ultrasound, and others, with X-ray taking the lead in 2023 with a market share of 38.5%.

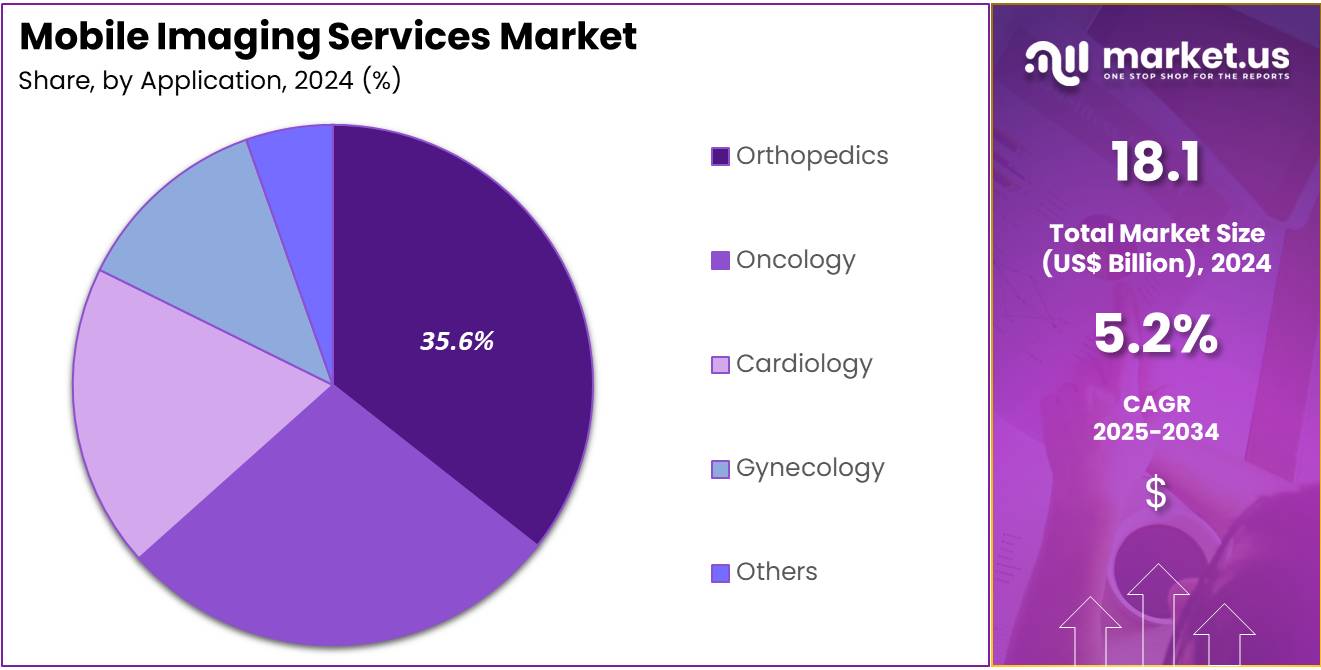

- Considering application, the market is divided into oncology, cardiology, gynecology, orthopedics, and others. Among these, orthopedics held a significant share of 35.6%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & ASCs, diagnostic imaging centers, specialty clinics, homecare settings, and others. The diagnostic imaging centers sector stands out as the dominant player, holding the largest revenue share of 41.7% in the mobile imaging services market.

