Global Ice-cream and Frozen Dessert Market By Product Type (Ice-cream, Gelato, Frozen Custard, Frozen Novelties, Sorbet & Sherbet, Frozen Yogurt, Confectionery & Candies), By Category (Conventional and Sugar-free), By Ingredient Source (Dairy-based and Non-dairy (Vegan)), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail), By End-use (Food Service and Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 32700

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Latest Trends

- By Product Type Analysis

- By Category Analysis

- By Ingredient Source Analysis

- By Distribution Channel Analysis

- By End-use Analysis

- Market Key Segmentation

- Geopolitics and Recession Impact Analysis

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

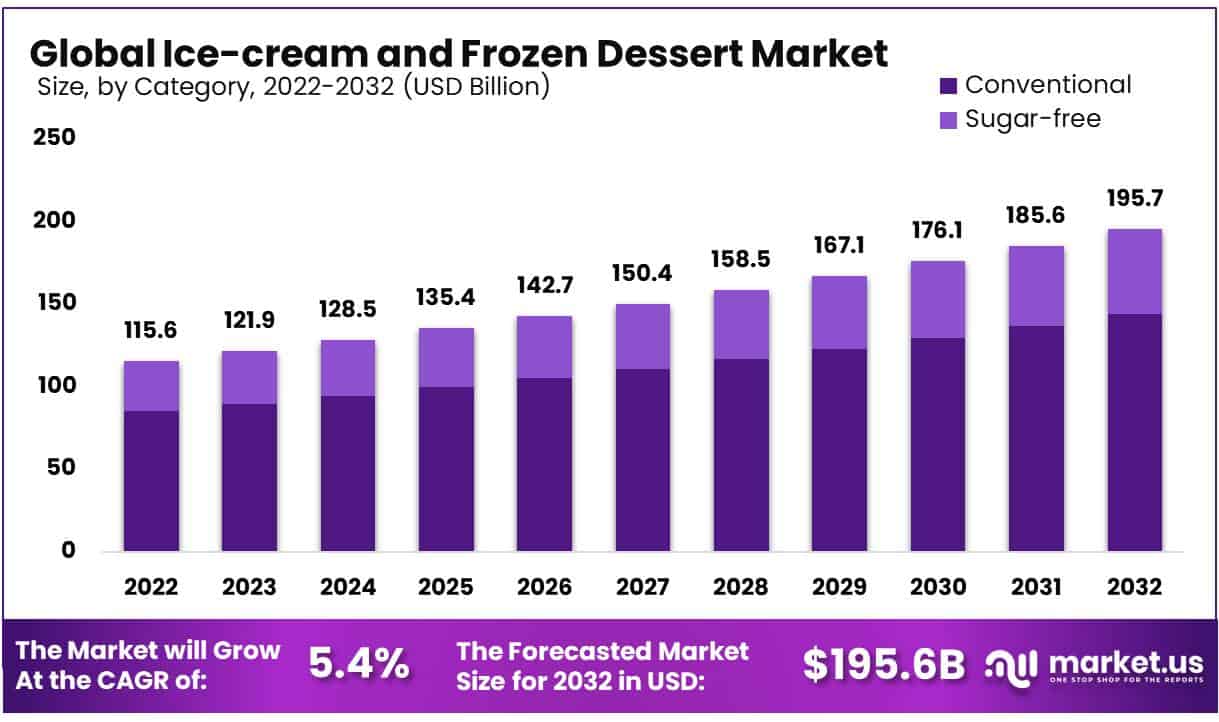

In 2022, the global ice-cream and frozen dessert market was valued at USD 115.6 billion, and is expected to reach USD 195.7 Billion in 2032 Between 2023 and 2032, this market is estimated to register the highest CAGR of 5.4%.

Introduction

The ice cream and frozen dessert market category has experienced significant transformation in recent years. A decade ago, it primarily consisted of traditional ice cream flavors like vanilla, chocolate, and strawberry, as well as a few variations such as kesar pista, mango, elaichi, and traditional kulfi.

