Global Wellness Tourism Market By Service (Lodging, Food and Beverage, Shopping, Activities and Excursion, and Other Services), By Travelers (Personal and Corporate), By Location (Domestic and International), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 63457

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

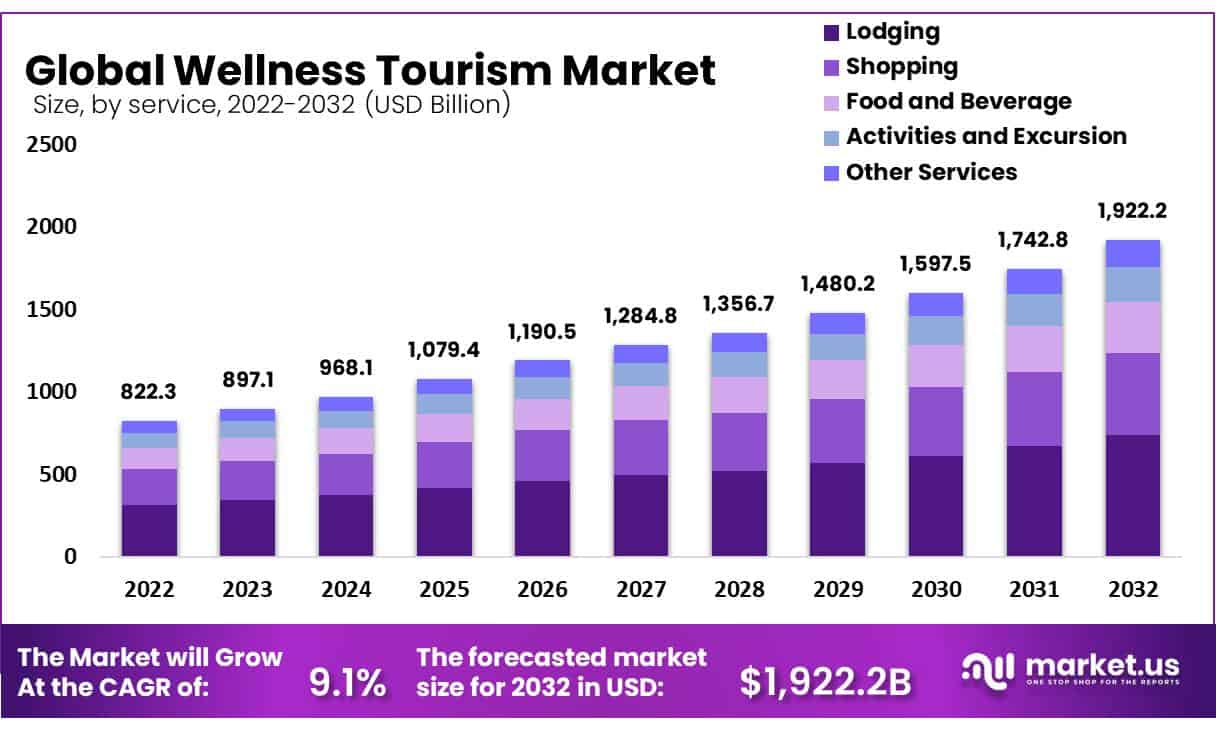

In 2022, the global Wellness Tourism market accounted for USD 822.3 billion and is expected to grow to around USD 1922.2 billion in 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 9.1%.

The wellness tourism market refers to the travel industry that serves individuals who looking to improve their mental, emotional, and physical comfort while on vacation. This includes activities like meditation, spa treatments, healthy eating options, yoga classes, fitness programs, and other wellness offerings. The COVID-19 pandemic has driven increased demand for health and safety experiences in the destinations.

Key Takeaways

- In 2022, the global wellness tourism market was valued at USD 822.3 billion.

- Expected to reach approximately USD 1922.2 billion by 2032, with an estimated CAGR of 9.1% between 2023 and 2032.

- Wellness tourism involves activities such as meditation, spa treatments, healthy eating, yoga, fitness programs, and other wellness offerings.

- The lodging segment dominates the wellness tourism market.

- Shopping is the fastest-growing segment, with a CAGR of 8.7% in 2022, focusing on health and wellness-related products.

