Global Organic Seed Market By Product Type(Vegetable Seeds, Gourd and Root Vegetable Seeds, Leafy and Cruciferous Vegetable seeds, Fruits and Nuts Seeds, Oil Seeds, Sunflower Seeds, Soybean Seeds, Other, Others), By Farm Type(Nurseries, Field, Greenhouse, Vertical Farming, Others), By Distribution Channel(Retailers, Wholesaler, Cooperatives, Online Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 55806

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

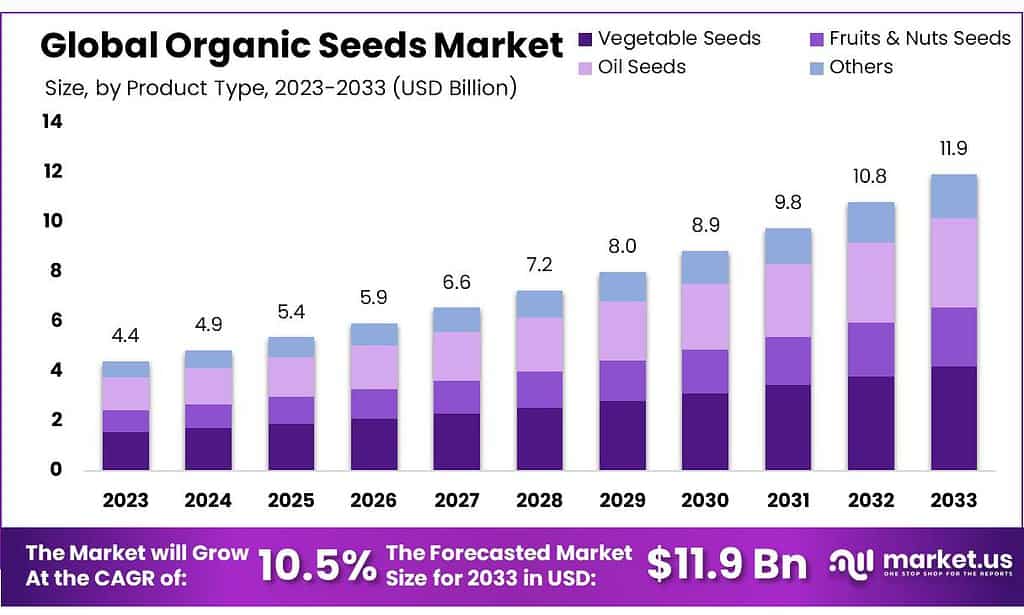

The Organic Seeds Market size is expected to be worth around USD 11.4 billion by 2033, from USD 4.4 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2023 to 2033.

Over the forecast period, the organic seed industry will be driven by an increasing organic food demand. This is due to the increasing awareness of adverse health effects related to agricultural chemicals.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth: The organic seed market is expected to witness robust growth, reaching approximately USD 11.4 billion by 2033 from USD 4.4 billion in 2023, at a compound annual growth rate (CAGR) of 10.5% during 2023-2033.

- Product Dominance: Vegetable seeds hold the largest market share, with Gourd and Root Vegetable Seeds notably contributing within this category. Leafy and cruciferous vegetable seeds also stand out due to their nutritional value and culinary versatility.

- Farm Type Impact: Field farming dominates the market, representing 42.3% of the organic seeds market share. However, Nurseries and Greenhouses also hold substantial segments, offering specialized seedling production and controlled cultivation environments.

