Global Blockchain Technology Market By Type (Private Cloud, Public Cloud, and Hybrid Cloud), By Component (Infrastructure & Protocols, Application & Solution, and Middleware), By Application (Exchanges, Digital Identity, Smart Contracts, Payments, Supply Chain Management, Other Applications), By Enterprise (Small & Medium Enterprises, Large Enterprises), By End-Users (Government, BFSI, Media & Entertainment, Transportation & Logistics, Healthcare, Retail, Travel & Hospitality, Other End-users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: April 2024

- Report ID: 62692

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

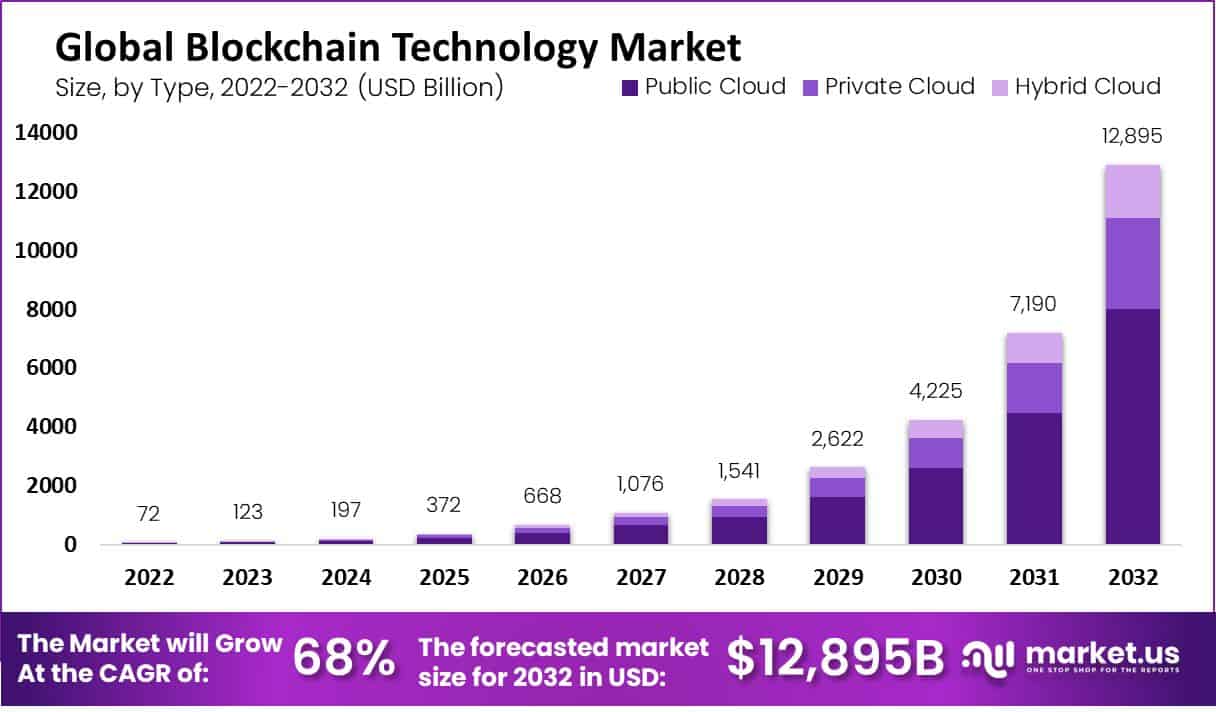

The Global Blockchain Technology Market size is expected to be worth around USD 12,895 Billion by 2033, from USD 123 Billion in 2023, growing at a CAGR of 68% during the forecast period from 2024 to 2033.

Blockchain technology is an innovative and decentralized system that enables secure and transparent transactions and data sharing. It is essentially a digital ledger that records and verifies transactions across multiple computers, creating a chain of blocks. Each block contains a list of transactions, and once added to the chain, it becomes permanent and cannot be altered.

The blockchain technology market has witnessed significant growth and adoption in recent years. The increasing recognition of its potential benefits and the need for secure and transparent systems have fueled the market’s expansion. Numerous companies, both established players and startups, are investing in blockchain technology to develop innovative solutions and applications.

The blockchain technology market is driven by factors such as increasing demand for secure and efficient digital transactions, the need for transparent supply chains, and the growing interest in decentralized finance (DeFi) applications. Additionally, regulatory advancements and collaborations between industry players and governments are contributing to market growth.

