Global Controlled Environment Agriculture Market Growing Method (Hydroponics, Aeroponics, Aquaponics, Other Growing Methods), Components (Lighting Systems, Climate Control Systems, Sensors and Monitoring Systems, Growing Media, Other Components), Farming Type ( Greenhouses, Vertical Farms, Indoor Farming, Container Farms, Other Farming Types), Crop Type (Vegetables, Fruits, Flowers and Ornamentals, Herbs, Other Crop Types), End-User (Commercial Growers, Research Institutes and Academies, Residential Users) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 99325

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

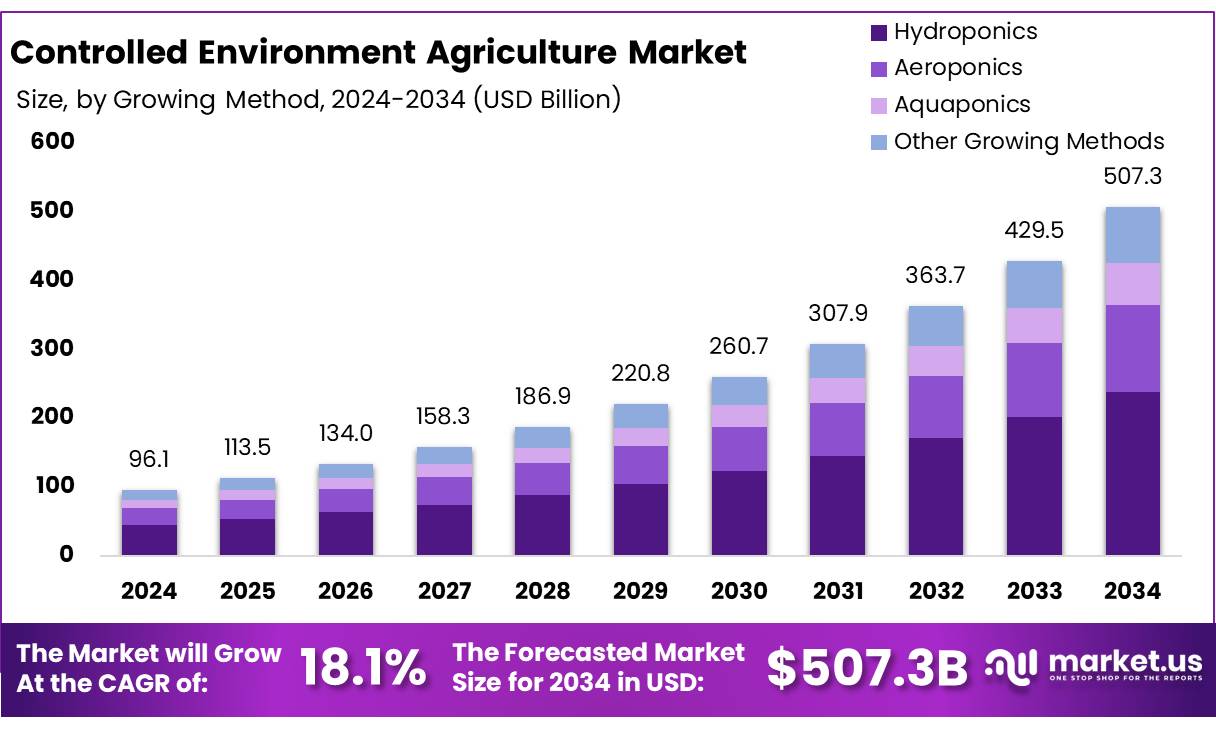

The controlled environment agriculture market size is expected to be worth around USD 507.3 Billion by 2034 from USD 96.1 Billion in 2024, growing at a CAGR of 18.1% during the forecast period 2025 to 2034.

Controlled Environment Agriculture (CEA) is a farming technique that involves growing crops in regulated environments where factors like water, temperature, light, nutrients, humidity, and gas concentrations are carefully controlled. This method includes practices such as high tunnels, greenhouses, vertical farms, and plant factories.

