Global Dietary Supplements Market By Type (Vitamins, Botanicals, Minerals, Proteins and Amino Acids, Fibers ans Specialty Carbohydrates, Omega Fatty Acids, Prebiotics and Probiotics, Others), By Form (Tablets, Capsules, Soft Gels, Powders, Gummies, Liquids, Others), By Distribution Channel (Supermarkets/ Hypermarkets, Pharmacies, Specialty Stores, Online Platforms, Others), By Gender (Women, Men), By Application(Energy and Weight Management, General Health, Bone and Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Others), By End-user (Adults, Geriatric, Pregnant Women, Children, Infants), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 23802

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

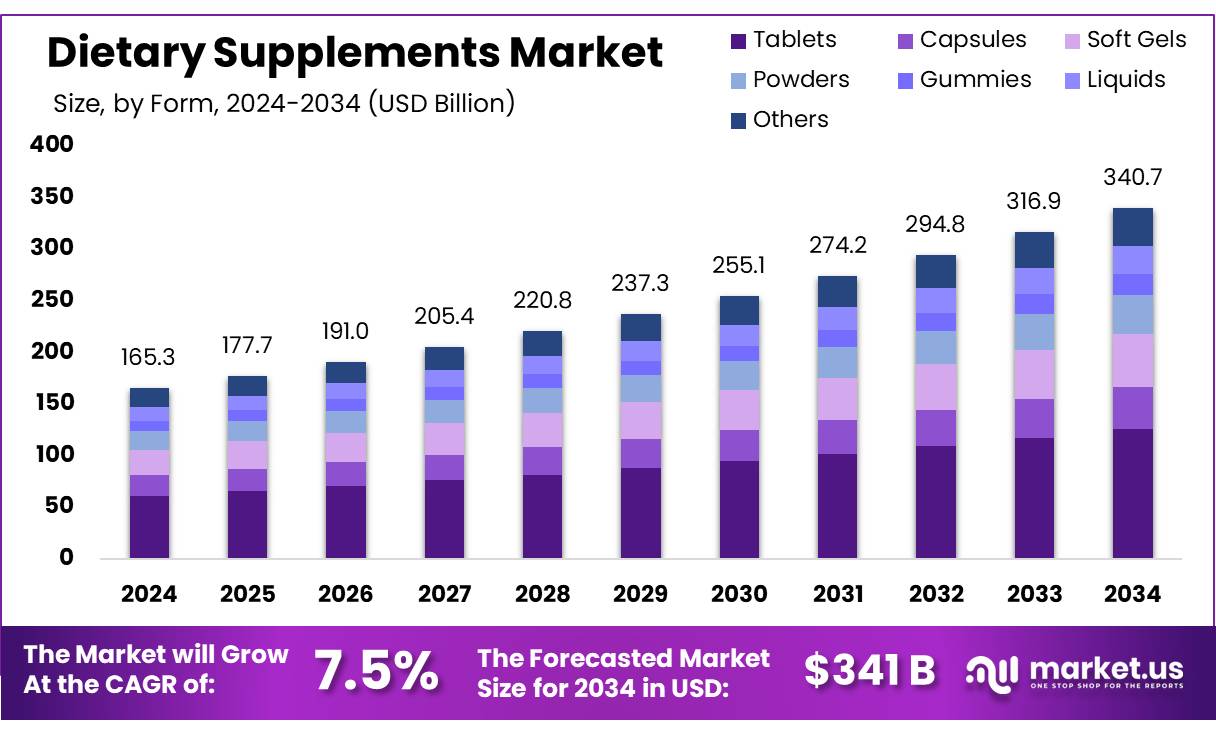

The global dietary supplements market size is expected to be worth around USD 340.7 billion by 2034, from USD 165.3 billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

The global dietary supplements market has experienced significant growth, driven by increasing consumer awareness of health and wellness. These supplements, which include vitamins, minerals, amino acids, probiotics, and herbal products, are designed to enhance diets and promote overall health. In recent years, the market has gained momentum, especially with the heightened focus on immune system support during the COVID-19 pandemic.

The dietary supplements market is growing due to factors like the rising aging population, which faces higher risks of nutrient deficiencies and chronic illnesses. According to the World Health Organization, the global population aged 60 and above is projected to double by 2050, surpassing 2 billion. This shift has driven demand for supplements targeting bone health, cognitive function, and immunity, addressing the specific needs of older adults.

