Global Alcoholic Drinks Market By Type (Beer, Wine, Spirits, Hard Seltzer, Cider, Perry & Rice Wine, and Others), By Distribution Channel (Pub, Bars & Restaurants, Liquor Stores, Internet Retailing, Supermarkets, Grocery Shops, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 32203

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

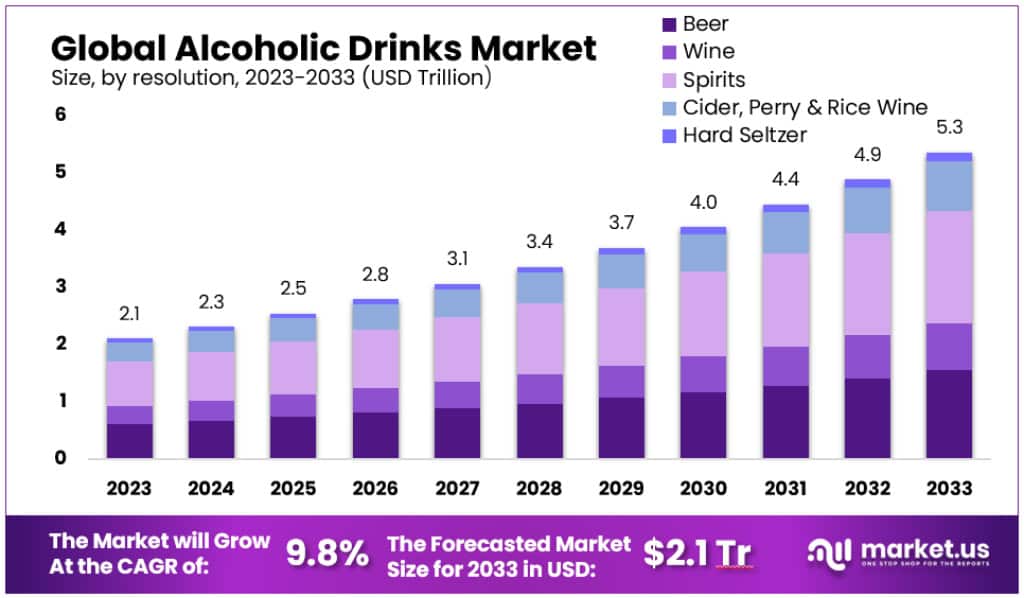

The Global Alcoholic Drinks Market size is expected to be worth around USD 5.3 Trillion by 2033, from USD 2.1 Trillion in 2023, growing at a CAGR of 9.8% during the forecast period from 2023 to 2033.

Alcoholic drinks, also known as alcoholic beverages, are drinks that contain ethanol, a type of alcohol produced by the fermentation of grains, fruits, or other sources of sugar. They are typically divided into three classes: beers, wines, and spirits, with alcohol content usually ranging between 3% and 50%. Some examples of alcoholic drinks include beer, wine, and distilled spirits such as whiskey, gin, vodka, and rum.

Alcoholic drinks market growth can be attributed due to the rising consumption of premium beer in developed economies like the U.S. and the U.K. The rising demand for beer and wine as well as dark spirits is increasing the sales of alcoholic beverages. Market growth is also expected to be boosted by the growing popularity of bars, restaurants, and pubs over the forecast period. This industry is driven by the acceptance of beer’s distinctive flavors to help the digestive system.

Key Takeaways

- The Global Alcoholic Drinks Market is expected to reach a value of USD 5.3 Trillion by 2033, up from USD 2.1 Trillion in 2023.

- The market is projected to grow at a CAGR of 9.8% during the forecast period from 2023 to 2033.

- These beverages are categorized into three main types: beers, wines, and spirits, typically having alcohol content ranging from 3% to 50%.

- Spirits hold the dominant market share, accounting for over 36.5% of the market.

- Liquor stores dominate distribution channels, capturing over 27.5% of the market.

- In 2023, the Asia Pacific region is dominate the market with a 38.2% share, with a value of USD 798 Billion.

Type Analysis

In 2023, the alcoholic drinks market, segmented by type such as beer, wine, spirits, cider, perry & rice wine, and hard seltzer, exhibited a dynamic landscape with varying market shares across each segment. Spirits held a dominant market position, capturing more than a significant 36.5% share. This prominence is indicative of the diverse consumer preferences and the evolving trends within the market.

Spirits

Spirits, with their dominant market share, benefitted from the growing consumer inclination towards premium and super-premium products. The strategic partnerships among leading manufacturers, like the Pernod Ricard’s investment in Sovereign Brands, exemplify the sector’s focus on high-quality, consumer-centric offerings. This segment also experienced a surge in demand for unique flavors and premium quality, contributing to its market strength.

