Global Chocolate Confectionery Market By Product (Boxed, Molded Bars, and Other Products), By Type (Milk Chocolate, Dark Chocolate, and White Chocolate), By Age Group, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 64085

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

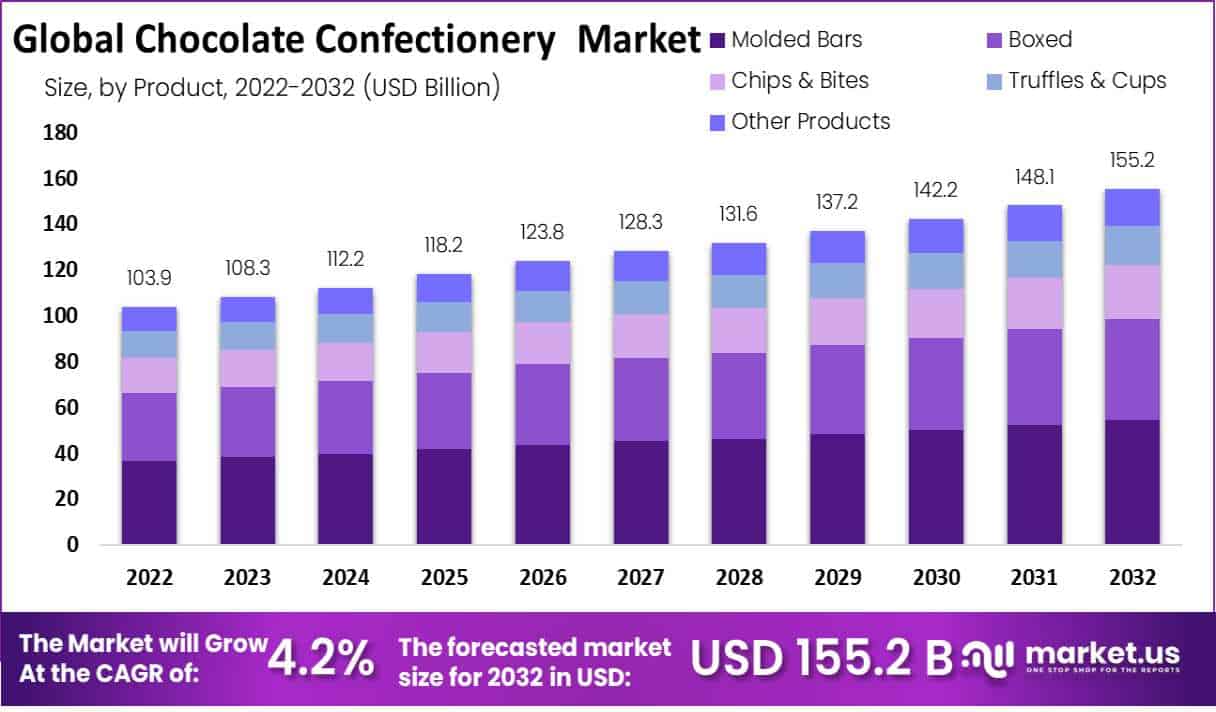

In 2022, the global Chocolate Confectionery market accounted for USD 103.9 billion and is expected to reach USD 155.2 billion in 2032. This market is estimated to register a CAGR of 4.2% between 2023 and 2032.

Market consumers are seeking premium confectionery that offers a variety of textures and high quality. Approximately 57% of global consumers are willing to spend more for products that have multiple flavors, textures, and premium quality.

Key brands are taking advantage of this demand. Five bars are available in three different flavors, including peanut butter, creamy caramel, and milk mousse.

These bars are non-GMO, Kosher, and trans-fat-free. In addition, a growing number of consumers worldwide are adopting healthy eating habits that have specific needs and demand “better-for-me” alternatives. Health & wellbeing has become a priority.

When shopping for confectionery, consumers consider many factors. Many purchase premium products. In recent years, the premium confectionery segment in chocolate has grown as more brands have launched products with labels such as veganism, cruelty-free products, organic products, and paleo. This is to differentiate their products by using healthier titles.

Key Takeaways

- Market Growth and Projections: In 2022, the global Chocolate Confectionery market accounted for USD 103.9 billion. It is expected to reach USD 155.2 billion in 2032, with a projected Compound Annual Growth Rate (CAGR) of 4.2% between 2023 and 2032.

