Microgrid Market By Service Type(Asset Management, Network Monitoring, Meter Data Management, Remote Metering, Others), By Component(Smart Solar Panels, Smart Inverters, Energy Management Systems, Communication and Networking Devices, Others), By Deployment(On-Grid, Off-Grid), By Application(Utility, Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 115701

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

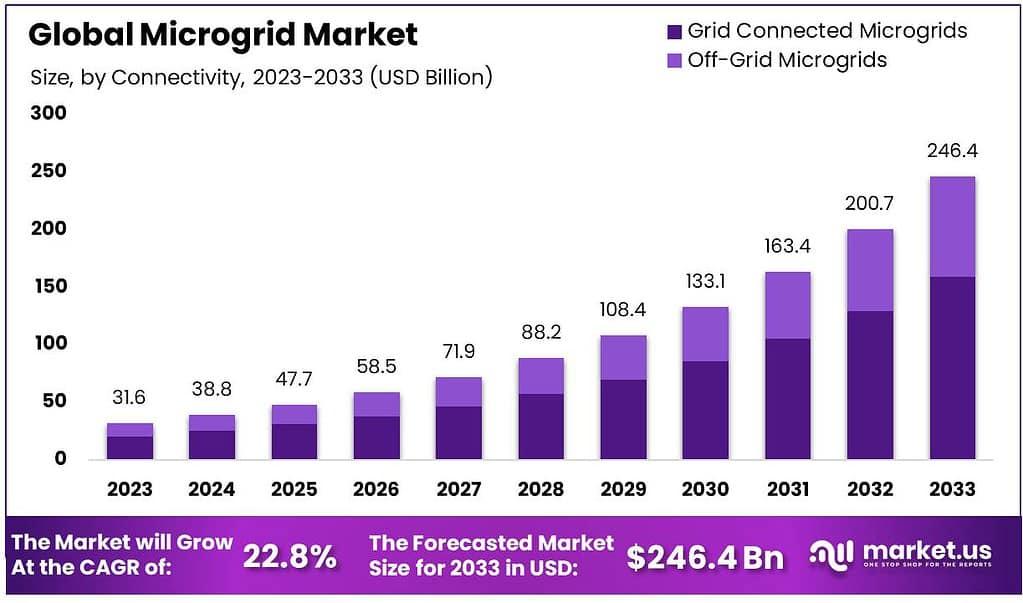

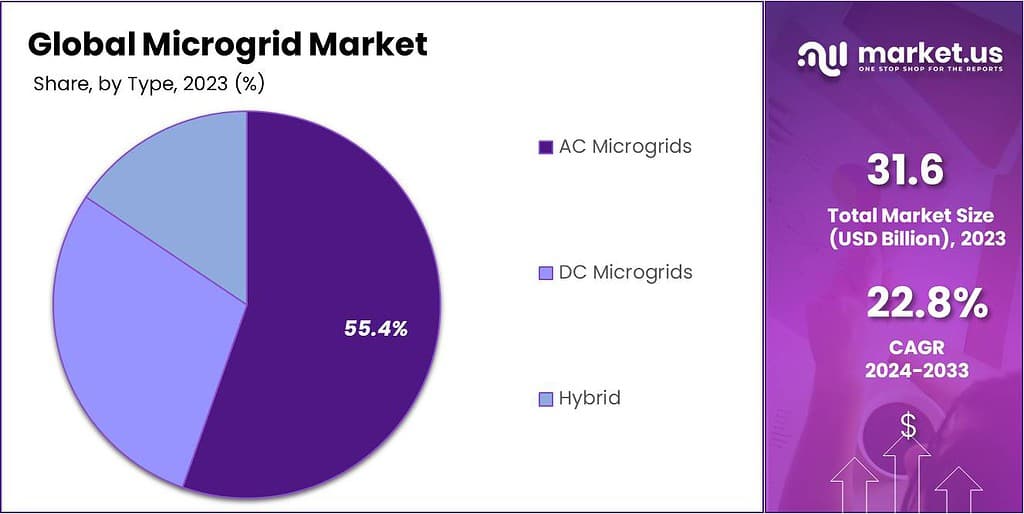

The global Microgrid Market size is expected to be worth around USD 246.4 billion by 2033, from USD 31.6 billion in 2023, growing at a CAGR of 22.8% during the forecast period from 2023 to 2033.

The microgrid market comprises systems that are small-scale versions of centralized electricity networks. These systems achieve specific local goals, such as reliability, carbon emission reduction, diversification of energy sources, and cost reduction, established by the community being served. Microgrids can disconnect from the traditional grid to operate autonomously and help mitigate grid disturbances to strengthen grid resilience.