Beer

Beer, accounting for a substantial market portion, continues to innovate with varieties like ale, German-style altbier, and California common beer. Craft beer, in particular, has seen a revolution with new variants and flavors, catering to a wide range of consumer tastes. The segment’s growth is further supported by the increasing production in regional breweries and microbreweries, particularly in the United States.

Wine

Wine, securing the second-highest revenue share of more than 23.0% in 2021, is favored for its health benefits, like promoting heart health and longevity. The rise in antioxidant-rich red wines has further fueled this segment’s growth, reflecting consumer interest in health-conscious drinking options.

Hard Seltzer

Hard seltzer is projected to register the highest growth rate in the market. Its popularity in regions like Europe and the U.S., especially for fruit-flavored options, is driving this segment. The demand for unique flavors like arctic chill ginger-lime and orange guava is a testament to the evolving consumer preferences in alcoholic beverages.

Distribution Channel Analysis

In 2023, the distribution channels for alcoholic drinks, including pubs, bars & restaurants, liquor stores, supermarkets, online platforms, and others, have shown varied market shares, reflecting shifts in consumer purchasing behavior and the influence of global trends. Notably, liquor stores held a dominant market position, capturing more than a significant 27.5% share.

Liquor Stores

Liquor stores, with their substantial market share, have benefited from consumer preferences for convenience and variety. These stores offer a wide range of alcoholic beverages, from craft beers to premium spirits, catering to diverse customer needs. The segment’s strength is further underlined by its accessibility and the ability to provide a quick retail solution for consumers seeking various alcoholic options.

Pubs, Bars & Restaurants

The food service sector, encompassing pubs, bars, and restaurants, holds a larger market share, driven by the increase in socializing post-pandemic. There’s been a notable shift from beer to brown liquors like rum, scotch, whisky, and brandy in these establishments. The sector’s growth is fueled by the expansion of restaurant and bar chains and the rise in social gatherings, underscoring the role of social experiences in alcohol consumption.

Supermarkets

Supermarkets have also emerged as key players in the alcoholic drinks market, offering convenience and a wide selection of products. They cater to the everyday shopper, providing easy access to a range of alcoholic beverages. The growth of this segment is a testament to the changing shopping habits of consumers, who increasingly prefer one-stop shopping experiences.

Online Retail

Online retail platforms have witnessed significant growth, especially accelerated by the COVID-19 pandemic. Platforms like Drizly have seen an uptick in revenue, reflecting the shift towards digital channels for alcohol purchases. The convenience, variety, and often competitive pricing available online have made this channel increasingly popular among consumers.

Other Channels

Other distribution channels, including specialty stores and convenience stores, have seen varied performances. The pandemic initially impacted these channels, but recovery is underway as consumer habits continue to evolve. The diversity in these channels allows for targeted marketing and sales strategies, catering to niche markets and specific consumer preferences.

Key Market Segments

By Type

- Beer

- Wine

- Spirits

- Cider, Perry & Rice Wine

- Hard Seltzer

By Distribution Channel

- Pub, Bars & Restaurants

- Liquor Stores

- Supermarkets

- Online

- Others

Drivers

- Increased Consumption Among Young Adults: The rise in disposable income, especially in developing economies like China, India, and Indonesia, has led to increased spending on alcoholic beverages. The Organization for Economic Co-operation and Development (OECD) reported a 4.5% increase in total alcohol beverage duty receipts in the UK from April to October 2020, compared to the previous year. This trend is supported by a growing preference for premium alcoholic beverages among young adults.

- Growth in Wineries and Breweries: There has been a significant increase in the number of wineries and breweries, especially in the United States. The U.S. Census Bureau data shows an increase from 3,305 breweries in 2017 to 4,493 in 2020, and from 4,000 wineries in 2016 to 5,024 in 2020. This expansion reflects the growing demand for alcoholic drinks and the entry of craft, micro, and artisanal alcohol producers into the market.

Restraints

- Rising Demand for Non-Alcoholic Beverages: The Institute of Food Technologies (IFT) states that one in five consumers has reduced alcohol consumption for healthier beverage choices. The global consumption of non-alcoholic or low-alcoholic spirits is anticipated to increase by over 70% by 2024. This shift towards non-alcoholic beverages poses a significant challenge to the alcoholic beverages market.

Opportunities

- Increasing Demand for Artisanal Spirits: The rising popularity of artisanal spirits in developing economies, such as China and India, presents a significant opportunity for market growth. The growing demand for beers with distinctive flavors and the trend of entertainment at clubs and lounges are driving the sales of these unique alcoholic beverages.