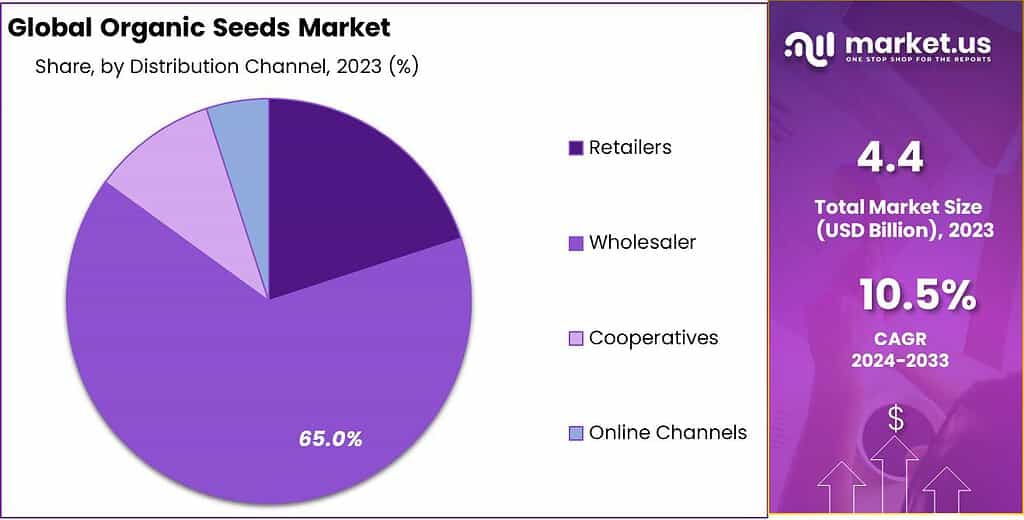

- Distribution Channels: Wholesalers lead in distributing organic seeds, followed by Retailers and Cooperatives, while Online Channels are steadily expanding, catering to niche markets and convenience shopping.

- Market Drivers: Growing concerns about chemical fertilizers’ impact on health and the environment, coupled with the increasing demand for organic food products, are major drivers.

- Opportunities: The rising preference for healthier dietary choices and the inherent nutritional value of fruit and vegetable seeds offer substantial growth opportunities

- Challenges: The market faces hurdles like the lack of infrastructure for organic farming practices, limited genetic diversity in organic seeds, and affordability issues due to higher costs compared to conventional seeds.

- Regional Analysis: Developed regions like North America and Europe currently hold the majority of the market share, while the Asia Pacific is expected to experience significant growth due to rising health awareness and favorable regulatory environments.

- Market Players: Key players like Vitalis Organic Seeds, Seeds of Change Inc., Seed Savers Exchange, among others, play significant roles in the market landscape.

Product Analysis

In 2023, the market for Vegetable Seeds took the lead, securing over 35.2% of the share. Within this category, Gourd and root Vegetable Seeds stood out, contributing significantly to this segment’s dominance.

They encompass seeds for various vegetables like pumpkins, cucumbers, carrots, and radishes. Leafy and cruciferous Vegetable Seeds also played a substantial role, including seeds for lettuce, spinach, cabbage, and broccoli, reflecting a robust market presence due to the popularity of these vegetables among consumers for their nutritional value and culinary versatility.

Fruits & Nuts Seeds held a notable portion in the organic seeds market, catering to the growing demand for fruit-bearing plants and nut-producing trees. This segment covered seeds for a diverse range of fruits such as apples, oranges, berries, and nuts like almonds and walnuts. The increasing focus on healthy eating habits and the popularity of home gardening further fueled the demand for these seeds, contributing to their significant market share.

Oil Seeds emerged as another influential segment within the organic seeds market. Among these, Sunflower Seeds took a prominent position, valued for their versatility in producing oil and snacks.

Soybean Seeds, with their widespread use in various food products and animal feed, also contributed substantially to this category. Other oil seeds completed this segment, representing a range of seeds like flaxseeds, sesame seeds, and hemp seeds, which, although occupying a smaller share individually, collectively bolstered the oil seeds segment’s presence in the market.

By Farm Type

In 2023, the Field segment emerged as the leader in the organic seeds market, securing over 42.3% of the market share. Field farming remained a cornerstone in organic seed production, utilizing open land for cultivation.

This method included the traditional practices of sowing and harvesting seeds in outdoor environments, making it a prevalent choice among organic seed producers due to its scalability and historical significance in agriculture.