However, over the past few years, the market revenue growth has been increasing with a multitude of innovations in ice cream becoming the focal point. Furthermore, the emergence of new subcategories in the market such as frozen yogurt and plant-based ice-creams & frozen desserts market are significantly influencing the product demand across the globe.

This evolution of the ice cream and frozen dessert market encompasses various aspects, including changes in consumer perception and the diversification of products and services. Ice cream and frozen desserts, once considered indulgent treats, have now successfully transitioned into being perceived as convenient snacking options by consumers.

This shift in perception can be attributed to rising disposable incomes and increased discretionary spending among consumers. Furthermore, the extensive reach of the media has enabled industry players to broaden their product offerings and enhance brand recognition. The transformation in consumer perception has contributed significantly to the growth in both the size and global presence of the ice cream and frozen desserts market.

Key Takeaways:

- In 2022, the global ice cream and frozen dessert market was valued at US$ 115.6 Billion.

- By product type, the ice cream held a major market share of 58.4% in 2022.

- By category, the conventional segment dominated the global market with a 73.6% market share in 2022.

- By ingredient source, in 2022, dairy-based ice cream and frozen desserts held a significant revenue share of 75.1%.

- By distribution channel, the supermarkets/hypermarkets distribution channel dominated the global ice cream and frozen dessert market with a market share of 38.9% in 2022.

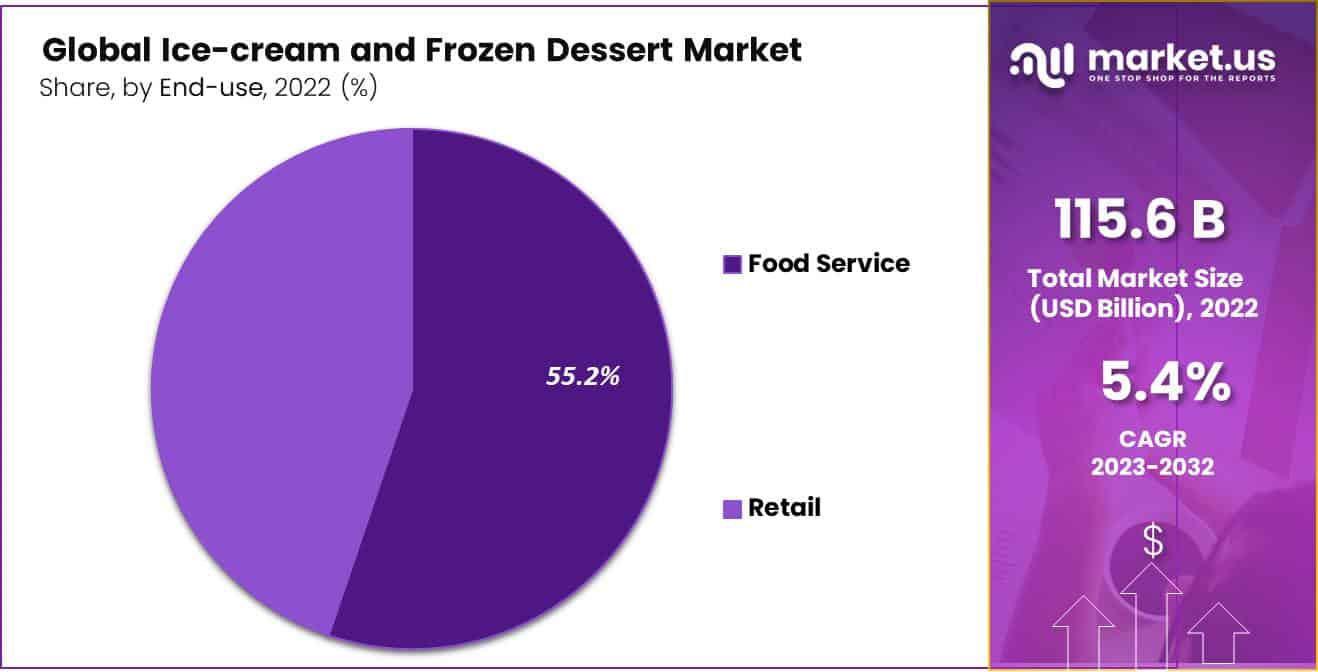

- By end-use, the food service segment has dominated the market in 2022 with 55.2% market share.

