Global Reconstituted Juice Market By Nature (Organic, Conventional), By Ingredient (Orange Juice, Apple Juice, Grape Juice, Mixed Fruit Juice, Others), By Packaging (Bottle, Can, Tetra Pak, Others), By End Use (Household, Food Service, Others), By Distribution Channel (Hypermarkets/Supermarkets, Modern Grocery Stores, Discount Stores, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 134001

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

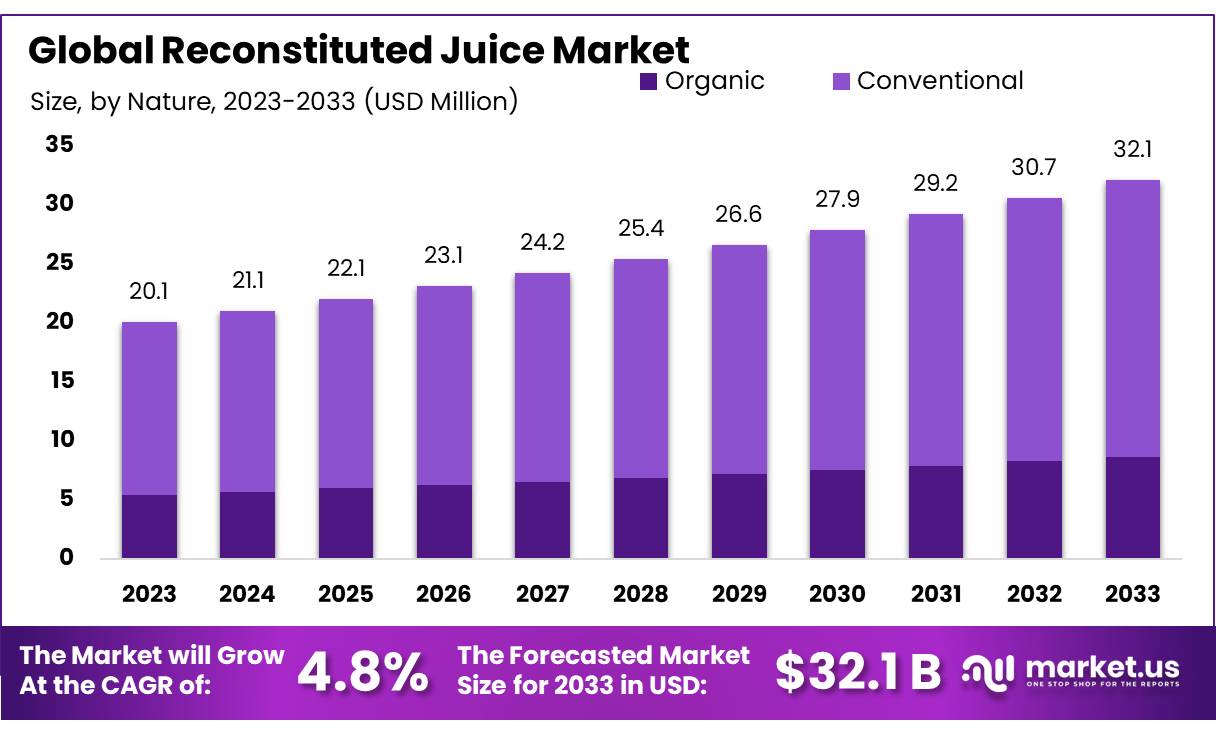

The Global Reconstituted Juice Market size is expected to be worth around USD 32.1 Bn by 2033, from USD 20.1 Bn in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

Reconstituted juice refers to juice that has been processed into concentrate by removing a significant portion of its water content, making it easier to store and transport. Once ready for consumption, water is added back to the concentrate to restore the juice to its original consistency.

This method of production plays a crucial role in the global beverage market, particularly in the fruit juice segment. According to the Food and Agriculture Organization (FAO), the global fruit juice market, including reconstituted juice, was valued at over USD 100 billion in 2023. Reconstituted orange juice, one of the most popular products in this category, continues to dominate the market, with the U.S. accounting for nearly 45% of global juice sales.

Reconstituted juice benefits from the ease of transportation and extended shelf life due to its concentrated form. In 2022, global production of orange juice reached approximately 3.7 million metric tons. The market continues to see growth, supported by investments in production facilities and distribution networks.

In 2023, U.S. imports of reconstituted juice increased by 6%, driven primarily by imports from Brazil, the largest supplier of reconstituted orange juice. The total value of juice imports to the U.S. surpassed USD 1.2 billion in 2023, highlighting the continued demand for these products.