Younger consumers are also contributing to market growth, as awareness of preventive healthcare and fitness trends increases. Innovations in product formulations, such as plant-based supplements and functional foods, have expanded the market’s appeal. Notably, plant-based supplements accounted for around 25% of total sales in 2023, reflecting the growing preference for sustainable and natural products.

The dietary supplements market offers abundant growth opportunities, fueled by advancements in research and development that enable the creation of more bioavailable and targeted formulations. The rise of nutrigenomics, which studies the interaction between nutrition and genes, is opening doors to personalized nutrition. This approach allows consumers to tailor supplements to their genetic profiles and health goals, offering a more customized and effective solution for their well-being.

Additionally, expanding regulatory support for labeling and quality standards is enhancing consumer confidence and product transparency. Emerging markets in regions like Africa and Southeast Asia also present untapped potential, driven by rising health awareness and improving economic conditions. As health and wellness continue to be prioritized globally, the dietary supplements market is set to grow further, solidifying its position as a key player in the health and wellness industry.

Key Takeaways

- Dietary Supplements market size is expected to be worth around USD 340.7 billion by 2034, from USD 165.3 billion in 2024, growing at a CAGR of 7.5%

- Vitamins held a dominant market position in the Dietary Supplements sector, capturing more than a 38.40% share.

- Tablets held a dominant market position in the Dietary Supplements sector, capturing more than a 37.50% share.

- Supermarkets/Hypermarkets held a dominant market position in the Dietary Supplements sector, capturing more than a 48.30% share.

- Energy & Weight Management held a dominant market position in the Dietary Supplements sector, capturing more than a 33.50% share.

- Adults held a dominant market position in the Dietary Supplements sector, capturing more than a 47.30% share.

- Multivitamins are the most commonly used dietary supplements in the US, with over 50% of adults reporting their use.

- In 2022, the FDA warned consumers about the potential for certain dietary supplements to be tainted with undeclared and potentially harmful ingredients.

Type Analysis

Vitamins Segment Holds Largest Share

In 2024, Vitamins held a dominant market position in the Dietary Supplements sector, capturing more than a 38.40% share. This prominence is attributed to the widespread acknowledgment of vitamins’ essential roles in maintaining general health, supporting immune function, and preventing chronic diseases. The surge in consumer health consciousness, particularly heightened by the global health crisis, has further propelled the demand for vitamin supplements as individuals seek to bolster their health proactively.

Botanicals also secured a significant segment of the market. These supplements, which include herbal extracts and natural plant-based products, are favored for their natural origin and perceived lower side effects compared to synthetic drugs.

Proteins & Amino Acids are particularly popular among the fitness and athlete community, supporting muscle repair and growth. The rising trend in fitness and personal health regimes has amplified the demand for these supplements, making it a robust area of growth in the dietary supplements market.

Fibers & Specialty Carbohydrates and Omega Fatty Acids segments are increasingly recognized for their benefits in heart health and digestive health, respectively. The growing body of research supporting the cardiovascular benefits of omega fatty acids and the importance of dietary fiber in maintaining a healthy gut microbiota has contributed to their market strength.

Prebiotics & Probiotics have gained traction due to their effectiveness in enhancing gut health and, subsequently, their impact on overall health, immunity, and even mental health. This has been particularly appealing amidst the rising trends in digestive health and an increasing understanding of the gut-brain axis.

Form Analysis

In 2024, Tablets held a dominant market position in the Dietary Supplements sector, capturing more than a 37.50% share. This preference for tablet form is largely due to their convenience, precise dosage, and extended shelf life. Tablets are favored by consumers seeking a straightforward and efficient means to incorporate supplements into their daily routines. Additionally, the cost-effectiveness of tablets compared to other forms makes them a popular choice among a wide range of demographics.

Capsules also represent a significant portion of the market. Capsules are preferred for their ability to mask the taste of the active ingredients, offering a more palatable option without the need for added flavors or sweeteners. They are particularly popular for oil-based supplements like fish oil, which benefits from the capsule’s protective properties that prevent oxidation.

Soft Gels have seen steady growth, appreciated for their ease of swallowing and faster absorption rates. These are often used for oil-based vitamins such as vitamin D and vitamin E, which are better absorbed in liquid form. Soft gels’ seamless digestion and rapid release make them attractive to consumers focused on immediate results.