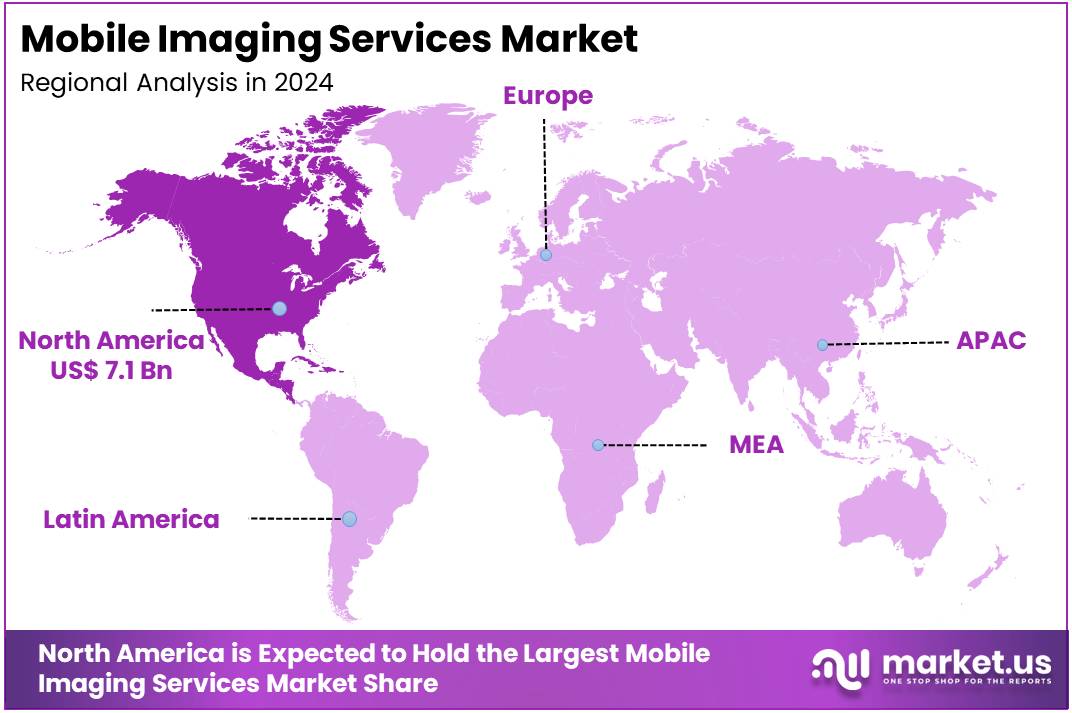

- North America led the market by securing a market share of 39.3% in 2024.

Product Type Analysis

The X-ray segment led in 2024, claiming a market share of 38.5% owing to its widespread use in diagnosing a variety of conditions such as fractures, lung diseases, and other structural abnormalities. X-ray technology offers the advantage of being portable, which allows for imaging in remote areas or emergency situations.

The increasing demand for quick and non-invasive diagnostic methods is projected to drive the growth of this segment. Technological improvements, such as digital X-ray systems, which offer enhanced image quality and reduced radiation exposure, are likely to contribute to this segment’s growth as healthcare providers seek more efficient and safer imaging solutions.

Application Analysis

The orthopedics held a significant share of 35.6% due to the increasing prevalence of musculoskeletal disorders and the need for imaging in the diagnosis and treatment of bone and joint diseases. Mobile imaging services, particularly X-ray and ultrasound, are essential in providing rapid assessments for orthopedic conditions such as fractures, arthritis, and dislocations.

The rise in aging populations and increased participation in physical activities are likely to drive the demand for orthopedic imaging services. Furthermore, the convenience and efficiency of mobile imaging for orthopedic surgeries and post-operative monitoring are expected to further contribute to the segment’s expansion.

End-User Analysis

The diagnostic imaging centers segment experienced significant growth, holding a revenue share of 41.7%. This surge is attributed to the escalating demand for diagnostic services in outpatient and specialized settings. Diagnostic centers provide critical services such as X-rays, ultrasounds, and CT scans. They increasingly benefit from mobile imaging solutions that offer on-demand services for patients who struggle to access traditional healthcare facilities.

The expansion of outpatient care, along with the trend towards decentralizing healthcare services, is poised to further drive demand for mobile imaging in these centers. Technological advancements in mobile imaging are enhancing both portability and image quality, which are expected to significantly contribute to the growth of this segment.

Key Market Segments

By Product Type

- X-ray

- MRI

- CT

- Ultrasound

- Others

By Application

- Oncology

- Cardiology

- Gynecology

- Orthopedics

- Others

By End-User

- Hospitals & ASCs

- Diagnostic Imaging Centers

- Specialty Clinics

- Homecare Settings

- Others

Drivers

Growing Prevalence of Chronic Conditions Driving the Mobile Imaging Services Market

Growing prevalence of chronic conditions is anticipated to drive the mobile imaging services market significantly. In May 2023, the Centers for Disease Control and Prevention reported that 60% of Americans were managing at least one chronic condition, while 40% dealt with two or more. Chronic diseases such as diabetes, cardiovascular disorders, and cancer require consistent imaging to monitor disease progression and evaluate treatment outcomes.

