Health And Wellness Market By Type (Health & Wellness Food, Beauty & Personal Care Products, Fitness Equipment, Wellness Tourism, and Other Types), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 101718

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

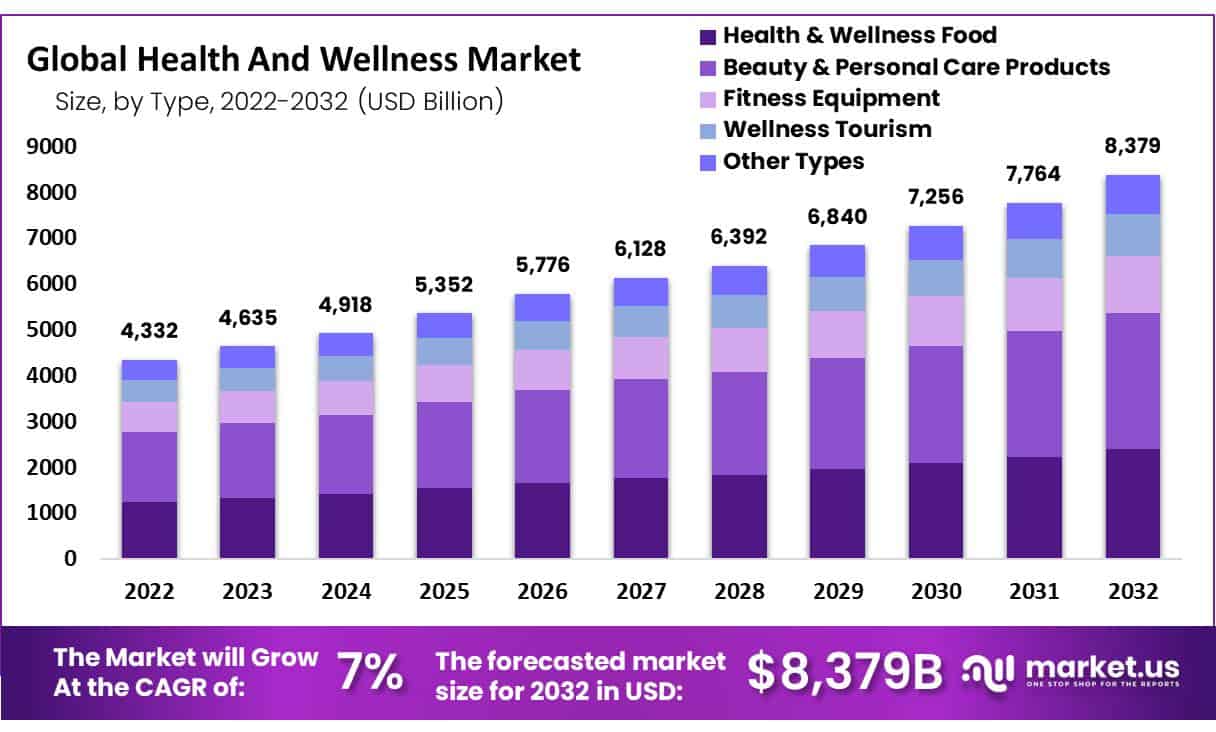

The Global Health And Wellness Market size is expected to be worth around US$ 8,379 Billion by 2033, from US$ 4,332 Billion in 2022, growing at a CAGR of 7% during the forecast period from 2023 to 2032.

In recent years, health and wellness have become increasingly significant concerns for people, particularly the middle-aged and younger generations. The major driver of the global health and wellness market share is rising consumer spending on different health and wellness products and services. The rising incidence of mental and physical illnesses, such as anxiety and depression, is largely to blame for the health and wellness market growth.

The state of complete mental, physical, and spiritual well-being is referred to as health and wellness. Personal care and beauty products, beauty tools, weight management, nutrition, fitness, and personalized and preventive medicine are just a few of the important facets of the health and wellness industry. In addition, services based on wellness tourism, health spas, wellness real estate, and mineral and thermal springs are provided to customers and are an essential part of the industry’s operations.

One of the key drivers of the market’s growth is the rising prevalence of chronic lifestyle diseases worldwide. Diabetes, asthma, high blood flow, blood sugar level, blood pressure, cancer, arthritis, dementia, and other stress-related disorders have significantly increased as a result of sedentary lifestyles and busy schedules. As a result, a wide range of health-related practices, such as meditation, yoga, and sports, have become popular.