However, challenges exist in the blockchain technology market. Scalability, interoperability, and energy consumption are areas that require further development and improvement. Additionally, addressing concerns related to data privacy, security, and regulatory compliance is crucial to gaining broader adoption across industries.

The research indicates that 77% of global executives believe blockchain technology will be a “disruptive force” in their industry within the next five years. This reflects the growing recognition of blockchain’s potential to revolutionize various sectors. Furthermore, predictions suggest that blockchain technology will contribute to a significant boost in global GDP, estimated to be around ~$1.76 trillion by 2030, highlighting its immense economic impact.

In terms of blockchain funding, the United States currently holds the majority share, accounting for 51% of the global funding in this field. This demonstrates the country’s strong position in investing and supporting blockchain initiatives. However, it is noteworthy that nearly 50% of the top 50 blockchains are based outside the United States, showcasing the global nature of blockchain innovation and adoption.

When it comes to cryptocurrency usage, approximately 3.9% of the world’s population, equivalent to around 300 million people, actively engage with cryptocurrencies. This significant number highlights the widespread adoption and growing popularity of digital currencies as an alternative form of payment and investment.

Key Takeaways

- The Blockchain Technology Market is projected to exceed USD 12,895 Billion by 2032, with a remarkable Compound Annual Growth Rate (CAGR) of 68% between 2023 and 2032.

- Public Cloud segment dominated the market in 2022, capturing over 62% share.

- Infrastructure & Protocols segment held a dominant position in 2022, with over 65.4% market share.

- Payments segment led the market in 2022, capturing over 44% share.

- Large Enterprise segment dominated the market in 2022, with over 68.5% share.

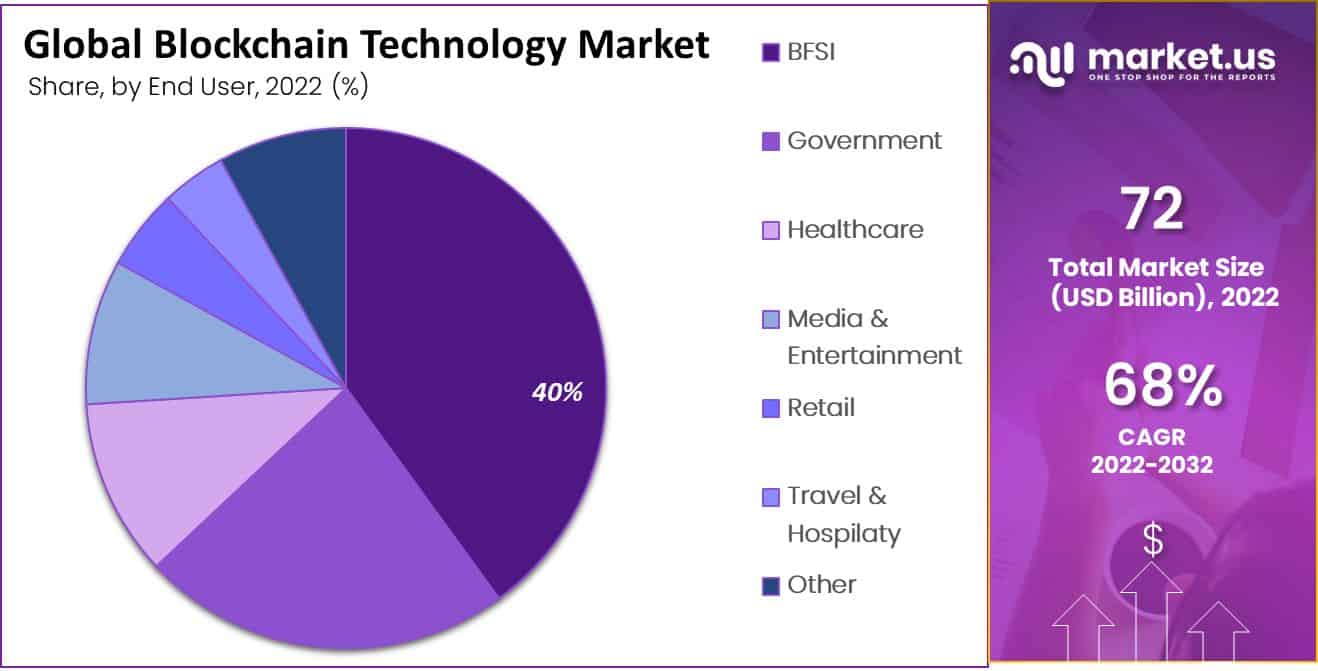

- Banking, Financial Services, and Insurance (BFSI) segment held a dominant position in 2022, with over 40% share.