- Online Retail Growth: The growth in online retailing, as evidenced by platforms like Drizly, offers a substantial opportunity for market expansion. This channel has become increasingly popular due to its convenience and variety, allowing consumers to explore a wider range of alcoholic beverages from the comfort of their homes.

Challenges

- Health Concerns and Regulatory Hurdles: Increased health consciousness among consumers and the potential health risks associated with alcohol consumption are major challenges. Additionally, starting a new business in the alcoholic drinks industry requires significant capital investment, legal certifications, and processing time, which can hinder market growth.

Trends

- Premiumization: According to the Distilled Spirits Council of the United States, in 2021, 21.7 million 9-liter cases of premium whiskey and 21.1 million 9-liter cases of premium vodka were consumed. The year-on-year growth rates for super-premium whiskey and vodka were 14.1% and 13.9%, respectively, indicating a strong trend towards premium and super-premium alcoholic beverages.

- Innovations in Flavor and Aroma: Manufacturers are focusing on creating innovative flavors and aromas, using ingredients like exotic fruits and botanicals. This trend is driven by consumers’ cravings for new and unique alcoholic drinks.

Regional Analysis

The alcoholic drinks market is experiencing dynamic growth across various regions, each displaying unique trends and consumer preferences. In 2023, the Asia Pacific region is dominating the market with a commanding 38.2% share, translating to USD 798 Billion.

Asia Pacific

Asia Pacific leads the market with significant growth due to changing lifestyles, rising disposable incomes, and a young population increasingly adopting Western cultural norms. This region is witnessing a surge in demand for premium alcoholic beverages. Key manufacturers like Asahi Group and Suntory Holdings Limited are expanding their market presence through strategic mergers and acquisitions.

For example, the merger of AB InBev Vietnam and SAB Beer in January 2021 has facilitated local production of popular beers like Hoegaarden and Budweiser. This region’s market is projected to grow at an impressive ~11.5% CAGR from 2023 to 2033.

North America

In North America, the market accounted for over ~33.5% of the global revenue in 2023. This is attributed to the rising demand for polished malt whisky in countries like Canada and the U.S. The region is also seeing a trend towards classic brands like Arnold Palmer Spiked Half & Half, with private firms in Canada investing in premium alcoholic beverages.

Furthermore, the U.S. wine market, led by more than 10,000 wineries, is catering to a health-conscious consumer base, with products highlighting attributes like gluten-free, low carb, vegan-friendly, etc.

Europe

Europe is experiencing the second-fastest growth rate in the alcoholic drinks market, with a projected CAGR of ~10.5% from 2023 to 2033. As the largest consumer and producer of alcoholic beverages globally, Europe’s market growth is significantly influenced by major players like Diageo Plc and Carlsberg A/S.

The region’s diverse alcohol preferences, with beer being predominant in Central Europe, wine in the Mediterranean, and spirits in Eastern and Northern Europe, contribute to its market strength. Eurostat reports that over a third of Europeans aged 15 and above consume alcohol at least once a week.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

In the global alcoholic drinks market, the competition is intense, with key players commanding significant market shares. Major companies like Diageo Plc, Anheuser-Busch InBev SA/NV, Heineken N.V., Bacardi Limited, and Constellation Brands Inc. are among the leaders in this space. These companies employ a variety of strategies to bolster their market positions, including mergers and acquisitions, strategic partnerships, and product innovation.

For example, in June 2021, Diageo India marked its entry into the craft whisky segment with United’s Epitome Reserve, a limited edition 100% rice whisky, introducing only 2,000 numbered bottles. This move reflects the company’s strategy to cater to niche markets and consumer preferences for unique and artisanal alcoholic beverages.

Additionally, a significant focus has been observed on the launch of aged rum products, catering to the rising demand for premium alcoholic drinks. Key players are not just focusing on maintaining the unique taste profiles of their beverages but are also exploring innovative e-commerce sales methodologies, despite their inherent challenges and limitations.

In the beer segment, Asahi’s acquisition of Carlton and United Breweries in June 2020 is a notable example. This acquisition not only expanded Asahi’s portfolio but also strengthened its market presence by adding some of Australia’s most popular beer brands to its offerings.

Moreover, Pernod Ricard’s partnership with the United Nations’ EducateAll platform in May 2020 exemplifies the industry’s shift towards sustainable practices and corporate social responsibility. This collaboration provides free, sustainable, and accessible bartending training through the EdApp mobile learning platform, a joint initiative with the United Nations Institute for Training and Research (UNITAR).

