Corporate Wellness Market By Service (Fitness, Health Risk Assessment, Health Screening, Smoking Cessation), By Category (Psychological Therapists, Fitness & Nutrition Consultants), By Delivery Model (Offsite and Onsite), By End-User (Large Scale organization, Medium Scale Organizations, and Small Scale Organization), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032.

- Published date: Aug 2024

- Report ID: 67466

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

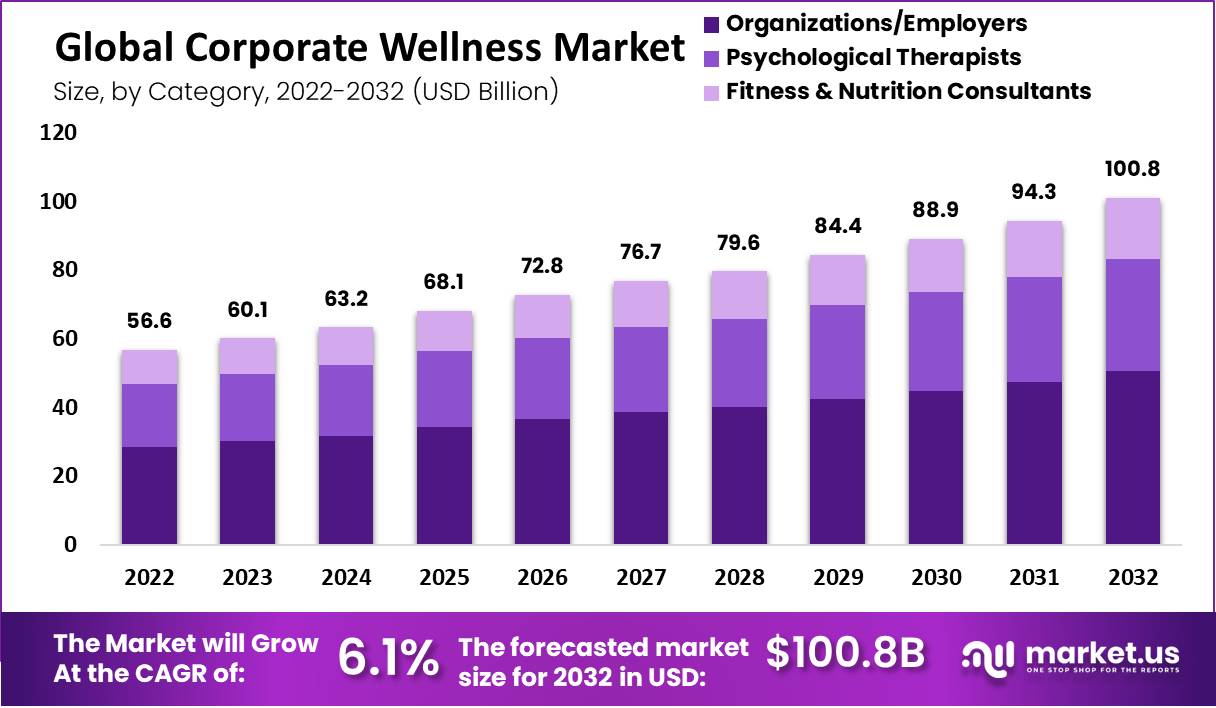

The Global Corporate Wellness Market Size is expected to be worth around USD 100.8 Billion by 2032 from USD 56.63 Billion in 2022, growing at a CAGR of 6.1% during the forecast period from 2022 to 2032.

Corporate wellness market demand has increased as health programs for employees have begun to be implemented by a large number of businesses across various industry verticals. Companies benefit from workplace health programs by increasing productivity and lowering overall operational costs. The market for corporate wellness is expected to grow due to rising awareness of employee health and well-being.

Both employers and employees stand to benefit significantly from wellness programs. People prefer workplaces with a positive work environment and health restoration plans. Health education and improvement initiatives have a positive effect on the culture and environment of the workplace. Additionally, wellness activities that are based on incentives are preferred by employees due to their significant impact on employee motivation.

Due to an unhealthy and sedentary lifestyle, many countries, including many industrialized nations, have been affected by chronic diseases like obesity, heart disease, and diabetes. Consequently, numerous chronic diseases are becoming more common. However, these illnesses can be avoided. Because of this, holistic approaches to workplace wellness programs are highly demanded to educate employees about the benefits of sticking to fitness goals and the significance of developing healthy habits.

Key Takeaways

- The Corporate Wellness Market is expected to reach USD 100.8 billion by 2032.

