Global Microbial Pesticides Market By Source (Microbials, Biochemicals), By Ingredient Type (Bacteria-based, Fungi-based, Virus-based, Others), By Product Type (Microbial Fungicide, Microbial Insecticide, Others) By Mode of Application (Foliar Application, Seed Treatment, Soil Application, Others), By Crop Type (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables , Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133687

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Source Analysis

- By Ingredient Type Analysis

- By Product Type Analysis

- By Mode of Application Analysis

- By Crop Type Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Trending Factors

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

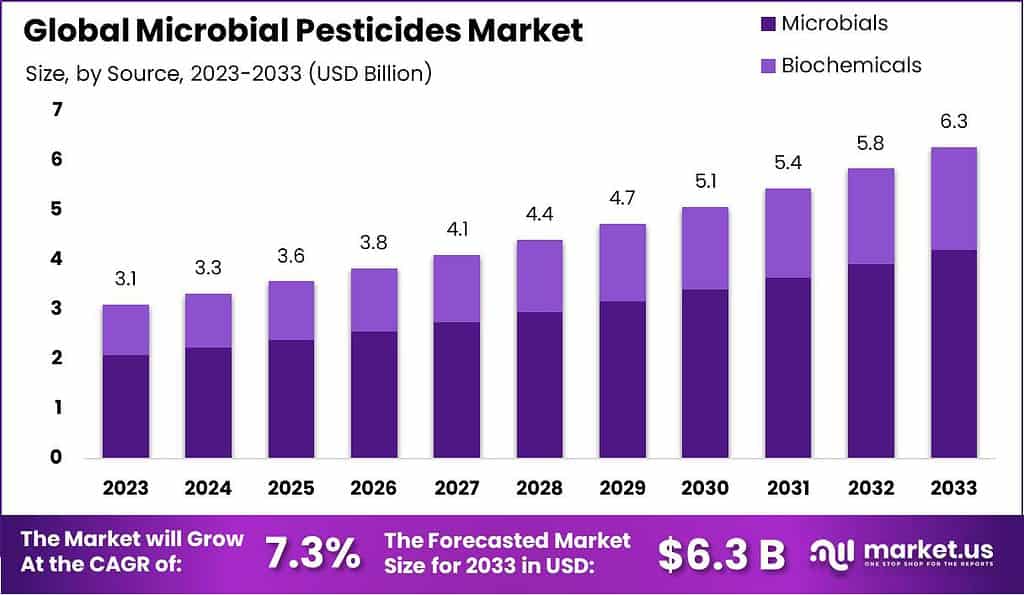

The Global Microbial Pesticides Market size is expected to be worth around USD 6.3 Billion by 2033, from USD 3.1 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

The microbial pesticides market is experiencing significant growth, driven by the increasing demand for sustainable and eco-friendly alternatives to traditional chemical pesticides. Microbial pesticides, which use natural organisms like bacteria, fungi, and viruses to control pests, are gaining popularity in agriculture due to rising concerns about the environmental and health impacts of chemical pesticides.

As more consumers, farmers, and governments focus on organic farming and environmental health, the demand for microbial pesticides is expected to continue to rise.

The agricultural sector holds the largest share of the microbial pesticides market, accounting for approximately 72% of total market revenue. Within agriculture, microbial pesticides are primarily used for crop protection, including fruits, vegetables, cereals, and pulses, which together represent about 56% of agricultural use.

Other significant applications include horticulture (16%) and turf and ornamental plants (28%). This broad application range shows that microbial pesticides are not only crucial for protecting food crops but also for improving the quality and health of non-food plants.

Regulatory support is a key factor driving the growth of the microbial pesticides market. In the United States, the Environmental Protection Agency (EPA) has approved over 200 microbial pesticide active ingredients since the 1970s. The European Union is also taking steps to encourage the use of microbial pesticides as part of its Farm to Fork Strategy, which aims to reduce pesticide use by 50% by 2030. This regulatory push is increasing the demand for alternative pest control solutions like microbial pesticides.

