Global Blood Transfusion Diagnostics Market Report By Product Type (Instruments, Reagents & Kits, and Other Product Types), By Application (Blood Screening and Blood Group Typing), By End User (Hospital Based Laboratories, Independent Laboratories, and Blood Banks), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 95419

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

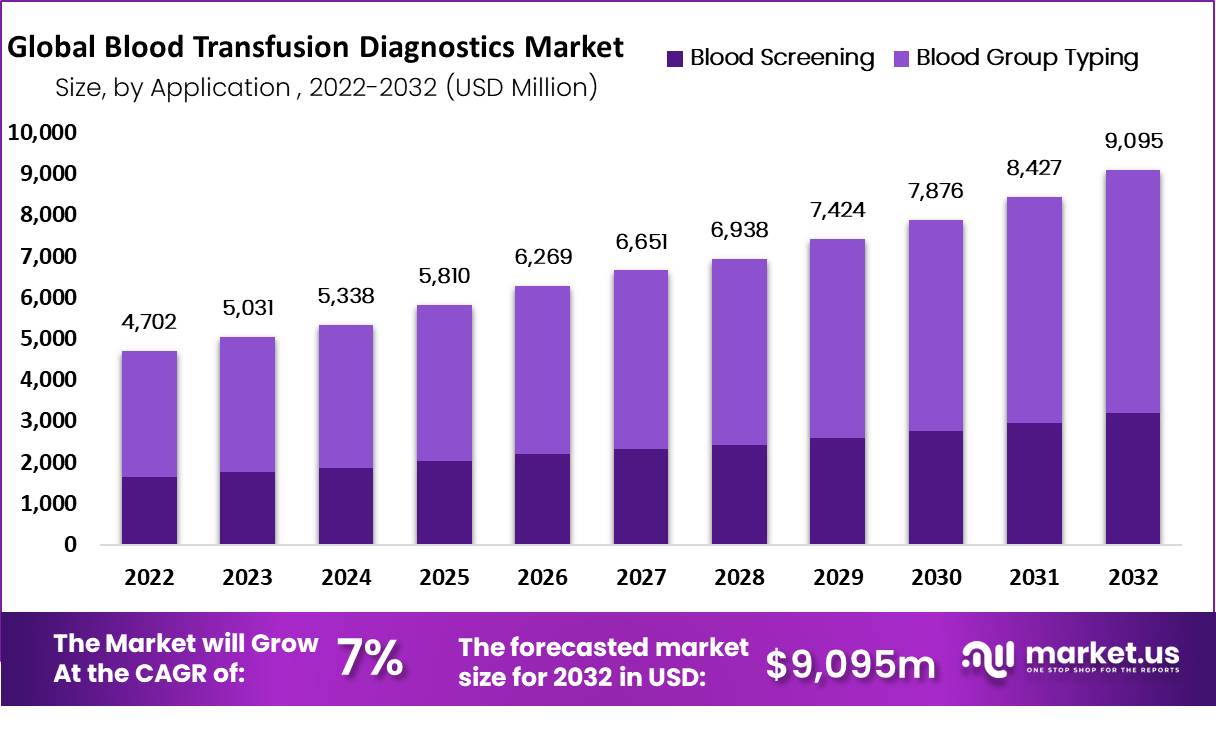

The Global Blood Transfusion Diagnostics Market size is expected to be worth around USD 9,095 Million by 2032 from USD 5,031 Million in 2023, growing at a CAGR of 7% during the forecast period from 2023 to 2032.

Blood transfusion diagnostics is a critical component of modern healthcare, ensuring the safety and compatibility of blood products before transfusion. The market for blood transfusion diagnostics is driven by the rising prevalence of chronic diseases, trauma cases, and surgical procedures that require blood transfusions. According to the World Health Organization (WHO), there are over 118 million blood donations annually, necessitating robust diagnostic systems to prevent transfusion-related complications.

Key components of blood transfusion diagnostics include blood typing, crossmatching, and screening for infectious diseases such as HIV, hepatitis B and C, syphilis, and others. Advanced technologies like nucleic acid amplification testing (NAT) and next-generation sequencing (NGS) are increasingly being adopted to enhance the accuracy and speed of these tests.

