Global Gin and Genever Market By Type (London Dry Gin, Plymouth Gin, Dutch Gin, Old Tim Gin, and Other Types), By Product Type (Flavored Gin and Plain Gin), By Distribution Channel (On-Trade, Off-Trade, and Online Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 106821

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

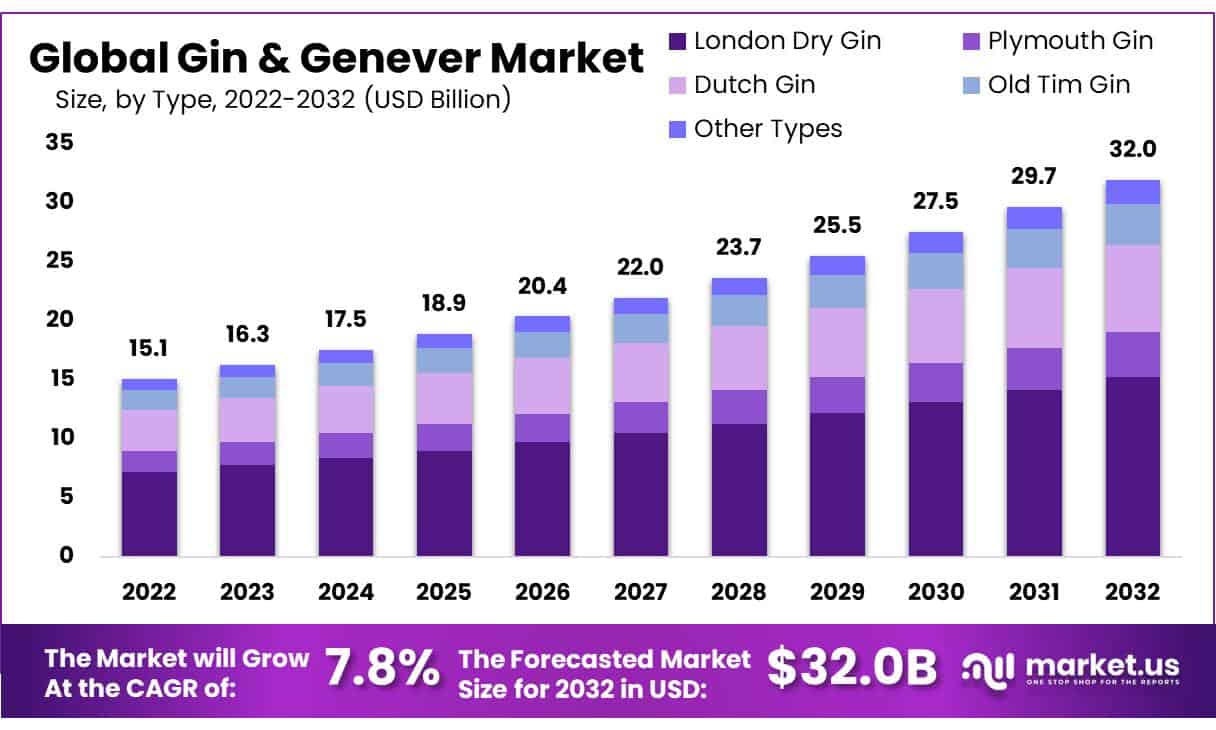

The Global Gin and Genever Market is valued at USD 15.1 Billion in 2022, and is expected to reach USD 25.3 Billion in 2032 It is expected to grow at a CAGR of 7.8% between 2023 and 2032.

Introduction

Gin and Genever are distinct distilled spirits known for their juniper and botanical flavors. Gin, specifically London Dry Gin, is a clear, juniper-forward spirit with a neutral base alcohol that’s redistilled with botanicals such as coriander and citrus peel. In contrast, Genever is a Dutch-style gin with a malt wine base, offering a smoother and slightly sweeter taste.

Both have gained recent popularity owing to their adaptability in cocktails and the craft spirits movement. They are essential in classic cocktails such as the Gin and Tonic, Negroni, and Martini and are favored by mixologists for creative flavor experimentation.

The rapid growth of the gin and ginger market can be attributed to renewed interest in craft and artisanal spirits, leading to a surge in small-batch producers offering unique flavors.