Notable investments are being made to expand production capacity. For instance, Florida Power & Light invested USD 50 million in 2023 to enhance citrus processing infrastructure in Florida, which is expected to boost reconstituted orange juice production. Additionally, in 2024, Coca-Cola, through its Minute Maid brand, acquired a major reconstituted juice processing plant in Brazil, further consolidating its market position.

Sustainability is also becoming increasingly important in the reconstituted juice market. Governments, particularly in the EU and U.S., are encouraging eco-friendly practices. The EU’s Green Deal aims for a 55% reduction in greenhouse gas emissions by 2030, prompting juice manufacturers to adopt more sustainable production processes.

In India, the Food Safety and Standards Authority (FSSAI) has imposed regulations preventing companies from labeling reconstituted juices as “100% fruit juice” to avoid misleading claims. These factors are shaping the future direction of the reconstituted juice market.

Key Takeaways

- Reconstituted Juice Market size is expected to be worth around USD 32.1 Bn by 2033, from USD 20.1 Bn in 2023, growing at a CAGR of 4.8%.

- Conventional reconstituted juices held a dominant market position, capturing more than 73.4% of the market share.

- Orange Juice held a dominant market position, capturing more than 37.2% of the reconstituted juice market share.

- Bottle packaging held a dominant market position, capturing more than 44.4% of the reconstituted juice market share.

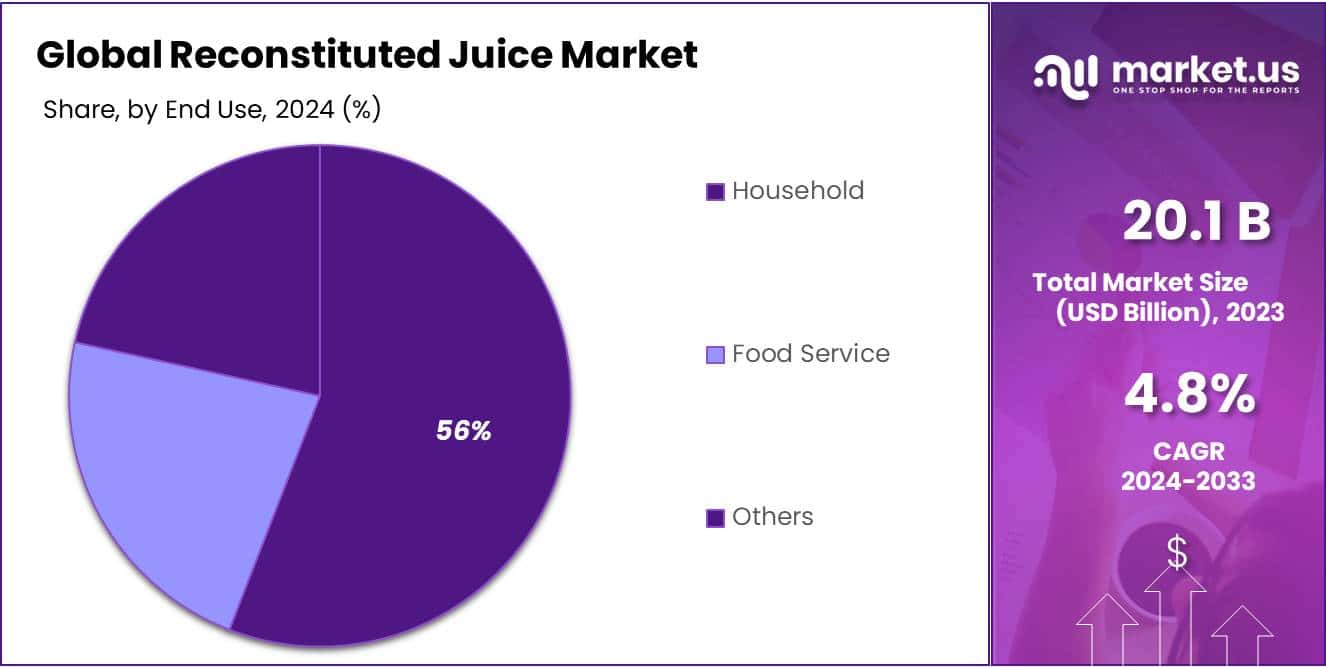

- Household held a dominant market position, capturing more than 57.4% of the reconstituted juice market share.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than 44.2% of the reconstituted juice market share.

