The US Transmission Line Market By Product Type (AC Transmission Lines, DC Transmission Lines), By Medium (Overhead Transmission Lines, Underground Transmission Lines, Submarine Transmission Line), By Voltage (132 kV to 220 kV, 221 kV to 660 kV, > 660 kV), By Conductor (Conventional, High Temperature, Others), By Application (Utility, Industrial), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 82539

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

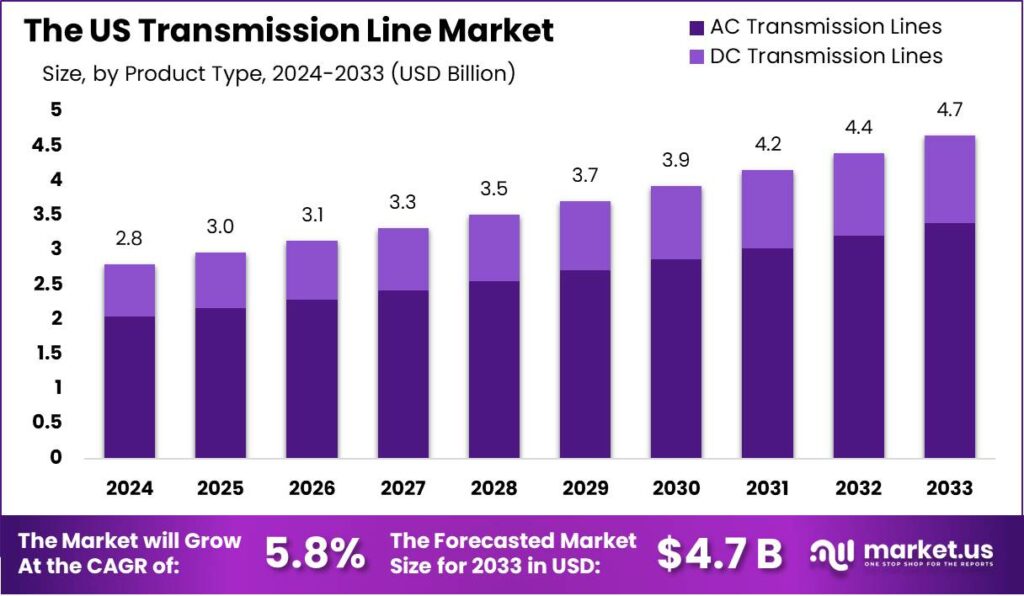

The US Transmission Line Market size is expected to be worth around USD 4.7 Billion by 2033, from USD 2.8 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

The US transmission line market is an essential component of the country’s energy infrastructure. With the increasing demand for electricity and the growing need for clean energy solutions, transmission lines are crucial for transferring power from generation sources to consumers.

The market has experienced steady growth driven by investments in upgrading and expanding the grid to accommodate renewable energy integration. Additionally, government initiatives focused on modernizing energy infrastructure have further bolstered the demand for more efficient, reliable transmission networks.

The demand for transmission lines in the US is primarily driven by the shift toward renewable energy sources such as wind and solar power. As these energy sources are often located far from urban centers, the need for new and upgraded transmission lines is becoming increasingly critical to ensure power can be transmitted effectively.

The popularity of transmission lines in the US has surged, especially in areas with a high concentration of renewable energy projects. States like Texas, California, and the Midwest have seen significant investments in transmission networks to link renewable generation sites to the broader grid. With ongoing government support and a growing focus on clean energy, transmission lines are gaining traction as a key solution to improve grid resilience and reliability.

The US transmission line market presents numerous growth opportunities. The ongoing modernization of the electrical grid, including initiatives like the Clean Energy Standard and investments in smart grid technologies, is creating avenues for new projects.

Companies that offer advanced materials, such as high-temperature superconducting cables, and technologies that improve grid management and efficiency stand to benefit from these trends.

The U.S. transmission line market is influenced by several key factors, including end-use industries such as power utilities, industrial sectors, and residential applications. In 2023, the market size for transmission lines in the U.S. was valued at approximately USD 2.5 billion and is expected to grow at a CAGR of 5.2% from 2024 to 2030.