Trade in microbial pesticides is expanding globally. The U.S. remains a dominant exporter, contributing to about 45% of global exports, followed by emerging exporters like India, which is increasing its exports to Africa and Asia as demand for organic farming solutions grows in these regions. The global microbial pesticide trade is also supported by key markets in China and India, where the demand for environmentally friendly agricultural solutions is rising rapidly.

Government initiatives are also playing a role in boosting demand. In the U.S., the Department of Agriculture (USDA) has allocated more than USD 10 million for sustainable agricultural programs, including microbial pesticide research, under the Sustainable Agriculture Research and Education (SARE) program.

Similarly, India’s National Mission on Agricultural Extension and Technology (NMAET) supports the use of biocontrol agents like microbial pesticides to reduce reliance on chemical pesticides. The EU has also invested over EUR 40 million in Horizon 2020 projects, focusing on alternative pest management solutions, which include microbial pesticides.

Private sector investment in microbial pesticides is increasing, with companies like BASF and Syngenta making strategic moves to expand their portfolios. BASF invested over USD 100 million to enhance its biological crop protection offerings, including the acquisition of AgraQuest in 2020. Syngenta, in partnership with Novozymes, invested USD 40 million in joint R&D efforts to develop new microbial pest control solutions.

The adoption of microbial pesticides is growing globally. In North America, the adoption rate has increased by 25% over the past five years, driven by the growth of organic farming. The Asia-Pacific region, particularly China and India, is expected to account for 34% of the global microbial pesticide market by 2030. This growth is fueled by strong government support for organic farming and sustainable agriculture practices.

Key Takeaways

- The Global Microbial Pesticides Market size is expected to be worth around USD 6.3 Billion by 2033, from USD 3.1 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

- Microbial dominated the Microbial Pesticides market with over 67.3% share.

- Bacteria-based microbial pesticides dominated the market with a 46.1% share in ingredient type.

- Microbial Fungicides dominated the market with a 46.1% share in product type.

- Foliar Application dominated the market with a 51% share in application mode.

- Grains & Cereals dominated the market with a 38.1% share in crop type.

- North America dominates the microbial pesticides market with a 41.6% share, valued at USD 1.3 billion.

By Source Analysis

Microbial dominated the Microbial Pesticides market with over 67.3% share.

In 2023, Microbial held a dominant market position in the By Source segment of the Microbial Pesticides market, capturing more than a 67.3% share. The substantial dominance of microbial-based pesticides can be attributed to their effectiveness, sustainability, and broad application across agricultural practices.

Microbial solutions, including bacterial, fungal, and viral agents, are increasingly preferred due to their ability to target specific pests and pathogens while being environmentally friendly. The rise in organic farming and the growing concern over the harmful effects of synthetic chemicals have significantly contributed to the widespread adoption of microbial pesticides in crop protection.

Biochemicals, which accounted for the remaining share, have also gained popularity due to their targeted, eco-friendly nature. These include naturally occurring substances like plant extracts, pheromones, and other biochemical compounds.

Biochemical pesticides are particularly valued for their specificity in controlling pests without harming beneficial organisms or the environment. While the microbial segment continues to dominate, the biochemicals segment is expected to experience steady growth, driven by advancements in sustainable pest management practices and increasing regulatory pressures on chemical pesticide use.

By Ingredient Type Analysis

Bacteria-based microbial pesticides dominated the market with a 46.1% share in ingredient type.

In 2023, Bacteria-based microbial pesticides held a dominant market position in the By Ingredient Type segment of the Microbial Pesticides market, capturing more than a 46.1% share. Bacteria-based products, particularly those containing Bacillus thuringiensis (Bt) and Bacillus subtilis, are widely recognized for their effectiveness in controlling a broad spectrum of pests, including insects and larvae.

The substantial market share can be attributed to the growing demand for eco-friendly pest control solutions in agriculture, especially in regions like North America and Europe, where regulatory pressures against synthetic chemicals are stronger.