Microgrids incorporate various power sources such as distributed generators, batteries, and renewable resources like solar panels. They are increasingly integrated with advanced technologies that provide automated control to efficiently supply electricity to the connected localities. They are designed to serve a discrete geographic footprint, such as college campuses, hospitals, business centers, or neighborhoods.

Key Takeaways

- The global Microgrid Market is projected to grow at a CAGR of 22.8% from 2024 to 2033, reaching 246.4 billion by 2033 by the end of the forecast period.

- In 2023, the battery electric vehicle (BEV) segment dominated the market, contributing to over 50% of the total market share.

- The Asia-Pacific region led the electric vehicle market in 2023, accounting for nearly half of the global market share, driven by high adoption rates in China.

- Government incentives and support, such as subsidies and tax rebates, have been pivotal in accelerating electric vehicle adoption worldwide.

- The decreasing cost of batteries, projected to fall by 50% by 2032, is expected to make electric vehicles more affordable and competitive with traditional vehicles.

By Service Type

In 2023, Asset Management held a dominant market position, capturing more than a 34.5% share in the microgrid market. This segment benefits greatly from the increasing complexity of distributed energy resources (DERs) and the need to optimize their performance and lifecycle. Asset management services are crucial for maintaining the health of microgrid components, ensuring operational efficiency, and maximizing return on investment.

Network Monitoring is another vital service in the microgrid market, ensuring the stability and reliability of power supply. With a significant market presence, this service employs advanced sensor technology and data analytics to anticipate, detect, and respond to network issues in real-time, thus preventing outages and ensuring the smooth operation of the microgrid.

Meter Data Management services are integral to the operation of microgrids, handling large volumes of data generated by smart meters. These services facilitate the collection, processing, and storage of meter data, providing valuable insights for energy usage optimization and billing processes.

Remote Metering services have also seen considerable adoption, enabling the remote reading and management of meter data. This service enhances the convenience and efficiency of data collection, contributing to the improved management of energy consumption patterns within the microgrid.

By Component

In 2023, Smart Solar Panels held a dominant market position within the microgrid market, capturing more than a 38.6% share. The prominence of smart solar panels is due to their integral role in generating renewable energy for microgrids, enhancing sustainability and reducing reliance on traditional energy sources. These panels, equipped with advanced technology, optimize power output by tracking the sun’s movement, thereby increasing overall efficiency.

Moving to Smart Inverters, form the backbone of modern microgrids by enabling the seamless conversion of DC electricity generated by solar panels into AC electricity, which can be used by the grid. Their smart capabilities allow for improved monitoring and management of energy flows, ensuring stability even with high levels of renewable penetration.

Energy Management Systems (EMS) are also a critical component, representing a substantial market segment. EMS is responsible for the intelligent distribution and optimization of energy resources within the microgrid, contributing to enhanced grid reliability and operational cost savings.

Communication and Networking Devices in microgrids cannot be overlooked. These components ensure the constant and secure exchange of data between various elements of the microgrid, facilitating real-time decision-making and responsive energy distribution.

By Deployment

In 2023, On-Grid microgrid systems held a dominant market position, capturing more than a 74.3% share. This substantial market share can be attributed to the on-grid systems’ ability to operate in tandem with the traditional power grid, providing enhanced energy security and reliability.

These systems are particularly beneficial in urban and suburban areas, where they can support the existing grid infrastructure during peak demand times or in the event of disruptions.

Off-grid microgrids, while holding a smaller share, are nonetheless significant in remote or rural areas where connectivity to the central grid is limited or nonexistent.

These standalone systems are crucial for providing a consistent power supply, leveraging various energy sources, including renewables, to bring electricity to off-the-beaten-path locations. The resilience and self-sufficiency of off-grid microgrids make them indispensable in fostering energy access in undeveloped or hard-to-reach regions.

By Application

In 2023, the Utility sector held a commanding position in the microgrid market, securing over a 41.3% share. This leading role can be linked to the growing need for stable and efficient energy distribution in public utility services. The adoption of microgrids by utility providers demonstrates a commitment to enhancing grid resilience and incorporating renewable sources into the energy mix, offering a sustainable approach to meeting large-scale energy demands.

The Residential segment also experienced significant growth, driven by homeowners’ increasing interest in energy independence and sustainable living. Microgrids in residential areas offer a dependable alternative to traditional power sources, especially in regions prone to outages or with inadequate grid infrastructure.

Commercial applications of microgrids are rising as businesses seek to reduce energy costs and minimize their environmental footprint. By managing energy consumption more effectively, commercial microgrids help businesses achieve greater operational efficiency.