Nurseries represented 28% of the organic seed market. Nurseries specialize in seedling production and propagation, providing an environment conducive to the initial stages of organic seed growth. Nurseries’ role of providing quality and diverse seedlings for transplantation contributed significantly to the organic seed market’s supply chain.

Greenhouses were another significant segment, representing approximately 20% of market share. Greenhouses provided benefits including year-round cultivation, protection from adverse weather conditions, and precise control over growing conditions. Greenhouses enabled the production of organic seeds in regions with challenging climates or crops requiring specific environmental conditions.

Vertical Farming was a small segment of the organic seeds market, accounting for roughly 9%. Utilizing vertical structures with hydroponic or aeroponic systems for space and resource efficiency, vertical farming quickly became one of the preferred methods for producing organic seeds in urban settings or areas with limited arable land.

Other farm types encompassing non-primary segments but which specialized or emerging methods not classified in these primary segments accounted for the remaining share, reflecting diversity and innovation within the organic seed production landscape. These alternative approaches often targeted niche markets or experimental approaches that added depth and variety to the organic seeds market overall.

By Distribution Channel

In 2023, Wholesalers took the lead in the organic seeds market, securing over 65% of the share. These wholesalers acted as key intermediaries, bridging the gap between organic seed producers and retailers or other distribution channels.

They facilitated bulk transactions and distribution to retailers, nurseries, and large-scale farming operations, offering a wide range of organic seed varieties in sizable quantities.

Retailers comprised an important share of the organic seed market, accounting for 25%. Their presence includes garden centers, supermarkets, and specialty stores which provide direct access to end consumers as they offer a selection of organic seeds specifically targeted towards individuals looking for smaller quantities for personal use.

Cooperatives were another significant segment, accounting for around 8% of the market. These organizations, often formed by groups of farmers or producers, focused on collective marketing and distribution of organic seeds. By pooling resources and taking advantage of group buying power, cooperatives provided benefits to both producers and buyers while simultaneously supporting sustainable agriculture practices.

Online Channels were a relatively smaller but steadily expanding segment, holding about 2% of market share. Thanks to digitization and convenience shopping online platforms that specialize in selling organic seeds were established – these offered consumers convenience along with access to an expansive variety of seeds without geographical limits or restrictions.

Other distribution channels encompassing non-primary segments made up the remaining share. These non-primary avenues often targeted niche markets or experimental approaches; their rapid evolution demonstrated how responsive organic seed markets and distribution methods could be to shifting consumer tastes.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Product Type

- Vegetable Seeds

- Gourd & Root Vegetable Seeds

- Leafy & Cruciferous Vegetable seeds

- Fruits & Nuts Seeds

- Oil Seeds

- Sunflower Seeds

- Soybean Seeds

- Other

- Others

By Farm Type

- Nurseries

- Field

- Greenhouse

- Vertical Farming

- Others

By Distribution Channel

- Retailers

- Wholesaler

- Cooperatives

- Online Channels

Drivers

The organic seed market dynamics are significantly influenced by several key drivers shaping its growth and prominence within the agricultural landscape. One key driver of demand for organic seeds as an environmentally sustainable agricultural method is increasing concern about chemical fertilizers’ adverse impacts on food chains.

Consumers, farmers, and regulatory bodies alike have become aware of how conventional agricultural practices involving chemical fertilizers, insecticides, and pesticides harm human health and the environment – prompting an increase in awareness among these stakeholders that prompted demand to rise rapidly for organic seeds – an increasing awareness that supports global movements toward more eco-friendly forms of agriculture.

The escalating demand for organic food products stands as another pivotal driver propelling the organic seed market. Within this sphere, organic vegetable seeds have emerged as a focal point due to heightened consumer consciousness about the presence of toxic chemical compounds in their daily vegetable diets.