Controlled Environment Agriculture provides protection from adverse weather conditions like droughts, floods, and unexpected frosts, while also improving crop growth. It helps minimize the risks posed by pests and diseases, boosts efficiencies, reduces costs, and has contributed to the growing popularity of this agricultural approach globally.

The increasing concerns over climate change and unpredictable weather have been significant drivers behind the adoption of Controlled Environment Agriculture systems, as these environments are less impacted by external conditions. Additionally, vertical farming offers a substantial water-saving advantage, using up to 95% less water compared to conventional farming, making it a particularly appealing solution in regions facing water scarcity.

Controlled Environment Agriculture growth has also been supported by advancements in sustainable farming technologies, such as hydroponics, aeroponics, and LED lighting. These innovations have made the CEA approach more efficient and productive, appealing to those seeking more sustainable agricultural practices. The focus on sustainability and water conservation has only added to the appeal of Controlled Environment Agriculture as an essential component of the future of agriculture.

Key Takeaways

- Controlled Environment Agriculture Market size is expected to be worth around USD 507.3 Billion by 2034 from USD 96.1 Billion in 2024, growing at a CAGR of 18.1%.

- Hydroponics held a dominant market position, capturing more than a 46.10% share.

- Lighting Systems held a dominant market position, capturing more than a 37.10% share of the controlled environment agriculture market.

- Greenhouses held a dominant market position, capturing more than a 38.10% share.

- Vegetables held a dominant market position, capturing more than a 41.20% share of the controlled environment agriculture market.