- It is growing at a CAGR of 6.1% between 2023 and 2032.

- In 2022, the market was valued at around USD 56.6 billion.

- The corporate wellness market is driven by increasing awareness of employee health and well-being.

- Wellness programs benefit both employees and employers.

- In 2022, the health risk assessment segment had a market share of approximately 21%.

- Organizations/employers dominated the market with nearly 50% market share.

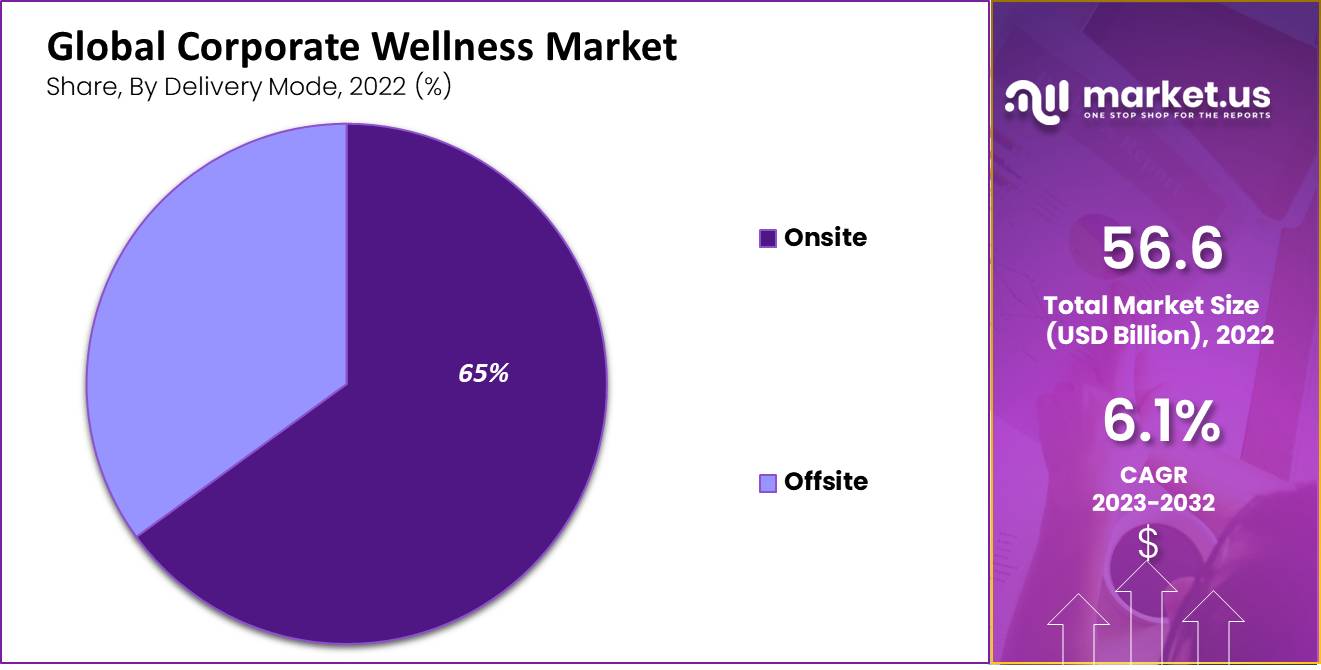

- Onsite delivery mode holds the majority of revenue share.

- Large corporations have the majority of the market share in the corporate wellness market.

