Global Enterprise Blockchain Market By Component (Solution, Blockchain as a Service), By Application (Digital Identity, Exchanges, Payments, Smart Contracts, Supply Chain Management, and Other Applications), By End-User (Financial Services, Government, Healthcare, Media & Entertainment, Retail, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Feb. 2024

- Report ID: 105546

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

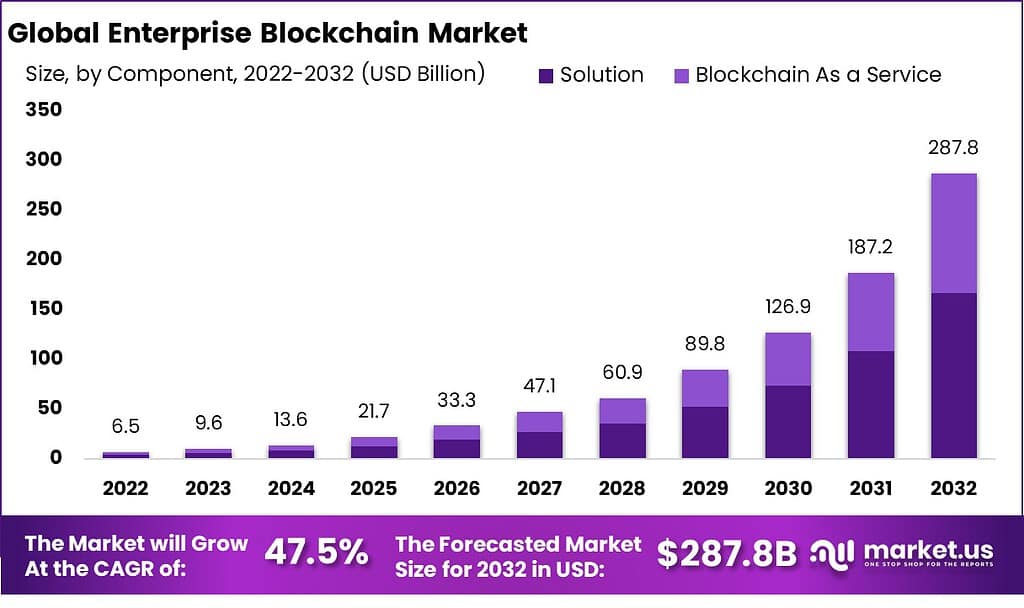

The Global Enterprise Blockchain Market is projected to grow at a CAGR of 47.5%, with its worth expected to increase from USD 9.6 Bn in 2023 to approximately USD 287.8 Bn by 2032.

Enterprise blockchain refers to implementing blockchain technology within businesses and organizations. Unlike public blockchains open to anyone, enterprise blockchains are often permission, meaning that participants must have specific authorization to join the network. This allows greater control over who can access and contribute to the blockchain. Enterprise blockchain networks can facilitate secure data sharing and collaboration among multiple parties. Participants can access shared information without compromising data security.

The enterprise blockchain market is characterized by its focus on solving business-specific problems, including supply chain management, identity verification, smart contracts, and transaction processing, among others. The growth of this market can be attributed to the increasing recognition of blockchain’s potential to streamline operations, reduce costs, and enhance security across various industries. Key sectors driving demand include finance, healthcare, logistics, and retail, with companies seeking to improve processes such as traceability, settlement times, and data management.

Key Takeaways

- The Enterprise Blockchain Market is projected to reach a value of USD 287.8 Billion by 2032, with a notable growth rate of 47.5% from 2023 to 2032.

- Enterprise blockchain technology is characterized by its permissioned nature, enabling controlled access and secure data sharing among authorized participants within businesses and organizations.

- The demand for enterprise blockchain solutions is primarily driven by the increasing emphasis on data protection, accounting for 58.0% of the market share, and the need to safeguard sensitive information in the digital age.

- Cloud service’s high penetration has further facilitated the adoption of enterprise blockchain technology by providing a scalable, cost-effective, and secure foundation for deploying blockchain solutions.

- Regulatory uncertainties, interoperability and scalability issues, and a lack of technical expertise are key restraining factors that could hinder the market’s growth in the forecasted period.

