Global Packed Pickles Market Size, Share, And Business Benefits By Product (Fruit, Vegetable, Meat and sea food), By Pickle Type (Cucumber Pickles, Gherkins, Onion Pickles, Mixed Pickles, Relishes), By Packaging Type (Glass Jars, Plastic Jars, Pouches, Cans), By Flavor (Dill, Sweet, Bread and Butter, Spicy, Mustard), By End-User (Household, Food Service, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137372

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Packed Pickles Market

- By Product Analysis

- By Pickle Type Analysis

- By Packaging Type Analysis

- By Flavor Analysis

- By End-User Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

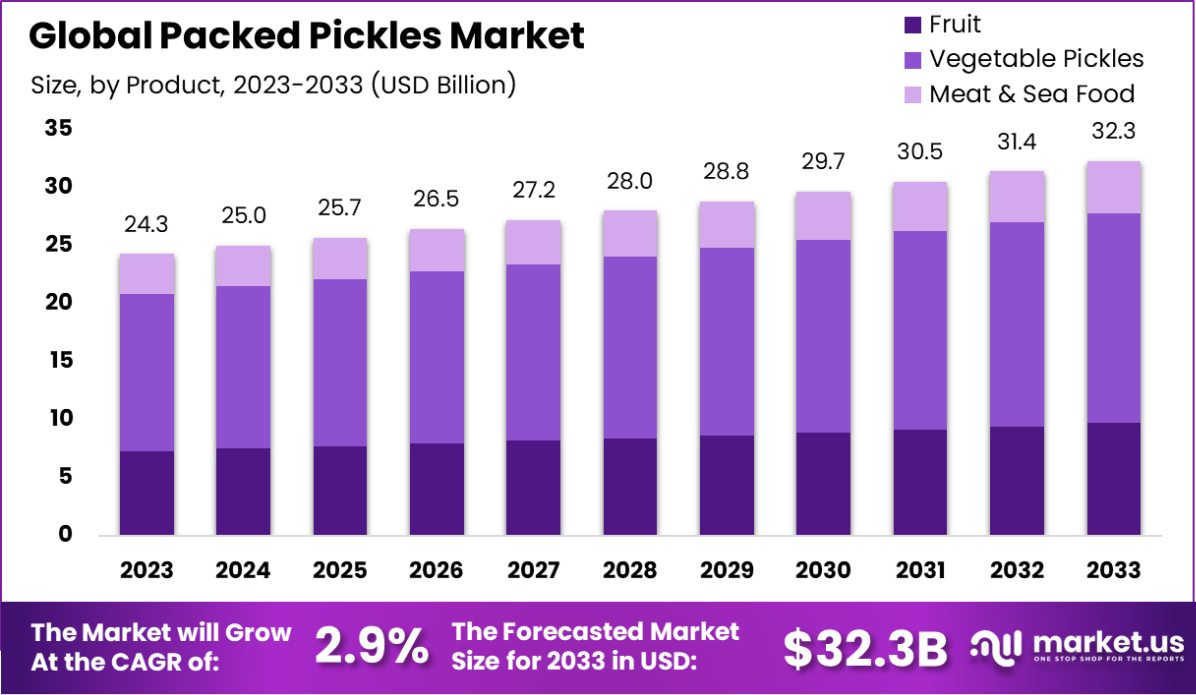

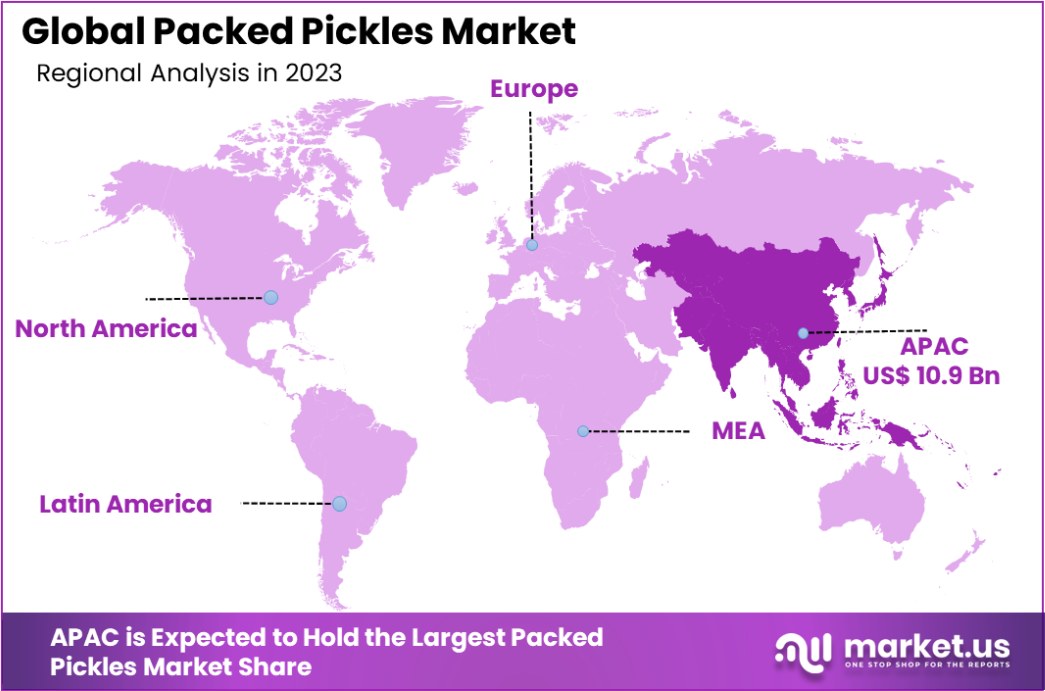

The Global Packed Pickles Market is expected to be worth around USD 32.3 Billion by 2033, up from USD 24.3 Billion in 2023, and grow at a CAGR of 2.9% from 2024 to 2033. The Asia-Pacific Packed Pickles Market holds a 45.2% share, valued at USD 10.9 billion.

The packed pickles market represents a dynamic segment of the global processed food industry, characterized by consistent consumer demand for preserved and flavorful food options. The industry has witnessed robust growth, propelled by urbanization, changing dietary preferences, and the growing demand for ready-to-eat condiments.

Pickles, traditionally consumed in homemade forms, have now transitioned into a convenient packaged format due to advancements in food preservation technologies and a shift towards branded and hygienically processed products.

Key drivers for the packed pickles market include increasing awareness of traditional and ethnic flavors in global cuisines, the rapid expansion of organized retail, and the rise in disposable incomes.