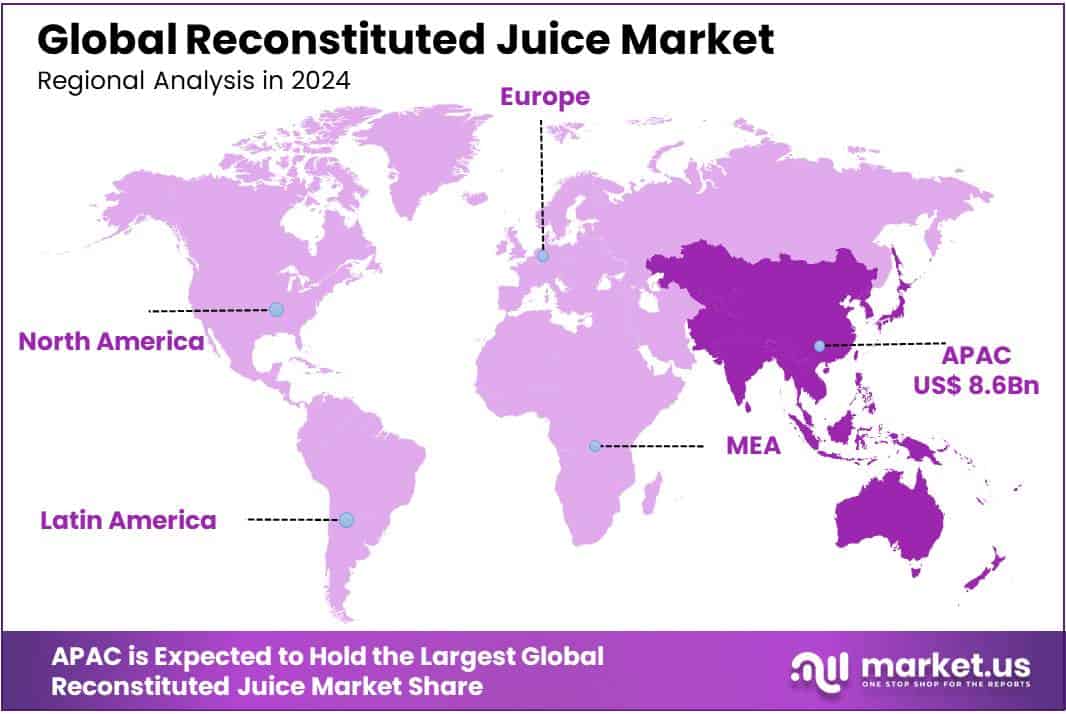

- Asia Pacific (APAC) holds a dominant position in the global reconstituted juice market, capturing more than 43.2% of the market share, valued at approximately USD 8.6 billion in 2023.

By Nature

By Ingredient

In 2023, Orange Juice held a dominant market position, capturing more than 37.2% of the reconstituted juice market share. Orange juice remains the most popular choice due to its widespread appeal and refreshing taste. It is often seen as a staple in households and breakfast routines, contributing to its strong market presence. Additionally, orange juice benefits from its perception as a rich source of vitamin C, which further drives consumer demand.

Apple Juice, the second-largest segment, accounted for a significant share of the market in 2023. Apple juice is widely consumed due to its mild, sweet flavor and versatility. It is commonly marketed as a healthier alternative for children and adults alike. The segment is also favored for its affordability and availability across a wide range of retail channels.

Grape Juice, while smaller in comparison, continues to maintain a steady share of the market. Grape juice is valued for its antioxidant properties and rich, distinct flavor. It is often marketed as a premium product, particularly those made from concentrated grape juice or those with added health benefits such as heart-healthy antioxidants.

Mixed Fruit Juice is another growing segment, offering a combination of various fruit flavors. This category appeals to consumers looking for variety and more complex taste profiles. As the trend toward multi-flavor beverages increases, mixed fruit juices have seen a rise in demand. The segment benefits from the ability to blend different fruits to cater to various taste preferences.

By Packaging

In 2023, Bottle packaging held a dominant market position, capturing more than 44.4% of the reconstituted juice market share. Bottles are the most commonly used packaging format for juices, offering convenience, portability, and a wide range of sizes. They are preferred by consumers for both single-serve and family-sized portions. The transparent nature of plastic and glass bottles also allows consumers to view the product, which is seen as an indicator of quality and freshness.

Can packaging, accounting for a significant share, remains popular for its cost-effectiveness and efficient storage. Cans are lightweight, durable, and offer good protection against external factors like light and air, helping to preserve the juice’s flavor and quality. The segment is especially prevalent in the ready-to-drink beverage market, with many consumers opting for cans due to their convenience for on-the-go consumption.