Powders form another important segment, offering versatility and customization in dosing that appeals to fitness enthusiasts who prefer to mix their supplements with shakes or smoothies. This format is ideal for protein powders and other formulations that require larger dosages that are impractical to deliver in tablet or capsule form.

Gummies have surged in popularity, particularly among younger demographics and those averse to swallowing pills. This form combines the nutritional benefits of dietary supplements with the appealing taste and convenience of a chewable candy, making it especially popular for vitamins and probiotics.

Liquids are favored for their ease of use and fast absorption, suitable for children and adults who have difficulty with solid supplements. This form is often used for multivitamins and specialty supplements where immediate absorption is desirable.

By Distribution Channel

In 2024, Supermarkets/Hypermarkets held a dominant market position in the Dietary Supplements sector, capturing more than a 48.30% share. This strong market presence can be attributed to the convenience these retail channels offer, allowing consumers to easily access a wide variety of dietary supplements while shopping for other everyday products. Supermarkets and hypermarkets are preferred by consumers for their large product selection, competitive pricing, and the ability to compare different brands and formulations in one place.

Following supermarkets, Online Platforms have become a key distribution channel, growing rapidly as consumers increasingly turn to e-commerce for convenience and home delivery options. The rise of online marketplaces, including platforms like Amazon and specialized health stores, has expanded the reach of dietary supplements, providing consumers with access to a broader range of products than they might find in physical stores.

Pharmacies and Specialty Stores continue to play an essential role as well, particularly for those seeking more personalized advice or specific health-related supplements. Pharmacies often provide trusted brands and offer expert guidance from pharmacists, which makes them a go-to channel for health-conscious consumers looking for premium or medically recommended products. Other channels, including direct sales and multi-level marketing, contribute a smaller portion to the overall market but are still relevant, especially for niche supplement brands and wellness advocates.

By Gender

In the dietary supplements market, products are often tailored specifically for either women or men, reflecting the distinct nutritional needs and health concerns of each gender. As of 2024, the segment for women’s dietary supplements has seen substantial growth, driven by increased awareness of women-specific health issues such as bone density, reproductive health, and menopause. Supplements such as calcium, iron, and folic acid are particularly popular among women, catering to needs that change with different life stages, from childbearing age to post-menopause.

Men’s dietary supplements also hold a significant market share, focusing on heart health, muscle building, and energy support. Products aimed at men often contain vitamins D and B12, zinc, magnesium, and omega-3 fatty acids, which support muscle health, testosterone levels, and cardiovascular health. The growing trend of fitness and a proactive approach to health has spurred more men to integrate dietary supplements into their daily routines to enhance performance and overall well-being.

By Application

In 2024, Energy & Weight Management held a dominant market position in the Dietary Supplements sector, capturing more than a 33.50% share. This segment continues to thrive due to growing consumer awareness around the importance of maintaining an active lifestyle and managing body weight. With rising concerns over sedentary lifestyles, obesity, and lifestyle diseases, energy-boosting and weight management supplements have become popular among consumers seeking to improve their physical performance and overall well-being.

Following closely, General Health supplements also represent a significant portion of the market. As consumers focus more on preventive healthcare, there is a growing trend toward products that support overall well-being and help fill nutritional gaps. The rise in interest around holistic health and self-care is driving the demand for supplements that aid in maintaining vitality and balance throughout the day.

Bone & Joint Health, Immunity, and Cardiac Health are seeing steady growth, driven by an aging population and increased attention to long-term health management. With many people becoming more health-conscious, particularly post-pandemic, supplements that support immune function, joint health, and heart health are gaining traction across all age groups.