Additionally, the availability of a diverse range of pickled products—vegetables, fruits, meats, and spices—caters to a broad spectrum of consumer preferences. Innovations in packaging, including resealable jars and eco-friendly materials, are further boosting consumer convenience and sustainability.

Emerging trends indicate a growing preference for organic, low-sodium, and sugar-free pickle variants, aligning with health-conscious consumer behavior. Moreover, the rising prominence of e-commerce platforms has enabled manufacturers to reach wider audiences, particularly in untapped rural and semi-urban markets.

Initiatives encouraging food exports have also contributed to the global visibility of region-specific pickled products, particularly from markets in Asia and Europe.

Future growth opportunities lie in expanding premium product offerings and leveraging digital marketing strategies to enhance brand visibility. Incorporating functional ingredients such as probiotics into pickled products could further align with the health and wellness trend, presenting significant innovation potential.

The Packed Pickles Market is witnessing significant growth, driven by increasing consumer preference for convenient, ready-to-eat food products coupled with a rising awareness of the health benefits associated with fermented foods. Pickled vegetables, rich in probiotics and essential nutrients, are gaining traction among health-conscious consumers.

According to the National Institutes of Health (NIH), regular consumption of pickled vegetables has notable health benefits. For instance, consuming 0-0.5 kg/month is associated with a 23% reduced risk of diabetes (Odds ratio: 0.77, 95% CI: 0.63, 0.94). Higher consumption, exceeding 0.5 kg/month, further reduces the risk by 63% (Odds ratio: 0.37, 95% CI: 0.23, 0.60).