Tetra Pak packaging, known for its advanced barrier technology, is also gaining traction in the reconstituted juice market. This packaging format is favored for its ability to preserve the juice’s freshness for a longer period without refrigeration. Tetra Pak is particularly popular in the premium juice market and among consumers looking for eco-friendly options, as the packaging is recyclable and often made from renewable materials.

By End Use

In 2023, Household held a dominant market position, capturing more than 57.4% of the reconstituted juice market share. The household segment remains the largest, driven by the consistent demand for juice as a staple beverage in daily consumption.

Reconstituted juices are commonly purchased in bulk for family use, making them a regular feature in kitchens and refrigerators. The convenience of ready-to-drink juices, combined with a variety of flavors and packaging options, continues to make them a popular choice for households worldwide.

The Food Service segment, while smaller than the household segment, is experiencing steady growth. Reconstituted juices are widely used in restaurants, cafes, hotels, and catering services. This segment benefits from the increasing popularity of juices as part of breakfast menus, health-conscious dining, and on-the-go options. Food service providers prefer reconstituted juices due to their cost-effectiveness and long shelf life compared to fresh juices, allowing for easier storage and handling.

By Distribution Channel

In 2023, Hypermarkets/Supermarkets held a dominant market position, capturing more than 44.2% of the reconstituted juice market share. Hypermarkets and supermarkets are the primary retail channels for juice sales, benefiting from their large product offerings and high foot traffic. These stores provide a wide variety of juice brands and packaging formats, making them the go-to destination for consumers looking for convenience and variety. Their expansive reach and frequent promotions also contribute to their dominance in the market.

Modern Grocery Stores, including convenience stores and smaller retail outlets, are increasingly becoming important distribution points for reconstituted juices. These stores offer a more compact selection of products but are valued for their convenience, particularly in urban areas. They cater to busy consumers who prioritize quick and easy shopping experiences. While the share of this segment is smaller compared to hypermarkets, it is growing due to the rising demand for on-the-go beverages.

Discount Stores represent a growing channel for reconstituted juices, driven by consumer demand for lower-priced alternatives. These stores typically focus on offering competitive pricing and bulk buying options, attracting price-sensitive shoppers. While their product range may be more limited, discount stores continue to capture a share of the market by offering affordable juice options for budget-conscious consumers.

Specialty Stores, which include organic, health food, and natural product retailers, cater to a more niche market of consumers seeking premium or health-focused juice products. These stores offer high-quality, often organic, reconstituted juices, catering to the increasing trend of health and wellness. While this segment holds a smaller share of the market, its growth potential is significant, as consumers become more aware of product sourcing, ingredients, and health benefits.

Key Market Segments

By Nature

- Organic

- Conventional

By Ingredient

- Orange Juice

- Apple Juice

- Grape Juice

- Mixed Fruit Juice

- Others

By Packaging

- Bottle

- Can

- Tetra Pak

- Others

By End Use

- Household

- Food Service

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Modern Grocery Stores

- Discount Stores

- Specialty Stores

- Others

Drivers

Growing Health Consciousness and Rising Demand for Nutritional Beverages

A major driving factor for the growth of the reconstituted juice market is the increasing global awareness of health and wellness, particularly concerning dietary habits. Consumers are progressively seeking beverages that offer nutritional value and health benefits, contributing to a shift away from sugary sodas and other processed drinks.

According to a 2023 report by the World Health Organization (WHO), there has been a significant rise in global concerns about obesity and lifestyle diseases, with a growing emphasis on improving dietary habits. The WHO states that approximately 39% of the global adult population was overweight in 2016, and this figure has only increased, further influencing consumer choices.

The rising focus on health has made reconstituted juices a favorable option due to their perceived natural ingredients and potential nutritional content. Orange juice, for example, is a top choice because of its high vitamin C content, which is linked to immune support and overall health.

Data from the U.S. Department of Agriculture (USDA) indicates that 100% orange juice provides an excellent source of vitamin C, with one 8-ounce serving offering about 124% of the recommended daily intake. As consumers become more health-conscious, their preference for natural, nutrient-dense beverages continues to rise, positively influencing demand for reconstituted juices globally.

Rising Focus on Clean Labels and Natural Ingredients

The trend toward clean labels and natural ingredients is another key driver for the reconstituted juice market. Consumers are increasingly avoiding products with artificial additives, preservatives, and colorings, which is pushing the food and beverage industry toward transparency and natural product formulations.

The Clean Label Project, an organization that focuses on ensuring transparency in food labeling, found in a 2022 survey that 75% of consumers are willing to pay more for products with cleaner, simpler ingredients. This growing preference for natural, organic ingredients has led to a surge in the availability of organic reconstituted juices, which are often marketed as free from pesticides and artificial ingredients.