By End-use

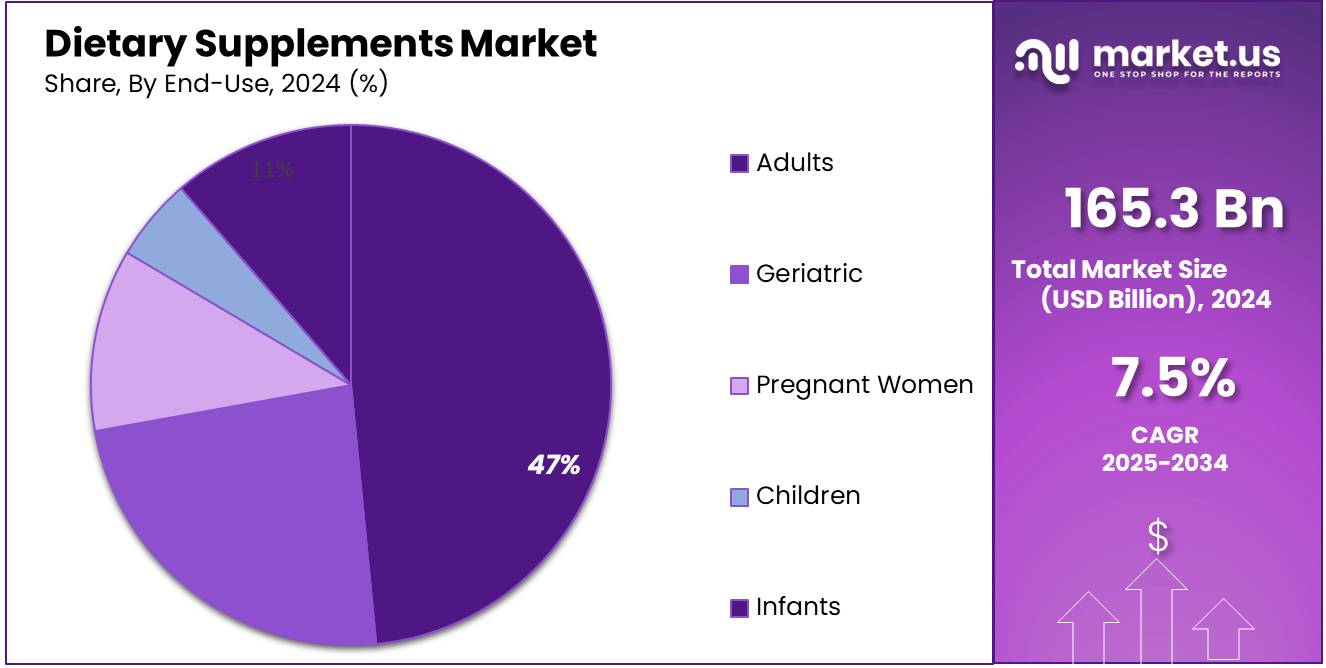

In 2024, Adults held a dominant market position in the Dietary Supplements sector, capturing more than a 47.30% share. This segment’s growth is driven by a growing focus on preventive healthcare, fitness, and overall well-being among adult consumers. With increasing awareness of the importance of maintaining a balanced diet, many adults are turning to supplements to fill nutritional gaps, support immunity, manage weight, and enhance energy levels. Popular categories include multivitamins, minerals, proteins, and supplements aimed at improving mental clarity and reducing stress.

Geriatric segment also saw strong demand, driven by the aging population’s need to address specific health concerns such as bone density, heart health, and cognitive function. The rise in chronic conditions and the desire to maintain quality of life in older age groups has made supplements targeting this demographic increasingly essential. Similarly, Pregnant Women accounted for a significant portion of the market, as prenatal vitamins and minerals are crucial for both maternal and fetal health.

Key Market Segments

By Type

- Vitamins

- Botanicals

- Minerals

- Proteins & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Prebiotics & Probiotics

- Others

By Form

- Tablets

- Capsules

- Soft Gels

- Powders

- Gummies

- Liquids

- Others

By Distribution Channel

- Supermarkets/ Hypermarkets

- Pharmacies

- Specialty Stores

- Online Platforms

- Others

By Gender

- Women

- Men

By Application

- Energy & Weight Management

- General Health

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-cancer

- Others

By End-user

- Adults

- Geriatric

- Pregnant Women

- Children

- Infants

Driving Factors

Increasing Health Consciousness and Preventive Healthcare

This trend is particularly strong in developed markets like North America and Europe, where the aging population and increasing healthcare costs are pushing individuals to seek out alternatives to traditional medicine. According to the World Health Organization (WHO), the global shift toward healthier lifestyles has been evident, with more than 60% of people in the U.S. and Europe now taking dietary supplements regularly. These trends are being fueled by various factors, including rising awareness about the importance of preventive healthcare, access to online health information, and the increasing popularity of wellness influencers on social media.