Key Takeaways

- The blood transfusion diagnostics market is expected to be valued at USD 9,094 million by 2032.

- The market will grow at a CAGR of 7% during the forecast period from 2023 to 2032.

- The market size accounted for USD 4,702 million in 2022.

- The reagents & kits segment generated the maximum revenue share in 2022.

- North America had the highest revenue share of 40.1% in 2022.

- Asia-Pacific is expected to grow at the fastest CAGR of 12.6% from 2023-2032.

- Europe held a revenue share of 15% in 2022.

- The American Red Cross (ARC) lost approximately 46,000 blood units due to the COVID-19 pandemic.

- The CDC estimates there are about 6 million auto accidents annually in the U.S., injuring 3 million people.

- The instruments segment in the blood transfusion diagnostics market is expected to grow at a CAGR of 6.2% during the forecast period.

- The World Health Organization (WHO) estimated that anemia affected approximately 1.62 billion people globally.

Type Analysis

The types of blood transfusion diagnostics include instruments, reagents & kits, and others. These kits are used to collect and transfuse blood. The technologies involved in blood transfusion diagnostics are nucleic acid amplification, western blot, the rapid test used for different applications such as disease screening and blood grouping, ELISA, and fluorescence assay.

The majority of the growth in the market can be attributed to the easy availability of the products needed to screen both donor and recipient samples and the frequent purchase of these products. Another driving factor of this segment’s expansion is the availability of a wide range of donor screening, blood grouping, typing reagents, kits, and assays made by international and domestic players.

In addition, the market expansion is anticipated to be fueled in the upcoming years by the increasing availability of rapid diagnostic kits for safe blood transfusion.

Due to the consistent sales of instruments and, reagents & kits for blood group typing and screening of donor and recipient samples, the reagents & kits segment held most of the market share in 2022. Despite this, the instruments segment had a relatively minor share in 2022 due to their longer shelf life and higher cost.

Application Analysis

Blood screening, as well as blood group typing, are the application-based segments of this market. Due to rising global rates of Transmissible Transfusion Infections (TTI), the blood screening segment dominate the global market in 2022.

Due to the introduction of automated analyzers and rising demand for group typing and cross-matching tests prior to transfusion therapy to determine the compatibility of donor and recipient blood samples, the blood group typing market is anticipated to expand at a significant CAGR.