In response to consumer demands for healthier and more transparent products, companies are reformulating their juices to focus on organic sourcing and minimal processing. The Organic Trade Association (OTA) reports that the organic food market in the U.S. reached a value of $61.9 billion in 2022, with beverages such as juices leading the trend.

Specifically, organic fruit juice sales grew by 6.3% in 2022, reflecting the wider consumer shift towards organic, clean-label products. As a result, manufacturers of reconstituted juices are increasingly focusing on providing products that are free from synthetic additives, which directly supports the growth of the organic juice segment within the broader reconstituted juice market.

Supportive Government Initiatives Promoting Fruit and Vegetable Consumption

Government initiatives promoting healthier dietary habits and the consumption of fruits and vegetables are further accelerating the demand for reconstituted juices. For example, the U.S. government has long supported the consumption of fruits and vegetables as part of a healthy diet.

The U.S. Department of Agriculture (USDA) recommends that adults consume about 2 cups of fruit per day, and in recent years, reconstituted juices have been marketed as a convenient way to help meet this goal. Similarly, the European Commission’s “Farm to Fork” strategy aims to increase the consumption of plant-based foods, including fruits and vegetables, which indirectly supports the demand for juice products made from natural sources.

In countries like India, where the government has launched various health campaigns to encourage the consumption of fresh fruits, the demand for reconstituted juices has benefited. For example, India’s National Health Mission includes efforts to enhance nutrition through fruit and vegetable consumption, directly impacting the reconstituted juice market.

Government-backed initiatives like the “National Fruit and Vegetable Promotion Campaign” are expected to increase awareness and demand for fruit-based beverages, contributing to a positive market outlook for reconstituted juices, particularly in emerging economies.

Convenience and Accessibility Driving Growth in Urban Markets

As urbanization continues to rise globally, the demand for convenient, ready-to-drink beverages has also increased. Reconstituted juices fit well within this trend, offering a quick and easy solution for consumers seeking healthy and accessible drink options.

According to the United Nations, the urban population was estimated to be 56.2% of the global population in 2020 and is expected to increase to 68.4% by 2050. This urban shift is associated with busier lifestyles, where consumers often prioritize convenience in their food and beverage choices.

Restraints

High Sugar Content and Rising Health Concerns

A significant restraining factor for the reconstituted juice market is the growing concern over the high sugar content in many juice products. While juices are often marketed as healthy, many reconstituted juices contain added sugars or natural sugars in high quantities, leading to increased consumer awareness of potential health risks.

According to the World Health Organization (WHO), excessive sugar consumption is linked to a variety of health issues, including obesity, type 2 diabetes, and cardiovascular disease. The WHO recommends that no more than 10% of total daily caloric intake come from free sugars, ideally reducing this to below 5% for additional health benefits. This guideline is particularly relevant for juice consumption, as a standard 8-ounce serving of reconstituted orange juice can contain up to 20 grams of sugar, which is nearly 5 teaspoons.

As consumers become more health-conscious, they are increasingly scrutinizing the nutritional content of the products they purchase. A study by the U.S. Centers for Disease Control and Prevention (CDC) found that about 61% of adults in the U.S. are concerned about the sugar content in beverages, with 24% actively reducing their sugar intake.

This has prompted a shift in consumer preferences, where many are opting for beverages with lower sugar content or alternatives like water, unsweetened teas, and plant-based drinks. For juice manufacturers, the pressure to reformulate products and reduce sugar content is increasing, especially as more countries, including the U.K. and Mexico, introduce sugar taxes and stricter regulations on sugary drinks.

Increasing Competition from Healthier Beverage Alternatives

The rising popularity of healthier beverage alternatives is another restraining factor for the reconstituted juice market. With increasing consumer preference for beverages perceived as healthier, such as bottled water, herbal teas, and plant-based drinks (e.g., almond milk or coconut water), reconstituted juices are facing stiff competition.

According to the International Bottled Water Association (IBWA), bottled water consumption in the U.S. reached 15.8 billion gallons in 2021, growing by 3.7% from the previous year. Meanwhile, the global market for plant-based beverages is also expanding rapidly, with the plant-based milk sector alone expected to reach $22 billion by 2024, according to data from the Plant Based Foods Association (PBFA).

Consumers are increasingly opting for beverages that align with broader trends such as clean eating, veganism, and low-calorie diets. These alternatives, which are often perceived as offering additional health benefits (such as lower sugar content, no preservatives, and higher nutritional value), are capturing a significant share of the beverage market.

As a result, reconstituted juice brands are under pressure to innovate and differentiate themselves. The competition from these healthier options could slow the growth of the reconstituted juice market, particularly in markets where wellness trends are gaining strong traction.