- In 2022, North America dominated the market with the highest revenue share of 38.4%.

- The emergence of lactose-free frozen ice cream is currently experiencing a noteworthy trend in the global market and is expected to continue evolving in the years ahead. This development is primarily spurred by the escalating incidence of food allergies and intolerances within the consumer base.

- The growing preoccupation with health and dietary considerations has cultivated a consumer preference for ice cream crafted from natural flavors, natural sweeteners, and handcrafted methods.

- The market is anticipated to experience growth in the forecast period due to increasing consumer demand for inventive flavor profiles and novel product formats, particularly in developing nations. Presently, there is a noteworthy trend towards fruit and alcohol-infused ice creams, with this segment exhibiting remarkable growth rates, estimated at approximately 70%.

- Key players include Nestlé S.A., General Mills, Fonterra Co-operative Group Limited, Meiji Holdings Co., Ltd. and Unilever, and others.

Actual Numbers Might Vary in the Final Report

Driving Factors

The rise of innovative flavors and varieties in the market is propelling the market revenue growth

Over the past few years, consumers have been seeking unique and culturally resonant flavor experiences, which in turn have influenced key manufacturers in the market to adopt of new product development strategy in order to gain a significant market share.

Achieving this, however, necessitates the establishment of a streamlined and effective supply chain management system. This system must proficiently source the necessary ingredients, navigate intricate inventory dynamics, and ensure punctual product deliveries to meet fluctuating demand patterns.

Furthermore, forging robust and collaborative relationships with suppliers, vendors, and industry peers to supply brands with invaluable insights into the prevailing market trends and consumer preferences.

Such insights empower brands to innovate and craft novel, captivating flavors that align with the ever-evolving tastes and preferences of the consumer base. Through the sensible utilization of innovation and collaborative endeavors, ice cream brands can captivate consumer attention and position themselves for success in this rapidly expanding industry.

The landscape of ice-cream and frozen dessert market flavors is currently undergoing a dual transformation. On one hand, there is a proclivity towards spicier profiles that draw inspiration from global culinary traditions. Simultaneously, there is a resurgence of interest in nostalgic flavors, invoking memories of bygone tastes.

Given the intrinsic association of ice cream with childhood, it possesses a unique capacity to evoke feelings of nostalgia, especially during times of uncertainty.

In China, for instance, 34% of consumers connect ice cream and cake with nostalgic sentiments, while in Brazil, 30% of ice cream consumers express a willingness to pay a premium for ice cream that evokes sensory nostalgia.

Restraining Factors

Rising health concerns among consumers are hampering the market revenue growth

Over the past few years, there has been increasing concern regarding obesity and related health issues such as diabetes and heart disease on the consumption of ice cream and frozen desserts. These products consist of relatively higher sugar content, calories, and unhealthy fats which in turn have an influence on weight gain and related health problems.

This health concern has been increasing significantly in developed and developing countries across the globe, which is adversely affecting the market revenue growth.

For instance, in the Indian market, consumers are showing an awareness of the elevated levels of both fat and sugar typically found in traditional ice-creams and frozen desserts. This has prompted manufacturers to adapt, with some reducing the standard fat content in ice cream products to as low as 5%.

Furthermore, sugar content in desserts remains notably high across India, reflecting consumers’ affinity for sweet flavors. However, it is foreseeable that the demand for lower sugar content options in ice creams will gain prominence as health-consciousness continues to evolve among the Indian population.

Furthermore, several local players in the market usually use very less amount of dairy real milk and instead heavily rely on whole milk powder and milk solids. This ingredient comprises oxidized cholesterol, which can have an adverse impact on the blood vessels and heart diseases.