Power utilities are the primary consumers, accounting for over 65% of the total market share. The growing demand for electricity transmission and grid expansion due to renewable energy integration and population growth are major growth drivers.

Government regulations and policies also play a crucial role in shaping the transmission line market. For instance, the U.S. government allocated USD 10 billion under the Infrastructure Investment and Jobs Act (IIJA) to improve grid infrastructure and modernize transmission systems. Additionally, the Federal Energy Regulatory Commission (FERC) has mandated improvements in grid resilience and reliability, encouraging investments in transmission lines.

In terms of imports and exports, the U.S. imports nearly 25% of its transmission line materials, primarily from countries like China, Canada, and Mexico. The import value of electrical transmission and distribution materials was around USD 1.1 billion in 2023. On the export side, the U.S. exports approximately USD 700 million worth of transmission-related materials annually.

In recent years, there has been a surge in private and public investments in grid modernization. For example, Xcel Energy, one of the leading U.S. utility companies, announced an investment of USD 10 billion over the next five years to enhance transmission infrastructure. Additionally, General Electric (GE) acquired Alstom’s grid business for USD 3.3 billion to strengthen its position in the transmission line market.

Innovations in high-voltage direct current (HVDC) transmission lines have also been driving market growth. In 2023, Siemens launched a new HVDC transmission system aimed at improving energy efficiency and reducing transmission losses. Moreover, the increasing demand for offshore wind energy is boosting the expansion of transmission lines in coastal regions, with USD 2 billion invested in offshore grid infrastructure.

Key Takeaways

- The US Transmission Line Market size is expected to be worth around USD 4.7 Billion by 2033, from USD 2.8 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

- AC Transmission Lines dominated the market in 2023, holding a 73.4% share By Product Type segment.

- Overhead Transmission Lines dominated the By Medium segment of the market in 2023, holding a 64.3% share.

- 221 kV to 660 kV dominated the market in 2023, holding a 52.3% share By Voltage segment.

- Conventional conductors dominated the market in 2023, holding a 56.7% share By Conductor segment.

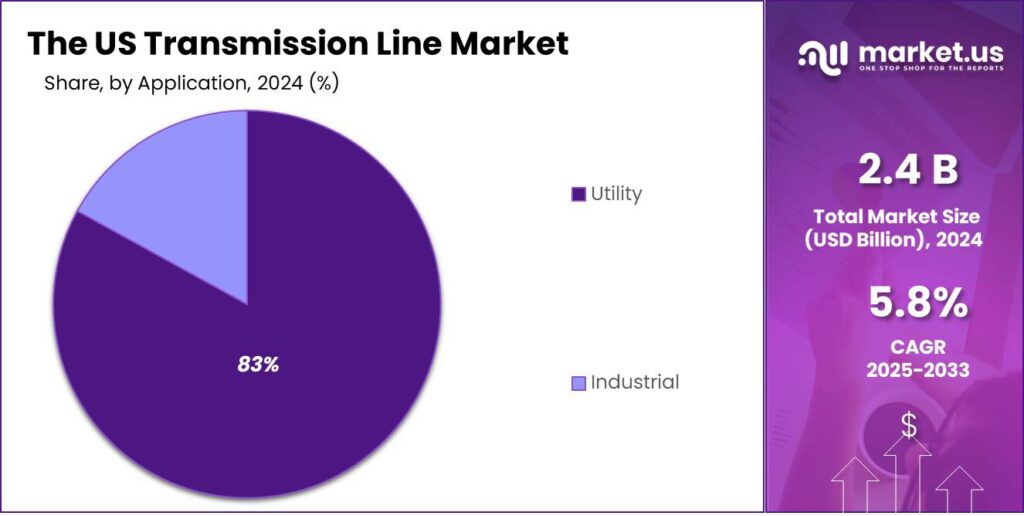

- Utility applications dominated the Application segment of the market in 2023, holding an 83.4% share.

By Product Type Analysis

In 2023, AC Transmission Lines held a dominant market position in the By Product Type segment of The US Transmission Line Market, capturing more than a 73.4% share. This significant market share is driven by the growing demand for efficient power transmission across the nation, as AC lines are widely preferred for long-distance transmission due to their cost-effectiveness and ability to handle higher loads.

