Global Self-Sampling Blood Collection and Storage Devices Market By Product (Collection Devices , Others) By Application-(Diagnostics, Research, Monitoring) By End-use-(Diagnostic Laboratories, Academic & Research Institutes, Home Settings, Others) By Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 84238

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

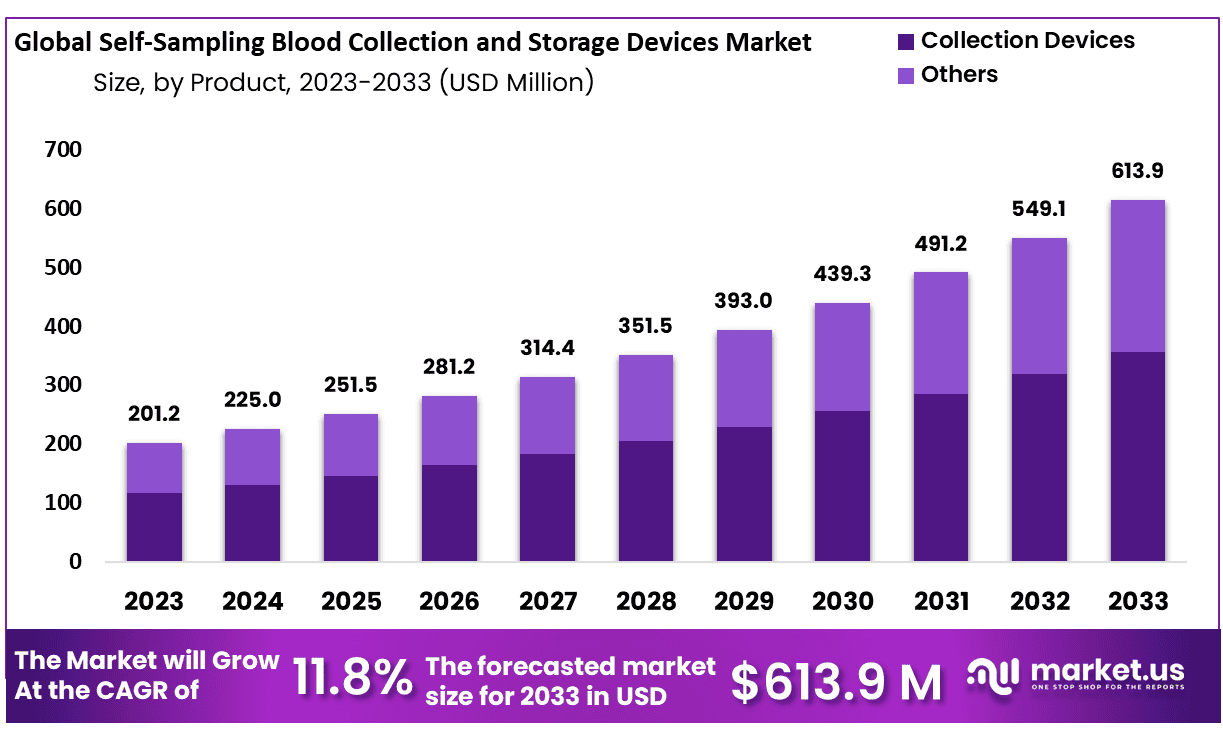

The Global Self-Sampling Blood Collection and Storage Devices Market size is expected to be worth around USD 613.9 Million by 2033 from USD 201.2 Million in 2023, growing at a CAGR of 11.8% during the forecast period from 2024 to 2033.

The Self-Sampling Blood Collection and Storage Devices Market refers to an industry involved with producing, distributing, and selling devices designed for individuals to collect and store their blood samples. These devices provide a simple and user-friendly alternative to traditional blood collection methods, enabling individuals to perform sample collection at home without needing healthcare professionals for support. Self-sampling blood collection devices typically include lancets for blood extraction, collection tubes, and storage mechanisms.

The global market for Self-Sampling Blood Collection and Storage Devices can be segmented according to product, application, customer base, and region. Of the product categories available for Self-Sampling Blood Collection and Storage Devices, Collection Devices lead in terms of collections; Disease Management is its main application segment while diagnostic labs will experience the fastest growth over the projected period – North America being particularly supportive in expanding this sector.