- Solutions dominate the market with a 58.0% revenue share in 2022, contributing to the traceability of transactions and data, fraud reduction, and enhanced accountability. Blockchain-as-a-service (BaaS) platforms are also expected to witness high growth during the forecasted period.

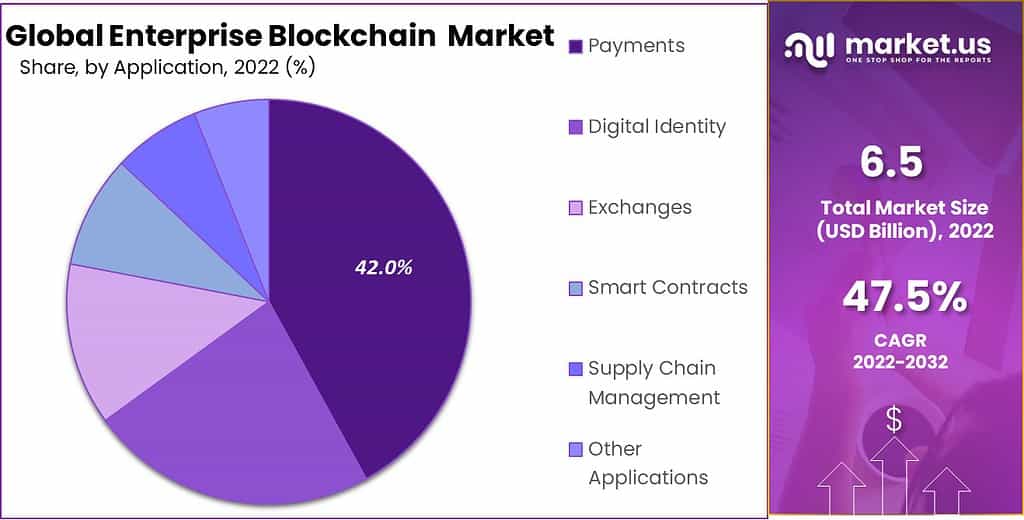

- The payment segment leads the application segment with a 42.0% revenue share, driven by blockchain’s ability to enhance security, efficiency, and transparency, addressing fraud prevention and data privacy through its immutable ledger.

- The financial services sector is expected to dominate the market, accounting for 41.0% of the revenue share, benefiting from blockchain’s potential to reshape the industry, enhance security, and streamline efficiency and cost reduction processes.