Fungi-based microbial pesticides accounted for the second-largest share, with products such as Trichoderma and Beauveria bassiana gaining traction for their ability to target soil-borne pathogens and pests. Fungi-based solutions are particularly popular in integrated pest management (IPM) systems, contributing to their steady growth.

Virus-based microbial pesticides, while capturing a smaller share, have found niche applications in controlling specific pests, particularly in high-value crops. These include products based on nucleopolyhedrovirus (NPV) and granulosis virus, which offer targeted pest control with minimal environmental impact.

By Product Type Analysis

Microbial Fungicides dominated the market with a 46.1% share in product type.

In 2023, Microbial Fungicides held a dominant market position in the By Product Type segment of the Microbial Pesticides market, capturing more than a 46.1% share. Microbial fungicides, which include products based on beneficial microorganisms such as Trichoderma and Beauveria bassiana, are highly effective in controlling fungal diseases and pathogens that affect crops.

The strong market share can be attributed to the increasing adoption of sustainable farming practices and the growing demand for eco-friendly alternatives to synthetic chemical fungicides. These products are particularly favored in integrated pest management (IPM) systems due to their safety and low environmental impact.

Microbial Insecticides accounted for the second-largest share of the market, with products like Bacillus thuringiensis (Bt) gaining widespread use for pest control, especially in agriculture and horticulture. These insecticides are valued for their ability to target specific pests while leaving beneficial insects unharmed, aligning with the rising trend of organic farming and sustainability.

By Mode of Application Analysis

Foliar Application dominated the market with a 51% share in application mode.

In 2023, Foliar Application held a dominant market position in the By Mode of Application segment of the Microbial Pesticides market, capturing more than a 51% share. The foliar application involves spraying microbial pesticides directly onto plant leaves, where they are absorbed and act against pests or pathogens.

This method is particularly popular for its efficiency in controlling a wide range of pests, including insects and fungal pathogens, as it provides rapid and targeted results. The strong market share of foliar application can be attributed to its widespread adoption in commercial agriculture, especially in high-value crops such as fruits, vegetables, and ornamental plants, where timely pest control is critical.

Seed Treatment accounted for the second-largest share, offering a preventive approach by applying microbial pesticides to seeds before planting. This method helps protect crops from soil-borne pathogens and pests early in the growth cycle, contributing to stronger plant development. It is particularly popular in the cultivation of cereals, legumes, and oilseeds.

Soil Application, which involves applying microbial pesticides directly to the soil to target root or soil-borne pests, also holds a significant portion of the market. This application method is essential for managing nematodes and other soil pathogens, particularly in agriculture.

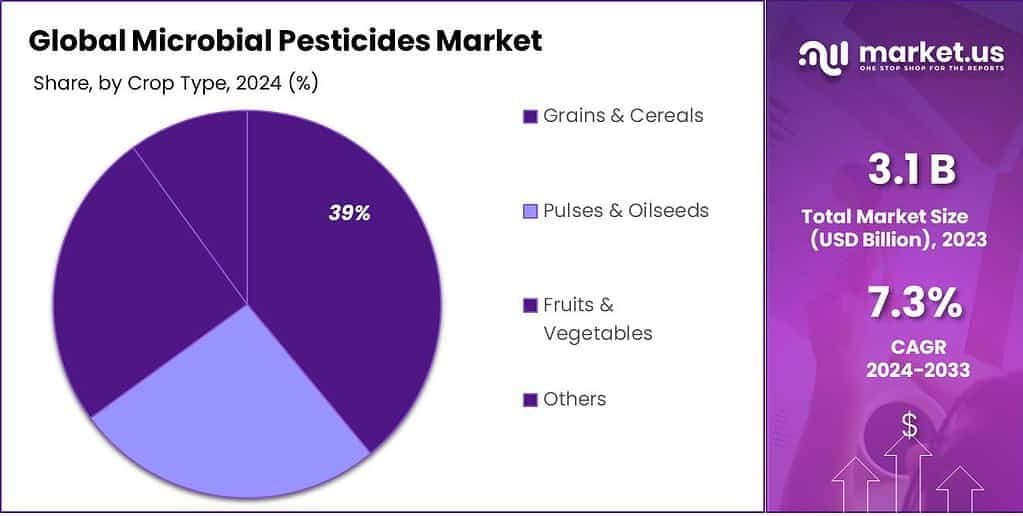

By Crop Type Analysis

Grains & Cereals dominated the market with a 38.1% share in crop type.