- Consumer Preferences: Chocolate remains a popular choice among consumers of all ages, serving as a treat, gift, and snack. Consumers are willing to pay more for premium confectionery with multiple flavors and high quality.

- Product Innovation: Chocolate producers continuously experiment with new flavors and products to cater to changing consumer preferences. Novel formats, textures, and packaging are introduced to entice customers.

- Marketing and Advertising: Effective marketing and advertising strategies, including celebrity endorsements and social media marketing, boost sales in the chocolate confectionery sector.

- Health Benefits: Dark chocolate is gaining popularity for its potential health benefits, such as improved cognitive function and reduced risk of heart disease.

- Health Concerns: Negative health effects of chocolate products, like diabetes and obesity, can deter health-conscious consumers from consumption.

- Volatility of Raw Material Prices: Cocoa prices can fluctuate due to factors like climate change, disease outbreaks, and political instability in cocoa-producing countries, impacting chocolate producers’ profitability.

- Intense Competition: The chocolate confectionery market is highly competitive, making it challenging for new players to enter, while established brands must fight to maintain their positions.

- Changing Consumer Preferences: Chocolate manufacturers need to stay updated with the latest trends to remain relevant and prevent a decline in sales.

- Segment Analysis – Product: Molded bars were the dominant segment in the Chocolate Confectionery market in 2022, with their convenience and growth driven by new product launches. Chips and bites experienced rapid growth, particularly due to increasing demand for premium products at festivals and home baking.

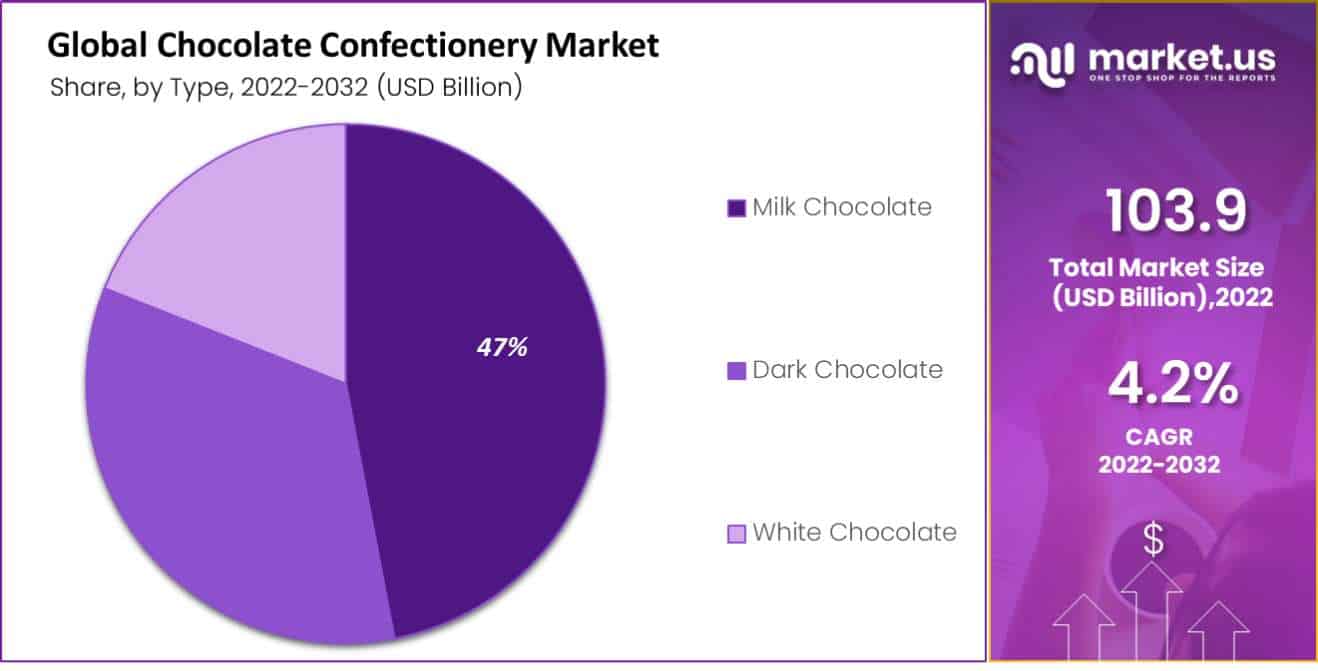

- Segment Analysis – Type: In 2022, milk chocolate held the highest revenue share, but dark chocolate is expected to grow the most, driven by changing taste preferences and health benefits.