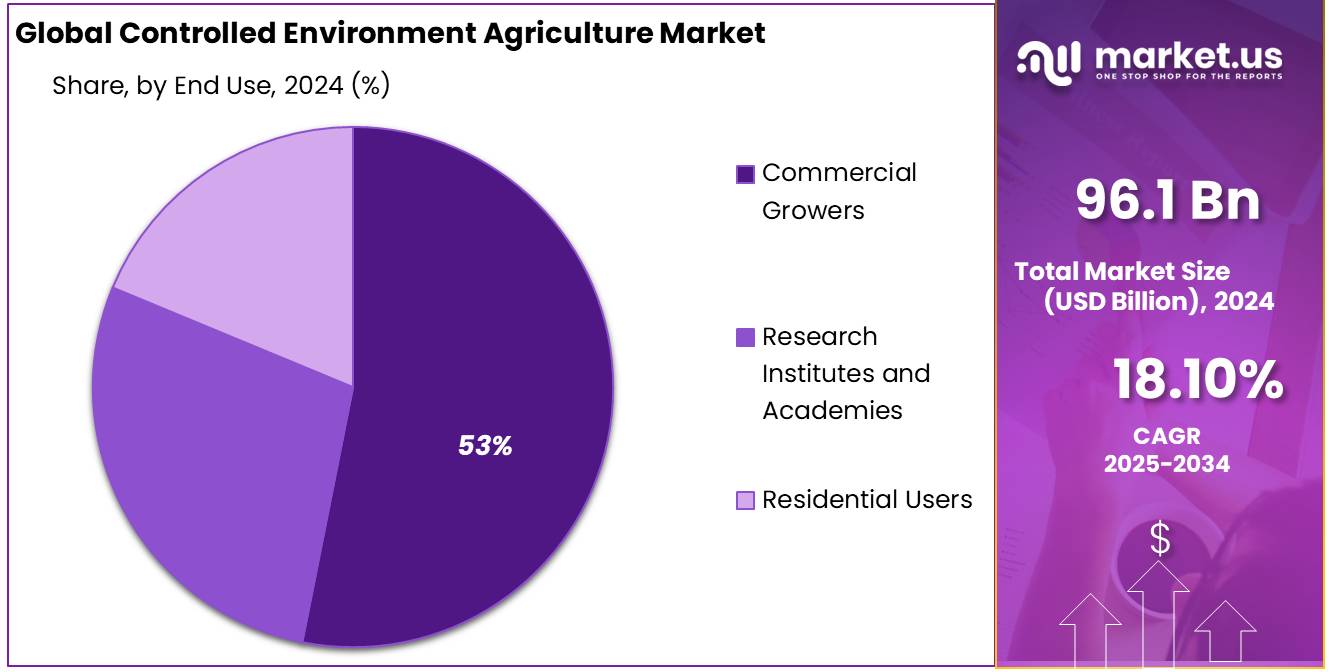

- Commercial Growers held a dominant market position, capturing more than a 53.10% share.

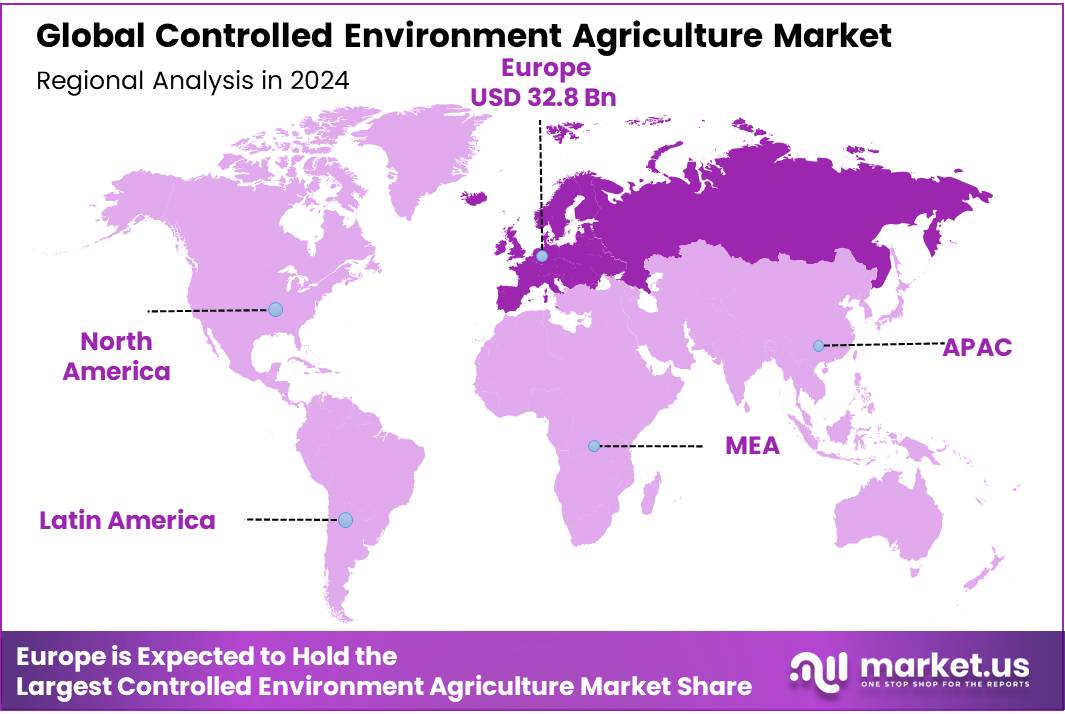

- Europe’s contribution is estimated to reach approximately 34.20%, equivalent to USD 32.8 billion.

By Growing Method Analysis

Hydroponics dominates the Controlled Environment Agriculture Market with 46.10% share in 2024

In 2024, Hydroponics held a dominant market position, capturing more than a 46.10% share of the controlled environment agriculture market. This method’s popularity continues to rise due to its water-efficient nature and ability to produce crops in a controlled environment, which is increasingly vital in regions facing water scarcity. Hydroponics provides the ability to grow a wide variety of plants without the need for soil, making it highly adaptable for urban farming.

