Global N-butanol Market By Application(Butyl Acrylate, Butyl Acetate, Glycol Ethers, Direct Solvent, Plasticizers, Others), By Production Process(Oxyhydrogenation of Propylene, Butane Oxidation, Fermentation of Biomass), By End-Use(Paints and Coatings, Chemicals and Petrochemicals, Pharmaceuticals, Textile, Automotive, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 115603

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

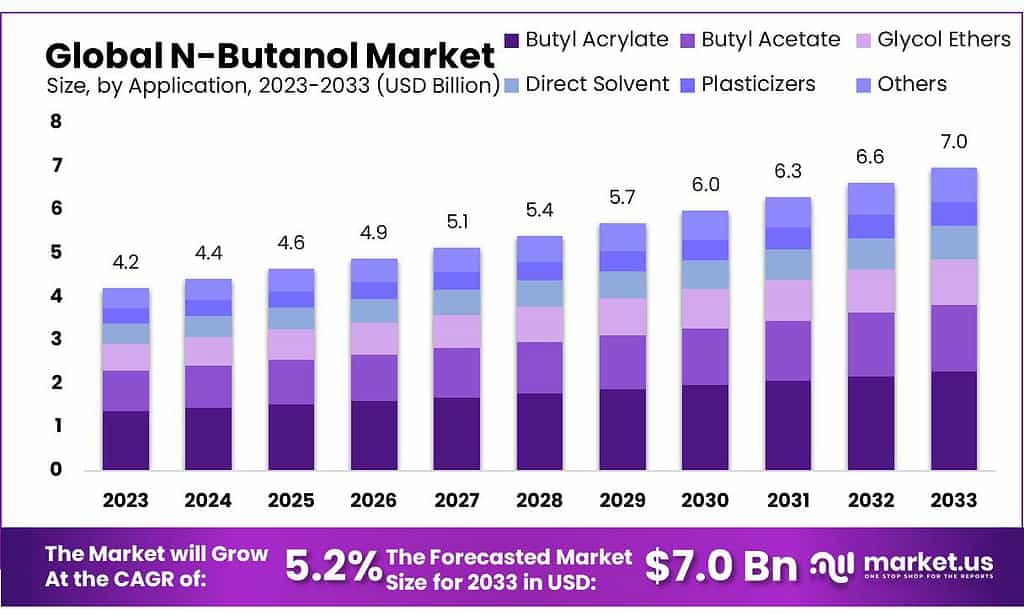

The global N-butanol Market size is expected to be worth around USD 7.0 billion by 2033, from USD 4.2 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

N-butanol, also known as normal butanol or n-butyl alcohol, is a four-carbon alcohol characterized by its clear liquid state and distinct alcoholic odor. It is a versatile solvent with applications across various industries, including chemicals, paints and coatings, pharmaceuticals, textiles, and plastics.

N-butanol is produced through the oxo process, involving the hydroformylation of propene to form butyraldehyde, which is then hydrogenated to yield n-butanol. As a chemical intermediate, solvent, and feedstock, n-butanol plays a crucial role in the synthesis of various products and finds widespread use in industrial processes.

Key Takeaways

- Market Growth: The n-butanol market to reach USD 7.0 billion by 2033, growing at 5.2% CAGR from USD 4.2 billion in 2023.

- Application Dominance: Butyl Acrylate leads with a 32.8% market share, crucial in coatings and adhesives, followed by Butyl Acetate.

- Production Processes: Oxyhydrogenation of Propylene dominates with a 60.3% market share, emphasizing efficiency in synthesis.