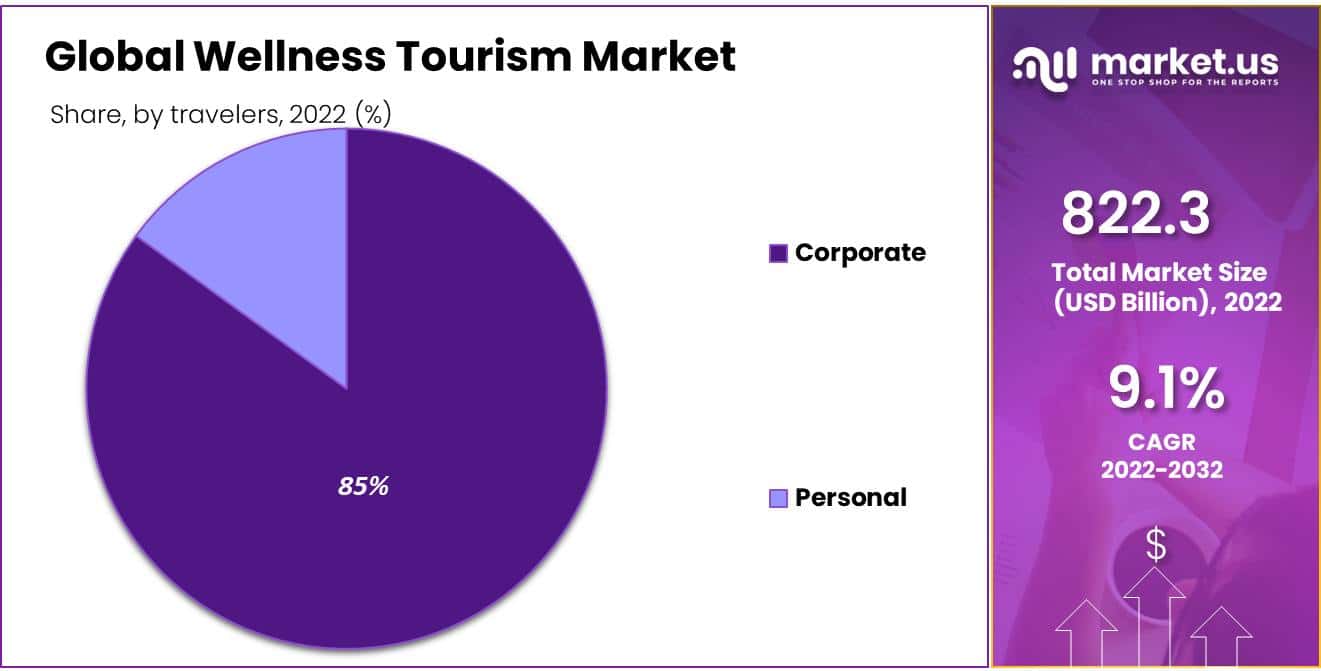

- The corporate segment dominated the market in 2022, accounting for over 85%.

- Asia-Pacific is a rapidly growing region due to rising incomes, health awareness, and a growing middle class.

Service Analysis

The Lodging Segment is Dominated in the Wellness Tourism Market

The service segment comprises lodging, food and beverage, shopping, activities and excursion, and other services. Among these segments, lodging is dominated the wellness tourism market. The lodging segment has a significant share in the wellness tourism market because lodging is the primary unit of the tourism industry. In addition, in popular tourist destinations, there is growing penetration of premium and luxury hotels.

The shopping segment is the fastest-growing segment in the wellness tourism market, with the highest CAGR of 8.7% in 2022. It focuses on the sale of health and wellness-related products. It includes supplements, fitness gear, yoga mats, organic and natural foods, beauty products, etc. Also, some tourism destinations sell unique and locally made products.

Travelers Analysis

The Corporate Segment has Dominated the Global Wellness Tourism Market with More than 85% Share in 2022.

The traveler’s segment is categorized as personal and corporate travelers. The corporate segment is dominated by the global wellness tourism market, with more than 85% share in 2022. The tourism industry focuses on businesses and employees looking for comfort-focused travel experiences. It includes everything from the corporate world, such as team building activities and other activities for happiness, mindfulness, and also for stress reduction or relaxation.

The individual segment will be the fastest-growing segment in the wellness tourism market in 2022. It focuses on individual travelers looking for wellness-focused travel experiences. This includes spa vacations, adventure tours, and many more activities that promote physical, emotional, and mental well-being.

Location Analysis

The Domestic Segment is Dominant in the Wellness Tourism Market.

Based on location, the market for wellness tourism is segmented into domestic and international. Among these segments, the domestic segment is dominant in the wellness tourism market. In this segment wellness tourism market focuses on the wellness experience within their own country or region. It includes everything from day spa visits to participating in yoga and meditation at nearby studios, etc. located within the traveler’s home country.