Growth Opportunities

Emergence of plant-based ice-cream and frozen dessert market

Ice cream and frozen dessert manufacturers have discerned the growing appeal and inherent value of plant-based frozen desserts, leading to a notable upswing in new product development by a substantial 27% prior to the onset of the pandemic.

In the landscape of 2020, a prevalent trend in these developments revolved around the creation of blends, artfully combining ingredients such as almond milk, coconut oil, and pea protein. This strategic shift towards blended bases underscores producers’ concerted efforts to deliver the flavor and texture that consumers traditionally associate with ice cream and frozen desserts.

Moreover, the year 2020 witnessed a notable surge in the introduction of oat-based frozen desserts. This aligns seamlessly with the rapid growth observed in oat milk sales across North America. Oat milk’s familiar taste, commendable nutritional profile, and positive environmental sustainability attributes have substantially contributed to favorable consumer perceptions and garnered significant interest from manufacturers.

The current range of offerings in this segment effectively meets consumer preferences for natural, health-conscious options, delivering a sweet, creamy, and conveniently servable experience.

Additionally, consumers are increasingly attuned to the availability of plant-based frozen desserts that offer high protein content, low or no fat, and organic certifications. This underscores the recognition of how these offerings align with various dietary considerations, thereby further fueling the market’s growth and acceptance.

Latest Trends

Environmental Concerns and Supply Chain Innovation: Environmental concerns may not currently top the list of factors influencing ice cream purchases, but consumers increasingly expect brands to incorporate sustainability into their fundamental operational practices. This expectation is poised to drive innovation within supply chains and facilitate reductions in water usage.

Additionally, the environmental impact of the frozen distribution chain will face scrutiny in the years ahead. A notable solution introduced by the US-based brand Cosmik involves the freeze-drying of ice cream, a process they claim removes all water content, resulting in a non-refrigerated product with a light and crispy texture.

Another example of energy conservation is evident in Unilever’s pilot programs, which involve transitioning freezer temperatures from -18°C to -12°C. These initiatives collectively underscore the industry’s growing commitment to addressing environmental considerations and minimizing its ecological footprint.

Metaverse and Brand Engagement: The burgeoning metaverse originating from the gaming sphere stands as a transformative force shaping the future of society and providing an avenue for escapism. One out of every ten US consumers asserts their active engagement with the metaverse, with 15% employing virtual reality (VR) and 8% engaging in augmented reality (AR).

In China, a substantial two-thirds (65%) of consumers affirm that the metaverse serves as a significant means of escape from real-life pressures. Notably, brands are now making their presence felt in the metaverse landscape. An illustrative instance is the collaborative effort between Magnum and Deliveroo, resulting in the establishment of a virtual ice cream museum within the metaverse.

Consumer Involvement and Co-Creation: Singapore’s Ice Cream & Cookie Co is preparing to launch an app that enables users to create ICC NFT (non-fungible tokens) “ingredients,” which can be combined to craft personalized ice cream NFTs. NFT holders will be rewarded with exclusive real-world incentives, including ice cream cakes. Consumers are increasingly interested in influencing the direction of their preferred brands.

For instance, Morgenstern’s Finest Ice Cream in the US has initiated an NFT-based membership community called “Morgenstern’s Connoisseurs,” offering members exclusive privileges such as tasting and voting for new flavors in 2023. This enthusiasm for brand involvement extends to Spain, where 53% of consumers express a strong desire to participate in the development of new flavors for their favorite brands. Additionally, the realm of gaming provides an avenue for consumers to voice their opinions.

Colombian lollipop brand Bon Bon Bum, for example, invited consumers to participate in building a new virtual world within the popular video game Fortnite. Several other brands are also exploring strategies that involve consumers in activities like logo creation and flavor proposal, thereby influencing future product development.

By Product Type Analysis

The ice cream segment held the largest market share in 2022 due to its wide range of applications

Based on product type, the market for ice-cream and frozen dessert market is segmented into ice cream, gelato, frozen custard, frozen novelties, sorbet & sherbet, frozen yogurt, confectionery & candies, and others. Among these, the ice cream segment was the most lucrative in the global ice cream and frozen dessert market, with a market share of 58.4% in 2022, and it is estimated to project a CAGR of 6.1%.