In 2023, Grains & Cereals held a dominant market position in the By Crop Type segment of the Microbial Pesticides market, capturing more than a 38.1% share. The substantial market share can be attributed to the widespread use of microbial pesticides in the cultivation of staple crops such as wheat, rice, corn, and barley.

Microbial-based solutions, including bacterial and fungal agents, are highly effective in controlling common pests and diseases that affect these crops, such as aphids, rootworms, and fungal pathogens. With an increasing global focus on sustainable farming and the need to reduce reliance on chemical pesticides, microbial pesticides have gained popularity in grain and cereal production.

Pulses & Oilseeds accounted for the second-largest share, with crops like soybeans, peas, and lentils benefiting from microbial pesticide applications. These crops are highly susceptible to both insect pests and fungal diseases, making microbial solutions an attractive option for maintaining crop health while adhering to organic and eco-friendly practices.

Fruits & Vegetables followed with a significant share, driven by the demand for safe, non-toxic pest control in high-value crops. Microbial pesticides, especially foliar sprays, are increasingly used to protect fruits and vegetables from pests and pathogens without compromising quality.

Key Market Segments

By Source

- Microbials

- Biochemicals

By Ingredient Type

- Bacteria-based

- Fungi-based

- Virus-based

- Others

By Product Type

- Microbial Fungicide

- Microbial Insecticide

- Others

By Mode of Application

- Foliar Application

- Seed Treatment

- Soil Application

- Others

By Crop Type

- Grains & Cereals

- Pulses & Oilseeds

- Fruits & Vegetables

- Others

Driving factors

Increasing Demand for Organic Farming Fuels Microbial Pesticide Market Growth

The growing global demand for organic farming is a pivotal driver of the microbial pesticide market. As consumers become more health-conscious and environmentally aware, the demand for organic produce continues to rise. Organic farming eschews the use of synthetic chemicals, instead favoring natural, non-toxic solutions like microbial pesticides to manage pests and diseases.

This shift has led to greater adoption of microbial pesticides, as they provide an effective, eco-friendly alternative to conventional chemical pesticides. Microbial pesticides, which include bacteria, fungi, and viruses, offer targeted pest control without harming beneficial organisms or leaving harmful residues on crops. As organic farming practices scale up to meet market demand, the microbial pesticide sector is expected to grow substantially.

Rising Awareness of Health Risks from Chemical Pesticides Accelerates Market Transition

The increasing awareness of the health risks associated with chemical pesticides has become a significant factor in the market’s growth. Chemical pesticides are linked to a range of health issues, including cancer, hormone disruption, and neurological disorders. Public concern over these health risks, along with regulatory pressures in many countries to limit pesticide use, is driving a shift toward safer, more sustainable alternatives like microbial pesticides.

Regulatory bodies such as the European Union and the U.S. Environmental Protection Agency (EPA) have introduced stricter regulations on pesticide residues and their environmental impact. This has made microbial pesticides an attractive alternative for growers who seek to comply with these stringent regulations while also protecting consumer health. The ongoing push for reduced chemical pesticide use is expected to continue steering farmers toward microbial options, further propelling market growth.

Rising Adoption in Integrated Pest Management (IPM) Systems Boosts Microbial Pesticide Utilization

Integrated Pest Management (IPM) is a holistic approach that combines biological, physical, cultural, and chemical methods to manage pests in an environmentally responsible way. The adoption of IPM systems has grown significantly in recent years, driven by the need for more sustainable agricultural practices. Within IPM, microbial pesticides play a key role, as they can be used as part of a comprehensive pest management strategy that minimizes the reliance on chemical pesticides.