The growing shift towards sustainable farming practices and the increasing demand for fresh, locally grown produce have played a significant role in Hydroponics’ expansion. In 2025, it is expected that Hydroponics will continue to lead the market, with a projected slight increase in its share as more farms and urban growers adopt this method to meet rising food demands while minimizing resource use. The advancement of technology, such as automated systems and nutrient management solutions, is likely to further strengthen Hydroponics’ hold on the market.

By Components Analysis

Lighting Systems lead the Controlled Environment Agriculture Market with 37.10% share in 2024

In 2024, Lighting Systems held a dominant market position, capturing more than a 37.10% share of the controlled environment agriculture market. This component is crucial for providing the necessary light for plant growth in indoor farming, where natural sunlight is limited. The growing demand for year-round cultivation and higher crop yields has significantly driven the adoption of advanced lighting solutions, including LED systems, which are more energy-efficient and cost-effective than traditional lighting methods.

In 2025, the market for lighting systems is expected to see further growth, with an anticipated increase in its share as technological advancements, such as smart lighting systems and energy-saving innovations, become more widespread. These developments are helping growers reduce operational costs while enhancing plant productivity, which is contributing to lighting systems’ continuing dominance in the market.

Farming Type Analysis

Greenhouses dominate the Controlled Environment Agriculture Market with 38.10% share in 2024

In 2024, Greenhouses held a dominant market position, capturing more than a 38.10% share of the controlled environment agriculture market. This farming method remains highly popular due to its ability to create a controlled environment that protects crops from extreme weather conditions while allowing for year-round production. Greenhouses offer a versatile solution for growing a wide range of crops, from vegetables to flowers, in both large-scale and small-scale operations.

Looking ahead to 2025, Greenhouses are expected to maintain their leading position in the market. As more growers seek to improve crop yield and quality while minimizing environmental impact, the demand for advanced greenhouse technologies, including climate control systems and energy-efficient structures, is likely to increase. The continued push for sustainable and local food production is also set to keep Greenhouses as a top choice for controlled environment agriculture.

By Crop Type Analysis

Vegetables dominate the Controlled Environment Agriculture Market with 41.20% share in 2024

In 2024, Vegetables held a dominant market position, capturing more than a 41.20% share of the controlled environment agriculture market. This crop type continues to lead due to the rising demand for fresh, locally grown vegetables and the ability to produce high-quality crops in a controlled environment. With the increasing preference for organic and pesticide-free produce, growing vegetables in controlled environments allows farmers to meet consumer demands while minimizing the use of harmful chemicals.

In 2025, the market for vegetables is expected to continue expanding, with further growth in both urban and rural farming operations. The ongoing trend of health-conscious eating and the need for sustainable farming practices will likely boost vegetable production in controlled environments, maintaining its dominant share of the market. Additionally, innovations in farming techniques, such as hydroponics and vertical farming, are expected to enhance vegetable yields and reduce resource consumption, ensuring their continued leadership in the market.

End-User Analysis

Commercial Growers lead the Controlled Environment Agriculture Market with 53.10% share in 2024

In 2024, Commercial Growers held a dominant market position, capturing more than a 53.10% share of the controlled environment agriculture market. This segment has been a major driver of the market, as commercial growers are increasingly turning to controlled environments to enhance productivity and ensure a consistent supply of high-quality crops throughout the year. The scalability and efficiency of these systems make them highly attractive for large-scale farming operations that aim to meet the growing demand for fresh produce in both local and global markets.

Looking ahead to 2025, the share of Commercial Growers is expected to remain strong, with further growth anticipated as more commercial farms adopt advanced technologies to improve yields and reduce costs. The demand for more sustainable and efficient farming practices is likely to continue pushing commercial growers toward controlled environments, solidifying their dominance in the market. Additionally, the rise of urban farming and the push for locally sourced produce are expected to provide further opportunities for commercial growers to expand their operations.

