Global Lactose Free Milk Market By Form (Liquid, Powder), By Category (Plain, Flavoured), By Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail Stores, Others), By End-Use (Household Consumption, Food and Beverage Industry), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133480

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

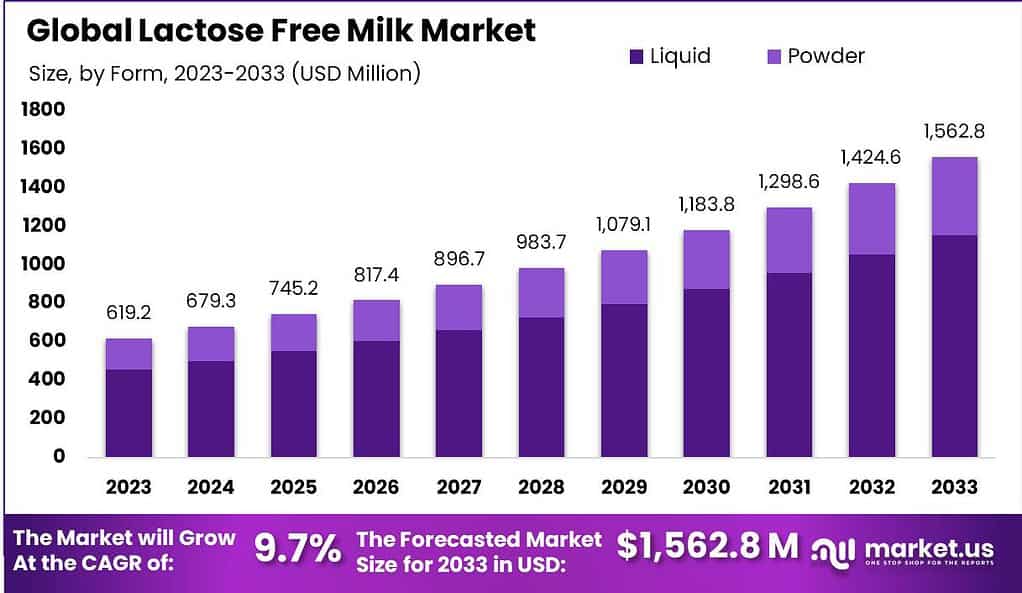

The Global Lactose-Free Milk Market size is expected to be worth around USD 1562.8 Million by 2033, from USD 619.2 Million in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

The lactose-free milk market refers to the segment of the dairy industry that produces milk without lactose, a type of sugar naturally found in milk that some people find hard to digest. This market caters specifically to those who are lactose intolerant, meaning their bodies cannot properly break down lactose, leading to discomfort. To address this, lactose-free milk is treated with an enzyme that breaks down lactose into simpler sugars, making it digestible.

The market demand for lactose-free milk has been rising steadily, reflecting a broader trend towards health-conscious food choices and dietary inclusivity. Many consumers are either lactose intolerant or simply prefer lactose-free products for digestive comfort. This shift in consumer preference has led to increased sales and greater shelf presence in supermarkets around the world.

The popularity of the lactose-free milk market has been increasing notably over the past few years. This rise in popularity can be attributed to a greater public awareness of lactose intolerance and other dietary sensitivities. More people are recognizing that lactose-free milk allows them to enjoy the benefits of milk without experiencing discomfort.

The food and beverage sector, which includes dairy alternatives, has seen a noticeable shift towards lactose-free products. This trend is driven by both consumer demand and innovations in food processing technologies. For instance, the retail sales of lactose-free milk in the United States reached approximately $1.2 billion in 2022, representing a growth of 12% over the previous year.

Regulatory frameworks across different regions enforce stringent guidelines on the labeling and marketing of lactose-free products. In the European Union, the ‘lactose-free’ label requires products to contain less than 0.01 grams of lactose per 100 grams or milliliters, fostering transparency and consumer trust. Additionally, governments are also facilitating the growth of this market through initiatives that promote dietary diversity and food safety.

The international trade of lactose-free milk products is influenced by regional dietary trends and regulatory environments. For instance, Nordic countries, where lactose intolerance is highly prevalent, import significant volumes of lactose-free milk, with Finland importing over 5 million liters in 2021, reflecting a 15% increase from 2020.