The benefits of microbial pesticides in IPM systems are clear: they provide highly specific control of pests, reducing the risk of resistance development and minimizing harm to non-target species. Their incorporation into IPM frameworks has led to their increasing use, particularly in regions where sustainability is a priority.

Restraining Factors

High Development Costs Limit Market Accessibility and Expansion

One of the significant restraints on the growth of the microbial pesticides market is the high development costs associated with creating effective and scalable microbial solutions. Developing microbial pesticides requires extensive research, regulatory approvals, and long development timelines. These costs include the need for laboratory studies, field trials, and sometimes complex formulation processes to ensure the microbial agents are stable, effective, and safe for both crops and the environment.

For instance, obtaining regulatory approvals for microbial pesticides can be an expensive and time-consuming process, as companies must demonstrate that the product meets rigorous safety and efficacy standards. In many countries, microbial pesticides must undergo extensive testing before they are allowed for commercial sale, which can delay time-to-market and drive up costs. This financial burden can be a barrier for smaller companies looking to enter the market and compete with larger, well-established pesticide producers.

Slow Market Penetration in Conventional Agriculture Hinders Broader Adoption

The slow adoption of microbial pesticides in conventional agriculture represents another challenge for market growth. Conventional farmers, who have long relied on chemical pesticides for pest control, may be hesitant to adopt microbial alternatives due to factors such as unfamiliarity, perceived efficacy concerns, and resistance to change from established practices.

Microbial pesticides are often seen as “niche” solutions, with conventional farmers questioning their reliability and cost-effectiveness, particularly when compared to the quick and broad-spectrum action of chemical pesticides. Furthermore, microbial pesticides often require more precise application methods and specific environmental conditions for optimal performance, which can be seen as less convenient than synthetic chemicals. These factors contribute to a slower rate of market penetration in traditional farming systems, where farmers may be reluctant to make the switch without more convincing evidence of the performance and economic benefits.

In addition, conventional agriculture is highly entrenched in established practices, with strong industry relationships with chemical pesticide manufacturers. This creates a significant barrier to the widespread acceptance and integration of microbial pesticides. Until microbial pesticides can demonstrate clear, cost-effective advantages in these systems, their adoption in conventional agriculture may remain limited.

Competition from Chemical Pesticides Challenges Microbial Pesticide Market Share

The widespread availability and use of chemical pesticides represent a formidable competitive challenge to the microbial pesticides market. Chemical pesticides are often more affordable, easier to use, and offer faster results than microbial counterparts, making them the go-to choice for many farmers, especially in regions where cost-efficiency is a critical factor in decision-making.

Chemical pesticides also benefit from well-established supply chains, long-term relationships with manufacturers, and extensive marketing support, which creates a strong competitive barrier for microbial pesticides. The infrastructure for chemical pesticides is already in place, and farmers are more familiar with these products, making them more likely to continue using them despite the growing awareness of the potential health and environmental risks associated with chemical pesticides.

Moreover, chemical pesticides are effective against a wide range of pests and diseases, which makes them a default choice for many large-scale commercial farming operations. While microbial pesticides are often specific to certain pests, chemical alternatives can offer broader-spectrum control, thus providing greater convenience for conventional growers.

Growth Opportunity

Development of Target-Specific Microbial Strains

One of the most promising opportunities for microbial pesticides is the development of more target-specific microbial strains. Traditional microbial pesticides have often been limited by their broad-spectrum activity, which can unintentionally affect non-target organisms, including beneficial insects like pollinators.

However, recent advancements in biotechnology and genomics are enabling the creation of microbial strains that are highly specific to certain pests. These tailored solutions not only improve pest control efficacy but also reduce ecological impact, aligning with the growing demand for environmentally friendly alternatives to chemical pesticides. As farmers seek more precise pest management tools, this specificity will become a significant competitive advantage for microbial pesticide products.