Revenue progress of the global self-sampling blood collection and storage devices market is considerably driven by expanding demand for effective and new drugs. Ongoing development activities and research (including DNA analysis) to cure and prevent new diseases, especially post Covid 19 pandemic, energize market growth. The surge in the patient pool with diverse chronic diseases, increased prevalence of numerous blood disorders, and rise in the senior population are expected to drive the global self-sampling blood collection and storage devices market from 2024 to 2033.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size: Self-Sampling Blood Collection and Storage Devices Market size is expected to be worth around USD 613.9 Million by 2033 from USD 201.2 Million in 2023.

- Market Growth: The market growing at a CAGR of 11.8% during the forecast period from 2024 to 2033.

- Product Analysis: Collection Devices emerging as market leaders with accounting 58.1% market share

- Application Analysis: Diagnostic applications continue to prove themselves with an impressive 45.7% market shar

- End-Use Analysis: Diagnostic Laboratories represent an end user segment accounting for 38.1% market share within the Self-Sampling Blood Collection and Storage Devices Market.

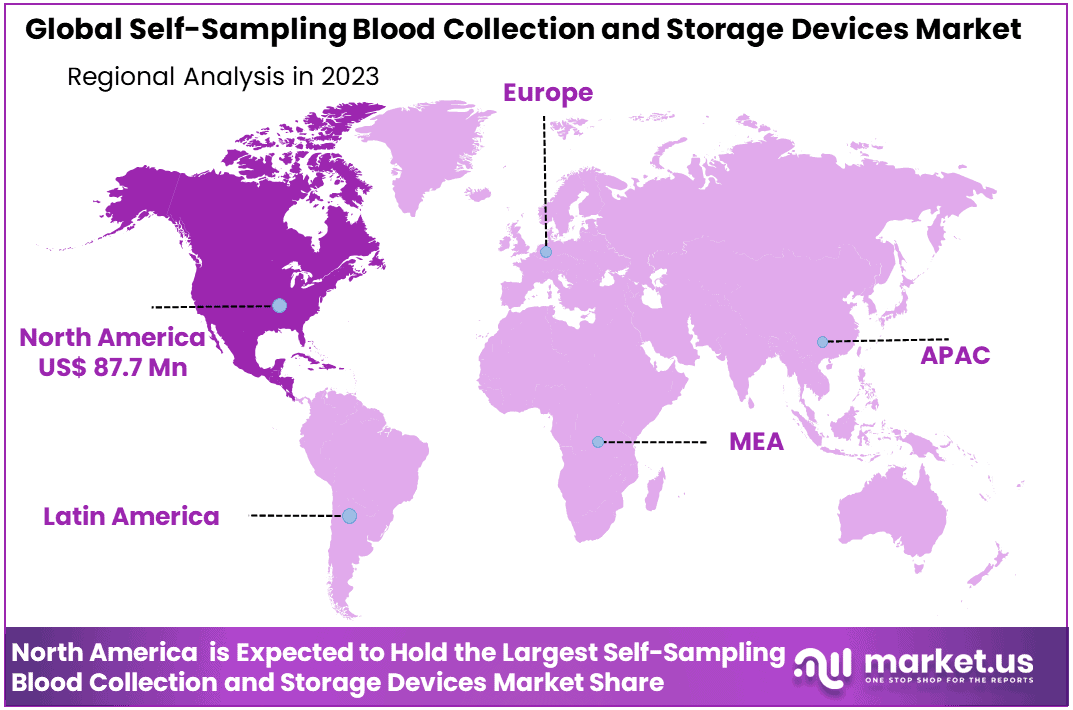

- Regional Analysis: North America accounted market share by 43.6% and holding USD 87.7 Million revenue in 2023

Product Analysis

Self-Sampling Blood Collection and Storage Devices Market has experienced significant growth, with Collection Devices emerging as market leaders with accounting 58.1% market share. These innovative devices revolutionize healthcare by making blood collection more convenient, accessible and efficient as more people opt to self-sample at home compared with conventional methods of sampling blood at hospital laboratories. Self-sampling offers numerous advantages: patient comfort is increased as diagnostic process efficiency increases while traditional collection methods become less reliable.

Collection Devices popularity can be attributed to their user-friendly designs, which make the blood collection process accessible and make monitoring one’s health easy for individuals in general and those living with chronic diseases in particular. Their rising demand demonstrates an emerging preference for self-sampling solutions which is shaping healthcare dynamics differently; as technological improvements improve these devices the Self-Sampling Blood Collection and Storage market promises sustained expansion allowing proactive health monitoring become part of everyday life.