Additionally, fermented bean curd consumption contributes to a 32% reduction in diabetes risk (Odds ratio: 0.68, 95% CI: 0.55, 0.84). These findings underscore the potential for packed pickles to position themselves as both a flavorful and health-enhancing product in the competitive packaged food market.

Key Takeaways

- The Global Packed Pickles Market is expected to be worth around USD 32.3 Billion by 2033, up from USD 24.3 Billion in 2023, and grow at a CAGR of 2.9% from 2024 to 2033.

- Packed pickles market sees vegetable pickles leading, capturing 56.5% of the total share.

- Cucumber pickles dominate the packed pickles market, holding a substantial 29.8% share globally.

- Glass jars emerge as the preferred choice for packed pickles, representing 49.1% market share.

- Dill flavor remains the top consumer favorite in packed pickles, contributing to 38.1% of market sales.

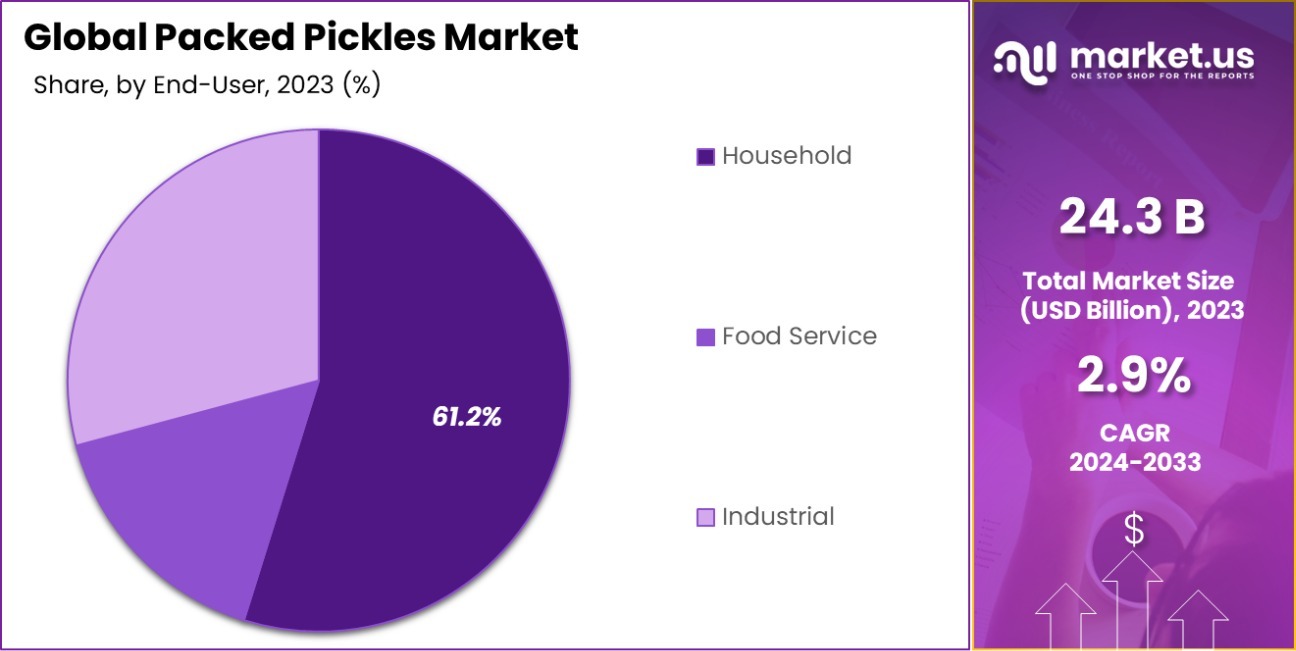

- Household consumption drives the packed pickles market, with a dominant 61.2% share across segments.

- Supermarkets and hypermarkets dominate distribution, accounting for 46.8% of packed pickles’ global sales share.