Market Key Segments

By Service Type

- Asset Management

- Network Monitoring

- Meter Data Management

- Remote Metering

- Others

By Component

- Smart Solar Panels

- Smart Inverters

- Energy Management Systems

- Communication and Networking Devices

- Others

By Deployment

- On-Grid

- Off-Grid

By Application

- Utility

- Residential

- Commercial

- Industrial

Drivers

The microgrid market is primarily driven by the increasing demand for reliable and secure power supply systems. The rising incidences of electricity outages and the growing emphasis on sustainable energy practices are compelling businesses and communities to invest in microgrid solutions. Furthermore, the integration of renewable energy sources such as solar and wind into the power grid has bolstered the adoption of microgrids.

These systems enable the efficient use of renewable energy by providing storage solutions and reducing transmission losses. Another significant driver is the advancement in battery storage technology, which has led to improved energy management and has made microgrids more viable for a broader range of applications.

Restraints

One of the main restraints in the microgrid market is the high initial investment and the complexity of design and operation, which can be daunting for potential adopters. Regulatory challenges also act as a barrier, as the interconnection of microgrids with conventional utility grids often faces bureaucratic hurdles.

Furthermore, the lack of standardization across different regions can impede the scalability of microgrid solutions, making it difficult for manufacturers and service providers to meet diverse regulatory and technical requirements.

Opportunity

The microgrid market is ripe with opportunities, especially in remote and off-grid areas where conventional energy distribution is either unreliable or non-existent. This opens up prospects for microgrid providers to explore untapped markets and cater to the energy needs of isolated communities. The ongoing reduction in the cost of renewable energy technologies presents another opportunity for market growth.

As the cost barrier lowers, microgrids become more accessible, leading to wider adoption. Lastly, the increasing need for energy security and resilience in the face of climate change-induced extreme weather events creates significant opportunities for microgrid deployment as a safeguard against power disruptions.

Trends

A notable trend in the microgrid market is the shift towards digitization and smart infrastructure. The use of Internet of Things (IoT) technology for monitoring and managing energy resources has enhanced the operational efficiency of microgrids.

Additionally, there is a growing trend of deploying microgrids as a service (MaaS), which reduces the upfront costs for end-users and promotes microgrid adoption. Decentralization of power generation is also a prevailing trend, wherein microgrids are being recognized as a solution to reduce the load on central grids and provide energy independence.

Regional Analysis

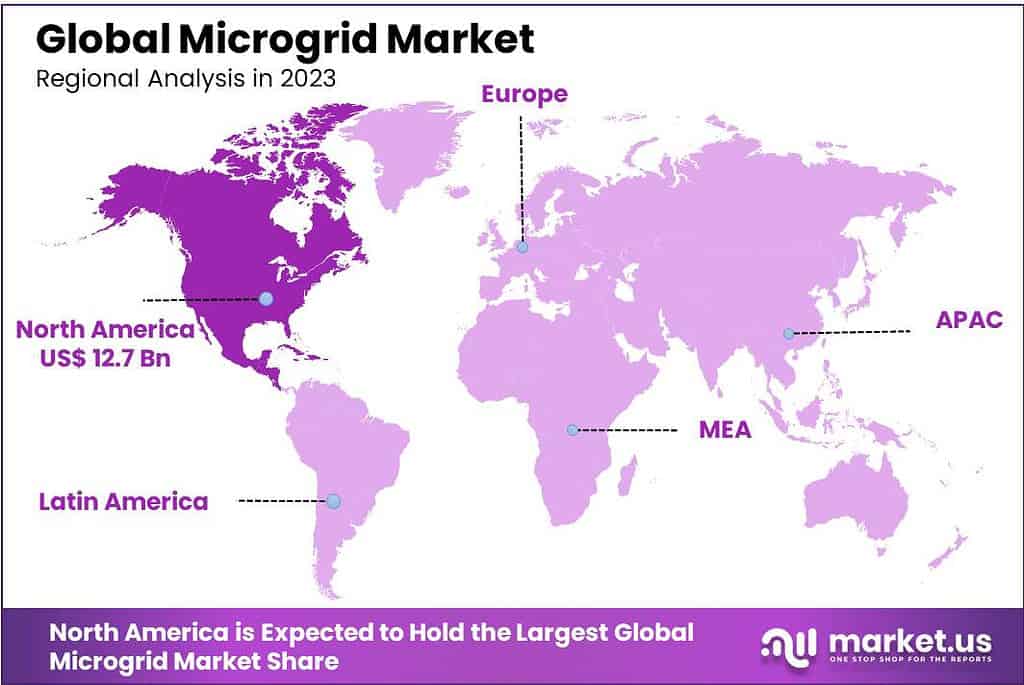

North America is anticipated to be the most microgrid market.