Investment in the lactose-free milk sector is robust, with private and government sectors participating actively. For example, a major U.S. dairy brand invested $30 million in 2022 to expand its lactose-free milk production capabilities, aiming to meet the rising domestic demand which is growing at an annual rate of 10%.

The market is witnessing considerable innovations and strategic partnerships. For example, in 2023, a leading dairy producer in Germany partnered with a technology firm to enhance the enzymatic process that removes lactose from milk, increasing the efficiency of production by 20%.

Mergers and acquisitions are also prevalent, facilitating expansion and diversification. A notable merger in 2022 involved two leading European dairy companies, aiming to leverage each other’s strengths in the lactose-free product segment and expand their market footprint globally.

Key Takeaways

- The Global Lactose-Free Milk Market size is expected to be worth around USD 1562.8 Million by 2033, from USD 619.2 Million in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

- Liquid lactose-free milk dominated the market “By Form segment” with a 74.3% share.

- Plain lactose-free milk dominates the market position in the By Category segment of the Lactose-Free Milk Market with a 64.2% share.

- Supermarkets/Hypermarkets dominated the lactose-free milk market with a 48.2% share.

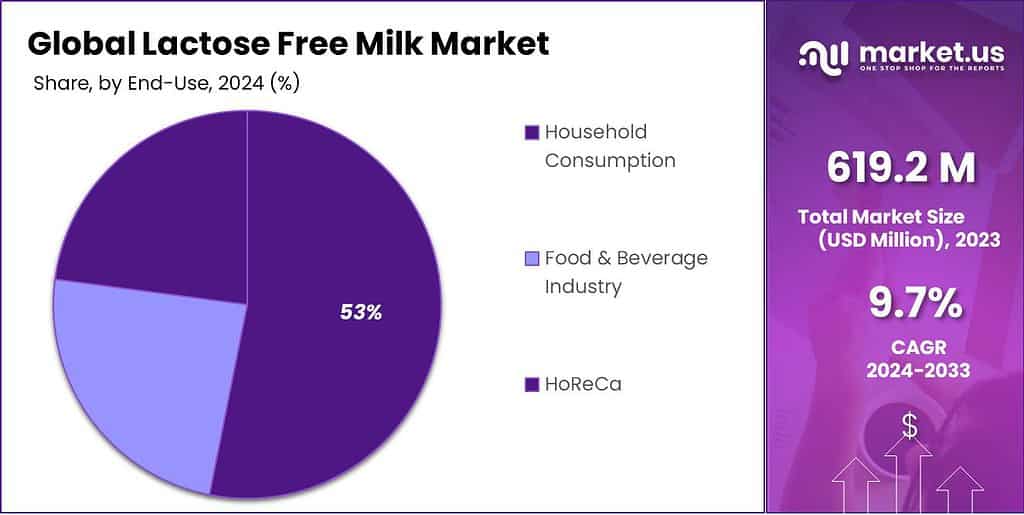

- Household Consumption dominated the “By End-Use segment” of the lactose-free milk market with a 56.1% share.

