Global Permanent Magnet Market By Product Type (Neodymium, Samarium Cobalt, Alnico, Ferrite Magnet, and Others), By Applications (Consumer Electronics, Automobile, Industrial Machineries, Medical Devices, Energy, Aerospace, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: August 2025

- Report ID: 21418

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

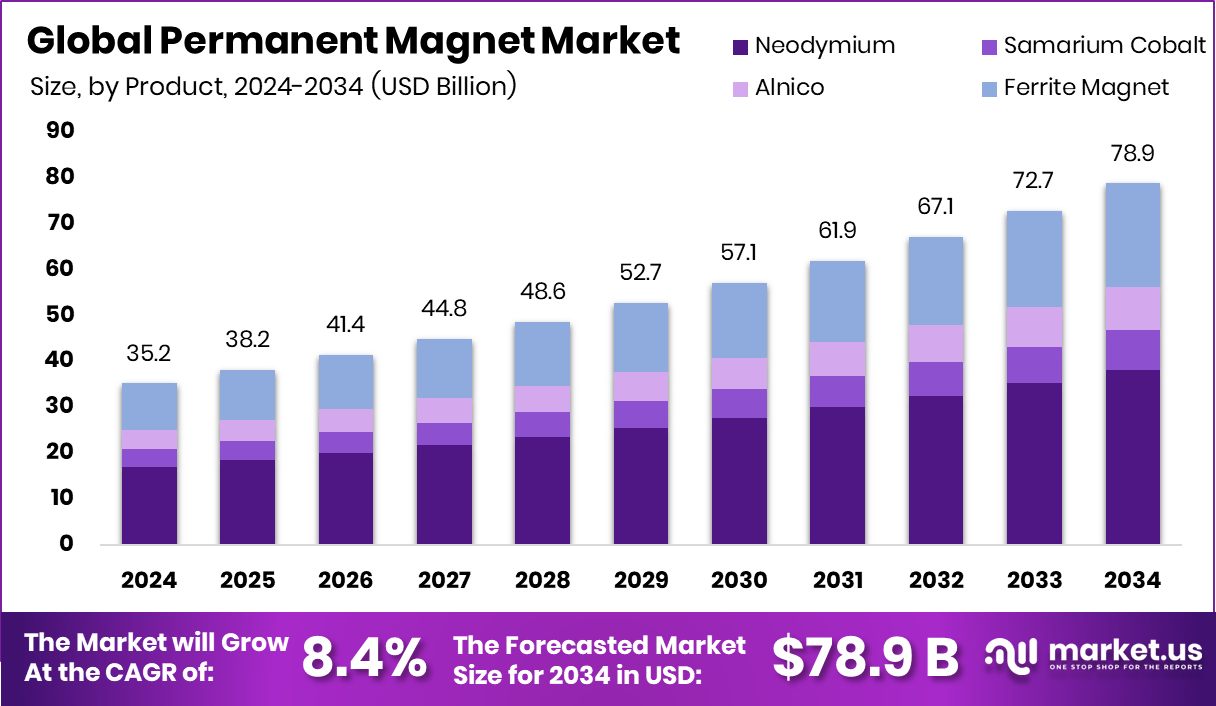

In 2024, the Global Permanent Magnet Market was valued at US$ 35.2 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 8.4%, reaching about US$ 78.9 billion by 2034.

Permanent magnets are materials where the magnetic field is generated by the internal structure of the material itself. They are mostly made from rare earth metals like neodymium and samarium, and heavy rare earth metals such as dysprosium are used to enhance the properties of the magnets.

They have a wide range of applications across various industries, such as electric motors, generators, loudspeakers, and magnetic storage devices like hard drives, due to their ability to create a magnetic field without external power. These magnets are mostly used in consumer electronics and the automotive industries. In recent years, magnets have also been used in the green energy sector, such as in wind energy.

As the consumer preference shifts towards sustainability, the environmentally focused production of permanent magnets as well as rare earth metals is gaining momentum. Despite various applications, the industry faces several challenges. Out of which, the scarcity of rare earth metals affects the market the most. The permanent magnet industry relies heavily on rare earth metals. Due to this, several companies are trying to manufacture permanent magnets by recycling end-of-life magnets.

In 2024, global rare earth oxide production reached 390,000 metric tons. China produced around 69.3%, and the United States produced around 11.2% of the total global production. Six countries, namely, China, the United States, Myanmar, Australia, Nigeria, and Thailand, accounted for almost 90% of the production.

Key Takeaways

- The global permanent magnet market was valued at US$ 35.2 billion in 2024.

- The global permanent magnet market is projected to grow at a CAGR of 8.4% and is estimated to reach US$ 78.9 billion by 2034.