Mobile imaging services provide a practical solution by delivering diagnostic imaging directly to patients in remote or underserved locations. These services reduce the need for patients to travel to centralized healthcare facilities, improving convenience and accessibility. Technological advancements in portable imaging devices enhance image quality and diagnostic accuracy, further boosting adoption.

Healthcare providers increasingly rely on mobile units to meet the rising demand for timely and efficient diagnostic solutions. Collaborations between mobile imaging providers and healthcare organizations expand service coverage. These trends highlight the critical role of mobile imaging in addressing the growing burden of chronic conditions globally.

Restraints

High Operational Costs Are Restraining the Mobile Imaging Services Market

High operational costs are restraining the mobile imaging services market. Maintaining mobile imaging units involves significant expenses, including equipment maintenance, fuel costs, and regular calibration to ensure optimal performance. Specialized imaging devices, such as mobile CT and MRI scanners, require substantial investment, making it challenging for smaller providers to operate profitably. The need for skilled technicians to manage these units further adds to labor costs.

Transportation logistics, particularly in rural or difficult-to-access areas, increase operational complexity and expenses. Limited insurance reimbursement for mobile imaging services in some regions discourages widespread adoption. Economic disparities between urban and rural areas create gaps in service availability, restricting market growth. Addressing these challenges requires cost-efficient solutions and supportive healthcare policies to make mobile imaging more sustainable.

Opportunities

Integration of AI as an Opportunity for the Mobile Imaging Services Market

Increasing integration of AI is projected to create significant opportunities for the mobile imaging services market. In 2022, Carestream Health secured 20 patents for advancements in mobile imaging, including innovations in digital radiography detectors, image quality improvements, and AI integration. AI-driven algorithms enhance diagnostic precision by automating image analysis and identifying anomalies with greater accuracy.

Mobile imaging units equipped with AI tools streamline workflows, enabling faster turnaround times for results and improving patient outcomes. AI-powered platforms facilitate remote consultations and second opinions, expanding access to expert diagnostics in underserved regions. Continuous advancements in AI technology support real-time data processing and predictive analytics, optimizing service delivery.

Collaboration between imaging providers and AI developers accelerates the deployment of cutting-edge solutions in mobile imaging. These innovations highlight the transformative potential of AI in advancing the capabilities of mobile imaging services and meeting the growing demand for accessible diagnostic care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a significant role in shaping the mobile imaging services market. On the positive side, increasing investments in healthcare infrastructure, particularly in emerging markets, drive the demand for mobile diagnostic solutions. These services offer flexibility and cost-effectiveness, particularly in rural and underserved regions, where access to traditional imaging centers is limited. The growing focus on preventive care and early disease detection further boosts demand for mobile imaging services.

However, economic recessions or cuts in healthcare spending can limit the availability and affordability of these services, especially in resource-constrained environments. Geopolitical challenges, such as regulatory differences, political instability, or trade restrictions, can disrupt the supply chains for mobile imaging equipment and technology, leading to delays in service delivery. Despite these challenges, the continued focus on improving healthcare accessibility and patient care ensures a positive long-term growth outlook for the market.

Trends

Surge in Mergers and Acquisitions Driving the Mobile Imaging Services Market

Rising mergers and acquisitions are fueling growth in the mobile imaging services market. High levels of consolidation among key players in the healthcare and diagnostic services sectors are expected to enhance service offerings and operational efficiency. These strategic partnerships enable companies to expand their portfolios, integrate advanced imaging technologies, and improve service delivery.

The growing demand for mobile imaging services, particularly in response to the increasing need for healthcare access in remote or underserved areas, is likely to continue driving market expansion. In March 2023, DMS Health Technologies, a U.S.-based provider of mobile diagnostic imaging services, acquired Advanced Imaging Management, a veteran-owned small business specializing in diagnostic imaging equipment and services.

This acquisition expanded DMS Health Technologies’ portfolio to include a range of mobile CT, MRI, and nuclear medicine systems deployed across North America. As mergers and acquisitions continue to rise, the market is expected to benefit from greater innovation, wider coverage, and enhanced technological capabilities.

Regional Analysis

North America is leading the Mobile Imaging Services Market

North America dominated the market with the highest revenue share of 39.3% owing to increasing demand for accessible and flexible diagnostic solutions. The government of New Brunswick, Canada, allocated US$ 1.1 million in May 2023 to enhance its Extra-Mural Program, making mobile X-ray services available to long-term care facility residents. This initiative exemplified the region’s focus on improving healthcare accessibility, particularly for elderly populations and those with mobility challenges.