- In Asia-Pacific, the Packed Pickles Market holds 45.2%, reaching USD 10.9 billion.

Business Benefits of Packed Pickles Market

The business benefits of the packed pickles market, as reflected in various government reports, highlight several key advantages. The USDA standards for grading pickles, including fresh-pack and refrigerated types, ensure product quality and consumer safety, which are crucial for maintaining public trust and supporting consistent sales.

Innovations in pickle processing have enhanced the market life of products, making them more appealing on shelves. Techniques such as optimizing pasteurization temperatures to retain desirable qualities in pickles have improved product quality and extended market life, which in turn helps businesses by reducing waste and enhancing customer satisfaction.

Moreover, the health benefits associated with fermented pickles, such as being low in calories and a good source of vitamin K, add a significant marketing advantage. The ability to promote these health benefits can attract health-conscious consumers, thus broadening the market base.

Overall, adherence to strict grading standards and the ongoing improvements in processing methods not only ensure product safety and quality but also aid in prolonging shelf-life, reducing costs, and appealing to a diverse customer base, which collectively contributes to the robust growth and profitability of the packed pickles sector.

By Product Analysis

Vegetable pickles dominate the packed pickles market with a 56.5% share globally.

In 2023, Vegetable Pickles held a dominant market position in the “By Product” segment of the Packed Pickles Market, capturing a 56.5% share. This segment outperformed others due to increasing consumer preference for vegetarian diets and the versatility of vegetable pickles in various cuisines.

Following Vegetable Pickles, Fruit Pickles also carved out a significant niche, securing 30.2% of the market. This category benefits from the rising popularity of exotic and traditional fruit-based pickles in both developed and emerging markets, which cater to a diverse taste preference and cultural affinity for fruit-based condiments.

The Meat and Seafood Pickles segment accounted for the remainder, holding a 13.3% share of the market. Despite its smaller proportion, this segment is experiencing steady growth, driven by a strong consumer base in regions with a historical preference for non-vegetarian foods.

Innovations in flavor and preservation techniques are helping to boost its appeal among younger demographics and in new geographic markets. As consumer eating habits continue to evolve, the dynamics within the By Product segment of the Packed Pickles Market are expected to shift, potentially leading to new opportunities for market expansion and product innovation.

By Pickle Type Analysis

Cucumber pickles account for 29.8%, showcasing their popularity among consumers.

In 2023, Cucumber Pickles held a dominant market position in the “By Pickle Type” segment of the Packed Pickles Market, with a 29.8% share. This segment benefits from the widespread popularity and traditional consumption of cucumber pickles in various global cuisines, making it a staple in households and food services alike. Following closely, Gherkins captured a 26.5% market share, appealing particularly to consumers looking for crunchy, mild flavors in their condiments.

Onion Pickles also made a significant impact, securing a 20.1% share. This segment is supported by the strong flavor profile of onion pickles, which are often favored in bold and spicy culinary dishes. Mixed Pickles followed with a 15.3% share, favored for their variety and the ability to complement multiple dishes, thus catering to diverse consumer palates.

Lastly, Relishes held an 8.3% share, which, while smaller, is integral in specific regional diets, particularly in Western cuisines where they are commonly used as spreads and flavor enhancers for sandwiches and burgers.

These diverse preferences underscore the dynamic nature of consumer tastes within the Packed Pickles Market, highlighting opportunities for product innovation and market expansion based on regional flavor trends and eating habits.

By Packaging Type Analysis

Glass jars lead, holding a 49.1% share, preferred for their preservation benefits.

In 2023, Glass Jars held a dominant market position in the “By Packaging Type” segment of the Packed Pickles Market, with a 49.1% share. This preference for glass jars stems from consumer perceptions of quality, purity, and sustainability, as glass packaging is widely regarded as safer and more eco-friendly than other materials.

Plastic Jars followed with a 27.4% market share, favored for their cost-effectiveness and lighter weight, which reduces shipping costs and appeals to manufacturers looking to optimize logistics.

