Global Still Wine Market By Type (Red, White, and Rose), By Variety (Cabernet Sauvignon, Merlot, Tempranillo, Airen, Chardonnay, and Other Varieties), By Distribution Channel (Bar, Pubs & Restaurants, Supermarkets/Hypermarkets, Liquor Stores, and Online Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 106526

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

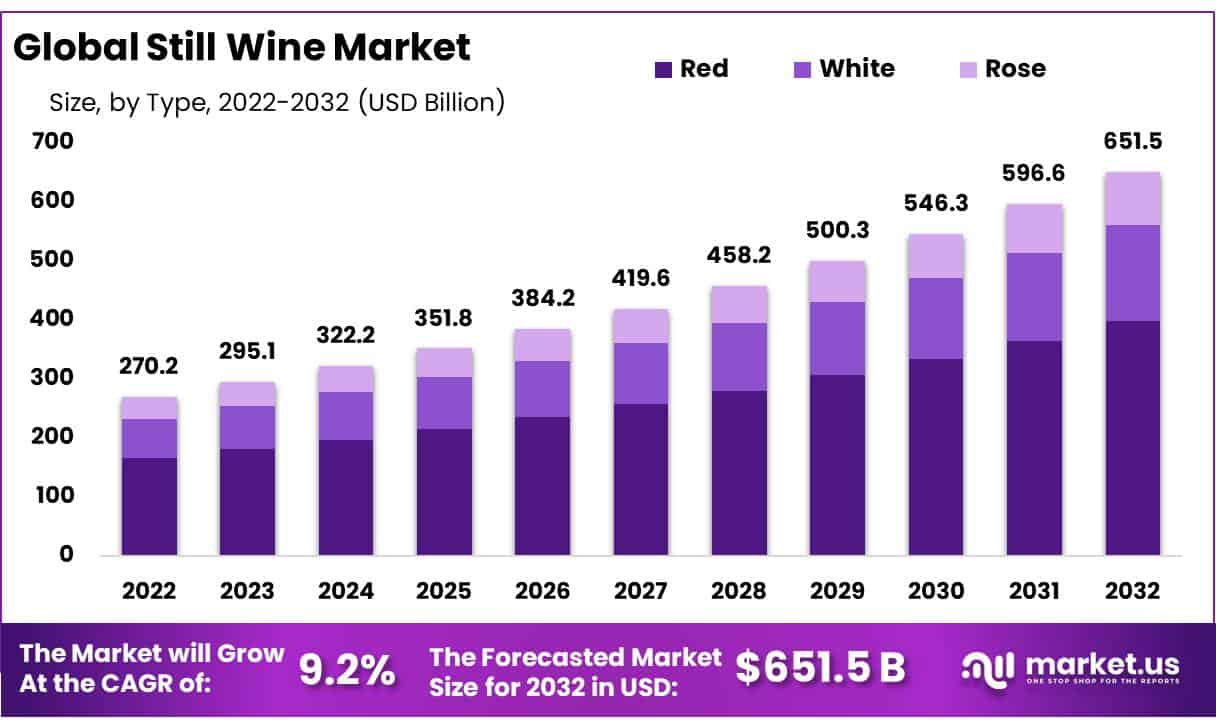

The global Still Wine market is valued at USD 270.2 Billion in 2022, This market is estimated to reach USD 25.0 Billion in 2032 It is expected to grow at a CAGR of 9.2% between 2023 and 2032.

Still, wine refers to non-sparkling wines without carbon dioxide bubbles, typically produced through the fermentation of grape juice without adding carbonation. Still, wines include red, white, and rose varieties.

Consumer preferences have been one of the main drivers of growth in the still wine market, as consumers increasingly choose wine over other alcoholic beverages due to its perceived health benefits and versatility. Furthermore, demand has been further supported by an upturn in moderate alcohol consumption as well as premium-quality product preference. Wine-producing regions around the globe have expanded their vineyards and enhanced winemaking techniques in response to this increase in consumer demand for quality still wines produced locally.

Various regions around the globe are known for producing exceptional still wines, such as Bordeaux in France, Napa Valley in America, and Tuscany in Italy.

Key Takeaways

- The global Still Wine market is valued at USD 2 Billion in 2022.

- By Type, the Red Still Wine segment dominates the market with a market share of 2% in 2022.

- By variety, the Cabernet Sauvignon Still Wine segment dominates the market with more than 60% market share in 2022.