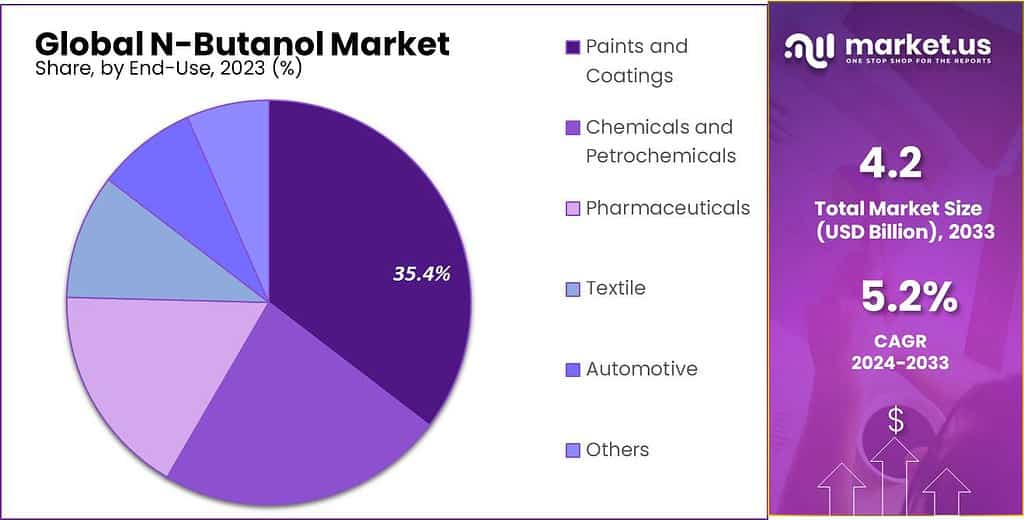

- End-Use Sectors: Paints and Coatings sector holds over 35.4% market share, highlighting N-butanol’s importance.

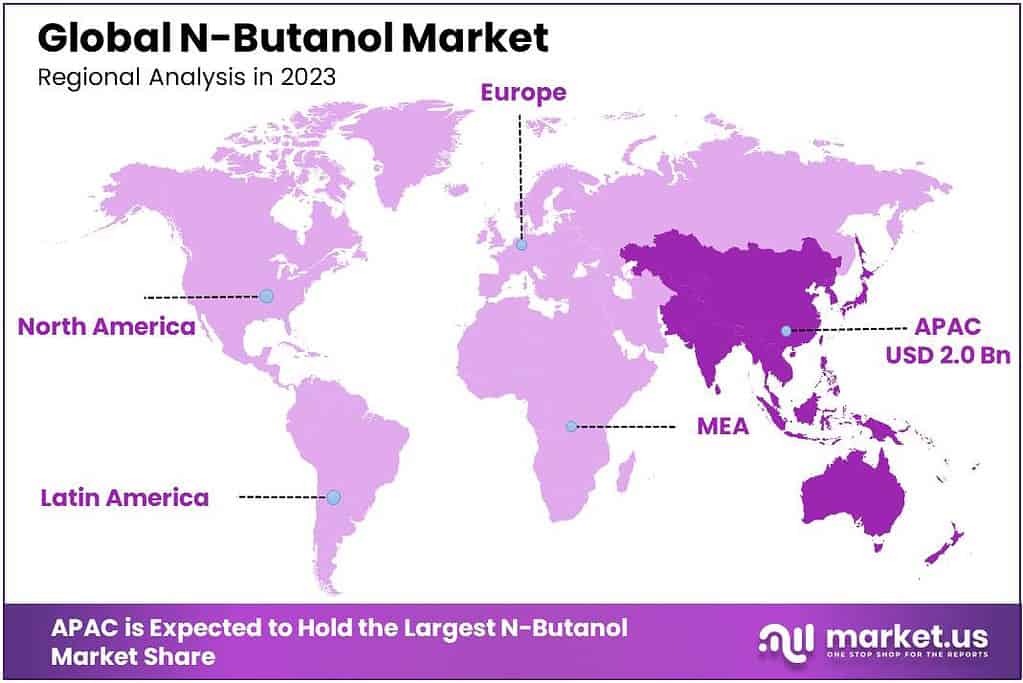

- Regional Analysis: Asia-Pacific dominates, with over 48.4% market share in 2023, driven by industrial growth and demand.

By Application

In 2023, Butyl Acrylate led the N-butanol market, claiming over 32.8% market share. Its dominance in applications is due to its role as a key ingredient in coatings, adhesives, and sealants, showcasing N-butanol’s significance in the chemical landscape.

Butyl Acetate, another major application in the N-butanol market, serves as a solvent in industries like paints and coatings. Its versatility and effectiveness contribute to N-butanol’s substantial market presence.

Glycol Ethers, with applications in solvents and cleaning products, marked a notable share in 2023. N-butanol’s role in their production underscores its importance in the chemical sector.

Direct Solvent applications showcase N-butanol’s efficiency in dissolving various substances, finding utility in diverse industries. Its dominance in this segment reflects its vital role as a solvent.

Plasticizers, crucial in enhancing the flexibility of plastics, rely on N-butanol. In 2023, N-butanol’s significant market share in this application emphasizes its importance in the plastic and polymer industries.