Pouches captured a 14.5% share of the market. Their rise in popularity is linked to the convenience they offer, including easy storage and portability, making them an attractive option for younger demographics and busy consumers. Lastly, Cans held a 9% share. While less popular, cans provide significant shelf life and durability, crucial attributes for long-term storage and stability in various environmental conditions.

These packaging preferences highlight significant trends in the Packed Pickles Market, where sustainability and convenience continue to shape consumer choices and influence product packaging innovations. Companies are thus incentivized to explore biodegradable and recyclable materials to align with consumer expectations and regulatory requirements.

By Flavor Analysis

Dill-flavored pickles are the top choice, capturing 38.1% of the market demand.

In 2023, Dill held a dominant market position in the “By Flavor” segment of the Packed Pickles Market, with a 38.1% share. This preference for dill flavoring is attributed to its classic, aromatic taste, which is both versatile and popular among consumers who appreciate traditional pickle flavors. Sweet pickles followed with a 25.2% share, capitalizing on the tastes of those who prefer a milder, sugary flavor profile, especially in North American and some Asian markets.

Bread and Butter pickles secured a 17.6% market share, favored for their distinct sweet and tangy taste, making them a popular choice for sandwiches and burgers. Spicy pickles garnered a 12.7% share, appealing particularly to consumers with a preference for bold flavors, common in regions such as South Asia and Latin America.

Lastly, Mustard pickles accounted for 6.4% of the market. This niche segment attracts customers looking for the sharp and tangy taste mustard seeds provide, commonly used in European cuisines.

These flavor preferences underscore the varied palate of the global consumer base in the Packed Pickles Market, indicating strong potential for innovation and regional product customization to cater to evolving taste preferences and dietary trends.

By End-User Analysis

Households constitute the largest consumer segment, representing 61.2% of total sales.

In 2023, Household held a dominant market position in the “By End-User” segment of the Packed Pickles Market, with a 61.2% share. This segment’s strong performance is largely due to the increasing consumer interest in home cooking and the rising popularity of pickles as a versatile ingredient in various culinary traditions.

The household segment benefits from the wide availability of pickles in grocery stores and supermarkets, catering to the needs of home chefs looking for quality, convenience, and flavor enhancement in their meals.

Food Service followed, capturing a 24.5% share of the market. Restaurants and cafés leverage pickles to add distinct flavors to their dishes, appealing to diners’ evolving taste preferences for artisan and niche food options.

Lastly, the Industrial segment accounted for a 14.3% share, driven by the use of pickles in packaged food products, including ready meals and snack foods, where they are used as flavor enhancers and ingredient staples.

The robust demand across these end-user segments illustrates the integral role of pickles in both home and commercial food preparations, highlighting opportunities for growth in product range and distribution channels to meet diverse consumer demands.

By Distribution Channel Analysis

Supermarkets and hypermarkets dominate distribution, accounting for 46.8% of overall sales.

In 2023, Supermarkets and Hypermarkets held a dominant market position in the “By Distribution Channel” segment of the Packed Pickles Market, with a 46.8% share. This channel’s success is attributed to the extensive variety and accessibility of pickle products offered, catering to consumers seeking both choice and convenience in their shopping experiences.

These retail giants continue to attract a significant customer base by providing competitive pricing, promotions, and one-stop shopping solutions.

Grocery Stores followed with a 22.1% market share, favored for their local presence and familiarity, especially in urban and suburban areas where consumers prefer quick access to daily essentials, including pickles. Convenience Stores captured a 16.4% share, benefiting from their strategic locations and extended hours, which appeal to consumers looking for immediate purchases.

Online Retailers are also gaining ground, securing 10.2% of the market. This growth is driven by the increasing trend of digital shopping, offering convenience and the ability to easily compare prices and products. Lastly, food service accounted for 4.5% of the market, primarily serving pickles directly to consumers within dining and hospitality settings.

This diverse landscape highlights the importance of multi-channel marketing strategies to cater to varying consumer shopping preferences and behaviors in the Packed Pickles Market.

