Global Frozen Food Market By Type (Raw, Half-Cooked, and Ready-to-Eat Meals), By Product (Fruits & Vegetables, Potatoes, and Other Products), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 22479

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview:

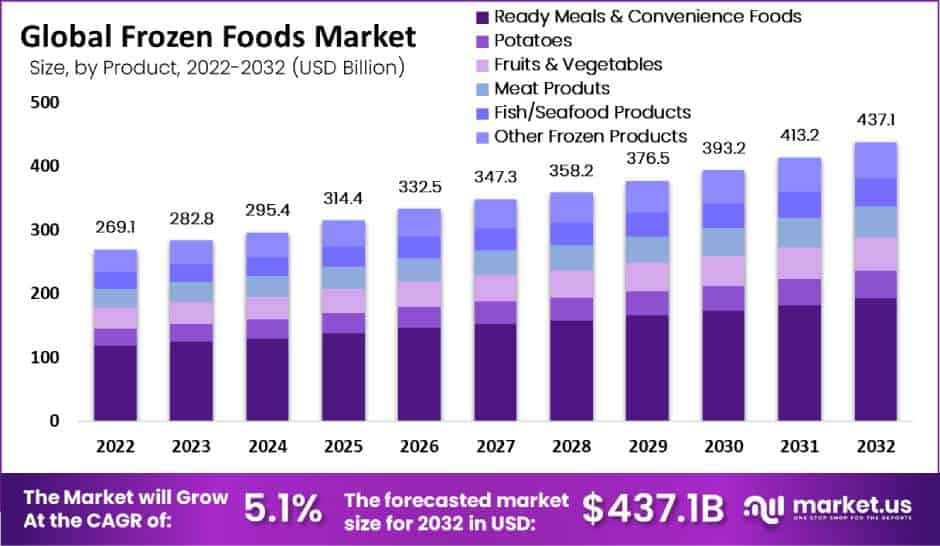

In 2022, the Global Frozen Food Market was valued at USD 269.1 billion. Between 2023 and 2032, this market is estimated to register the highest CAGR of 5.1%.

As a result of the worldwide spread of the COVID-19 disease, consumers rushed to make last-minute purchases, which positively helped the market for frozen foods. The rising demand for frozen foods from developing nations is the primary cause of the rise in CAGR.

Key Takeaways

- Market Growth: The Frozen Food Market is expected to reach a value of USD 437.1 billion by 2032, showing significant growth from USD 269.1 billion in 2022, with a CAGR of 5.1%.

- Drivers for Growth: Increasing Disposable Income Rising disposable income is driving the preference for convenient frozen foods, as they require less time and effort for preparation. Changing Lifestyles Hectic lifestyles and a growing population are also boosting the consumption of frozen food products.

- Consumer Concerns: Some consumers have reservations about frozen foods, perceiving them as inferior to fresh foods. However, organizations like IFIC and FDA have dispelled these myths, emphasizing the quality of frozen products.

- Product Segmentation: The market includes various product categories such as fruits & vegetables, potatoes, ready meals & convenience foods, meat products, seafood, and others. Ready meals & convenience foods dominate with a 44% market share.

- Distribution Channels: The offline segment, including supermarkets and hypermarkets, holds an 88% revenue share in 2022, as they are rapidly expanding and making products available even in smaller towns.

- Opportunities: Growing Popularity of Online Shopping Online grocery shopping is on the rise, presenting opportunities for businesses to showcase and sell frozen products. Temperature-Controlled Facilities The availability of temperature-controlled facilities in convenience stores and hypermarkets is fueling the growth of the Frozen Food Market.

- Trends: Convenience of Online Shopping The trend of online grocery shopping is gaining momentum due to its convenience, variety, and price comparison options, saving time and money for consumers.

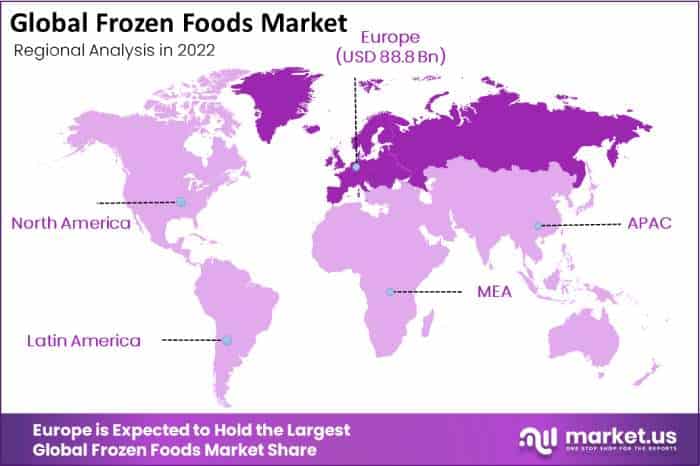

- Regional Analysis: Europe Dominates Europe holds a 33% market share in 2022, with rising living standards and growing demand for convenience driving frozen food consumption. Asia Pacific Growth Asia Pacific is expected to grow at a CAGR of 5.6% between 2023 and 2032, making it the fastest-growing market, driven by the availability of healthy and dietary-specific frozen foods.