By Production Process

In 2023, the N-butanol market was led by the Oxyhydrogenation of Propylene, securing over 60.3% market share. This dominant position reflects the preference for this production process, emphasizing its efficiency and significance in the chemical industry.

Butane Oxidation, another production method for N-butanol, exhibited notable presence in 2023. Its role in the market highlights the diverse approaches to N-butanol synthesis, catering to different industrial needs.

Fermentation of Biomass, a sustainable production process, contributed to the N-butanol market. In 2023, this method showcased its relevance, aligning with the industry’s increasing focus on environmentally friendly alternatives.

These production processes illustrate the adaptability of N-butanol manufacturing, offering a range of options to meet varied industry demands, from efficiency-focused oxyhydrogenation to sustainable biomass fermentation.

By End-Users

In 2023, the N-butanol market saw Paints and Coatings as a frontrunner, securing over 35.4% market share. This dominance underscores the integral role of N-butanol in the formulation of paints and coatings, reflecting its importance in enhancing product quality and performance.

Chemicals and Petrochemicals emerged as a significant end-user in 2023, emphasizing the versatile applications of N-butanol in various chemical processes. Its use in this sector signifies its value as a key chemical component.

Pharmaceuticals showcased notable presence in the N-butanol market, holding importance for its role in the synthesis of pharmaceutical products. The pharmaceutical industry’s reliance on N-butanol reflects its significance in drug development and manufacturing.

Textile also contributed to the N-butanol market in 2023. Its presence highlights the utilization of N-butanol in textile processes, emphasizing its role in enhancing the quality of textile products.

Automotive, as an end-user segment, played a considerable role in the N-butanol market in 2023. This indicates the diverse applications of N-butanol in the automotive sector, ranging from manufacturing processes to the production of automotive coatings.

Key Маrkеt Ѕеgmеntѕ

By Application

- Butyl Acrylate

- Butyl Acetate

- Glycol Ethers

- Direct Solvent

- Plasticizers

- Others

By Production Process

- Oxyhydrogenation of Propylene

- Butane Oxidation

- Fermentation of Biomass

By End-Use

- Paints and Coatings

- Chemicals and Petrochemicals

- Pharmaceuticals

- Textile

- Automotive

- Others

Market Drivers

Growing Demand in Chemical Industry

In the N-butanol market, a significant driver is the increasing demand within the chemical industry. N-butanol serves as a crucial intermediate in the production of various chemicals, including butyl acrylate and butyl acetate. The expanding chemical sector, driven by diverse applications across industries, fuels the demand for N-butanol.

Rising Adoption in Paints and Coatings

N-butanol experiences a boost in demand due to its widespread usage in the paints and coatings industry. As a solvent, it contributes to the formulation of coatings, providing improved viscosity and stability. The escalating demand for quality paints and coatings in construction, automotive, and industrial applications propels the N-butanol market.

Restraints

Fluctuating Raw Material Prices

A significant restraint faced by the N-butanol market is the volatility in raw material prices. As N-butanol is derived from feedstocks like propylene and butane, fluctuations in the prices of these raw materials impact production costs. This volatility poses challenges for market players in maintaining stable pricing structures.

Stringent Regulatory Standards

Stringent regulatory standards and environmental regulations pose a restraint on the N-butanol market. Compliance with safety and environmental norms requires continuous adaptation and investment in technologies to ensure sustainable and eco-friendly production processes. Meeting these standards adds complexity and cost to N-butanol production.

Market Opportunities

Expanding Applications in Renewable Energy

An opportunity lies in the exploration of N-butanol applications in the renewable energy sector. N-butanol, known for its potential as a biofuel, presents an avenue for growth in the renewable energy market. The development of bio-based N-butanol as a renewable fuel source aligns with the global focus on sustainable energy solutions.

Increasing Demand in Emerging Economies

The N-butanol market can capitalize on the increasing demand in emerging economies. As these regions undergo industrialization and urbanization, there is a growing need for N-butanol in various applications. Manufacturers can tap into these opportunities by strategically expanding their presence in emerging markets.

Market Trends

Shift towards Bio-based Production

A notable trend in the N-butanol market is the increasing emphasis on bio-based production processes. With a focus on sustainability and environmental concerns, manufacturers are exploring the fermentation of biomass as an alternative production method. This trend aligns with the industry’s commitment to eco-friendly practices and reducing carbon footprints.