Key Market Segments

By Product

- Fruit

- Vegetable Pickles

- Meat and sea food

By Pickle Type

- Cucumber Pickles

- Gherkins

- Onion Pickles

- Mixed Pickles

- Relishes

By Packaging Type

- Glass Jars

- Plastic Jars

- Pouches

- Cans

By Flavor

- Dill

- Sweet

- Bread and Butter

- Spicy

- Mustard

By End-User

- Household

- Food Service

- Industrial

By Distribution Channel

- Supermarkets and Hypermarkets

- Grocery Stores

- Convenience Stores

- Online Retailers

- Foodservice

- Others

Driving Factors

Increasing Consumer Demand for Convenient Food Options

The growing preference for convenience in meal preparation and consumption drives demand in the Packed Pickles Market. Consumers, especially those with busy lifestyles, seek quick, flavorful additions to their meals.

Packed pickles offer an easy, ready-to-use solution that enhances flavors without the time-consuming process of traditional pickling, making them a popular choice for both meal prep and instant consumption.

Rising Popularity of Ethnic Cuisines Globally

As global cuisines become more intertwined, the demand for authentic and diverse flavors rises. Packed pickles, integral to many ethnic dishes, have seen increased popularity as consumers explore more international foods.

This trend is supported by demographic shifts and the expansion of multicultural populations, especially in urban areas, driving the growth of the market as consumers seek to replicate traditional flavors at home.

Enhanced Focus on Health-Conscious Food Choices

Health awareness has significantly influenced consumer preferences, leading to a surge in demand for products like packed pickles, known for their probiotic qualities and low-calorie profiles.

Consumers are increasingly drawn to foods that offer health benefits, including better digestion and improved gut health, making pickles a preferred choice for health-conscious individuals looking to add nutritious yet flavorful options to their diet.

Restraining Factors

High Sodium Content in Pickles is Restraining Growth

Packed pickles often contain high sodium levels, which pose health risks such as hypertension, heart disease, and kidney problems. This has led to concerns among health-conscious consumers, reducing their preference for pickled products. Additionally, increasing awareness campaigns about the adverse effects of excessive salt intake further discourage buyers.

Regulatory bodies imposing stricter sodium limits on packaged foods are adding compliance challenges for manufacturers. These factors are collectively slowing market growth, as brands struggle to balance taste with healthier, low-sodium formulations.

Limited Shelf Life is Restricting Market Expansion

Packed pickles, despite preservatives, face challenges due to their limited shelf life. Exposure to air, moisture, or improper storage can lead to spoilage, reducing product quality and consumer trust. Retailers often hesitate to stock large volumes due to potential losses from expired goods.

This shelf-life limitation also hampers the export potential of pickles, particularly to distant markets. Manufacturers are exploring advanced packaging solutions, but high costs deter many players, making this a significant barrier to broader market growth.

Cultural and Regional Preferences Affect Market Demand

Pickles are deeply rooted in cultural and regional preferences, which vary widely across the globe. What appeals to one region’s palate might not resonate with another. This diversity limits the scalability of packed pickle products, as brands must cater to localized tastes.

Additionally, traditional homemade pickles often hold a strong cultural preference, overshadowing commercial alternatives. As a result, the market faces hurdles in standardizing products that can achieve universal appeal while respecting cultural authenticity.

Growth Opportunity

Expansion into Emerging Markets with Rising Middle Class

Emerging markets present significant growth opportunities for the Packed Pickles Market, driven by the rising middle class with increasing disposable income. As these consumers seek more varied and convenient dietary options, there is a growing opportunity to introduce packed pickles as a staple condiment.

Tailoring flavors to local tastes and investing in regional marketing strategies can help brands capture this expanding customer base and foster long-term loyalty.

Development of Innovative Flavor Combinations

There is a growing trend towards unique and bold flavors in the food industry. By developing innovative pickle flavors that combine traditional and exotic ingredients, manufacturers can attract adventurous eaters and food enthusiasts.