- Key Market Players: The market is highly competitive, with major players including Unilever, Nestle, General Mills, Tyson Foods, and others. These companies focus on expanding product lines and targeting emerging markets.

Drivers

Increasing Disposable Income

As they require less time and effort than cooking from scratch, the growing preference of consumers for convenience foods boosts demand for frozen products. An additional factor that has a significant impact on the expansion of the frozen food market is an increase in disposable income. The convenience of packaged edible goods, which entices consumers of all ages, is the primary driver of the processed food industry.

The global Frozen Food Market has undergone rapid change as a result of consumer preference for RTE and convenience foods. The primary driver of demand for frozen food products is that this type of food requires less effort and less time than cooked foods. The growing population and frantic lifestyle are also expected to encourage the consumption of frozen food.

Restraints

Conservative Perspective Toward Frozen Foods

The primary disadvantage of this market is that certain consumers view frozen foods as inferior to fresh foods. Consumers believe that edibles that have been stored for more than a year lose their nutritional value. However, the IFIC (International Food Information Council) and the US Food and Drug Administration (FDA) dispelled these myths.

Frozen foods can be just as good as natural and fresh ones. However, because they are more concerned about the product’s freshness, consumers with lower incomes typically prefer fresh food. This factor may impede the market’s expansion during the forecast period due to consumers’ preference for fresh produce over frozen ones.

Type Analysis

The Ready Meals & Convenience Foods Segment Dominates With a 44% Market Share

Fruits & vegetables, potatoes, dairy products, ready meals & convenience foods, meat products, seafood, and other frozen products comprise the market’s segmentation based on products. The ready meals & convenience foods category dominated the global Frozen Food Market in 2022 with a 44% market share.

This is because people’s ever-changing and hectic lifestyles have created an increase in the consumption of frozen foods all over the world. Foods that are frozen can be prepared quickly and easily, and they’re packed with necessary nutrients. Due to consumer acceptance of these products and brand awareness in developing nations, the frozen food industry has grown recently.

Distribution Channel Analysis

Offline Segment has 88% Revenue Share

In 2022, the offline segment had a roughly 88% revenue share. Supermarkets & hypermarkets, convenience stores, grocery stores, and local shops are examples of offline channels. The distribution of frozen food has increased as the number of these stores has increased in various regions. The offline industry is being transformed by the rapid growth of the supermarket and hypermarket sectors.

The main idea behind supermarkets and hypermarkets is to make customers feel at ease, and manufacturers are working hard to show off their products in these places. In developing nations, supermarkets are expanding their presence in tier 2 and tier 3 cities, making products available in smaller towns. The expansion of the Frozen Food Market into new markets and smaller nations have benefited from this factor.

Key Market Segments

Based on Product

- Fruits & Vegetables

- Potatoes

- Ready Meals & Convenience Foods

- Meat Products

- Fish/Seafood Products

- Bakery Products

- Breads & Pizza Crusts

- Other Frozen Products

Based on the Distribution Channel

- Online Platforms

- Offline Stores

Opportunities

Growing Popularity of Smartphones and the Internet

Nearly 25% of people purchased food and other necessities from online retailers in 2022. Online grocery shopping is emerging as one of the opportunities for businesses to showcase and sell their products in light of the growing popularity of smartphones and the Internet.

The expansion of this Frozen Food Market as a distribution channel for frozen products is being fueled by the presence of temperature-controlled facilities in the infrastructure of convenience stores and hypermarkets.

Trends

The Convenience of Online Shopping

Online grocery shopping is one of the most recent market trends, which has led to the development of the most recent apps that make it easier for customers to select the products they want. Due to the convenience and variety of online shopping options, customers are more likely to shop there.

Another advantage of online grocery shopping is the ability to compare prices and products from different stores. Customers can easily search for the best deals and discounts available and choose the most affordable option. This not only saves time but also helps customers save money.

Regional Analysis

Europe Dominates with a 33% Market Share

Europe is the world’s largest market for frozen food items, with a 33% market share in 2022. In Europe, rising living standards and increasing demand for convenience have influenced consumers’ attitudes toward frozen food.