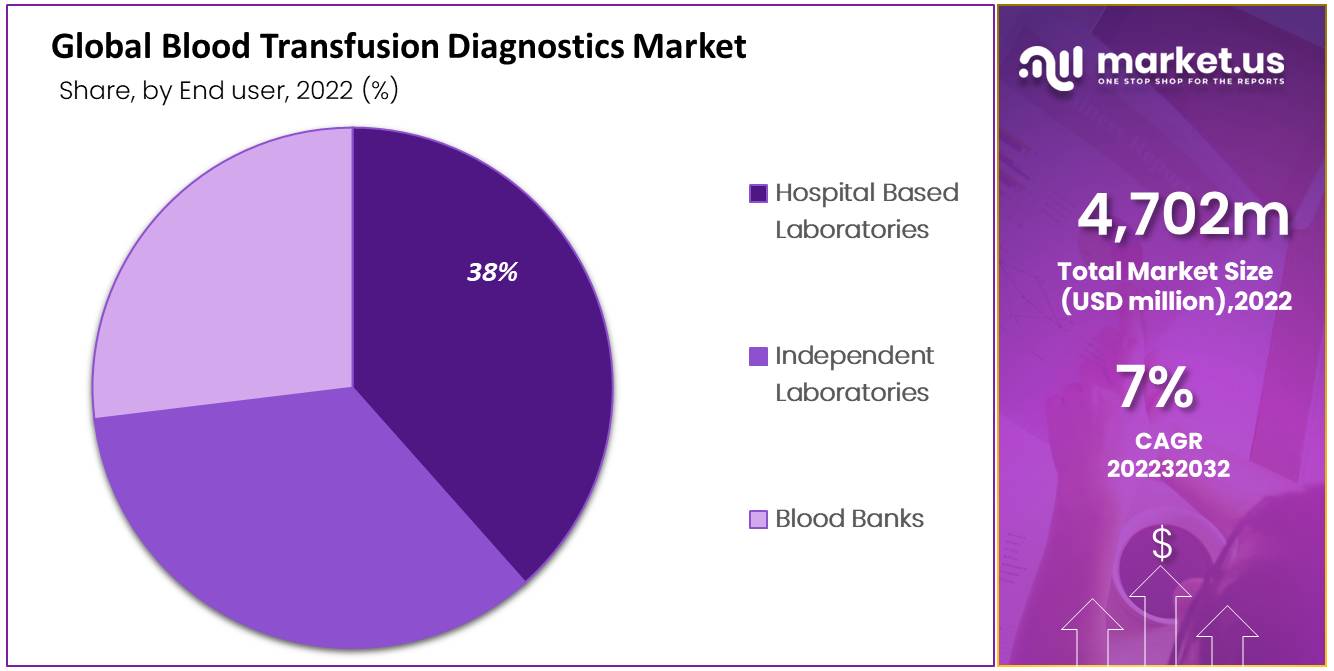

End-User Analysis

The market is segmented into hospital-based laboratories and, independent labs & blood banks by end users. Due to the rising number of blood transfusion procedures performed in hospitals, it is anticipated that the hospital-based laboratories segment will experience significant growth over the course of the forecast period.

Additionally, the market is expected to expand as more hospitals actively implement blood management programs to save blood units and make the transfusion process easier. In the year 2022, the market was dominated by the independent laboratories and blood banks segment.

The large number of blood transfusions performed in these settings and the growing number of independent blood banks and laboratories in both developed and developing nations are responsible for the dominance.

Key Market Segments

Based on Product Type

- Instruments

- Reagents & Kits

- Other Product Types

Based on Application

- Blood Screening

- Blood Group Typing

By End User

- Hospital Based Laboratories

- Independent Laboratories

- Blood Banks

Drivers

Increasing frequency of blood disorders

Due to the increasing frequency of blood-related disorders, like thrombocytopenia, hemophilia, cancer, etc., and Chronic Kidney Disease, the demand for complete blood transfusion and blood products has been propelled. Likely, in 2020, as per the data published on World Kidney Day, around 850 people globally were suffering from kidney disorders.

Moreover, it was noticed that one in ten adults was suffering from Chronic Kidney Disease, and this condition may become 5th most common cause of death by the end of the year 2040.

The rise in the number of patients suffering from anemia

Anemia requires red blood cell transfusion for its treatment. Due to the increase in the number of patients suffering from anemia, the requirement for red blood cell transfusion was also increasing; this will anticipate surging the demand for blood transfusion diagnosis. World Health Organization (WHO) estimated that around 1.62 billion people worldwide were affected by anemia.

Programs in developed and growing countries are run to increase awareness about blood safety from infectious diseases. As a result, it increased the demand for diagnostics tools and blood screening tests. Therefore, the factors mentioned earlier are improving the need for global blood transfusion diagnostics.

Restraints

Bloodborne Infections

Sometimes due to blood transfusion, bloodborne infections may get transferred from donor to recipient, which can hamper the growth of the global blood transfusion diagnostics market.

Furthermore, some of the adverse side effects because of the blood transfusion system are allergic reactions, bloodborne diseases, and virus and infection illnesses that cause fever may restrain this market’s growth.

In addition, the global blood transfusion diagnostics market is being constrained due to high prices of equipment and a lack of infrastructure.

Opportunity

Factors that influence the growth of the market

Due to the need for blood transfusion because of the rise in organ transplant surgeries and the rapid increase in chronic disease, the growth of the global blood market is attributed. To overcome blood loss, patients undergoing surgical procedures need a blood transfusion.

Before transferring the blood to the patient, blood transfusion diagnostics are used to screen the blood. If this technique is not used, there will be chances of transmission of infectious diseases.

According to an article published National Institute of Health, US National Library of Medicine, around 310 million surgeries are being performed in one year. Hence, the increase in the number of procedures will result in a boost for blood transfusion diagnostics.