Rising prevalence of chronic diseases like cancer and cardiovascular conditions further fueled the adoption of on-site imaging services. Technological advancements in portable imaging devices enhanced diagnostic accuracy and efficiency, making mobile solutions a preferred choice for many healthcare providers. Expanding healthcare coverage and reimbursement policies supported the growth of these services across the U.S. and Canada.

Partnerships between healthcare providers and mobile imaging companies improved service delivery in underserved and remote areas. Increased investments in telemedicine and integrated care solutions also contributed to market expansion, as mobile imaging seamlessly complemented remote consultations. The market benefited from heightened awareness about early diagnostics and preventive care among patients and providers alike.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising healthcare demand and improving access to medical technologies. Expanding healthcare infrastructure in countries like India and China is expected to enhance the adoption of mobile diagnostic solutions, particularly in rural and semi-urban areas. Increasing prevalence of chronic and age-related diseases is anticipated to fuel demand for on-site imaging services.

Government initiatives aimed at improving healthcare accessibility and affordability are likely to support market expansion. Collaborations between local healthcare providers and international companies are projected to drive innovation and widen service availability. Medical tourism in the region, fueled by cost-effective yet advanced healthcare services, is expected to further boost adoption of mobile imaging.

Technological advancements in portable devices and AI-powered imaging solutions are likely to improve diagnostic precision and efficiency, encouraging wider use. The growing focus on home healthcare and telemedicine integration is estimated to create additional opportunities for mobile imaging companies to expand their reach and services.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the mobile imaging services market focus on expanding their fleet of portable diagnostic equipment to provide on-site imaging solutions for hospitals, nursing homes, and outpatient centers. Companies invest in advanced imaging technologies like digital X-rays, portable ultrasounds, and mobile CT scanners to enhance service quality and efficiency.

Partnerships with healthcare providers help increase accessibility to diagnostic services in underserved areas. Geographic expansion into regions with growing demand for remote healthcare supports further market growth. Many players prioritize affordability and quick turnaround times to improve patient satisfaction and drive adoption.

Alliance HealthCare Services is a leading provider in this market, offering comprehensive mobile imaging solutions, including MRI, PET/CT, and X-ray services. The company focuses on delivering high-quality diagnostics directly to healthcare facilities, ensuring convenience and efficiency for patients and providers. Alliance HealthCare Services’ commitment to innovation and operational excellence makes it a trusted name in mobile diagnostic services.

Top Key Players in the Mobile Imaging Services Market

- Siemens Healthineers

- Philips Healthcare

- Johns Hopkins Medicine

- Jefferson Abington Hospital

- GE Healthcare

- DispatchHealth

- Carestream Health

- Canon Medical Systems

Recent Developments

- In June 2023, Jefferson Abington Hospital in the U.S. launched a new portable MRI system designed to enhance patient access to brain imaging and improve the overall diagnostic process.

- In April 2021, DispatchHealth expanded its capabilities in mobile healthcare by acquiring Professional Portable X-Ray (PPX), a provider of mobile imaging services. This strategic move allowed the company to deliver radiology services directly to patients at home, further strengthening its position as a leader in comprehensive in-home care.

- A 2024 report from Johns Hopkins Medicine revealed that around one in four Americans aged 18 and above, approximately 26%, experience a diagnosable mental health condition each year, emphasizing the growing need for accessible mental health resources.

Report Scope

Report Features Description Market Value (2024) US$ 18.1 billion Forecast Revenue (2034) US$ 30.0 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (X-ray, MRI, CT, Ultrasound, and Others), By Application (Oncology, Cardiology, Gynecology, Orthopedics, and Others), By End-User (Hospitals & ASCs, Diagnostic Imaging Centers, Specialty Clinics, Homecare Settings, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers, Philips Healthcare, Johns Hopkins Medicine, Jefferson Abington Hospital , GE Healthcare, DispatchHealth , Carestream Health, and Canon Medical Systems. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Imaging Services MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Imaging Services MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers

- Philips Healthcare

- Johns Hopkins Medicine

- Jefferson Abington Hospital

- GE Healthcare

- DispatchHealth

- Carestream Health

- Canon Medical Systems