- North America held a dominant market position in 2022, capturing over 39% share.

- Over 300 million people worldwide are actively using blockchain technology.

- 28% are interested in blockchain applications, decentralized apps (dApps), and the technologies used to develop them.

- In 2023, the financial services industry was the largest user of blockchain, with a market value of $1.92 billion.

- 73% of organizations in the United States had adopted or were planning to adopt blockchain technology by the end of 2023.

- The adoption of blockchain in the supply chain and logistics sector grew by 32% in 2023, driven by the demand for more transparency and traceability.

- In 2023, blockchain technology’s use in healthcare for secure data sharing and managing electronic health records increased by 28%.

- 61% of executives reported that their companies had some involvement with blockchain technology in 2023.

- The implementation of blockchain-based digital identity solutions rose by 22% in 2023, tackling data privacy and security concerns.

- By the end of 2024, blockchain technology’s adoption in the gaming industry for secure management and ownership of in-game assets is expected to grow by 45%.

Type Analysis

In 2022, the Public Cloud segment held a dominant market position within the Blockchain Technology Market, capturing more than a 62% share. This significant market share can be attributed to the segment’s robust scalability, cost-effectiveness, and ease of access. Public Cloud solutions offer blockchain technology that is accessible over the internet, allowing for greater flexibility and minimal infrastructure costs. These features are particularly appealing to startups and small to medium-sized enterprises (SMEs) that require blockchain solutions without the need for significant capital investment in IT infrastructure.

The leading status of the Public Cloud segment is further bolstered by its scalability and global reach. It enables organizations to scale their blockchain solutions according to demand, with the advantage of paying only for the resources used. This flexibility is crucial for businesses looking to adapt quickly to market changes or to experiment with blockchain applications without the risk of overinvestment.

Additionally, Public Cloud providers offer a wide array of services and integration capabilities that facilitate the development and deployment of blockchain applications, making it a preferred choice for businesses aiming to leverage blockchain for innovation and operational efficiency.

Component Analysis

In 2022, the Infrastructure & Protocols segment held a dominant market position within the Blockchain Technology Market, capturing more than a 65.4% share. This segment’s leading status is primarily due to its foundational role in the blockchain ecosystem.

Infrastructure and protocols form the core on which blockchain networks operate, enabling the creation, validation, and storage of transactions in a secure and immutable manner. This segment includes the underlying technology such as the blockchain’s distributed ledger technology (DLT), consensus algorithms, and the architectural frameworks that support different types of blockchain, including public, private, and consortium blockchains.

The significance of the Infrastructure & Protocols segment is underscored by the growing demand for secure and transparent systems across various industries, including finance, healthcare, supply chain, and more. As these sectors increasingly recognize the value of blockchain for enhancing security, reducing costs, and improving operational efficiencies, the need for robust blockchain infrastructure and protocols intensifies. This segment’s offerings are critical for businesses and organizations aiming to leverage blockchain technology to its full potential, ensuring the integrity and reliability of blockchain networks.

Application Analysis

In 2022, the Payments segment held a dominant market position within the Blockchain Technology Market, capturing more than a 44% share. This prominence is largely attributable to the inherent advantages blockchain technology offers for making payments, such as enhanced security, transparency, and reduced transaction costs.

Blockchain’s decentralized nature eliminates the need for intermediaries, streamlining the process and allowing for quicker settlements compared to traditional banking systems. This capability is particularly beneficial in cross-border transactions, where blockchain can significantly reduce processing times and fees.

The leadership of the Payments segment is further reinforced by the growing acceptance of cryptocurrencies and the increasing demand for more efficient payment solutions across various sectors. As businesses and consumers seek alternatives to conventional payment methods that can be slow, costly, and susceptible to fraud, blockchain presents a viable solution. Its ability to provide immutable transaction records and instant verifiability has made it an attractive option for enhancing transactional security and transparency.

Enterprise Size Analysis

In 2022, the Large Enterprise segment held a dominant position in the Blockchain Technology Market, capturing more than a 68.5% share. This substantial market share can be attributed to several key factors.