Additionally, the growing use of wearable devices like trackers and fitness bands is boosting market expansion. The market is also being driven by the rapid expansion of wellness tourism and mineral spas. For various rheumatism, cardiovascular conditions, circulation disorders, spinal column conditions, asthma, and bronchitis, spa operators use specialized therapeutic waters like Malkinskaya mineral water and iodine-bromine.

The market is estimated to be further pushed by other key factors, such as rising disposable incomes, rapid urbanization, and an increase in the number of health-conscious consumers worldwide.

Key Takeaways

- The global health and wellness market is projected to grow from US$ 4332 billion in 2022 to US$ 8379 billion by 2032 at a 7% CAGR.

- Increased spending on health products, rising physical and mental health issues, and a focus on overall well-being are key growth drivers.

- The market includes personal care products, fitness equipment, wellness tourism, nutrition services, fitness programs, and preventive healthcare.

- Sedentary lifestyles and busy schedules contribute to chronic diseases like diabetes, hypertension, and obesity, boosting market demand.

- The use of wearable fitness trackers and bands is enhancing market expansion.

- Wellness tourism, including mineral spas, is rapidly growing as a significant market driver.

- Growing disposable incomes, urbanization, and an increase in health-conscious consumers worldwide are propelling market growth.

- Beauty and personal care products represent the largest market share at 35.2%, with health and wellness foods poised for rapid growth.

- There is a rising demand for sustainable, organic, and eco-friendly health and wellness products, presenting market opportunities.

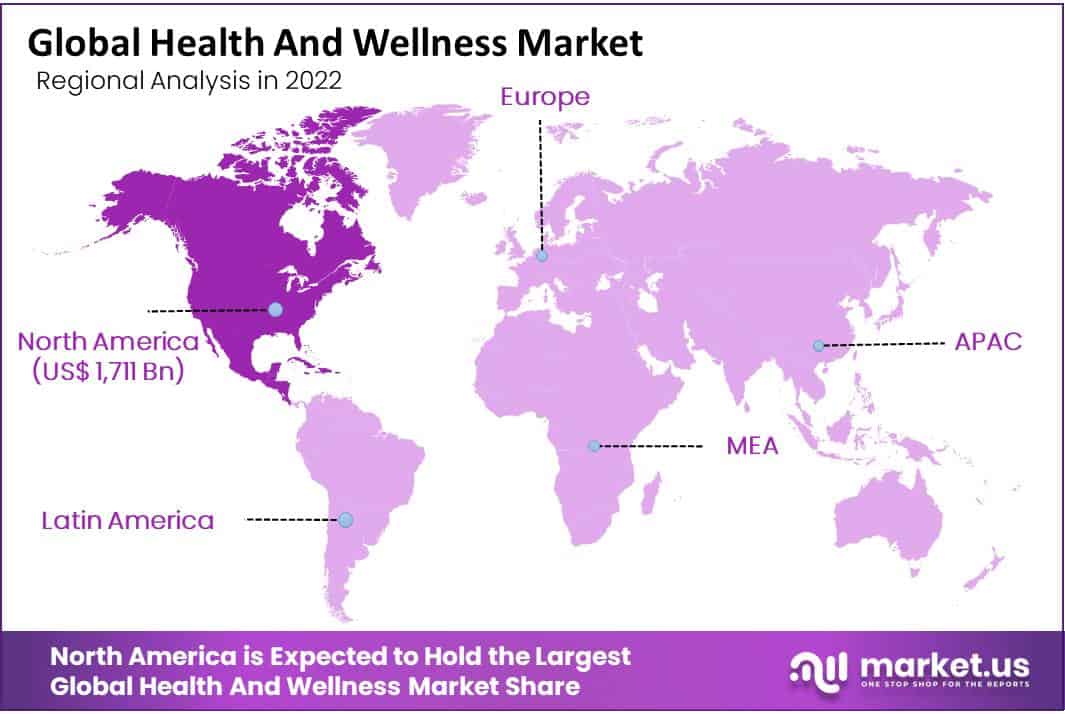

- North America holds the largest market share at 39.5%, with Asia-Pacific expected to show substantial growth.

Type Analysis

In 2022, Health and wellness food, beauty and personal care products, fitness equipment, wellness tourism, and other types make up the market. The health & wellness food segment is expected to grow at the fastest rate during the forecast period, while the beauty & personal care products segment holds the largest market share of 35.2%.