AC transmission lines are also known for their mature infrastructure and ease of maintenance, making them the go-to choice for both new installations and upgrades to existing networks.

DC Transmission Lines, while holding a smaller share of the market, are gaining traction due to their efficiency in transmitting large amounts of power over long distances without losses typically associated with AC systems.

The integration of HVDC (High Voltage Direct Current) technology offers better control over the transmission of electricity and is increasingly being adopted for cross-border power transmission and renewable energy integration.

By Medium Analysis

In 2023, Overhead Transmission Lines held a dominant market position in the By Medium segment of The US Transmission Line Market, capturing more than a 64.3% share. The widespread adoption of overhead transmission lines can be attributed to their cost-effectiveness, ease of installation, and established infrastructure across the country. Overhead lines are highly favored for long-distance power transmission due to their relatively low operational and maintenance costs compared to other mediums.

Underground Transmission Lines, although accounting for a smaller market share, are gaining popularity due to their ability to provide aesthetic benefits and enhanced safety, particularly in urban and densely populated areas.

Underground lines are less susceptible to weather-related disruptions and provide a more visually appealing alternative to overhead lines. However, the higher installation and maintenance costs associated with underground transmission systems limit their widespread adoption.

Submarine Transmission Lines, a niche segment, are used for transmitting electricity across bodies of water, such as between islands or undersea cable links. While they serve a specific purpose and are essential for cross-border power transmission, their market share remains relatively small, contributing to about 10-12% of the overall transmission line market.

By Voltage Analysis

In 2023, the 221 kV to 660 kV voltage range held a dominant market position in the By Voltage segment of The US Transmission Line Market, capturing more than a 52.3% share. This range is particularly favored due to its suitability for medium to long-distance transmission, efficiently delivering power across vast regions while minimizing energy loss.

The 221 kV to 660 kV lines are ideal for interconnecting power plants to the grid and for high-capacity electricity transmission. Their robust performance, along with advancements in insulation and conductor technologies, has contributed to their widespread adoption.

The 132 kV to 220 kV voltage range, while holding a smaller market share, continues to play a crucial role in regional power distribution networks. These lines are typically used for transmitting power from substations to local distribution systems. The relatively lower voltage compared to higher voltage lines makes them more suitable for urban and suburban areas, offering a balance between cost-efficiency and transmission capability.

Transmission lines above 660 kV, though less prevalent, are gaining importance in specific use cases such as ultra-high-voltage direct current (UHVDC) systems for long-distance and cross-border power transmission. Their market share remains smaller, contributing to approximately 15-18% of the market, due to their specialized applications and high costs.

By Conductor Analysis

In 2023, Conventional conductors held a dominant market position in the By Conductor segment of The US Transmission Line Market, capturing more than a 56.7% share. Conventional conductors, primarily made of aluminum and steel, are widely used in transmission line construction due to their reliability, cost-effectiveness, and long-standing industry familiarity.

Their proven track record in performance and ease of installation make them the go-to choice for most transmission projects, especially in mature grid infrastructure. These conductors are particularly effective in standard high-voltage transmission applications, making them a dominant force in the market.

High-temperature conductors, though representing a smaller portion of the market, are gaining traction due to their ability to carry more current without overheating. This advantage makes them particularly useful in regions with high demand or for upgrading existing transmission lines without the need for new infrastructure. These conductors can operate at higher temperatures, allowing for better efficiency and reduced transmission losses, which is essential for future-proofing power grids.

By Application Analysis

In 2023, Utility applications held a dominant market position in the By Application segment of The US Transmission Line Market, capturing more than an 83.4% share. This dominance is largely driven by the widespread use of transmission lines for public utility purposes, including electricity distribution to residential, commercial, and industrial sectors.

Utility companies rely heavily on transmission lines to deliver power from generation sources to substations and end-users, making them a core part of the national grid infrastructure. The vast demand for electricity, coupled with the need to expand and modernize the grid to accommodate renewable energy sources, has solidified the utility sector’s lead in the transmission line market.