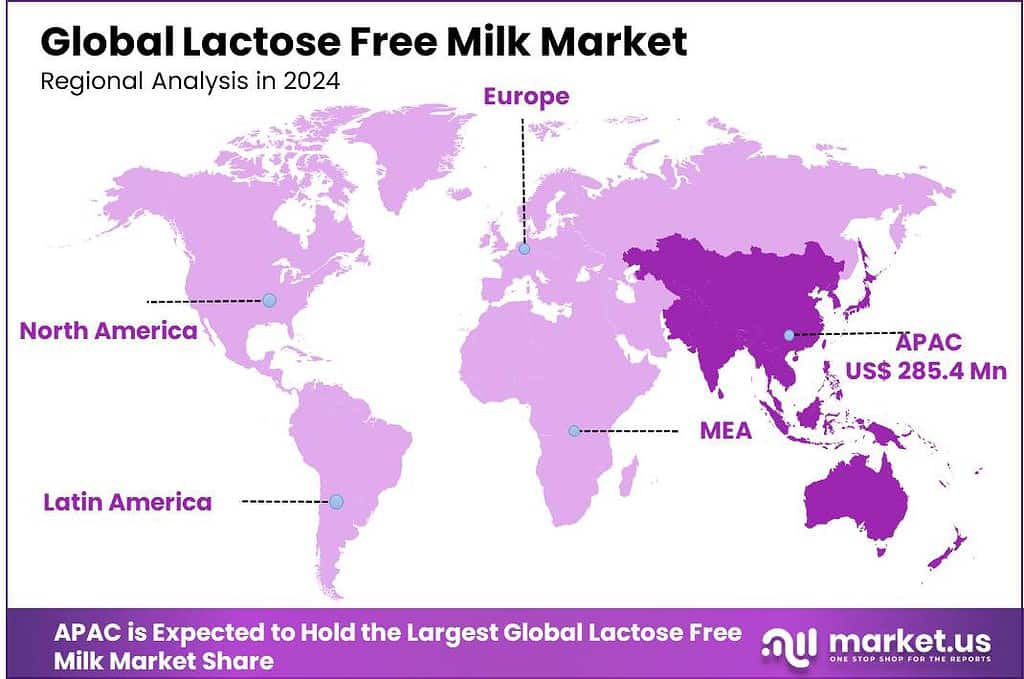

- APAC dominates the lactose-free milk market with a 46.1% share at $285.4 million.

By Form Analysis

Liquid lactose-free milk dominated the market with a 74.3% share.

In 2023, Liquid held a dominant market position in the By Form segment of the Lactose-Free Milk Market, capturing more than a 74.3% share. This significant market share is largely attributed to the widespread consumer preference for liquid lactose-free milk due to its convenience and similarity to traditional milk in terms of usage and taste. Liquid lactose-free milk is readily available in various retail channels, making it accessible to a broad consumer base, which further supports its dominant position.

The Powder form of lactose-free milk, while smaller in market share, presents a niche yet vital segment. Powdered lactose-free milk is primarily valued for its longer shelf life and portability, making it an excellent option for consumers who travel frequently or those who prefer to stock up on dairy products. Although it occupies a smaller portion of the market, the powder segment benefits from specific use cases, such as in baking and emergency food supplies, where its ease of storage and versatility in use are highly advantageous.

By Category Analysis

Plain lactose-free milk dominates the market position in the By Category segment of the Lactose-Free Milk Market with a 64.2% share.

In 2023, Plain held a dominant market position in the By Category segment of the Lactose-Free Milk Market, capturing more than a 64.2% share. This substantial share underscores the strong preference among consumers for plain lactose-free milk, which is often chosen for its versatility and similarity to traditional milk. Plain lactose-free milk serves as a direct substitute for regular milk, used in cooking, baking, and direct consumption, thereby appealing to a broad audience seeking lactose-free alternatives without added flavors.

The Flavored segment, while smaller, caters to specific consumer preferences that seek variety in their diet. Flavored lactose-free milk, such as chocolate, vanilla, or strawberry, offers appealing options particularly popular among children and those looking for a tastier alternative to plain milk. Despite holding a smaller market share, flavored lactose-free milk is crucial for diversifying the market and attracting segments of the population that might not otherwise consume milk substitutes.

By Distribution Channel Analysis

Supermarkets/Hypermarkets dominated the lactose-free milk market with a 48.2% share.

In 2023, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Lactose-Free Milk Market, capturing more than a 48.2% share. This significant market share is largely due to the extensive reach and accessibility of these outlets. Supermarkets and hypermarkets offer a wide variety of lactose-free milk products under one roof, catering to consumer preferences for one-stop shopping experiences where they can compare different brands and varieties easily.

Convenience and grocery stores, which are more widespread, particularly in urban and suburban areas, also play a vital role in the distribution of lactose-free milk. These stores provide quick access to daily essentials, including lactose-free options, thus serving the needs of consumers looking for both convenience and immediacy in their purchases.

Online retail stores have seen a surge in popularity as well, driven by the increasing consumer preference for home deliveries and the convenience of online shopping. This channel has been particularly crucial during the COVID-19 pandemic, providing a safe and reliable means for consumers to obtain their preferred lactose-free products without leaving their homes.

By End-Use Analysis

Household Consumption dominated the “By End-Use segment” of the lactose-free milk market with a 56.1% share.