Primarily, large enterprises have been at the forefront of adopting blockchain technology, driven by their substantial resources and the pressing need to innovate in order to maintain competitive advantages. These organizations typically have complex operational and supply chain challenges that blockchain technology can address, offering transparency, security, and efficiency improvements.

Furthermore, large enterprises are more likely to invest in blockchain technology as part of their digital transformation strategies. They possess the capital to undertake significant investments in new technologies and the foresight to leverage blockchain for enhancing data integrity, facilitating faster transactions, and reducing costs. This segment’s leadership in the market is also bolstered by their ability to pilot and scale blockchain solutions across multiple business units and geographies, demonstrating the technology’s value and encouraging further adoption.

End-Use Analysis

In 2022, the Banking, Financial Services, and Insurance (BFSI) segment held a dominant market position in the Blockchain Technology Market, capturing more than a 40% share. This leading position is largely due to the critical need for transparency, security, and efficiency in financial transactions, which blockchain technology is uniquely positioned to provide.

The BFSI sector has been among the earliest adopters of blockchain, driven by the technology’s potential to revolutionize how financial transactions and data are handled, offering unparalleled security against fraud and reducing operational costs through decentralized ledger systems. Blockchain technology’s appeal in the BFSI sector is further magnified by its ability to streamline cross-border payments, enhance compliance with regulatory requirements, and facilitate secure and efficient real-time transactions.

These benefits are pivotal for financial institutions aiming to improve customer satisfaction and operational efficiency. Additionally, blockchain enables the development of innovative financial products and services, such as smart contracts, decentralized finance (DeFi) platforms, and digital currencies, further cementing the BFSI sector’s leadership in the blockchain market.

Key Market Segments

Based on Type

- Private Cloud

- Public Cloud

- Hybrid Cloud

Based on Component

- Infrastructure & Protocols

- Application & Solution

- Middleware

Based on Application

- Exchanges

- Digital Identity

- Smart Contracts

- Payments

- Supply Chain Management

- Other Applications

Based on Enterprise

- Small & Medium Enterprises

- Large Enterprises

Based on End-User

- Government

- BFSI

- Media & Entertainment

- Transportation & Logistics

- Healthcare

- Retail

- Travel & Hospitality

- Other End-users

Driver

Enhanced Security and Transparency

Blockchain technology offers enhanced security and transparency, acting as a significant driver for its adoption across various industries. By enabling decentralized storage of data across a network of computers, blockchain ensures that each transaction is encrypted and linked to the previous one, making it nearly impossible to alter historical data. This level of security is crucial for industries like BFSI, healthcare, and government, where the integrity of data is paramount.

Furthermore, the transparency provided by blockchain allows all parties involved in a transaction to view its history, fostering trust and reducing the instances of fraud. The demand for secure and transparent transactions is growing, as businesses and consumers alike seek safer ways to conduct operations and exchange data, driving the adoption of blockchain technology.

Restraint

Scalability and Performance Issues

One of the main restraints facing the blockchain technology market is the challenge of scalability and performance. Blockchain networks, especially those using proof of work (PoW) consensus mechanisms, can handle a limited number of transactions per second, leading to potential delays and increased transaction costs when the network is congested. This limitation affects the technology’s ability to scale and meet the demands of larger organizations and sectors with high transaction volumes, such as retail and BFSI.

Additionally, the energy consumption associated with PoW blockchains raises concerns about sustainability. These scalability and performance issues necessitate ongoing research and development into alternative consensus mechanisms and scalability solutions, which can be costly and time-consuming, potentially hindering the wider adoption of blockchain technology.

Opportunity

Integration with Emerging Technologies

The integration of blockchain technology with other emerging technologies like artificial intelligence (AI), the Internet of Things (IoT), and 5G presents significant opportunities. Such integration can lead to the development of more secure, efficient, and innovative applications across various sectors. For example, combining blockchain with IoT can enhance supply chain transparency and security, enabling real-time tracking of products from manufacture to delivery.

Similarly, AI can analyze blockchain data to identify trends and improve decision-making processes, while 5G technology can enhance the speed and efficiency of blockchain-based transactions. This convergence of technologies opens up new avenues for blockchain applications, offering businesses the potential to create more personalized and secure services, driving further growth in the blockchain market.

Challenge

Regulatory and Legal Uncertainties

The lack of clear regulatory and legal frameworks surrounding blockchain technology poses a significant challenge to its adoption. Regulations governing the use of blockchain vary greatly between countries and are often unclear or in a state of flux, creating a complex environment for businesses and investors. This uncertainty can deter investment in blockchain projects and slow down innovation, as companies may be hesitant to develop or adopt blockchain solutions without a clear understanding of the legal implications.