The international segment is the fastest-growing segment in the wellness tourism market, with the highest CAGR of 8.4% in 2022. It includes visiting wellness centers in different countries, experiencing different cultural practices, and participating in outdoor activities in natural settings.

Key Market Segments

Based on Service

- Lodging

- Food and Beverage

- Shopping

- Activities and Excursion

- Other Services

Based on Travelers

- Personal

- Corporate

Based on Location

- Domestic

- International

Drivers

Nowadays, people are aware of health and wellness, which can increase the demand for wellness tourism. People are becoming more health conscious, so they are looking for not only relaxation and entertainment but also to offer opportunities to improve mental, physical, and emotional happiness. For stress management and relaxation, many people demand wellness tourism.

Older adults are looking for wellness and to maintain their health as they age, so they prefer wellness tourism because it offers services and programs such as yoga classes, gentle fitness programs, consultations, etc. Some wellness tourism provides fitness programs, nutrition, and medical consultations for chronic disease travelers because of the increased no. of diabetes, heart disease, and obesity among people. In recent years travelers can easily access and book wellness tourism experiences. Technologies are becoming advanced such as wearable devices and health monitoring apps.

Restraints

Wellness tourism packages are expensive, so many consumers may not afford such packages, and this can restrict the no. of potential customers. These are located in remote areas, which can be difficult for many consumers who live in urban areas because of limited transportation. The demand for this tourism is during the summer season, so this can be for specific seasons or climates.

There is not enough standardization in this industry, so consumers are confused about comparing offerings and prices. Some tourism destinations are located in ecologically sensitive areas, and the growth of this industry can harm the environment. After the pandemic, many consumers are hesitant to travel due to health problems.

Opportunity

Growing demand for wellness and healthy lifestyles may lead to a rise in the demand for wellness tourism offerings. Some wellness tourism is diverse and offers a range of opportunities for business, such as meditation retreats, ecotourism, etc. This can attract specific demographic or health needs.

In this industry, technology is transforming digital health telemedicine and wearables which may offer more personalized and accessible wellness experiences. Many Governments support the tourism industry by offerings infrastructure development, incentives, and policy initiatives. This can open up new opportunities for growth.

Trends

Today’s People are searching for customized wellness programs tailored specifically to their personal requirements and preferences that address physical, mental, and spiritual well-being. As technology has advanced, digital wellness has gained increasing prominence. Examples are virtual retreats dedicated to wellness and online fitness classes, wellness apps, and wearable devices that monitor health and well-being data.

Awareness of mental health and well-being has grown, prompting more travelers to search for wellness retreats that provide stress relief through mindfulness, meditation, and other activities that promote the well-being of the mind. Wellness tourism based around nature has seen an explosion of interest. Tourists are drawn to destinations offering outdoor activities like hiking and forest bathing and ecotourism or wellness retreats within natural settings.

Sustainability and wellness have become more widely acknowledged, leading to people searching for eco-friendly wellness hotels with organic food options from local sources and eco-aware travel strategies that promote both aspects. Wellness for families is becoming more widespread as more hotels and resorts offer activities and wellness programs tailored specifically for them. Activities may include yoga with family, healthy cooking classes, or outdoor activities that suit them all.