Industrial applications, while contributing a smaller share, are still important, particularly in sectors that require high-power transmission for heavy manufacturing, processing plants, and mining operations.

Industrial customers often require dedicated transmission solutions for specific energy needs that differ from general utility distribution, and the need for such infrastructure is increasing with the growth of energy-intensive industries.

Key Market Segments

By Product Type

- AC Transmission Lines

- DC Transmission Lines

By Medium

- Overhead Transmission Lines

- Underground Transmission Lines

- Submarine Transmission Line

By Voltage

- 132 kV to 220 kV

- 221 kV to 660 kV

- > 660 kV

By Conductor

- Conventional

- High Temperature

- Others

By Application

- Utility

- Industrial

Driving factors

Growing Demand for Reliable and Efficient Power Supply

As the US population and energy consumption continue to grow, the demand for a reliable and efficient power supply has increased significantly. Transmission lines play a vital role in ensuring electricity reaches consumers without interruption.

This rising demand for electricity, combined with the shift towards renewable energy sources, is driving the need for expanded and modernized transmission infrastructure to meet both current and future energy needs.

Government Support for Renewable Energy Integration

The transition to renewable energy sources like wind and solar is driving the need for upgraded transmission lines. Government initiatives and incentives aimed at reducing carbon emissions are accelerating this shift.

As more renewable energy projects come online, the grid needs to be expanded and modernized to accommodate the distribution of this energy efficiently. This push for cleaner energy sources is a key factor propelling growth in the transmission line market.

Technological Advancements in Smart Grid and Automation

Technological advancements in smart grid systems and automation are transforming the transmission line market. The integration of digital technologies allows for real-time monitoring, better load management, and quicker response times to faults or disruptions.

Smart grids improve the overall efficiency and reliability of transmission networks, reducing energy loss and operational costs. These innovations are driving investments in upgrading existing transmission lines and constructing new ones, enhancing grid flexibility and performance.

Restraining Factors

Regulatory and Policy Barriers to Infrastructure Expansion

Strict federal and state regulations are a key factor restraining the growth of the US transmission line market. Regulatory hurdles related to land use, environmental impact assessments, and permitting processes slow down the development of new transmission infrastructure.

Changes in energy policy, such as renewable energy mandates, further complicate the market by requiring additional investments in infrastructure upgrades, leading to uncertainty for investors and operators.

Environmental Concerns and Opposition from Local Communities

Environmental concerns play a significant role in limiting the expansion of transmission lines. Local communities often oppose new transmission projects, citing potential environmental damage, disruption of ecosystems, and the visual impact of new infrastructure.

This resistance leads to legal battles and delays in construction, making it more difficult to meet the growing demand for power transmission capacity, especially in densely populated or ecologically sensitive areas.

Competition from Alternative Energy Solutions and Technologies

The rise of alternative energy solutions, such as distributed energy resources (DERs), battery storage, and microgrids, presents a competitive challenge to the traditional transmission line market. As these technologies become more cost-effective and reliable, some regions may opt to rely on localized energy systems instead of expanding the traditional grid.

This shift in preference can limit the need for new transmission lines, reducing the market potential for traditional infrastructure investments.

Growth Opportunity

Integration of Renewable Energy Sources into the Grid

One of the most significant growth opportunities in the US transmission line market lies in facilitating the integration of renewable energy sources such as solar and wind power. As renewable energy generation increases, there will be a greater demand for new transmission infrastructure to connect renewable power plants with population centers.

The growing emphasis on reducing carbon emissions and transitioning to clean energy makes this an area ripe for investment and expansion.

Adoption of Smart Grid Technologies for Efficiency

The US transmission line market is expected to benefit from the widespread adoption of smart grid technologies. These systems allow for real-time monitoring, control, and optimization of the power grid, improving overall efficiency and reliability.

The ability to incorporate advanced technologies such as IoT sensors, artificial intelligence, and data analytics into transmission networks presents a major growth opportunity for utilities and infrastructure developers seeking to modernize the aging grid and reduce operational costs.