The shift in consumer preferences towards healthier and chemical-free food options has led to a surge in demand for organic vegetable seeds worldwide. This trend is further bolstered by government policies and regulations in developing regions like the Asia-Pacific, which actively promote the adoption of organic vegetable seeds and newer farming techniques, incentivizing farmers to embrace organic practices.

Factors driving the organic seed market include changing consumer lifestyles, rising awareness of health issues, changing diet patterns and spending habits, and shifting spending preferences towards organic foods. Together these factors foster greater appreciation of organic produce while creating demand for seeds that support sustainable and healthful agriculture practices.

Restraints

The organic seed market encounters notable restraints that impede its growth, particularly regarding the lack of infrastructure within regulatory bodies for organic farming practices. The coexistence of contrasting agricultural methods poses a significant challenge to the organic seed market’s expansion during the forecast period.

The absence of a well-established framework or guidelines for harmonizing opposing agricultural practices hampers the seamless growth of organic seed cultivation. This lack of clear regulatory infrastructure creates complexities and uncertainties, affecting the market’s stability and hindering the smooth transition toward organic farming methods.

Additionally, the current market scenario is being negatively impacted by raw material shortages and shipping delays, significantly impacting the organic seed industry. These factors have caused disruption and challenge throughout supply chains; restricting availability of essential raw materials needed for production while shipping delays cause logistical complications that threaten timely deliveries resulting in uncertain meeting of market demands that ultimately create production delays or lead to market instability.

Opportunities

Fruit and vegetable seeds have gained substantial market acceptance due to their inherent nutritional value and the growing preference for healthier dietary choices. Within this category, organic seeds hold a pivotal role due to their numerous benefits and widespread availability, paving the way for significant growth opportunities in the market. The appeal of organic seeds lies in their avoidance of synthetic chemicals, pesticides, and GMOs, aligning perfectly with consumer demands for natural and wholesome food options.

Consumers today prioritize health and seek foods that are free from harmful additives, making organic seeds a preferred choice for fruit and vegetable cultivation. These seeds offer a sustainable and environmentally friendly approach to producing nutrient-rich and chemical-free produce, appealing to health-conscious consumers seeking to incorporate nutritious options into their diets.

Moreover, the accessibility of organic seeds further amplifies their appeal, contributing to a fertile ground for substantial growth within the market. As consumers increasingly gravitate towards organic and nutritious foods, the demand for organic seeds continues to rise, presenting ample opportunities for expansion and innovation within the fruit and vegetable seed market segment.

Challenges

In the organic seeds market, several challenges influence its trajectory and growth potential. One of the significant hurdles revolves around the complexities of certification and regulation. Obtaining and maintaining organic certification can be a rigorous and costly process for seed producers and farmers. The standards and guidelines set by regulatory bodies often require meticulous adherence to specific practices, documentation, and inspections, which can be challenging, especially for small-scale producers or those transitioning to organic farming methods.

One major challenge affecting organic seeds is limited genetic diversity. A diverse gene pool is essential to building resilience against diseases, pests, and changing environmental conditions; yet organic seed varieties may be relatively scarce due to factors like lower investments in organic breeding programs or prioritizing conventional varieties over organic seeds – potentially impacting resilience and adaption to emerging environmental challenges.

Organic seed availability and affordability pose serious hurdles. While demand for organic seeds continues to increase, meeting this demand remains a top concern. Certain organic varieties might limit farmers’ options and hinder the adoption of organic farming practices; furthermore, organic seeds often come at a higher cost compared to conventional seeds, restricting accessibility for smaller farms with tight budgets.

Genetically modified organisms (GMOs) pose another challenge to organic seed producers in regions with widespread cultivation of genetically engineered crops, making maintaining purity essential. GMO-related contamination must be minimized to keep organic seeds pure for consumers.

Regional Analysis

The recent history of the global industry shows that more than half the global market was in developed regions, including North America and Europe. This trend is likely to continue during the forecast period due to increasing organic food demand. North America held the highest revenue share at over 36.6% in 2023

The Asia Pacific is expected to experience the highest rate of growth in the next seven years due to several important factors like increased health awareness, rising disposable income, and a favorable regulatory environment.