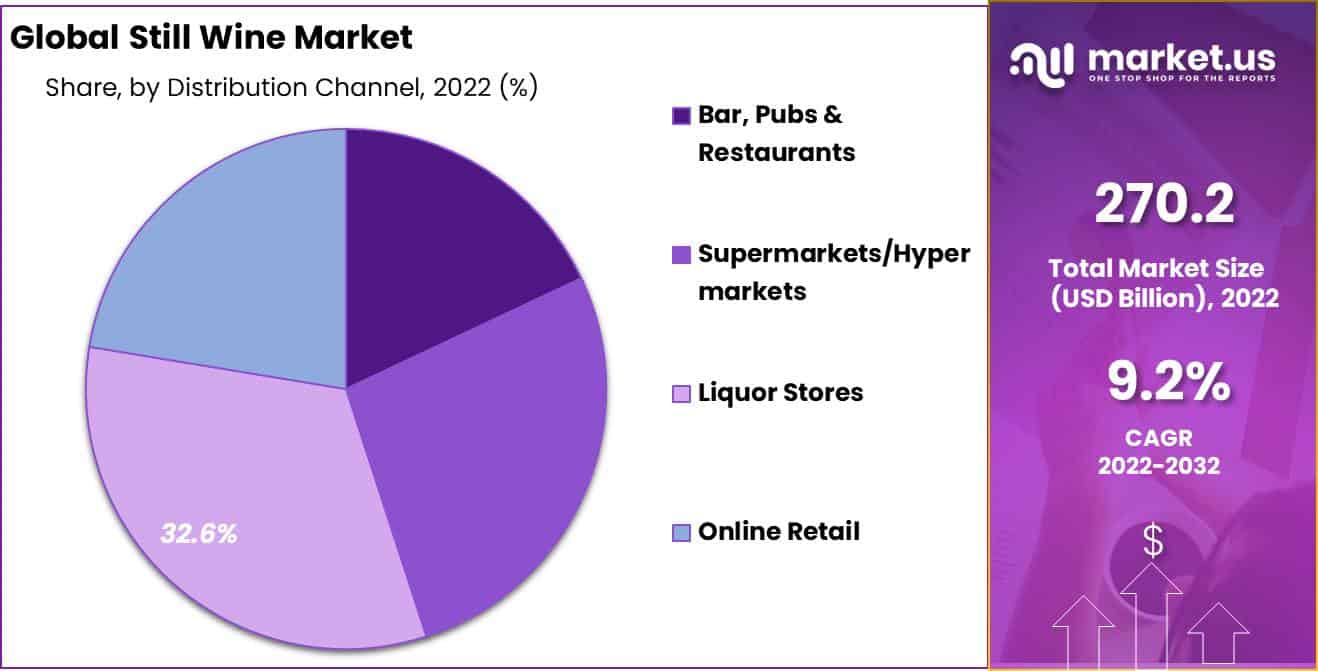

- The distribution Channel Liquor Stores segment led the market in 2022 with a market share of 32.6%.