Ice cream is among the most widely consumed frozen foods across the globe. It is a mixture of cream, milk, fruits, flavoring agents, and sugar or artificial sweeteners. The product is available in a variety of flavors including, chocolate, vanilla, fruit, cookies n’ cream, and butterscotch, among others.

The demand for ice cream is expected to grow significantly in the estimated years owing to rising disposable incomes, increasing urbanization, consumer awareness, enhanced cold supply chain, the emergence of flavors, and growth in modern format retail facilities.

Furthermore, the emergence of plant-based, probiotic, low-fat, and zero-sugar varieties of ice-creams is propelling the revenue growth of the segment in the global ice cream and frozen dessert market.

By Category Analysis

Conventional ice cream and Frozen desserts held a Significant Market Share Owing to Various Attributes Associated with them such as Classic, Indulgent Sweetness and Texture

By type, the global ice cream and frozen dessert can be further categorized into conventional and sugar-free. The conventional segment dominated the market with a significant share of 73.6% in 2022. Conventional ice cream and frozen desserts are the beloved classics known for their traditional sweet and creamy profiles.

Crafted from a base of dairy ingredients like cream and milk, these treats are characterized by their use of standard levels of sugar to achieve a satisfyingly indulgent sweetness. Complementing the dairy are various flavorings, ranging from classic choices like vanilla and chocolate to a diverse array of fruity and nutty options. Stabilizers and emulsifiers are sometimes added to ensure a smooth and consistent texture.

Conventional frozen desserts hold enduring appeal among consumers for rich taste and texture reminiscent of traditional frozen delights. With a broad spectrum of flavors and styles available, they continue to be a go-to choice for those seeking the quintessential ice cream experience.

By Ingredient Source Analysis

The Dairy-Based Segment Held a substantial share in the Market Due to Nutritional Benefits Associated with them

Based on ingredient source, the market can be segregated as dairy-based and non-dairy (vegan). In 2022, the dairy-based segment dominated the global market with a substantial market share of 75.1%. Dairy-based ice cream and frozen desserts are the quintessential classics, relying on dairy ingredients as their foundational source.

These delectable treats derive their luxurious creaminess and iconic flavor from ingredients like milk and cream, often sourced from various animals such as cows or goats. Complementing these dairy components are sugar for sweetness and a medley of flavorings, spanning from timeless favorites like vanilla and chocolate to more ingenious and exotic options.

In some instances, stabilizers and emulsifiers are introduced to ensure a consistently smooth and delightful texture. With an unmistakable richness and texture, dairy-based frozen desserts remain a favorite choice for those who relish the timeless pleasure of traditional ice cream.

By Distribution Channel Analysis

The Supermarkets/Hypermarkets Distribution Channel Dominated the Global Market Owing to Recurrent Promotional Initiatives, Discounted Offerings, and Seasonal Campaigns

By distribution channel, the market is further segmented as, supermarkets/hypermarkets, convenience stores, specialty stores, online retail, and others. The supermarkets/hypermarkets distributional channel dominated the ice cream and frozen dessert market with a noteworthy revenue share of 38.9%.

Supermarkets and hypermarkets have consistently maintained their preeminent position within the global ice cream and frozen desserts market, owing to a confluence of pivotal factors. These expansive retail establishments proffer an extensive and diversified array of frozen dessert alternatives, encompassing both renowned brands and specialized, artisanal offerings.

They afford consumers the convenience of a comprehensive shopping experience, seamlessly integrating ice cream and frozen desserts into their routine grocery excursions. Capitalizing on their capacious shelf space and storage capabilities, supermarkets and hypermarkets adeptly showcase an extensive spectrum of flavors and assorted packaging dimensions, thus resonating with a broad and diverse consumer demographic.