Multiple initiatives have been taken by agricultural agencies and governments, including tax incentives and favorable policies to encourage organic agriculture. The regional market will benefit from such initiatives and a growing awareness of the benefits of organic farming shortly.

The Asia Pacific and Central & South America are catering to the increasing organic food demand in the advanced regions. The majority of the produce grown in developing countries is exported into developed markets, such as North America or Europe. Australia, Brazil, India, and China will be the leaders of their respective markets in the coming seven years.

Note: Actual Numbers Might Vary In the Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Numerous industry players including local and regional organic farmers, play a large part in the organic seed market share. This leads to fierce industry competition. A significant supply-demand imbalance is due to the rapid growth of demand in recent years. This industry position is characterized by high supplier bargaining strength and low buyer bargaining.

There is a high risk of new entrants because there is plenty of growth and development potential, particularly in developing regions like the Asia Pacific or Central & South America.

Key Market Players

- Vitalis Organic Seeds

- Seeds of Change Inc.

- Seed Savers Exchange

- Southern Exposure Seed Exchange

- Johnny’s Selected Seeds

- High Mowing Organic Seeds

- Baker Creek Heirloom Seeds

- Uprising Seeds

- Fedco Seeds Inc.

- Wild Garden Seeds

- Tamar Organics

- Territorial Seed Company

- Adaptive Seeds

- Sow True Seed

- Peaceful Valley Farm & Garden Supply

Recent Developments

On 2 July 2022, Villupuram hosted a two-day expo on organic paddy seeds and a traditional cuisine festival featuring over 50 farmers from Northern districts. Ryots shared their knowledge on organic farming techniques, climate change mitigation, and fighting climate change with new farmers at this year’s show.

Report Scope

Report Features Description Market Value (2023) USD 4.4 Billion Forecast Revenue (2033) USD 11.4 Billion CAGR (2023-2032) 10.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Vegetable Seeds, Gourd & Root Vegetable Seeds, Leafy & Cruciferous Vegetable seeds, Fruits & Nuts Seeds, Oil Seeds, Sunflower Seeds, Soybean Seeds, Other, Others), By Farm Type(Nurseries, Field, Greenhouse, Vertical Farming, Others), By Distribution Channel(Retailers, Wholesaler, Cooperatives, Online Channels) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Vitalis Organic Seeds, Seeds of Change Inc., Seed Savers Exchange, Southern Exposure Seed Exchange, Johnny’s Selected Seeds, High Mowing Organic Seeds, Baker Creek Heirloom Seeds, Uprising Seeds, Fedco Seeds Inc., Wild Garden Seeds, Tamar Organics, Territorial Seed Company, Adaptive Seeds, Sow True Seed, Peaceful Valley Farm & Garden Supply Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are organic seeds?Organic seeds are harvested from organically grown plants that have been cultivated without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs). They are produced through natural methods and are free from chemical alterations.

How are organic seeds different from conventional seeds?Organic seeds are grown without synthetic inputs, while conventional seeds might be produced using synthetic chemicals and genetic modification. Organic seeds promote biodiversity and sustainable farming practices.

Are organic seeds better for the environment?Organic seeds promote sustainable agriculture by reducing the use of synthetic chemicals, preserving biodiversity, and supporting natural ecosystems. They contribute to healthier soils and water systems.

-

-

- Vitalis Organic Seeds

- Seeds of Change Inc.

- Seed Savers Exchange

- Southern Exposure Seed Exchange

- Johnny's Selected Seeds

- High Mowing Organic Seeds

- Baker Creek Heirloom Seeds

- Uprising Seeds

- Fedco Seeds Inc.

- Wild Garden Seeds

- Tamar Organics

- Territorial Seed Company

- Adaptive Seeds

- Sow True Seed

- Peaceful Valley Farm & Garden Supply