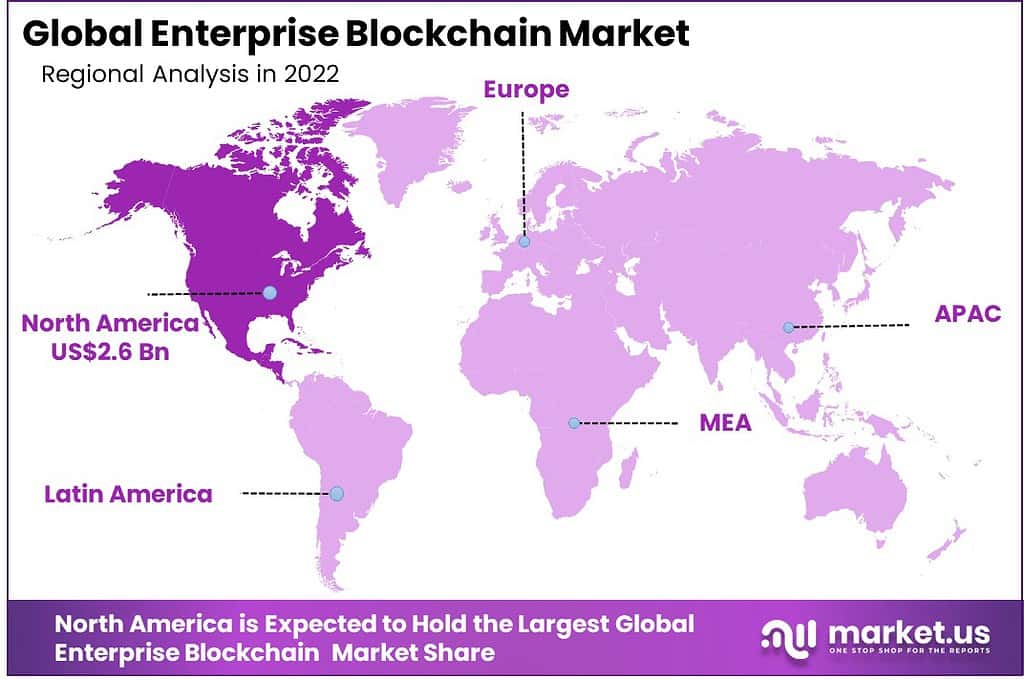

- North America is leading the market, with a 40.0% revenue share during the forecast period, driven by industry-specific adoption, regulatory compliance, digital transformation, and increasing awareness. The Asia-Pacific region is expected to experience significant growth, fueled by economic development, government support, and industry-specific needs.

- Key players in the enterprise blockchain market include Microsoft Corporation, IBM Corporation, Digital Asset Holdings, LLC, BTL Group Ltd., The Linux Foundation, Deloitte Touche Tohmatsu Ltd., Global Arena Holding, Inc., Oracle Corporation, Ripple, and Circle Internet Financial Limited, among others.

By Component Analysis

The solutions segment dominated the market in 2022 with the largest revenue share of 58.0%. Blockchain solution’s ability to provide an immutable and transparent ledger ensures the traceability of transactions and data, reducing fraud and enhancing accountability. These solutions enable new business models and revenue streams, such as tokenization of assets, fractional ownership, and decentralized finance. In industries like agriculture and fashion, these solutions help verify product authenticity and ethical sourcing, meeting consumer demands. As a result, several benefits offered by enterprise solutions will likely contribute to the segment’s growth during the projection period.

Also, blockchain as a service is expected to witness high growth over the forecasted time. Blockchain-as-a-Service (BaaS) platforms abstract the complexities of blockchain technology, enabling businesses to adopt it without requiring in-depth technical expertise. It offers convenience, cost-effectiveness, and the potential to streamline the adoption of blockchain technology for businesses. It is a significant factor anticipated to positively impact the segment growth during the projection period.

By Application Analysis

The payment segment leads the application segment by accounting for a revenue share of 42.0% in 2022. The demand for enterprise blockchain technology in the payments sector is propelled by its ability to enhance security, efficiency, and transparency. It addresses fraud prevention and data privacy through its immutable ledger, ensuring secure transactions and reducing the risk of breaches. Real-time settlements and reduced intermediaries accelerate payment processing and lower transaction costs.

Additionally, blockchain’s borderless nature improves cross-border payments, while intelligent contracts automate processes and foster transparency. The rise of DeFi, tokenization of assets, and innovative payment models demonstrate how blockchain is reshaping payments by providing secure, efficient, and inclusive solutions that meet regulatory compliance.

Furthermore, the digital identity segment will likely witness high growth over the forecast period. The demand for enterprise blockchain technology in digital identity is propelled by its capacity to revolutionize identity management and authentication. Key drivers include heightened security through cryptographic principles, identity fraud prevention, streamlined verification processes, and user-controlled data privacy.

Blockchain’s decentralization enhances resilience against cyberattacks, while interoperability ensures seamless information sharing. Self-sovereign identity solutions empower individuals, and blockchain’s applications span industries like finance, healthcare, and government. This technology simplifies onboarding, reduces costs, and facilitates global identity verification. As digital economies expand, blockchain-based identities ensure secure participation, driving the adoption of this transformative solution.

By End-User Analysis

Financial services are expected to dominate the market with a revenue share of 41% throughout the forecast period. The demand for enterprise blockchain technology in financial services is powered by its potential to reshape the industry. Key drivers include heightened security through encryption and immutability, traceability and accountability transparency, streamlined efficiency and cost reduction processes, and real-time settlements that eliminate delays.

Blockchain also facilitates cross-border payments, automates contracts through smart contracts, and ensures regulatory compliance. It enhances remittances, promotes financial inclusion, and introduces novel concepts like asset tokenization and decentralized finance. Moreover, blockchain improves identity verification, interoperability, and trust-building in financial transactions. As an innovation catalyst, it positions early adopters as leaders in shaping the future of financial services.

Moreover, the government segment will likely experience high growth during the projection period. As governments seek digital transformation, blockchain is a pivotal tool to modernize operations, improve services, and foster global collaboration. This is a key factor stimulating the segment’s growth during the projection period.