The focus on mergers, acquisitions, and partnerships is a strategic move by various regional and international players to gain a competitive edge and facilitate market growth. By establishing manufacturing facilities in different regions and expanding their geographical presence, these companies aim to increase their consumer reach and strengthen their market positions.

Key Market Players

- Bacardi Limited

- Carlsberg A/S

- Anheuser-Busch InBev SA/NV

- Beam Suntory Inc.

- Diageo Plc

- Constellation Brands Inc.

- United Spirits Ltd.

- Molson Coors Brewing Co.

- Heineken N.V.

- Pernod Ricard SA

- Brown-Forman Corporation

- Kirin Holdings Company, Limited

- Asahi Group Holdings, Ltd.

- Thai Beverage Public Company Limited

- Boston Beer Company

- Moutai

- LVMH Moët Hennessy Louis Vuitton SE

- Other Key Players

Recent Developments

Acquisitions

- Oct 2023: Diageo Plc acquires Seedlip, a non-alcoholic spirits brand, for an undisclosed sum. This move strengthens Diageo’s position in the rapidly growing non-alcoholic beverage market.

- Nov 2023: Constellation Brands acquires the remaining 50% stake in Bruichladdich Distillery, a premium Scotch whisky producer, for $1.2 billion. This gives Constellation full ownership of the brand and expands its portfolio of high-end spirits.

- Dec 2023: Pernod Ricard acquires Monkey Shoulder, a blended Scotch whisky brand, from Beam Suntory for $750 million. This acquisition aims to boost Pernod Ricard’s presence in the lucrative Scotch whisky market.

New Trends

- Canned cocktails: Canned cocktails continue their explosive growth, with brands like High Noon and White Claw seeing significant market share gains. Consumers appreciate their convenience, portability, and affordability.

- Direct-to-consumer (DTC) sales: The rise of online alcohol sales platforms like Drizly and Minibar is disrupting traditional distribution channels. DTC allows brands to connect directly with consumers, offering personalized experiences and exclusive offerings.

- Functional ingredients: Beverages infused with CBD, adaptogens, and other functional ingredients are gaining traction, targeting health-conscious consumers seeking beverages with additional benefits.

- Premiumization: Consumers are increasingly willing to pay more for high-quality, artisanal drinks. Craft beers, small-batch spirits, and premium wine brands are experiencing significant growth.

Company News

- Molson Coors launches a new line of hard seltzers made with real fruit juices.

- Heineken announces its commitment to using 100% renewable energy in its breweries by 2030.

- Bacardi partners with a sustainable packaging company to develop biodegradable bottles for its rum.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Trillion Forecast Revenue (2033) USD 5.3 Trillion CAGR (2023-2032) 9.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Beer, Wine, Spirits, Cider, Perry & Rice Wine and Hard Seltzer) By Distribution Channel (Pub, Bars & Restaurants, Liquor Stores, Supermarkets, Online and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bacardi Limited, Carlsberg A/S, Anheuser-Busch InBev SA/NV, Beam Suntory Inc., Diageo Plc, Constellation Brands Inc., United Spirits Ltd., Molson Coors Brewing Co., Heineken N.V., Pernod Ricard SA, Brown-Forman Corporation, Kirin Holdings Company, Limited, Asahi Group Holdings, Ltd., Thai Beverage Public Company Limited, Boston Beer Company, Moutai, LVMH Moët Hennessy Louis Vuitton SE and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the Alcoholic Drinks market in 2023?The Alcoholic Drinks market size was USD 2.1 Trillion in 2023.

Q: What is the projected CAGR at which the Alcoholic Drinks market is expected to grow at?The Alcoholic Drinks market is expected to grow at a CAGR of 9.8% (2023-2033).

Q: List the segments encompassed in this report on the Alcoholic Drinks market?Market.US has segmented the Alcoholic Drinks market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Beer, Wine, Spirits, Hard Seltzer, Cider, Perry & Rice Wine, and Others. By Distribution Channel, the market has been further divided into Pub, Bars & Restaurants, Liquor Stores, Internet Retailing, Supermarkets, Grocery Shops, and Others.

-

-

- Bacardi Limited

- Carlsberg A/S

- Anheuser-Busch InBev SA/NV

- Beam Suntory Inc.

- Diageo Plc

- Constellation Brands Inc.

- United Spirits Ltd.

- Molson Coors Brewing Co.

- Heineken N.V.

- Pernod Ricard SA

- Brown-Forman Corporation

- Kirin Holdings Company, Limited

- Asahi Group Holdings, Ltd.

- Thai Beverage Public Company Limited

- Boston Beer Company

- Moutai

- LVMH Moët Hennessy Louis Vuitton SE

- Other Key Players