Federal Funding and Incentives for Infrastructure Development

The US government’s increasing focus on infrastructure development, particularly through programs like the Infrastructure Investment and Jobs Act, presents significant opportunities for the transmission line market.

Federal funding and incentives for grid modernization and the expansion of transmission capacity will drive investments into new projects. This financial support can help overcome some of the budgetary constraints faced by utilities, enabling them to accelerate the construction of new transmission lines and related infrastructure.

Challenge

High Infrastructure Upgrade Costs and Funding Gaps

The US transmission line market faces significant challenges due to the high costs associated with upgrading existing infrastructure. This includes the need for new power lines, substations, and smart grid technologies.

Limited funding from the government and private sectors further complicates the issue, leading to delays in essential infrastructure improvements. The lack of consistent funding for long-term upgrades hampers the ability to meet increasing energy demands and improve grid reliability.

Land Acquisition and Environmental Regulation

Hurdles Obtaining land for new transmission lines is a major challenge. Land acquisition issues, coupled with stringent environmental regulations, delay the construction of new infrastructure. Permitting processes can be lengthy, and environmental reviews often lead to setbacks in project timelines.

Resistance from local communities, especially in areas where transmission lines are planned to pass through, also adds complexity, increasing costs and the time needed to complete projects.

Aging Transmission Lines and Rising Maintenance Costs

A significant portion of the US transmission network is outdated, with many lines and components nearing the end of their lifespan. Aging infrastructure requires constant maintenance to ensure reliability and safety, which leads to rising operational costs.

These issues are compounded by the increasing risk of power outages and system failures, especially during extreme weather events. The need for substantial investments to replace or repair aging lines further exacerbates financial challenges for utilities and operators.

Emerging Trends

The US transmission line market is evolving rapidly, driven by several emerging trends that are reshaping the industry. One of the most significant trends is the integration of renewable energy sources. As the country moves towards cleaner energy solutions, there is a growing need for efficient transmission systems to transport energy from renewable sources like wind and solar farms to consumers. The development of new transmission lines, especially in remote areas where renewable projects are often located, is critical.

Moreover, smart grid technology is gaining momentum. Smart grids are designed to optimize energy distribution by using digital communications to monitor and manage the flow of electricity. This helps prevent outages and improves efficiency by automatically rerouting power when issues occur.

Energy storage technologies are also gaining attention as they help balance intermittent renewable energy generation. With large-scale battery storage systems, energy can be stored when supply exceeds demand and distributed when needed, reducing reliance on traditional power plants.

Finally, climate resilience has become a priority. Transmission lines must be built to withstand extreme weather events, which are becoming more frequent due to climate change. The focus is on reinforcing existing infrastructure and implementing technologies to improve reliability during storms or heatwaves.

Business Benefits

Upgrading and expanding the US transmission line infrastructure offers a range of business benefits. One of the most prominent advantages is the improved reliability of the power grid. With modernized transmission lines, power outages become less frequent, and the grid becomes more capable of handling increasing energy demands. This translates into reduced downtime for businesses and lower costs associated with power disruptions.

Economic growth is another significant benefit. By investing in new transmission lines and technologies, the US can stimulate job creation in the construction, manufacturing, and technology sectors. The expansion of transmission networks opens new business opportunities, particularly in rural and underserved regions, where the development of infrastructure can lead to new industrial investments and growth.

The market also benefits from increased efficiency in energy distribution. Smart grids and energy storage systems ensure that power is distributed optimally, reducing energy waste. This results in a more efficient use of resources, which is particularly important as energy prices fluctuate. Additionally, improving transmission lines can lower energy costs for consumers.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the U.S. Transmission Line Market is marked by the continued dominance of several key players, each bringing its unique strengths to the table. Among these, ABB, Prysmian Group, Siemens Energy, and Quanta Services Inc. (M.J. Electric LLC) stand out as major contributors to market growth.

ABB is a global leader in power and automation technologies and has been instrumental in the U.S. transmission line market through its innovations in high-voltage direct current (HVDC) technology. The company’s strong portfolio, which includes cutting-edge transformers and transmission systems, allows it to secure high-value contracts with utility companies. ABB’s focus on sustainability, particularly with the development of smart grid solutions, positions it well to meet the growing demand for more efficient, reliable transmission infrastructure.