Key Market Segments

Component

- Solution

- Blockchain as a Service

Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Other Applications

End-User

- Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail

- Other End-Users

Driving Factors

Increasing Awareness Regarding Data Protection

Data protection has emerged as a paramount concern for businesses across industries in an era defined by the digitization of information and the increasing prevalence of cyber threats. This growing awareness of the need to safeguard sensitive data and maintain the privacy of individuals is a significant driver behind the escalating demand for enterprise blockchain technology. As regulatory scrutiny intensifies and data breaches become more prevalent, the demand for blockchain’s inherently secure and transparent framework is expected to grow, positioning it as a foundational technology for safeguarding sensitive information in the digital age.

Rise in Penetration of Cloud Services

The high penetration of cloud services has synergized with the demand for enterprise blockchain technology, offering businesses a scalable, cost-effective, and secure foundation for deploying blockchain solutions. The cloud’s versatility, accessibility, and integration capabilities complement the features of blockchain networks, accelerating adoption and innovation across industries. As businesses continue to harness the power of cloud services to support their digital transformations, the integration of enterprise blockchain technology is poised to reshape operations, enhance security, and drive efficiency in the modern business landscape.

Restraining Factors

Regulatory Uncertainties

The evolving regulatory landscape surrounding blockchain and cryptocurrencies varies by jurisdiction. Businesses must navigate a complex web of regulations, which can be time-consuming and costly. This uncertainty can deter enterprises from fully committing to blockchain projects. Thus, regulatory uncertainties associated with enterprise blockchains may limit the market growth during the projected time.

Interoperability and Scalability issues

Different blockchain platforms often lack interoperability, making integrating blockchain solutions with existing legacy systems challenging. This lack of compatibility can hinder seamless data exchange between various systems and networks. Blockchain networks face scalability limitations, especially in public blockchains. As transaction volumes increase, these networks can experience slower transaction times and higher costs. This scalability issue has implications for enterprises looking to handle large-scale operations. Therefore, interoperability and scalability issues involved in enterprise blockchain are expected to hurt the market’s growth over the forecasted period.

Lack of Technical Expertise

Implementing and managing blockchain technology requires a high level of technical expertise. Developing intelligent contracts, configuring nodes, ensuring security, and handling consensus mechanisms can be complex and resource-intensive. Many businesses lack the in-house skills necessary to navigate these complexities. This may restrain the growth of the market over the estimated period.

Opportunity

Key Opportunities in the Healthcare Sector

Blockchain can facilitate secure and interoperable sharing of electronic health records (EHRs) across healthcare providers and institutions. Patients’ medical histories can be stored in a tamper-proof and accessible manner, leading to more accurate diagnoses, reduced redundancy, and improved patient outcomes. It can enhance transparency and reliability in clinical trials by securely recording and sharing research data. This can expedite the research process, improve research collaboration, and provide accurate data for regulatory compliance. With the rise of telehealth services, maintaining the security and privacy of patient data is paramount.

Blockchain can offer a secure platform for storing and sharing patient information across telehealth providers. Thus, the healthcare sector presents significant growth opportunities for adopting and integrating enterprise blockchain technology. As the industry continues to evolve, several promising avenues emerge for leveraging blockchain’s capabilities to transform healthcare operations, data management, and patient care.

Trends

Emergence of DeFi and Decentralized Applications (dApps)

Decentralized Finance (DeFi) platforms are gaining traction, offering financial services like lending, borrowing, and trading without intermediaries. This trend showcases the potential of blockchain beyond traditional industries, paving the way for decentralized applications (dApps) in various sectors. Thus, the emergence of DeFi and decentralized applications can be considered a positive trend and will likely boost market growth in the upcoming period.

Regional Analysis

North America leads the market by holding a significant revenue share.

The North America region is anticipated to witness the highest growth, with a revenue share of 40.0% during the projected period. Various factors drive the demand for enterprise blockchain technology in North America, including industry-specific adoption, regulatory compliance, supply chain needs, digital transformation, cross-border transactions, FinTech innovation, partnerships, and increasing awareness. As the technology matures and addresses specific challenges faced by businesses in the region, the demand for blockchain solutions will continue growing, reshaping how enterprises operate and collaborate in an increasingly digital world.