Application Analysis

Within the rapidly developing Self-Sampling Blood Collection and Storage Devices Market, diagnostic applications continue to prove themselves with an impressive 45.7% market share. Their applications represent a transformative shift in healthcare by giving individuals convenient blood sampling at any time for comprehensive testing; it shows they want their health in control through regular diagnostic monitoring.

Diagnostic devices play a pivotal role in preventive healthcare and early disease diagnosis. Furthermore, their versatility extends well beyond diagnosis to serve research initiatives and long-term monitoring – the latter two being key drivers behind technological progress that promises to reshape healthcare paradigms with personalized and proactive health management becoming standard practice in future healthcare paradigms.

End-User Analysis

Diagnostic Laboratories represent an end user segment accounting for 38.1% market share within the Self-Sampling Blood Collection and Storage Devices Market, reflecting their vital role in professional healthcare settings for efficient diagnostic testing processes and precise patient care. Self-sampling devices enable labs to streamline testing procedures while offering patients better care with greater diagnostic precision.

Academic & Research Institutes also play an integral part in shaping the market, acknowledging the immense benefit that self-sampling technologies bring in terms of medical research. Their versatile use in controlled research environments accentuates their versatility for exploring uncharted territories of healthcare knowledge.

As Self-Sampling Blood Collection and Storage Devices become an ever more integral component of home settings, individuals become empowered to actively manage their health management. As this market expands due to numerous end users, diagnostic capabilities will continue to seamlessly blend into all areas of healthcare from laboratories to academic research studies and into everyday household lives.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

Product

- Collection Devices

- Others

Application

- Diagnostics

- Research

- Monitoring

End-use

- Diagnostic Laboratories

- Academic & Research Institutes

- Home Settings

- Others

Drivers

The market for self-sampling blood collection and storage devices is set for rapid revenue expansion due to rising awareness of their benefits. Such devices enable efficient collection, shipment and storage at ambient temperature of remote blood samples while cutting research costs associated with global R&D activities; with diabetes now impacting over 424 million globally this demand for convenient blood collection methods has skyrocketed.

Diabetes and high blood pressure are driving up demand for therapeutic drug monitoring and regular testing of therapeutic agents, prompting individuals to use self-sampling devices instead of visiting health clinics – something made more challenging by COVID-19 pandemic restrictions on hospital gatherings.

Trend

Self-Sampling Blood Collection and Storage Devices market has experienced significant expansion due to increasing consumer interest in convenient healthcare solutions that can be performed from within their homes. Due to increasing awareness about preventive healthcare, individuals are opting for self-sampling blood collection devices which enable simple sample collection without the assistance of healthcare providers. This trend has become particularly evident since the COVID-19 pandemic, when remote healthcare solutions became an integral component of treatment plans.

Technology developments such as user-friendly interfaces and reliable storage mechanisms also contribute to this market’s expansion. Consumers prioritize accessible healthcare management that facilitates innovation within this sector of industry development.

Restraints

Although self-sampling blood collection and storage devices appear promising on paper, several factors impede global growth of self-sampling blood collection devices. These include fear of testing on an ongoing basis, needle phobia, painstaking collection methods and potential errors with kits; fear of needle pricks is among them, in addition to increased R&D for new drug development as well as increasing incidences of blood disorders as well as private investments into health and wellness obstruct market revenue growth; government initiatives providing drug accessibility has also had negative impacts on market demand as a whole.

Opportunities

Amid its numerous challenges, this market offers exciting prospects driven by government initiatives to promote technological advances and digitalize research laboratories. Cloud software advances provide data analysis for diverse blood samples to aid medical practitioners make informed decisions; contact-free testing has become standard practice due to COVID-19 pandemic; this trend creates favorable prospects for both established players as well as new entrants alike – heralding an optimistic outlook for self-sampling blood collection and storage devices market in general.

Regional Analysis

Regionally, North America accounted market share by 43.6% and holding USD 87.7 Million revenue in 2023. Revenue progress in the North American market is mainly attributed to the continuing technological progressions in the healthcare industry, vast government investments in research activities for emerging drugs for rare diseases, and solid medical repayment policies concerning self-sampling blood collection and storage devices. In Europe, the self-sampling blood collection and storage devices market is anticipated to record strong growth in revenue in 2024-2033, owing to growing awareness of clinic visits and regular testing for healthy lifestyles. Asia Pacific’s self-sampling blood collection and storage devices market is estimated to record the fastest development in CAGR in 2024-2033.