Prysmian Group, a key player in cables and systems, leverages its advanced cable technologies to meet the increasing need for power transmission in the U.S. With a focus on the energy transition, including renewable energy integration, Prysmian is strengthening its position in both overhead and underground transmission systems.

Siemens Energy is another major contributor, offering a broad range of solutions including high-voltage transmission equipment, and power transmission services. Their consistent investments in R&D and green technologies, such as offshore wind transmission, are helping them maintain competitiveness in a rapidly evolving energy market.

Lastly, Quanta Services Inc. (via M.J. Electric LLC) is a key player in the construction, installation, and maintenance of transmission lines. With its extensive experience in handling complex power infrastructure projects, Quanta continues to lead the market in ensuring grid reliability.

These companies are driving technological innovation, sustainability, and grid modernization in the U.S. Transmission Line Market.

Market Key Players

- ABB

- AECOM

- American Wire Group

- Bekaert

- Burns & McDonnell

- CTC Global Corporation

- Electrical Manufacturing Company Limited

- Kiewit Corporation

- LS Corp.

- Michels Corporation

- MYR Group Inc.

- Nexans

- Prysmian Group

- Quanta Services Inc. (M.J. Electric LLC)

- Siemens Energy

- Southwire Company, LLC.

- Sumitomo Electric Industries, Ltd.

- Wilson Construction Company

Recent Development

- In May 2024, PG&E committed to a $500 million initiative to bolster transmission line resilience in Northern California, aimed at reducing wildfire risks. This involves upgrading nearly 300 miles of high-voltage transmission lines, including reinforcing towers and installing advanced fire detection systems. The upgrade is expected to decrease wildfire-related outages by 40%, ensuring more reliable energy delivery in vulnerable areas.

- In March 2024, Xcel Energy unveiled its plan to expand its transmission network in Colorado, including the addition of 1,000 miles of new transmission lines. The project, valued at $2 billion, is designed to facilitate the integration of renewable energy sources like solar and wind. The project is set to improve energy delivery reliability for over 1.5 million customers in Colorado and is expected to reduce transmission bottlenecks by up to 25%.

- In January 2024, PacifiCorp, a utility company based in the western US, announced the completion of its new 500kV transmission line, connecting the Wasatch Front region in Utah to the southern part of Idaho. This 200-mile-long transmission line aims to support the growing demand for renewable energy, especially from wind farms in the area. The $400 million investment is expected to improve grid reliability and enhance energy transmission capacity by 30%.

Report Scope

Report Features Description Market Value (2023) USD 2.8 Billion Forecast Revenue (2033) USD 4.7 Billion CAGR (2024-2032) 5.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (AC Transmission Lines, DC Transmission Lines), By Medium (Overhead Transmission Lines, Underground Transmission Lines, Submarine Transmission Line), By Voltage (132 kV to 220 kV, 221 kV to 660 kV, > 660 kV), By Conductor (Conventional, High Temperature, Others), By Application (Utility, Industrial) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ABB, AECOM, American Wire Group, Bekaert, Burns & McDonnell, CTC Global Corporation, Electrical Manufacturing Company Limited, Kiewit Corporation, LS Corp., Michels Corporation, MYR Group Inc., Nexans, Prysmian Group, Quanta Services Inc. (M.J. Electric LLC), Siemens Energy, Southwire Company, LLC., Sumitomo Electric Industries, Ltd., Wilson Construction Company Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  The US Transmission Line MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

The US Transmission Line MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- AECOM

- American Wire Group

- Bekaert

- Burns & McDonnell

- CTC Global Corporation

- Electrical Manufacturing Company Limited

- Kiewit Corporation

- LS Corp.

- Michels Corporation

- MYR Group Inc.

- Nexans

- Prysmian Group

- Quanta Services Inc. (M.J. Electric LLC)

- Siemens Energy

- Southwire Company, LLC.

- Sumitomo Electric Industries, Ltd.

- Wilson Construction Company