North America is leading the charge, accounting for 34.5% of the global microgrid market share as of 2023. The region, and particularly the United States, is at the forefront of microgrid adoption, driven by the increasing demand for energy security and reliability, especially in the face of aging grid infrastructure and the escalating incidence of extreme weather events.

There is a heightened consciousness in North American industries and communities regarding energy independence and sustainability. This awareness is propelling the expenditure on advanced energy solutions, including microgrids. Users in this market are well-informed about the advantages that microgrids bring, such as grid resilience, cost savings, and reduced carbon emissions, and are therefore willing to invest in these systems.

The region boasts an advanced energy infrastructure, complemented by a robust network of energy professionals and technology providers. This foundation facilitates the growth and integration of microgrid solutions, as energy experts often advocate for the adoption of microgrids in both commercial and residential settings. A significant number of leading microgrid technology companies have their roots in North America, with substantial investments in research and innovation. This has led to the availability of a diverse array of sophisticated and high-quality microgrid products within the market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The microgrid market is characterized by a dynamic and competitive landscape, with several key players dominating the sector. As of 2023, prominent companies in this field are leveraging technological advancements to consolidate their market positions. These players are heavily invested in research and development to innovate and deliver comprehensive microgrid solutions that are resilient, efficient, and scalable.

These key players specialize in a variety of components integral to microgrid systems, such as energy management systems, smart inverters, and advanced storage technologies. Their offerings are not limited to hardware but also encompass software platforms for optimized energy distribution and management. By providing full-spectrum services and solutions, these companies cater to a diverse clientele, including utility, commercial, industrial, and residential sectors.

Strategic partnerships and collaborations are also a hallmark of these market leaders, allowing for expanded reach and the integration of various renewable energy sources into microgrid configurations. Their commitment to sustainability is reflected in the increased incorporation of renewable energy technologies, which not only enhances environmental benefits but also aligns with global energy transition trends.

Market Key Players

- ABB Group

- GE Power

- Itron Inc.

- Schneider Electric

- Siemens AG

- Echelon Corporation

- Landis+GYR AG

- Silver Spring Networks Inc.

- Urban Green Energy International

- Solarcity

- Vivint Solar

- Smart Solar Ltd.

- Huawei Technologies Co., Ltd.

Recent Developments

2023 ABB Group: Launched their “Microgrid Plus” solution, integrating microgrids with battery energy storage systems for enhanced grid stability and resilience.

2023 GE Power: Awarded contracts for several microgrid projects across North America and Asia, focusing on renewable energy integration and community power solutions.

2023 Itron Inc.: Partnered with various utilities to implement advanced metering and grid management solutions for microgrids, enabling real-time monitoring and optimization.

2023 Schneider Electric: Launched “EcoStruxure Microgrid Flex,” a pre-engineered and standardized microgrid solution aimed at faster project timelines and improved return on investment.

Report Scope

Report Features Description Market Value (2022) US$ 31.6 Bn Forecast Revenue (2032) US$ 246.4 Bn CAGR (2023-2032) 22.8% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type(Asset Management, Network Monitoring, Meter Data Management, Remote Metering, Others), By Component(Smart Solar Panels, Smart Inverters, Energy Management Systems, Communication and Networking Devices, Others), By Deployment(On-Grid, Off-Grid), By Application(Utility, Residential, Commercial, Industrial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB Group, GE Power, Itron Inc., Schneider Electric, Siemens AG, Echelon Corporation, Landis+GYR AG, Silver Spring Networks Inc., Urban Green Energy International, Solarcity, Vivint Solar, Smart Solar Ltd., Huawei Technologies Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Microgrid Market?Microgrid Market size is expected to be worth around USD 246.4 billion by 2033, from USD 31.6 billion in 2023

What is the CAGR for the Microgrid Market?The Microgrid Market expected to grow at a CAGR of 22.8% during 2023-2032.Who are the key players in the microgrid market?ABB Group, GE Power, Itron Inc., Schneider Electric, Siemens AG, Echelon Corporation, Landis+GYR AG, Silver Spring Networks Inc., Urban Green Energy International, Solarcity, Vivint Solar, Smart Solar Ltd., Huawei Technologies Co., Ltd.

-

-

- ABB Group

- GE Power

- Itron Inc.

- Schneider Electric

- Siemens AG

- Echelon Corporation

- Landis+GYR AG

- Silver Spring Networks Inc.

- Urban Green Energy International

- Solarcity

- Vivint Solar

- Smart Solar Ltd.

- Huawei Technologies Co., Ltd.