Regulatory Pressures and Sugar Tax Initiatives

Government regulations and sugar tax initiatives are further challenging the reconstituted juice market. In an effort to curb the rising prevalence of obesity and diet-related diseases, several countries have introduced taxes on sugary drinks, including reconstituted juices.

For instance, the United Kingdom implemented a “Soft Drinks Industry Levy” in 2018, which imposes a tax on beverages with added sugar content exceeding a certain threshold. The policy has had a measurable impact on the market.

According to the U.K. government’s Department of Health and Social Care, over 50% of drinks that were previously subject to the levy have reduced their sugar content, indicating the pressure on manufacturers to reformulate products to comply with these regulations.

Opportunity

Expansion of the Organic Reconstituted Juice Segment

One of the key growth opportunities for the reconstituted juice market is the increasing demand for organic juices. As consumers become more health-conscious and environmentally aware, they are increasingly seeking products made from organic ingredients, free from pesticides, synthetic chemicals, and genetically modified organisms (GMOs).

The global organic food market, including beverages like juices, is experiencing robust growth. According to the Organic Trade Association (OTA), the organic food market in the U.S. reached $61.9 billion in 2022, with organic beverages accounting for a significant portion of this growth. The organic fruit juice segment grew by 6.3% in 2022, reflecting strong consumer demand for clean-label, health-focused beverages.

Organic reconstituted juices are positioned well within this growing trend, as they meet the demand for both natural ingredients and transparency in product sourcing. The organic certification, often seen as a mark of higher quality, appeals to consumers who are increasingly wary of artificial additives in food and beverages.

For example, 100% organic juices are seen as healthier alternatives, with many consumers willing to pay a premium for products that offer these perceived benefits. As organic agriculture continues to expand, the supply of raw materials for organic reconstituted juices is likely to increase, enabling manufacturers to scale production and meet demand.

Increasing Popularity of Functional and Fortified Juices

Another significant growth opportunity lies in the growing demand for functional and fortified reconstituted juices. Functional beverages, which provide additional health benefits beyond basic nutrition, have gained popularity in recent years as consumers seek beverages that contribute to overall wellness.

According to the U.S. Department of Agriculture (USDA), more than 50% of Americans regularly consume fortified foods and beverages, including juices that are enhanced with added vitamins, minerals, antioxidants, and other nutrients. Reconstituted juices, particularly those fortified with vitamins such as vitamin D, calcium, or probiotics, are becoming popular as consumers seek to boost their immune system, improve digestion, or support bone health.

In addition, the functional beverage market is projected to continue growing at a strong pace. The global functional beverage market is expected to reach $208.13 billion by 2027, growing at a CAGR of 7.9% from 2020 to 2027, according to the World Health Organization (WHO). This growth is driven by increasing health awareness, as consumers shift toward beverages that offer added nutritional value.

Reconstituted juices enriched with additional nutrients are capitalizing on this trend. Manufacturers can leverage this demand by creating juice products that cater to specific health needs, such as boosting immunity or enhancing energy levels. As more consumers look for beverages that serve a dual purpose—hydration and health benefits—the market for functional reconstituted juices is expected to expand.

Growth in Emerging Markets and Expanding Middle-Class Population

The expanding middle class in emerging markets presents a substantial growth opportunity for the reconstituted juice market. According to the World Bank, the global middle class is expected to reach 5.4 billion people by 2030, with much of this growth coming from developing regions, particularly in Asia and Africa.

This rising middle class is driving increased demand for packaged food and beverages, including reconstituted juices. In countries like India, China, and Brazil, economic growth and urbanization are fueling higher disposable incomes, leading to greater consumption of convenience products, such as juices. As urban populations grow and living standards rise, the demand for ready-to-drink beverages like reconstituted juices is expected to grow significantly.

For example, India’s fruit juice market is projected to grow at a CAGR of 10.5% from 2020 to 2025, according to the Food and Agriculture Organization (FAO). This growth is driven by an expanding middle class and a shift towards modern retail formats such as supermarkets and hypermarkets, where reconstituted juices are easily accessible.

Similarly, in China, the government has been promoting healthier diets through initiatives like the “China Healthy Eating Index,” which encourages the consumption of fruits and vegetables, indirectly boosting the demand for fruit-based beverages. These emerging markets offer significant untapped potential for the reconstituted juice industry, especially as consumers in these regions shift toward healthier and more convenient beverage options.