Key Market Segments

Based on Growing Method

- Hydroponics

- Aeroponics

- Aquaponics

- Other Growing Method

Based on Components

- Lighting Systems

- Climate Control Systems

- Sensors and Monitoring Systems

- Growing Media

- Other Components

Farming Type

- Greenhouses

- Smart

- Traditional

- Vertical Farms

- Indoor Farming

- Container Farms

- Other Farming Types

Based on Crop Types

- Vegetables

- Fruits

- Flowers and Ornamentals

- Herbs

- Other Crop Types

End-User

- Commercial Growers

- Research Institutes and Academies

- Residential Users

Driving Factors

Government Support and Initiatives Drive Growth in Controlled Environment Agriculture

One major driving factor for the growth of controlled environment agriculture (CEA) is the increasing support from governments and industry bodies worldwide. As the global population continues to rise and concerns about food security intensify, governments are investing heavily in sustainable farming methods, including CEA, to ensure a consistent, safe, and reliable food supply. The ability to grow crops in controlled environments offers a promising solution to the challenges posed by climate change, land degradation, and water scarcity.

In particular, government policies aimed at supporting sustainable agriculture practices are significantly driving the adoption of CEA technologies. For example, in the United States, the USDA (United States Department of Agriculture) has been a strong advocate for vertical farming and hydroponics, providing grants and funding to support these technologies.

The USDA’s commitment to these initiatives is in line with its goal to help farmers reduce the environmental impact of traditional farming methods while enhancing food production. According to the USDA, the vertical farming market could be worth $12.77 billion by 2026, highlighting the significant growth potential for controlled environment agriculture.

Internationally, initiatives such as the European Union’s Farm to Fork strategy are also driving the adoption of CEA. The strategy aims to make food systems fair, healthy, and environmentally-friendly by encouraging the use of alternative farming methods, including controlled environments. By focusing on sustainability, these policies are encouraging investment in CEA, which is seen as a viable solution to address the challenges of conventional farming.

Additionally, the increasing focus on urban agriculture and food self-sufficiency in cities is driving government action. Cities like Singapore have committed to producing 30% of their nutritional needs through local, sustainable farming by 2030. This aligns with Singapore’s push to develop high-tech farming solutions, including vertical farming and hydroponics, to meet food demands while conserving resources.

Restraints Factors

High Initial Investment Costs Pose a Restraining Factor for Controlled Environment Agriculture

One of the primary challenges facing the widespread adoption of controlled environment agriculture (CEA) is the high initial investment required to set up these systems. While the technology behind CEA is advancing rapidly, the costs associated with establishing and maintaining such systems remain a significant barrier for many potential growers.

These costs typically include the construction of infrastructure, such as greenhouses or vertical farms, the installation of specialized lighting and climate control systems, and the purchase of advanced agricultural technologies, all of which can be prohibitively expensive, especially for small and medium-sized farms.

According to a report by the United Nations Food and Agriculture Organization (FAO), the cost of setting up a vertical farm can range from $100,000 to $300,000 per acre, depending on the complexity of the system and the location. This substantial upfront cost can make it difficult for many farmers, particularly those in developing regions, to make the transition to controlled environment farming. The cost of energy for running lighting systems and climate controls, particularly in areas with high electricity costs, further adds to the financial strain.

Government incentives and subsidies are essential to address this barrier, and some countries have started to offer financial support to make CEA more accessible. For instance, the Netherlands, a global leader in greenhouse farming, provides subsidies and research grants to help offset the high costs of advanced farming technologies.

Similarly, the U.S. Department of Agriculture (USDA) has introduced programs to assist farmers in adopting sustainable farming practices, including those that support controlled environment agriculture. However, these initiatives are still in the early stages, and not all regions benefit from such support.

Growth Opportunity

Urban Farming and Local Food Production Present Significant Growth Opportunities for Controlled Environment Agriculture

One of the most promising growth opportunities for controlled environment agriculture (CEA) lies in the expansion of urban farming and local food production. As cities continue to grow, there is increasing demand for fresh, locally sourced produce, and CEA presents a sustainable solution to this need.