The trend toward healthier, natural ingredients benefits these spirits due to their botanical components associated with health and wellness. The rise of e-commerce has made it easier for consumers to access a broad product type of gin and genever brands, further driving market growth.

Key Takeaways

- The Global Gin & Genever Market is valued at USD 1 Billion in 2022.

- In 2022, the London Dry Gin accounted for a market share of 47.6%.

- The flavored gin segment holds a significant market share. Due to its diverse range of flavors, it caters to evolving consumer preferences for unique taste experiences.

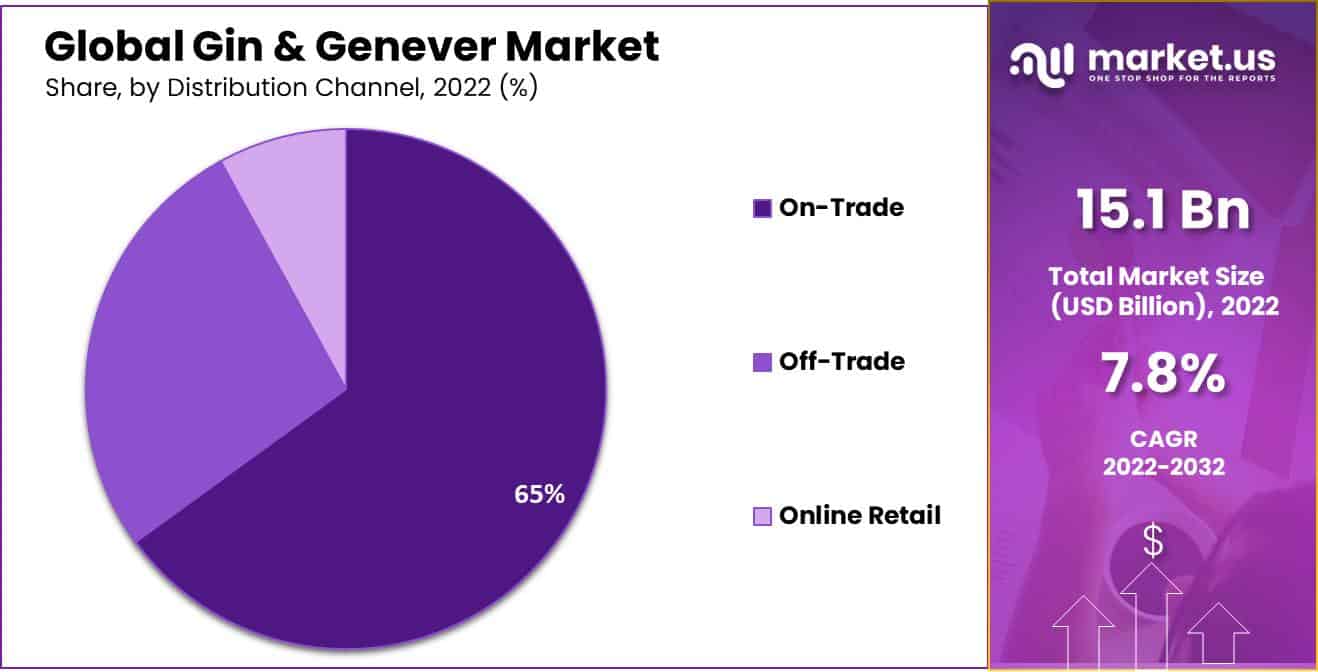

- The on-trade segment led the market with a market share of 65.0% in 2022.

