Global Payment Processing Solutions Market Size, Share, Upcoming Investments Report By Component (Solution and Service), By Deployment Mode (Credit Card, Debit Card, E-Wallet, Automated Clearing House (ACH), and Others), By Industry Vertical, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Dec. 2024

- Report ID: 99255

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

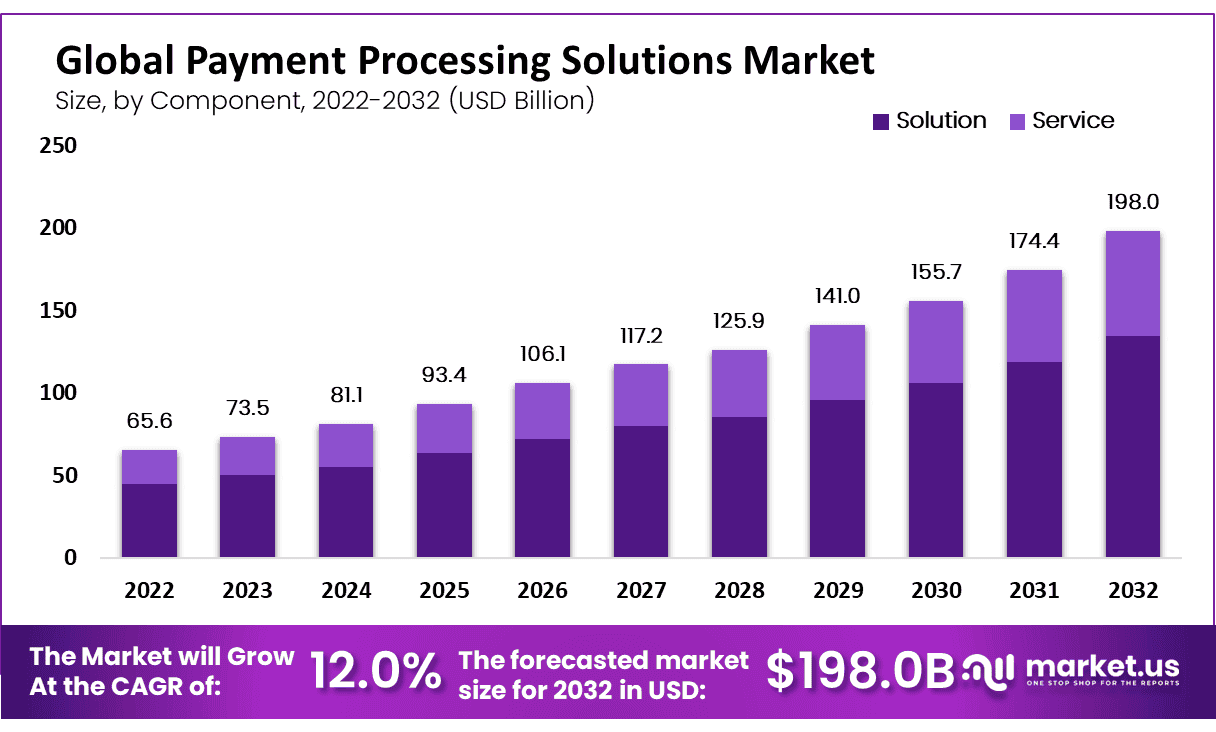

The Global Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032 from USD 81.0 Billion in 2024, growing at a CAGR of 12.00% during the forecast period from 2023 to 2032.

Payment processing solutions encompass the services and technologies that facilitate financial transactions for businesses. This is primarily achieved through the secure processing of credit and debit card payments, along with other forms of electronic payments. These solutions ensure that transactions are carried out efficiently and securely, transferring information from the merchant to the banking network to authorize and finalize payments.

The focus is on streamlining the process to enhance the user experience and reduce operational costs, making it an essential aspect for businesses operating in the digital era. The market for payment processing solutions is experiencing rapid growth, driven by the increasing shift towards digital commerce and the adoption of mobile payment platforms.