Urban farming, particularly through methods like vertical farming and hydroponics, allows for food production in spaces where traditional agriculture is not feasible—such as rooftops, warehouses, and unused urban spaces. This method not only reduces the carbon footprint associated with food transportation but also helps ensure a more reliable food supply within cities.

According to a report by the Food and Agriculture Organization (FAO), urban farming can contribute significantly to food security. It’s estimated that urban agriculture could account for up to 15% of the total food supply in some cities by 2030. The ability to grow food in close proximity to where it is consumed reduces transportation costs, minimizes food waste, and improves the overall efficiency of the food supply chain.

Latest Trends

Integration of Artificial Intelligence and Automation in Controlled Environment Agriculture

One of the latest trends in controlled environment agriculture (CEA) is the increasing integration of artificial intelligence (AI) and automation technologies. These technologies are transforming the way crops are grown, monitored, and harvested in controlled environments, improving efficiency and productivity while reducing labor costs. By using AI-driven systems, farmers can automate processes such as monitoring plant health, managing climate conditions, and optimizing nutrient delivery systems, allowing them to focus on scaling operations and ensuring the health of the crops.

In 2024, the global vertical farming industry, a key component of CEA, is expected to see substantial growth, with automation and AI expected to play a major role in this expansion. The integration of AI allows for predictive analytics that can anticipate potential issues before they arise, such as nutrient deficiencies, pest outbreaks, or environmental imbalances. This helps reduce waste and increases yield consistency. According to a report by the Food and Agriculture Organization (FAO), vertical farms utilizing AI and automation have shown improvements in yield efficiency by up to 30%, making these technologies a significant driver of growth in the sector.

Governments around the world are also encouraging the adoption of AI and automation in agriculture. The U.S. Department of Agriculture (USDA) has been promoting the use of these technologies through various programs, including research grants aimed at supporting the development of AI tools for sustainable farming. The European Union’s Horizon 2020 program has funded numerous projects focused on advancing AI in agriculture, highlighting the potential for AI to drive sustainability and food security.

Regional Analysis

Europe, as a key region in the Controlled Environment Agriculture (CEA) market, is projected to hold a significant share of the global market value. In 2025, Europe’s contribution is estimated to reach approximately 34.20%, equivalent to USD 32.8 billion, reinforcing its status as the leading region. The region’s dominance is underpinned by strong government initiatives promoting sustainable agricultural practices, coupled with substantial investments in advanced technologies.

In terms of crop production, Europe has made notable strides in cultivating high-value crops such as leafy greens, tomatoes, and herbs within controlled environments, ensuring year-round supply and consistent quality. The region’s ability to integrate cutting-edge automation, IoT-enabled monitoring systems, and renewable energy sources further bolsters its competitiveness.

Moreover, consumer demand for locally sourced, pesticide-free, and fresh produce continues to drive the growth of the CEA market in Europe. With its comprehensive approach, supportive policies, and leading market share, Europe is well-positioned to maintain its dominance and further influence the global adoption of controlled environment agricultural practices.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Heliospectra AB is a leading provider of intelligent lighting systems for controlled environment agriculture. The company specializes in advanced LED lighting solutions designed to optimize plant growth and enhance crop yield. With a focus on energy efficiency and sustainability, Heliospectra’s solutions are widely used in vertical farming, greenhouses, and research applications. Their technology offers precise control over light spectrum, intensity, and duration, contributing to improved plant performance and quality.

Signify N.V. (formerly Philips Lighting) is a global leader in lighting solutions, including advanced horticultural lighting systems for controlled environment agriculture. The company offers a range of LED lighting products tailored for indoor and vertical farming. Signify’s innovations in horticulture lighting help growers optimize plant growth, reduce energy consumption, and improve crop yields. The company’s products are widely adopted by growers around the world for their efficiency, sustainability, and superior performance in various cultivation environments.