This approach not only differentiates products in a crowded market but also caters to younger demographics looking for new taste experiences. Such innovations can potentially open new segments within the market, increasing consumer interest and sales.

Leveraging E-commerce Platforms for Direct Distribution

The rise of online shopping offers a lucrative growth opportunity for the Packed Pickles Market. By leveraging e-commerce platforms, brands can reach a wider audience, improve consumer convenience, and reduce dependency on traditional retail channels.

Establishing a robust online presence, coupled with effective digital marketing strategies, can enhance brand visibility and drive direct sales, particularly among tech-savvy consumers who prefer shopping online.

Latest Trends

Increasing Adoption of Organic and Non-GMO Pickle Products

Consumers are becoming more health-conscious and environmentally aware, leading to a rising demand for organic and non-GMO-packed pickles. This trend reflects a broader shift towards natural and safer food ingredients, with consumers willing to pay a premium for products that are free from synthetic chemicals and genetically modified organisms.

Manufacturers are responding by expanding their product lines to include organic options, thereby catering to this growing segment and enhancing their brand image as health-oriented and eco-friendly.

Surge in Plant-Based and Vegan Pickle Varieties

The global shift towards plant-based diets has influenced the packed pickles market, with an increased introduction of vegan-friendly pickle products. These pickles ensure that all ingredients, including the brine and flavorings, are free from animal-derived substances, aligning with vegan and vegetarian dietary preferences.

This trend not only appeals to vegans but also to a broader audience looking to reduce meat consumption due to health or environmental reasons, expanding the market base significantly.

Integration of Ethnic and Fusion Flavors

As culinary borders blur, there is a notable trend towards ethnic and fusion flavors in the packed pickles market. Manufacturers are experimenting with a mix of traditional and novel ingredients to create unique flavor profiles that cater to a culturally diverse consumer base.

This includes launching products inspired by global cuisines such as Korean, Indian, and Middle Eastern. Such innovations meet the increasing consumer appetite for new and exotic tastes, driving interest and consumption in the packed pickles category.

Regional Analysis

In 2023, Asia-Pacific dominated the Packed Pickles Market with a 45.2% share, valued at USD 10.9 billion.

The Packed Pickles Market exhibits significant regional diversification, with Asia-Pacific leading the market share at 45.2%, equivalent to USD 10.9 billion. This region’s dominance is driven by a deep-rooted cultural affinity for pickled foods in diets across countries like China, India, and Japan, where pickles are an essential part of daily meals.

North America also holds a substantial market segment, primarily due to the increasing consumer demand for organic and naturally fermented pickles, aligning with the growing health consciousness among American and Canadian consumers.

Europe follows closely, with a strong preference for traditional flavors such as dill and gherkin, supported by local production in Eastern Europe and Scandinavia. The market in this region is bolstered by the high demand in Germany, the UK, and France.

Meanwhile, the Middle East & Africa, and Latin America are emerging as growth areas, driven by increasing urbanization and the expanding presence of international food retailers. These regions are experiencing a surge in demand for convenience foods, including packed pickles, which are being incorporated more frequently into local cuisines, reflecting a blend of traditional tastes with new, global flavors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Packed Pickles Market remains highly competitive, with key players strategically positioning themselves to capture larger market shares and cater to diverse consumer preferences. ADF Foods Limited continues to expand its footprint by offering a wide range of traditional and innovative pickle products, catering to both domestic and international markets. Their emphasis on quality and adherence to authentic recipes has helped solidify their position.

Angel Camacho Alimentación, S.L., known for its commitment to sustainable practices, leverages its expertise in organic pickle production to meet the growing consumer demand for eco-friendly and healthy food options. The company’s ability to adapt to consumer trends without compromising on traditional flavors is a key factor in its enduring market presence.

Bennett Opie Ltd. capitalizes on its long-standing history and reputation in the UK, focusing on heritage products that appeal to a segment of consumers looking for premium, artisanal pickles. Their strategic marketing and distribution efforts have enabled them to maintain a strong position in competitive markets.