Moreover, the Asia-Pacific region will likely have a high growth rate during the forecast period. Economic growth, supply chain needs, financial inclusion, government support, smart city initiatives, trade transformation, healthcare improvements, DeFi experimentation, partnerships, and sustainability goals drive the rising demand for enterprise blockchain technology in Asia Pacific. As industries and governments in the region recognize blockchain’s value in addressing their unique challenges, the adoption and integration of blockchain solutions are expected to accelerate, reshaping sectors and fostering innovation across the Asia Pacific.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Major technology companies like IBM, Microsoft, and Oracle lead the way with comprehensive blockchain solutions catering to various industries. Additionally, a growing ecosystem of specialized blockchain startups offers innovative applications and platforms. Consortiums and alliances, like Hyperledger and Enterprise Ethereum Alliance, facilitate collaboration and standardization within the industry. As adoption expands, traditional players in finance, supply chain, healthcare, and other sectors are also entering the market, contributing to a diverse and competitive environment. The race to provide scalable, interoperable, and secure blockchain solutions underscores the intense competition in this transformative technology space.

Top Key Players

- Microsoft Corporation

- IBM Corporation

- Digital Asset Holdings, LLC

- BTL Group Ltd.

- The Linux Foundation

- Deloitte Touche Tohmatsu Ltd.

- Global Arena Holding, Inc.

- Oracle Corporation

- Ripple

- Circle Internet Financial Limited

- Other Key Players

Recent Developments

- In May 2023, Deloitte disclosed its plan to incorporate KILT blockchain technology to issue reusable digital credentials to aid KYB and KYC procedures. This adoption of KILT’s identity infrastructure for creating such credentials aims to address common challenges linked with KYB/KYC processes. These challenges encompass tasks resulting from paper-based certificates, vulnerabilities to data breaches, single-use certificates, and the need for multiple data points for identity verification.

- In May 2021, Circle Internet Financial Ltd., a company specializing in blockchain technology solutions, revealed that it secured $440 million in investment from both strategic and institutional backers. The funds obtained are directed towards bolstering the company’s internal growth and extending its presence in the market.

Report Scope

Report Features Description Market Value (2023) US$ 9.6 Bn Forecast Revenue (2032) US$ 287.8 Bn CAGR (2023-2032) 47.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Blockchain As a Service), By Application (Digital Identity, Exchanges, Payments, Smart Contracts, Supply Chain Management, and Other Applications), By End-User (Financial Services, Government, Healthcare, Media & Entertainment, Retail, and Other End-Users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Microsoft Corporation, IBM Corporation, Digital Asset Holdings, LLC BTL Group Ltd., The Linux Foundation, Deloitte Touche Tohmatsu Ltd., Global Arena Holding, Inc., Oracle Corporation, Ripple, Circle Internet Financial Limited and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is enterprise blockchain?An enterprise blockchain is a type of blockchain that is designed for use by businesses. It is a distributed ledger that is shared among a group of authorized participants, and it can be used to record transactions, track assets, and manage data.

What are the benefits of enterprise blockchain?The benefits of enterprise blockchain include:

- Security: The data on an enterprise blockchain is encrypted and distributed across multiple nodes, making it very difficult to hack or tamper with.

- Transparency: All participants on the blockchain have access to the same data, which can help to improve transparency and trust.

- Efficiency: Enterprise blockchains can automate many of the manual processes involved in business transactions, which can save time and money.

- Scalability: Enterprise blockchains can be scaled to accommodate a large number of participants and transactions.

What are the leading enterprise blockchain platforms?Some of the leading enterprise blockchain platforms include:

- Hyperledger Fabric

- R3 Corda

- Quorum

- IBM Blockchain Platform

- SAP Leonardo Blockchain

What are the future trends in enterprise blockchain?The future trends in enterprise blockchain include:

- Increased adoption by businesses

- Development of new use cases

- Standardization of the technology

- Reduced costs

- Improved security

Enterprise Blockchain MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Enterprise Blockchain MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- IBM Corporation

- Digital Asset Holdings, LLC

- BTL Group Ltd.

- The Linux Foundation

- Deloitte Touche Tohmatsu Ltd.

- Global Arena Holding, Inc.

- Oracle Corporation

- Ripple

- Circle Internet Financial Limited

- Other Key Players