Trends

The rapid increase in chronic diseases

Chronic Diseases, such as cardiovascular disorders, renal disorders, and cancer, are major causes of human death around the globe. Surgical procedures usually treat these conditions.

However, surgical procedures may cause excessive blood loss. Therefore, fresh blood is given to patients to keep the patient’s blood levels.

The diagnostics are used during the reinfusion processes or blood infusion. Hence, the global blood glucose transfusion diagnostic market is growing due to the rise in chronic diseases.

According to the data published by the Indian Council of Medical Research (ICMR) and the National Institute of Cancer Prevention (NICPR), the yearly frequency of cancer in India is estimated at around 2.26 million, leading to surgical procedures in ample amounts.

Regional Analysis

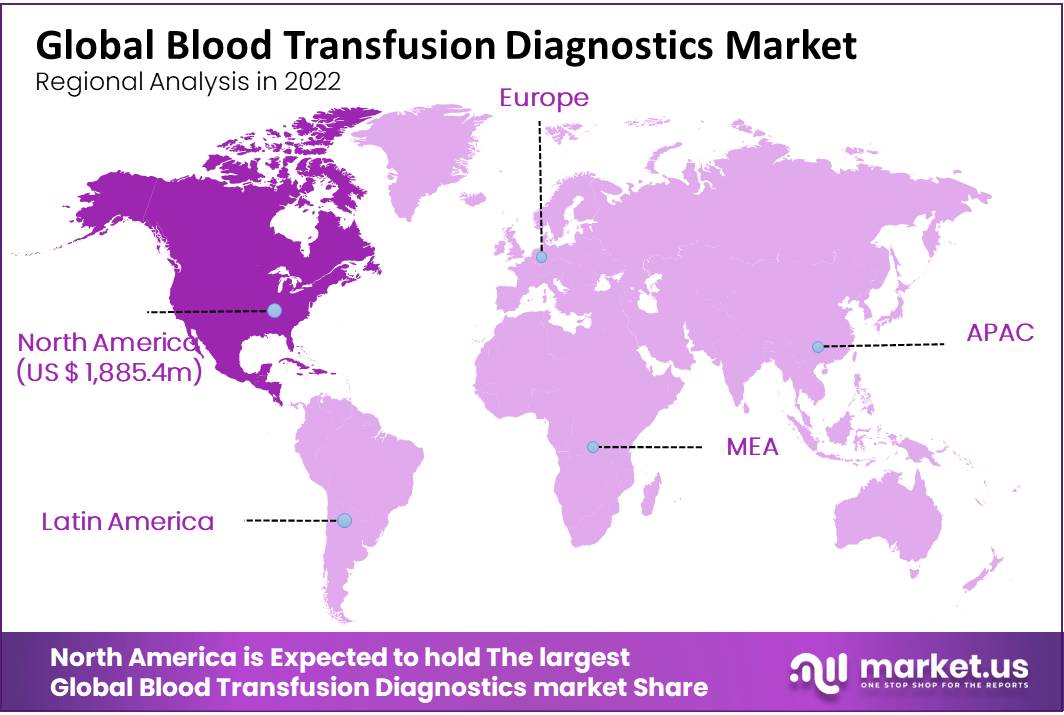

North America accounted for the largest revenue in the market.

The market was constrained by North America, which holds the highest revenue share of 40.1% in 2022. However, it is anticipated that the segment will hold its position throughout the forecast period.

The regional market is driven by a growing awareness of health care, a high disposable income, and favorable reimbursement policies. According to data from the Community Blood Center, approximately 43,000 points of donated blood are used daily in Canada and the United States.

The United States had the largest share in NA. Over 600 independent donation facilities, easy access to various testing assays, and the presence of main market players are the primary contributors to its dominance.

Independent blood centers are dependable for 25% of the supply of blood collected in Canada and contain approximately 60% of blood donation in the United States.

During the forecast period, it is anticipated that the market in Asia Pacific will expand faster. Australia is becoming increasingly aware of the possibility of launching various campaigns, and India is encouraging regional expansion.