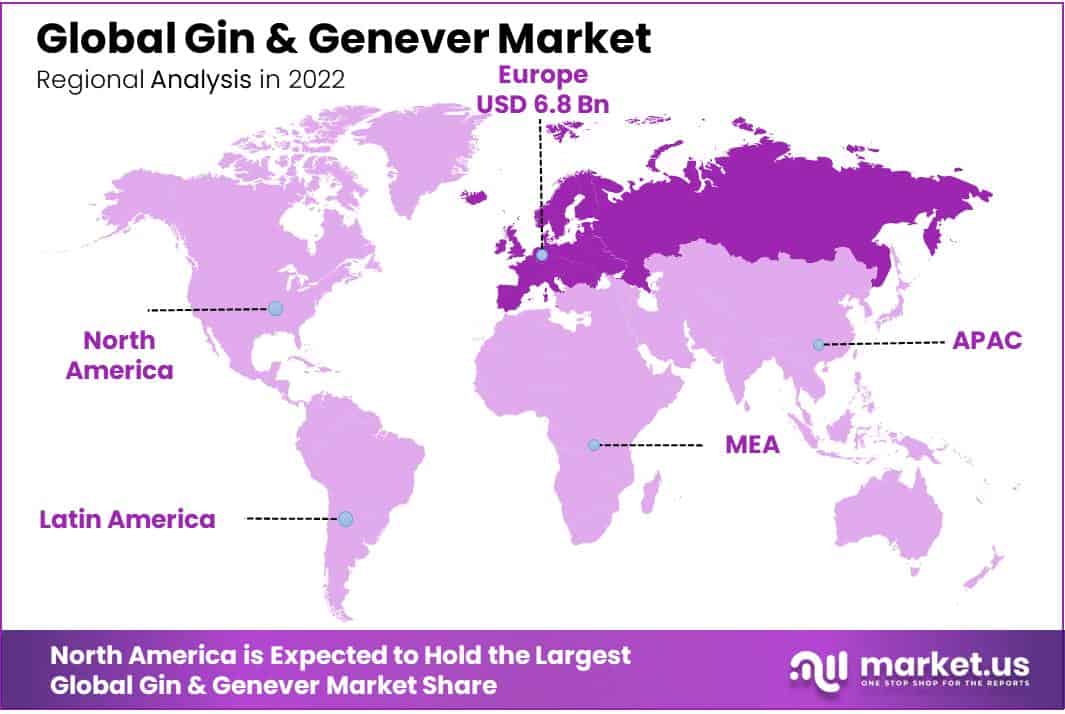

- Europe is the dominant region in the global Gin & Genever market, with a market share of 45.2%.

- The Gin Guild reported a 33% year-over-year increase in the value of UK gin exports in 2022.

Market Analysis

By Type Analysis

By type, the global gin and genever market is divided into London dry gin, Plymouth gin, dutch gin, old tim gin, and other types. Among these, the London dry gin is the most lucrative segment in the market. In 2022, the London dry gin accounted for a market share of 47.6%, and it is predicted to maintain this dominance in the forecasted period.

London dry gin has a long-standing reputation for its classic and versatile flavor profile, making it a preferred choice for traditional gin-based cocktails such as the Gin and Tonic and Martini. Additionally, London Dry Gin is recognized for its juniper-forward taste, which appeals to purists and cocktail enthusiasts alike. Its clarity and neutrality in cocktails provide a blank canvas for mixologists to craft diverse creations.

Afterward, London dry gin, the second most dominant segment, is Dutch Gin. This segment has steadily gained popularity due to its distinct malt wine base, which provides a smoother and slightly sweet flavor profile. Dutch Gin appeals to consumers seeking a unique gin experience beyond the traditional London Dry style. Its historical significance and craft production methods have also contributed to its growth.

Product Type Analysis

By product type, the global gin and genever market is further divided into flavored gin and plain gin. Among these, the flavored gin segment holds a significant market share. Due to its diverse range of flavors, it caters to evolving consumer preferences for unique taste experiences.

It has also tapped into the growing trend of craft and artisanal spirits, offering high-quality, small-batch products that align with authenticity and craftsmanship. Flavored gin is also a favorite among mixologists and cocktail enthusiasts due to its ability to blend seamlessly with various mixers and ingredients, offering endless possibilities for creative drinks.

Distribution Channel Analysis

The global gin and genever market is further segmented based on distribution channels into on-trade, off-trade, and online retail. Among these, the on-trade segment led the market with a market share of 65.0% in 2022.

The on-trade channel, including bars, restaurants, and clubs, experienced a resurgence in socializing and dining out, leading to increased demand for alcoholic beverages such as gin and ginger. This segment offers an immersive social drinking experience, particularly appealing to younger demographics seeking unique, Instagram-worthy cocktails.

The on-trade sector offers an extensive selection of premium and craft gin brands, and personalized service and knowledgeable bartenders contribute to its market dominance.