The market for beauty and personal care products has grown as a result of consumers’ increasing desire for organic and natural products. Because more women are concerned with their appearance, the market for beauty and personal care goods has gradually increased over time.

The introduction of an online shopping model, the development of a distribution channel, and increasing awareness of the value of maintaining long-term attractiveness are just a few of the additional factors that have contributed to the market growth for beauty and personal care products.

Key Market Segments

Based on Type

- Health & Wellness Food

- Beauty & Personal Care Products

- Fitness Equipment

- Wellness Tourism

- Other Types

Based On Sector

- Nutrition & Weight Loss

- Personal Care Beauty & Anti-Aging

- Wellness Tourism

- Physical Activity

- Spa Economy

- Preventive & Personalized Medicine

- Other Sectors

Drivers

Increase in the Prevalence of Chronic Diseases

Unhealthy lifestyles contribute significantly to the prevalence of chronic diseases, influencing an increase in health consciousness. By mid-thirties, extended exposure to harmful behaviors such as smoking, inadequate exercise, and consumption of high-salt, high-fat diets, often labeled as ‘junk food’, can lead to conditions like diabetes, hypertension, obesity, and hyperlipidemia. These conditions often remain underdiagnosed or mismanaged in healthcare systems primarily designed for acute care, not chronic disease management.

Engaging in regular physical activity is essential for enhancing physical fitness, life quality, and overall health, thereby reducing the risk of chronic illnesses including various cancers, cardiovascular diseases, and metabolic disorders like type 2 diabetes and Alzheimer’s. Physical exercises strengthen muscles, improve endurance, facilitate daily activities, and stabilize joints, contributing to improved mental health by alleviating stress and anxiety. Additionally, anti-aging cosmetics play a crucial role in personal care by moisturizing skin and offering radiance. Formulations enriched with antioxidants such as vitamins E and C help slow the skin’s aging process, extending their necessity across skin, hair, and eye care products.

The anti-aging cosmetics sector thrives on product diversity, technological advancements, and effective marketing strategies that emphasize customer-centric approaches. Factors such as improper climate exposure, alcohol consumption, and tobacco use further necessitate these products, driving continuous innovation and variety in the market to meet the evolving consumer demands.

Restraints

High Cost of Products

In the dietary supplement market, cost considerations vary significantly based on the form and composition of the product. Tablet-based supplements, for instance, are generally less expensive to manufacture than capsule-based ones due to simpler production processes. However, tablets often incorporate fillers and binders, which can impede digestion. Despite their lower production cost, tablets may offer lower bioavailability compared to other forms.

On the other hand, liquid supplements, though costlier, are favored for their higher absorption rates and lack of chemical additives. The raw materials used in supplements also play a crucial role in determining costs. Synthetic ingredients are cheaper to produce and do not require the extraction processes needed for natural sources. Yet, they are considered to have lower quality compared to their natural counterparts, which are more bioavailable but can fluctuate in price due to seasonal availability variations. These factors make the production of natural supplements more complex and potentially more expensive.

Overall, the choice of ingredients and their source—natural or synthetic—significantly impacts the final retail price of supplements. Market fluctuations in the availability of natural ingredients can lead to variable production costs throughout the year, influencing pricing strategies for manufacturers and ultimately affecting consumer choices in the health and wellness sector.

Opportunities

Sustainability is Important for Personal Care Products

Sustainability is becoming a critical factor in the health and wellness industry, propelled by increasing consumer demand for eco-friendly organic food products and sustainable personal care items. This trend is driving market expansion and prompting existing manufacturers to innovate through technological partnerships, product development, and strategic acquisitions. The growing consumer willingness to invest in sustainable brands, particularly among Millennials, is expected to further stimulate market growth in the upcoming years.

In the realm of personal care, esters are gaining prominence due to their ability to enhance the texture, performance, and aroma of products such as hair care items, body lotions, and baby cleansers. Unlike synthetic compounds that may pose health risks, esters offer a dermatologically safe alternative. Their biodegradable nature underscores their environmental benefits, making them a preferable choice in bio-based oleochemical cosmetics. As a result, an increasing number of consumers worldwide are showing a readiness to pay a premium for brands committed to environmental sustainability.

Trends

Demand for Clean-Labeled, Sustainable, Organic, and Eco-Friendly Products

In the rapidly evolving health and wellness market, vendors are innovating with clean-labeled, sustainable, and organic products to meet consumer demand. One notable example is EVOLVE’s Supernola brand, which offers whole food-based products free from artificial fillers. This trend towards whole, organic offerings is expected to significantly accelerate market growth during the forecast period.