In 2024, dietary supplements are being seen as an essential tool in combating common health issues like chronic fatigue, joint pain, and mental stress, among others. A notable example of this is the surge in immunity-boosting supplements, especially since the COVID-19 pandemic heightened public awareness of the need to maintain strong immune systems. According to the National Institutes of Health (NIH), products like vitamin D, vitamin C, and zinc supplements saw a dramatic rise in usage, with vitamin D consumption increasing by 12% between 2020 and 2023 in the U.S. alone

Another important aspect contributing to the rise in dietary supplement use is the growing awareness of the role nutrition plays in managing chronic diseases such as heart disease, diabetes, and osteoarthritis. As reported by the American Heart Association (AHA), individuals are increasingly turning to supplements like omega-3 fatty acids and magnesium to support cardiovascular health, with omega-3 supplements alone accounting for over $5 billion in sales annually in the U.S.

Restraining Factors

Regulatory Challenges

The dietary supplements market faces significant growth hurdles, primarily due to stringent regulatory challenges across various regions. These regulations are primarily aimed at ensuring safety and efficacy of supplements but often result in prolonged product approval times and increased production costs.

Europe also has its stringent norms governed by the European Food Safety Authority (EFSA), which demands a comprehensive safety assessment and clear labeling before any supplement can be sold in the market. These regulations, while ensuring consumer safety, also limit the speed with which products can reach the market.

Moreover, the regulatory environment is not uniform globally, which presents additional challenges for manufacturers aiming to expand into international markets. Each country has its own set of compliance requirements, making it difficult for companies to launch their products worldwide without facing substantial regulatory hurdles and associated costs.

Government initiatives aimed at tightening the control on supplement safety are also becoming more prevalent. For instance, initiatives like the National Institutes of Health (NIH) Office of Dietary Supplements (ODS) provide resources and funding for research into the safety and efficacy of dietary supplements, further shaping the regulatory landscape.

On the humane side, these regulations are fundamentally aimed at protecting consumers. Stories abound of individuals who have suffered due to poorly regulated supplements, driving home the need for such oversight. These regulatory frameworks are not just bureaucratic hurdles; they are essential measures that safeguard public health by ensuring that only safe and effective products are available to consumers.

Opportunities

Expansion in Personalized Nutrition

Personalized nutrition is grounded in the understanding that different individuals have varied nutritional requirements based on their genetic profiles, lifestyles, and health conditions. This customized approach is rapidly gaining popularity, particularly among health-conscious consumers seeking targeted health outcomes. According to the National Institutes of Health (NIH), personalized nutrition could play a pivotal role in preventing and treating diseases such as obesity, diabetes, and heart disease by aligning individual health needs with specific dietary practices.

The interest in personalized nutrition is not just a fleeting trend. A survey conducted by the Council for Responsible Nutrition (CRN) showed that over 77% of U.S. adults consume dietary supplements, and a significant portion of these consumers are increasingly inclined towards personalized supplement solutions. This presents a lucrative opportunity for supplement manufacturers to innovate and expand their product lines to include personalized supplement packs, which could significantly boost market growth.

Moreover, the advent of digital health technology has made it easier for consumers to access personalized nutrition plans. Apps and online platforms use algorithms to analyze personal health data and provide customized dietary and supplement recommendations. These technologies not only enhance consumer engagement but also help in tracking health outcomes, thereby improving the effectiveness of personalized nutrition strategies.

Government initiatives also support the growth of personalized nutrition. The U.S. Food and Drug Administration (FDA) has launched the “New Era of Smarter Food Safety” initiative which includes a blueprint mentioning personalized nutrition as a key component for the future of food medicine. This initiative highlights the potential of using technology in food and dietary supplement sectors to cater to individual health needs effectively.

From a humane perspective, personalized nutrition represents a compassionate approach to health care. It acknowledges the unique health journeys of individuals and provides them with tools and solutions that are specifically designed to improve their quality of life. This personal touch not only enhances the effectiveness of dietary supplements but also builds a deeper trust between consumers and supplement providers.

Trending Factors

Rising Demand for Plant-Based Supplements

The trend towards plant-based diets has been bolstered by data suggesting a significant portion of the population is moving away from animal products. According to a report by the United Nations Food and Agriculture Organization (FAO), there is a global trend of rising plant-based consumption as part of a sustainable diet that minimizes environmental impact. This dietary shift is not only influencing food choices but also the selection of supplements.

The plant-based supplement market is particularly appealing to millennials and Gen Z consumers, who are more likely to prioritize sustainability and ethical considerations in their purchasing decisions. These demographics are increasingly opting for supplements that are not only beneficial to their health but also align with their values concerning environmental conservation and animal welfare.