- Among the product types, neodymium-based permanent magnets dominated the market, valued at around 48% in 2024.

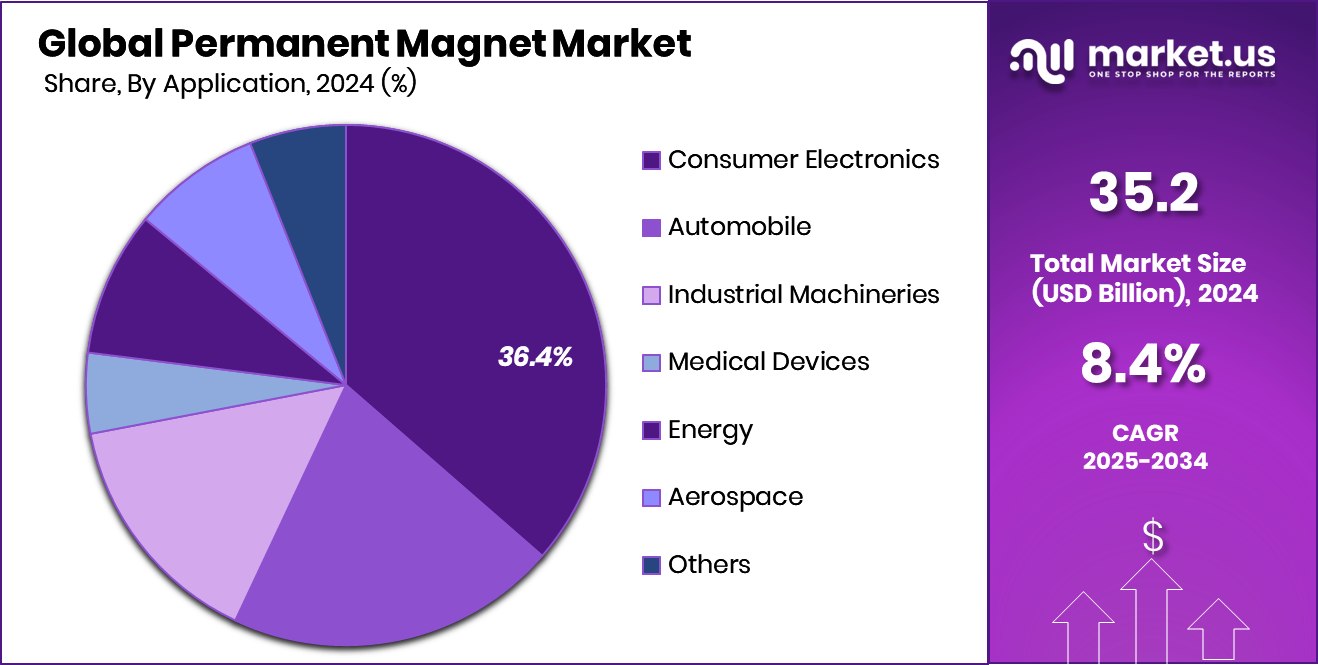

- On the basis of applications, the permanent magnet market was dominated by consumer electronics with a market share of 36.4% in 2024.