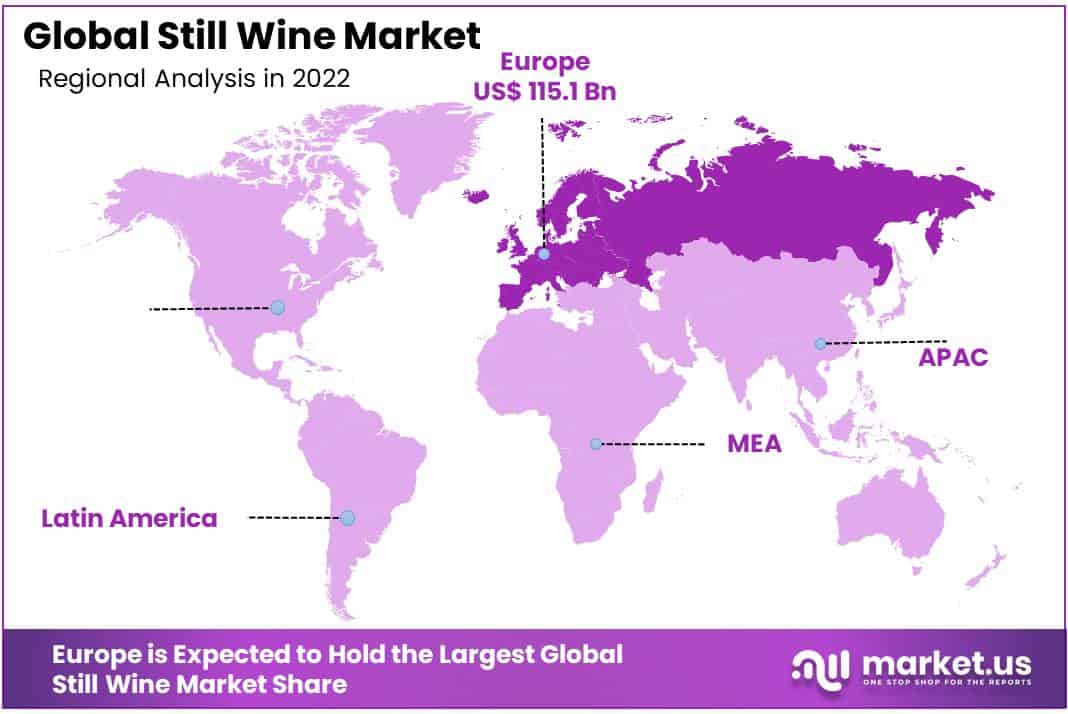

- In 2022, the European region is the dominant region in the global Still Wine market, with a market share of 42.6% of global revenue.

- Italy, France, and Spain account for almost half of all the wine produced in the world.

- The United States consumes the largest volume of wine of any country, at 3,400 million liters in 2022.

Market Analysis

By Type Analysis

By type, the global still wine market is divided into red, white, and rose. Among these, the red still wine segment dominates the market with a market share of 61.2%. Red still wine’s dominance is attributed to its long-established tradition and cultural significance, particularly in Europe.

Its rich history and association with celebrations, fine dining, and social gatherings have solidified its position as the leader in the wine market.

Moderate red wine consumption is widely recognized for its health benefits, including antioxidants like resveratrol, which are believed to impact heart health positively, leading to consumer preferences for red wine as a healthier choice.

White wine holds the second position in the global still wine market due to its versatility, perceived health benefits, and lower tannin levels. Its production is less complex and time-consuming than red wine, allowing for quicker turnover and cost-effectiveness. The popularity of crisp, refreshing white wines in emerging markets further boosts the growth of this segment.

Variety Analysis

By variety, the global still wine market is further divided into cabernet sauvignon, merlot, tempranillo, airen, chardonnay, and other varieties. Among these, the Cabernet Sauvignon segment emerges as the leader of the market because Cabernet Sauvignon grapes are known for their adaptability to diverse climates and soils, ensuring a reliable supply across regions.

Their exceptional quality and long-term aging capacity result in rich, intricate flavor profiles with a well-balanced blend of tannins, acidity, and fruity notes, making them appealing to both seasoned and casual wine enthusiasts.

Chardonnay held a significant market share in the global still wine market due to its versatility, attractive flavor characteristics, and ability to thrive in various winemaking approaches and geographic areas. Its popularity among both consumers and winemakers alike has been a key driver behind its substantial market share.

Distribution Channel Analysis

The global still wine market is further segmented based on distribution channels into bars, pubs & restaurants, supermarkets/hypermarkets, liquor stores, and online retail. Among these, the liquor store segment is the most lucrative in the market, with a 32.6% market share.

Liquor stores typically offer a diverse and extensive selection of wine brands and varieties, catering to a wide range of consumer preferences. This breadth of choice attracts customers seeking specific tastes or brands, contributing to a higher share.

Furthermore, liquor stores often carry premium and rare wine collections that attract connoisseurs willing to pay premium prices for exclusive vintages or limited-edition releases.

The online retail segment has emerged as the fastest-growing segment in the still wine market. Consumers increasingly prefer the ease of browsing and purchasing wines from the comfort of their homes, saving time and effort associated with traditional brick-and-mortar shopping.

The digital space offers an extensive platform for wineries to showcase their products and reach a global audience, eliminating geographical constraints. Additionally, online platforms often provide educational resources and customer reviews, helping buyers make informed choices.

Key Market Segments

Based on Type

- Red

- White

- Rose

Based on Variety

- Cabernet Sauvignon

- Merlot

- Tempranillo

- Airen

- Chardonnay

- Other Varieties

Based on Application

- Bar, Pubs & Restaurants

- Supermarkets/Hypermarkets

- Liquor Stores

- Online Retail

Driving Factors

Growing Consumer Awareness of Health Benefits

One of the significant drivers of the global still wine market is the increasing consumer awareness of the potential health benefits associated with moderate wine consumption. Various studies have suggested that moderate wine consumption, particularly red wine, has certain health advantages due to its antioxidant properties.