In 2023, Household Consumption held a dominant market position in the By End-Use segment of the Lactose-Free Milk Market, capturing more than a 56.1% share. This leading position highlights the strong preference for lactose-free milk among individual consumers who use these products daily in their homes. The accessibility and variety of lactose-free milk in retail outlets, along with growing awareness of lactose intolerance and digestive wellness, have significantly contributed to its widespread use in household settings.

Meanwhile, the Food & Beverage industry also incorporates lactose-free milk into various products, catering to the dietary needs of consumers in restaurants, cafes, and food processing. Although this segment is smaller compared to household consumption, it is essential for providing lactose-free options in public dining and packaged goods, broadening the reach and acceptance of lactose-free milk products.

Key Market Segments

By Form

- Liquid

- Powder

By Category

- Plain

- Flavored

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail Stores

- Others

By End-Use

- Household Consumption

- Food & Beverage Industry

- HoReCa

Driving factors

Growing Incidence of Lactose Intolerance

The increasing incidence of lactose intolerance globally is a primary driver for the lactose-free milk market. As more individuals are diagnosed with or self-identify as lactose intolerant, the demand for products that cater to this dietary need rises. Lactose intolerance affects a significant portion of the population, particularly in regions such as Asia and Africa, where the majority of adults have some degree of lactose malabsorption.

This medical condition leads many to seek lactose-free alternatives to conventional dairy products, creating a steady customer base for lactose-free milk. In the United States alone, the lactose-free product market has been expanding by approximately 12% annually, indicating strong consumer demand linked directly to the prevalence of lactose intolerance.

Health and Wellness Trends

Health and wellness trends significantly contribute to the popularity of lactose-free milk. In recent years, there has been a shift towards more health-conscious eating habits, with consumers increasingly prioritizing products that are perceived as natural, healthy, and beneficial for overall well-being.

Lactose-free milk is often marketed not only as a necessity for those with lactose intolerance but also as a healthier alternative to regular milk, due to its easier digestibility and sometimes fortified with additional nutrients like calcium and vitamin D. This aligns well with the broader health and wellness trend, where more consumers are looking for food and beverage products that support a healthy lifestyle.

Increased Dietary Awareness

Heightened dietary awareness is another critical factor boosting the lactose-free milk market. Today, consumers are more informed about food intolerances and allergies, thanks in part to more accessible information via social media, health blogs, and nutritional apps. This increased awareness has led to more people actively seeking out lactose-free products when shopping for groceries.

Furthermore, the clear labeling of lactose-free products aids consumers who are vigilant about their dietary intake, reinforcing trust and reliability in these products. This informed consumer base not only understands their dietary needs better but is also more likely to purchase lactose-free products regularly.

Restraining Factors

Competition from Non-Dairy Alternatives

One significant restraint in the growth of the lactose-free milk market is the stiff competition it faces from non-dairy alternatives. Products like almond milk, soy milk, oat milk, and coconut milk are gaining traction among consumers, not only for those with lactose intolerance but also for vegans, those allergic to dairy, and individuals seeking lower-calorie options.

These alternatives are often perceived as more sustainable and ethical, aligning with the environmental concerns of modern consumers. The popularity of these alternatives can divert potential customers away from lactose-free dairy milk, impacting its market share.

High Product Cost

Another factor limiting the market expansion for lactose-free milk is the higher cost associated with its production. The process of removing lactose or adding lactase enzyme to make the milk lactose-free adds additional steps in the production chain, increasing the final price of the product.

This price difference can be significant, making lactose-free milk less accessible to price-sensitive consumers. In regions with lower economic flexibility, the higher cost can be a considerable barrier, restricting the market growth to more affluent consumers or those who prioritize dietary needs over cost.

Taste Preferences

Taste preferences also play a crucial role in restraining the lactose-free milk market. While many consumers might try lactose-free milk for health reasons, some find that it tastes sweeter than regular milk, which can be off-putting for those accustomed to the flavor of traditional dairy milk. This difference in taste can discourage ongoing consumption among new users who do not find the flavor profile appealing, limiting repeat purchases and reducing overall market penetration.