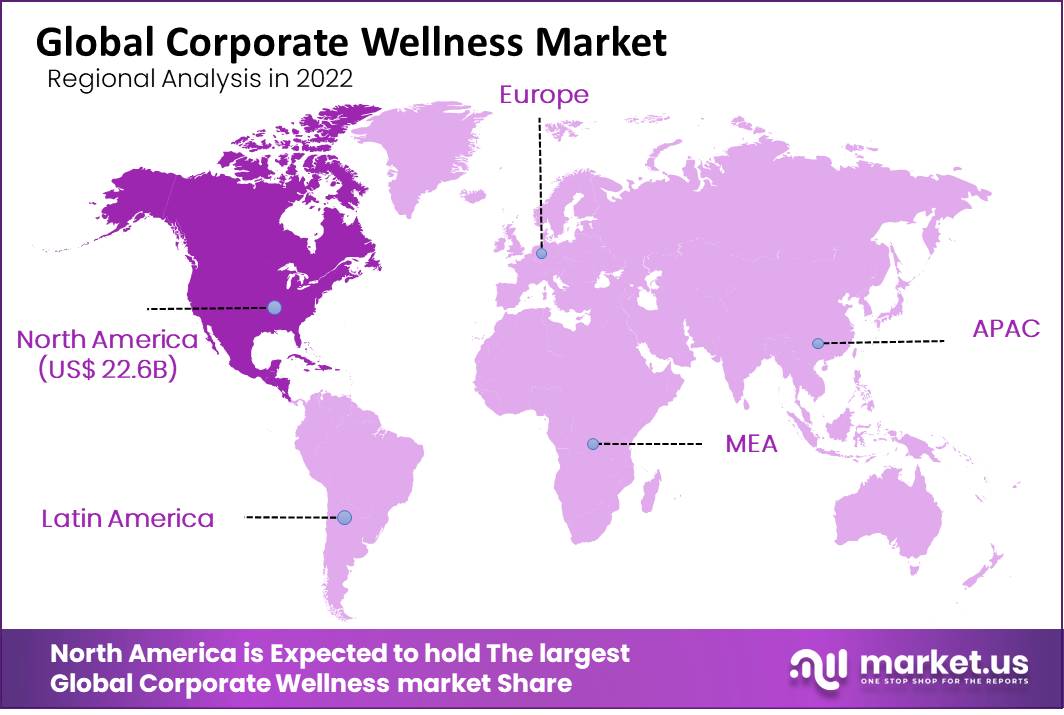

- North America dominated the market in 2022 with over 39.9% of revenue share.

- The APAC region is expected to experience higher growth.

- Factors driving market growth include increasing chronic diseases, high-quality service, and rising awareness.

- The COVID-19 pandemic has boosted the corporate wellness market.

- Key players in the market include Marino Wellness, Wellness Corporate Solutions, and Fitbit, Inc.

Service Analysis

The Health Risk Assessment segment dominates the market

The corporate wellness market is divided into smoking cessation, risk assessment for health, health screening, fitness, stress management, nutrition and weight management, and other services. With a 20.9% share, the health risk assessment sector dominated the market. Most corporate employee health programs include screenings to identify health risks and implement appropriate interventions to encourage employees to live healthy lives.

Employees’ health risk assessments are the choice of roughly 80% of businesses that offer employee well-being services. The WCS Analytics+ platform, which Wellness Corporate Solutions introduced in June 2016 and consists of an interactive data dashboard, enables clients to plan and carry out healthy activities that result in productive workplaces.

A Key component of any workplace health program is a fitness program. In the past, many businesses gave their employees Fitbit-style health wristbands to track their daily physical activity. Employees are encouraged to be more active by their employers, and those who achieve daily goals receive special recognition. The fitness market is anticipated to expand as more people use remote patient monitoring devices.

The smoking cessation market is expanding due to several significant factors, including increasing smokers and awareness of side effects. To ensure normal body function, health screening includes checking vital body stats like cholesterol, blood sugar, and urine, among others.

It has been discovered that many diseases can be avoided if caught early enough. Therefore, conditions will be detected earlier and can be avoided if businesses invest in health screenings. As a result, employee healthcare plans can be reduced by investing in screenings.

Category Analysis

The organizations/employers segment dominated the corporate wellness market

The market comprises organizations and employers, fitness and nutrition consultants, and psychological therapists. In 2021, the most significant segment was the organizations/employers segment, with around 50.2% of the market. The providers provide outsourced and in-house health management services for big and small businesses.

By providing healthy catering options on campus, employers are making crucial investments in maintaining healthy diets for employees. Unwell employees raise the incidence of diseases, which reduces productivity and increases absenteeism. Employers must also pay an additional premium for health insurance for such types of employees. To put it another way, employers strive to lessen the financial stress posed by employees’ ill health. It is driving the fitness and nutrition market.

For stress relief, employers frequently offer yoga and meditation classes to employees. Stressful employees are more likely to get frustrated often, which can negatively impact an organization. As a result, organizations deliver art therapy, a novel approach to stress relief.

It is thought to be a type of expressive psychotherapy; with the help of art, it helps people to feel better physically, emotionally, and mentally. With this therapy’s help, professionals treat mental and emotional disorders. The psychological therapist market is expanding at a rapid rate due to rising demand.

Delivery Mode Analysis

The onsite segment held the majority of the share in this market.

In 2021, the onsite segment will stay at the top of the market based on the delivery model. Over the forecast period, it is anticipated that the sector will experience rapid growth. Employees can exercise under the supervision of fitness consultants and coaches as part of onsite wellness initiatives, which add a personal touch to the well-being of employees.