Growing Applications in Pharmaceuticals

The market experiences a trend towards heightened applications of N-butanol in the pharmaceutical sector. N-butanol plays a crucial role in pharmaceutical synthesis, particularly in the extraction and purification processes. The expanding pharmaceutical industry, driven by research and development activities, contributes to the rising trend of N-butanol utilization.

Regional Analysis

In 2023, the Asia-Pacific (APAC) region demonstrated its dominance in the N-butanol market, securing a notable market share exceeding 48.4%. The market attained a valuation of USD 2.03 billion, signifying substantial growth propelled by the region’s robust demand for N-butanol.

This dominance underscores the significant interest and application of N-butanol across diverse industries in the APAC region. The flourishing industrial sector, especially in segments such as chemicals, paints and coatings, and pharmaceuticals, played a pivotal role in driving the considerable demand for N-butanol, contributing significantly to market expansion.

The economic prosperity of the region, coupled with extensive infrastructural development and a surge in manufacturing activities, stimulated the consumption of N-butanol. Additionally, the increasing population and the expanding middle-class demographic further heightened the demand for chemicals, coatings, and pharmaceutical products—all of which extensively integrate N-butanol in their production processes.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The N-butanol market is characterized by the presence of key players who significantly contribute to its dynamics and growth. In 2023, major industry players demonstrated a robust presence and influence. Companies such as BASF SE, Dow Chemical Company, OXEA Group, Eastman Chemical Company, and Mitsubishi Chemical Corporation played pivotal roles in shaping the market landscape.

BASF SE, a global chemical giant, continued to be a key player, leveraging its extensive expertise in the production and distribution of N-butanol. Similarly, Dow Chemical Company, renowned for its diversified chemical offerings, contributed significantly to the market’s development. OXEA Group, a leading supplier of oxo products including N-butanol, maintained its prominence, influencing market trends.

Top Key Рlауеrѕ

- BASF SE

- DOW INC.

- Eastman Chemical Company

- INEOS GROUP

- SABIC

- SASOL

- Mitsubishi Chemical Corporation

- PETRONAS Chemicals Group Berhad

- OQ Chemicals GmbH

- Formosa Plastics Corporation, U.S.A.

- KH Neochem Co., Ltd.

- MERCK KGAA

- Anhui Shuguang Chemical Group

- Vizag Chemical

Recent Developments

2023 BASF SE: Focused on expanding n-butanol applications in biofuels and renewable chemicals.

2023 Eastman Chemical Company: No major announcements related to n-butanol in 2023.

Report Scope

Report Features Description Market Value (2023) USD 4.2 Bn Forecast Revenue (2033) USD 7.0 Bn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Butyl Acrylate, Butyl Acetate, Glycol Ethers, Direct Solvent, Plasticizers, Others), By Production Process(Oxyhydrogenation of Propylene, Butane Oxidation, Fermentation of Biomass), By End-Use(Paints and Coatings, Chemicals and Petrochemicals, Pharmaceuticals, Textile, Automotive, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, DOW INC., Eastman Chemical Company, INEOS GROUP, SABIC, SASOL, Mitsubishi Chemical Corporation, PETRONAS Chemicals Group Berhad, OQ Chemicals GmbH, Formosa Plastics Corporation, U.S.A., KH Neochem Co., Ltd., MERCK KGAA, Anhui Shuguang Chemical Group, Vizag Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of N-butanol Market?N-butanol Market size is expected to be worth around USD 7.0 billion by 2033, from USD 4.2 billion in 2023

What is the CAGR for the N-butanol Market?The N-butanol Market expected to grow at a CAGR of 05.02% during 2023-2032.Who are the key players in the N-butanol Market?BASF SE, DOW INC., Eastman Chemical Company, INEOS GROUP, SABIC, SASOL, Mitsubishi Chemical Corporation, PETRONAS Chemicals Group Berhad, OQ Chemicals GmbH, Formosa Plastics Corporation, U.S.A., KH Neochem Co., Ltd., MERCK KGAA, Anhui Shuguang Chemical Group, Vizag Chemical

-

-

- BASF SE

- DOW INC.

- Eastman Chemical Company

- INEOS GROUP

- SABIC

- SASOL

- Mitsubishi Chemical Corporation

- PETRONAS Chemicals Group Berhad

- OQ Chemicals GmbH

- Formosa Plastics Corporation, U.S.A.

- KH Neochem Co., Ltd.

- MERCK KGAA

- Anhui Shuguang Chemical Group

- Vizag Chemical