Even though growth in the consumption of frozen foods is limited in some regions of Europe, the overall level of consumption remains high. This can be attributed to the fierce competition from chilled prepared foods, which are better tasting and of higher quality than frozen alternatives. In countries like Germany, France, and the United Kingdom, recent evidence suggests that the frozen food market is once again expanding.

The market is also being driven by the increasing number of dedicated online and offline frozen food stores in European nations like France. Frozen food is readily available to consumers in France thanks to the presence of dedicated frozen product stores. For instance, Picard Surgelés is a French food company that has over 900 stores in France and specializes in the manufacturing and retail distribution of frozen products.

Asia Pacific is expected to grow at a CAGR of 5.6% between 2023 and 2032, making it the market with the fastest growth. The growth in the region will be driven by the increasing availability of frozen foods that are high in protein, low in calories, and fat, and meet specific dietary requirements like dairy-free, vegan, sugar-free, gluten-free, and plant-based products.

Poor infrastructure in cold chain logistics has also directly impacted the import & export business of frozen food products in developing countries such as Bangladesh, South Africa, and Myanmar.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Western Europe

- Germany

- UK

- France

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Spain

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Colombia

- Chile

- Costa Rica

- Rest of South America

- MEA

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

There are numerous regional and international competitors in the frozen food market, which is highly competitive. The market is dominated by Unilever, General Mills, Nestle SA, Nomad Foods Ltd., Wawona Frozen Foods, Tyson Foods Inc., and ConAgra Foods, Inc. The global market is dominated by the largest frozen food companies in the world.

Expanding their product lines to meet the needs of various Frozen Food Market segments, particularly frozen desserts, is these businesses’ primary focus. Additionally, they profit from emerging markets. Businesses compete on a variety of factors, including product offerings, flavors and ingredients, price, functionality, packaging, and marketing strategies to gain market share.

Market Key Players

- Unilever PLC

- Nestle S.A.

- General Mills, Inc.

- Nomad Foods

- Tyson Foods

- Conagra Brands Inc.

- Wawona Frozen Foods

- Bellesio Parent, LLC

- The Kellogg Company

- The Kraft Heinz Company

Recent Developments

- Keventer Agro, an FMCG company based in Kolkata, is set to collaborate with Disney India’s consumer products division to launch a food range. The “Disney Delights,” “Marvel Avengers Delights,” and “Marvel Spider-Man Delights” food lines are aimed at children and families and include frozen savory snacks, milk, and milkshakes.

- Since the pandemic, ITC Ltd.’s frozen snack business has expanded three times, driven by consumers’ desire for variety in home-cooked meals. During this time, the conglomerate has introduced ten new products.

- In the next three years, the frozen food company Sumeru plans to expand its domestic market to 250 crores.

Report Scope

Report Features Description Market Value (2022) USD 269.1 Bn Forecast Revenue (2032) USD 437.1 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product- Fruits & Vegetables, Potatoes, Ready Meals & Convenience Foods, Meat Products, Fish/Seafood Products, Bakery Products, Breads & Pizza Crusts, and Other Frozen Products; By Distribution Channel- Online Platforms and Offline Stores Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Unilever PLC, Nestle S.A., General Mills, Inc., Nomad Foods, Tyson Foods, Conagra Brands Inc., Wawona Frozen Foods, Bellesio Parent, LLC, The Kellogg Company, The Kraft Heinz Company, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Frozen Food Market?The Global Frozen Food Market size was estimated to be USD 269.1 Bn in 2022.

What is the total valuation stated in the Frozen Food Market report?The Global Frozen Food Market size was USD 269.1 Bn in 2022 and is expected to reach USD 437.1 Bn by 2032 at a CAGR of 5.1% over the forecast period of 2023-2032.

Which region is projected to be at the forefront of the Global Frozen Food Market?Europe led the Frozen Food Market in 2022 with a market share of over 33% and is expected to expand further at the same rate.

How is the Frozen Foods Market segmented?The Frozen Foods Market is segmented By Product, By Distribution Channel, and Region

What are the latest trends in the Frozen Foods Market?The latest trends in the Frozen Foods Market include online shopping, introduction of healthier and organic frozen foods, plant-based frozen foods, and the use of eco-friendly packaging.

What are the major factors driving the growth of the Frozen Foods Market?The major factors driving the growth of the Frozen Foods Market include increasing demand for convenience foods, busy lifestyles, growing urbanization, and rising disposable incomes.

-

-

- Unilever PLC

- Nestle S.A.

- General Mills, Inc.

- Nomad Foods

- Tyson Foods

- Conagra Brands Inc.

- Wawona Frozen Foods

- Bellesio Parent, LLC

- The Kellogg Company

- The Kraft Heinz Company