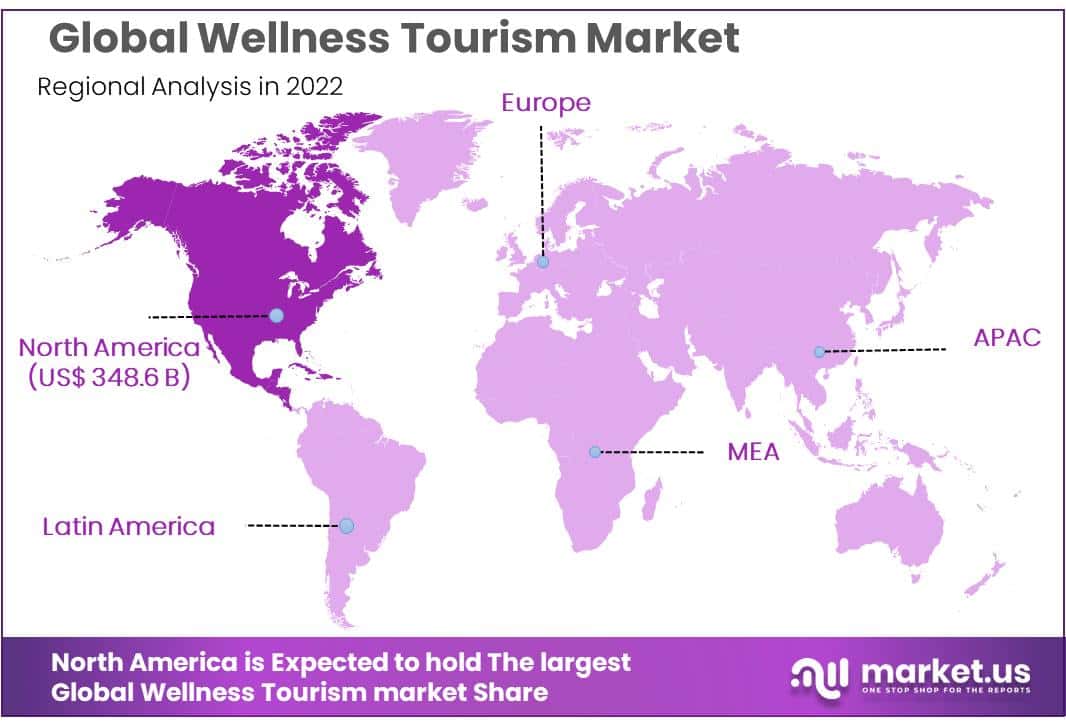

Regional Analysis

North America is estimated to be the most lucrative market in the global wellness tourism market, with the largest market share, 42.4%, in 2022. The North American dominant position is attributed to the focus on premium and luxury wellness experiences. In this region, some of the world’s most popular wellness destinations are Arizona, California, and Hawaii.

Asia-Pacific is one of the fastest-growing regions in the wellness tourism market because of rising disposable incomes, increasing awareness about health and wellness, and the growing middle class. Some famous destinations in this region include Bali, Thailand, and India.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market for wellness tourism is predicted to keep expanding in the future. This growth is driven by raising awareness about the significance of maintaining good health and well-being. There is also an increasing demand for luxurious travel experiences that emphasize wellness. While the COVID-19 pandemic has had an impact on the tourism industry, the wellness tourism market has shown flexibility with many travelers seeking destinations and experiences that promote health and safety.

Market Key Players

- Hilton Worldwide

- Accor Hotels

- Hyatt Hotels

- Rancho La Puerta Inc.

- Marriot International

- Rosewood Hotels

- PRAVASSA

- InterContinental Group

- Omni Hotels & Resorts

- Radisson Hospitality

- Four Seasons Hotels

- Other Key Players

Recent Developments

- Increased focus on mental health and wellness due to the impact of the COVID-19 pandemic. More wellness retreats, spa resorts, and other businesses are incorporating mental health services and activities into their offerings.

- Growth of digital wellness tourism, with virtual wellness experiences such as online fitness classes, meditation apps, and wellness coaching becoming more popular.

- In May 2022, Hilton announced that it had signed an agreement with CKR Resort to launch the flagship brand Hilton Hyderabad Resort & Spa in Hyderabad.

Report Scope

Report Features Description Market Value (2022) US$ 822.3 Bn Forecast Revenue (2032) US$ 1922.2 Bn CAGR (2023-2032) 9.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (Lodging, Food and Beverage, Shopping, Activities and Excursion, Other Services), By Travelers (Personal, Corporate), By Location (Domestic, International) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hilton Worldwide, Accor Hotels, Hyatt Hotels, Rancho La Puerta Inc., Marriot International, Rosewood Hotels, PRAVASSA, InterContinental Group, Omni Hotels & Resorts, Radisson Hospitality, Four Seasons Hotels, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Wellness Tourism Market Size in the Year 2022?In 2022, the global Wellness Tourism market accounted for USD 822.3 billion and is expected to grow to around USD 1922.2 billion in 2032.

What is the Wellness Tourism Market CAGR During the Forecast Period 2022-2032?The Global Wellness Tourism Market size is growing at a CAGR of 9.1% during the forecast period from 2022 to 2032.What are some key players in the global wellness tourism market?Key players in the global wellness tourism market include Hilton Worldwide, Accor Hotels, Hyatt Hotels, Rancho La Puerta Inc., Marriot International, Rosewood Hotels, PRAVASSA, InterContinental Group, Omni Hotels & Resorts, Radisson Hospitality, Four Seasons Hotels, Other Key Players.

-

-

- Hilton Worldwide

- Accor Hotels

- Hyatt Hotels

- Rancho La Puerta Inc.

- Marriot International

- Rosewood Hotels

- PRAVASSA

- InterContinental Group

- Omni Hotels & Resorts

- Radisson Hospitality

- Four Seasons Hotels

- Other Key Players