Globally, there has been a surge in popularity for thermal/mineral springs and spas, renowned for their health benefits. These facilities are particularly sought after for their effectiveness in alleviating mental and physical fatigue, improving circulation, and treating various ailments such as rheumatism and respiratory conditions. The high demand across Europe, Asia, and North America is contributing to the expansion of this segment.

To capitalize on these trends, major players in the market are strategically partnering with regional distributors to enhance their market reach and effectiveness. For example, Estee Lauder Companies (ELC) has recently partnered with a diversified chemical manufacturing company based in Saudi Arabia, aiming to tap into new distribution channels. Such strategic alliances are poised to further drive growth in the healthcare market.

Regional Analysis

North America Dominates the Global Health And Wellness Market During the Forecast Period.

North America leads the global health and wellness market, holding a 39.5% revenue share. This region’s dominance is expected to persist, driven by higher disposable incomes and a strong consumer focus on health. North Americans are more inclined to purchase health-related products, fueled by heightened awareness and the presence of key industry players. These factors, along with strategic growth initiatives by these companies, have significantly propelled the market’s expansion in this region.

In contrast, the Asia-Pacific region presents substantial growth opportunities during the forecast period. The market’s expansion in APAC is fueled by rapid urbanization, a burgeoning population, and supportive government policies that encourage foreign direct investment. Additionally, fast-paced industrialization and the vast potential in various health and wellness sectors are pivotal. Countries like India, Japan, China, and South Korea are driving this growth, making APAC an increasingly lucrative market for health and wellness initiatives.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global market landscape is notably fragmented, featuring an array of key players, including Amway Corp., Bayer AG, Johnson Health Tech Co. Ltd., and L’Oréal SA, among others. These companies are actively expanding their market presence through strategic partnerships, mergers, and acquisitions, as well as by enhancing their product and service offerings. Additionally, competitive pricing strategies are being employed to attract and retain customers, contributing to market growth.

In a significant move to bolster its Consumer Products Division, L’Oréal SA acquired Thayers Natural Remedies, a U.S.-based company known for its natural skin care products. This acquisition is part of L’Oréal’s broader strategy to integrate innovative natural remedies into its extensive portfolio, aiming to meet the growing consumer demand for natural and sustainable products. Such strategic acquisitions are pivotal, as they provide companies with opportunities to introduce innovative products and tap into new market segments, driving overall market expansion.

Health And Wellness Market Key Players are

- Cleveland Travel Ltd.

- Abbott Laboratories

- Herbalife Nutrition Ltd

- L’Oréal S.A.

- Nestlé SA

- Procter & Gamble

- Unilever Plc

- Vitabiotics Ltd.

- Other Key Players.

Recent Developments

- In June 2024: Abbott received U.S. FDA clearance for two new over-the-counter continuous glucose monitoring (CGM) systems designed to enhance metabolic health management. The products, named Lingo and Libre Rio, are part of Abbott’s strategy to make advanced health monitoring more accessible. Lingo is aimed at the general population for lifestyle and wellness tracking, while Libre Rio specifically supports people with Type 2 diabetes managing their condition non-invasively.

- In February 2024: Herbalife Nutrition Ltd launched the “Herbalife GLP-1 Nutrition Companion,” a line of food and supplement product combos. This initiative is tailored to support the nutritional needs of individuals using GLP-1 and other weight-loss medications, available in both classic and vegan options across various flavors in the United States and Puerto Rico. This product launch is part of Herbalife’s strategy to integrate specialized dietary needs into their offerings.

Report Scope

Report Features Description Market Value (2022) US$ 4,332 Bn Forecast Revenue (2032) US$ 8,379 Bn CAGR (2023-2032) 7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Health & Wellness Food, Beauty & Personal Care Products, Fitness Equipment, Wellness Tourism, and Other Types Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Cleveland Travel Ltd., Abbott Laboratories, Herbalife Nutrition Ltd, L’Oréal S.A., Nestlé SA, Procter & Gamble, Unilever Plc, Vitabiotics Ltd., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cleveland Travel Ltd.

- Abbott Laboratories

- Herbalife Nutrition Ltd

- L'Oréal S.A.

- Nestlé SA

- Procter & Gamble

- Unilever Plc

- Vitabiotics Ltd.

- Other Key Players.