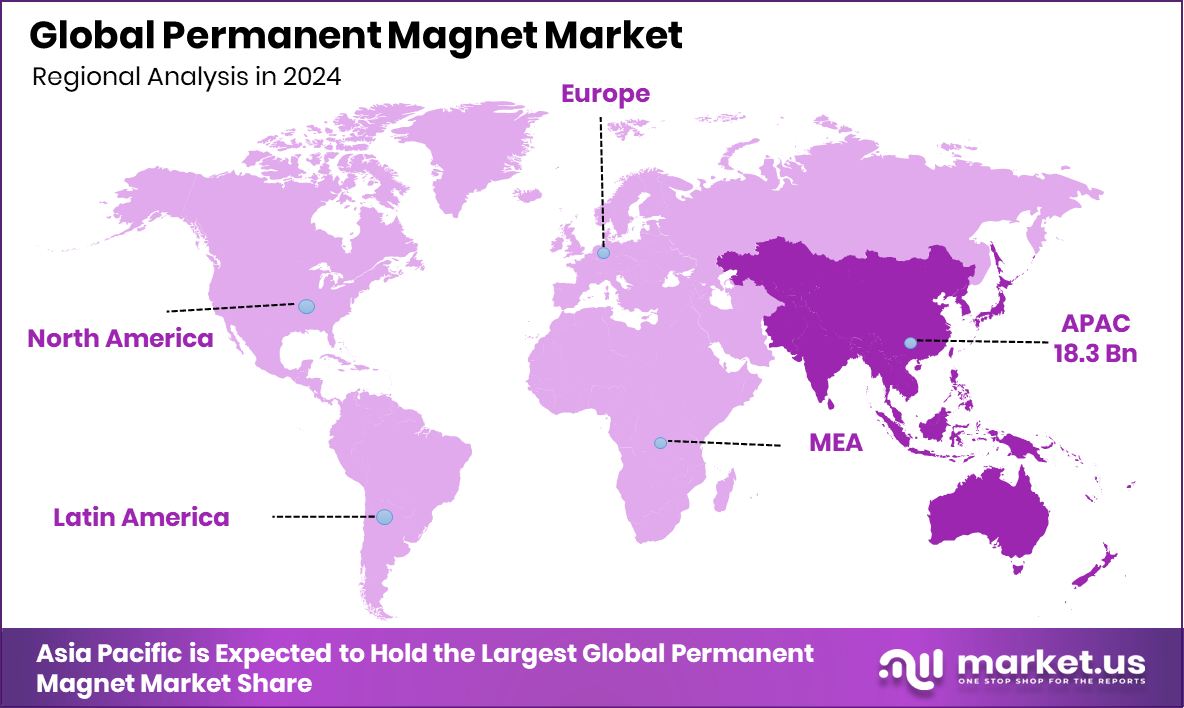

- In 2024, the Asia Pacific was the biggest market for permanent magnets, constituting around 52.1% of the total market share, valued at approximately US$18.3 billion.

Product Type Analysis

Neodymium-Based Permanent Magnets Dominated the Market

The permanent magnet market is segmented based on product type as neodymium, samarium cobalt, alnico, and ferrite magnets. In 2024, neodymium magnets held a dominant market position, capturing more than a 48% share of the global market. Neodymium magnets are the strongest type of permanent magnet commercially available.

This high magnetic force allows them to be effective even in smaller sizes, which is crucial for miniaturization in many applications. They are particularly favored in industries like electronics, automotive, and renewable energy, as well as in everyday household items.

Additionally, while they are made from rare earth elements, the cost of neodymium magnets is generally affordable for most applications. Furthermore, they exhibit good resistance to demagnetization under normal operating conditions, although they can be susceptible to high temperatures.

Application Analysis

Consumer Electronics Sector Dominated the permanent magnet market with around 36.4% of the total market share.

Based on applications, the market can be divided into consumer electronics, automobiles, industrial machinery, medical devices, energy, aerospace, and other applications. In 2024, the consumer electronics sector dominated the global permanent magnet market, valued at about US$ 12.8 billion with a share of 36.4%.

In consumer electronics, they are used in devices such as speakers, televisions, mobile phones, hard drives, ovens, refrigerators, vacuum cleaners, and in the motors of electric vehicles and other appliances.

The strong and durable magnetic fields produced by permanent magnets are crucial for the operation of these devices. In 2024, the number of smartphones that use permanent magnets alone exceeded 7 billion. As the consumer electronics industry expands, there is a high demand for permanent magnets in the market.

Key Market Segments

By Product Type

- Neodymium (NdFeB)

- Samarium Cobalt (SmCo)

- Alnico (AlNiCo)

- Ferrite Magnet

- Others

By Application

- Consumer Electronics

- Automobile

- Industrial Machineries

- Medical Devices

- Energy

- Aerospace

- Other Applications

Drivers

Rapid Growth of the Automotive Sector Drives the Demand for Permanent Magnets.

One of the major drivers of the permanent magnet market is the rapid expansion of the automotive sector. According to the European Automobile Manufacturers’ Association (ACEA), in 2024, global car manufacturing reached 75.5 million units. Similarly, the same year, global car sales reached 74.6 million units, marking a 2.5% increase compared to 2023.

Furthermore, according to the International Energy Agency, in 2024, global electric car production reached 17.3 million units, a 25% increase compared to 2023. China accounted for the majority of this production, with 12.4 million electric cars manufactured, representing over 70% of the global total production. Permanent magnet is used in various applications, from electric motors and sensors to oil pan chip collection. They play a key role in enhancing vehicle performance, fuel efficiency, and overall functionality.

Neodymium magnets are essential components in electric vehicle motors and are also used in various other motors within a vehicle, such as those for power windows, sunroofs, side mirror adjustments, and the air conditioning fan. As a permanent magnet is one of the important materials for several vehicle parts, there is a high demand for magnets from the automotive industry.

Restraints

Scarcity of Rare Earth Metals Poses a Significant Challenge to the Market.