- Segment Analysis – Age Group: Adult chocolate dominates the market, targeting consumers looking for premium and artisanal products. Children’s chocolate products appeal to parents and caregivers with colorful packaging and fun flavors.

- Distribution Channels: Supermarkets and hypermarkets made the largest contribution to the market in 2022, with online distribution channels growing the fastest.

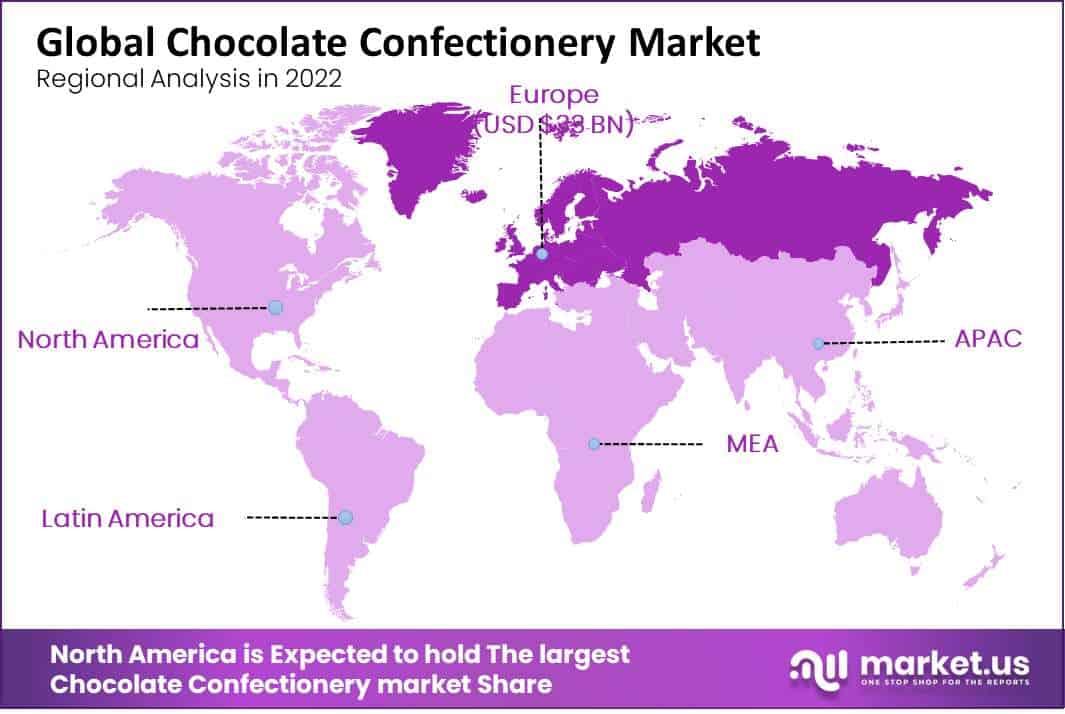

- Regional Analysis: In 2022, Europe held the largest market share due to increased production of artisanal products and innovations in flavors. Asia Pacific is the fastest-growing region, driven by a growing population, increased disposable income, and awareness of chocolate products.

- Key Players: Major industry players include Nestle SA, Ferrero International, Lindt & Sprungli AG, Mars Incorporated, Mondelaz International, The Hershey Company, and others. Companies are focusing on product innovation, creating unique products with higher cocoa content to meet consumer demand.

Driving Factors

Consumer Preferences: Consumer preferences dominate the chocolate market. All ages enjoy chocolate, and it’s popular as a treat, a gift, and a snack.

Growing Demand: Due to reasons including urbanization, rising disposable income, and shifting lifestyles, the demand for chocolate confectionery is increasing globally.

Product Innovation: Chocolate producers regularly experiment with new flavors and products to appeal to consumer preferences. Creating novel formats, textures, and packaging is a part of this.

Marketing and Advertising: Effective marketing and advertising initiatives will boost sales in the chocolate confectionery sector. Manufacturers use a range of tactics, including celebrity endorsements, in-store promotions, and social media marketing, to draw customers.