By End-use Analysis

The Food Service Sector Held a Significant Market Share Due to its Capacity to Deliver Memorable and Enjoyable Frozen Dessert Experiences, Complemented by the Social and Culinary Aspects

Based on end-use, the market can be further categorized as, food service and retail. In 2022, the food service sector held a substantial market share of 55.2%. The food service segment has asserted its dominance in the global ice cream and frozen desserts market for several compelling reasons.

Food service establishments, including restaurants, ice cream parlors, and fast-food chains, offer consumers a unique and immersive dessert experience as part of their dining or takeaway encounters. This sector excels in curating diverse and elaborate frozen dessert menus, ranging from classic scoops to indulgent sundaes and shakes, elevating the overall dining experience.

The application lies in the atmosphere, customization, and presentation, making it ideal for special occasions or social gatherings. Additionally, food service outlets often introduce innovative and exclusive dessert creations, fostering consumer loyalty and anticipation.

Actual Numbers Might Vary in the Final Report

Market Key Segmentation

Based on Product Type

- Ice-cream

- Gelato

- Frozen Custard

- Frozen Novelties

- Sorbet & Sherbet

- Frozen Yogurt

- Confectionery & Candies

- Others

Based on Category

- Conventional

- Sugar-free

Based on Ingredient Source

- Dairy-based

- Non-dairy (Vegan)

Based on the Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Based on End-use

- Food Service

- Retail

Geopolitics and Recession Impact Analysis

The ice cream and frozen dessert market is highly susceptible to the dual influences of geopolitics and economic recessions. Geopolitical tensions and trade disputes, exemplified by the intensified trade tensions between major players like the United States and China in 2022, can severely disrupt global supply chains within the industry.

Such disruptions manifest as ingredient shortages and volatile price fluctuations, notably impacting essential ice cream ingredients. Furthermore, these geopolitical uncertainties may affect market access and trading relationships, adding complexity to business strategies.

Conversely, economic recessions significantly influence consumer behavior within this market. During economic downturns, consumers often exhibit price sensitivity and reduce expenditures on premium frozen desserts, favoring more cost-effective options or abstaining from indulgent purchases altogether.

The year 2022 witnessed the industry grappling with these shifting consumer preferences and navigating the unpredictable economic landscape.

Regional Analysis

In 2022, North America held a significant position in the global ice cream and frozen dessert market, with around 38.4%. In 2022, North America held a significant position in the global ice-cream and frozen dessert market, with around 38.4%. The major contributor to revenue growth in the region is the US.

This growth can be attributed to various factors including, rising disposable incomes, the emergence of new & fresh flavors, and increasing adoption of plant-based frozen desserts in the region.

As per the National Dairy Association, in the US there are approximately 80,000 ice cream, gelato, and frozen yogurt shops, and is expected that this will increase in the upcoming years. As per a survey conducted in the US, around 70 percent of Americans usually enjoy dessert at least once a week, which accounts for 23 pounds of ice cream each year.

Furthermore, the rising adoption of plant-based frozen desserts in the region is significantly enhancing the revenue growth of the ice cream and frozen dessert market. This growth can be attributed to rising health consciousness, enhanced standard diet, and well-educated consumers in the region.

Furthermore, over the past few years, in the US, 2/5th of ice cream and frozen dessert manufacturing companies have experienced continuous growth in the premium ice cream and frozen desserts category. Thus, North America’s ice cream and frozen dessert market would have a positive influence in the forecast period.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Key Players Analysis

Key players in the global ice-cream and frozen dessert market include Nestlé S.A., General Mills, Amul, Mondelēz International, Inc., Unilever, Dunkin’ Brands Group, Inc., and more. They are focusing on product innovation, continuously introducing new flavors and formats to cater to changing consumer preferences.

Additionally, strategic partnerships and acquisitions are common tactics for market expansion, allowing companies to reach new markets and demographics. Pricing strategies, including promotional offers and bundle deals, are used to attract price-sensitive consumers. Strong branding and marketing efforts are also prevalent, creating a strong brand image and consumer loyalty.