This consumer shift has encouraged supplement manufacturers to innovate and expand their range of plant-based products. These products often come with claims of being organic, non-GMO, and free from artificial additives, making them particularly attractive to health-conscious consumers. Additionally, advancements in extraction and processing technologies have improved the bioavailability and efficacy of plant-based supplements, making them competitive with their synthetic counterparts.

Governmental and non-profit organizations are also supporting the shift towards plant-based nutrition. Initiatives like the “Plant Forward” campaign by the U.S. Department of Agriculture (USDA) promote plant-based diets for their health and environmental benefits. Such initiatives not only raise consumer awareness but also support the growth of the plant-based supplement market by reinforcing the health credentials of plant-based diets.

From a humane perspective, the choice of plant-based supplements reflects a caring approach towards personal health and the health of the planet. Consumers are increasingly making choices that help reduce their carbon footprint and promote a more sustainable and ethical food system. This trend is about more than just personal health; it’s about making decisions that contribute to a collective wellbeing.

The market’s enthusiasm for plant-based supplements is evident in the proliferation of products and increased investment in the sector. Companies are responding to consumer demand by expanding their plant-based offerings and ensuring that these products are accessible across various retail channels.

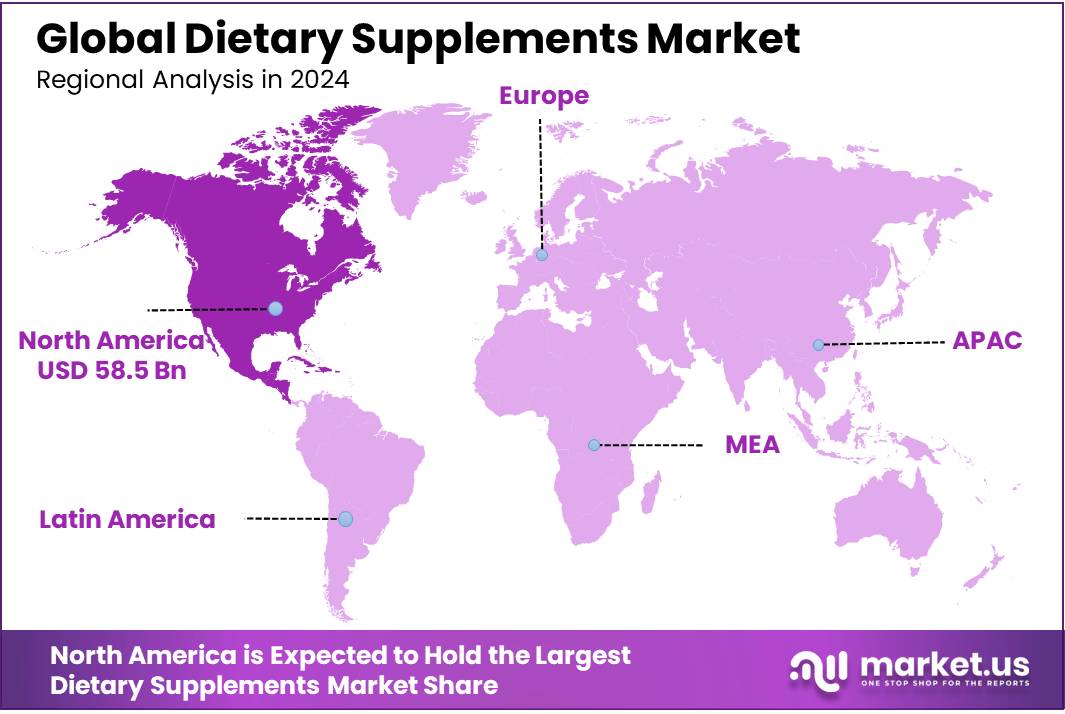

Regional Analysis

North America Holds Largest Market Share

The dietary supplements market exhibits substantial growth across various regions, with North America leading the industry. North America dominates the global dietary supplements market, accounting for 35.40% of the total share, valued at approximately USD 58.5 billion. The region’s dominance is driven by high consumer awareness, increasing adoption of personalized nutrition, and the presence of key market players. The U.S. leads in supplement consumption, supported by a well-established regulatory framework under the FDA and growing preference for functional nutrition.

Europe is another significant market, benefiting from stringent regulations by the European Food Safety Authority (EFSA) that ensure product quality and consumer safety. Germany, the UK, and France contribute significantly to market growth due to rising health consciousness and increasing demand for botanical and probiotic supplements. The market is further supported by an aging population seeking preventive healthcare solutions.