As businesses and consumers move more of their financial transactions online, the demand for robust, secure, and efficient payment processing systems has surged. This market encompasses a wide range of services including online payment processing, mobile wallets, and point of sale systems, tailored to meet the diverse needs of businesses across various sectors.

Several key factors are driving the expansion of the payment processing solutions market. Firstly, the global increase in online shopping and e-commerce activities has necessitated more advanced payment solutions. Secondly, businesses are looking for more integrated payment systems that offer seamless transaction experiences across multiple platforms.

Additionally, the growing acceptance of mobile payments globally is pushing merchants to adopt versatile payment processing technologies that can accommodate a variety of payment methods. Market demand in the payment processing solutions sector is heavily influenced by consumer preference for quick and easy transaction methods.

Consumers today expect instant processing, high security, and flexible payment options, which compel businesses to upgrade their payment systems. This demand is also propelled by the increasing number of small and medium-sized enterprises (SMEs) that are moving their operations online and require affordable, reliable payment processing services.

The payment processing solutions market is ripe with opportunities, particularly in developing regions where digital payment infrastructures are still evolving. Innovations that offer enhanced security and convenience at lower costs are particularly attractive.

There is also a significant opportunity in the integration of artificial intelligence and machine learning technologies to detect fraud and personalize the customer payment experience, offering a competitive edge to forward-thinking companies.

Technological advancements are at the heart of the growth in the payment processing solutions market. The development of blockchain technology, for instance, offers unprecedented security features, reducing the risk of fraud.

Innovations in near-field communication (NFC) and biometric authentication methods are further enhancing the ease and security of transactions. Such technologies not only improve the user experience but also streamline backend operations, making them more cost-effective and efficient for businesses of all sizes.

Key Takeaway

- Market Statistics: The Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032, growing at a CAGR of 12.00%.

- Demand: Payment processing solutions are in great demand due to the proliferation of digital payments and surge in e-commerce trends.

- Driving Factors: E-Commerce Industry’s Growth as A Driver of Market Expansion

- Restraining Factors: Lack Of Standardization For Cross-Border Transactions Could Slow Market Growth

- Opportunities: Emerging markets and New payment technologies

- Challenges: Security concerns and High cost of implementation

- Component Analysis: The solution segment holds the highest market share.