Furthermore, a growing emphasis on health-conscious options, such as low-fat, dairy-free, and plant-based products, has prompted several key players to diversify their product portfolios to meet evolving dietary trends.

Market Key Players

- Nestlé S.A.

- General Mills

- Fonterra Co-operative Group Limited

- Meiji Holdings Co., Ltd.

- Unilever

- Dunkin’ Brands Group, Inc.

- Amul

- Bulla Dairy Foods

- Dairy Farmers of America, Inc.

- Yasso

- Mondelēz International, Inc.

- Inner Mongolia Yili Industrial Group Co., Ltd.

- Lotte Corporation

- Danone S.A.

- Wells Enterprises, Inc.

- Other Key Players

Recent Developments

- In May 2023, Nestle SA announced the launch of Häagen-Dazs, a Plant-Based Frozen Dessert. Häagen-Dazs, renowned for its creamy and indulgent ice cream, has introduced a range of innovative plant-based frozen desserts. Crafted with the flexitarian consumer in mind, this new collection, based on oats, aims to redefine the perception of plant-based frozen treats. These vegan-certified offerings, produced in London, Ontario, uphold Häagen-Dazs’ tradition of delivering a premium and luxurious experience, featuring exceptional flavors and decadent inclusions, offering Canadians an opportunity to savor these delectable offerings.

- In January 2022, Unilever, the world’s largest ice cream company, unveiled its new 2022 portfolio offerings across four of its packaged ice cream and frozen novelty brands, including Breyers, Klondike, Magnum ice cream, and Talenti Gelato & Sorbetto. These new creations, which were available in major retailers nationwide throughout January and February 2022, included a reimagined twist on classic American flavors, unexpected pairings for the perfect flavor combinations, and the expansion of fan-favorite lines, better-for-you offerings, and non-dairy options.

Report Scope

Report Features Description Market Value (2022) US$ 115.6 Bn Forecast Revenue (2032) US$ 195.7 Bn CAGR (2023-2032) 5.4 % Base Year for Estimation 2022 Historic Period 2020-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ice-cream, Gelato, Frozen Custard, Frozen Novelties, Sorbet & Sherbet, Frozen Yogurt, Confectionery & Candies and Others), By Category (Conventional and Sugar-free), By Ingredient Source (Dairy-based and Non-dairy (Vegan)), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail and Others), By End-use (Food Service and Retail) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Nestlé S.A., General Mills, Fonterra Co-operative Group Limited, Meiji Holdings Co., Ltd., Unilever, Dunkin’ Brands Group, Inc., Amul, Bulla Dairy Foods, Dairy Farmers of America, Inc., Yasso, Mondelēz International, Inc., Inner Mongolia Yili Industrial Group Co., Ltd., Lotte Corporation, Danone S.A., Wells Enterprises, Inc. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the global ice-creams and frozen desserts market?In 2022, the global ice creams and frozen dessert market was valued at USD 115.6 billion, and is expected to reach USD 195.7 Billion in 2032 Between 2023 and 2032.

How is the ice-creams and frozen desserts market impacted by seasonal variations?The demand for ice creams and frozen desserts typically increases during warm seasons and decreases during colder months. However, manufacturers often introduce seasonal flavors and marketing strategies to maintain sales during the off-peak seasons.

How is technology influencing the ice-creams and frozen desserts market?Technology plays a role in improving production efficiency, enhancing product quality, developing innovative flavors and textures, and addressing environmental sustainability through better refrigeration and energy-efficient manufacturing processes.

Ice-creams and Frozen Desserts MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample

Ice-creams and Frozen Desserts MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé S.A.

- General Mills

- Fonterra Co-operative Group Limited

- Meiji Holdings Co., Ltd.

- Unilever

- Dunkin' Brands Group, Inc.

- Amul

- Bulla Dairy Foods

- Dairy Farmers of America, Inc.

- Yasso

- Mondelēz International, Inc.

- Inner Mongolia Yili Industrial Group Co., Ltd.

- Lotte Corporation

- Danone S.A.

- Wells Enterprises, Inc.

- Other Key Players