Quick urbanization, the growing occurrence of chronic diseases, mainly in emerging countries including China, India, Indonesia, and Malaysia, and growing government investments in the healthcare infrastructure are the main factors leading the APAC market development.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The key players accept vital strategies, including geographical expansion, product development, mergers and acquisitions, and many other methods to increase the demand for coin batteries. Prominent participants in the global self-sampling blood collection and storage devices market are presented through detailed profiles, covering such key aspects as company overview, product portfolio overview, financial summary summary, recent advances and competitive business strategies.

Market Key Players

- Neoteryx, LLC.

- DBS System SA

- PanoHealth

- Tasso, Inc

- Seventh Sense Biosystems

- LAMEDITECH

- Capitainer

- Spot On Sciences

- Trajan Scientific and Medical

- Drawbridge Health

- Weavr Health

- Microdrop

Recent Developments

- Neoteryx LLC: Established partnerships with laboratories and healthcare providers; increased self-sampling access for various health conditions.

- DBS System SA: Introduced dried blood spot (DBS) collection cards for newborn screening and other diagnostic tests; providing an easy, safe, and cost-effective method for collecting and storing blood samples without refrigeration.

- PanoHealth: Recently unveiled their PanoBox home blood collection and analysis system which integrates finger-prick blood collection with portable analyzer for instantaneous results on various health parameters.

- Tasso, Inc.: has developed the Microneedle Patch for continuous glucose monitoring offering diabetics a pain-free alternative to finger pricking.

- Seventh Sense Biosystems: unveiled the Mitra device for self-collection of menstrual blood. This non-invasive solution enables non-invasive collection and analysis of female hormones and biomarkers.

Report Scope

Report Features Description Market Value (2023) USD 201.2 Million Forecast Revenue (2033) USD 613.9 Million CAGR (2024-2033) 11.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product-(Collection Devices , Others);By Application-(Diagnostics, Research, Monitoring);By End-use-(Diagnostic Laboratories, Academic & Research Institutes, Home Settings, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Neoteryx, LLC., DBS System SA, PanoHealth, Tasso, Inc, Seventh Sense Biosystems, LAMEDITECH, Capitainer, Spot On Sciences, Trajan Scientific and Medical, Drawbridge Health, Weavr Health, Microdrop Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Self-Sampling Blood Collection and Storage Devices Market?The market involves innovative devices enabling individuals to collect and store their blood samples for diagnostic purposes in various settings.

How big is the Self-Sampling Blood Collection and Storage Devices Market?The global Self-Sampling Blood Collection and Storage Devices Market size was estimated at USD 201.2 Million in 2023 and is expected to reach USD 613.9 Million in 2033.

What is the Self-Sampling Blood Collection and Storage Devices Market growth?The global Self-Sampling Blood Collection and Storage Devices Market is expected to grow at a compound annual growth rate of 11.8%. From 2024 To 2033

Who are the key companies/players in the Self-Sampling Blood Collection and Storage Devices Market?Some of the key players in the Self-Sampling Blood Collection and Storage Devices Markets are Neoteryx, LLC., DBS System SA, PanoHealth, Tasso, Inc, Seventh Sense Biosystems, LAMEDITECH, Capitainer, Spot On Sciences, Trajan Scientific and Medical, Drawbridge Health, Weavr Health, Microdrop,

Which Segment Dominates the Market?The dominant segment is diagnostics, holding a significant 45.7% market share, emphasizing the pivotal role of self-sampling in healthcare monitoring.

Who are the Key End-Users in the Market?Key end-users include Diagnostic Laboratories, constituting 38.1% of the market share, Academic & Research Institutes, and Home Settings.

What Drives the Popularity of Collection Devices?Collection Devices dominate with 58.1% market share, offering user-friendly designs for convenient at-home blood sample collection.

Self-Sampling Blood Collection and Storage Devices MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Self-Sampling Blood Collection and Storage Devices MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Neoteryx, LLC.

- DBS System SA

- PanoHealth

- Tasso, Inc

- Seventh Sense Biosystems

- LAMEDITECH

- Capitainer

- Spot On Sciences

- Trajan Scientific and Medical

- Drawbridge Health

- Weavr Health

- Microdrop