GrowGroup IFS is a global provider of integrated solutions for controlled environment agriculture. The company offers a comprehensive range of products, including automated systems for monitoring and managing indoor farms. GrowGroup specializes in providing technologies for efficient crop production, such as climate control, lighting, irrigation, and nutrient delivery systems. Their solutions are designed to enhance productivity and sustainability in vertical farming and other controlled environment settings, making them a preferred choice for large-scale growers.

Market Key Players

- Sky Greens

- Heliospectra AB

- Signify N.V.

- Philips Lighting

- Urban Crop Solutions

- GrowGroup IFS

- EVERLIGHT ELECTRONICS CO., LTD

- AGRIFY CORP

- Plenty Unlimited, Inc.

- Intelligent Growth Solutions Limited

- Freight Farms

- Gavita International B.V.

- AeroFarms

- BrightFarms

- Greenlux Lighting Solutions

- Valoya, Inc.

- AGronomic IQ

- Urban Crop Solutions

- Bowery Farming

- AmHydro

- CubicFarm Systems

- Other Key Players

Recent Developments

- In December 2023, Plenty Unlimited Inc. opened its new farm in Compton, California, named “Plenty Compton Farm,” which is set to supply fresh produce to over 430 Walmart stores in California.

Report Scope

Report Features Description Market Value (2024) USD 96.1 Bn Forecast Revenue (2034) USD 507.3 Bn CAGR (2025-2034) 18.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Growing Method (Hydroponics, Aeroponics, Aquaponics, Other Growing Methods), Components (Lighting Systems, Climate Control Systems, Sensors and Monitoring Systems, Growing Media, Other Components), Farming Type ( Greenhouses, Vertical Farms, Indoor Farming, Container Farms, Other Farming Types), Crop Type (Vegetables, Fruits, Flowers and Ornamentals, Herbs, Other Crop Types), End-User (Commercial Growers, Research Institutes and Academies, Residential Users) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Heliospectra AB, Signify N.V., Philips Lighting, Urban Crop Solutions, GrowGroup IFS, EVERLIGHT ELECTRONICS CO., LTD, AGRIFY CORP, Plenty Unlimited, Inc., Intelligent Growth Solutions Limited, Sky Greens, Freight Farms, Gavita International B.V., AeroFarms, BrightFarms, Greenlux Lighting Solutions, Valoya, Inc., AGronomic IQ, Urban Crop Solutions, Bowery Farming, AmHydro, CubicFarm Systems, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Controlled Environment Agriculture (CEA) Market?Controlled Environment Agriculture refers to the practice of growing crops within a controlled environment, such as greenhouses or indoor vertical farms, where various environmental factors like temperature, humidity, light, and nutrient levels are tightly controlled and monitored. This allows for year-round production, increased crop yield, and reduced reliance on external factors like weather and pests

What are the potential future trends in the Controlled Environment Agriculture market?Potential future trends in CEA include the integration of AI and machine learning for predictive analytics and precise control, the development of more sustainable energy sources for powering indoor farms, and the expansion of CEA into new geographic regions to address local food security and reduce transportation distances.

Controlled Environment Agriculture MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Controlled Environment Agriculture MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sky Greens

- Heliospectra AB

- Signify N.V.

- Philips Lighting

- Urban Crop Solutions

- GrowGroup IFS

- EVERLIGHT ELECTRONICS CO., LTD

- AGRIFY CORP

- Plenty Unlimited, Inc.

- Intelligent Growth Solutions Limited

- Freight Farms

- Gavita International B.V.

- AeroFarms

- BrightFarms

- Greenlux Lighting Solutions

- Valoya, Inc.

- AGronomic IQ

- Urban Crop Solutions

- Bowery Farming

- AmHydro

- CubicFarm Systems

- Other Key Players