The International Organisation of Vine and Wine (OIV) reports a significant increase in wine consumption, reaching 235 million hectoliters in 2022, with a steady increase in the consumption of still wine varieties.

This trend can be attributed to consumers’ increasing awareness of the health benefits of moderate wine consumption and their desire for more diverse and premium wine offerings.

Expanding Wine Tourism

Wine tourism has been gaining traction worldwide, driving the demand for still wine products. Wine tours, tastings, and events not only promote the wine culture but also boost wine sales. The Wine Institute reported that in 2022, there were 25.2 million wine-related tourist visits annually to California wineries, with an estimated $8.6 billion in wine tourism spending.

Restraining Factors

Regulatory Barriers and Trade Dispute hindering the Growth of Still Wine Market.

Regulatory barriers such as tariffs, trade restrictions, and labeling requirements can have a devastating impact on the global still wine market. They create difficulties for wine producers and exporters who seek access to international markets while increasing operational costs significantly.

As of August 2023, the Australian wine industry faces a huge loss, with exports to China shrinking to just A$8.1 million ($5.2 million) in the year to June from a peak of A$1.3 billion ($840 million) in 2019.

Climate Change Poses A Significant Restraint on The Global Still Wine Market.

The wine industry is facing a major challenge due to shifting climate patterns. The grapevines used for wine are highly susceptible to alterations in temperature and the changing seasons, which makes them a vital gauge for understanding how climate change is affecting agriculture. Furthermore, the wine sector is being impacted by extreme weather occurrences like prolonged dry spells, destructive wildfires, limited water resources, and intense rainfall, all of which are widely recognized as consequences of the evolving climate.

Growth Opportunities

Increasing Global Wine Consumption

The greatest opportunities in the global wine market lie in the steady increase in consumption, which has expanded beyond traditional wine-producing countries. This growth is attributed to factors such as perception as a healthier beverage, increased disposable income, and evolving cultural norms, allowing wine to expand into new markets for producers.

Online Retail and Direct-to-Consumer (DTC) Sales

The shift towards online retail and DTC sales channels presents a substantial growth opportunity for the still wine market. With the advent of e-commerce platforms and the COVID-19 pandemic accelerating online shopping trends, consumers are increasingly comfortable purchasing wine online.

Trending Factors

Wine Tourism is Trending in the Global Still Wine Market

Wine tourism has become increasingly popular, with wine enthusiasts seeking immersive experiences at vineyards and wineries. This trend is not just about tasting wine but also about learning about the winemaking process, enjoying scenic vineyard tours, and participating in wine-related activities.

Wineries are investing in creating attractive destinations, complete with restaurants, tasting rooms, and event spaces, to cater to this demand.

Rise of Premium and Craft Wines

The global still wine market has witnessed a surge in demand for premium and craft wines. Consumers are increasingly willing to explore unique, high-quality wines that offer a distinctive flavor profile and story behind them. This trend is driven by the desire for more authentic and exclusive wine experiences.

Wineries are responding by producing limited-edition, small-batch wines and showcasing their winemaking expertise. Wine enthusiasts are willing to pay a premium for these exceptional products, and this has created opportunities for both established wineries and new entrants to the market.

Geopolitics and Recession Impact Analysis

Trade Tariffs and Trade Agreements: Geopolitical tensions and trade disputes have the power to undermine international wine trading, with U.S.-EU tensions leading to tariffs on European wine imports to the US; more recently, in 2019, tariffs of 25% were applied against French, German Spanish and British wines exported into America by these nations, leading to a decline in wine exports from these nations.

Climate Change and Geopolitical Responses: Global climate change impacts wine production worldwide, and geopolitical responses can be critical in dealing with such issues. For instance, the Paris Agreement has led to greater emphasis being put on sustainable agriculture practices that are climate resilient in wine-producing regions worldwide.

Impact on Wine Production: The economic slowdown disrupted wine production and supply chains. Many wineries faced challenges in terms of labor shortages, transportation delays, and reduced exports. According to the International Organisation of Vine and Wine (OIV), global wine production saw a decline in 2020 and 2021, affecting the availability of wine in the market.