However, despite that, fewer blood transfusion diagnostic tools have been implemented in APAC due to the declining count of donors in South Korea and Singapore.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market is getting a lot of attention from various regulatory authorities and businesses. In order to increase the production and development of diagnostic blood tests, businesses in the global market for blood transfusion diagnostics are continuously engaging in a variety of strategic initiatives.

Market Key Players

- Hoffmann-La Roche Ltd

- Ortho Clinical Diagnostics

- Immucor, Inc.

- Bio-Rad Laboratories, Inc.

- DiaSorin S.P.A.

- Abbott

- BAG Healthcare GmbH

- Danaher

- Quotient Limited

- Grifols S.A.

- Other Key Players

Key Industry Developments

- Hoffmann-La Roche Ltd (March 2023): Hoffmann-La Roche Ltd acquired Tasso, Inc., a company specializing in innovative blood collection technologies. This acquisition aims to enhance Roche’s blood transfusion diagnostics portfolio, providing more accurate and efficient diagnostic solutions.

- Ortho Clinical Diagnostics (February 2023): Ortho Clinical Diagnostics launched the VISION Max System, an advanced blood screening platform designed to improve the speed and accuracy of blood transfusion diagnostics, enhancing overall laboratory efficiency.

- Bio-Rad Laboratories, Inc. (January 2023): Bio-Rad Laboratories introduced the IH-Complete automated system, designed to streamline blood transfusion diagnostics by automating blood typing and crossmatching processes, thereby improving laboratory workflows and accuracy.

- DiaSorin S.P.A. (May 2023): DiaSorin S.P.A. acquired Quantitative Diagnostics, a company known for its innovative transfusion medicine solutions. This acquisition aims to strengthen DiaSorin’s position in the blood transfusion diagnostics market by broadening its product offerings.

- Abbott (June 2023): Abbott launched the Alinity s System, a next-generation blood screening solution that enhances the detection of infectious diseases in blood donations, ensuring higher safety standards in blood transfusion diagnostics.

Report Scope

Report Features Description Market Value (2023) USD 5,031 Million Forecast Revenue (2032) USD 9,095 Million CAGR (2023-2032) 7% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type- Instruments, Reagents & Kits, and Others; By Application- Blood Screening and Blood Group Typing; and By End User- Hospital Based Laboratories, Independent Laboratories, and Blood Banks. Regional Analysis North America – The US, Canada, and Mexico; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Eastern Europe – Russia, Poland, The Czech Republic, Greece Rest of Eastern Europe; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA. Competitive Landscape F. Hoffmann-La Roche Ltd, Ortho Clinical Diagnostics, Immucor, Inc., Bio-Rad Laboratories, Inc., DiaSorin S.P.A., Abbott, BAG Healthcare GmbH, Danaher, Quotient Limited, Grifols S.A., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the global blood transfusion diagnostics market worth?the-market.us says that the global market stood at USD 5 billion in 2023 and is projected to reach USD 9.25 billion by 2032.

What is the blood transfusion diagnostics market growth?The global blood transfusion diagnostics market is expected to grow at a compound annual growth rate of 7% from 2023 to 2032 to reach USD 9.25 billion by 2032.

Who are the key companies in the Global Blood Transfusion Diagnostics Market?Key companies in the Global Blood Transfusion Diagnostics Market include Hoffmann-La Roche Ltd Ortho Clinical Diagnostics Immucor, Inc. Bio-Rad Laboratories, Inc. DiaSorin S.P.A. Abbott BAG Healthcare GmbH Danaher Quotient Limited Grifols S.A. Other Key Players

What is the estimated value of the Global Blood Transfusion Diagnostics Market?The Global Blood Transfusion Diagnostics Market was estimated to be valued at USD 5 billion in 2023.

Blood Transfusion Diagnostics MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Blood Transfusion Diagnostics MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Hoffmann-La Roche Ltd

- Ortho Clinical Diagnostics

- Immucor, Inc.

- Bio-Rad Laboratories, Inc.

- DiaSorin S.P.A.

- Abbott

- BAG Healthcare GmbH

- Danaher

- Quotient Limited

- Grifols S.A.

- Other Key Players