The scarcity of rare earth metals presents a critical challenge to the permanent magnet market, particularly due to the heavy reliance on specific elements such as neodymium, samarium, dysprosium, and terbium, which are essential for producing high-performance magnets like neodymium-iron-boron magnets.

In terms of relative abundance in the crust of the Earth, dysprosium is less than 1% of all rare earths. In order for Neo magnets to perform at elevated temperatures, they require dysprosium at up to 12 weight percent. However, there is a dysprosium shortage in the global market. These shortages can disrupt the supply chain, leading to delays in manufacturing.

For instance, in July 2025, a shortage of dysprosium led to the disruption in the production of Apple’s AirPods at Foxconn’s Telangana plant, after China imposed restrictions on the export of rare earth metals. Moreover, the technical challenges further decelerate the market.

NdFeB offers the highest energy density but is sensitive to temperature, while SmCo provides better thermal stability and corrosion resistance. Ferrite is cost-effective but weaker, and Alnico has excellent temperature stability but lower coercivity.

Opportunity

Rising Application of Permanent Magnet in the Energy Sector Boosts the Market.

The surging utilization of permanent magnets across the energy sector, especially within renewable technologies, is serving as a pivotal growth engine for the global permanent magnet market. In the wind energy arena, particularly offshore, permanent magnet generators are increasingly favored due to their streamlined design, higher efficiency, and reduced maintenance compared to conventional geared systems.

The growth in demand for permanent magnets in the wind power industry is the most dramatic, ramping from 92 to 2428 tons per year. In an average wind turbine, 250–650 kg of NdFeB magnets are used to generate 1 MW of electricity. To spread green energy technology, the installed global wind capacity is expected to increase from 324 GW in 2020 to 578 GW by 2040.

The manufacture of generators with neodymium–iron–boron magnets for use in wind turbines requires the use of rare earth elements, especially neodymium and dysprosium. According to the International Energy Agency, in the electricity sector, the renewable energy share is forecast to expand from 30% in 2023 to 46% in 2030, out of which 14% is comprised of wind energy.

Trends

Sustainable Production of Rare Earth Magnets Gains Momentum.

The sustainable production of rare earth magnets is gaining momentum in the permanent magnet market as global demand for clean technologies, such as electric vehicles and wind turbines, continues to surge. In the United States, several companies are expanding domestic rare earth magnet production and recycling capabilities to reduce reliance on Chinese supply chains.

For instance, in July 2025, MP Materials announced a definitive, long-term agreement to supply Apple with rare earth magnets manufactured in the United States from 100% recycled materials. The feedstock will be sourced from post-industrial and end-of-life magnets, marking a major milestone in both companies’ efforts to create sustainable supply chains.

Geopolitical Impact Analysis

Impact of Geopolitical Tensions

Geopolitical tensions significantly impact the permanent magnet market, primarily due to the industry’s heavy reliance on rare earth elements (REEs), particularly neodymium, dysprosium, and samarium. These tensions, including trade disputes and export restrictions, create supply chain disruptions, price volatility, and hinder market expansion.

Strong permanent magnets are often made from neodymium and samarium, and dysprosium is added to these magnets to enhance their properties. The concentration of REE mining and processing in a few countries, primarily China, makes the market susceptible to disruptions caused by geopolitical events.

The biggest example is the trade war between China and the United States. China continues to hold a dominant position in the global rare earth market, controlling a significant portion of both mining and refining. In April 2025, in response to U.S. tariffs, China implemented export controls on seven rare earth elements and associated magnets, disrupting global supply chains for industries reliant on these materials.

China’s export controls have not banned rare earth exports entirely but require government approval for each shipment, resulting in potential delays and increased costs for manufacturers worldwide. This has caused some manufacturers, particularly in the automotive and permanent magnet industry, to face production disruptions. These tensions are leading to shifts in investment and trade patterns, with some countries seeking to diversify their supply chains and reduce dependence on China.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Permanent Magnet Market.

In 2024, the Asia Pacific dominated the global permanent magnet market, holding about 52.1%, valued at approximately US$ 18.3 billion. The dominance of the region is attributed to the production and refining capacity of China.

The country is the world’s largest producer and exporter of rare earth elements, which are critical raw materials for producing neodymium magnets and samarium cobalt magnets, the most powerful type of permanent magnet. In 2024, China produced 270,000 metric tons of rare earth metals, which was about 69.3% of the total global production.