Health Benefits: It has been demonstrated that dark chocolate provides health advantages such as enhancing cognitive function and lowering the risk of heart disease. Consumers looking for a healthier option are increasingly choosing dark chocolate. As a result, the demand for high-end chocolate has increased.

Restraining Factors

Health Concerns: The negative health effects of chocolate products, such as diabetes and obesity, can discourage health-conscious consumers from consuming them.

Volatility of Raw Material Prices: Owing to climate change, disease outbreaks, and political instability of countries that produce cocoa, cocoa prices can fluctuate. This can affect the profitability of chocolate producers.

Intense Competition: Market share is fiercely competitive in the chocolate confectionery sector, as there are many players competing for it. It is difficult for new players to gain a foothold in the market, and incumbents have to fight to keep their positions.

Changing Consumer Preferences: Chocolate manufacturers must stay abreast of the latest trends to remain relevant. A decline in sales could be the result of chocolate manufacturers’ failure to keep up with consumer preferences.

By Product Analysis

In Product Analysis, Molded Bars segment dominated the Chocolate Confectionery market in 2022

The molded bars segment is expected to continue dominating the market during the forecast period. The most popular chocolate form is bar chocolate. The size of these chocolates is convenient for consumers. The growth of this segment is driven by the launch of new products in this segment.

The fastest segment growth is expected to be in the chips & bits segment. The demand for chips and bites has also increased due to the increasing demand for premium products at festivals and other small occasions. Around the world, people were preparing unusual dishes at home, especially baked goods, when all bakeries and restaurants closed. The product’s popularity is growing among millennials, as well as centennials.

By Type Analysis

Milk Type chocolate dominate the market in 2022 with the highest revenue share

In 2022, the milk-type segment was the biggest. To expand their product portfolio, companies are launching products with clean labels, such as vegan, organic, and certified Kosher. The dark-type segment is expected to grow the most during the forecast period.

The popularity of dark chocolate among consumers has increased in recent years, particularly in Asian countries. This is due to changing taste preferences and increased awareness of its health benefits. Numerous product manufacturers have launched a variety of products, ranging from organic to vegan.

By Age Group Analysis

Adult Group Dominate the Chocolate Confectionery Market

The adult chocolate market is a diverse range of products aimed at adults. These include premium chocolates, artisanal products, and mass-market chocolates like truffles and chocolate bars. Adult chocolate is marketed to consumers looking for special treats or gifts.

It emphasizes high-quality ingredients and unique flavors. Children’s chocolate products include chocolate bars, candy, and novelty items with popular characters or brands. Children’s chocolates are marketed to parents and caregivers. They feature colorful packaging, fun flavors, and appealing packaging.

By Distribution Channel Analysis

Supermarket and Hypermarket segments dominate the Chocolate Confectionery Market

In 2022, the biggest contribution to the global marketplace was made by supermarkets and hypermarkets. This segment is expected to maintain its dominance over the forecast period due to consumers’ high preference for shopping at supermarkets.

Due to the larger customer base, most products are launched at supermarkets and hypermarkets such as Walmart, Tesco, and Kroger. These stores also boost sales by offering both private label and premium brands.

The online distribution channel will grow the fastest during the forecast period. One of the main factors that drive product sales online is the shift in consumer shopping habits. Companies have begun to sell products online because of the growing preference of consumers for online platforms.

Online platforms have become a popular way for many brands to reach consumers around the world. They offer fewer barriers and allow products to be delivered by third-party distributors such as Amazon or online companies.

Key Market Segments

Based on Product

- Boxed

- Molded Bars

- Chips & Bites

- Truffles & Cups

- Other Products

Based on Type

- Milk Chocolate

- Dark Chocolate

- White Chocolate

Based on Age Group

- Children

- Adult

- Geriatic

Based on the Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online stores

- Specialty Stores

- Pharmaceutical and Drug Stores

- Other Distribution Channels

Growth Opportunity

Emerging Markets: As disposable incomes rise and lifestyles change, the demand for chocolate products is increasing.

Product Innovation: The market for chocolate confectionery can grow and create new opportunities in product innovation continues. It includes new flavors, formats, textures, and ingredients.

Online Sales: Online sales and e-commerce are growing in popularity, which gives chocolate producers the opportunity to reach more people and increase their customer base. Online sales also allow for personalized and customized products, which may increase customer loyalty.