Furthermore, the decentralized and borderless nature of blockchain makes it difficult to apply traditional regulatory approaches, requiring new legal concepts and international cooperation. Addressing these regulatory and legal uncertainties is crucial for the continued growth and maturity of the blockchain market

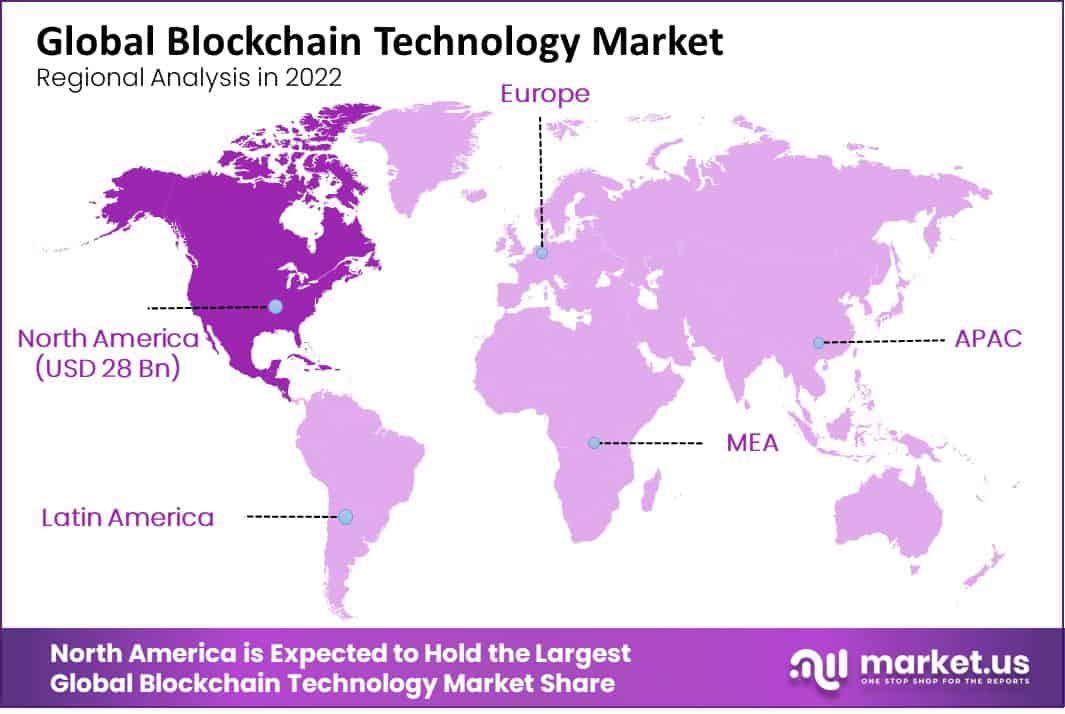

Regional Analysis

In 2022, North America held a dominant market position in the blockchain technology sector, capturing more than a 39% share of the global market. The demand for Blockchain Technology in North America was valued at USD 28 billion in 2023 and is anticipated to grow significantly in the forecast period.

This substantial market share can be attributed to several key factors that underscore the region’s leadership in this innovative technology space. Primarily, the presence of a robust technological infrastructure and a highly conducive regulatory environment have fostered an ecosystem ripe for the growth and adoption of blockchain technologies.

Additionally, North America is home to a significant number of pioneering blockchain startups and tech giants who are continuously investing in research and development. This investment drives innovation, further propelling the region to the forefront of blockchain advancements. Moreover, the application of blockchain technology across various industries, including finance, healthcare, and supply chain management, has been rapidly increasing in North America.

The region’s financial sector, in particular, has been a significant adopter, utilizing blockchain for enhancing the security and efficiency of transactions. The advent of smart contracts and decentralized finance (DeFi) platforms has also contributed to the blockchain boom in the region. With the United States leading the charge, followed by Canada, these countries have established a fertile ground for blockchain technology, attracting substantial venture capital investments.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The market’s competitive landscape is highly fragmented. Market players focus on strategies such as mergers or acquisitions to strengthen their market position. Circle Internet Financial Limited acquired SeedInvest, an equity crowdfunding blockchain platform. This acquisition created a token market allowing investors and individuals to interact through the open cryptocurrency infrastructure. Blockchain Technology Market players are also focusing on improving their product offerings to meet customer satisfaction and remain competitive.