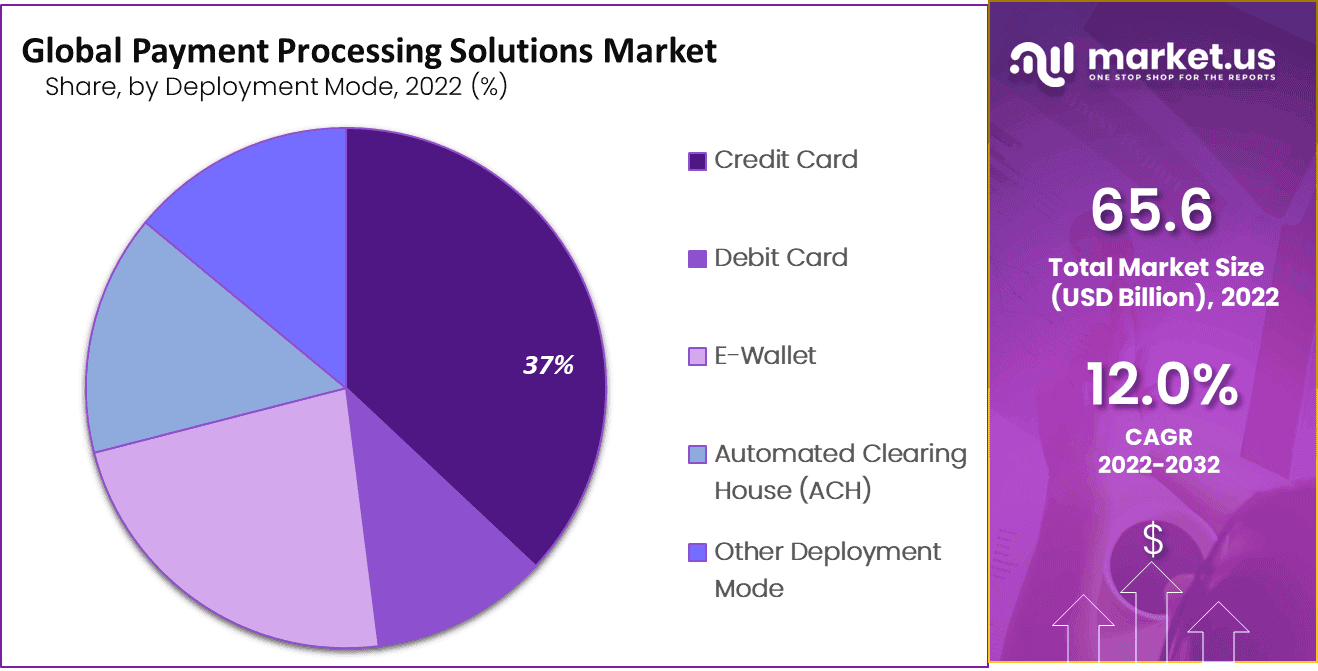

- Deployment Mode Analysis: By component, credit cards account for most of the market growth.

- Industry Vertical Analysis: The BFSI sector leads market expansion and holds the greatest market share.

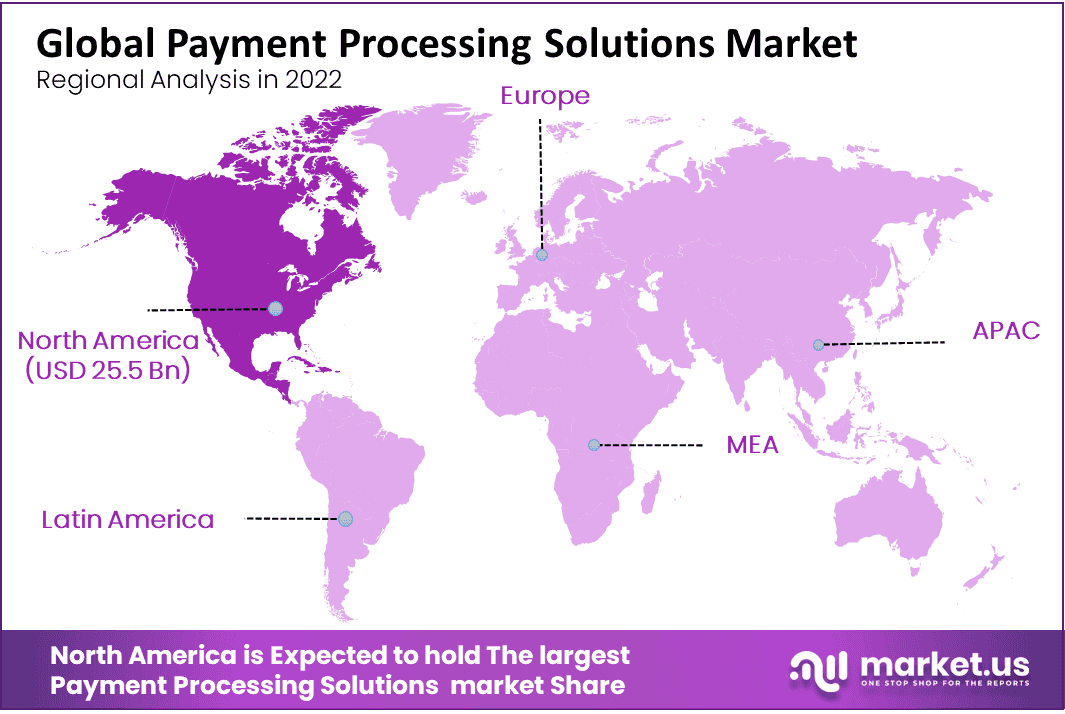

- Regional Analysis: North America has long held a major share of the market and this trend is projected to continue during the forecast period.