Regional Analysis

Europe Held The Leading Position In The Global Still Wine Market With Highest Revenue Share In 2022

Europe is the dominant region in the global Still Wine market, with a market share of 42.6%. Europe boasts a rich and diverse winemaking heritage, including world-famous regions like Bordeaux in France, Tuscany in Italy, and Rioja in Spain.

These wine-producing regions have consistently produced high-quality wines that have earned worldwide renown and consumer support. Furthermore, Europe benefits from an established distribution network offering easy access to an expansive variety of wines; its strong cultural ties relating to its use as an integral component of cuisine further fuel the growth of this market.

North America is the fastest-growing region in the global still wine market. The region experienced a surge in domestic wine production, with key wine-producing states like California, Oregon, and Washington continuing to excel in grape cultivation and winemaking.

This bolstered North America’s supply capabilities, reducing the need for excessive imports. Additionally, changing consumer preferences for wine, driven by a growing interest in wine culture, health-conscious choices, and an appreciation for locally sourced products, contributed to the region’s prominence.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Still Wine market is highly competitive, with several players competing in the market. Major companies such as E & J Gallo, The Wine Group, Diageo Plc, Castel Freres, Pernod Ricard SA, Constellation Brands, Treasury Wine Estate, among other players are competing in the market.

Market Key Players

- Castel Freres

- E & J Gallo

- Constellation Brands

- The Wine Group

- Vina Concha y Toro

- Accolade Wines

- Pernod Ricard SA

- Trinchero Family Estates

- Delicato Family Vineyards

- Diageo Plc

- Bacardi Limited

- Brown-Forman Corporation

- Beam Suntory

- Treasury Wine Estates

- Other Key Players

Recent Developments

In September 2023, E & J Gallo Wine Group has recently acquired Massican, a Napa-based white wine specialist. The acquisition includes the Massican brand and its inventory of wines. Gallo has also partnered with Massican’s founder and winemaker, Dan Petrosk.

In June 2023, Constellation Brands, Inc. acquired Domaine Curry wine brand from Coup De Foudre Napa Valley at an undisclosed sum and will incorporate this acquisition into The Prisoner Wine Company’s portfolio of brands. This deal marks an expansion of The Prisoner Wine Company’s portfolio of wine labels.

In July 2023, Treasury Wine Estates launched its first China-sourced wine in the 2023 Penfolds Collection. The Chinese Winemaking Trial (CWT) is a $150-a-bottle red wine made from Chinese grapes. This marks the next step in TWE’s China winemaking strategy.

Report Scope

Report Features Description Market Value (2022) USD 270.2 Bn Forecast Revenue (2032) USD 25.0 Bn CAGR (2023-2032) 9.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Red, White, and Rose), By Variety (Cabernet Sauvignon, Merlot, Tempranillo, Airen, Chardonnay, and Other Varieties), By Distribution Channel (Bar, Pubs, & Restaurants, Supermarkets/Hypermarkets, Liquor Stores, and Online Retail) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Castel Freres, E & J Gallo, Constellation Brands, The Wine Group, Vina Concha y Toro, Accolade Wines, Pernod Ricard SA, Trinchero Family Estates, Delicato Family Vineyards, Diageo Plc, Bacardi Limited, Brown-Forman Corporation, Beam Suntory, Treasury Wine Estates Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the market size of Still Wine market?The global Still Wine market is valued at USD 270.2 Billion in 2022, This market is estimated to reach USD 25.0 Billion in 2032 It is expected to grow at a CAGR of 9.2% between 2023 and 2032.

What is still wine, and how is it different from other types of wine?Still wine is a type of wine that is not sparkling or effervescent. It is typically fermented once, and the carbon dioxide produced during fermentation is allowed to escape. This distinguishes it from sparkling wines like champagne.

How is the still wine market evolving with changing consumer preferences?The still wine market is evolving to cater to changing consumer preferences, with a growing demand for organic and sustainably-produced wines. Consumers are also showing interest in unique varietals and exploring wines from lesser-known regions.

-

-

- Castel Freres

- E & J Gallo

- Constellation Brands

- The Wine Group

- Vina Concha y Toro

- Accolade Wines

- Pernod Ricard SA

- Trinchero Family Estates

- Delicato Family Vineyards

- Diageo Plc

- Bacardi Limited

- Brown-Forman Corporation

- Beam Suntory

- Treasury Wine Estates

- Other Key Players