Biocontrol Integration with Genetic Engineering

Another opportunity lies in the integration of biocontrol methods with genetic engineering. By combining microbial biocontrol agents with genetically modified crops, farmers can potentially achieve more efficient pest control. Genetically engineered crops designed to support the growth of beneficial microbes or enhance resistance to pests could significantly reduce the reliance on chemical pesticides. This integration has the potential to reshape pest management systems, offering a sustainable, long-term solution to pest issues.

In 2024, advancements in genetic engineering are expected to enable more seamless integration between microbial pesticides and genetically modified crops, creating synergies that enhance both crop yield and pest resistance.

Microbial Pesticides for Pest Resistance Management

With the growing issue of pesticide resistance among pests, microbial pesticides are emerging as a key tool for pest resistance management. Microbial agents work through mechanisms that are less likely to induce resistance compared to traditional chemical pesticides. Their use in rotation or combination with chemical pesticides can help delay or prevent resistance, making them an invaluable part of integrated pest management (IPM) strategies.

As resistance to conventional pesticides becomes a more widespread issue, microbial pesticides will become an increasingly attractive option for farmers seeking to maintain effective pest control over the long term.

Trending Factors

Rise in Biopesticide Product Development

One of the most notable trends in 2024 is the increase in biopesticide product development. With the heightened awareness of the environmental and health risks posed by chemical pesticides, there is a clear push toward more sustainable alternatives. Biopesticides, including microbial-based solutions, are gaining momentum as safer, more eco-friendly options for pest control.

This is driving significant investments into R&D, leading to the development of new microbial strains with improved efficacy and target specificity. As biopesticides become more accessible and effective, they are expected to capture a larger share of the global pesticide market, spurred by both government support and consumer demand for safer food products.

Interest in Plant-Health Products

Another significant trend is the growing interest in plant health products, which combine pest control with enhanced plant vitality. Microbial pesticides, often part of integrated plant-health solutions, not only protect crops from pests but also boost plant growth and resilience.

This holistic approach to pest management is particularly appealing to farmers looking to improve crop yield and sustainability simultaneously. The increased focus on plant-health products underscores a broader shift in agriculture toward more integrated and biologically diverse pest management strategies.

Consumer Preference for Eco-Friendly Products

Consumer preference for eco-friendly products is another driving force behind the growth of microbial pesticides. As more consumers demand organic and sustainably grown produce, farmers are turning to microbial pesticides as a way to align with these preferences. The ability of microbial pesticides to offer effective pest control without leaving harmful residues or harming beneficial insects appeals to both environmentally conscious consumers and regulatory bodies.

In 2024, this trend is expected to accelerate, with more farmers adopting eco-friendly pest control methods to meet both market demands and stricter environmental regulations.