Trends

Increased Demand for Low-Sugar and Sugar-Free Reconstituted Juices

One of the latest trends in the reconstituted juice market is the rising demand for low-sugar and sugar-free options. As consumers become more health-conscious and aware of the risks associated with excessive sugar consumption, they are increasingly seeking beverages that offer lower sugar content.

According to the World Health Organization (WHO), excessive sugar intake is linked to a variety of health problems, including obesity, type 2 diabetes, and cardiovascular disease. The WHO recommends that added sugars make up no more than 10% of total daily calorie intake, with a further reduction to below 5% for added health benefits. This recommendation has driven consumer behavior, with many looking for alternatives to traditional juices, which often contain significant amounts of added sugar.

In response to this growing concern, many reconstituted juice brands have begun offering products with reduced sugar or completely sugar-free formulations. The U.S. Food and Drug Administration (FDA) reports that in 2021, sugar-free beverage sales grew by 6.7% compared to the previous year, indicating a shift toward healthier options in the beverage sector.

Brands like Tropicana, Minute Maid, and others are now focusing on producing low-sugar or no-added-sugar juices to meet the demands of health-conscious consumers. Additionally, the increasing popularity of “naturally sweetened” juices—those sweetened with alternative ingredients like stevia or monk fruit—has also gained traction in the market, offering a healthier alternative to traditional sweeteners.

Shift Towards Functional and Enriched Juices

Another significant trend in the reconstituted juice market is the growing popularity of functional and fortified juices. These are juices that go beyond basic hydration, offering additional health benefits such as improved digestion, enhanced immunity, and increased energy levels.

According to the U.S. Department of Agriculture (USDA), there is a growing preference for beverages that not only quench thirst but also support overall wellness. The global functional beverage market is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2020 to 2027, driven in part by the increasing demand for beverages with added nutritional value.

Reconstituted juices fortified with vitamins, minerals, antioxidants, and probiotics are gaining popularity as consumers seek to boost their immune systems, improve gut health, and increase their daily intake of essential nutrients. For example, juices fortified with vitamin D, calcium, or probiotics are becoming more common, reflecting the increased focus on health and wellness.

The Organic Trade Association (OTA) has reported that in 2022, the sale of functional beverages, including juices, grew by 6.3%, with probiotic-infused drinks seeing a 10% increase in sales. This trend is expected to continue, as consumers look for products that contribute to their overall health, not just their taste.

Sustainability and Eco-Friendly Packaging

Sustainability is becoming an increasingly important factor for both consumers and manufacturers in the reconstituted juice market. As environmental concerns continue to rise, many juice brands are focusing on reducing their carbon footprint by adopting eco-friendly packaging and sourcing practices.

The global packaging market for beverages is expected to reach $1.26 trillion by 2025, with a growing emphasis on sustainable materials such as recyclable plastic, glass, and biodegradable packaging. The shift towards sustainability is also being driven by government regulations and consumer demand for more environmentally friendly products.

According to the Environmental Protection Agency (EPA), plastic packaging accounts for about 13% of total waste in the U.S., with a significant portion of this waste coming from beverage containers. In response to this, many leading juice brands, including Coca-Cola and PepsiCo, have committed to making their packaging more sustainable.

For example, Coca-Cola has pledged to make 100% of its packaging recyclable by 2025 and is focusing on increasing the use of recycled plastic in its bottles. Similarly, PepsiCo has introduced initiatives to reduce plastic waste, including offering more juice products in recyclable aluminum cans and glass bottles. This trend is not only beneficial for the environment but also appeals to consumers who are increasingly prioritizing sustainability when making purchasing decisions.

Regional Analysis

Asia Pacific (APAC) holds a dominant position in the global reconstituted juice market, capturing more than 43.2% of the market share, valued at approximately USD 8.6 billion in 2023. This region’s robust market growth is driven by a rapidly expanding middle class, rising health awareness, and an increasing preference for convenience beverages.

Countries like China, India, and Japan are witnessing strong demand for both traditional fruit juices and functional beverages, with growing consumption patterns reflecting an increased shift toward healthier alternatives. The APAC market is expected to continue its strong growth, driven by urbanization, rising disposable incomes, and greater availability of packaged juice through modern retail channels.

North America is another significant market for reconstituted juices, with the U.S. being a key player in this region. The market in North America is projected to grow steadily, supported by rising consumer demand for organic, low-sugar, and fortified juices. In 2022, the U.S. organic juice market alone accounted for over USD 3.5 billion, as per the Organic Trade Association, reflecting a shift toward healthier, natural alternatives.

Europe also represents a substantial portion of the market, with a growing inclination toward functional and organic reconstituted juices. The European market is expected to continue expanding, driven by an increasing focus on health and wellness, with a projected market value of USD 5.1 billion by 2026. Government regulations promoting healthier diets further bolster demand in this region.