Growth Opportunity

Lactose-Free Dairy Farms

The establishment and expansion of lactose-free dairy farms present a significant growth opportunity for the lactose-free milk market. By investing in specialized dairy farms that focus exclusively on producing lactose-free milk, companies can ensure a consistent and controlled supply of high-quality products. This not only helps in maintaining product standards but also in scaling production to meet the increasing consumer demand.

Furthermore, these farms can adopt sustainable farming practices, appealing to the eco-conscious consumer base that values environmentally friendly products.

Expansion into Food Service

Another strategic opportunity lies in expanding lactose-free milk offerings into the food service sector. As more restaurants, cafés, and institutional food services seek to accommodate diverse dietary needs, including lactose intolerance, the demand for specialized dairy options is set to rise. Providing lactose-free milk to these establishments can significantly widen market reach and brand visibility, making it a lucrative area for growth.

Nutritional Fortification

Enhancing the nutritional value of lactose-free milk through fortification is a critical opportunity for differentiation and market growth. Adding essential vitamins and minerals such as Vitamin D, calcium, and omega fatty acids can attract health-conscious consumers looking for added benefits in their dietary choices. This approach not only caters to the wellness trend but also positions lactose-free milk as a superior nutritional alternative to both regular and other non-dairy milks.

Latest Trends

Increased Focus on Organic Products

A significant trend shaping the lactose-free milk market is the increased focus on organic products. Consumers are becoming more health-conscious, not only seeking lactose-free options but also demanding that these products are organic and free from synthetic additives.

This shift is driving manufacturers to source milk from organically raised cows and to ensure that all stages of production adhere to organic standards. This trend not only meets consumer demands for purity and healthiness but also adds a premium aspect to the products, potentially increasing profitability.

Flavor Innovation

Flavor innovation is another key trend poised to impact the lactose-free milk market in 2024. As the market becomes more saturated, differentiation through unique and appealing flavors can attract a broader consumer base. Flavors like almond, coconut, and honey are becoming popular, moving beyond traditional chocolate and vanilla. This innovation caters to a palette-seeking variety and can significantly enhance consumer interest and market growth.

Celebrity and Influencer Endorsements

The trend of leveraging celebrity and influencer endorsements to promote lactose-free milk products is expected to gain momentum. Celebrities and influencers can play a pivotal role in shaping consumer preferences and expanding market reach, especially among younger demographics. By associating lactose-free milk with popular figures who advocate for health, wellness, and sustainable living, brands can enhance their visibility and appeal significantly.

Regional Analysis

APAC dominates the lactose-free milk market with a 46.1% share at $285.4 million.

The Lactose-Free Milk Market exhibits varied trends and opportunities across different regions, reflecting diverse dietary preferences, economic conditions, and levels of consumer awareness.

North America is a significant market for lactose-free milk, characterized by high consumer awareness and a robust health and wellness industry. The U.S. and Canada have seen a steady increase in demand due to a growing number of consumers identifying as lactose intolerant or opting for dairy alternatives for health reasons. This region benefits from advanced dairy processing technologies and strong distribution networks, making lactose-free products widely available.

Europe also represents a mature market with stringent food labeling regulations and high consumer awareness about food intolerances. Countries such as Finland, Sweden, and the UK, where lactose intolerance is particularly prevalent, exhibit strong demand for lactose-free dairy products. European consumers also show a strong preference for organic and locally sourced dairy alternatives, further driving the market’s growth.

Asia Pacific (APAC) is the fastest-growing and dominating region in the lactose-free milk market, holding a significant 46.1% market share with a value of $285.4 million. The increase in lactose intolerance among the population, coupled with rising health consciousness and improvements in retail infrastructure, contribute to this rapid growth. Countries like China, India, and Australia are spearheading this expansion, with local manufacturers increasingly entering the market.

Middle East & Africa and Latin America are emerging markets with growth potential. These regions are experiencing increased urbanization and changing lifestyles, which are gradually leading to greater acceptance and demand for lactose-free milk. However, these areas still face challenges such as lower consumer awareness and limited availability of lactose-free products compared to more developed markets.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, several key players are poised to shape the global lactose-free milk market through strategic initiatives, product innovation, and market expansion efforts. Here’s an analyst’s viewpoint on four of these companies:

Arla Foods Amba stands out for its comprehensive approach to catering to lactose-intolerant consumers. With a strong foothold in Europe and expanding presence in emerging markets, Arla is focusing on innovation in lactose-free dairy products. Their commitment to quality and extensive product range are expected to solidify their market position further in 2024.