Regional Analysis

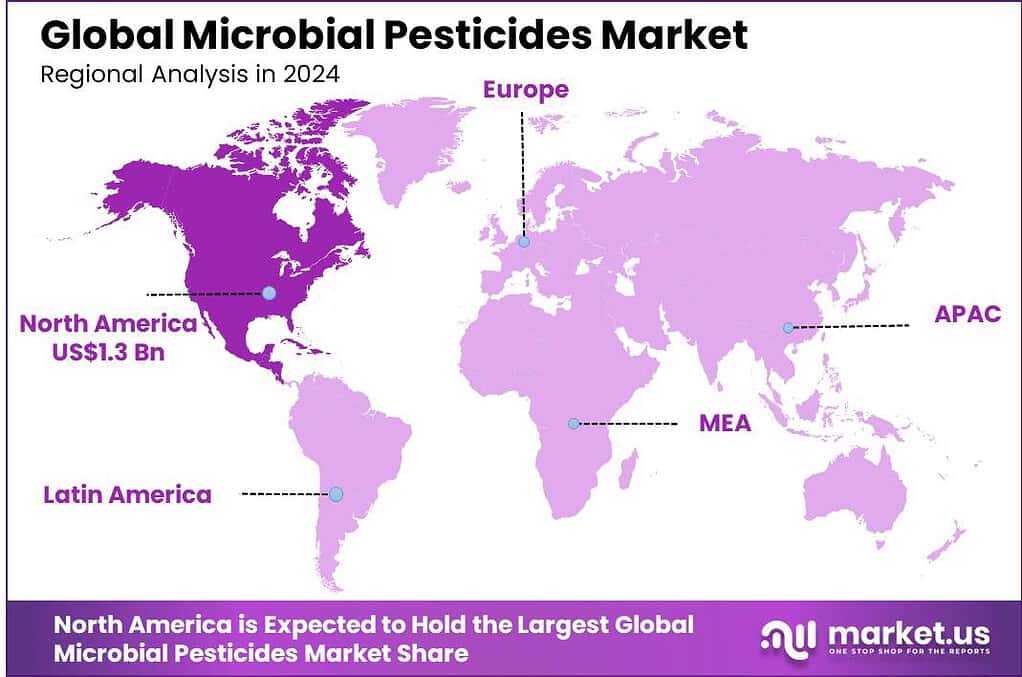

North America dominates the microbial pesticides market with a 41.6% share, valued at USD 1.3 billion.

The North American microbial pesticide market is the largest, holding a dominant share of 41.6%, valued at approximately USD 1.3 billion in 2024. This growth is driven by the high adoption rate of sustainable agricultural practices, robust regulatory support, and a strong consumer demand for organic products. The U.S., in particular, leads the region, with increasing investments in biopesticide research and a well-established market for organic farming. As more farmers shift towards eco-friendly pest control solutions, North America remains the most significant contributor to the global market.

In Europe, the microbial pesticide market is also expanding, supported by stringent regulations on chemical pesticide usage and a strong emphasis on organic farming. The European Union’s Green Deal and Farm to Fork strategy aim to reduce pesticide use, which is expected to further propel demand for biopesticides. The European market is expected to grow steadily, with countries like Germany, France, and the UK leading the adoption of microbial solutions in agriculture.

Asia Pacific is witnessing the fastest growth in the microbial pesticide market, driven by the increasing demand for sustainable farming practices in emerging economies like China and India. The rising awareness of pesticide residues and their environmental impact is pushing farmers to adopt alternative pest control methods. Additionally, the region’s large agricultural sector, which is heavily reliant on chemical pesticides, presents a significant opportunity for microbial pesticide adoption.

The Middle East & Africa and Latin America regions, while smaller in market share, are gradually seeing growth in the microbial pesticides sector, driven by agriculture’s increasing focus on sustainability and reduced reliance on harmful chemicals. These regions are expected to grow at a steady pace as farmers seek affordable, environmentally friendly alternatives.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, The microbial pesticides market continues to be shaped by the strategic moves and innovations of leading players such as ADAMA, BASF SE, Bayer AG, and Marrone Bio Innovations. These companies are leveraging their strong R&D capabilities, global distribution networks, and diverse product portfolios to maintain competitive advantages and capitalize on the growing demand for sustainable agriculture.

ADAMA has been actively expanding its biopesticide portfolio through strategic partnerships and acquisitions. The company is positioning itself as a key player in the microbial pesticides segment by offering a range of natural pest control solutions, contributing to the growing shift away from chemical pesticides.

BASF SE, with its established reputation in the agricultural sector, is making significant strides in developing and commercializing innovative microbial solutions. The company’s research and development efforts in biocontrol agents are expected to accelerate market growth, particularly as demand for eco-friendly pest management solutions intensifies globally.

Bayer AG and its subsidiary Bayer CropScience are continuing to push the boundaries of integrated pest management (IPM) systems, which increasingly incorporate microbial pesticides as a key component. Bayer’s deep commitment to sustainability, combined with its strong market presence, positions the company for long-term growth in the microbial pesticides space.