The use of cutting-edge technology continuously improves health services. For instance, Virgin Pulse plans to use its Diabetes Prevention Program to promote diabetes prevention in January 2020 by acquiring digital therapeutics provider Blue Mesa Health, Inc. It is driving the growth of the offsite market.

Service providers are raising employees’ awareness of COVID-19-related negative aspects of working from home. For instance, virtual meetings have replaced in-person ones due to the pandemic. However, problems like having to focus harder to process nonverbal cues like facial expressions and body language, having bad internet connections that make it hard to connect to the meeting, and meetings are more stressful and exhausting than in-person ones for multitasking during sessions.

End-User Analysis

The large-scale organization held the majority of the share among the end-user segment.

In 2021, the market was dominated by large corporations. Well-documented studies show that adequately implemented programs can give a return on investment of around 3:1. Programs and services can be incorporated into the infrastructure of larger businesses. Outsourcing services and corporate memberships can be beneficial to small organizations.

The monitoring of various diseases is made more accessible by implementing corporate wellness programs. Health screening programs are carried out regularly to keep a health check, encourage preventative care, and cut treatment costs. The burden of these diseases and the total cost of healthcare premiums paid by the employer to any insurance provider can be reduced by focusing on these conditions. Even though office lockdowns and closures have forced many workers to work from home, ensuring they can access and continue using workplace health services is critical.

Small and medium-sized businesses’ expansion is anticipated to be aided by increased absenteeism and attrition and rising awareness of employee health programs. These businesses can offer yoga and meditation classes onsite to their employees. It can be carried out once a month or twice a month.

Key Market Segments

Based on Service

- Fitness

- Health Risk Assessment

- Health Screening

- Smoking Cessation

- Stress Management

- Nutrition & Weight Management

- Other Services

Based on Category

- Psychological Therapists

- Fitness & Nutrition Consultants

- Organizations/Employers

Based on the Delivery Mode

- Offsite

- Onsite

Based on End-User

- Large Scale organization

- Medium Scale Organizations

- Small Scale Organization

Drivers

Growing awareness about stress and the prevalence of chronic diseases

The working class population is so occupied and workaholic that they tend to take on the stress and fail to manage their lives, which is bad for their physical and mental health. Employees’ increased depression and anxiety have necessitated behavioral and mental health management, resulting in a demand for wellness programs for their employers. Hence, it drives demand for health-related goods and services and propels market expansion.

Longer working hours and a longer life expectancy

The market is influenced by several important factors, which cause the corporate wellness industry to grow. They are essential for a holistic approach, which means that employees and employers get the most out of their work and keep the work culture healthy. Employees must work longer hours to compete in business and maintain their health and life expectancy. The company chooses a variety of wellness policies and programs to maintain employee productivity and health, which ultimately helps the corporate wellness market.

The rising dominance of Artificial Intelligence

A new era of AI-driven personalized education and wellness solutions for each employee will revolutionize the global market for corporate wellness. Several businesses are using artificial intelligence to help them scale up their wellness plans without heavily relying on human resources and to maintain employee interaction between human touchpoints. Services made possible by AI can identify patterns, predict how actual health issues or statistics will develop, and come up with a plan to prevent illnesses and other problems with health and well-being. As a result, it is a significant driver of market expansion.

Restraints

Low awareness about the programs of corporate wellness

Numerous studies indicate that a lack of communication is a significant factor in the fact that many employees are unaware of their company’s programs related to health. Many people are unaware of the programs’ pros or other aspects, even if they know they exist in their organization. As a result, they lack enthusiasm for taking part in them. Some employees will not be motivated to make positive changes, while others will be unwilling to do so.

To encourage employees to step outside of their comfort zones, employers must provide them with all pertinent details about corporate wellness programs. Employees must be enabled to participate and be informed about the objectives, rewards, and purpose. People may be more inclined to join if awards and incentives are presented. Employees who see excellent benefits and changes are more likely to stay. As a result, the market expansion is somewhat hampered by unawareness regarding wellness programs offered by companies.

Trends

The market trend toward AI has increased.

The booming corporate wellness industry, which was established to manage employee stress and maintain employees’ spirits while working in a hostile environment, is attributed to the pandemic. Various wellness policies have been developed to assist businesses in waging war and operating efficiency without sacrificing quality.

However, companies encountered difficulties and required time to adjust to the new environment in the epidemic’s early stages. The work-from-home model also needed several wellness programs and plans, which added to the overall cost. Overall, the market for corporate wellness has been boosted by COVID-19 not only during the allotted time period but also in the years to come. It is now required by businesses to cut down on absenteeism and maintain a positive work environment.