Asia Pacific is witnessing the fastest growth due to increasing disposable incomes, urbanization, and a rising middle-class population. Countries such as China, Japan, and India are key contributors, with China emerging as a major hub for herbal and traditional supplements. The region’s demand is also fueled by government initiatives promoting nutritional well-being.

The Middle East & Africa region is experiencing steady growth, particularly in Gulf countries, where rising health awareness and the expansion of the wellness industry are driving demand. Latin America, led by Brazil and Mexico, is expanding due to increasing fitness trends and a growing preference for natural supplements. Overall, North America remains the dominant market, while Asia Pacific shows the highest growth potential.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The dietary supplements market is highly competitive, with several leading global players driving innovation and market expansion. Nestlé S.A., Amway Corporation, and Abbott Laboratories are among the dominant companies, leveraging extensive research and development capabilities to offer high-quality nutritional supplements.

Pfizer Inc., a pharmaceutical giant, has strengthened its presence in the dietary supplements sector with science-backed products, while Herbalife International of America, Inc. and Nu Skin Enterprises, Inc. focus on direct selling models, making their products widely accessible to consumers. Nature’s Sunshine Products, Inc. and NOW Foods cater to the increasing demand for plant-based and organic supplements, further diversifying the market landscape.

Other notable players such as Bayer AG, Glanbia PLC, and ADM have established strong footholds through product innovation and strategic acquisitions. Koninklijke DSM N.V. plays a crucial role in ingredient supply, offering advanced nutritional solutions to supplement manufacturers worldwide.

Sabinsa Corporation is recognized for its research-driven approach to herbal extracts, catering to the growing demand for Ayurveda and natural supplements. Sanofi S.A. and Procter & Gamble have leveraged their extensive consumer healthcare portfolios to expand their dietary supplement offerings.

Market Key Players

- Amway Corporation

- Abbott Laboratories

- Nestlé S.A.

- ADM

- Pfizer Inc.

- Herbalife International of America, Inc.

- Nu Skin Enterprises, Inc.

- Nature’s Sunshine Products, Inc.

- Bayer AG

- Glanbia PLC

- Sabinsa Corporation

- Sanofi S.A.

- NOW Foods

- Procter & Gamble

- Koninklijke DSM N.V.

- Other Key Players

Recent Developments

- In 2024, Nestlé S.A. reported sales of CHF 45.0 billion, a 2.7% decrease from CHF 46.3 billion in the same period of 2023.

- In 2024, Philips continued to advance its technology, emphasizing energy efficiency and sustainability, crucial factors for modern agriculture practices.

- In 2024, Vitamins held a dominant market position in the Dietary Supplements sector, capturing more than a 38.40% share.

Report Scope

Report Features Description Market Value (2024) US$ 163.3 Bn Forecast Revenue (2034) US$ 340.7 Bn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2022 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Vitamins, Botanicals, Minerals, Proteins and Amino Acids, Fibers ans Specialty Carbohydrates, Omega Fatty Acids, Prebiotics and Probiotics, Others), By Form (Tablets, Capsules, Soft Gels, Powders, Gummies, Liquids, Others), By Distribution Channel (Supermarkets/ Hypermarkets, Pharmacies, Specialty Stores, Online Platforms, Others), By Gender (Women, Men), By Application(Energy and Weight Management, General Health, Bone and Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Others), By End-user (Adults, Geriatric, Pregnant Women, Children, Infants) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Amway Corporation, Abbott Laboratories , Nestlé S.A., ADM, Pfizer Inc., Herbalife International of America, Inc., Nu Skin Enterprises, Inc., Nature’s Sunshine Products, Inc., Bayer AG, Glanbia PLC, Sabinsa Corporation, Sanofi S.A., NOW Foods, Procter & Gamble, Koninklijke DSM N.V., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amway Corporation

- Abbott Laboratories

- Nestlé S.A.

- ADM

- Pfizer Inc.

- Herbalife International of America, Inc.

- Nu Skin Enterprises, Inc.

- Nature's Sunshine Products, Inc.

- Bayer AG

- Glanbia PLC

- Sabinsa Corporation

- Sanofi S.A.

- NOW Foods

- Procter & Gamble

- Koninklijke DSM N.V.

- Other Key Players