Marrone Bio Innovations, a leader in biopesticide development, is focused on advancing its microbial product offerings, particularly targeting soil health and plant disease control. With a pipeline rich in innovative solutions, Marrone is well-positioned to meet the evolving needs of farmers looking for safer, more sustainable pest control options.

In summary, the microbial pesticides market is witnessing increased competition and innovation from key players like ADAMA, BASF, Bayer, and Marrone Bio Innovations. These companies, along with others like Valent BioSciences and Syngenta, are driving growth in the sector by enhancing product offerings and focusing on eco-friendly, targeted pest management solutions that align with the increasing global demand for sustainable agriculture practices.

Market Key Players

- ADAMA

- Agri Life

- Arysta LifeScience

- BASF SE

- Bayer AG

- Bayer CropScience

- Bio Works Inc.

- BotanoCap

- Certis USA LLC

- Compass Minerals

- De Sangosse

- FMC Corporation

- GAT Microencapsulation

- IsAgro Spa

- Israel Chemical Company

- K+S Group

- Marrone Bio Innovations

- Novozymes Biologicals

- Nufarm Limited

- Reed Pacific

- Sumitomo Chemical Co. Ltd

- Syngenta Crop Protection AG

- UPL

- Valent BioSciences

- Yara International

Recent Development

- In February 2024, BASF launched a new microbial biopesticide product called Xemium, aimed at combating fungal diseases in key crops like cereals and vegetables. This product leverages innovative biological active ingredients to provide an eco-friendly alternative to chemical pesticides, enhancing crop protection and supporting sustainable farming practices.

- In March 2024, Marrone Bio Innovations, a leader in microbial pesticide development, was acquired by Bioceres Crop Solutions in a strategic move to strengthen its position in the biopesticide market. This acquisition enhances Bioceres’ portfolio of microbial-based solutions and accelerates its ability to deliver innovative, sustainable pest control technologies to global markets.

- In April 2024, Valent BioSciences, a key player in the microbial pesticides sector, introduced a new biological fungicide for the control of soil-borne pathogens. This product aims to improve crop yield while maintaining ecological balance, responding to the growing demand for natural pest management solutions that minimize environmental impact.

Report Scope

Report Features Description Market Value (2023) USD 3.1 Billion Forecast Revenue (2033) USD 6.3 Billion CAGR (2024-2032) 7.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Microbials, Biochemicals), By Ingredient Type (Bacteria-based, Fungi-based, Virus-based, Others), By Product Type (Microbial Fungicide, Microbial Insecticide, Others) By Mode of Application (Foliar Application, Seed Treatment, Soil Application, Others), By Crop Type (Grains & Cereals, Pulses & Oilseeds, Fruits & Vegetables, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ADAMA, Agri Lif, Arysta LifeScience, BASF SE, Bayer AG, Bayer CropScienc, Bio Works Inc, BotanoCap, Certis USA LL, Compass Minerals, De Sangoss, FMC Corporation, GAT Microencapsulation, IsAgro Sp, Israel Chemical Company, K+S Group, Marrone Bio Innovation, Novozymes Biological, Nufarm Limited, Reed Pacific, Sumitomo Chemical Co. Lt, Syngenta Crop Protection AG, UPL, Valent BioSciences, Yara International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Microbial Pesticides MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Microbial Pesticides MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ADAMA

- Agri Life

- Arysta LifeScience

- BASF SE

- Bayer AG

- Bayer CropScience

- Bio Works Inc.

- BotanoCap

- Certis USA LLC

- Compass Minerals

- De Sangosse

- FMC Corporation

- GAT Microencapsulation

- IsAgro Spa

- Israel Chemical Company

- K+S Group

- Marrone Bio Innovations

- Novozymes Biologicals

- Nufarm Limited

- Reed Pacific

- Sumitomo Chemical Co. Ltd

- Syngenta Crop Protection AG

- UPL

- Valent BioSciences

- Yara International