Latest Trends

Innovative Flavors and Formats: Chocolate manufacturers constantly innovate to create new flavors, formats, and packaging that consumers will enjoy. It includes new textures such as crunchy and crispy, as well as the addition of unique ingredients like chili, matcha, and turmeric.

Personalization: Customers want items that they can personalize to suit their preferences The development of customized chocolate products has been a result. Consumers can select the type of product, the ingredients, and the packaging for a unique, personalized product.

Health and Wellness: An increasing trend is towards healthier chocolates that are made with natural ingredients and less sugar. It has led to products like sugar-free, vegan, and dark chocolates that are popular for their health benefits.

Regional Analysis

In 2022, Europe held the largest Chocolate Confectionery market share

In 2022, Europe will have the largest market share. Regional market growth is driven primarily by the increased production of artisanal products, innovations in flavors, and promotions in stores.

Customers are seeking high-quality products that are safe for the environment and their health. During the forecast period, the robust food and drinks industry in Europe will likely boost market growth.

Asia Pacific is the fastest-growing region of the chocolate confectionery market

Asia Pacific will likely be the fastest-growing region. The region’s growing millennial and young target population is responsible for this growth.

The growing population in the region, as well as the increasing disposable income of consumers and the increased awareness of such products, are all contributing factors to the growth.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the large number of domestic and international companies, there is a high level of competition in this market. These key players are adopting a variety of strategies to expand the reach of their products, including marketing and promotions and introducing new product offerings.

Market Key Players:

- Nestle SA

- Ferrero International

- Chocoladefabriken Lindt & Sprungli AG

- Mars Incorporated

- Mondelaz International

- The Hershey Company

- CEMOI Group

- Barry Callebaut

- Lake Champlain Chocolates

- Lotte Corporation

- Haribo Gmbh & Co. KG

- Other Market Players

Recent Developments

In April 2023, Companies invested in product innovation and development, with an emphasis on creating unique products that stand out from the crowd in a crowded marketplace. Many consumers are now looking for products that have a higher cocoa percentage.

Report Scope:

Report Features Description Market Value (2022) USD 103.9 Bn Forecast Revenue (2032) USD 155.2 Bn CAGR (2023-2032) 4.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Boxed, Molded Bars, Chips & Bites, Truffles & Cups, and Other Products) By Type (Milk Chocolate, Dark Chocolate, White Chocolate)

By Age Group (Children, Adult, Geriatic)

By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online stores, Specialty Stores, Pharmaceutical and Drug Stores, and Other Distribution Channels)

Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nestle SA, Ferrero International, Chocoladefabriken Lindt & Sprungli AG, Mars Incorporated, Mondelaz International, The Hershey Company, CEMOI Group, Barry Callebaut, Lake Champlain Chocolates, Lotte Corporation, Haribo Gmbh & Co. KGand Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Chocolate Confectionery Market in 2032?In 2032, the Chocolate Confectionery Market will reach USD 155.2 billion.

What CAGR is projected for the Chocolate Confectionery Market?The Chocolate Confectionery Market is expected to grow at 4.2% CAGR (2023-2032).

List the segments encompassed in this report on the Chocolate Confectionery Market?Market.US has segmented the Chocolate Confectionery Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Product, market has been segmented into Boxed, Molded Bars, Chips & Bites, Truffles & Cups and Other Products. By Type, the market has been further divided into Milk Chocolate, Dark Chocolate and White Chocolate.

Which segment dominate the Chocolate Confectionery industry?With respect to the Chocolate Confectionery industry, vendors can expect to leverage greater prospective business opportunities through the Molded Bars segment, as this dominate this industry.

Name the major industry players in the Chocolate Confectionery Market.Nestle SA, Ferrero International, Chocoladefabriken Lindt & Sprungli AG, Mars Incorporated, Mondelaz International, The Hershey Company and Other Key Players are the main vendors in this market.

Chocolate Confectionery MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Chocolate Confectionery MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestle SA

- Ferrero International

- Chocoladefabriken Lindt & Sprungli AG

- Mars Incorporated

- Mondelaz International

- The Hershey Company

- CEMOI Group

- Barry Callebaut

- Lake Champlain Chocolates

- Lotte Corporation

- Haribo Gmbh & Co. KG

- Other Market Players