The market trend toward AI has increased. With the involvement of major AI players, the sector is undergoing significant transformation, arriving in a new era of individualized employee well-being-focused education and solutions.

Regional Analysis

North America held the largest market share in the global corporate wellness market.

North America dominated the corporate wellness market with a 40% revenue share in 2022. According to the RAND employer survey, wellness programs are offered to employees in the United States in approximately 50% of cases. Larger employers offer more complex wellness programs. Additionally, the significant dominance of the office culture prompts business owners in the region to incorporate such services to support employee health.

Over the forecast period, Asia-Pacific will likely experience an impressive growth rate. Due to the rising working population and increased awareness of employee health management, corporate health initiatives are necessary for the Asia-Pacific region. Additionally, the market will benefit from the aging working-class population because businesses are making significant investments in healthcare infrastructure, creating a significant opportunity to meet unmet demands in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market is marked by an increasing focus on expanding in-house corporate wellness services. More than 550 businesses provide health benefits to their employees in the United States.

Major players are concentrating on increasing their market presence through investment activities, mergers, and acquisitions to accommodate and cater to larger groups of employees. Headspace Inc., for instance, introduced Sayana, an AI-powered mental health company, in January 2022. Some prominent players in the market are SOL Wellness, Truworth Wellness, and others responsible for market growth.

Market Key Players

- Marino Wellness

- Wellness Corporate Solutions

- Vitality Group

- Wellsource, Inc.

- Fitbit, Inc.

- Privia Health

- Beacon Health Options

- ComPsych

- Central Corporate Wellness

- Other Key Players

Key Industry developments

- In May 2024: Vitality Group launched a health and wellness marketplace for employers, named Vitality Gateway Flex. This platform stands out for its simplicity and cost-effectiveness, allowing employers to pay only for the services used. The program integrates various strategic partners to connect employees to appropriate health resources, thereby aiming to enhance engagement and overall health outcomes.

- In January 2024: Fitbit co-founders James Park and Eric Friedman departed from Google, and the company underwent significant restructuring within Google’s Devices & Services team. This organizational change is part of a broader integration strategy following Google’s acquisition of Fitbit, with a focus on consolidating hardware efforts. These changes have raised concerns about the future trajectory and innovation strategy of Fitbit under Google’s stewardship.

- In July 2023: Investment in Lifestyle Spending Accounts (LSAs): In response to growing demands for personalized wellness benefits, Wellness Corporate Solutions increased investments in Lifestyle Spending Accounts. These accounts allow employees to allocate wellness funds according to their unique needs and preferences, reflecting a broader industry trend towards customization and flexibility in wellness programs.

Report Scope

Report Features Description Market Value (2022) USD 56.63 Bn Forecast Revenue (2032) USD 100.8 Bn CAGR (2023-2032) 6.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service- Fitness, Health Risk Assessment, Health Screening, Smoking Cessation, Stress Management, Nutrition & Weight Management, and Other Services; By Category- Psychological Therapists, Fitness & Nutrition Consultants, and Organizations/Employers; By Delivery Mode- Offsite and Onsite; and By End Users- Large Scale organization, Medium Scale Organizations, and Small Scale Organization. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Marino Wellness, Wellness Corporate Solutions, Vitality Group, Wellsource, Inc., Fitbit, Inc., Privia Health, Beacon Health Options, ComPsych, Central Corporate Wellness, and other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the Global Corporate Wellness Market worth?Global market size is worth USD 100.8 Billion by 2032.

What was the value of the Corporate Wellness Market in 2023?In 2023, the market value stood at USD 56.63 Billion.

What is the CAGR of Corporate Wellness Market?The Global Corporate Wellness Market is growing at a CAGR of 6.1% during the forecast period 2022 to 2033.

Who are the major players operating in the Corporate Wellness Market?Marino Wellness, Wellness Corporate Solutions, Vitality Group, Wellsource, Inc., Fitbit, Inc., Privia Health, Beacon Health Options, ComPsych, Central Corporate Wellness, and other Key Players.

Which region will lead the global Corporate Wellness Market?North America is estimated to be the fastest-growing region during the forthcoming years.

-

-

- Marino Wellness

- Wellness Corporate Solutions

- Vitality Group

- Wellsource, Inc.

- Fitbit, Inc.

- Privia Health

- Beacon Health Options

- ComPsych

- Central Corporate Wellness

- Other Key Players