Companies like Conagra Brands, Inc. and Del Monte Foods, Inc. have successfully utilized their extensive distribution networks to ensure the widespread availability of their products, enhancing brand visibility and consumer accessibility. These corporations have also been agile in their product offerings, frequently introducing low-sodium and no-sugar-added options to appeal to health-conscious consumers.

Emerging players like Freestone Pickle Company and Desai Foods Private Limited are making significant inroads by focusing on niche markets and specialized products, such as regionally flavored pickles, which resonate well with local palates and dietary habits.

Larger conglomerates like Kraft Heinz and Nestle S.A. continue to dominate by leveraging their global reach, extensive R&D capabilities, and marketing prowess to innovate and meet the evolving tastes and preferences of consumers worldwide. Their focus on branding and consumer engagement through digital platforms has also been pivotal in maintaining their market dominance.

Top Key Players in the Market

- ADF Foods Limited

- Angel Camacho Alimentación, S.L.

- Bennett Opie Ltd.

- Columbia Valley Family Farms

- Conagra Brands, Inc.

- Del Monte Foods, Inc.

- Desai Foods Private Limited

- Freestone Pickle Company

- G.D. Foods Mfg. (India) Pvt. Ltd.

- Kraft Heinz

- Maille .

- Mitoku Company Ltd

- Mt. Olive Pickle Company, Inc.

- Nestle S.A.

- Nilons Enterprises Pvt Ltd

- Orkla ASA

- Peter Piper’s Pickle Palace Inc.

- Pinnacle Foods Inc

- Reitzel S.A.

- The Kraft Heinz Company

- Unilever

Recent Developments

- In 2024, Columbia Valley Family Farms, based in Pasco, Washington, launched pickled red onions, expanding their natural ingredient-based product range. The company focuses on specialty pickled vegetables, fostering innovation and customer satisfaction.

- In 2023, Conagra Brands experienced significant growth in the packed pickles sector with its Vlasic brand. The company’s innovative approach and community engagement, including sponsoring pickleball tournaments, boosted its market presence and operational performance.

Report Scope

Report Features Description Market Value (2023) USD 24.3 Billion Forecast Revenue (2033) USD 32.3 Billion CAGR (2024-2033) 2.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fruit, Vegetable, Meat and seafood), By Pickle Type (Cucumber Pickles, Gherkins, Onion Pickles, Mixed Pickles, Relishes), By Packaging Type (Glass Jars, Plastic Jars, Pouches, Cans), By Flavor (Dill, Sweet, Bread and Butter, Spicy, Mustard), By End-User (Household, Food Service, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ADF Foods Limited, Angel Camacho Alimentación, S.L., Bennett Opie Ltd., Columbia Valley Family Farms, Conagra Brands, Inc., Del Monte Foods, Inc., Desai Foods Private Limited, Freestone Pickle Company, G.D. Foods Mfg. (India) Pvt. Ltd., Kraft Heinz, Maille., Mitoku Company Ltd, Mt. Olive Pickle Company, Inc., Nestle S.A., Nilons Enterprises Pvt Ltd, Orkla ASA, Peter Piper’s Pickle Palace Inc., Pinnacle Foods Inc, Reitzel S.A., The Kraft Heinz Company, Unilever Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADF Foods Limited

- Angel Camacho Alimentación, S.L.

- Bennett Opie Ltd.

- Columbia Valley Family Farms

- Conagra Brands, Inc.

- Del Monte Foods, Inc.

- Desai Foods Private Limited

- Freestone Pickle Company

- G.D. Foods Mfg. (India) Pvt. Ltd.

- Kraft Heinz

- Maille .

- Mitoku Company Ltd

- Mt. Olive Pickle Company, Inc.

- Nestle S.A.

- Nilons Enterprises Pvt Ltd

- Orkla ASA

- Peter Piper's Pickle Palace Inc.

- Pinnacle Foods Inc

- Reitzel S.A.

- The Kraft Heinz Company

- Unilever