Key Market Segments

Based on Type

- London Dry Gin

- Plymouth Gin

- Dutch Gin

- Old Tim Gin

- Other Types

Based on Product Type

- Flavored Gin

- Plain Gin

Based on the Distribution Channel

- On-Trade

- Off-Trade

- Online Retail

Driving Factors

Cocktail and Mixology Culture Drives the Growth of the Global Gin & Genever Market

The growing popularity of cocktail culture and mixology has significantly boosted the gin and genever market. Bartenders and mixologists are increasingly experimenting with these spirits to create innovative and exciting cocktails.

The versatility of Gin and its ability to pair well with various mixers and ingredients make it a favorite choice for crafting unique and flavorful cocktails. The rise of cocktail bars, craft cocktail lounges, and home mixology enthusiasts has driven up the demand for Gins and Genevers worldwide.

Health and wellness trends have also played a role in driving the Gin & Genever market.

Several consumers are opting for spirits that they perceive as healthier options compared to other alcoholic beverages. Gin, in particular, has a lower calorie content than other spirits, such as whiskey or rum.

Additionally, the botanicals used in gin and the historical association of some of them with medicinal properties have led some consumers to perceive gin as a somewhat healthier choice. This health-conscious consumer segment has contributed to the market’s growth.

Restraining Factors

High Production Costs

High production costs in gin and genever manufacturing, including high costs for juniper berries and botanicals, can hinder market entry for new players and potentially increase consumer prices.

The distillation process requires specialized equipment and skilled personnel, further exacerbating production expenses. This could hinder entry for new players and potentially lead to higher consumer prices.

Intense Competition

The global gin and genever market is highly competitive, with numerous brands competing for consumer attention. Established brands often have a strong presence, making it difficult for newcomers to gain traction. Intense competition can lead to price wars, eroding profit margins.

Substantial marketing and promotional efforts are required to stand out, straining budgets. Therefore, companies must continuously innovate and differentiate their products to maintain or gain market share.

Growth Opportunities

Rising Consumer Interest in Craft Gins

The global gin and ginger market is experiencing a surge in consumer interest in craft gins produced by small, independent distilleries known for their unique flavors and artisanal quality. This presents a significant growth opportunity for the market as consumers seek authentic experiences.

Craft gins offer a wide range of botanical blends and flavor profiles, distinguishing them from mass-produced brands. Distilleries can capitalize on this trend by expanding their craft gin offerings.

Health-Conscious Consumers Driving Demand for Low-Alcohol and Low-Calorie Gins

The global gin and ginger market is experiencing growth due to the growing preference for craft and artisanal spirits. Consumers are seeking unique, high-quality gin products driven by premium and handcrafted beverages.

Craft gin brands use locally sourced botanicals and innovative production techniques, appealing to discerning consumers seeking distinct flavors. This trend presents an opportunity for both established and emerging gin producers to expand their product portfolios.

Trending Factors

Rising Demand for Artisanal and Craft Gin

In recent years, there has been a surge in the popularity of craft gin. Consumers are increasingly drawn to artisanal and small-batch gin brands that offer unique and distinctive flavor profiles. This trend is driven by a desire for premium and authentic experiences, with consumers valuing quality over quantity.

Craft gin distillers often experiment with botanicals, resulting in a wide range of flavors that cater to diverse tastes. As a result, craft gin has carved out a significant niche in the global gin market, appealing to discerning consumers seeking a more refined drinking experience.

The Surge of Low and No-Alcohol Gin and Genever Due to Health and Wellness Trend

The alcoholic beverage industry, including gin and ginger, is experiencing a shift towards health and wellness. Health-conscious consumers are seeking alternatives to traditional high-alcohol drinks, leading to the rise of low and no-alcohol gin and genever options.

These products offer similar botanical flavors and aromas but significantly reduce alcohol content. This trend is driven by a desire for moderation, health-consciousness, and socializing without alcohol effects. As these alternatives improve in taste and quality, they are gaining traction among a wider audience.

Geopolitics and Recession Impact Analysis

The global gin and genever market is significantly influenced by geopolitical factors such as trade tensions, tariffs, and diplomatic relations between key countries. Brexit disrupted supply chains, affecting the UK-EU gin and genever trade.