- Top Vendors: Adyen, Alipay, Amazon Payments, Inc., Authorize.Net, PayPal Holdings Inc., PayU, SecurePay, Stripe, Inc., Apple Inc. (Apple Pay), Alphabet (Google Pay) and Other Key Players

Driving Factors

The Rise In The E-Commerce Sector to Help the Market Development

The rapid adoption of advanced technologies, which is driving the use of devices such as tablets and smartphones, and the rapid rise in the e-commerce sector, are driving the growth of the market. The rapid acceleration of the e-commerce sector is eventually supporting the massive use of e-payments which results in the growth of the market. The process of carrying out payments and other financial services is eased by the e-payment process, which is driving the growth of the market globally. Due to the advancement in electronic payments and online payment technologies, the e-commerce sector is seeing growth. The growth of the e-commerce sector is a major opportunity for the growth of the payment processing solution market.

Restraining Factors

The Absence Of Standardization For Cross-Border Transactions to Slow Down the Market Growth

Recently, trade in the across-border has seen significant growth as more companies are importing and exporting goods and services globally. But due to the lack of an international payment system, which is convenient to use, digital payment vendors are unable to grow with these opportunities. There is a lack of standardization and automation across the countries due to the independent development of payment systems, which affects businesses and banks and results in manual intervention to repair and collect data. These are the factors that are restraining the growth of the market.

Growth Opportunities

The Rise in the Financial Inclusion to Create Opportunities

The major key players, governments, and development organizations have recognized the importance of financial services for the people living in rural and remote regions. Due to this, people are gaining access to financial services. Online banking and online payment play an important role in raising the number of people holding bank accounts, as the opening and operation of bank accounts can be done with the use of smartphones, even in remote places. The introduction of e-wallets has had a greater impact on the rise of financial services. The increasing use of smartphones and laptops is the major opportunity driving the growth of the market. The decreasing number of unbanked people is the major opportunity that is driving the growth of the market.

Trending Factors

The Rise in the Adoption of the Value Added Services by Fintech Firms and Banks

Customer and business-based modules have been adopted by the major key players in the market based on contextual and customized offerings. Financial firms and Banks are moving away from standard offerings to gain a competitive advantage in the market. These services will allow banks to adopt a more strategic role and open new income for the clients as well as themselves. The adoption of advanced technologies by the fintech firms and banks has automated important accounting operations and managed liquidity operations

Component Analysis

The Solution Segment Dominates The Growth Of The Market

The solution segment dominates the market with the largest market share. The solution segment includes pay-by-link, recurring payments, shopping carts, mobile wallets, etc., which can quickly process payments and can reduce time and effort for both merchants and customers. It is reliable and convenient while make online payments via mobile phones and tablets. The service segment will see significant growth during the forecasted period.

Deployment Mode Analysis

The Credit Card Segment Dominates the Growth of the Market

By Component, the credit card segment dominates the growth of the market. The processing tools of credit cards are widely used by businesses, which allows them to align the essential data of their businesses, which includes shipping & invoicing, business order, etc. so that the business can run smoothly. There is a continuous flow of data to the ERP system, which eliminates the errors at entry and avoids data redundancy in integrated credit card payment processing solutions. The e-wallet segment is growing at a significant rate during the forecasted period. The rise in the penetration of smartphones globally is driving the growth of the e-wallet segment. The rise in the opportunity of the segment is seen due to the high payment process speed and convenience of these e-wallets.