Market players are increasing their research and development investment to improve their product offerings. Companies are also working with universities worldwide to support academic research and technical development in cryptocurrency and blockchain technology.

Top Market Leaders

- IBM Corporation

- The Linux Foundation

- Microsoft Corporation

- Chain, Inc.

- Circle Internet Financial Ltd.

- Earthport Plc

- BitFury Group Ltd

- Deloitte Touche Tohmatsu Limited

- BTL Group Ltd.

- Digital Asset Holdings, LLC

- Deloitte Touche Tohmatsu Ltd.

- Global Arena Holding, Inc. (GAHI)

- Indian Banks’ Blockchain Infrastructure Company Private Limited (IBBIC)

- Oracle Corporation

- Other Key Players

Recent Developments

- April 2023 – The German government plans to regulate startups in financial innovation, aiming to digitize capital markets with blockchain-based e-securities under the Future Finance Act.

- April 2023 – Ava Labs introduced new institutional deployments to bolster the Avalanche blockchain platform, enhancing its ecosystem for various applications.

- April 2023 – The BBK Network launched a state-based architecture on an Ethereum Virtual Machine (EVM), removing the need for open payment channels and pushing for wider Decentralized Applications (DApps) adoption.

Report Scope

Report Features Description Market Value (2023) USD 123 Bn Forecast Revenue (2032) USD 12,895 Bn CAGR (2023-2032) 68% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Private Cloud, Public Cloud, and Hybrid Cloud; By Component – Infrastructure & Protocols, Application & Solution, and Middleware; Exchanges, Digital Identity, Smart Contracts, Payments, Supply Chain Management, and Other Applications; By Enterprise Size – Small & Medium Enterprises, and Large Enterprises; By End-User- Government, Financial Services, Media & Entertainment, Transportation & Logistics, Healthcare, Retail, Travel & Hospitality, and Other End-Users Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, The Linux Foundation, Microsoft Corporation,. Chain, Inc., Circle Internet Financial Ltd., Earthport Plc, BitFury Group Ltd, Deloitte Touche Tohmatsu Limited, BTL Group Ltd., Digital Asset Holdings, LLC, Deloitte Touche Tohmatsu Ltd., Global Arena Holding, Inc. (GAHI), Indian Banks’ Blockchain Infrastructure Company Private Limited (IBBIC), Oracle Corporation, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is blockchain technology?Blockchain technology is a decentralized digital ledger system that records transactions across multiple computers in a way that is secure, transparent, and tamper-proof.

How big is Blockchain Technology Market?The Global Blockchain Technology Market size is expected to be worth around USD 12,895 Billion by 2033, from USD 123 Billion in 2023, growing at a CAGR of 68% during the forecast period from 2024 to 2033.

Who are the key companies/players in the blockchain technology market?Some key players operating in the blockchain technology market include IBM Corporation, The Linux Foundation, Microsoft Corporation,. Chain, Inc., Circle Internet Financial Ltd., Earthport Plc, BitFury Group Ltd, Deloitte Touche Tohmatsu Limited, BTL Group Ltd., Digital Asset Holdings, LLC, Deloitte Touche Tohmatsu Ltd., Global Arena Holding, Inc. (GAHI), Indian Banks’ Blockchain Infrastructure Company Private Limited (IBBIC), Oracle Corporation, and Other Key Players

What is driving the growth of the blockchain technology market?Factors driving the growth of the blockchain technology market include increasing adoption of cryptocurrencies, rising demand for secure and transparent transaction systems, advancements in technology, and growing investments in blockchain projects.

What are some challenges facing the blockchain technology market?Challenges facing the blockchain technology market include scalability issues, regulatory uncertainties, interoperability concerns, energy consumption of blockchain networks, and potential security vulnerabilities.

Blockchain Technology MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Blockchain Technology MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- The Linux Foundation

- Microsoft Corporation

- Chain, Inc.

- Circle Internet Financial Ltd.

- Earthport Plc

- BitFury Group Ltd

- Deloitte Touche Tohmatsu Limited

- BTL Group Ltd.

- Digital Asset Holdings, LLC

- Deloitte Touche Tohmatsu Ltd.

- Global Arena Holding, Inc. (GAHI)

- Indian Banks' Blockchain Infrastructure Company Private Limited (IBBIC)

- Oracle Corporation

- Other Key Players