Trade disputes, such as those between the US and its trading partners, can lead to retaliatory tariffs, impacting the cost and availability of these spirits and affecting consumer choices and market dynamics. During the recessions, the spirits industry, including gin and genever, faces challenges and opportunities.

Consumers may reduce discretionary spending, leading to reduced consumption. However, these affordable luxuries can also benefit from reduced spending. Some market segments may see increased demand for budget-friendly options, while premium and craft brands may need to adapt their marketing and pricing strategies to remain competitive.

Regional Analysis

Europe held the highest revenue share in the global gin and genever market.

Europe is the dominant region in the global gin and genever market, with a market share of 45.2%; due to its rich historical connection to gin and genever production has led to numerous distilleries with unique recipes and traditions.

This diversity appeals to a wide range of consumers, from classic brands to adventurous connoisseurs seeking new flavor profiles and styles. Europe’s diverse range of gin and genever brands appeals to a diverse consumer base seeking authentic and high-quality spirits.

Due to changing consumer preferences, the Asia-Pacific region is experiencing a significant surge in demand for gin and genever. The region’s rising middle class and disposable income have led to a larger consumer base for premium spirits.

Additionally, the region’s tourism industry has introduced these spirits to international visitors, creating a ripple effect in terms of demand. This trend is expected to continue in the coming years.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Gin and Genever market is a mix of global giants and craft distilleries, with top companies such as Diageo plc, Pernod Ricard, Bacardi Limited, and William Grant & Sons focusing on artisanal appeal. These companies emphasize brand recognition, marketing, quality, and unique flavor profiles, catering to diverse consumer preferences and market segments.

Market Key Players

- William Grant & Sons

- Diageo plc

- Sipsmith Gin

- Bacardi Limited

- Pernod Ricard

- San Miguel Corporation

- Southwestern Distillery

- Davide Campari-Milano N.V.

- Remy Cointreau

- Lucas Bols

- Forest Spirits’ Gin.

- The East India Company Ltd

- Ginebra San Miguel Inc.

- Other Key Players

Recent Developments

- In September 2023, William Grant & Sons, a Scottish spirits firm, has acquired Silent Pool Distillers, a UK-based gin producer, for an undisclosed sum. Silent Pool Distillers is known for its ultra-premium gin. The acquisition will add a new gin to William Grant & Sons’ portfolio and be a stablemate for its Hendrick’s gin.

Report Scope

Report Features Description Market Value (2022) USD 15.1 Bn Forecast Revenue (2032) USD 32.0 Bn CAGR (2023-2032) 7.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (London Dry Gin, Plymouth Gin, Dutch Gin, Old Tim Gin, and Other Types), By Product Type (Flavored Gin and Plain Gin), By Distribution Channel (On-Trade, Off-Trade, and Online Retail) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape William Grant & Sons, Diageo plc, Sipsmith Gin, Bacardi Limited, Pernod Ricard, San Miguel Corporation, Southwestern Distillery, Davide Campari-Milano N.V., Remy Cointreau, Lucas Bols, Forest Spirits’ Gin, The East India Company Ltd, Ginebra San Miguel Inc., and other key players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are the key botanicals used in gin production?Common botanicals in gin include juniper berries (which give gin its distinctive flavor), coriander, angelica root, citrus peel, cardamom, and orris root. These botanicals contribute to the flavor and aroma profile of the gin.

What is the origin of gin and genever market?Genever originated in the Netherlands and Belgium in the 16th century. Gin, as we know it today, has its roots in 17th-century England, where it gained popularity during the Gin Craze. Both spirits have evolved over centuries to become the beverages we enjoy today.

How is gin and genever market production regulated?Production of gin and genever is subject to regulations and standards specific to their respective regions. For example, London dry gin has strict production guidelines, including the requirement of using natural botanicals during the distillation process.

-

-

- William Grant & Sons

- Diageo plc

- Sipsmith Gin

- Bacardi Limited

- Pernod Ricard

- San Miguel Corporation

- Southwestern Distillery

- Davide Campari-Milano N.V.

- Remy Cointreau

- Lucas Bols

- Forest Spirits’ Gin.

- The East India Company Ltd

- Ginebra San Miguel Inc.

- Other Key Players