Fonterra Co-operative Group Limited, a leader in dairy innovation, is leveraging its expertise in dairy science to enhance its lactose-free product offerings. Based in New Zealand, Fonterra is strategically positioned to tap into Asia-Pacific’s burgeoning demand, focusing on both the nutritional content and flavor profiles that appeal to local tastes.

The Danone Company has consistently been at the forefront of the health-oriented dairy segment. With a strong portfolio that includes popular brands like Activia and Actimel, Danone is likely to boost its lactose-free offerings by integrating probiotics and other health-enhancing features, appealing to health-conscious consumers globally.

Nestle S.A. is utilizing its vast R&D capabilities to innovate in the lactose-free milk segment. Known for its scientific approach to nutrition, Nestle is expected to introduce highly differentiated products that cater to specific dietary needs and preferences, thus driving growth in both developed and emerging markets.

These companies, through their focused strategies on innovation, consumer health, and global market penetration, are well-positioned to capitalize on the growing demand for lactose-free milk products. Their efforts are likely to not only enhance their competitive edge but also significantly contribute to the expansion of the lactose-free milk market globally.

Market Key Players

- Alpro

- Arla Foods amba

- Blooming Sweet Life Corp.

- Cabot Creamery Corporation

- Fonterra Co-operative Group Limited

- Green Valley Creamery

- Hiland Dairy Foods

- Johnson & Johnson

- Lactalis

- McNeil Nutritionals

- Nestle S.A.

- Organic Valley

- Saputo Dairy Products

- Schwarzwaldmilch GmbH

- Smith Dairy Products

- The Agropur Dairy Cooperative

- The Coca-Cola Company

- The Danone Company

- Valio International

- General Mills

- Gujrat Cooperative Milk Marketing Federation

Recent Development

- In October 2024, Nestle inaugurated a new R&D facility in Switzerland focused exclusively on innovation in the lactose-free product segment. The facility aims to pioneer advancements in lactose-free dairy processing technologies, aiming to improve both the nutritional profile and taste of their products.

- In August 2024, Fonterra Co-operative Group Limited announced a partnership with local dairy farms in New Zealand to boost the production of lactose-free milk. This initiative is designed to ensure a sustainable supply chain and support community-based agriculture, reinforcing Fonterra’s commitment to both quality and local economy.

- In April 2024, Arla Foods introduced a new line of lactose-free yogurts and cheeses in Europe. This expansion aims to cater to the growing consumer demand for a broader range of lactose-free dairy options beyond milk, enhancing consumer choice and satisfaction.

Report Scope

Report Features Description Market Value (2023) USD 619.2 Million Forecast Revenue (2033) USD 1562.8 Million CAGR (2024-2032) 9.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder), By Category (Plain, Flavoured), By Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail Stores, Others), By End-Use (Household Consumption, Food & Beverage Industry) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Alpro, Arla Foods amba, Blooming Sweet Life Corp., Cabot Creamery Corporation, Fonterra Co-operative Group Limited, Green Valley Creamery, Hiland Dairy Foods, Johnson & Johnson, Lactalis, McNeil Nutritionals, Nestle S.A., Organic Valley, Saputo Dairy Products, Schwarzwaldmilch GmbH, Smith Dairy Products, The Agropur Dairy Cooperative, The Coca-Cola Company, The Danone Company, Valio International, General Mills, Gujrat Cooperative Milk Marketing Federation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lactose Free Milk MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Lactose Free Milk MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alpro

- Arla Foods amba

- Blooming Sweet Life Corp.

- Cabot Creamery Corporation

- Fonterra Co-operative Group Limited

- Green Valley Creamery

- Hiland Dairy Foods

- Johnson & Johnson

- Lactalis

- McNeil Nutritionals

- Nestle S.A.

- Organic Valley

- Saputo Dairy Products

- Schwarzwaldmilch GmbH

- Smith Dairy Products

- The Agropur Dairy Cooperative

- The Coca-Cola Company

- The Danone Company

- Valio International

- General Mills

- Gujrat Cooperative Milk Marketing Federation