Latin America and Middle East & Africa are emerging markets, with moderate but steady growth anticipated in the coming years, primarily driven by the increasing adoption of healthier, ready-to-drink beverages in urban centers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Reconstituted Juice Market is highly competitive, with several major players dominating the landscape. PepsiCo Inc. and The Coca-Cola Company are two of the largest global players in the market, leveraging their extensive distribution networks and brand recognition.

PepsiCo’s Tropicana and Coca-Cola’s Minute Maid are among the leading reconstituted juice brands, known for their wide range of fruit juice offerings and innovative product lines, including low-sugar, organic, and fortified juices. These companies have a significant market presence, supported by their strategic acquisitions and continuous product diversification.

Other prominent companies such as Nestlé S.A., Del Monte Foods Inc., and Ocean Spray Cranberries Inc. also hold substantial shares in the market. Nestlé’s focus on offering health-oriented beverages, including functional juices, aligns with consumer demand for nutritious products.

Del Monte and Ocean Spray are key players in the fruit juice sector, offering premium and specialty juices, including those made from cranberries and tropical fruits. Dr Pepper Snapple Group (now Keurig Dr Pepper), Welch’s, and Dole Food Company Inc. are also notable contributors to the reconstituted juice market, providing a diverse range of juice products with a focus on quality and taste.

Additionally, companies like Citrus World Inc., Lassonde Industries Inc., Parle Agro Pvt. Ltd., and Britvic PLC are expanding their market footprint, primarily through regional dominance and expanding product offerings.

Smaller but growing players such as Hain Celestial Group Inc., Sun Orchard Inc., Cott Corporation, Refresco Group, and National Beverage Corp. are making significant strides by introducing innovative juice options, catering to the growing demand for organic, functional, and sugar-free alternatives. These key players continue to drive market growth through strategic mergers, product innovation, and adaptation to evolving consumer preferences.

Top Key Players in the Market

- PepsiCo Inc.

- The Coca-Cola Company

- Nestlé S.A.

- Tropicana Products Inc.

- Del Monte Foods Inc.

- Ocean Spray Cranberries Inc.

- Dr Pepper Snapple Group

- Welch’s

- Minute Maid

- Dole Food Company Inc.

- Citrus World Inc.

- Lassonde Industries Inc.

- Parle Agro Pvt. Ltd.

- Britvic PLC

- Keurig Dr Pepper Inc.

- Hain Celestial Group Inc.

- Sun Orchard Inc.

- Cott Corporation

- Refresco Group

- National Beverage Corp.

Recent Developments

In 2023, PepsiCo’s beverage segment, which includes Tropicana, generated over USD 22 billion in revenue, contributing significantly to the company’s overall performance.

In 2023, Coca-Cola’s total beverage segment, including Minute Maid, generated approximately USD 44 billion in revenue, with juices contributing significantly to this figure.

Report Scope

Report Features Description Market Value (2023) USD 20.1 Bn Forecast Revenue (2033) USD 32.1 Bn CAGR (2024-2033) 6.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Ingredient (Orange Juice, Apple Juice, Grape Juice, Mixed Fruit Juice, Others), By Packaging (Bottle, Can, Tetra Pak, Others), By End Use (Household, Food Service, Others), By Distribution Channel (Hypermarkets/Supermarkets, Modern Grocery Stores, Discount Stores, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PepsiCo Inc., The Coca-Cola Company, Nestlé S.A., Tropicana Products Inc., Del Monte Foods Inc., Ocean Spray Cranberries Inc., Dr Pepper Snapple Group, Welch’s, Minute Maid, Dole Food Company Inc., Citrus World Inc., Lassonde Industries Inc., Parle Agro Pvt. Ltd., Britvic PLC, Keurig Dr Pepper Inc., Hain Celestial Group Inc., Sun Orchard Inc., Cott Corporation, Refresco Group, National Beverage Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PepsiCo Inc.

- The Coca-Cola Company

- Nestlé S.A.

- Tropicana Products Inc.

- Del Monte Foods Inc.

- Ocean Spray Cranberries Inc.

- Dr Pepper Snapple Group

- Welch's

- Minute Maid

- Dole Food Company Inc.

- Citrus World Inc.

- Lassonde Industries Inc.

- Parle Agro Pvt. Ltd.

- Britvic PLC

- Keurig Dr Pepper Inc.

- Hain Celestial Group Inc.

- Sun Orchard Inc.

- Cott Corporation

- Refresco Group

- National Beverage Corp.