In addition, countries such as China, Japan, and South Korea have well-established manufacturing ecosystems that heavily utilize permanent magnets, especially in industries like automotive, electronics, energy, and consumer appliances. Moreover, investments in infrastructure, green energy, and electric mobility have significantly boosted demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Adams Magnetic Products Co., Earth-Panda Advance Magnetic Material Co., Ltd., Arnold Magnetic Technologies, Daido Kogyo Co., Ltd., Eclipse Magnetics Ltd., Electron Energy Corporation, Goudsmit Magnetics Groep B.V., Hangzhou Permanent Magnet Group, Ltd., Magnequench International, LLC, Ningbo Yunsheng Co., Ltd., Shin-Etsu Chemical Co., Ltd., TDK Corporation, and Vacuumschmelze GMBH & Co. KG are the global major players in the permanent magnet market.

As the permanent magnet market is very competitive, many players try to gain consumer attention by engaging in strategic activities, such as product development, mergers, partnerships, and investments. For instance, in July 2023, WEG announced investments for its motor manufacturing plant located in Manaus, Brazil. The company invested R$48 million to expand production capacity and adapt the plant to produce a new line of permanent magnet electric motors for split-type air conditioners.

TDK Corporation, a Japanese multinational electronics company, is a major player in the permanent magnet market, particularly with its ferrite magnets. They are a leading manufacturer of electronic components, including magnetic materials, and have a strong presence in various industries like automotive, industrial equipment, and consumer electronics.

Vacuumschmelze is a leading global manufacturer of advanced magnetic solutions, rare earth permanent magnets, and inductive components that contribute significantly to the decarbonisation of our planet, aligning with the sustainability initiatives.

Shin-Etsu is a major global manufacturer with a significant presence in the permanent magnet market, particularly in rare earth magnets. They have a well-established manufacturing base with a focus on quality control, production efficiency, and meeting customer specifications.

Top Key Players in the Market

- Adams Magnetic Products Co.

- Earth-Panda Advance Magnetic Material Co., Ltd.

- Arnold Magnetic Technologies

- Daido Kogyo Co., Ltd.

- Eclipse Magnetics Ltd.

- Electron Energy Corporation

- Goudsmit Magnetics Groep B.V.

- Hangzhou Permanent Magnet Group, Ltd.

- Magnequench International, LLC

- Ningbo Yunsheng Co., Ltd.

- Ninggang Permanent Magnetic Materials Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- TDK Corporation

- Thomas & Skinner, Inc.

- Vacuumschmelze GMBH & Co. Kg

- MP Materials

- Other Key Players

Recent Developments

- In June 2025, Dexter Magnetic Technologies, Electron Energy Corporation, and Magnetic Component Engineering, a unified group of leading companies for magnetic solutions, announced a joint effort to achieve DFARS 252.225-7052 compliance for neodymium-iron-boron and samarium-cobalt magnets by mid-2026. The three companies have identified and are in negotiations to work with suppliers outside of China to provide these essential materials.

- In October 2024, Arnold Magnetic Technologies Corporation, a subsidiary of Compass Diversified and a leading global manufacturer of high-performance magnets, magnetic assemblies, precision thin metals, and electric motors, expanded its global footprint with a facility of around 26,250 square feet in Amata City, Chonburi, Thailand.

Report Scope

Report Features Description Market Value (2024) USD 35.2 Billion Forecast Revenue (2034) USD 78.9 Billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Neodymium, Samarium Cobalt, Alnico, Ferrite Magnet), By Applications (Consumer Electronics, Automobile, Industrial Machineries, Medical Devices, Energy, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adams Magnetic Products Co., Earth-Panda Advance Magnetic Material Co., Ltd., Arnold Magnetic Technologies, Daido Kogyo Co., Ltd., Eclipse Magnetics Ltd., Electron Energy Corporation, Goudsmit Magnetics Groep B.V., Hangzhou Permanent Magnet Group, Ltd., Magnequench International, LLC, Ningbo Yunsheng Co., Ltd., Ninggang Permanent Magnetic Materials Co., Ltd., Shin-Etsu Chemical Co., Ltd., TDK Corporation, Thomas & Skinner, Inc., Vacuumschmelze GMBH & Co. KG, MP Materials, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Permanent Magnets MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Permanent Magnets MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adams Magnetic Products Co.

- Earth-Panda Advance Magnetic Material Co., Ltd.

- Arnold Magnetic Technologies

- Daido Kogyo Co., Ltd.

- Eclipse Magnetics Ltd.

- Electron Energy Corporation

- Goudsmit Magnetics Groep B.V.

- Hangzhou Permanent Magnet Group, Ltd.

- Magnequench International, LLC

- Ningbo Yunsheng Co., Ltd.

- Ninggang Permanent Magnetic Materials Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- TDK Corporation

- Thomas & Skinner, Inc.

- Vacuumschmelze GMBH & Co. Kg

- MP Materials

- Other Key Players