Note: Actual Numbers Might Vary In Final Report

Industry Vertical Analysis

The BFSI Segment to Dominate the Market

The BFSI segment dominates the growth of the market and holds the largest market share. The rise in the adoption of advanced payment processing solutions by banks and fintech firms resulted in the growth of the market. Many projects have been initiated by the banks to create a stable cost-effective payment mechanism, which can increase the network trade activities. The retail segment is expected to grow at a significant rate during the forecasted period. The vendors are mainly focusing on offering personalized solutions for retail payment, which is expected to drive the growth of the segment.

Key Market Segments

Based on Component

- Solution

- Service

Based on the Deployment Mode

- Credit card

- Debit card

- E-wallet

- Automated Clearing House (ACH)

- Others

Based on Industry Vertical

- BFSI

- Government & Utilities

- It & Telecom

- Healthcare

- Retail & E-commerce

- Media & Entertainment

- Travel & Hospitality

- Others

Regional Analysis

North America Dominates The Growth Of The Market

North America dominates the market and is expected to hold the largest market share during the forecast period. Due to the combination of the expansion of interest and the rise in the growth of online transactions, the growth of the region was observed. The growth of the region is attributed to the higher acceptance of digital payments in the region.

The rise in the demand for mobile wallets is the main factor that will drive the growth of the market in the region. Europe will grow at a significant rate during the forecast period. The presence of major key players in the market in the region has resulted in market growth. The growth of the market in the region can be seen due to the increase in the adoption of online channels by retail customers. The rise in customers who are shifting from cash to advanced payment solutions is the main factor driving the growth of the market in the region.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

The major key players in the market are focusing on launching new offerings which can drive the growth of the company in the market. Companies are heavily investing in research and development activities for the development of payment processing solutions. Some of the key players are focusing on partnerships and collaboration with other competitors to gain a strong market position.

Market Key Players

- Adyen

- Alipay

- Amazon Payments, Inc.

- Authorize.Net

- PayPal Holdings Inc.

- PayU

- SecurePay

- Stripe, Inc.

- Apple Inc. (Apple Pay)

- Alphabet (Google Pay)

- Other Key Players

Recent Developments

- ACI Worldwide collaborated with Swedbank in June 2021, which can improve their customer experience and also drive the growth of Swedbank. This development aims to control fraudulent activities and improve security.

- RealNet was launched by the FIS in April 2021, which can enable A2A, which is also called as account to account transactions for customers, government, companies, etc., over real-time payment networks.

Report Scope

Report Features Description Market Value (2022) USD 65.62 Bn Forecast Revenue (2032) USD 198 Bn CAGR (2023-2032) 12.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component: Solution and Service; By Deployment Mode: Credit Card, Debit Card, E-Wallet, Automated Clearing House (ACH), and Others; By Industry Vertical: BFSI, Government & Utilities, IT & Telecom, Healthcare, Retail & E-commerce, Media & Entertainment, Travel & Hospitality, and Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Adyen, Alipay, Amazon Payments, Inc., Authorize.Net, PayPal Holdings Inc., PayU, SecurePay, Stripe, Inc., Apple Inc. (Apple Pay), Alphabet (Google Pay), and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Payment Processing Solutions Market CAGR in 2023 – 2032?The Global Payment Processing Solutions Market size is growing at a CAGR of 12.00% during the forecast period from 2023 to 2032.

What was the Payment Processing Solutions Market in Year 2022?The Global Payment Processing Solutions Market size was around from USD 65.6 Billion in 2022.

What will be the Payment Processing Solutions Market During the Forecast Period from 2023 to 2032?The Global Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032 during the forecast period from 2023 to 2032.

Payment Processing Solutions MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Payment Processing Solutions MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Adyen

- Alipay

- Amazon Payments, Inc.

- Authorize.Net

- PayPal Holdings Inc.

- PayU

- SecurePay

- Stripe, Inc.

- Apple Inc. (Apple Pay)

- Alphabet (Google Pay)

- Other Key Players